Company Reports Record Year, With 105%

Increase in Reported Revenues

Freedom Holding Corp. (NASDAQ: FRHC) (“Freedom”, or the

"Company"), a multi-national diversified financial services holding

company with a presence through its subsidiaries in 20 countries,

today announced its financial results for the twelve months ended

March 31, 2024, or fiscal 2024.

Commenting on the results, Timur Turlov, the Company's

founder and chief executive officer, stated:

“I am pleased to report that fiscal 2024 has been a record year

for our company, both from a revenue and earnings perspective. Our

core brokerage and banking businesses constituted approximately 75%

of our revenue for the period and we continued to focus on our

strategy to build upon our traditional financial services

businesses, our ancillary services offerings, and our newly formed

telecom subsidiary to create a robust fintech ecosystem in

Kazakhstan, a region that remains our biggest growth driver. We

also continued to add complementary service offerings to our

product line-up with the completion of five acquisitions during the

fiscal year, allowing us to offer services that further serve our

customers across their savings, investing, and necessary and

discretionary spending needs.

“Through sustained investment in digitalization we were able to

better manage our large-scale operation efficiently and retain our

position as a leading player in the digital financial services

industry in Kazakhstan. In fiscal 2024 we began the implementation

of our strategy to enter the telecommunications market in

Kazakhstan supported by a $200 million domestic bond offering, the

biggest retail bond offering to date on the Astana International

Exchange.

“To remain competitive in a fast-paced industry, we are

constantly evolving to adapt to increasingly complex market

conditions and shifting client needs. We expect to continue to

expand our operations globally, including further development of

our investment banking, capital markets advisory, and research

offering in the US, and seek growth opportunities in Central Asia

and Europe. We have strengthened our risk and compliance functions

and look forward to delivering value through sustained organic

growth, strategic acquisitions, and continued investment in

technological innovation.”

Fiscal 2024 Highlights:

- Revenue totaled approximately $1.6 billion compared to $796

million for the prior fiscal year, an increase of 105%, primarily

attributable to an increase in interest income, fee and commission

income, and insurance underwriting income.

- Fee and commission income was $440 million, an increase of 35%

from $327 million for fiscal 2023, driven by an increase in number

of retail brokerage customers from 370,000 in 2023 to 530,000 in

2024, as well as increased trading volumes across key markets.

- Interest income increased by 181% to $828 million, as a result

of an increase in interest income on trading securities, interest

income on margin loans to customers, and interest income on loans

to customers.

- Net income for the fiscal year was $375 million as compared to

$206 million in 2023.

- Basic and diluted earnings per share were $6.37 and $6.33,

respectively, for fiscal 2024. This compares to $3.50 and $3.45 for

fiscal 2023.

- Total assets were $8.3 billion as of March 31, 2024, as

compared to $5.1 billion as of March 31, 2023. The main increase

was attributable to our proprietary trading portfolio which

increased by 53% to $3.7 billion as of March 31, 2024 from $2.4

billion as of March 31, 2023, customer loans issued due to the loan

portfolio of Freedom Bank KZ which increased by 68% to $1.4 billion

as of March 31, 2024 from $826.3 million as of March 31, 2023, as

well as margin lending, brokerage, and other receivables which

increased by 341% to $3.7 billion as of March 31, 2024 from $376

million as of March 31, 2023.

- Acquisitions in Kazakhstan of Aviata LLP and Internet-Tourism

LLP in April 2023, Arbuz in May 2023, ReKassa in July 2023 and

DITel LLP in January 2024 contributed to revenue growth during the

year. In addition, in November 2023, the board of directors

approved a plan to expand the business by entering into the

telecommunications market in Kazakhstan through our Freedom Telecom

subsidiary.

- The Company opened new representative offices in Austria,

Belgium, Bulgaria, Italy, and the Netherlands.

- The Company’s Shapagat Non-Profit Corporate Fund, founded in

August 2023, endeavors to support and contribute to sports,

culture, and educational causes amongst local communities. In

fiscal 2024, $2.9 million was committed to charitable endeavors,

which included supporting the Kazakhstan Chess Federation, the

International Collegiate Programming Contest (ICPC), the “Teach for

Qazaqstan” initiative, the construction of a new educational

building at SDU University in Almaty and the design and

construction of a sports hall for persons with disabilities in

Uralsk. During the fiscal year, a new campus of the IQanat school

opened in Kazakhstan, with its construction partially financed by

the Fund.

- An inaugural Sustainability Report was published in December

2023, emphasizing the Company’s dedication to ESG principles,

covering personnel care, community impact, corporate governance,

and key environmental data.

Division Segment Breakdown:

Brokerage

- Total brokerage customers increased by 43% to approximately

530,000 as of March 31, 2024, as compared to approximately 370,000

customers as of March 31, 2023.

- Total net revenue increased to $617 million, up 60% over the

previous fiscal year, primarily driven by fee and commission income

and interest income. Fee and commission income from brokerage

services grew by 18% to $352 million primarily driven by a general

increase in brokerage activity between the two periods. Interest

income increased by $233 million during fiscal 2024 in comparison

to $65 million during fiscal 2023, due to an increase in interest

accrued on securities held in our proprietary trading portfolio and

interest income on margin loans to customers.

- Total expenses increased by 47% primarily driven by a rise in

interest expense, mainly due to interest paid on securities

repurchase agreements. Additionally, an increase in payroll and

bonuses reflected our efforts to attract and retain top talent.

General and administrative expenses rose due to the overall growth

of operations. However, these increases were partially offset by a

decrease in provision for impairment and fee and commission

expenses.

- The omnibus brokerage arrangement with FST Belize was

terminated as of March 31, 2024.

Banking

- There were approximately 3.4 million bank accounts held in the

Freedom Bank KZ subsidiary as of March 31, 2024, as compared to

approximately 1.7 million as of March 31, 2023.

- Total net revenue of $615 million, a 151% increase, was mainly

attributable to higher interest income from trading securities in

Freedom Bank KZ’s proprietary portfolio and interest income on

loans to customers. An increase in net gain on trading securities,

due to the growth of the proprietary trading portfolio within this

segment, also contributed to the revenue increase. However, these

gains were partially offset by a net loss on derivatives.

- Total expenses increased by 160%, primarily driven by a rise in

interest expense on securities repurchase agreements within this

segment, and a $37.8 million increase in interest expense on

customer deposits. Additionally, payroll and bonuses increased by

$27.2 million, reflecting the growth of Freedom Bank KZ's

operations. General and administrative expenses rose by $17.1

million, further contributing to the overall increase.

Insurance

- The number of active insurance contracts grew from 681,667 as

of March 31, 2023, to 807,173 as of March 31, 2024. This growth

reflects our successful efforts in diversifying our insurance

product offerings and expanding our insurance customer base.

- Total net revenue in the insurance segment increased by 100% to

$341 million, mainly due to an increase in underwriting income,

reflecting the overall growth of our insurance operations.

- Insurance underwriting income increased 129% to $264 million,

due an 110% increase in written insurance premiums in FY 2024 to

$287.8 million, driven by the expansion of insurance

operations.

- The increase in insurance revenue was partially offset by a

$9.7 million, or 127%, increase in the negative change in

reinsurance premiums ceded.

- Total expenses increased by 119% due to higher fee and

commission expenses, attributable to the overall growth of the

insurance operations, in addition to higher interest expenses,

primarily from securities repurchase agreements.

Other

- In fiscal 2024, total net revenue in the Other segment

increased to $62.5 million, from $4.7 million loss in 2023, mainly

due to higher fee and commission income from payment processing at

Paybox and its subsidiaries, which were acquired in the fourth

quarter of fiscal 2023.

- Total expenses in the Other segment increased by 172% due to

increases in payroll, professional services and advertising

expenses related to FRHC and Paybox. Higher fee and commission

expenses resulted from the overall growth in the provision of

acquiring payment services, as well as online aggregators for

buying air and railway tickets.

- We established Aviata LLP and Internet Tourism LLP during the

reporting period. Aviata's preeminent position in the air and rail

ticketing sectors makes it an important strategic asset to the

enterprise as it works to develop a comprehensive digital fintech

ecosystem in Kazakhstan, while Internet-Tourism LLP, a

Kazakhstan-based online aggregator for buying air and railway

tickets, aids in expanding our presence in the digital services

ecosystem in Kazakhstan.

- We acquired Arbuz Group LLP, a food tech service, to accelerate

our growth in e-commerce sector.

- We completed the acquisition of 90% of Comrun LLP ("Rekassa"),

a Kazakhstan-based digital service for cash transaction data

management, in order to expand our presence in the digital services

ecosystem in Kazakhstan.

- We formed Freedom Telecom to establish a new independent

telecom business in Kazakhstan.

- We established Freedom Media, with the goal of becoming a

national media content platform in Kazakhstan.

Corporate Governance and Compliance

As part of its commitment to strong governance and compliance,

in October 2023 the Company appointed a new Chief Compliance

Officer, focused on further improving Freedom’s robust control

framework and policies, and investing in staff, tools, and

technology to support best practice in customer onboarding and

ongoing monitoring.

In January 2024 the Company appointed a new Chief Risk Officer,

focused on further enhancing Freedom’s comprehensive risk

management framework and policies. This role is concentrated on

identifying, assessing, and mitigating risks across the

organization, ensuring that our operations are aligned with best

practices in risk management.

In related news, and in line with its dedication to maintaining

a robust legal and compliance infrastructure, the Company also

appointed a new chief legal officer in May 2024. The position will

oversee all legal matters for the enterprise, ensuring Freedom's

operations comply with all relevant laws and regulations. This role

will be pivotal in supporting the Company's governance framework,

providing expert legal advice, and driving initiatives that promote

a culture of compliance and integrity across our organization.

Outlook

In fiscal 2025 we expect to focus on further digital

integration, expanding our market presence in Europe and Central

Asia, and enhancing AI-driven customer solutions. We will also

continue to seek to acquire financial services-related companies,

complementary businesses, and financial and complementary

technologies on an opportunistic basis, aligned with our

acquisition strategy to expand our presence globally. In the US, we

anticipate that our investment banking and our increased research

capabilities will help us secure a greater foothold in the capital

markets space.

We expect that our balance sheet will allow the Company to add

complementary services through acquisitions and further increase

our product offerings, leaving us optimally placed to expand our

platform into additional markets as regulatory and market

conditions dictate. In November 2023, consistent with our strategy

to build a digital fintech ecosystem, our board of directors

approved a plan to enter the telecommunications market in

Kazakhstan through our Freedom Telecom subsidiary.

As part of our investment in strategic expansion, we expect to

open new representative offices in Lithuania, the Czech Republic,

and Denmark, which we believe will leave us well positioned to

further navigate evolving client needs.

About Freedom Holding Corp.

Freedom Holding Corp., a Nevada corporation, is a diversified

financial services holding company conducting retail securities

brokerage, securities trading, investment research, investment

counseling, investment banking and underwriting services,

mortgages, insurance, and commercial banking as well as several

ancillary businesses which complement its core financial services

businesses, all through its subsidiaries, operating under the name

Freedom24 in Europe and Central Asia, and Freedom Capital Markets

in the United States. Through its subsidiaries, Freedom Holding

Corp. employs more than 6,000 people and is a professional

participant in the Kazakhstan Stock Exchange, the Astana

International Exchange, the Republican Stock Exchange of Tashkent,

the Uzbek Republican Currency Exchange, and is a member of the New

York Stock Exchange and the Nasdaq Stock Exchange.

Freedom Holding Corp. is headquartered in Almaty, Kazakhstan,

and has operations and subsidiaries in 20 countries, including

Kazakhstan, the United States, Cyprus, Armenia, Uzbekistan,

Azerbaijan, and others.

Freedom Holding Corp.'s common shares are registered with the

United States Securities and Exchange Commission and are traded

under the symbol FRHC on the Nasdaq Capital Market, operated by

Nasdaq, Inc.

To learn more about Freedom Holding Corp., visit

www.freedomholdingcorp.com.

Cautionary Note Regarding Forward-Looking Statements

This release contains "forward-looking" statements, including

with respect to our future results of operations and financial

position, business strategy and plans and our objectives for future

operations, as well as the capital investment required to be

successful in any aspect of our strategic plans, and is subject to

a number of factors, many of which are beyond our control. All

forward-looking statements are subject to uncertainty and changes

in circumstances. In some cases, forward-looking statements can be

identified by terminology such as "expect," "new," "plan," "seek,"

and "will," or the negative of such terms or other comparable

terminology used in connection with any discussion of future plans,

actions, and events. Forward-looking statements are not guarantees

of future results or performance and involve risks, assumptions,

and uncertainties that could cause actual events or results to

differ materially from the events or results described in, or

anticipated by, the forward-looking statements. Factors that could

materially affect such forward-looking statements include certain

economic, business, and regulatory risks and factors identified in

the Company's periodic and current reports filed with the U.S.

Securities and Exchange Commission. All forward-looking statements

are made only as of the date of this release and the Company

assumes no obligation to update forward-looking statements to

reflect subsequent events or circumstances. Readers should not

place undue reliance on these forward-looking statements.

FREEDOM HOLDING CORP.

CONSOLIDATED BALANCE SHEETS

(All amounts in thousands of United States dollars, unless

otherwise stated)

March 31, 2024

March 31, 2023

ASSETS

Cash and cash equivalents (including $203

and $35,549 with related parties)

$

545,084

$

581,417

Restricted cash (including $— $114,885

with related parties)

462,637

445,528

Trading securities (including $1,326 and

$556 with related parties)

3,688,620

2,412,556

Available-for-sale securities, at fair

value

216,621

239,053

Margin lending, brokerage and other

receivables, net (including $22,039 and $295,611 due from related

parties)

1,660,275

376,329

Loans issued (including $147,440 and

$121,316 to related parties)

1,381,715

826,258

Fixed assets, net

83,002

54,017

Intangible assets, net

47,668

17,615

Goodwill

52,648

14,192

Right-of-use asset

36,324

30,345

Insurance contract assets

24,922

13,785

Other assets, net (including $5,257 and

$16,102 with related parties)

102,414

73,463

TOTAL ASSETS

$

8,301,930

$

5,084,558

LIABILITIES AND SHAREHOLDERS'

EQUITY

Securities repurchase agreement

obligations

$

2,756,596

$

1,517,416

Customer liabilities (including $44,127

and $130,210 to related parties)

2,273,830

1,925,247

Margin lending and trade payables

(including $507 and $3,721 to related parties)

867,880

122,900

Liabilities from insurance activity

(including $470 and $34 to related parties)

297,180

182,502

Current income tax liability

32,996

4,547

Debt securities issued

267,251

60,025

Lease liability

35,794

30,320

Liability arising from continuing

involvement

521,885

440,805

Other liabilities (including $9,854 and

$46 to related parties)

81,560

30,060

TOTAL LIABILITIES

$

7,134,972

$

4,313,822

Commitments and Contingent Liabilities

(Note 29)

—

—

SHAREHOLDERS’ EQUITY

Preferred stock - $0.001 par value;

$20,000,000 shares authorized, no shares issued or outstanding

—

—

Common stock - $0.001 par value;

500,000,000 shares authorized; 60,321,813 and 59,659,191 shares

issued and outstanding as of March 31, 2024 and March 31, 2023,

respectively

60

59

Additional paid in capital

183,788

164,162

Retained earnings

998,740

647,064

Accumulated other comprehensive loss

(18,938

)

(34,000

)

TOTAL FRHC SHAREHOLDERS’ EQUITY

$

1,163,650

$

777,285

Non-controlling interest

3,308

(6,549

)

TOTAL SHAREHOLDERS’ EQUITY

$

1,166,958

$

770,736

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

8,301,930

$

5,084,558

FREEDOM HOLDING CORP.

CONSOLIDATED STATEMENTS OF OPERATIONS AND STATEMENTS OF OTHER

COMPREHENSIVE INCOME

(All amounts in thousands of United

States dollars, unless otherwise stated)

Years ended March 31,

2024

2023

2022

(Recasted)

Revenue:

Fee and commission income (including

$65,972, $199,235 and $291,163 from related parties)

$

440,333

$

327,215

$

335,211

Net gain on trading securities

133,854

71,084

155,252

Interest income (including $24,941 ,

$23,191 and $10,191 from related parties)

828,224

294,695

121,609

Insurance underwriting income

264,218

115,371

72,981

Net gain on foreign exchange

operations

72,245

52,154

3,791

Net (loss)/gain on derivatives

(103,794

)

(64,826

)

946

TOTAL REVENUE, NET

1,635,080

795,693

689,790

Expense:

Fee and commission expense (including

$127, $2,988 and $16,307 from related parties)

154,351

65,660

85,909

Interest expense (including $955, $1,578

and $217 from related parties)

501,111

208,947

76,947

Insurance claims incurred, net of

reinsurance

139,561

77,329

54,447

Payroll and bonuses

181,023

81,819

46,288

Professional services

34,238

17,006

12,682

Stock compensation expense

22,719

9,293

7,859

Advertising expense

38,327

14,059

11,916

General and administrative expense

(including $10,341, $2,953 and $790 from related parties)

120,888

59,971

23,533

Allowance for expected credit losses

21,225

29,119

2,502

Other (income)/expense, net

(13,734

)

(3,448

)

4,014

TOTAL EXPENSE

1,199,709

559,755

326,097

INCOME BEFORE INCOME TAX

435,371

235,938

363,693

Income tax expense

(60,419

)

(42,776

)

(38,570

)

INCOME FROM CONTINUING

OPERATIONS

374,952

193,162

325,123

Income/(loss) before income tax

(expense)/benefit of discontinued operations

—

68,160

(117,199

)

Reclassification of loss from cumulative

translation adjustment of discontinued operations

—

(25,415

)

—

Loss from divestiture of discontinued

operations

—

(26,118

)

—

Income tax benefit/(expense) of

discontinued operations

—

(4,203

)

13,004

Income/(loss) from discontinued

operations

—

12,424

(104,195

)

NET INCOME

374,952

205,586

220,928

Less: Net (loss)/income attributable to

non-controlling interest in subsidiary

(588

)

446

(6,566

)

NET INCOME ATTRIBUTABLE TO CONTROLLING

INTEREST

$

375,540

$

205,140

$

227,494

OTHER COMPREHENSIVE INCOME

Change in unrealized gain on investments

available-for-sale, net of tax effect

6,196

1,431

(4,292

)

Reclassification adjustment for net

realized (loss)/gain on available-for-sale investments disposed of

in the period, net of tax effect

(3,209

)

(2,916

)

2,222

Reclassification of loss from cumulative

translation adjustment of discontinued operations

—

25,415

—

Foreign currency translation

adjustments

12,075

5,195

(20,622

)

OTHER COMPREHENSIVE

INCOME/(LOSS)

15,062

29,125

(22,692

)

COMPREHENSIVE INCOME BEFORE

NON-CONTROLLING INTERESTS

$

390,014

$

234,711

$

198,236

Less: Comprehensive (loss)/income

attributable to non-controlling interest in subsidiary

(588

)

446

(6,566

)

COMPREHENSIVE INCOME ATTRIBUTABLE TO

CONTROLLING INTEREST

$

390,602

$

234,265

$

204,802

EARNINGS PER COMMON SHARE (In U.S.

dollars):

Earnings from continuing operations per

common share - basic

6.37

3.29

5.59

Earnings from continuing operations per

common share - diluted

6.33

3.24

5.59

Earnings/(loss) from discontinued

operations per common share - basic

—

0.21

(1.75

)

Earnings/(loss) from discontinued

operations per common share - diluted

—

0.21

(1.75

)

Earnings per common share - basic

6.37

3.50

3.84

Earnings per common share - diluted

6.33

3.45

3.84

Weighted average number of shares

(basic)

58,958,363

58,629,580

59,378,207

Weighted average number of shares

(diluted)

59,362,982

59,504,811

59,378,207

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240613257789/en/

Ramina Fakhrutdinova (KZ) Public Relations Freedom

Finance JSC +7 777 377 8868 pr@ffin.kz Al Palombo (US)

Global Communications Chief Freedom US Markets +1 212-980-4400,

Ext. 1013 apalombo@freedomusmkts.com

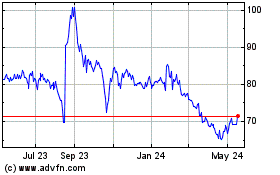

Freedom (NASDAQ:FRHC)

Historical Stock Chart

From Nov 2024 to Dec 2024

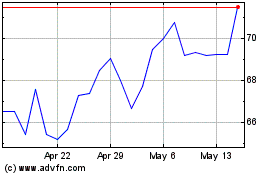

Freedom (NASDAQ:FRHC)

Historical Stock Chart

From Dec 2023 to Dec 2024