Current Report Filing (8-k)

March 20 2023 - 5:32PM

Edgar (US Regulatory)

FALSE000091577900009157792023-03-192023-03-190000915779us-gaap:CommonStockMember2023-03-192023-03-190000915779us-gaap:PreferredStockMember2023-03-192023-03-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 19, 2023

Daktronics, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

South Dakota | 0-23246 | 46-0306862 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

201 Daktronics Drive

Brookings, SD 57006

(Address of Principal Executive Offices Zip Code)

(605) 692-0200

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Securities registered or to be registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, No Par Value | DAKT | Nasdaq Global Select Market |

| Preferred Stock Purchase Rights | DAKT | Nasdaq Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 1 - Registrant's Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

On March 19, 2023, Daktronics, Inc. (the “Company”) entered into a Standstill and Voting Agreement (the “Agreement”) with Alta Fox Capital Management, LLC (the “Investor”) and Connor Haley (each, with its or his respective affiliates and associates, an “Investor Party,” and collectively, the “Investor Parties”) in connection with ongoing negotiations between the Company and the Investor Parties regarding a potential financing transaction.

With respect to each annual or special meeting of the Company’s shareholders during the term of the Agreement, each Investor Party has agreed to vote the shares of the Company’s common stock, no par value (the “Common Stock”) then held by it in accordance with the recommendations of the Company’s Board of Directors (the “Board”) on director election proposals and any other proposals submitted by the Company or a shareholder, except that the Investor Parties may vote in their discretion on Extraordinary Transactions (as defined in the Agreement) and, with respect to any proposal (other than as related to the election, removal or replacement of any director), in accordance with Institutional Shareholder Services, Inc. and Glass Lewis & Co. if such proxy advisor firms recommend differently from the Board.

The Investor Parties have also agreed to certain customary standstill provisions prohibiting them from, among other things, (i) making certain announcements regarding the Company’s transactions, (ii) soliciting proxies, (iii) selling securities of the Company to any third party with a known history of activism or known plans to engage in activism, (iv) taking actions to change or influence the Board, Company management or the direction of certain Company matters, and (v) exercising certain shareholder rights.

The Agreement will terminate on the one-year anniversary of the date of the Agreement, subject to an automatic extension until the day following the conclusion of the Company’s 2024 Annual Meeting of Shareholders if the Company and the Investor sign and execute definitive financing documents.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits:

(d)Exhibits. The following exhibits are filed as part of this Form 8-K:

104 Cover page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| DAKTRONICS, INC. |

| | |

| By: /s/ Sheila M. Anderson |

| | Sheila M. Anderson, Chief Financial Officer |

Date: March 20, 2023 | | |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover page Interactive Data File (embedded within the Inline XBRL document) |

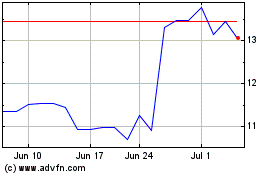

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Jun 2024 to Jul 2024

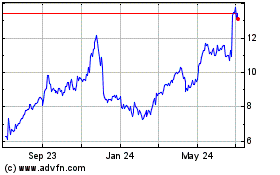

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Jul 2023 to Jul 2024