Form SCHEDULE 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

January 06 2025 - 5:30PM

Edgar (US Regulatory)

EXHIBIT 99.2

LIMITED POWER OF ATTORNEY

Know all by these present,

that I, David J. Snyderman, hereby make, constitute and appoint each of Michael Turro, Karl Wachter and Hayley

Stein, or any of them acting individually, and with full power of substitution, as my true and lawful attorney-in-fact for the purpose

of executing in my name, (a) in my personal capacity or (b) in my capacity as Manager or in other capacities of Supernova Management

LLC, a Delaware limited liability company, and each of its affiliates or entities advised or controlled by me or Supernova

Management LLC, all documents, certificates, instruments, statements, filings and agreements (“documents”) to be filed

with or delivered to the United States Securities and Exchange Commission (the “SEC”) pursuant to the Securities and Exchange

Act of 1934, as amended (the “Act”), and the rules and regulations promulgated thereunder, including, without limitation,

all documents relating to the beneficial ownership of securities required to be filed with the SEC pursuant to Section 13(d) or Section

16(a) of the Act, including, without limitation: (a) any acquisition statements on Schedule 13D or Schedule 13G and any amendments thereto,

(b) any joint filing agreements pursuant to Rule 13d-1(k) under the Act, and (c) any initial statements of, or statements of changes in,

beneficial ownership of securities on Form 3, Form 4 or Form 5.

All past acts of the attorney-in-fact

in furtherance of the foregoing are hereby ratified and confirmed.

This

Power of Attorney shall remain in full force and effect until the earlier of it being (a) revoked by the undersigned in a signed writing

delivered to the foregoing attorney-in-fact or (b) superseded by a new power of attorney regarding the purposes outlined herein as of

a later date.

IN

WITNESS WHEREOF, the undersigned has caused this Power of Attorney to be executed as of this 22 day

of December, 2022.

| |

/s/

David J. Snyderman |

| |

David J. Snyderman |

Exhibit 99.3

SCHEDULE A

Funds

| Date | |

Number of Shares Bought | | |

Price Per Share($) (1)(2) | |

| 12/19/2024 | |

| 50,720 | | |

| 17.92479 | (3) |

| 12/20/2024 | |

| 135,700 | | |

| 17.90460 | |

| 12/23/2024 | |

| 34,522 | | |

| 17.88283 | (4) |

| 12/24/2024 | |

| 15,526 | | |

| 17.94974 | (5) |

| 12/26/2024 | |

| 18,581 | | |

| 17.96386 | (6) |

| 12/27/2024 | |

| 27,614 | | |

| 17.98054 | (7) |

| 12/30/2024 | |

| 38,635 | | |

| 18.00899 | (8) |

| 12/31/2024 | |

| 12,681 | | |

| 18.11968 | (9) |

| 1/2/2025 | |

| 43,316 | | |

| 18.11946 | (10) |

TB(1) Excludes commissions

and other execution-related costs.

(2) Upon request by the staff of the Securities and Exchange

Commission, full information regarding the number of shares bought or sold (as the case may be) at each separate price will be provided.

(3)

Reflects a weighted average purchase price of $17.92479 per share, at prices ranging from $17.9 to $17.95 per share.

(4)

Reflects a weighted average purchase price of $17.88283 per share, at prices ranging from $17.84 to $17.91 per share.

(5)

Reflects a weighted average purchase price of $17.94974 6per share, at prices ranging from $17.9 to $17.97 per share.

(6)

Reflects a weighted average purchase price of $17.96386 per share, at prices ranging from $17.9 to $18.00 per share.

(7)

Reflects a weighted average purchase price of $17.98054 per share, at prices ranging from $17.95 to $18.00 per share.

(8)

Reflects a weighted average purchase price of $18.00899 per share, at prices ranging from $17.96 to $18.08 per share.

(9)

Reflects a weighted average purchase price of $18.11968 per share, at prices ranging from $18.08 to $18.15 per share.

(10)

Reflects a weighted average purchase price of $18.11946 per share, at prices ranging from $18.01 to $18.15 per share.

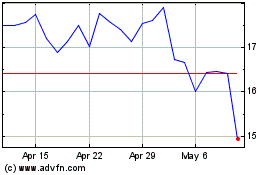

Cross Country Health (NASDAQ:CCRN)

Historical Stock Chart

From Dec 2024 to Jan 2025

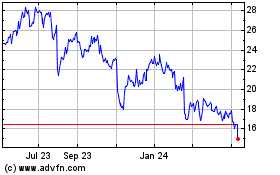

Cross Country Health (NASDAQ:CCRN)

Historical Stock Chart

From Jan 2024 to Jan 2025