UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The

Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

|

|

|

☒

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as

permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Under § 240.14a-12

|

Firsthand Technology Value Fund, Inc.

(Name of Registrant as Specified in Its Charter)

SCOTT KLARQUIST

(Name of Persons(s) Filing Proxy Statement, if Other Than the

Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(1) and 0-11

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction

applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction

applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the

amount on which the filing fee is calculated and state how

it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials:

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by

Exchange Act Rule 0-11(a)(2) and identify the filing for

which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the

form or schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount previously paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH [__], 2022

SCOTT KLARQUIST

[ ], 2022

Dear Fellow SVVC Stockholders:

Scott Klarquist (the "Nominee", "Mr Klarquist" or "I") is a beneficial

owner of an aggregate of 3,000 shares of the outstanding common stock, par

value $0.001 per share (the "Common Stock") of Firsthand Technology Value

Fund, Inc., a Maryland corporation ("SVVC" or the "Company"). For the

reasons set forth in the attached Proxy Statement, I believe a change to

the composition of the Board of Directors of the Company (the "Board") is

necessary to ensure that SVVC is managed and overseen in a manner

consistent with your best interests. I have nominated myself as a director

candidate for election to the Board at the Company's upcoming 2022 Annual

Meeting of Stockholders (the "Annual Meeting"), to replace septuagenarian

incumbent director Nicholas Petredis. (Please note that this is the only

SVVC directorship expected to be on the ballot at this year's annual

meeting.) As you may be aware, I filed two investor presentations critical

of company leadership and SVVC's third-party management fee structure on

EDGAR in January 2022. If you have not reviewed these yet, please do so at

your earliest convenience.

My goal is to create value for the benefit of all stockholders. I believe a

critical step towards achieving this objective is to elect a director to

the Board who has a strong and relevant skill set and who will provide

renewed accountability and will serve in the best interests of all

stockholders. Mr Petredis is a stale director, having served on SVVC's

board since 2014. According to company SEC filings, he also currently owns

ZERO SHARES of SVVC stock, meaning he refuses to invest his own money

alongside the shareholders. Moreover, Mr Petredis does not appear to have

sufficient "true independence" (as opposed to technically meeting the

definition of "independent" in form, but not substance) from Kevin Landis,

SVVC's Board Chairman and CEO and the Chief Investment Officer of SVVC's

external investment manager Firsthand Capital Management, LLC ("FCM"), to

properly represent the interests of SVVC's unaffiliated shareholders.

Notably, Mr Petredis served as the Chief Compliance Officer for Firsthand

Funds from 2008 to 2013 and the Chief Compliance Officer of SVVC from 2010

to 2013. He also appears to have opposed any significant change to the

status quo at SVVC despite the resounding anti-Landis and anti-FCM (and

pro-change) mandates rendered by the shareholders at the 2020 and 2021

annual meetings (which have been totally ignored by our board). Replacing

Mr Petredis on SVVC's board would finally allow a shareholder-friendly

advocate, as opposed to a seemingly Landis-friendly rubber stamp director,

into the boardroom, without which I do not believe any REAL LONG-TERM

POSITIVE CHANGE at SVVC will be possible.

The Company has a classified Board, which is currently divided into three

classes. The term of the sole Class II director will expire at the Annual

Meeting. Through the attached Proxy Statement and enclosed WHITE proxy

card, I am soliciting proxies to elect only the Nominee. Accordingly, the

enclosed WHITE proxy card may only be voted for the Nominee and does not

confer voting power with respect to the Company's director nominee. You can

only vote for the Company's director nominee by signing and returning a

proxy card provided by the Company. Stockholders should refer to the

Company's proxy statement for the name, background, qualifications and

other information concerning the Company's nominee.

I will also support and solicit proxies through the attached Proxy

Statement and the enclosed WHITE proxy card in favor of the [termination of

the external investment advisory and management agreement between the

Company and FCM, should a proposal to that effect (whether mandatory or

precatory) be included on the Company's proxy statement]. At last year's

annual meeting, independent shareholder Donald Chambers submitted such a

proposal, which fell slightly short of achieving the 66 2/3% vote required

for passage. My understanding is that a similar proposal will be on the

ballot this year and hopefully, with your support, it will finally pass and

liberate the shareholders from the FCM management agreement's punishing and

irrational fee structure.

I look forward to continuing to engage with you as we approach the Annual

Meeting. I urge you to carefully consider the information contained in the

attached Proxy Statement and then support my efforts by signing, dating,

and returning the enclosed WHITE proxy card today. If you have already

voted for the Company's nominee, you have every right to change your vote

by signing, dating, and returning a later dated proxy or by voting in

person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please

contact me at the address listed below.

|

|

|

|

|

|

|

Thank you for your support.

|

|

|

|

|

|

|

/s/ Scott Klarquist

|

|

|

|

|

|

|

|

|

|

|

Scott Klarquist

|

i

If you have any questions, require assistance in voting your

WHITE proxy card, or need additional copies ofMr Klarquist's proxy materials, please contact Mr Klarquist

at the phone number, physical address or email address listed below.

Scott Klarquist

[85 Broad Street, 18th Floor]

New York, NY 10005

(646) 592-0498

Email: info@sevencornerscapital.com

ii

2022 ANNUAL MEETING OF STOCKHOLDERS

OF

FIRSTHAND TECHNOLOGY VALUE FUND, INC.

PROXY STATEMENT

OF

SCOTT KLARQUIST

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Scott Klarquist (the "Nominee", "Mr Klarquist", "I" or "me") beneficially

owns 3,000 shares of Common Stock, par value $0.001 per share (the "Common

Stock"), of Firsthand Technology Value Fund, Inc., a Maryland corporation

("SVVC" or the "Company"). I have nominated myself to the Company's Board

of Directors (the "Board") because I believe the Board would benefit from

the insight of a new and independent member to ensure that the interests of

the common stockholders, the true owners of SVVC, are appropriately

represented in the boardroom. I believe I have a strong, relevant

background and am committed to demanding accountability by our Board to all

stockholders and to fully exploring all opportunities to unlock stockholder

value. IMPORTANTLY, I HAVE NO TIES (DIRECT OR INDIRECT) WHATSOEVER TO

SVVC's CHAIRMAN AND CEO KEVIN LANDIS OR SVVC'S EXTERNAL INVESTMENT MANAGER,

FIRSTHAND CAPITAL MANAGEMENT, LLC ("FCM"), of which Mr Landis is the Chief

Investment Officer. I am seeking your support at the Company's 2022 Annual

Meeting of Stockholders, scheduled to be held on [ ], 2022, at [ ] [ ].m.

(Eastern Time) (including any adjournments or postponements thereof and any

meeting which may be called in lieu thereof, the "Annual Meeting"), which

will be held for the following purposes1:

|

|

1.

|

To elect Scott Klarquist as a Class II director to hold

office until the 2025 Annual Meeting of Stockholders and

until his successor has been duly elected and qualified;

|

|

|

2.

|

To ratify the appointment of Tait, Weller & Baker LLP

as the Company's independent registered public accounting

firm for the fiscal year ending December 31, 2022;

|

|

|

3.

|

To [approve a binding proposal to terminate the Company's

external investment advisory and management agreement with

FCM]; and

|

|

|

4.

|

To transact such other business as may properly come before

the Annual Meeting.

|

This Proxy Statement and the enclosed WHITE proxy card are first being

furnished to stockholders on or about [ ], 2022.

[According to the Company's proxy statement, the Company has disclosed that

the Annual Meeting will be held exclusively online via a live interactive

webcast on the internet. You will not be able to attend the Annual Meeting

in person at a physical location.]2 In order to attend the

Annual Meeting, you must pre-register by visiting [ ] by [ ] [ ].m. Eastern

Time on [ ], 2022. Stockholders of record may vote at the virtual Annual

Meeting or vote by proxy. Please see the "Voting and Proxy

Procedures-[Virtual Meeting]" beginning on Page 15 for additional

information.

|

1

|

As of the date of this Proxy Statement, the Company's proxy

statement has not been filed with the Securities and

Exchange Commission (the "SEC"). The proposal numbers in

this Proxy Statement may not correspond to the proposal

number that will be used in the Company's proxy statement.

Certain information in this Proxy Statement will be updated

after the Company's proxy statement is filed.

|

|

2

|

This Proxy Statement will be updated with the details of

the format of the Company's Annual Meeting after the

Company's proxy statement is filed.

|

1

The Company has set the close of business on [ ], 2022 as the record date

for determining stockholders entitled to notice of, and to vote at, the

Annual Meeting (the "Record Date"). The mailing address of the principal

executive offices of the Company is 150 Almaden Boulevard, Suite 1250, San

Jose, California 95113.

According to the Company's proxy statement, anyone who is a holder of

record of Common Stock at the close of business on the Record Date, or

holds a valid proxy for the Annual Meeting, is entitled to vote at the

Annual Meeting or any postponement or adjournment of the Annual Meeting.

Every stockholder is entitled to one vote for each share of Common Stock

held on the Record Date.

The Company has a classified Board, which is currently divided into three

classes. The term of the sole current Class II director will expire at the

Annual Meeting. Through the attached Proxy Statement and enclosed WHITE

proxy card, I am soliciting proxies to elect only the Nominee. Accordingly,

the enclosed WHITE proxy card may only be voted for the Nominee and does

not confer voting power with respect to the Company's director nominee. You

can only vote for the Company's director nominee by signing and returning a

proxy card provided by the Company. Stockholders should refer to the

Company's proxy statement for the name, background, qualifications and

other information concerning the Company's nominee. If elected, the Nominee

will constitute a minority on the Board and there can be no guarantee that

the Nominee will be able to implement any actions that he may believe are

necessary to unlock stockholder value.

As of the date hereof, Mr Klarquist beneficially owns 3,000 shares of

Common Stock (the "Nominee's Shares"). I intend to vote all of the

Nominee's Shares FOR my election, FOR the

ratification of the appointment of Tait, Weller & Baker LLP as the

Company's independent registered public accounting firm, and FOR the [binding shareholder proposal to terminate the

Company's external management agreement with FCM].

According to the Company's proxy statement, on the Record Date, there were

[ ] shares of Common Stock issued and outstanding.

THIS SOLICITATION IS BEING MADE BY MR KLARQUIST AND NOT ON BEHALF OF THE

BOARD OR MANAGEMENT OF THE COMPANY. I AM NOT AWARE OF ANY OTHER MATTERS TO

BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY

STATEMENT. SHOULD OTHER MATTERS, WHICH MR KLARQUIST

IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT

BEFORE THE ANNUAL MEETING, I WILL VOTE ON SUCH MATTERS IN MY DISCRETION.

MR KLARQUIST URGES YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN

FAVOR OF THE ELECTION OF THE NOMINEE.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR

THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS

DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING, AND RETURNING THE

ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT

COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY

DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE

ANNUAL MEETING OR BY VOTING AT THE ANNUAL MEETING.

2

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you

own. Mr Klarquist urges you to sign, date, and return the enclosed

WHITE proxy card today to vote FOR the election of the Nominee and in

accordance with Mr Klarquist's recommendations on the other proposals

on the agenda for the Annual Meeting.

|

|

•

|

|

If your shares of Common Stock are registered in your own

name, please sign and date the enclosed WHITE proxy card

and return it to Mr Klarquist, in the enclosed postage-paid

envelope today.

|

|

|

•

|

|

If your shares of Common Stock are held in a brokerage

account or bank, you are considered the beneficial owner of

the shares of Common Stock, and your broker or bank will be

forwarding these proxy materials, a WHITE proxy card, and a

voting form. As a beneficial owner, you must instruct your

broker, trustee or other representative how to vote. Your

broker cannot vote your shares of Common Stock on your

behalf without your instructions. As a beneficial owner,

you may vote the shares at the Annual Meeting only if you

obtain a legal proxy from the broker or bank giving you the

rights to vote the shares.

|

|

|

•

|

|

Depending upon your broker or custodian, you may be able to

vote either by toll-free telephone or by the Internet.

Please refer to the voting form provided by your broker or

bank for instructions on how to vote electronically. You

may also vote by signing, dating and returning the enclosed

WHITE proxy card.

|

|

|

•

|

|

You may vote your shares at the Annual Meeting. Even if you

plan to attend the Annual Meeting, I recommend that you

submit your WHITE proxy card by mail by the applicable

deadline so that your vote will be counted if you later

decide not to attend the Annual Meeting.

|

Since only your latest dated proxy card will count, I urge you

not to return any proxy card you receive from the Company.

Remember, you can vote for the Nominee only on the WHITE proxy

card. So please make certain that the latest dated proxy card

you return is the WHITE proxy card.

If you have any questions, require assistance in voting your

WHITE proxy card, or need additional copies of Mr Klarquist's

proxy materials, please reach out to me via the contact information

listed below.

Scott Klarquist

[85 Broad Street, 18th Floor]

New York, NY 10005

(646) 592-0498

Email: info@sevencornerscapital.com

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting-This Proxy Statement and the WHITE proxy card are

available at

www.sevencornerscapital.com

3

BACKGROUND TO THE SOLICITATION

The following is a chronology of material events leading up to this proxy

solicitation:

|

|

•

|

|

During 2020 and 2021, Mr Klarquist followed the Company's

annual meeting results and noted in particular the

Company's poor corporate governance practices and lack of

responsiveness to unambiguous shareholder votes for change.

|

|

|

•

|

|

In early November 2021, Mr Klarquist acquired 100 shares of

the Company's common stock and subsequently transferred

these shares into record ownership.

|

|

|

•

|

|

On December 14, 2021, Mr Klarquist submitted a letter to

the company nominating himself to the board of directors of

the Company.

|

|

|

•

|

|

On January 12, 2022, the Company unilaterally rejected Mr

Klarquist's nomination as containing insufficient

information under the Company's bylaws and, moreover,

claimed that he did not have the right to nominate himself

"or any other candidate" as a director at the Annual

Meeting, notwithstanding the Company's bylaw requirement

that shareholders be given five (5) business days to update

information in a director nomination letter if such

information is deemed "inaccurate" by the Company. The

Company did not send Mr Klarquist a Director questionnaire

(as he had requested), nor did the company identify any

specific item of information that was missing from the

nomination letter.

|

|

|

|

|

|

|

|

•

|

|

On January 12, 2022, Mr Klarquist responded to the

Company's rejection notice via an email response as

follows: "

I am not sure what information 'required by Regulation

14A' [SVVC's corporate secretary] thinks is missing

(why hasn't he specified in his letter what he believes

is missing?), however to be clear I disagree with his

contention. [SVVC's corporate secretary's] letter is

conclusory and void of any real substance, and frankly

unprofessional in its dismissive tone. Given SVVC's

pathetically poor track record, the company needs to do

better than this. PLEASE ADVISE ASAP WHAT ADDITIONAL

INFORMATION YOU NEED (WITH SPECIFICITY)

."

|

|

|

•

|

|

On January 13, 2022, Mr Klarquist sent the following email

communication to the Company: "

I would like to emphasize for the record that to the

extent any of the statements in [SVVC's corporate

secretary's] letter were made in bad faith (i.e.,

knowingly false or intentionally disingenuous), he is

in violation of SVVC's Code of Ethics, which states as

follows:

1. Fiduciary Duty: Employees, officers and

directors/trustees of an investment company and its

investment adviser owe a fiduciary duty to fund

shareholders. This means a duty of loyalty, fairness

and good faith toward the shareholders, and a

corresponding duty not to do anything prejudicial to or

in conflict with the interests of the shareholders.

This is a higher standard than that applicable to

ordinary arm's-length business transactions between

persons who do not owe a fiduciary duty to the other

parties.

Does SVVC take its Code of Ethics seriously, or is it

simply window-dressing? I would appreciate it if you

could please forward this email, as well as my

nomination letter & [SVVC's corporate secretary's]

response, to the Board of Directors so they can

determine for themselves whether the Code of Ethics

will be enforced at SVVC (or not). IN OTHER WORDS,

PLEASE CONSIDER THIS AN OFFICIAL COMMUNICATION TO THE

BOARD FROM A CONCERNED SHAREHOLDER. Thank you very much

."

|

|

|

•

|

|

Eleven days later, on January 24, 2022, Mr Klarquist

received a communication from SVVC's corporate secretary

claiming that "

the Company and management are aware of, and take

seriously, their duties and responsibilities to the

Company and its stockholders

" and reiterated the Company's contention that Mr Klarquist

"

failed to provide all of the information required by

the advance notice provisions

" including "

your involvement in various legal proceedings during

the past ten years as required by Regulation 14A of the

Securities Exchange Act of 1934, as amended

."

|

|

|

•

|

|

On January 24, 2022, Mr Klarquist responded to the

Company's communication (from earlier that day) that he had

nothing to disclose regarding "various legal proceedings

during the past ten years" under Regulation 14A and again

asked the Company to inform him, with specificity, what

information was missing from his original nomination

letter.

|

4

|

|

•

|

|

In late January 2022, Mr Klarquist purchased additional

shares of SVVC on the open market.

|

|

|

•

|

|

On February 2, 2022, SVVC's corporate secretary sent Mr

Klarquist a letter claiming that Mr Klarquist asserted that

it was "

incumbent upon [the Company] to guide [Mr Klarquist]

through the director nomination process by 'cit[ing]

chapter & verse' the information required by the

Company's publicly-available advance notice bylaw

provisions

" and, furthermore, that "

[SVVC] consider[s] this matter closed and will not

continue to engage on this particular topic

".

|

|

|

•

|

|

On February 24, 2022, Mr Klarquist notified the Company by

email of a Reuters article, dated February 19, 2022,

entitled "U.S. judge rules for Saba Capital in closed-end

fund voting litigation" and advised the Company in the

email as follows: "

A judge has ruled that a bylaw change of the type SVVC

enacted in August 2020 (and which SVVC [deliberately?]

hid from shareholders in its 2020 10-K filing) is

ILLEGAL and a VIOLATION OF THE INVESTMENT COMPANY ACT

OF 1940. Given the company's purported desire to

operate strictly in accordance with statutes &

regulations, I'm sure you and [SVVC's corporate

secretary] will now want to advise the company's

leadership to reverse this illegal bylaw (which

exempted Landis and his "associates" - but nobody

else(!) - from the Maryland Control Statute). Illegal

bylaws, of course, need to be overturned ASAP (duh). I

believe that the failure to do so could expose SVVC to

potential legal liability, which I would not want as a

shareholder

."

|

|

|

•

|

|

On March 1, 2022, the Company acknowledged receipt of Mr

Klarquist's February 24th email.

|

|

|

•

|

|

On March 5, 2022, Mr Klarquist emailed the Company

requesting the date of the 2022 annual meeting. Two days

later, on March 7, 2022, the Company replied that the

details regarding the 2022 annual meeting "

will be included in the proxy statement when it goes

out

".

|

|

|

•

|

|

On March 9, 2022, Mr Klarquist notified the Company that "

I plan on soliciting proxies from certain SVVC

shareholders in favor of (1) my director candidacy and

(2) any proposal in the proxy which advocates or

mandates the termination of FCM's external management

agreement with SVVC (i.e., a proposal similar to that

contained in the proxies for the prior two years).

Thus, the 2022 election will qualify as a "contested

election" under SVVC's bylaws

." To date, Mr Klarquist has received no response from the

Company regarding this communication.

|

|

|

•

|

|

On March 11, 2022, Mr Klarquist filed a Form DFAN14A with

the SEC containing an open letter to SVVC's shareholders

(which he amended on March 15, 2022).

|

|

|

•

|

|

On March 28, 2022, Mr Klarquist purchased additional shares

of SVVC on the open market and filed his preliminary proxy

statement with the SEC.

|

7

REASONS FOR THE SOLICITATION

Mr Klarquist has significant concerns regarding the Company's poor

corporate governance, chronic underperformance and the resulting

unprecedented trading price discount to its net asset value ("NAV") of

76%(!) [calculated as follows: $3.44 closing market price as of March 25,

2022 versus $14.50/share NAV as of January 31, 2022, as disclosed by the

Company in it press release of February 18, 2022]. Since the Company's

initial listing of shares on NASDAQ in April 2011, I believe that our Board

has overseen poor operational and financial performance and failed to take

meaningful actions to change the status quo despite clear evidence of

shareholder discontent therewith, as evidenced by the annual meeting vote

results for 2020 and 2021.

I believe immediate boardroom change is needed to help ensure objective and

independent oversight of the Company's operations, strategy and governance.

I have nominated myself as an independent candidate for election to the

Board at the Company's upcoming Annual Meeting.

Unfortunately, despite my efforts to engage constructively with the

Board, my director nomination has been unilaterally rebuffed by SVVC

without adequate explanation (although I was informed that "information

was missing" from my nomination notice, the Company has refused to

identify with specificity what exactly is missing and now claims the

matter is permanently "closed").

Moreover, against standard public-company practice, SVVC did not sent me a

Director questionnaire to fill out (despite my affirmative request for such

a questionnaire in my nomination letter), nor did any member of the Board's

Nominating Committee contact or attempt to interview me. I believe that I

possesses significant and relevant expertise regarding proper corporate

governance practices and the alignment of incentives of insiders with those

of Company shareholders (as evidenced by the two investor presentations

regarding the Company that I filed with the SEC on EDGAR in January 2022,

as well as the various investment writeups on my website,

www.sevencornerscapital.com). These skills appear to be sorely lacking at

our Company. If elected, I will not only push the Board to explore all

paths to maximizing stockholder value and addressing the Company's steep

trading price discount relative to its NAV, but also try to restore SVVC's

credibility with market participants, demand accountability from its

executives, and ensure an overall results-driven culture.

The Board Has Overseen Negative Returns and Significant Relative

Underperformance Since Listing

At the time the Company initially listed its shares as a closed-end fund in

April 2011, it reported that its NAV was $27 per share (see Company press

release, dated April 18, 2011). Since listing, the trading price of the

Company's stock has plummeted, subjecting its investors to significant

stock price depreciation and losses while FCM, an affiliate of the

Company's Chairman and CEO, Kevin Landis, extracts exorbitant management

fees. The last closing trading price of the Company's stock (on March 25,

2022) was $3.44 per share, representing an 76% trading price discount

relative to its last reported NAV of $14.50 as of January 31, 2022 (as set

forth in the Company's press release dated February 18, 2022).

Additionally, since its April 2011 listing,

the Company's stock price has massively underperformed the broader

market

(conveniently, the company cannot apparently identify a proper "peer" group

for itself).

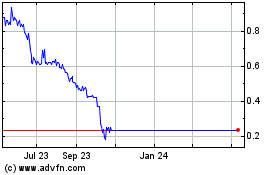

[SEE PDF COPY FOR STOCK PRICE CHART]

Source: SVVC 2021 Form 10-K, page 25.

Additionally, according to its fiscal year 2021 financial results, the

Company posted

net realized and unrealized losses on investments of $10.5 million (and

over $100 million of such losses over the past three fiscal years!)

, despite the stock market increasing in value during the relevant periods.

To date, the Board has failed to communicate any credible plan to address

the Company's stock price, balance sheet erosion and financial challenges.

8

The Incumbent Board Has Fostered Exceedingly Poor Corporate

Governance and Severely Limited Stockholders' Rights

I believe the Company's poor corporate governance demonstrates that the

Board is more focused on entrenching itself than unlocking value for

stockholders. I believe stockholders should be concerned about the various

conflicts of interests plaguing our Board, including:

|

|

•

|

|

Directors' Prior Ties to Company Chairman and CEO and

FCM CIO Kevin Landis

-All of the members of the Board, including Nicholas

Petredis (the incumbent director up for reelection at the

2022 Annual Meeting) appear conflicted due to prior ties to

Kevin Landis, SVVC's Chairman and CEO and FCM's CIO, and

his "Firsthand Funds" fund complex. For example, Mr

Petredis was the Chief Compliance Officer for Firsthand

Funds from 2008 to 2013 and Chief Compliance Officer of the

Company from 2010 to 2013. Another Company Director, Greg

Burglin, has also served as Trustee to Firsthand Funds, a

Delaware statutory trust, since November 2008. Meanwhile,

Company Directors Yee and Lee have served on the boards of

other Firsthand funds. [Source: SVVC 2021 Proxy Statement;

press release of Ralweigh Ralls dated May 20, 2021]

|

|

|

•

|

|

So-Called "Independent Directors" Lack Alignment with

SVVC Shareholders

-None of the four Company "independent directors" (other

than Director Burglin, who purchased 2,250 shares in late

2020) have purchased SVVC stock on the open market during

the past 5 years, despite it trading near all-time lows for

much of that period. Moreover, despite being members of our

board for multiple years each, on a combined basis these

four directors own less than 3,000 shares of SVVC stock, or

just 0.00041% of the outstanding stock [Source: SVVC 2021

Proxy Statement]:

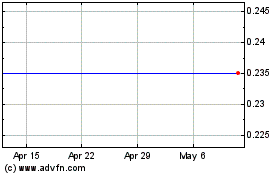

[SEE PDF COPY FOR CHART OF SHARES HELD BY "INDEPENDENT"

DIRECTORS]

|

|

|

•

|

|

Non-Independent Chairman

-Kevin Landis is both Chairman and Chief Executive Officer

of SVVC, a practice that Institutional Shareholder

Services, Glass Lewis and other independent proxy advisory

firms strongly disfavor.Mr. Landis is also CIO of the Company's

external investment advisor and manager, Firsthand

Capital Management

. Mr. Landis's various roles denies the Company independent

leadership that is not beholden to FCM. [Source: Company

filings, LinkedIn]

|

|

|

•

|

|

Restrictive Bylaw Amendments

-In recent years, our Board has made amendments to our

Company's bylaws which are materially restrictive and

anti-shareholder friendly, exhibiting worst-in-class

corporate governance practices.

For example, in October 2019, our Board added language

to the bylaws carving out an exception to the normal

plurality voting standard for Director elections,

stating that in contested elections a candidate must

receive a majority of all outstanding shares (not

merely of shares actually voted) to be elected (in

effect, the reverse of good corporate governance).

Given the number of outstanding shares not voted (including

"broker non-votes") for directors at recent annual meetings

for our Company, it seems unlikely that any candidate in a

contested election will surpass the required "majority of

outstanding shares" vote threshold, which would cause a

"failed election" (as a result of which the incumbent

director remains in office,

even if he or she receives less votes than the

challenger

). This situation is even worse given that, unlike most

public companies, SVVC apparently does not have a mandatory

director resignation policy in effect for directors who do

not receive more "FOR" votes than "WITHHOLD" votes. Also, in August 2020,

SVVC's board amended the Company's bylaws to

specifically exempt Kevin Landis and "any associates

thereof" from the Maryland Control Share Acquisition

Act

, which is significant given that Mr Landis is already up

against the 10% ownership threshold cited in the Act. A

federal judge recently ruled that this type of bylaw

amendment is violative of the 1940 Investment Company Act's

requirement that all shares of closed-end funds have equal

voting rights [Source: Company filings; Reuters article

from February 19, 2022, entitled "U.S. judge rules for Saba

Capital in closed-end fund voting litigation"]

|

9

|

|

•

|

|

Conflict-Ridden External Investment Management

Agreement

-We question how a fully engaged and truly independent

Board could allow the Company to enter into a generous

advisory deal in favor of FCM, an affiliate of Kevin

Landis, which automatically renews for

successive one-year terms (subject to board, rather

than shareholder, approval) and entitles the advisor to

an annual base management fee equal to 2% of SVVC's

gross (not net) assets REGARDLESS OF INVESTMENT

PERFORMANCE and REGARDLESS OF THE PERFORMANCE OF SVVC'S

STOCK AGAINST ANY BENCHMARK INDEX (SUCH AS THE S&P

500)

. Notwithstanding the huge discount to NAV and the

significant operating losses to date, over the past three

years the Board allowed the Company to pay approximately

$11 million in management fees and other fee

reimbursements to FCM and other third-party service

providers

. [Source: SVVC 2021 10-K filing] I believe the Board has

clearly prioritized the interests of FCM and its affiliates

over creating value for stockholders by wasting the

Company's money on egregious advisory agreements and

operating expenses with affiliates of certain Board members

while investors have been forced to endure negative

returns. In addition, the FCM Investment Management

Agreement's Incentive Fee applies only to net realized gains, thereby

providing FCM with an incentive to "water the weeds and cut

the flowers" in managing SVVC's assets. [Source: Nominee's

Investor Presentation, dated January 19, 2022, filed on

EDGAR]

|

|

|

•

|

|

Flawed and/or Irrelevant Rationale for Retaining

Conflict-Ridden FCM External Management Agreement

-In last year's proxy statement, the Company claimed that

"FCM believes the Company has one or more portfolio

companies among our top holdings that may be ideal targets

for SPAC transactions. If the Company were to pursue such

opportunities in 2021 and beyond, the SPAC expertise of FCM

would be extremely important." Yet, since then no SPAC

transaction involving any of the Company's portfolio

holdings has been entered into or has even (as far as I am

aware) been publicly mooted. Moreover, SPACs have fallen

out of favor among investors, so it seems as though SVVC's

management team completely missed out on the

previously-raging SPAC bull market despite their claimed

SPAC expertise. Shareholders should ask themselves whether

FCM ever has demonstrated any ability to

consistently compound shareholder capital, as opposed to

generating egregiously large fees for conflicted insiders.

|

|

|

•

|

|

Classified Board

-The Company has a classified or "staggered" Board, meaning

each director is only up for election every three years as

opposed to every year. This protects incumbent directors

from annual scrutiny and makes it more difficult for

stockholders to enact change.

|

A New, Independent Director is Key to Addressing Our Company's

Perpetual Underperformance

It has become clear to me that true stockholder representation is

desperately needed in the boardroom to instill accountability, help reverse

the Company's prolonged underperformance and ensure the interests of

stockholders always remain paramount. I believe stockholders have a unique

opportunity at the 2022 Annual Meeting to address the issues created by the

Company's insular Board.

10

In order to turn the tide, I have nominated myself as a Director candidate

for our Company's board at the 2022 Annual Meeting of shareholders. I

believe that, with direct access to (and influence on) SVVC's board-level

investment management and other decision-making processes, I can be an

agent for meaningful change and help unlock the significant value trapped

within the Company's underperforming stock. The Nominee's resume appears on

page 12 below under "PROPOSAL NO. 1: ELECTION OF DIRECTOR-THE NOMINEE" .

11

PROPOSAL NO. 1

ELECTION OF DIRECTOR

The Company currently has a classified Board, which is divided into three

classes. The directors in each class are elected for terms of three years

so that the term of office of one class of directors expires at each annual

meeting of stockholders. The term of the sole Class II director expires at

the Annual Meeting. I am seeking your support at the Annual Meeting to

elect me as a Class II director, in opposition to the Company's director

nominee for a three-year term ending in 2025. Your vote to elect me will

have the legal effect of replacing an incumbent director of the Company. If

elected, I will represent just 20% of the Board (the Company currently has

5 directors in total), and therefore it is not guaranteed that I will be

able to implement any actions that I may believe are necessary to enhance

stockholder value. You should refer to the Company's proxy statement for

the name, background, qualifications, and other information concerning the

Company's nominee.

THE NOMINEE

The following information sets forth the age, business address, present

principal occupation, and employment and material occupations, positions,

offices and employments for the past five years of the Nominee. Mr

Klarquist maintains that he made the nomination in a timely manner and in

compliance with the applicable provisions of the Company's governing

instruments. The specific experience, qualifications, attributes and skills

that led me to conclude that I should serve as a director of the Company

are set forth above in the section entitled "Reasons for the Solicitation"

beginning on Page 8 and below. The Nominee is a citizen of the United

States.

SCOTT KLARQUIST

EDUCATION

B.A., English, University of Virginia, 1991-1995

J.D., University of Virginia School of Law, 1998-2001

WORK EXPERIENCE

Legal Assistant, Baach Robinson & Lewis LLP, Washington DC, 1996-1998

Corporate Attorney, Thacher Proffitt & Wood LLP, New York NY, 2001-2008

Corporate Attorney, SNR Denton LLP (and predecessor firms), New York NY,

2008-2013

Private Investor, New York NY, 2013-present

Chief Investment Officer, Seven Corners Capital Management, LLC, New York

NY, 2016-present

INVESTMENT WRITEUPS

Available on Seven Corners Capital website (www.sevencornerscapital.com),

See Blog & Activist Tabs

GENERAL

I am well versed in (1) (A) corporate governance best practices and (B)

optimal senior executive compensation schemes, both of which SVVC is

woefully bad at implementing (in my estimation) and (2) identifying and,

more importantly, proposing actionable mechanisms for correcting the

misalignment in financial incentives between Company insiders and outside

shareholders. I believe that my experience, background and financial

expertise, including 15 years of investing in the public capital markets

(the past 8.5 years full-time), will allow me to bring valuable expertise

to the Board. My principal business address is [85 Broad Street, 18th

Floor], New York, New York 10005.

12

The Nominee may be deemed to beneficially own 3,000 shares of Common Stock

of the Company. I believe that I am, and if elected as a director of the

Company, would be, an "independent director" within the meaning of (i)

applicable NASDAQ listing standards applicable to board composition and

(ii) Section 301 of the Sarbanes-Oxley Act of 2002. Notwithstanding the

foregoing, Mr Klarquist acknowledges that no director of a NASDAQ listed

company qualifies as "independent" under the NASDAQ listing standards

unless the board of directors affirmatively determines that such director

is independent under such standards. Accordingly, Mr Klarquist acknowledges

that if the Nominee is elected, the determination of the Nominee's

independence under the NASDAQ listing standards ultimately rests with the

judgment and discretion of the Board. If I am elected as a director of the

Company, I believe I would be independent under the applicable independence

standards of the Company's audit committee, compensation committee and

nominating and corporate governance committee.

Other than as stated herein, there are no arrangements or understandings

between Mr Klarquist and any other person or persons pursuant to which the

nomination of the Nominee as described herein is to be made, other than the

consent by the Nominee to be named in this Proxy Statement and to serve as

a director of the Company if elected as such at the Annual Meeting. The

Nominee is not an adverse party to the Company or any of its subsidiaries

and does not have a material interest adverse to the Company or any of its

subsidiaries in any material pending legal proceedings.

The Nominee should be able to stand for election, but in the event I am

unable to serve or, for good cause, will not serve as a member of the

Board, the shares of Common Stock represented by the enclosed WHITE proxy

card will be voted for a substitute nominee determined by me. In addition,

I reserve the right to nominate a substitute person if the Company makes or

announces any changes to the Bylaws or takes or announces any other action

that has, or if consummated would have, the effect of disqualifying the

Nominee. In any such case, shares of Common Stock represented by the

enclosed WHITE proxy card will be voted for such substitute nominee. I

reserve the right to nominate additional person(s) if the Company increases

the size of the Board above its existing size or increases the number of

directors whose terms expire at the Annual Meeting. Additional nominations

made pursuant to the preceding sentence are without prejudice to the

position of Mr Klarquist that any attempt to increase the size of the

current Board or to reconstitute or reconfigure the classes on which the

current directors serve, constitutes a manipulation of the Company's

corporate governance.

I URGE YOU TO VOTE FOR MY ELECTION ON THE ENCLOSED WHITE PROXY CARD.

13

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

As discussed in further detail in the Company's proxy statement, the

Company has proposed that stockholders ratify the Audit Committee's

appointment of Tait, Weller & Baker LLP as the Company's independent

registered public accounting firm for the fiscal year ending December 31,

2022. Additional information regarding this proposal is contained in the

Company's proxy statement.

I MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO

VOTE MY SHARES "FOR" THIS PROPOSAL.

PROPOSAL NO. [3]

[BINDING PROPOSAL TO TERMINATE THE EXTERNAL INVESTMENT ADVISORY AND

MANAGEMENT AGREEMENT BETWEEN THE COMPANY AND FIRSTHAND CAPITAL

MANAGEMENT, LLC]

As discussed in further detail in the Company's proxy statement, a Company

stockholder, [Donald Chambers], submitted the following proposal for

inclusion in the Company's proxy materials:

[RESOLVED: All investment advisory and management agreements between The

Firsthand Technology Value Fund, Inc. and Firsthand Capital Management,

Inc. shall be terminated.]

Additional information regarding this proposal is contained in the

Company's proxy statement.

I URGE YOU TO VOTE FOR "FOR" PROPOSAL NO. [3] ON THE ENCLOSED WHITE

PROXY CARD AND INTEND TO VOTE MY SHARES "FOR" THIS PROPOSAL.

14

VOTING AND PROXY PROCEDURES

According to the Company's proxy statement, only stockholders of record as

of the close of business on the Record Date will be entitled to notice of

and to vote at the Annual Meeting. Stockholders who sell their shares of

Common Stock before the Record Date (or acquire them without voting rights

after the Record Date) may not vote such shares of Common Stock.

Stockholders of record on the Record Date will retain their voting rights

in connection with the Annual Meeting even if they sell such shares of

Common Stock after the Record Date.

Shares of Common Stock represented by properly executed WHITE proxy cards

will be voted at the Annual Meeting as marked and, in the absence of

specific instructions, will be voted FOR the election of

the Nominee, FOR the ratification of the appointment of

Tait, Weller & Baker LLP as the Company's independent registered public

accounting firm, FOR the [termination of the Company's

external investment management agreement with FCM], and in the discretion

of the persons named as proxies on all other matters as may properly come

before the Annual Meeting, as described herein.

According to the Company's proxy statement for the Annual Meeting, the

current Board intends to nominate one candidate for election at the Annual

Meeting. This Proxy Statement is soliciting proxies to elect only the

Nominee. Accordingly, the enclosed WHITE proxy card may only be voted for

the Nominee and does not confer voting power with respect to the Company's

nominee. The participants in this solicitation intend to vote the Nominee's

Shares in favor of the Nominee. Stockholders should refer to the Company's

proxy statement for the name, background, qualification and other

information concerning the Company's nominee.

[Virtual Meeting]

9

As discussed in the Company's proxy statement, the Company has implemented

a virtual format for the Annual Meeting, which will be conducted via live

webcast and online stockholder tools. You will not be able to attend the

Annual Meeting in person. As discussed above, you are entitled to

participate in the Annual Meeting only if you were a stockholder of record

as of the close of business on the Record Date or hold a legal proxy for

the meeting provided by your broker, bank or other nominee.

According to the Company's proxy statement, in order to attend the Annual

Meeting virtually, you must pre-register by visiting [ ] and follow the

instructions to complete your registration request by [ ] [ ].m. Eastern

Time on [ ], 2022.

According to the Company's proxy statement, stockholders of record and/or

their designated representatives will need the control number included on

the Company's Notice of Annual Meeting, proxy card or voting instruction

form and should follow the instructions thereon to complete their

registration request.

According to the Company's proxy statement, if you are the beneficial owner

of shares (that is, your shares are held in "street name" through a bank,

broker, or other nominee) as of the Record Date, you have the right to

direct your broker, bank or other nominee as to how to vote your shares.

According to the Company's proxy statement, beneficial owners are also

invited to attend the Annual Meeting; however, since a beneficial owner is

not the stockholder of record, you may not vote your shares live at the

Annual Meeting unless you follow your broker, bank or other nominee's

procedures for obtaining a legal proxy. If you request a printed copy of

the proxy materials by mail, your broker, bank or other nominee will

provide a voting instruction form for you to use.

Although the live webcast will begin at [ ] [ ].m. Eastern Time on [ ],

2022, you are encouraged to access the meeting site prior to the start time

to allow ample time to log into the meeting webcast and test your computer

system. According to the Company's proxy statement, the Annual Meeting site

will first be accessible to registered stockholders beginning at [ ] [ ].m.

Eastern Time on the day of the Annual Meeting.

|

9

|

Details of the Company's Annual Meeting to be updated after

the Company files its proxy statement with the SEC.

|

15

Whether or not you plan to attend the Annual Meeting, please sign, date and

return the enclosed WHITE proxy card in the postage-paid envelope provided,

or vote via the Internet or by telephone as instructed on the WHITE proxy

card. Additional information and proxy materials can also be found at

[www.sevencornerscapital.com under the "Activism" tab]. If you have any

difficulty following the registration process, please email

info@sevencornerscapital.com.

Quorum; Broker Non-Votes; Discretionary Voting

A quorum is the minimum number of shares of Common Stock that must be

represented at a duly called meeting in person or by proxy in order to

legally conduct business at the meeting under the Company's Bylaws and

Maryland law. A majority of the shares of Common Stock outstanding on the

Record Date present at the Annual Meeting, either in person via webcast or

by proxy, is required for a quorum at the Annual Meeting.

Abstentions and "broker non-votes" are counted as shares present and

entitled to vote for purposes of determining a quorum.

However, if you hold your shares in street name and do not provide voting

instructions to your broker, your shares will not be voted on any proposal

on which your broker does not have discretionary authority to vote (a

"broker non-vote"). Under applicable rules, your broker will only have

discretionary authority to vote your shares at the Annual Meeting as to the

ratification of the appointment of Tait, Weller & Baker LLP as the

Company's independent registered accounting firm for the year ending

December 31, 2022. Your broker will not be able to vote your shares with

respect to the Nominee (Proposal 1) or the [termination of the FCM

investment management agreement (Proposal [3])].

If you are a stockholder of record, you must deliver your vote by mail, the

Internet, by telephone or attend the Annual Meeting to be counted in the

determination of a quorum.

If you are a beneficial owner, your broker will vote your shares pursuant

to your instructions from your broker, and those shares will count in the

determination of a quorum. If you are a beneficial holder and do not return

a voting instruction form, your broker, bank or nominee may only vote on

the ratification of the appointment of Tait, Weller & Baker LLP as the

Company's independent registered accounting firm for the year ending

December 31, 2022.

Votes Required For Approval

Election of Director

-According to the Company's proxy statement, [in a "contested election" the

Company's bylaws requires that a director candidate receive the affirmative

vote of a majority of SVVC's outstanding shares at a meeting at which a

quorum is present, in person via webcast or by proxy, in order to be

elected; failure to achieve this result by any candidate will result in a

"failed election", in which case the incumbent Director will remain in

office]. Each share may be voted for as many individuals as there are

directors to be elected and for whose election the share is entitled to be

voted. Abstentions and broker non-votes, if any, will not be counted as

votes cast and will have no effect on the result of the vote, although they

will be considered present for the purpose of determining the presence of a

quorum.

Ratification of the

Appointment of Independent Registered Public Accounting Firm

-According to the Company's proxy statement, the proposal to ratify the

appointment of Tait, Weller & Baker LLP to serve as the Company's

independent registered public accounting firm for the fiscal year ending

December 31, 2022, requires the affirmative vote of a majority of all of

the votes cast at a meeting at which a quorum is present. Abstentions and

broker non-votes, if any, will not be counted as votes cast and will have

no effect on the result of the vote, although they will be considered

present for the purpose of determining the presence of a quorum.

[Termination of the Company's Investment Management Agreement with FCM

-According to the Company's proxy statement, the stockholder proposal to

terminate the investment advisory and management agreement between the

Company and FCM requires the approval of the affirmative vote of the

"majority of the outstanding voting securities" of the Company. Under the

1940 Act, a "majority of the outstanding voting securities" is defined as

the lesser of: (1) 67% or more of the voting securities of the Company

present at the Annual Meeting, if the holders of more than 50% of the

outstanding voting securities of the Company are present or represented by

proxy; or (2) more than 50% of the outstanding voting securities of the

Company.]

Under applicable Maryland law, none of the holders of Common Stock are

entitled to appraisal rights in connection with any matter to be acted on

at the Annual Meeting. If you sign and submit your WHITE proxy card without

specifying how you would like your shares voted, your shares will be voted

in accordance with Mr Klarquist's recommendations specified herein and in

accordance with the discretion of the persons named on the WHITE proxy card

with respect to any other matters that may be voted upon at the Annual

Meeting.

16

How Proxies Will Be Voted

If you complete and return a WHITE proxy card to me, and unless you direct

otherwise, your shares will be voted FOR Proposals 1, 2 and 3. In addition,

if you complete and return a WHITE proxy card to me, and unless you direct

otherwise, I may determine not to attend the Annual Meeting if I believe

that either or both of Proposal 1 (regarding my election to the Board) and

Proposal 3 (regarding termination of the FCM Management Agreement) is less

likely to be defeated if your shares are not represented at the Meeting (by

making it more difficult for more than 50% of the outstanding shares to be

present in person or by proxy, i.e., to achieve the required quorum for the

meeting) than if they are represented at the meeting.

Revocation of Proxies

Stockholders of the Company may revoke their proxies at any time prior to

the Annual Meeting by notifying the Company's Secretary in writing,

attending the Annual Meeting and voting in person via webcast, returning

another proxy card dated after such stockholder's first or prior proxy

card, if the Company receives it before the Annual Meeting, or authorizing

a new proxy via the Internet or by telephone to vote such stockholder's

shares of Common Stock. The revocation may be delivered either to Mr

Klarquist at the address set forth on the back cover of this Proxy

Statement or to the Company at 150 Almaden Boulevard, Suite 1250, San Jose,

CA 95113 or any other address provided by the Company. Although a

revocation is effective if delivered to the Company, we request that either

the original or copies of all revocations be mailed to Mr Klarquist at the

address set forth on the back cover of this Proxy Statement so that he will

be aware of all revocations and can more accurately determine if and when

proxies have been received from the holders. Additionally, Mr Klarquist may

use this information to contact stockholders who have revoked their proxies

to solicit later dated proxies for his election.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEE TO THE BOARD,

PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED

WHITE

PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

17

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made

by Mr Klarquist. Proxies may be solicited by mail, facsimile, telephone,

Internet, in person and by advertisements.

Mr Klarquist will solicit proxies from individuals, brokers, banks, bank

nominees and other holders. Mr Klarquist has requested banks, brokerage

houses and other custodians, nominees and fiduciaries to forward all

solicitation materials to the beneficial owners of the shares they hold of

record. Mr Klarquist will reimburse these record holders for their

reasonable out-of-pocket expenses in so doing.

The entire expense of soliciting proxies is being borne by Mr Klarquist.

Costs of this solicitation of proxies are currently estimated to be

approximately (A) in cash, up to $10,000 (including, but not limited to,

costs incidental to the solicitation) and (B) in kind, up to [$150,000 in

value of legal & other solicitation services being performed by Mr

Klarquist in his individual capacity, as opposed to being performed by

third-party service providers such as law firms and proxy solicitors (as is

typical in proxy contests)]. Mr Klarquist estimates that through the date

hereof its expenses in furtherance of, or in connection with, (i) in cash,

negligible and (ii) in kind, [$30,000]. The actual amount could be higher

or lower depending on the facts and circumstances arising in connection

with any solicitation. Mr Klarquist may seek reimbursement from the Company

of some or all expenses he incurs in connection with this solicitation, but

does not intend to submit the question of such reimbursement to a vote of

security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

[Not applicable]

18

The shares of Common Stock owned directly by Mr Klarquist were purchased

with working capital (which may, at any given time, include margin loans

made by brokerage firms in the ordinary course of business).

Except as set forth in this Proxy Statement (including the Schedules

hereto), (i) during the past 10 years, no participant in this solicitation

has been convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors); (ii) no participant in this solicitation directly

or indirectly beneficially owns any securities of the Company; (iii) no

participant in this solicitation owns any securities of the Company which

are owned of record but not beneficially; (iv) no participant in this

solicitation has purchased or sold any securities of the Company during the

past two years; (v) no part of the purchase price or market value of the

securities of the Company owned by any participant in this solicitation is

represented by funds borrowed or otherwise obtained for the purpose of

acquiring or holding such securities; (vi) no participant in this

solicitation is, or within the past year was, a party to any contract,

arrangements or understandings with any person with respect to any

securities of the Company, including, but not limited to, joint ventures,

loan or option arrangements, puts or calls, guarantees against loss or

guarantees of profit, division of losses or profits, or the giving or

withholding of proxies; (vii) no associate of any participant in this

solicitation owns beneficially, directly or indirectly, any securities of

the Company; (viii) no participant in this solicitation owns beneficially,

directly or indirectly, any securities of any parent or subsidiary of the

Company; (ix) no participant in this solicitation or any of his or its

associates was a party to any transaction, or series of similar

transactions, since the beginning of the Company's last fiscal year, or is

a party to any currently proposed transaction, or series of similar

transactions, to which the Company or any of its subsidiaries was or is to

be a party, in which the amount involved exceeds $120,000; (x) no

participant in this solicitation or any of his or its associates has any

arrangement or understanding with any person with respect to any future

employment by the Company or its affiliates, or with respect to any future

transactions to which the Company or any of its affiliates will or may be a

party; and (xi) no participant in this solicitation has a substantial

interest, direct or indirect, by securities holdings or otherwise, in any

matter to be acted on at the Annual Meeting.

There are no material proceedings to which any participant in this

solicitation or any of his or her or its associates is a party adverse to

the Company or any of its subsidiaries or has a material interest adverse

to the Company or any of its subsidiaries. With respect to the Nominee,

none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of

the Exchange Act occurred during the past 10 years.

OTHER MATTERS AND ADDITIONAL INFORMATION

Mr Klarquist is unaware of any other matters to be considered at the Annual

Meeting. However, should other matters, which Mr Klarquist is not aware of

a reasonable time before this solicitation, be brought before the Annual

Meeting, the persons named as proxies on the enclosed WHITE proxy card will

vote on such matters in their discretion.

STOCKHOLDER PROPOSALS

According to the Company's proxy statement for the Annual Meeting,

stockholders may present proper proposals for inclusion in the Company's

proxy statement and for consideration at the 2023 Annual Meeting of

Stockholders (the "2023 Annual Meeting") by submitting their proposals in

writing to the Company's Secretary in a timely manner. For a stockholder

proposal to be considered for inclusion in the Company's proxy statement

for the 2023 Annual Meeting, the Company's Secretary must receive the

written proposal at the Company's principal executive offices not later

than [ ], 2022. In addition, stockholder proposals must comply with the

requirements of Rule 14a-8 under the Exchange Act regarding the inclusion

of stockholder proposals in company-sponsored proxy material.

19

According to the Company's proxy statement, the Bylaws also establish an

advance notice procedure for stockholders who wish to present a proposal

before an annual meeting of stockholders but do not intend for the proposal

to be included in the Company's proxy statement. To be timely for the 2023

Annual Meeting, the Company's Secretary must receive the written notice at

its principal executive offices not earlier than [ ], 2022 and not later

than [ ] p.m. Eastern Time on [ ], 2022.

The information set forth above regarding the procedures for submitting

stockholder proposals for consideration at the 2023 Annual Meeting is based

on information contained in the Company's proxy statement for the Annual

Meeting. The incorporation of this information in this Proxy Statement

should not be construed as an admission by Mr Klarquist that such

procedures are legal, valid or binding.

ADDITIONAL INFORMATION

Some banks, brokers and other nominee record holders may be participating

in the practice of "householding" proxy statements and annual reports. This

means that only one copy of this Proxy Statement may have been sent to

multiple stockholders in your household. Mr Klarquist will promptly deliver

a separate copy of the document to you if you contact him directly. If you

want to receive separate copies of these proxy materials in the future, or

if you are receiving multiple copies and would like to receive only one

copy for your household, you should contact your bank, broker or other

nominee record holder.

INCORPORATION BY REFERENCE

MR KLARQUIST HAS OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE

REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY'S

PROXY STATEMENT RELATING TO THE ANNUAL MEETING BASED ON RELIANCE ON RULE

14A-5(C). THIS DISCLOSURE IS EXPECTED TO INCLUDE, AMONG OTHER THINGS,

CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY'S DIRECTORS, INFORMATION

CONCERNING EXECUTIVE COMPENSATION, AND OTHER IMPORTANT INFORMATION. SEE

SCHEDULE I FOR INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN

5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND

MANAGEMENT OF THE COMPANY.

The information concerning the Company contained in this Proxy Statement

and the Schedules attached hereto has been taken from, or is based upon,

publicly available information.

Scott Klarquist

[ ], 2022

20

SCHEDULE I

The following table is reprinted from the Company's definitive

proxy statement filed with the Securities and Exchange Commission

on [ ], 2022.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

[To be added once the Company's proxy statement is filed.]

IMPORTANT

Tell your Board what you think! Your vote is important. No matter how many

shares of Common Stock you own, please give Mr Klarquist your proxy FOR the election of the Nominee and in accordance with Mr

Klarquist's recommendations on the other proposals on the agenda for the

Annual Meeting by taking three steps:

|

|

•

|

|

SIGNING the enclosed WHITE proxy card;

|

|

|

•

|

|

DATING the enclosed WHITE proxy card; and

|

|

|

•

|

|

MAILING the enclosed WHITE proxy card TODAY in the envelope

provided (no postage is required if mailed in the United

States).

|

You may vote your shares virtually at the Annual Meeting, however, even

if you plan to attend the Annual Meeting virtually, please submit your

WHITE proxy card by mail by the applicable deadline so that your vote

will still be counted if you later decide not to attend the Annual

Meeting. If any of your shares of Common Stock are held in the name of

a brokerage firm, bank, bank nominee or other institution, only it can

vote such shares of Common Stock and only upon receipt of your specific

instructions.

Depending upon your broker or custodian, you may be able to vote either by

toll-free telephone or by the Internet. Please refer to the voting form

provided by your broker or custodian for instructions on how to vote

electronically. You may also vote by signing, dating and returning the

enclosed WHITE proxy card.

If you have any questions, require assistance in voting your WHITE

proxy card, or need additional copies of Mr Klarquist's proxy

materials, please reach out to him using the contact information listed

below.

Scott Klarquist

[CONFIRM: 85 Broad Street, 18th Floor]

New York, NY 10005

(646) 592-0498

Email: info@sevencornerscapital.com

WHITE PROXY CARD

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH [__], 2022

FIRSTHAND TECHNOLOGY VALUE FUND, INC.

2022 ANNUAL MEETING OF STOCKHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF SCOTT KLARQUIST

THE BOARD OF DIRECTORS OF FIRSTHAND TECHNOLOGY VALUE FUND, INC.

IS NOT SOLICITING THIS PROXY

P R O X Y

The undersigned appoints Scott Klarquist as attorney and agent with full

power of substitution to vote all shares of Common Stock, par value $0.001

per share (the "Common Stock"), which the undersigned would be entitled to

vote if personally present at the 2022 Annual Meeting of Stockholders of

Firsthand Technology Value Fund, Inc., a Maryland corporation (the

"Company"), scheduled to be held [CONFIRM: virtually / in person at

[__________], on [ ], 2022, at [ ] [ ].m. (Pacific Time)] (including

any adjournments or postponements thereof and any meeting called in lieu

thereof, the "Annual Meeting").

The undersigned hereby revokes any other proxy or proxies heretofore given

to vote or act with respect to the shares of Common Stock of the Company

held by the undersigned, and hereby ratifies and confirms all action Scott

Klarquist may lawfully take by virtue hereof. If properly executed, this

Proxy will be voted as directed on the reverse and in the discretion of the

herein named attorneys and proxies or their substitutes with respect to any

other matters as may properly come before the Annual Meeting that are

unknown to Scott Klarquist a reasonable time before this solicitation.

IF NO DIRECTION IS INDICATED WITH RESPECT TO THE PROPOSALS ON THE

REVERSE, THIS PROXY WILL BE VOTED "FOR" PROPOSAL 1, "FOR" PROPOSAL 2

AND "FOR" PROPOSAL 3.

This Proxy will be valid until the completion of the Annual Meeting. This

Proxy will only be valid in connection with Mr Klarquist's solicitation of

proxies for the Annual Meeting.

IMPORTANT: PLEASE SIGN, DATE AND MAIL THIS PROXY CARD PROMPTLY!

CONTINUED AND TO BE SIGNED ON REVERSE SIDE

WHITE PROXY CARD

☒

Please mark vote as in this example

MR KLARQUIST STRONGLY RECOMMENDS THAT STOCKHOLDERS VOTE IN FAVOR OF (A)

THE NOMINEE LISTED BELOW IN PROPOSAL 1 AND (B) BINDING STOCKHOLDER

PROPOSAL 3.

MR KLARQUIST MAKES NO RECOMMENDATION WITH RESPECT TO PROPOSAL 2.

|

1.

|

Proposal to elect Scott Klarquist as a Class II director of

the Company.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR THE NOMINEE

|

|

WITHHOLD AUTHORITY TO

VOTE FOR THE NOMINEE

|

|

Nominee:

|

|

Scott Klarquist

|

|

[ ]

|

|

[ ]

|

Scott Klarquist (the "Nominee") should be able to stand for election, but,

in the event he is unable to serve or for good cause will not serve, the

shares of Common Stock represented by this proxy card will be voted for any

substitute nominee, to the extent this is not prohibited under the

Company's organizational documents and applicable law. In addition, Mr

Klarquist has reserved the right to nominate a substitute person if the

Company makes or announces any changes to its organizational documents or

takes or announces any other action that has, or if consummated would have,

the effect of disqualifying the Nominee, to the extent this is not

prohibited under the Company's organizational documents and applicable law.

In any such case, shares of Common Stock represented by this proxy card

will be voted for such substitute nominee.

MR KLARQUIST INTENDS TO USE THIS PROXY TO VOTE "FOR THE NOMINEE".

THERE IS NO ASSURANCE THAT THE CANDIDATE WHO HAS BEEN NOMINATED BY THE

COMPANY WILL SERVE AS A DIRECTOR IF THE ABOVE NOMINEE IS DULY ELECTED.

2. The Company's proposal to ratify the appointment of Tait, Weller &

Baker LLP as the Company's independent registered public accounting firm

for the fiscal year ending December 31, 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

FOR

|

|

☐

|

|

AGAINST

|

|

☐

|

|

ABSTAIN

|

3. A [binding stockholder proposal to terminate the investment advisory and

management agreements between Firsthand Technology Value Fund, Inc. and

Firsthand Capital Management, Inc.]

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

FOR

|

|

☐

|

|

AGAINST

|

|

☐

|

|

ABSTAIN

|

|

|

|

DATED:

|

|

|

|

|

|

(Signature)

|

|

|

|

|

|

(Signature, if held jointly)

|

|

|

|

|

|

(Title)

|

WHEN SHARES ARE HELD JOINTLY, JOINT OWNERS SHOULD EACH SIGN. EXECUTORS,

ADMINISTRATORS, TRUSTEES, ETC., SHOULD INDICATE THE CAPACITY IN WHICH

SIGNING. PLEASE SIGN EXACTLY AS NAME APPEARS ON THIS PROXY.

This regulatory filing also includes additional resources: