Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

July 07 2022 - 2:26PM

Edgar (US Regulatory)

SIGNATURES

Pursuant to the

requirements of the Securities and Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized, in the city of

Buenos Aires, Argentina.

|

|

Cresud

Sociedad Anónima, Comercial, Inmobiliaria, Financiera y

Agropecuaria

|

|

|

|

|

|

By:

|

/S/ Saúl

Zang

|

|

|

|

|

Saúl

Zang

|

|

|

|

|

Responsible

for the Relationship with the Markets

|

|

July 7,

2022

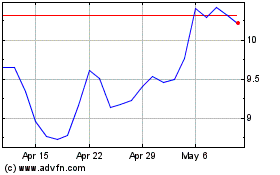

Cresud S A C I F y A (NASDAQ:CRESY)

Historical Stock Chart

From Jun 2024 to Jul 2024

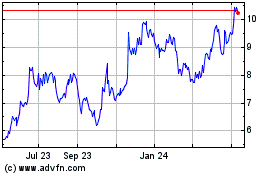

Cresud S A C I F y A (NASDAQ:CRESY)

Historical Stock Chart

From Jul 2023 to Jul 2024