NASDAQ false 0001746466 0001746466 2024-10-30 2024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

October 30, 2024

Date of Report (Date of earliest event reported)

Equillium, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-38692 |

|

82-1554746 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 2223 Avenida de la Playa |

|

|

| Suite 105 |

|

|

| La Jolla, California |

|

92037 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (858) 240-1200

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

EQ |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Ono Asset Purchase Agreement

Under that certain Asset Purchase Agreement, dated December 5, 2022 (the “Ono Agreement”), by and between Equillium, Inc. (the “Company”) and Ono Pharmaceutical Co., Ltd. (“Ono”), Ono made a strategic business decision to allow its option (the “Option”) to acquire the Company’s rights to itolizumab (EQ001) to lapse. As a result, effective October 30, 2024, the Option and the Ono Agreement automatically terminated pursuant to the terms of the Ono Agreement. The Company maintains all of its commercial rights to itolizumab (EQ001).

EQUATOR Study and Product Pipeline

On October 31, 2024, the Company announced it was temporarily pausing enrollment in its EQUATOR study, a Phase 3 clinical study of itolizumab (EQ001) in acute graft-versus-host disease, to review clinical options for the program, including the potential to accelerate the Company’s timeline to topline data to the first quarter of 2025 while preserving registrational integrity of the study. The accelerated timeline would be based on reduced enrollment to approximately 150 patients and unblinding after primary and key secondary endpoints at Day 29. To date, the Company has enrolled over 150 patients in EQUATOR.

The Company maintains orphan drug and fast track designations for first-line acute graft-versus-host disease, where currently no drugs are approved. In addition, in collaboration with the Company, Biocon SA has recently completed a robust placebo-controlled Phase 2 study of itolizumab in biologic-naïve patients with moderate to severe ulcerative colitis, and the Company expects topline data from this study in the first quarter of 2025.

The Company also announced that it has repositioned itolizumab (EQ001) as its top priority in its pipeline, and is taking operational steps to extend its cash runway, which measures are expected to provide operating runway into Q4 2025, assuming acceleration of EQUATOR study completion. As part of the operational steps, the Company is pausing further activities related EQ101 and EQ302.

Corporate Presentation

On October 31, 2024, the Company will host a conference call accompanied by a slide presentation to provide a corporate update focused on the Company’s retention of rights to itolizumab (EQ001), for analysts and institutional investors. A copy of the presentation is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. Forward-looking statements may be identified by the use of words such as “anticipate”, “believe”, “could”, “continue”, “expect”, “estimate”, “may”, “plan”, “outlook”, “future,” “potential” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements include, but are not limited to, statements regarding the Company’s plans and strategies with respect to developing itolizumab (EQ001), including repositioning itolizumab (EQ001) as the top priority in the pipeline, anticipated upcoming milestones, timelines for topline data for itolizumab (EQ001), the temporary pausing and potential acceleration of the EQUATOR study, the pausing of further activities related to EQ101 and EQ302, the extension of the Company’s cash runway and related assumptions, including the acceleration of EQUATOR study completion, and the potential benefits of the Company’s product candidates. Because such statements are subject to risks and uncertainties, many of which are outside of the Company’s control, actual results may differ materially from those expressed or implied by such forward-looking statements. Risks that contribute to the uncertain nature of the forward-looking statements include: the Company’s ability to execute its plans and strategies; risks related to performing clinical and pre-clinical studies; whether the results from clinical and pre-clinical studies will validate and support the safety and efficacy of the Company’s product candidates; changes in the competitive landscape; changes in the Company’s strategic plans; uncertainties related to the Company’s capital requirements and ability to obtain sufficient financing to fund the

Company’s strategic plans; the potential impact on the registrational integrity that would be caused by the Company’s decision to accelerate the completion of EQUATOR; and other risks and uncertainties described in the Company’s filings with the Securities and Exchange Commission, including, without limitation, the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and in other filings subsequently made by the Company with the Securities and Exchange Commission. All forward-looking statements contained in this report speak only as of the date on which they were made and are based on management’s assumptions and estimates as of such date. The Company is under no duty to update any of these forward-looking statements after the date they are made to conform these statements to actual results or revised expectations, except as required by law. You should, therefore, not rely on these forward-looking statements as representing the Company’s views as of any date subsequent to the date the statements are made. Moreover, except as required by law, neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements contained in this report.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

|

|

| (d) |

|

Exhibit Number |

|

Description. |

|

|

|

|

|

99.1 |

|

Corporate Presentation |

|

|

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirement of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

EQUILLIUM, INC. |

|

|

|

|

| Date: October 31, 2024 |

|

|

|

By: |

|

/s/ Bruce D. Steel |

|

|

|

|

Name: |

|

Bruce D. Steel |

|

|

|

|

Title: |

|

President and Chief Executive Officer |

Exhibit 99.1 Itolizumab Update October 31, 2024

Forward-Looking Statements and Other Disclaimers This presentation

contains forward-looking statements about Equillium, Inc. (the “Company”). In some cases, you can identify forward-looking statements by the words “will,” “expect,” “intend,” “plan,”

“objective,” “believe,” “estimate,” “potential,” “continue” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about

the future. These statements are based on Company management’s current beliefs and expectations. These statements include but are not limited to statements regarding the Company’s business strategy, the Company’s plans to develop

and commercialize its product candidates, the safety and efficacy of the Company’s product candidates, the Company’s plans and expected timing with respect to regulatory filings and approvals, size and growth potential of the markets for

the Company’s product candidates and cash runway. These statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, levels of activity, performance or achievements to be

materially different from the information expressed or implied by these forward- looking statements. The Company may not actually achieve the plans, intentions or expectations disclosed in its forward-looking statements, and you should not place

undue reliance on the Company’s forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed or implied in the forward-looking statements the Company makes due to the risks

and uncertainties inherent in the Company’s business, including without limitation, the risks described in the Company’s filings with the Securities and Exchange Commission (“SEC”). You are cautioned not to place undue

reliance on these forward-looking statements, which represent the Company’s views as of the date of this presentation. The Company anticipates that subsequent events and developments will cause its views to change. However, while the Company

may elect to update these forward-looking statements at some point in the future, the Company has no current intention of doing so except to the extent required by applicable law. These and other risks and uncertainties are described more fully

under the caption “Risk Factors” and elsewhere in the Company’s filings and reports, which may be accessed for free by visiting EDGAR on the SEC web site at http://www.sec.gov and on the Company’s website under the heading

“Investors.” All forward-looking statements are qualified in their entirety by this cautionary statement. This caution is made under the “safe harbor” provisions of Section 21E of the Securities Exchange Act of 1934, as

amended. This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and

copyrights referred to in this presentation may be listed without the TM, SM © or ® symbols, but Equillium will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service

marks, trade names and copyrights. This presentation discusses product candidates that are under clinical study, and which have not yet been approved for marketing by the US Food and Drug Administration. No representation is made as to the safety or

effectiveness of these product candidates for the use for which such product candidates are being studied. Caution should be exercised when comparing data across trials of different products and product candidates, as significant differences may

exist between trial designs, patient populations and other study characteristics. Furthermore, the results across such trials may not have interpretative value on our existing or future results. 2

Equillium Retains Rights to Itolizumab Ono provided substantial

non-dilutive funding for itolizumab through two key milestones: 1. Positive interim data analysis in Phase 3 EQUATOR study of first-line aGVHD: • “Study should proceed” recommendation from the IDMC 2. Positive PoC data in Phase 1b

EQUALISE study of lupus nephritis: • Clinically meaningful, deep responses in highly proteinuric patients Ono decision to allow itolizumab option to expire due to strategic business reasons Itolizumab approaching two major data events: 1.

Topline data from Phase 3 EQUATOR study in aGVHD: potential acceleration to Q1 2025 2. Topline data from Phase 2 ulcerative colitis study recently completed in India: expected Q1 2025 Equillium expects that its existing cash can fund operations into

Q4 2025, based on recent operational changes and assuming acceleration of EQUATOR study completion: reduced enrollment to ~150 and unblinding after primary and key secondary endpoints at Day 29 (CR & ORR, respectively) Equillium intends to meet

with the FDA to review the EQUATOR study during Q1 2025 3 Abbreviations: aGVHD, acute graft-versus-host disease; CR, complete response; ORR, overall response rate; PoC, proof of concept; IDMC, independent monitoring data committee

Diversified Pipeline of Differentiated Immunology Assets Indication

Pre-Clinical Phase 1 Phase 2 Phase 3 Rights Status FDA Fast Track & Enrollment paused: Potential acceleration acute graft-versus-host disease of topline data to Q1 2025 Orphan Drug Designations US, CAN, EQ001 FDA Fast Track AUS & NZ systemic

lupus erythematosus itolizumab Positive data announced Q2 2024 (SLE) / lupus nephritis (LN) Designation for LN anti-CD6 Conducted by Biocon ulcerative colitis Topline data expected Q1 2025 in India EU / Japan EQ101 PoC data & FDA/EMA Orphan

Activities on hold pending additional alopecia areata / CTCL IL-2/9/15 resources (intravenously delivered peptide) Drug Designations for CTCL inhibitor EQ302 gastrointestinal indications Activities on hold pending additional IL-15/21 (orally

delivered peptide) resources inhibitor 4 Abbreviations: SLE, Systemic lupus erythematosus; LN, lupus nephritis; PoC, proof-of-concept; CTCL, Cutaneous T-cell lymphoma

Itolizumab: Critical Mass of Safety Data and Positive Clinical Results

Over 1,000 subjects dosed with itolizumab across numerous clinical studies Acute GVHD - Pivotal Phase 3 (ongoing) IDMC Interim Review @ 100 patients in July 2024; recommended study should proceed Acute GVHD - Phase 1b (completed) Study demonstrated

high rates of rapid and durable complete response Lupus nephritis - Phase 1b (completed) Study demonstrated clinically meaningful responses in highly proteinuric subjects Ulcerative colitis - Phase 2 (topline data – expected Q1 2025)

Additional Biocon Studies • Healthy volunteers • Rheumatoid arthritis • Psoriasis (approved in India) • COVID-19 CRS (approved EUA in India) 5 Abbreviations: GVHD, graft-versus-host disease; IDMC, independent data monitoring

committee; CRS, cytokine release syndrome, EUA, emergency use authorization

Itolizumab First-in-Class immune-modifying mAb targeting the CD6-ALCAM

signaling pathway

CD6-ALCAM Pathway is Central to Immuno-Inflammation CD6 is a

co-stimulatory receptor overexpressed on T eff T cell eff activation and down-regulated on T reg High CD6 cells exhibit greater pathogenic capacity Activated leukocyte cell adhesion molecule (ALCAM), is expressed on both antigen-presenting cells and

tissues CD6-ALCAM including BBB, skin, gut, lung, liver and kidney Pathway The binding of CD6-ALCAM is important for: • Immune synapse formation • Optimal co-stimulation and activation of T eff T cell • Trafficking into tissues eff

Trafficking The CD6-ALCAM pathway modulates T cell activity and trafficking central to the pathogenesis of multiple immuno-inflammatory diseases Cytokines reduces Including but not limited to IFN-γ, TNF-α, IL-4, IL-5, IL-6, IL-13 and

IL-17. Consuegra-Fernandez et al., Cellular & Molecular Immunology 2018; Ma et al., 7 Journal of Crohn’s and Colitis 2019 Abbreviations: ALCAM, activated leukocyte cell adhesion molecule; BBB, blood brain barrier

High CD6 Cells Exhibit Greater Pathogenic Capacity Highest levels of CD6

are found on activated T effector cells (T ) and associated with eff amplification of the auto-reactive cascade low/- high CD6 CD6 • Low proliferation• High Proliferation T • Regulatory phenotype• Pathogenic Phenotypes reg T

eff • Anti-inflammatory cytokines• Pro-inflammatory cytokines 8 Consuegra-Fernandez et al., Cell Mol Immunol 2018; Ma et al., J Crohns & Colitis 2019 **p < 0.01, and ***p < 0.001

Itolizumab-induced Loss of Cell Surface CD6 Inhibits T Cells eff

Itolizumab leads to loss of CD6 in both a dose and time-dependent † manner resulting in T cells that are hyporesponsive to TCR stimulation Pathogenic hi CD6✱✱✱ ✱✱ T Cells 20000 500000 eff 1.2 400000 15000 0.9

1* 300000 10* 10000 0.6 Itolizumab 200000 Antigenic 0.3 5000 Modulation 100000 (shedding) 0.0 0 0 1 10 100 1000 10000 high isotype Tx 10µg/ml (CD6 ) Incubation Time (Minutes) low itolizumab Tx 10µg/ml (CD6 ) ^ low • Itolizumab binds

to domain-1 of CD6 causing dose-dependent loss of CD6 Non-pathogenic CD6 T Cells eff • Itolizumab-induced loss of CD6 results in hyporesponsive T cells ^ • Loss of CD6 is a pharmacodynamic marker that can be monitored in patients †

Chu, D., Ampudia, J., Connelly, S., & Ng, C. (2021). American Association of Immunologists 104th annual meeting. See Equillium website for details. *clinically relevant doses, **p<0.01, ***p<0.001 ^ 9 detected with a non-competing anti-CD6

antibody Abbreviations: TCR, T-cell receptor Surface CD6 Expression (MFI normalized to Isotype) CD25 MFI IL-2 MFI

A Differentiated Approach to Treating Immuno-Inflammatory Disease

Selectively targets auto-reactive effector T cells, while sparing regulatory T cells to promote immune tolerance and homeostasis, resulting in durable disease remission Synergistic inhibition of multiple Inhibition of T Restoration of immune

regulation eff T cells and cytokines* trafficking into key without broad immunosuppression eff target organs T eff T eff T T T eff eff reg T eff T eff T 1 / T 2 / T 17 h h h 10 * including but not limited to IFN-γ, TNF-α, IL-4, IL-5, IL-6,

IL-13 & IL-17

Itolizumab Acute Graft-Versus-Host Disease

Itolizumab in GVHD: Executive Summary • Positive topline data

from Phase 1b EQUATE study in acute graft-versus-host disease • Achieved CR and ORR at Day 29 of 61% and 67%, respectively* • Response at Day 29 was associated with improved progression-free survival through 1 year • Responders

were able to taper steroids by 70% at Day 29 and 99% at Day 169 • Itolizumab continued to demonstrate favorable safety, tolerability and efficacy profile • Positive data from Phase 3 EQUATOR study is expected to support registration

• Currently no drugs approved for first-line aGVHD • Commercial scale manufacturing in place (Biocon) • Significant market: 2021 JAMA Oncology study estimated ~10,000 patients receive allo-HSCT annually • ~ 20-40% of HSCT

patients develop acute GVHD** • ~ 40-50% develop chronic GVHD** • Approved therapies in 2L aGVHD & 2L cGVHD approaching $1 billion in revenue • Attractive commercial opportunity: ability to launch independently with small

commercial team • Opportunities for rapid indication expansion through single Phase 3 studies * All subjects dosed within 72 hours of corticosteroid administration 12 ** 2022 Dana-Farber Report Abbreviations: CR, complete response rate; ORR,

overall response rate; GVHD, graft-versus-host disease; HSCT, hematopoietic stem cell transplant

GVHD Competitive Landscape Growing strategic interest in GVHD with

recently demonstrated market potential: JAKAFI: US sales in SR-aGVHD and 2L cGVHD estimated at $500M REZUROCK: US sales in 2L cGVHD estimated at $425M, ~3 years into launch (acquired by Sanofi $1.9B in 2021) Prophylaxis 1L acute GVHD 1L cGVHD 2L/3L

cGVHD 2L/SR aGVHD No approvals No approvals ORENCIA JAKAFI JAKAFI REZUROCK cell therapy APPROVED APPROVED APPROVED 2L Phase 3 APPROVED 2L Microbiome Alpha-1 antitrypsin itolizumab IMBRUVICA NIKTIMVO cell therapy biotherapeutic Phase 2/3 Phase 3

ongoing APPROVED 2L APPROVED 3L Phase 3 Phase 3 Alpha-1 antitrypsin IL-2Ra mAb itolizumab itolizumab Phase 3 Phase 3 future Phase 3 oppty future Phase 3 oppty 0-100 days following transplant 100+ days following transplant 13 2024 revenue estimates,

sources Evaluate Pharma & Incyte report, July 2024 Abbreviations: SR-aGVHD, steroid refractory acute graft-versus-host disease; cGVHD, chronic graft-versus-host disease; 1L, first-line; 2L, second-line; 3L, third-line

Standard of Care: High-Dose Steroids Achieve Poor CR Outcomes MacMillan

Steroids alone yield poor Complete Response rates et al. 2015 GRAVITAS-301 EQUATE (steroids alone) (steroids alone) (itolizumab + steroids) 100% Complete Reponses are associated with improved long-term clinical outcomes Standard risk High risk* 80%

Clinicians indicate a 10% improvement in Complete 70% 67% ORR High risk Response rate is clinically meaningful ORR 12% 6% 56% 60% ORR High risk 43% 16% ORR 21% 40% Phase 1b open-label, dose escalation study 16% of itolizumab in patients with high

risk aGVHD 61% • 61% of patients on itolizumab achieved a Complete Response 42% 20% at Day 29 when dosed within 72 hours of steroid 35% 27% • Early responses allowed for rapid steroid tapering • Adverse events, including SAEs, are

consistent with high-risk 0% aGVHD population N=269 N=57 N=163 N=18 Partial Response • Overall survival of 67% at 6 months in subjects across Very Good Partial Response ¥ treatment groups Complete Response * EQUATE high-risk is defined as

Grade III-IV by MAGIC criteria and Grade II with Ann Arbor Score of 2 or 3; 76% of subjects also met Minnesota high-risk criteria used by MacMillan and ¥ GRAVITAS-301; data shown for subjects dosed with 72 hours of steroid administration. Only

subjects that have met the endpoint or have been studied for 6 months (up to 4 months post- treatment) are included. Data with cut-off date of 13 Oct 2021. 14 Abbreviations: ORR=CR+VGPR+PR, ORR = overall response rate; PR = partial response; CR =

complete response; VGPR = very good partial response defined as achieving all the criteria for skin, liver, and gut involvement per Martin 2009 Consensus criteria without meeting the criteria for CR. MacMillan et al. BBMT 2015; Zeiser et al. EHA

Abstract Library 2020. Response Rate at Day 29

EQUATOR Study: First-line Treatment of High-Risk aGVHD Over 50 US

clinical sites active, including 9 of top 10 U.S. allogeneic HSCT centers High exposure of itolizumab to key hospital systems and KOLs Phase 3 randomized, double-blind, global pivotal study of itolizumab in ~ 200 patients John Koreth, MD,

Dana-Farber Cancer Institute, Principal Investigator Primary Outcome • CR at Day 29 Itolizumab: IV 1.6 mg/kg loading dose followed by 0.8 mg/kg Q2W x 6 doses (n=100) Key Secondary Outcomes Eligible Patients: • ORR at Day 29 Grade III-IV

& • Durability of Complete Response Grade II with from Day 29 through Day 99 lower GI R Steroid tapering recommendation Dosing: concomitant Interim IDMC Review within 72 hours of high-dose @ 100 patients Placebo: corticosteroid •

Futility and efficacy (n=100) treatment • Completed 31 July 2024 (2 mg/kg) • Result: study should proceed Day Day Day Day Day Day Day 1 15 29 43 57 71 85 Dosing Schedule: patients followed out to Day 365 15 Abbreviations: aGVHD, acute

graft-versus-host disease; GI, gastrointestinal; HSCT, hematopoietic stem cell transplant; KOL, key opinion leader

Itolizumab Ulcerative Colitis

Itolizumab in Ulcerative Colitis: Executive Summary Strong mechanistic

rationale Near term Phase 2 clinical data in GI disease read out high • CD6 T cells have greater • Itolizumab vs. placebo vs. adalimumab eff pathogenic potential and are study complete (n=90) associated with GI inflammation •

Topline data expected in Q1 2025 • The CD6-ALCAM pathway is • High concentration formulation upregulated in inflammatory lesions of developed to enable delivery of patients with GI inflammation and pre-filled syringe correlates with

disease severity • Itolizumab shown to be effective in treating GI inflammation in multiple models of GI disease 17 Abbreviations: GI, gastrointestinal

UC Phase 2 Study – Conducted by Biocon in India Itolizumab Q2W +

SoC + SoC (Fixed Dose 140 mg) ltolizumab Q2W + SoC N=3 n=30 Primary endpoint: Proportion of subjects who Biologics naive achieved clinical remission patients with Placebo + SoC per Total Mayo Score at moderate to severe Placebo + SoC Week 12 n=30

ulcerative colitis n=90 Endoscopy at screening, week 12 and week 24 Adalimumab + SoC Adalimumab + SoC n=30 Induction of remission (Treatment Period 2) (Treatment Period 1) Wk–4 Wk 0 Wk 10 Wk 12 Wk 22 Wk 24 Wk 34 EoT EoS Safety Analysis Follow

up Stratification factor: Responder: Non-responder: Azathioprine/6-MP: Yes or No Double blind Open Label Abbreviations: Q2W, once every two weeks; EoS, end of study; EoT, end of therapy; SOC, standard of care Total Mayo Score: rectal bleeding, stool

frequency, physician assessment, and endoscopy appearance. Each rated 0 to 3, total score of 0 to 12 18 Clinical remission defined as Total Mayo Score ≤ 2 and no subscore >1 Randomization Double Blind

Corporate 19

Itolizumab Intellectual Property & Regulatory Exclusivity Biologics

Exclusivity 12 years Itolizumab Compositions / Methods 12 patent families Formulations 27 issued patents 34 applications pending Method of Treating MS and IBD (as of October 2024) Method of Inhibiting CD6 Method of Treating Lupus Method of Treating

Severe Asthma Lupus sCD6/sALCAM Diagnostic T-Cell Modulation Methods Method of Treating Coronavirus/COVID-19 Method of Treating Organ Damage Resulting from Invasive Surgery Biocon Filings EQ Filings 2014 2018 2022 2026 2030 2034 2038 2042 2044 2006

2010 Assumptions: • Listed applications will issue 20 • Biologics Exclusivity will be granted and will begin at NDA approval Itolizumab filings under exclusive license to Equillium for US, CA, AU, NZ • Potential patent term

extensions not shown

Equillium Financial Overview Key Financial Metrics $ Total Cash and

Investments (as of June 30, 2024) 33.3 M $ Q2 2024: Net Cash Generated (as of June 30, 2024) 0.7 M Equillium funded * Shares Outstanding (as of August 5, 2024) 35.4 M into Q4 2025 $ Market Cap (as of close October 30, 2024) 48.9 M Please refer to

the Form 10-Q filed on August 8, 2024 for complete financials of the company as of June 30, 2024 21 * Assuming acceleration of EQUATOR study completion to Q1 2025 and other operational adjustments

Equillium Summary Anticipated Major Milestones Itolizumab Derisked

• Phase 3 aGVHD topline data – potential to • EQUATOR Phase 3 interim safety and efficacy review July 2024: accelerate to Q1 2025 (modified study) IDMC recommended study to proceed as planned • Phase 2 Ulcerative Colitis data

expected Q1 2025• Positive topline LN data reported • Commercial-scale manufacturing in place w/ Biocon Commercial Rights to Itolizumab Attractive Market Opportunity • Full commercial rights to all indications• No drugs

approved in 1L aGVHD • EQ Territories: US, Canada, Australia & New Zealand • Approved GVHD drugs approaching $1B in US sales ® • JAKAFI 2L aGVHD /cGVHD (Incyte) ® • REZUROCK 2L cGVHD (Sanofi) • Ability to

market independently with small commercial team 22 Abbreviations: aGVHD, acute graft-versus-host disease; cGVHD, chronic graft-versus-host disease; IDMC, independent data monitoring committee; LN, lupus nephritis; 1L, first-line; 2L,

second-line

Thank you www.equilliumbio.com 23

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

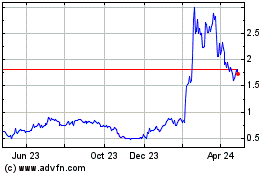

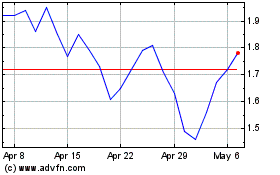

Equillium (NASDAQ:EQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Equillium (NASDAQ:EQ)

Historical Stock Chart

From Dec 2023 to Dec 2024