Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

February 13 2025 - 5:00PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-266487

Dated February 13, 2025

Exelon Corporation

Pricing Term Sheet

$1,000,000,000 6.500% Fixed-to-Fixed Reset

Rate Junior Subordinated Notes Due 2055

| Issuer: |

Exelon

Corporation |

| Expected Ratings*: |

Baa3 (Moody’s);

BBB (S&P) |

| |

|

| Principal Amount: |

$1,000,000,000 |

| |

|

| Security Type: |

Fixed-to-Fixed Reset Rate Junior

Subordinated Notes (the “Notes”) |

| |

|

| Trade Date: |

February 13, 2025 |

| |

|

| Settlement Date**: |

February 19, 2025 (T+3) |

| |

|

| Interest Rate: |

The Notes will bear interest (i) from and including February 19, 2025 to, but excluding, March 15, 2035 (the “First

Reset Date”) at the rate of 6.500% per annum and (ii) from and including the First Reset Date, during each Reset Period (as

defined in the Preliminary Prospectus Supplement) at a rate per annum equal to the Five-year U.S. Treasury Rate (as defined in the Preliminary

Prospectus Supplement) as of the most recent Reset Interest Determination Date (as defined in the Preliminary Prospectus Supplement)

plus a spread of 1.975%, to be reset on each Reset Date (as defined in the Preliminary Prospectus Supplement). For additional

information and the definitions of the terms Reset Period, Five-year U.S. Treasury Rate, Reset Interest Determination Date and Reset

Date, see “Description of the Notes—Interest Rate and Maturity” in the Preliminary Prospectus Supplement. |

| |

|

| Maturity Date: |

March 15, 2055 |

| |

|

| Interest Payment Dates: |

March 15 and September 15

of each year, beginning on September 15, 2025 (each, an “interest payment date”) (subject to the Company’s right

to defer interest payments as described under “Optional Interest Deferral” below). |

| |

|

| Optional Interest Deferral: |

So long as no event of default (as defined in the Preliminary Prospectus Supplement) with respect to the Notes has occurred and is

continuing, the Company may, at its option, defer interest payments on the Notes, from time to time, for one or more Optional Deferral

Periods (as defined in the Preliminary Prospectus Supplement) of up to 20 consecutive semi-annual Interest Payment Periods (as defined

in the Preliminary Prospectus Supplement) each, except that no such Optional Deferral Period may extend beyond the final maturity date

of the Notes or end on a day other than the day immediately preceding an interest payment date. No interest will be due or payable on

the Notes during any such Optional Deferral Period unless the |

| Issuer: |

Exelon Corporation |

| |

Company elects, at its option, to redeem Notes during such Optional

Deferral Period, in which case accrued and unpaid interest to, but excluding, the redemption date will be due

and payable on such redemption date only on the Notes being redeemed, or unless the principal of and interest

on the Notes shall have been declared due and payable as the result of an event of default with respect to the

notes, in which case all accrued and unpaid interest on the Notes shall become due and payable. The Company may

elect, at its option, to extend the length of any Optional Deferral Period that is shorter than 20 consecutive

semi-annual Interest Payment Periods (so long as the entire Optional Deferral Period does not exceed 20 consecutive

semi-annual Interest Payment Periods or extend beyond the final maturity date of the Notes) and to shorten the

length of any Optional Deferral Period. The Company cannot begin a new Optional Deferral Period until the Company

has paid all accrued and unpaid interest on the Notes from any previous Optional Deferral Period. During any Optional

Deferral Period, interest on the Notes will continue to accrue at the then-applicable interest rate on the Notes

(as reset from time to time on any Reset Date occurring during such Optional Deferral Period in accordance with

the terms of the Notes). In addition, during any Optional Deferral Period, interest on the deferred interest will

accrue at the then-applicable interest rate on the Notes (as reset from time to time on any Reset Date occurring

during such Optional Deferral Period in accordance with the terms of the Notes), compounded semi-annually, to

the extent permitted by applicable law.

For additional information and the definitions of the terms event of

default, Optional Deferral Period and Interest Payment Period, see “Description of the Notes—Events

of Default” and “Description of the Notes—Option to Defer Interest Payments” in the Preliminary

Prospectus Supplement. |

| |

|

| Price to Public: |

100.000% of the principal amount,

plus accrued interest, if any |

| |

|

| Proceeds to Company: |

Approximately $990 million, after

deducting the underwriting discount but before deducting the estimated offering expenses payable by the Company. |

| |

|

| Optional Redemption Provisions:

|

The Company may redeem some or all of the Notes, at its option, in whole or in part (i) on any day in the period commencing on the date falling 90 days prior to the First Reset Date and ending on and including the First Reset Date and (ii) after the First Reset Date, on any interest payment date, at a redemption price in cash equal to 100% of the principal amount of the Notes being redeemed, plus, subject to the terms described in the first paragraph under “Description of the Notes—Redemption—Redemption Procedures; Cancellation of Redemption” in the Preliminary Prospectus Supplement, accrued and unpaid interest on the Notes to be redeemed to, but excluding, the redemption date.

The Company may at its option redeem the Notes, in whole but not in part, at any time following the occurrence and during the continuance of a Tax Event (as defined in the Preliminary Prospectus Supplement) at a redemption price in cash equal to 100% of the principal amount |

| Issuer: |

Exelon

Corporation |

| |

of the Notes, plus,

subject to the terms described in the first paragraph under “Description of the Notes—Redemption—Redemption Procedures;

Cancellation of Redemption” in the Preliminary Prospectus Supplement, accrued and unpaid interest on the Notes to, but excluding,

the redemption date. |

| |

|

| |

The Company may at its option redeem the Notes, in whole

but not in part, at any time following the occurrence and during the continuance of a Rating Agency Event (as defined in the Preliminary

Prospectus Supplement) at a redemption price in cash equal to 102% of the principal amount of the Notes, plus, subject to the terms

described in the first paragraph under “Description of the Notes—Redemption—Redemption Procedures; Cancellation

of Redemption” in the Preliminary Prospectus Supplement, accrued and unpaid interest on the Notes to, but excluding, the redemption

date.

For additional information and the definitions of the terms Tax

Event and Rating Agency Event, see “Description of the Notes—Redemption” in the Preliminary Prospectus Supplement.

|

| CUSIP/ISIN: |

30161N BQ3 / US20161NBQ34 |

Joint Bookrunners: |

Barclays Capital Inc.

Citigroup Global Markets Inc.

Goldman Sachs & Co. LLC

J.P. Morgan Securities LLC

Morgan Stanley & Co. LLC

Credit Agricole Securities (USA) Inc.

RBC Capital Markets, LLC

Wells Fargo Securities, LLC |

| |

Senior Co-Managers:

|

Loop Capital Markets LLC

M&T Securities, Inc. |

| |

|

| Co-Managers: |

Academy Securities, Inc.

Multi-Bank Securities, Inc.

Siebert Williams Shank & Co., LLC

Stern Brothers & Co. |

*Note: A securities rating is not a recommendation

to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

**We expect to deliver the bonds on or about

February 19, 2025, which will be the third business day following the date of this term sheet (“T+3”). Under

Rule 15c6-1 under the Exchange Act, trades in the secondary market generally are required to settle in one business day, unless

the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade bonds any day other than the

business day preceding the settlement date will be required, by virtue of the fact that the bonds initially will settle in T+3, to

specify an alternate settlement cycle at the time of any such trade to prevent failed settlement and should consult their own

advisors.

The issuer has filed a registration statement

(including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus

in

that registration statement and other documents

the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free

by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering

will arrange to send you the prospectus if you request it by calling Barclays Capital Inc. toll-free at 1-888-603-5847, Citigroup Global

Markets Inc. toll-free at 1-800-831-9146, Goldman Sachs & Co. LLC toll-free at 1-866-471-2526, J.P. Morgan Securities LLC collect

at 1-212-834-4533 and Morgan Stanley & Co. LLC toll-free at 1-866-718-1649.

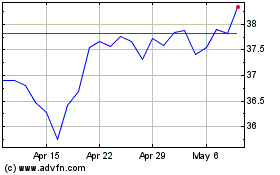

Exelon (NASDAQ:EXC)

Historical Stock Chart

From Jan 2025 to Feb 2025

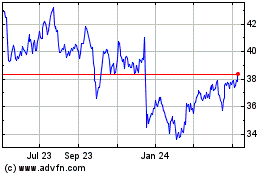

Exelon (NASDAQ:EXC)

Historical Stock Chart

From Feb 2024 to Feb 2025