UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)

Cronos Group

Inc.

(Name of Issuer)

Common Shares, no par value

(Title of Class of Securities)

22717L101

(CUSIP Number)

W. Hildebrandt Surgner, Jr.

Vice President, Corporate Secretary and

Associate General Counsel

Altria Group, Inc.

6601

West Broad Street

Richmond, Virginia 23230

(804) 274-2200

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

Copy to:

Andrew

J. Nussbaum, Esq.

John L. Robinson, Esq.

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New

York, New York 10019

(212) 403-1000

December 16, 2022

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g), check the following box. ☐

Note: Schedules filed in paper format

shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

(Continued on following pages)

CUSIP No. 22717L101

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

Altria Group, Inc. |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP

(a) ☒ (b) ☐ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

WC, OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Virginia |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

-0- |

| |

8 |

|

SHARED VOTING POWER

156,573,537 (1) |

| |

9 |

|

SOLE DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED DISPOSITIVE POWER

156,573,537

(1) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

156,573,537 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☒ (2) |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 41% (3) |

| 14 |

|

TYPE OF REPORTING

PERSON HC and CO |

| (1) |

The amount reported represents 156,573,537 common shares, no par value (the “Common Shares”),

of Cronos Group Inc. (“Cronos” or the “Issuer”) directly held by Maple Acquireco (Canada) ULC (“Canada Acquireco”) and beneficially owned by Altria Group, Inc. (“Altria”) with

respect to which Altria has shared dispositive power and voting power. Canada Acquireco is a wholly owned subsidiary of Altria. |

| (2) |

The amount reported in Row (11) excludes 84,243,223 Common Shares issuable pursuant to the exercise in

full of a warrant (the “Warrant”) directly held by Altria Summit LLC (“Altria Summit”), a wholly owned subsidiary of Altria, as of December 14, 2022. Following the abandonment of the Warrant on

December 16, 2022, each of Altria and Altria Summit disclaim any beneficial ownership of the Warrant and the 84,243,223 Common Shares underlying the Warrant as of December 14, 2022. |

| (3) |

Based on a total of 379,094,507 Common Shares issued and outstanding as of December 14, 2022, based on

information provided by the Issuer. |

CUSIP No. 22717L101

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

Altria Summit LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP

(a) ☒ (b) ☐ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

AF |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Virginia |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

-0- |

| |

8 |

|

SHARED VOTING POWER

156,573,537 (1) |

| |

9 |

|

SOLE DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED DISPOSITIVE POWER

156,573,537

(1) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

156,573,537 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☒ (2) |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 41% (3) |

| 14 |

|

TYPE OF REPORTING

PERSON OO (limited liability company) |

| (1) |

The amount reported represents 156,573,537 Common Shares directly held by Canada Acquireco and beneficially

owned by Altria Summit with respect to which Altria Summit has shared dispositive power and voting power. |

| (2) |

The amount reported in Row (11) excludes 84,243,223 Common Shares issuable pursuant to the exercise in

full of the Warrant held by Altria Summit, as of December 14, 2022, based on information provided by the Issuer. Following the abandonment of the Warrant on December 16, 2022, Altria Summit disclaims any beneficial ownership of the Warrant

and the 84,243,223 Common Shares underlying the Warrant as of December 14, 2022, based on information provided by the Issuer. |

| (3) |

Based on a total of 379,094,507 Common Shares issued and outstanding as of December 14, 2022, based on

information provided by the Issuer. |

CUSIP No. 22717L101

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

Maple Holdco (Bermuda) Ltd. |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP

(a) ☒ (b) ☐ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

AF |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Bermuda |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

-0- |

| |

8 |

|

SHARED VOTING POWER

156,573,537 (1) |

| |

9 |

|

SOLE DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED DISPOSITIVE POWER

156,573,537

(1) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

156,573,537 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 41% (2) |

| 14 |

|

TYPE OF REPORTING

PERSON OO (limited company) |

| (1) |

The amount reported represents 156,573,537 Common Shares directly and beneficially owned by Canada Acquireco

and beneficially owned by Maple Holdco (Bermuda) Ltd. (“Bermuda Holdco”) with respect to which Bermuda Holdco has shared dispositive power and voting power. Bermuda Holdco is a wholly owned subsidiary of Altria.

|

| (2) |

Based on a total of 379,094,507 Common Shares issued and outstanding as of December 14, 2022, based on

information provided by the Issuer. |

CUSIP No. 22717L101

|

|

|

|

|

|

|

| 1 |

|

NAME OF REPORTING PERSON

Maple Acquireco (Canada) ULC |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP

(a) ☒ (b) ☐ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

AF |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Canada |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

-0- |

| |

8 |

|

SHARED VOTING POWER

156,573,537 (1) |

| |

9 |

|

SOLE DISPOSITIVE POWER

-0- |

| |

10 |

|

SHARED DISPOSITIVE POWER

156,573,537

(1) |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

156,573,537 (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 41% (2) |

| 14 |

|

TYPE OF REPORTING

PERSON OO (unlimited liability company) |

| (1) |

The amount reported represents 156,573,537 Common Shares directly and beneficially owned by Canada Acquireco

with respect to which Canada Acquireco has shared dispositive power and voting power. |

| (2) |

Based on a total of 379,094,507 Common Shares issued and outstanding as of December 14, 2022, based on

information provided by the Issuer. |

This Amendment No. 1 is being filed by Altria Group, Inc. (“Altria”) in order to amend

and supplement certain of the information set forth in the Schedule 13D (as so amended, the “Schedule 13D”) originally filed by Altria on March 18, 2019, with respect to the common shares, no par value (the “Common

Shares”), of Cronos Group Inc., a corporation incorporated under the laws of the Province of British Columbia, Canada (“Cronos” or the “Issuer”). Each Item below amends and supplements the information

disclosed under the corresponding Item of the Schedule 13D. Except as specifically provided herein, this Amendment No. 1 does not modify any of the information previously reported in the Schedule 13D. Unless otherwise indicated herein,

capitalized terms used but not defined in this Amendment No. 1 shall have the same meanings herein as are ascribed to such terms in the Schedule 13D.

ITEM 1. Security and Issuer.

The last sentence of

Item 1 of the Schedule 13D is hereby amended and restated as follows:

The principal executive offices of the Issuer are located at 111 Peter Street,

Suite 300, Toronto, Ontario M5V 2H1, Canada.

ITEM 2. Identity and Background.

Item 2 of the Schedule 13D is hereby amended and restated as follows:

This Schedule 13D is being filed by Altria Group, Inc. (“Altria”), Altria Summit LLC (“Altria Summit”), Maple Holdco

(Bermuda) Ltd. (“Bermuda Holdco”) and Maple Acquireco (Canada) ULC (“Canada Acquireco,” and, together with Altria, Altria Summit and Bermuda Holdco, the “Reporting Persons”).

The business address of Altria and Altria Summit is 6601 West Broad Street, Richmond, Virginia 23230. The address of the registered office of Bermuda Holdco

is Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda. The address of the registered office of Canada Acquireco is 1600 - 925 West Georgia Street, Vancouver, Canada. Altria is a holding company incorporated in the Commonwealth of Virginia in

1985. As of the date of Amendment No. 1 to the Schedule 13D, Altria’s wholly owned subsidiaries include, among others, Philip Morris USA Inc. (“PM USA”), which is engaged in the manufacture and sale of cigarettes in the

United States; John Middleton Co., which is engaged in the manufacture and sale of machine-made large cigars and pipe tobacco and is a wholly owned subsidiary of PM USA; UST LLC, which through its wholly owned subsidiary U.S. Smokeless Tobacco

Company LLC, is engaged in the manufacture and sale of moist smokeless tobacco products and snus products; Helix Innovations LLC, which operates in the United States and Canada, and Helix Innovations GmbH and its subsidiaries, which operate

internationally in the rest-of-world, are engaged in the manufacture and sale of oral nicotine pouches. Additional information regarding Altria’s business is

available in Altria’s publicly filed reports with the Securities and Exchange Commission (the “SEC”).

Altria Summit is a limited

liability company organized under the laws of the Commonwealth of Virginia in 2013 and a wholly owned subsidiary of Altria. Its primary business is as an investment vehicle of Altria. Altria Summit is a manager-managed limited liability company and

Altria is its sole member.

Bermuda Holdco is a limited company organized under the laws of Bermuda in 2019 and a wholly owned subsidiary of Altria

Summit. Its primary business is as an investment vehicle of Altria in connection with the Transaction (as defined in Item 6). As of the date of Amendment No. 1 to the Schedule 13D, Bermuda Holdco has not conducted any material activities other

than those incidental to its formation and the matters contemplated in the Subscription Agreement (as defined in Item 6).

Canada Acquireco is an

unlimited liability company organized under the laws of British Columbia, Canada in 2019 and a wholly owned subsidiary of Bermuda Holdco. Its primary business is to invest from time to time in the securities of Cronos. As of the date of Amendment

No. 1 to the Schedule 13D, Canada Acquireco has not conducted any material activities other than those incidental to its formation and the matters contemplated in the Subscription Agreement.

Information required by Instruction C to Schedule 13D with respect to each executive officer and director of Altria, Bermuda Holdco and Canada Acquireco and

each executive officer and manager of Altria Summit is set forth on Annex A (collectively, the “Covered Persons”), attached and incorporated by reference.

The Reporting Persons have not and, to the best knowledge of the Reporting Persons, none of the Covered

Persons has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

The Reporting

Persons have not and, to the best knowledge of the Reporting Persons, none of the Covered Persons has, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of

such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

ITEM 4. Purpose of Transaction.

Item 4 of the

Schedule 13D is hereby amended and restated as follows:

The information set forth in Item 6 of this Amendment and Items 3 and 6 of the Schedule 13D is

incorporated by reference.

The Reporting Persons will continuously evaluate the Issuer’s business and prospects and all other factors deemed

relevant in determining whether the Reporting Persons or their affiliates will acquire additional Common Shares or whether the Reporting Persons will dispose of Common Shares in the open market, in privately negotiated transactions (which may be

with the Issuer or with third parties) or otherwise. The Reporting Persons expect to evaluate on an ongoing basis the Issuer’s financial condition and prospects and their interest in, and intentions with respect to, the Issuer and their

investment in the securities of the Issuer, and may propose various strategic transactions or changes to the Issuer’s strategic plan in response to general economic and industry conditions, the securities markets in general and those for the

Issuer’s securities in particular, as well as other developments and other investment opportunities, any of which, if effected, could result in the occurrence of any of the matters identified in Items 4(a)–(j) of Schedule 13D. As part of

their ongoing evaluation of this investment, the Reporting Persons may at any time consider such matters and, subject to applicable federal and state laws, formulate a plan with respect to such matters. From time to time, the Reporting Persons may

hold discussions with management, other members of the board of directors of Cronos (the “Cronos Board”), other shareholders of the Issuer or other third parties regarding such matters.

Other than as described in this Schedule 13D, the Reporting Persons do not have any present plans or proposals that relate to or would result in: (a) the

acquisition by any person of additional securities of the Issuer, or the disposition of securities of the Issuer; (b) an extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its

subsidiaries; (c) a sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries; (d) any change in the present Cronos Board or management of the Issuer, including any plans or proposals to change the number or

term of directors or to fill any existing vacancies on the Cronos Board; (e) any material change in the present capitalization or dividend policy of the Issuer; (f) any other material change in the Issuer’s business or corporate

structure; (g) changes in the Issuer’s charter, by-laws or instruments corresponding thereto or other actions that may impede the acquisition of control of the Issuer by any person; (h) causing

a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association; (i) a class of equity

securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Act; or (j) any action similar to any of those enumerated above.

ITEM 5. Interest in Securities of the Issuer.

Item

5 of the Schedule 13D is hereby amended and restated as follows:

Percentage interest calculations for Bermuda Holdco, Canada Acquireco, Altria and Altria Summit are based on

a total of 379,094,507 Common Shares issued and outstanding as of December 14, 2022, based on information provided by the Issuer, and do not account for any Common Shares issuable upon the exercise of the Warrant.1

The aggregate number of Common Shares that Canada Acquireco owns beneficially pursuant to Rule 13d-3 under the Act is 156,573,537 Common Shares, which constitutes approximately 41% of the Common Shares issued and outstanding as of December 14, 2022.

As the sole shareholder of Canada Acquireco, Bermuda Holdco may be deemed the beneficial owner of the 156,573,537 Common Shares directly held by Canada

Acquireco, which constitutes approximately 41% of the Common Shares issued and outstanding as of December 14, 2022.

The aggregate number of Common

Shares that Altria Summit owns beneficially pursuant to Rule 13d-3 under the Act is 156,573,537 Common Shares as of the date hereof, which constitutes approximately 41% of the Common Shares issued and

outstanding as of December 14, 2022 and excluding any Common Shares issuable pursuant to the Warrant. This number includes 156,573,537 Common Shares directly held by Canada Acquireco, of which Altria Summit may be deemed the beneficial owner as

the sole shareholder of Bermuda Holdco.

The aggregate number of Common Shares that Altria owns beneficially pursuant to Rule 13d-3 under the Act is 156,573,537 Common Shares as of the date hereof, which constitutes approximately 41% of the Common Shares issued and outstanding as of December 14, 2022 and excluding any Common Shares

issuable pursuant to the Warrant. This number includes 156,573,537 Common Shares directly held by Canada Acquireco, of which Altria may be deemed the beneficial owner as the sole member of Altria Summit.

In addition, as of the date hereof, certain of the Covered Persons beneficially own the number and percentage of Common Shares set forth on Annex A attached

and incorporated by reference.

Additionally, pursuant to the IRA, Altria is entitled to customary pre-emptive and

top-up rights to subscribe for additional Common Shares to maintain its ownership interest following issuances by Cronos in connection with certain triggering events, subject to a minimum ownership threshold

and receipt of any necessary approvals.

The Reporting Persons received the shared power to vote or to direct the vote and to dispose or to direct the

disposition of 156,573,537 Common Shares.

Except as described in this Schedule 13D, to the knowledge of the Reporting Persons, no transactions in the

Common Shares were effected by the Reporting Persons or any Covered Person during the 60 days prior to the date of this Schedule 13D.

To the knowledge of

the Reporting Persons, no other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the securities reported in this Item 5.

ITEM 6. Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

Item 6 of the Schedule 13D is hereby amended and restated as follows:

Subscription Agreement

On

December 7, 2018, Altria Summit, Cronos and, solely for the purposes set forth therein, Altria, entered into a Subscription Agreement (the “Subscription Agreement”). Pursuant to the Subscription Agreement, on March

| 1 |

The Warrant was issued on March 8, 2019 and provided Altria Summit the right to purchase up to an

additional 73,990,693 Common Shares at an exercise price of CAD$19.00 per Common Share, subject to customary anti-dilution adjustments. Following the Warrant Abandonment (as defined below), each of Altria and Altria Summit disclaim any beneficial

ownership of the 84,243,223 Common Shares which, as of December 14, 2022, based on information provided by the Issuer, were issuable upon the exercise in full of the Warrant. |

8, 2019 (i) Cronos sold and Canada Acquireco, as the designee of Altria Summit pursuant to the Subscription Agreement, purchased 149,831,154 Common Shares and (ii) Cronos sold and Altria

Summit purchased a warrant to purchase up to an additional 73,990,693 Common Shares of Cronos (the “Warrant” and, together with 149,831,154 Common Shares, the “Purchased Securities”) at an

exercise price of CAD$19.00 per Common Share. The Warrant was exercisable until March 8, 2023 and was subject to customary anti-dilution adjustments. As a result of the purchase of the Common Shares (the “Transaction”), Canada

Acquireco owned approximately 45% of the Common Shares issued and outstanding as of March 8, 2019. The aggregate purchase price for the Purchased Securities was approximately CAD$2.4 billion, allocated between the Warrant and 149,831,154

Common Shares.

On December 16, 2022, Altria Summit notified Cronos of its irrevocable abandonment of the Warrant and of any and all

rights that it may have held in the Warrant or any Common Shares underlying the Warrant for no consideration (the “Warrant Abandonment”) and returned to Cronos the certificate evidencing the Warrant. As a result of the Warrant

Abandonment, Altria expects to claim a capital tax loss of $483 million on its U.S. federal consolidated income tax return for 2022.

Investor

Rights Agreement

In connection with the Subscription Agreement, Altria and Cronos entered into an Investor Rights Agreement (the

“IRA”) on March 8, 2019, pursuant to which the Cronos Board was increased from five to seven directors, of which Altria designated four nominees for appointment and election, including one director that is independent from

Altria, and has the continuing right to designate four nominees, with at least one of such director nominees qualifying as independent from Altria (the “Altria Nominees”), for election or appointment to the Cronos Board so long as

Altria continues to hold at least 40% of outstanding Common Shares. In the event that Altria no longer meets such minimum ownership requirements but holds more than ten percent of outstanding Common Shares, Altria will be entitled to designate a

number of Altria Nominees that represents its proportionate share of the number of directors comprising the Cronos Board (rounded up to the next whole number) based on its percentage ownership of outstanding Cronos Common Shares. Altria will no

longer have director designation rights if and when its ownership falls below 10%. For as long as Altria continues to have director designation rights, Altria may, from time to time, cause one or more of the Altria Nominees to resign from the Cronos

Board and designate new nominees for appointment or election to the Cronos Board, in accordance with the terms of the IRA.

The IRA

provides Altria with certain rights with respect to its interest in Cronos, including, among others, approval rights for specified categories of transactions and customary registration rights, subject in each case to specified minimum ownership

thresholds. Additionally, pursuant to the IRA, Altria is entitled to customary pre-emptive and top-up rights to subscribe for additional Common Shares to maintain its

ownership interest following issuances by Cronos in connection with certain triggering events, subject to a minimum ownership threshold and receipt of any necessary approvals.

The IRA further requires Altria and its affiliates, subject to specified conditions, to adhere to certain

non-competition restrictions including, among others, that: (x) Altria will not develop, manufacture, market, sell or distribute cannabis products (or invest in businesses that develop, manufacture,

market, sell or distribute cannabis products) other than through Cronos; and (y) Cronos be presented exclusively all Cannabis Opportunities (as defined in the IRA) until the earlier of (i) the

six-month anniversary of the date that Altria’s beneficial ownership of Common Shares is less than ten percent of outstanding Common Shares and (ii) the

six-month anniversary of the termination of the IRA. Notwithstanding the foregoing, Altria may pursue any Cannabis Opportunity that becomes a Rejected Opportunity (as defined in the IRA). The IRA also provides

that, until the earlier of the date that the Warrant has been exercised in full or the expiration of the Warrant, Altria will not acquire additional Common Shares other than as contemplated in the IRA.

The IRA terminates when Altria ceases to beneficially own at least 5% of outstanding Common Shares, calculated in accordance with the IRA. It

may also be terminated by a party following the material uncured breach by the other party if a court orders termination of the agreement or following the bankruptcy of the other party.

Other Commercial Agreements

In connection with the Transaction, Cronos and Altria Ventures Inc., an affiliate of Altria (“AVI”), entered into a Services

Agreement, dated February 18, 2019, which was amended on June 28, 2019 to provide that Altria Pinnacle LLC, an affiliate of Altria, provides certain services to Cronos.

Also in connection with the Transaction, Cronos and National Smokeless Tobacco Canada Limited, an affiliate of Altria

(“NSTC”) entered into a Services Agreement, dated May 16, 2019, pursuant to which NSTC provides certain services to Cronos.

Incorporation by Reference; Joint Filing Agreement

The foregoing description of the Subscription Agreement and the IRA does not purport to be complete and is qualified in its entirety by

reference to each of the Subscription Agreement and the IRA, copies of which are attached as Exhibit 99.2 and Exhibit 99.3, respectively, and are incorporated by reference. The foregoing description of the Warrant Abandonment does not purport to be

complete and is qualified in its entirety by reference to that certain letter, dated as of December 16, 2022, from Altria Summit LLC to Cronos Group Inc., which is attached as Exhibit 99.4 and is incorporated by reference.

In connection with the Transaction and the Schedule 13D, Altria and Altria Summit entered into a Joint Filing Agreement, which is attached as

Exhibit 99.1 and incorporated by reference.

ITEM 7. Material to be Filed as Exhibits.

The following documents are filed as exhibits to this Amendment No. 1 to Schedule 13D:

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

| Date: December 19, 2022 |

|

|

|

ALTRIA GROUP, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Heather A. Newman |

|

|

|

|

Name: |

|

Heather A. Newman |

|

|

|

|

Title: |

|

Senior Vice President, Chief Strategy and Growth Officer |

|

|

|

| Date: December 19, 2022 |

|

|

|

ALTRIA SUMMIT LLC |

|

|

|

|

|

|

|

|

By: |

|

/s/ Michael E. Manson |

|

|

|

|

Name: |

|

Michael E. Manson |

|

|

|

|

Title: |

|

Vice President and Treasurer |

|

|

|

| Date: December 19, 2022 |

|

|

|

MAPLE HOLDCO (BERMUDA) LTD. |

|

|

|

|

|

|

|

|

By: |

|

/s/ David A. Wise |

|

|

|

|

Name: |

|

David A. Wise |

|

|

|

|

Title: |

|

President |

|

|

|

| Date: December 19, 2022 |

|

|

|

MAPLE ACQUIRECO (CANADA) ULC |

|

|

|

|

|

|

|

|

By: |

|

/s/ David A. Wise |

|

|

|

|

Name: |

|

David A. Wise |

|

|

|

|

Title: |

|

President |

Annex A

The following table sets forth the name and present occupation or employment of each director and executive officer of Altria Group, Inc. Maple Holdco

(Bermuda) Ltd. and Maple Acquireco (Canada) ULC and each executive officer of Altria Summit LLC. With the exception of Ian L.T. Clarke, each such person is a citizen of the United States. Mr. Clarke is a citizen of Canada. The business address

of each such person is 6601 West Broad Street, Richmond, Virginia 23230.

Directors of Altria Group, Inc.:

|

|

|

| Name |

|

Present Occupation or Employment |

| Ian L.T. Clarke |

|

Chief Financial Officer, Greater Toronto Airports Authority |

|

|

| Marjorie M. Connelly |

|

Retired Chief Operating Officer, Convergys Corporation |

|

|

| R. Matt Davis |

|

President, Driftwood Leadership, LLC Retired

President, North America, and Senior Vice President, Global Corporate Affairs, Dow Inc. |

|

|

| William F. Gifford, Jr. |

|

Chief Executive Officer, Altria Group, Inc. |

|

|

| Jacinto J. Hernandez2 |

|

Retired Partner, Capital Group |

|

|

| Debra J. Kelly-Ennis |

|

Retired President and Chief Executive Officer, Diageo Canada, Inc. |

|

|

| W. Leo Kiely III |

|

Retired Chief Executive Officer, MillerCoors LLC |

|

|

| Kathryn B. McQuade |

|

Retired Executive Vice President and Chief Financial Officer, Canadian Pacific Railway Limited |

|

|

| George Muñoz |

|

Principal, Muñoz Investment Banking Group, LLC

Partner, Tobin & Muñoz |

|

|

| Nabil Y. Sakkab3 |

|

Retired Senior Vice President, Corporate Research and Development,

The Procter & Gamble Company |

|

|

| Virginia E. Shanks |

|

Retired Executive Vice President and Chief Administrative Officer, Pinnacle Entertainment, Inc. |

|

|

| Ellen R. Strahlman |

|

Retired Executive Vice President, Research & Development and Chief Medical Officer, Becton, Dickinson and Company |

|

|

| M. Max Yzaguirre |

|

Retired Executive Chairman, Forbes Bros. Holdings, Ltd. |

Executive Officers of Altria Group, Inc.:

|

|

|

| Name |

|

Present Occupation or Employment |

| Jody L. Begley |

|

Executive Vice President and Chief Operating Officer |

|

|

| Daniel J. Bryant |

|

Vice President and Treasurer |

|

|

| Steven D’Ambrosia |

|

Vice President and Controller |

|

|

| Murray R. Garnick |

|

Executive Vice President and General Counsel |

|

|

| William F. Gifford, Jr. |

|

Chief Executive Officer |

|

|

| Salvatore Mancuso |

|

Executive Vice President and Chief Financial Officer |

|

|

| Heather Newman |

|

Senior Vice President, Chief Strategy and Growth Officer |

|

|

| W. Hildebrandt Surgner, Jr. |

|

Vice President, Corporate Secretary and Associate General Counsel |

|

|

| Charles N. Whitaker |

|

Senior Vice President, Chief Human Resources Officer and Chief Compliance Officer |

| 2 |

Mr. Hernandez beneficially owns 3,379 Common Shares, which represents less than 1% of the Common Shares

issued and outstanding as of December 14, 2022, based on information provided by the Issuer. |

| 3 |

Dr. Sakkab beneficially owns 5,000 Common Shares, which represents less than 1% of the Common Shares

issued and outstanding as of December 14, 2022, based on information provided by the Issuer. |

Directors of Maple Holdco (Bermuda) Ltd.:

|

|

|

|

|

| Name |

|

Position at Reporting Person |

|

Present Occupation or

Employment |

|

|

|

|

|

| David A. Wise |

|

Director |

|

Managing Director, Adjacency Strategy, Altria Ventures Inc. |

Executive Officers of Maple Holdco (Bermuda) Ltd.:

|

|

|

|

|

| Name |

|

Position at Reporting Person |

|

Present Occupation or Employment |

| David A. Wise |

|

President |

|

Managing Director, Adjacency Strategy, Altria Ventures Inc. |

Directors of Maple Acquireco (Canada) ULC:

|

|

|

|

|

| Name |

|

Position at Reporting Person |

|

Present Occupation or Employment |

| David A. Wise |

|

Director |

|

Managing Director, Adjacency Strategy, Altria Ventures Inc. |

Executive Officers of Maple Acquireco (Canada) ULC:

|

|

|

|

|

| Name |

|

Position at Reporting Person |

|

Present Occupation or Employment |

| David A. Wise |

|

President |

|

Managing Director, Adjacency Strategy, Altria Ventures Inc. |

|

|

|

| Mary C. Bigelow |

|

Secretary |

|

Sr. Assistant General Counsel, Altria Client Services LLC |

Managers of Altria Summit LLC:

|

|

|

|

|

| Name |

|

Position at Reporting Person |

|

Present Occupation or Employment |

| Michael E. Manson |

|

Manager |

|

Vice President, Enterprise Strategy, Planning & New Ventures, Altria Ventures

Inc. |

|

|

|

| Mary C. Bigelow |

|

Manager |

|

Sr. Assistant General Counsel, Altria Client Services LLC |

Executive Officers of Altria Summit LLC:

|

|

|

|

|

| Name |

|

Position at Reporting Person |

|

Present Occupation or Employment |

| Michael E. Manson |

|

Vice President and Treasurer |

|

Vice President, Enterprise Strategy, Planning & New Ventures, Altria Ventures

Inc. |

|

|

|

| Mary C. Bigelow |

|

Vice President and Secretary |

|

Sr. Assistant General Counsel, Altria Client Services LLC |

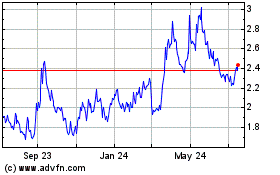

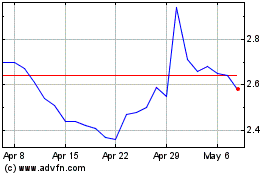

Cronos (NASDAQ:CRON)

Historical Stock Chart

From Aug 2024 to Sep 2024

Cronos (NASDAQ:CRON)

Historical Stock Chart

From Sep 2023 to Sep 2024