0001880613

false

0001880613

2023-10-19

2023-10-19

0001880613

DRCT:ClassAcommonstockparvaluedollarpershareMember

2023-10-19

2023-10-19

0001880613

DRCT:WarrantstopurchaseClassAcommonstockMember

2023-10-19

2023-10-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

October 19, 2023

Direct Digital Holdings, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41261 |

|

87-2306185 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1177 West Loop South, Suite 1310

Houston, Texas |

|

77027 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (832) 402-1051

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A common stock, par value $0.001 per share |

|

DRCT |

|

The Nasdaq Stock Market LLC |

| Warrants to purchase Class A common stock |

|

DRCTW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (the “Exchange Act”) (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 1.01 | Entry into a Material Definitive

Agreement. |

As

previously reported, Direct Digital Holdings, Inc.’s (the “Company”) offer to each holder of its outstanding

warrants (the “Warrants”) to purchase shares of its Class A common stock, par value $0.0001 per share, to purchase

any and all outstanding Warrants for $1.20 in cash per Warrant, without interest (the “Offer”), expired one minute

after 11:59 P.M., Eastern Time, on September 28, 2023 (the “Expiration Date”), in accordance with its terms. In connection

with the Offer, the Company also solicited consents from holders of outstanding Warrants to amend that certain Warrant Agency Agreement,

dated as of February 15, 2022, by and between the Company and Equiniti Trust Company, LLC (formerly known as American Stock Transfer

and Trust Company, LLC) (the “Warrant Agent”), which governs all of the Warrants (the “Warrant Amendment”),

to permit the Company to redeem all, but not less than all, outstanding Warrants for $0.35 in cash per Warrant, without interest (the

“Redemption Price”). The valid tender of Warrants in connection with the Offer, that were not validly withdrawn prior

to the Expiration Date, constituted the holder’s consent to the Warrant Amendment. Equiniti Trust Company, LLC, the depositary

for the Offer, indicated to the Company that as of the Expiration Date, 2,193,021 outstanding Warrants (excluding Warrants tendered via

guaranteed delivery), or approximately 68.2% of the then outstanding Warrants, were validly tendered in and not withdrawn prior to the

expiration of the Offer, and therefore such Warrants consented to the Warrant Amendment.

Accordingly,

on October 19, 2023, the Company and the Warrant Agent entered into the Warrant Amendment effective as of October 3, 2023, which permits

the Company to redeem each Warrant that is outstanding following the closing of the Offer for the Redemption Price. Pursuant to

the Warrant Amendment, the Company has the right to redeem not less than all of the Warrants at any time while such warrants are exercisable

and prior to their expiration, at the office of the Warrant Agent, upon notice to the registered holders of the outstanding Warrants at

least five days prior to the date of redemption fixed by the Company. The Company will exercise its right to redeem all remaining outstanding

Warrants in accordance with the terms of the Warrant Amendment, and has fixed October 30, 2023 as the redemption date.

The

foregoing description of the Warrant Amendment is qualified in its entirety by reference to the Warrant Amendment, which is filed as Exhibit

10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

| Item 3.03 | Material Modification to Rights

of Security Holders |

Item

1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

On

October 23, 2023, the Company distributed a notice of redemption (the “Notice of Redemption”) to the registered holders

of its outstanding Warrants announcing the redemption of those warrants for the Redemption Price pursuant to the terms of the Warrant

Agreement, as amended by the Warrant Amendment. The terms of the Redemption are more specifically described in the Notice of Redemption,

a copy of which is filed as Exhibit 99.1 hereto and is incorporated herein by reference.

Neither

this Current Report on Form 8-K nor the Notice of Redemption attached hereto as Exhibit 99.1 constitutes an offer to sell or the solicitation

of an offer to buy any of the Company’s securities, and shall not constitute an offer, solicitation or sale in any jurisdiction

in which such offering, solicitation or sale would be unlawful.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

October 24, 2023

(Date) |

Direct Digital Holdings, Inc.

(Registrant) |

| |

|

| |

/s/ Mark Walker |

| |

Mark Walker

Chief Executive Officer |

Exhibit 10.1

AMENDMENT TO WARRANT AGREEMENT

This Amendment to Warrant Agreement (this “Amendment”)

is made effective as of October 3, 2023 by and between Direct Digital Holdings, Inc., a Delaware corporation (the “Company”),

and Equiniti Trust Company, LLC (formerly American Stock Transfer & Trust Company, LLC), a New York corporation, as warrant agent

(the “Warrant Agent”), and constitutes an amendment to that certain Warrant Agreement, dated as of February 15,

2022 (the “Existing Warrant Agreement”), between the Company and the Warrant Agent. Capitalized terms used but not

otherwise defined in this Amendment shall have the meanings given to such terms in the Existing Warrant Agreement.

WHEREAS, Section 8.8 of the Existing Warrant

Agreement provides that the Company and the Warrant Agent may amend the Existing Warrant Agreement with the written consent of the Registered

Holders of a majority of the outstanding Warrants as it relates to the Warrants;

WHEREAS, the Company desires to amend the Existing

Warrant Agreement to provide the Company with the right to redeem the Warrants for cash on the terms and subject to the conditions set

forth herein; and

WHEREAS, following a consent solicitation undertaken

by the Company, the Registered Holders of a majority of the outstanding Warrants have consented to and approved this Amendment.

NOW, THEREFORE, in consideration of the mutual

agreements contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and

intending to be legally bound hereby, the parties hereto agree to amend the Existing Warrant Agreement as set forth herein.

| 1. | Amendment of Existing Warrant

Agreement. The Existing Warrant Agreement is hereby amended by adding the new Section 6A thereto: |

“6A. 6A Redemption.

6A.1 Company Election to Redeem.

Notwithstanding any other provision in this Agreement to the contrary, not less than all of the outstanding Warrants may be redeemed,

at the option of the Company, at any time while they are exercisable and prior to their expiration, at the office of the Warrant Agent,

upon notice to the Registered Holders of the Warrants, as described in Section 6A.2 below, for $0.35 in cash for every Warrant held

by the holder thereof (the “6A Redemption Price”) (subject to equitable adjustment by the Company in the event of any

stock splits, stock dividends, recapitalizations or similar transaction with respect to the Common Stock).

6A.2 Date Fixed for, and Notice of,

Redemption. In the event that the Company elects to redeem all of the Warrants, the Company shall fix a date for the redemption (the

“6A Redemption Date”). Notice of redemption shall be mailed by first class mail, postage prepaid, by the Company not

less than five (5) days prior to the 6A Redemption Date to the Registered Holders of the Warrants at their last addresses as they

shall appear on the registration books. Any notice mailed in the manner herein provided shall be conclusively presumed to have been duly

given whether or not the Registered Holder received such notice.

6A.3 Exercise After Notice of Redemption.

The Warrants may be exercised for cash only in accordance with subsection 3.3.1 of this Agreement at any time after notice of redemption

shall have been given by the Company pursuant to Section 6A.2 hereof and prior to the 6A Redemption Date. On and after the 6A Redemption

Date, the record holder of the Warrants shall have no further rights except to receive, upon surrender of the Warrants, the 6A Redemption

Price.

8. Miscellaneous Provisions.

8.1 Severability. This Amendment shall be deemed severable, and the

invalidity or unenforceability of any term or provision hereof shall not affect the validity or enforceability of this Amendment or of

any other term or provision hereof. Furthermore, in lieu of any such invalid or unenforceable term or provision, the parties hereto intend

that there shall be added as a part of this Amendment a provision as similar in terms to such invalid or unenforceable provision as may

be possible and be valid and enforceable.

8.2 Applicable Law and Exclusive Forum. The validity, interpretation

and performance of this Amendment shall be governed in all respects by the laws of the State of New York. Subject to applicable law, the

parties hereby agree that any action, proceeding or claim against them arising out of or relating in any way to this Amendment shall be

brought and enforced in the courts of the State of New York or the United States District Court for the Southern District of New York,

and irrevocably submit to such jurisdiction, which jurisdiction shall be exclusive forum for any such action, proceeding or claim. Each

of the parties hereby waives any objection to such exclusive jurisdiction and that such courts represent an inconvenient forum. Notwithstanding

the foregoing, the provisions of this section will not apply to suits brought to enforce any liability or duty created by the Exchange

Act or any other claim for which the federal district courts of the United States of America are the sole and exclusive forum.

8.3 Counterparts. This Amendment may be executed in any number of counterparts,

and by facsimile or portable document format (pdf) transmission, and each of such counterparts shall for all purposes be deemed to be

an original and all such counterparts shall together constitute but one and the same instrument.

8.4 Effect of Headings. The section headings herein are for convenience

only and are not part of this Amendment and shall not affect the interpretation thereof.

8.5 Entire Agreement. The Existing Warrant Agreement, as modified by

this Amendment, constitutes the entire understanding of the parties and supersedes all prior agreements, understandings, arrangements,

promises and commitments, whether written or oral, express or implied, relating to the subject matter hereof, and all such prior agreements,

understandings, arrangements, promises and commitments are hereby canceled and terminated.

[Signatures Appear on Following Page]

IN

WITNESS WHEREOF, each of the parties has caused this Amendment to be duly executed as of October 19, 2023.

| |

DIRECT DIGITAL HOLDINGS, INC. |

| |

|

| |

By: |

/s/ Mark Walker |

| |

|

Name: Mark Walker |

| |

|

Title: Chief Executive Officer |

| |

|

| |

|

| |

EQUINITI TRUST COMPANY, LLC |

| |

|

| |

By: |

/s/ Michael Legregin |

| |

|

Name: Michael Legregin |

| |

|

Title: Senior Vice President, Corporate Actions Relationship Management & Operations |

[Signature Page to Amendment to Warrant

Agreement]

Exhibit 99.1

October 23, 2023

NOTICE OF REDEMPTION OF WARRANTS (CUSIP 25461T113)

Dear Warrant Holder,

Direct Digital Holdings, Inc. (the “Company”)

hereby gives notice that it is redeeming, at 5:00 p.m. New York City time on October 30, 2023 (the “Redemption Date”),

all of the Company’s outstanding warrants (the “Warrants”) to purchase shares of the Company’s Class

A Common Stock, par value $0.0001 per share (the “Common Stock”), that were issued under that certain Warrant

Agency Agreement, dated February 15, 2022 (as amended, the “Warrant Agreement”), by and between the Company

and American Stock Transfer & Trust Company, LLC (now Equiniti Trust Company, LLC), a New York limited liability company, as warrant

agent (the “Warrant Agent”), as amended by that certain Amendment to Warrant Agreement, effective as of October

3, 2023, by and among the Company and the Warrant Agent, as part of the units sold in the Company’s initial public offering for

a redemption price of $0.35 per Warrant (the “Redemption Price”). Each Warrant entitles the holder thereof to

purchase one share of Common Stock for a purchase price of $5.50 per share (the “Exercise Price”), subject to

customary adjustments. Any Warrants that remain unexercised at 5:00 p.m. New York City time on the Redemption Date will be void and no

longer exercisable and their holders will have no rights with respect to those Warrants, except to receive the Redemption Price or as

otherwise described in this notice for holders who hold their Warrants in “street name.”

The Warrants are listed on the Nasdaq Capital

Market under the symbol “DRCTW”. On October 20, 2023, the closing price of the Warrants was $0.36, and the closing price of

the Common Stock, listed on the Nasdaq Capital Market under the symbol “DRCT,” was $2.62.

TERMS OF REDEMPTION; CESSATION OF RIGHTS

The rights of the Warrant holders to exercise

their Warrants will terminate immediately prior to 5:00 p.m. New York City time on the Redemption Date. At 5:00 p.m. New York City

time on the Redemption Date and thereafter, holders of unexercised Warrants will have no rights with respect to those Warrants, except

to receive the Redemption Price or as otherwise described in this notice for holders who hold their Warrants in “street name.”

We encourage you to consult with your broker, financial advisor and/or tax advisor to consider whether or not to exercise your Warrants.

The Company is exercising this right to redeem

the Warrants pursuant to Section 6A of the Warrant Agreement. Pursuant to Section 6A.1 of the Warrant Agreement and at the Company’s

option, the Company has the right to redeem not less than all of the outstanding Warrants for $0.35 in cash for every Warrant held by

the holder thereof (subject to equitable adjustment by the Company in the event of any stock splits, stock dividends, recapitalizations

or similar transaction with respect to the Common Stock).

EXERCISE PROCEDURE

Warrant holders have until 5:00 p.m. New York

City time on the Redemption Date to exercise their Warrants to purchase Common Stock. Each Warrant entitles the holder thereof to

purchase one share of Common Stock at the Exercise Price.

In accordance with Section 6A.3 of the Warrant

Agreement, the Warrants may be exercised for cash only in accordance with subsection 3.3.1 of the Warrant Agreement at any time after

this Notice of Redemption has been given by the Company pursuant to Section 6A.2 of the Warrant Agreement and prior to the Redemption

Date.

Those who hold their Warrants in “street

name” should immediately contact their broker to determine their broker’s procedure for exercising their Warrants.

Persons who are holders of record of their Warrants

may exercise their Warrants by delivery (whether via facsimile, electronic mail or otherwise) of a written notice, (i) in the form attached

to the form of Warrant as Exhibit A thereto or (ii) via an electronic warrant exercise through the DTC system (the “Exercise

Notice”), of the Holder’s election to exercise the Warrant

The method of delivery of the Warrants is at the

option and risk of the holder, but if mail is used, registered mail properly insured is suggested.

The fully and properly completed Exercise Notice

must be received by the Warrant Agent prior to 5:00 p.m. New York City time on the Redemption Date. Any failure to deliver a fully

and properly completed Exercise Notice before such time will result in such holder’s Warrants being redeemed and not exercised.

REDEMPTION PROCEDURE

Payment of the Redemption Price will be made by

the Company upon presentation and surrender of a Warrant for payment after 5:00 p.m. New York City time on the Redemption Date. Those

who hold their shares in “street name” should contact their broker to determine their broker’s procedure for redeeming

their Warrants.

Any questions you may have about redemption and

exercising your Warrants may be directed to the Warrant Agent at its address and telephone number set forth above.

| Sincerely, |

|

| |

|

| DIRECT DIGITAL HOLDINGS, INC. |

|

| |

|

| /s/ Mark Walker |

|

| Mark Walker |

|

| Chief Executive Officer |

|

v3.23.3

Cover

|

Oct. 19, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 19, 2023

|

| Entity File Number |

001-41261

|

| Entity Registrant Name |

Direct Digital Holdings, Inc.

|

| Entity Central Index Key |

0001880613

|

| Entity Tax Identification Number |

87-2306185

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1177 West Loop South

|

| Entity Address, Address Line Two |

Suite 1310

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77027

|

| City Area Code |

832

|

| Local Phone Number |

402-1051

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A common stock, par value $0.001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, par value $0.001 per share

|

| Trading Symbol |

DRCT

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase Class A common stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase Class A common stock

|

| Trading Symbol |

DRCTW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=DRCT_ClassAcommonstockparvaluedollarpershareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=DRCT_WarrantstopurchaseClassAcommonstockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

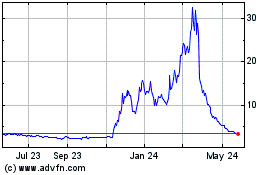

Direct Digital (NASDAQ:DRCT)

Historical Stock Chart

From Apr 2024 to May 2024

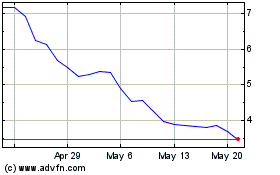

Direct Digital (NASDAQ:DRCT)

Historical Stock Chart

From May 2023 to May 2024