Record Revenues, Order Backlog and Operating Cash Flow HAIFA,

Israel, March 15 /PRNewswire-FirstCall/ -- Elbit Systems Ltd. (the

"Company") (NASDAQ:ESLT), the international defense electronics

company, today reported its consolidated results for the fourth

quarter and year-ended December 31, 2005. The Company's backlog of

orders as of December 31, 2005 reached $3.35 billion, as compared

to $2.15 billion at the end of 2004. 72% of the backlog relates to

orders outside of Israel. Approximately 65% of the Company's

backlog as of December 31, 2005 is scheduled to be performed during

2006 and 2007. Consolidated revenues for the year ended December

31, 2005 increased by 13.8% to $1,070 million, as compared to $940

million in 2004. Consolidated revenues for the fourth quarter of

2004 increased by 18.8% to $321.8 million, as compared to $270.8

million in the corresponding quarter of 2004. Impact on 2005

results. As previously reported, the Company's 2005 financial

results were expected to be effected by the acquisition of 40% of

the shares of Tadiran Communications Ltd. ("Tadiran"), which were

purchased in several stages in the fourth quarter of 2004 and

during 2005, and by the purchase of 70% of the shares of Elisra

Electronic Systems Ltd. ("Elisra") in the fourth quarter of 2005.

As a result of the above purchases the Company recorded one-time

In-Process R&D ("IPR&D") and one-time write-offs related to

the acquisitions. The effects of the Tadiran transactions are

recorded as part of the Company's earnings from affiliated

companies in its income statement. In addition, the Company's net

earnings were affected by $5.4 million of value impairment recorded

with respect to its holdings in ImageSat International N.V.

("ISI"), which is included in the Company's other expenses.

Reported consolidated net earnings for the year ended December 31,

2005 were $32.5 million, as compared to $51.9 million in 2004.

Reported diluted earnings per share ("EPS") in 2005 were $0.78, as

compared to $1.26 in 2004. Excluding one-time IPR&D and other

one-time expenses and write-offs related to the purchase of the

Tadiran and Elisra shares, the Company's net income in 2005 was

$51.1 million, and the diluted EPS was $1.23, as compared to net

income of $52.9 million and diluted EPS of $1.29 in 2004. Reported

consolidated net loss for the fourth quarter of 2005 was $5.7

million, as compared to net income of $13 million in the same

period of 2004. Reported diluted EPS for the fourth quarter of 2005

was $(0.14), as compared to $0.31 for the fourth quarter of 2004.

Excluding one-time IPR&D and other one-time expenses and

write-offs related to the purchase of the Tadiran and Elisra

shares, the Company's net income in the fourth quarter of 2005 was

$7.6 million, and the diluted EPS was $0.18. Gross profit for the

year ended December 31, 2005 was $279.8 million, as compared to

gross profit of $250.3 million in 2004, and the gross profit margin

in 2005 was 26.1%, as compared to 26.6% in 2004. Excluding one-time

restructuring expenses related to the purchase of Elisra, the

Company's gross profit in 2005 was $283.3 million, and the gross

profit margin was 26.5%. Gross profit for the fourth quarter of

2005 was $78.5 million, as compared to gross profit of $72.6

million in the fourth quarter of 2004, and the gross profit margin

in the fourth quarter of 2005 was 24.4%, as compared to 26.8% in

the fourth quarter of 2004. Excluding one-time restructuring

expenses related to the purchase of Elisra, the Company's gross

profit in the fourth quarter of 2005 was $81.9 million, and the

gross profit margin was 25.5%. Operating cash flow produced by the

Company in 2005 was $187.6 million, as compared to $81.5 in 2004.

The President and CEO of Elbit Systems, Joseph Ackerman, commented:

"2005 was a very significant year for the Elbit Systems Group, both

operationally and strategically. Operationally we achieved

unprecedented growth in revenues, backlog of orders and cash flow.

On the strategic level we completed the acquisitions of controlling

interests in both Elisra and Tadiran Communications, creating the

largest defense group in Israel. These important complementary

additions to our Group enable us to expand even further our

portfolio of advanced defense electronics systems and solutions for

our customers worldwide, enhancing our competitive position in the

international market. The process of implementing the new synergies

within the Group companies has already begun, and we believe both

acquisitions will be accretive. We intend to continue to invest in

the development of new technologies and markets and to execute our

long-term plan of profitable organic growth, while pursuing our

acquisition strategy in Israel and globally." The Board of

Directors has declared a dividend of $0.14 per share for the fourth

quarter of 2005. The dividend will be paid on April 10, 2006, net

of taxes and levies, at the rate of 22.1%. The record date of the

dividend is March 28, 2006. Conference Call The Company will be

hosting a conference call on Wednesday, March 15, at 10.00am EST.

To participate, please call one of the following teleconferencing

numbers. Please begin placing your calls at least 5 minutes before

the conference call commences. If you are unable to connect using

the toll-free numbers, please try the international dial-in number.

US Dial-in Numbers: +1-866-744-5399 UK Dial-in Number:

0-800-917-5108 ISRAEL Dial-in Number: 03-918-0609 INTERNATIONAL

Dial-in Number: +972-3-918-0609 At: 10:00am Eastern Standard Time

7:00am Pacific Standard Time 3:00pm Greenwich Mean Time 5:00pm

Israel Time This call will be broadcast live on Elbit Systems'

web-site at http://www.elbitsystems.com/. An online replay will be

available from 24 hours after the call ends, and will be available

online for 30 days. Alternatively, for two days following the end

of the call, investors will be able to dial a replay number to

listen to the call. The dial-in number is either: +1-888-269-0005

(US) 0-800-917-4256 (UK) or +972-3-925-5945 (Israel and

International). About Elbit Systems Ltd. Elbit Systems Ltd. is an

international defense electronics company engaged in a wide range

of defense-related programs throughout the world. The Elbit Systems

Group, which includes the company and its subsidiaries, operates in

the areas of aerospace, land and naval systems, command, control,

communications, computers, intelligence, surveillance and

reconnaissance ("C4ISR"), advanced electro-optic and space

technologies, EW suites, airborne warning systems, ELINT systems,

data links and military communications systems and equipment. The

Group also focuses on the upgrading of existing military platforms

and developing new technologies for defense and homeland security

applications. Company Contact: Ilan Pacholder V.P. Finance &

Capital Markets Corporate Secretary Elbit Systems Ltd. Tel:

+972-4-831-6632 Fax: +972-4-831-6659 IR Contact: Ehud Helft/Kenny

Green Gelbart Kahana Tel: 1-866-704-6710 Fax: +972-3-607-4711

E-mail: E-mail: STATEMENTS IN THIS PRESS RELEASE WHICH ARE NOT

HISTORICAL DATA ARE FORWARD-LOOKING STATEMENTS WHICH INVOLVE KNOWN

AND UNKNOWN RISKS, UNCERTAINTIES OR OTHER FACTORS NOT UNDER THE

COMPANY'S CONTROL, WHICH MAY CAUSE ACTUAL RESULTS, PERFORMANCE OR

ACHIEVEMENTS OF THE COMPANY TO BE MATERIALLY DIFFERENT FROM THE

RESULTS, PERFORMANCE OR OTHER EXPECTATIONS IMPLIED BY THESE

FORWARD-LOOKING STATEMENTS. THESE FACTORS INCLUDE, BUT ARE NOT

LIMITED TO, THOSE DETAILED IN THE COMPANY'S PERIODIC FILINGS WITH

THE SECURITIES AND EXCHANGE COMMISSION. (FINANCIAL TABLES TO

FOLLOW) ELBIT SYSTEMS LTD. CONSOLIDATED BALANCE SHEETS (In thousand

of US Dollars) December 31 December 31 2005 2004* Audited Audited

Assets Current Assets: Cash and short term deposits 94,629 34,847

Trade receivable and others 416,067 266,610 Inventories, net of

advances 328,428 248,041 Total current assets 839,124 549,498

Affiliated Companies & other Investments 201,339 59,618

Long-term receivables & others 151,557 85,100 Fixed Assets, net

284,997 244,288 Other assets, net 142,728 95,987 1,619,745

1,034,491 Liabilities and Shareholder's Equity Current liabilities

612,168 376,157 Long-term liabilities 543,893 221,810 Minority

Interest 12,907 4,340 Shareholder's equity 450,777 432,184

1,619,745 1,034,491 ELBIT SYSTEMS LTD. CONSOLIDATED STATEMENTS OF

INCOME (In thousand of US Dollars, except for per share amounts)

For the Year Ended Three Months Ended December 31 December 31 2005

2004* 2005 2004* Audited Unaudited Revenues 1,069,876 939,925

321,760 270,775 Cost of revenues 786,616 689,826 239,836 198,198

Restructuirng expenses 3,488 - 3,488 - Gross Profit 279,772 250,299

78,446 72,577 Research and development, net 71,903 66,846 18,460

23,277 Marketing and selling 78,648 69,912 23,953 19,190 General

and administrative 54,417 47,832 16,155 12,876 IPR&D write-off

7,490 - 7,490 - Total operating expenses 212,458 184,590 66,058

55,343 Operating income 67,314 65,709 12,388 17,234 Financial

expenses, net (11,472) (5,852) (5,199) (2,974) Other income

(expenses), net (5,326) 770 (5,134) 831 Income before income taxes

50,516 60,627 2,055 15,091 Provisions for income taxes 16,335

15,219 4,046 3,507 34,181 45,408 (1,991) 11,584 Equity in net

earnings (losses) of affiliated companies and partnership **

(1,636) 6,645 (2,974) 2,059 Minority rights (58) (180) (710) (639)

Net income 32,487 51,873 (5,675) 13,005 Earnings per share Basic

net earnings per share 0.80 1.30 (0.14) 0.32 Diluted net earnings

per share 0.78 1.26 (0.14) 0.31 * Adjusted due to the Tadiran share

purchase transaction ** Includes IPR&D write-off of $8,500 in

2005 DATASOURCE: Elbit Systems Ltd. CONTACT: Ilan Pacholder, V.P.

Finance & Capital Markets, Corporate Secretary, Elbit Systems

Ltd., Tel: +972-4 831-6632, Fax: +972-4 831-6659, IR Contact: Ehud

Helft/Kenny Green, Gelbart Kahana, Tel: +1-866-704-6710, Fax:

+972-3-607-4711, E-mail: , E-mail:

Copyright

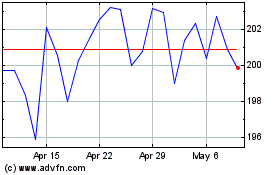

Elbit Systems (NASDAQ:ESLT)

Historical Stock Chart

From Jun 2024 to Jul 2024

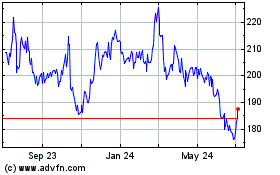

Elbit Systems (NASDAQ:ESLT)

Historical Stock Chart

From Jul 2023 to Jul 2024