Current Report Filing (8-k)

December 23 2022 - 5:24PM

Edgar (US Regulatory)

false

0001460329

0001460329

2022-12-23

2022-12-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 23, 2022

FLUENT, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-37893

|

|

77-0688094

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

300 Vesey Street, 9th Floor

New York, New York

|

|

10282

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (646) 669-7272

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0005 par value per share

|

|

FLNT

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement

The information described below under “Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant” is hereby incorporated by reference into this Item 1.01.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On December 20, 2022, a wholly-owned subsidiary of the Registrant, Fluent, LLC and its subsidiaries (the "Borrower"), Citizens Bank, N.A., and certain lenders entered into the second amendment to credit agreement, waiver, acknowledgment and joinder (the “Amendment”) to that to that certain Credit Agreement, dated as of March 31, 2021 (the “Existing Credit Agreement”, as amended by that certain First Amendment to Credit Agreement, dated as of September 3, 2021, and as the same may be amended, modified, extended, restated, replaced or supplemented from time to time, including by the Amendment (the “Credit Agreement”)). All capitalized terms used unless otherwise indicated are defined in the Credit Agreement, a copy of which was previously filed with Securities and Exchange Commission as Exhibit 10.1 on March 31, 2021 (

https://www.sec.gov/ix?doc=/Archives/edgar/data/1460329/000143774921007842/flnt20210328_8k.htm) and is incorporated herein by reference. The following description of the terms of the Credit Agreement (as amended by the Amendment) does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Credit Agreement.

The Amendment amends certain provisions of the Credit Agreement to: (i) reflect the replacement of the current benchmark settings with TERM SOFR pursuant to an Early Opt-In Election; (ii) acknowledge certain litigation matters; and (iii) join additional subsidiaries of Borrower as guarantors of the loan facilities (the “Credit Facilities”) provided under the Credit Agreement. The Credit facilities consist of an existing term loan facility in the aggregate principal amount of $50.0 million and an undrawn revolving credit facility of $15.0 million (the “Revolving Credit Facility”).

Borrowings under the Credit Facilities bear interest at a rate per annum equal to the benchmark selected by the Borrower, which may be based on the Alternative Base Rate or Term SOFR (subject to a floor of 0.00%), plus a margin applicable to the selected benchmark. The applicable margin is between 0.75% and 1.75% for borrowings based on the Alternative Base Rate and 1.75% and 2.75% for borrowings based on Term SOFR, depending upon the Borrower's Total Leverage Ratio. The opening interest rate of the Credit Facility was 2.50% (LIBOR + 2.25%), which increased to 4.87% (LIBOR + 1.75%) as of September 30, 2022. The Credit Facility matures on March 31, 2026 (the “Maturity Date”).

The Borrower may voluntarily prepay loans or reduce commitments under the Credit Agreement, in whole or in part, without premium or penalty. Subject to the terms and conditions set forth in the Credit Agreement, the Borrower may be required to make certain mandatory prepayments prior to the Maturity Date.

The Credit Agreement contains negative covenants that, among other things, limit the Borrower's ability to: incur indebtedness; grant liens on its assets; enter into certain investments; consummate fundamental change transactions; engage in mergers or acquisitions or dispose of assets; enter into certain transactions with affiliates; make changes to its fiscal year; enter into certain restrictive agreements; and make certain restricted payments (including for dividends and stock repurchases, which are generally prohibited except in a few circumstances and/or up to specified amounts). Each of these limitations are subject to various conditions.

The Credit Agreement also contains certain affirmative covenants and customary events of default provisions, including, subject to thresholds and grace periods, among others, payment default, covenant default, cross default to other material indebtedness, and judgment default.

The Credit Agreement also contains certain customary conditions to extensions of credit, including that representations and warranties made in the Existing Credit Agreement be materially true and correct at the time of such extension. One such representation concerning the absence of litigation or proceedings is not currently true and correct as a result of the matters pending involving the Federal Trade Commission and the Pennsylvania Office of the Attorney General described in the Company’s Form 10-Q filed with the SEC on November 7, 2022. These matters do not represent events of default under the Credit Agreement, but the Borrowers are not currently able to draw on the Revolving Credit Facility due the representation and warranty requirement for an extension of credit. The Company believes that it will have sufficient cash resources to finance its operations and expected capital expenditures for the next twelve months and beyond regardless of access to the Revolving Credit Facility.

Item 3.03 Material Modification to Rights of Security Holders.

The information described above under “Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant” with respect to the limitation on the Company’s ability to declare dividends is hereby incorporated by reference into this Item 3.03.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| |

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

| |

|

|

|

| |

Fluent, Inc.

|

|

| |

|

|

|

|

December 23, 2022

|

By:

|

/s/ Donald Patrick

|

|

| |

Name:

|

Donald Patrick

|

|

| |

Title:

|

Chief Executive Officer

|

|

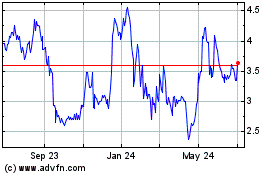

Fluent (NASDAQ:FLNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

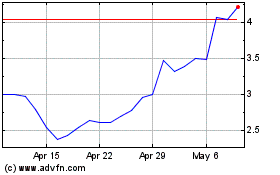

Fluent (NASDAQ:FLNT)

Historical Stock Chart

From Apr 2023 to Apr 2024