CVRx, Inc. (NASDAQ: CVRX) (“CVRx”), a commercial-stage medical

device company focused on developing, manufacturing and

commercializing innovative neuromodulation solutions for patients

with cardiovascular diseases, today announced its financial and

operating results for the first quarter of 2023.

Recent Highlights

- Totality of evidence from BeAT-HF

post-market study shows long-term benefits for patients with heart

failure

- U.S. Heart Failure (HF) revenue for

the first quarter of 2023 was $6.8 million compared to $2.9 million

in the prior year quarter, an increase of 132% over prior year

quarter

- Active implanting centers in the

U.S. grew to 122, an increase of 118% over the first quarter of

2022

- Worldwide revenue for the first

quarter of 2023 was $8.0 million, an increase of 96% over prior

year quarter

“I am thrilled with our first quarter performance, which

demonstrated solid execution on multiple fronts. We were able to

share the preliminary data from BeAT-HF during the first quarter

and grow our US heart failure business. This is a testament to our

team’s ability to accelerate adoption of Barostim through the

increased capabilities of our commercial organization and our

marketing and awareness efforts,” said Nadim Yared, President and

Chief Executive Officer of CVRx. “As we look ahead to the rest of

2023, we are excited about the opportunities that lie ahead and

confident that we will bring relief to patients suffering from

heart failure.”

First Quarter 2023 Financial and Operating

Results

Revenue was $8.0 million for the three months ended March 31,

2023, an increase of $3.9 million, or 96%, over the three months

ended March 31, 2022.

Revenue generated in the U.S. was $6.9 million for the three

months ended March 31, 2023, an increase of $3.9 million, or 127%,

over the three months ended March 31, 2022. HF revenue units in the

U.S. totaled 225 and 99 for the three months ended March 31, 2023

and 2022, respectively. HF revenue in the U.S. totaled $6.8 million

and $2.9 million for the three months ended March 31, 2023 and

2022, respectively. The increases were primarily driven by

continued growth in the U.S. HF business as a result of the

expansion into new sales territories, new accounts and increased

physician and patient awareness of Barostim.

As of March 31, 2023, the Company had a total of 122 active

implanting centers, as compared to 106 as of December 31, 2022.

Active implanting centers are customers that have completed at

least one commercial HF implant in the last 12 months. The number

of sales territories in the U.S. increased by three to a total of

29 during the three months ended March 31, 2023.

Revenue generated in Europe was $1.0 million for the three

months ended March 31, 2023, an increase of $0.02 million, or 2%,

over the three months ended March 31, 2022. Total revenue units in

Europe increased to 52 for the three months ended March 31, 2023

from 50 in the prior year period. The number of sales territories

in Europe remained consistent at six for the three months ended

March 31, 2023.

Gross profit was $6.7 million for the three months ended March

31, 2023, an increase of $3.5 million, or 113%, over the three

months ended March 31, 2022. Gross margin increased to 83% for the

three months ended March 31, 2023 compared to 77% for the three

months ended March 31, 2022. Gross margin for the three months

ended March 31, 2023 improved due primarily to a decrease in the

cost per unit driven by an increase in the production volume.

R&D expenses increased $1.2 million, or 51%, to $3.4 million

for the three months ended March 31, 2023 compared to the three

months ended March 31, 2022. This change was driven by a $0.5

million increase in compensation expenses as a result of increased

headcount, a $0.4 million increase in non-cash stock-based

compensation expense and a $0.4 million increase in consulting

fees.

SG&A expenses increased $4.6 million, or 43%, to $15.4

million for the three months ended March 31, 2023 compared to the

three months ended March 31, 2022. This change was primarily driven

by a $2.6 million increase in compensation expenses, mainly as a

result of increased headcount, a $0.8 million increase in travel

expenses, a $0.6 million increase in marketing and advertising

expenses associated with the commercialization of Barostim in the

U.S., and a $0.5 million increase in non-cash stock-based

compensation expense.

Other income, net was $1.1 million for the three months ended

March 31, 2023 compared to other expense, net of $57,000 for the

three months ended March 31, 2022. The income in the first quarter

of 2023 was primarily driven by interest income on our

interest-bearing account.

Net loss was $11.4 million, or $0.55 per share, for the three

months ended March 31, 2023, compared to a net loss of $10.0

million, or $0.49 per share, for the three months ended March 31,

2022. Net loss per share was based on 20,693,224 weighted average

shares outstanding for the first quarter of 2023 and 20,453,341

weighted average shares outstanding for the first quarter of

2022.

As of March 31, 2023, cash and cash equivalents were $103.3

million. Net cash used in operating and investing activities was

$10.5 million for the quarter ended March 31, 2023, compared to

$10.9 million for the quarter ended March 31, 2022.

Business Outlook

For the full year of 2023, the Company expects:

- Total revenue

between $35.5 million and $38.0 million, compared to prior guidance

of between $35.0 million and $38.0 million;

- Gross margin

between 80.0% and 83.0%, compared to prior guidance of between 78%

and 79%;

- Operating expenses

between $76.0 million and $80.0 million.

For the second quarter of 2023, the Company expects to report

total revenue between $8.2 million and $8.8 million.

Webcast and Conference Call Information

The Company will host a conference call to review its results at

5:00 p.m. Eastern Time today. A live webcast of the investor

conference call will be available online at the investor relations

page of the Company’s website at ir.cvrx.com. To listen to the

conference call on your telephone, please dial 1-877-704-4453 for

U.S. callers, or 1-201-389-0920 for international callers,

approximately ten minutes prior to the start time.

About CVRx, Inc.

CVRx is a commercial-stage medical device company focused on

developing, manufacturing and commercializing innovative

neuromodulation solutions for patients with cardiovascular

diseases. Barostim™ is the first medical technology approved by FDA

that uses neuromodulation to improve the symptoms of patients with

heart failure. Barostim is an implantable device that delivers

electrical pulses to baroreceptors located in the wall of the

carotid artery. Baroreceptors activate the body’s baroreflex, which

in turn triggers an autonomic response to the heart. The therapy is

designed to restore balance to the autonomic nervous system and

thereby reduce the symptoms of heart failure. Barostim received the

FDA Breakthrough Device designation and is FDA-approved for use in

heart failure patients in the U.S. It has also received the CE Mark

for heart failure and resistant hypertension in the European

Economic Area. To learn more about Barostim, visit

www.cvrx.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements other than statements of historical facts are

forward-looking statements, including statements regarding our

future financial performance (including, specifically, our

2023 expected operating and financial results), our anticipated

growth strategies, anticipated trends in our industry, our business

prospects and our opportunities. In some cases, you can

identify forward-looking statements by terms such as “may,” “will,”

“should,” “expect,” “plan,” “anticipate,” “could,” “outlook,”

“guidance,” “intend,” “target,” “project,” “contemplate,”

“believe,” “estimate,” “predict,” “potential” or “continue” or the

negative of these terms or other similar expressions, although not

all forward-looking statements contain these words.

The forward-looking statements in this press release are only

predictions and are based largely on our current expectations and

projections about future events and financial trends that we

believe may affect our business, financial condition, and results

of operations. These forward-looking statements speak only as of

the date of this press release and are subject to a number of known

and unknown risks, uncertainties and assumptions, including, but

not limited to, our history of significant losses, which we expect

to continue; our limited history operating as a commercial company

and our dependence on a single product, Barostim; our ability to

establish and maintain sales and marketing capabilities; our

ability to demonstrate to physicians and patients the merits of our

Barostim; any failure by third-party payors to provide adequate

coverage and reimbursement for the use of Barostim; our

competitors’ success in developing and marketing products that are

safer, more effective, less costly, easier to use or otherwise more

attractive than Barostim; any failure to receive access to

hospitals; our dependence upon third-party manufacturers and

suppliers, and in some cases a limited number of suppliers; a

pandemic, epidemic or outbreak of an infectious disease in the U.S.

or worldwide, including the outbreak of the novel strain of

coronavirus, COVID-19; any failure of clinical studies for future

indications to produce results necessary to support regulatory

clearance or approval in the U.S. or elsewhere; product liability

claims; future lawsuits to protect or enforce our intellectual

property, which could be expensive, time consuming and ultimately

unsuccessful; any failure to retain our key executives or recruit

and hire new employees; and other important factors that could

cause actual results, performance or achievements to differ

materially from those that are found in “Part I, Item 1A. Risk

Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2022, as such factors may be updated from time to time

in our other filings with the Securities and Exchange Commission.

Except as required by applicable law, we do not plan to publicly

update or revise any forward-looking statements contained herein,

whether as a result of any new information, future events, changed

circumstances or otherwise.

Investor Contact:Mark Klausner or Mike

VallieICR Westwicke443-213-0501ir@cvrx.com

Media Contact:Laura O’NeillFinn

Partners402-499-8203laura.oneill@finnpartners.com

CVRx, INC.Condensed

Consolidated Balance Sheets(In thousands, except

share and per share data)(Unaudited)

|

|

|

|

|

|

|

|

| |

|

March 31, |

|

December 31, |

| |

|

2023 |

|

2022 |

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

103,276 |

|

|

$ |

106,194 |

|

|

Accounts receivable, net of allowances of $641 and $679,

respectively |

|

|

6,434 |

|

|

|

5,504 |

|

|

Inventory |

|

|

8,241 |

|

|

|

6,957 |

|

|

Prepaid expenses and other current assets |

|

|

2,631 |

|

|

|

4,223 |

|

|

Total current assets |

|

|

120,582 |

|

|

|

122,878 |

|

| Property

and equipment, net |

|

|

1,805 |

|

|

|

1,698 |

|

|

Operating lease right-of-use asset |

|

|

277 |

|

|

|

334 |

|

| Other

non-current assets |

|

|

27 |

|

|

|

27 |

|

|

Total assets |

|

$ |

122,691 |

|

|

$ |

124,937 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,996 |

|

|

$ |

1,719 |

|

|

Accrued expenses |

|

|

5,961 |

|

|

|

6,369 |

|

|

Total current liabilities |

|

|

7,957 |

|

|

|

8,088 |

|

|

Long-term debt |

|

|

14,218 |

|

|

|

6,747 |

|

|

Operating lease liability, non-current portion |

|

|

59 |

|

|

|

117 |

|

| Other

long-term liabilities |

|

|

815 |

|

|

|

805 |

|

|

Total liabilities |

|

|

23,049 |

|

|

|

15,757 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

| Common stock, $0.01 par value,

200,000,000 authorized as of March 31, 2023 and

December 31, 2022; 20,708,940 and 20,633,736 shares

issued and outstanding as of March 31, 2023 and

December 31, 2022, respectively |

|

|

207 |

|

|

|

207 |

|

|

Additional paid-in capital |

|

|

547,195 |

|

|

|

545,362 |

|

|

Accumulated deficit |

|

|

(447,556 |

) |

|

|

(436,182 |

) |

|

Accumulated other comprehensive loss |

|

|

(204 |

) |

|

|

(207 |

) |

|

Total stockholders’ equity |

|

|

99,642 |

|

|

|

109,180 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

122,691 |

|

|

$ |

124,937 |

|

CVRx, INC.Condensed

Consolidated Statements of Operations and Comprehensive

Loss(In thousands, except share and per share

data)(Unaudited)

|

|

|

|

|

|

|

|

| |

|

Three months ended |

| |

|

March 31, |

| |

|

2023 |

|

2022 |

|

Revenue |

|

$ |

7,979 |

|

|

$ |

4,076 |

|

| Cost of

goods sold |

|

|

1,328 |

|

|

|

949 |

|

|

Gross profit |

|

|

6,651 |

|

|

|

3,127 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

Research and development |

|

|

3,416 |

|

|

|

2,258 |

|

|

Selling, general and administrative |

|

|

15,397 |

|

|

|

10,777 |

|

|

Total operating expenses |

|

|

18,813 |

|

|

|

13,035 |

|

|

Loss from operations |

|

|

(12,162 |

) |

|

|

(9,908 |

) |

| Interest

expense |

|

|

(240 |

) |

|

|

— |

|

| Other

income (expense), net |

|

|

1,062 |

|

|

|

(57 |

) |

|

Loss before income taxes |

|

|

(11,340 |

) |

|

|

(9,965 |

) |

|

Provision for income taxes |

|

|

(34 |

) |

|

|

(26 |

) |

|

Net loss |

|

|

(11,374 |

) |

|

|

(9,991 |

) |

|

Cumulative translation adjustment |

|

|

3 |

|

|

|

(6 |

) |

|

Comprehensive loss |

|

$ |

(11,371 |

) |

|

$ |

(9,997 |

) |

| Net loss

per share, basic and diluted |

|

$ |

(0.55 |

) |

|

$ |

(0.49 |

) |

|

Weighted-average common shares used to compute net loss per share,

basic and diluted |

|

|

20,693,224 |

|

|

|

20,453,341 |

|

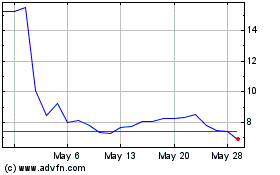

CVRx (NASDAQ:CVRX)

Historical Stock Chart

From Apr 2024 to May 2024

CVRx (NASDAQ:CVRX)

Historical Stock Chart

From May 2023 to May 2024