By Sarah Nassauer

The strong U.S. economy wasn't enough to boost all retailers

during the key holiday season, with Macy's Inc. and other

mall-based stores continuing to lose customers to discounters and

e-commerce.

Shares of Macy's Inc. were down almost 19% in morning trading

Thursday as the department store lowered its full-year guidance

following weak December sales. Rival Kohl's Corp. and mall stalwart

Victoria's Secret owner L Brands also posted tepid holiday sales,

triggering a broad-based sell off in retail stocks.

"The holiday season began strong -- particularly during Black

Friday and the following Cyber Week, but weakened in the

mid-December period," said Macy's Chief Executive Jeff

Gennette.

The negative sentiment even weighed on discounters like Target

Corp. and Costco Wholesale Corp., which reported strong holiday

sales. Those chains, which are less dependent on apparel, and

Amazon.com Inc. have been taking market share from department

stores. Target cited strong demand for toys and baby products along

with seasonal gifts.

"The rising tide of retail sales hasn't floated all boats," said

Neil Saunders, managing director of research firm GlobalData. "What

we are seeing is a polarization between winners and losers.

Macy's said comparable sales, including licensed departments,

rose 1.1% during November and December. The chain lowered its

sales-growth and profit forecasts for the full year, which ends in

February.

The retailer has been investing in a group of stores it calls

magnets, adding new lighting, fixtures, a better assortment of

merchandise and technology, while trying to shrink less-promising

locations. But the changes weren't enough to accelerate growth

through what was expected to be one of the most successful holiday

seasons in years.

"It's almost as if Macy's is two companies," Mr. Saunders said,

adding that the magnet stores have been doing well but the rest of

the chain has struggled. "The other stores are dispiriting and

crammed with stock, " he added. "That is the issue that Macy's has

got to get to grips with."

Kohl's comparable sales rose 1.2% in November and December but

the growth was slower than the gains it reported last year. The

company sells similar merchandise to Macy's but its stores

typically aren't located in enclosed malls.

Target's store and web sales rose 5.7% between Nov. 4 and Jan.

5, the company said Thursday. Sales rose 3.4% during the same

period last year. The results put Target on track to have its best

full year of sales growth in 13 years, the company said.

At Costco, sales climbed 7%, excluding gasoline and currency

fluctuations, during the five weeks ended Jan. 6, the company said

Wednesday. Both retailers said more shoppers visiting stores drove

growth over the holidays.

Both Target and Costco, and the biggest retailer Walmart Inc.,

have reported a string of strong sales figures in recent quarters

as they have benefited from low unemployment and U.S. wage

gains.

Their results suggest retailers that have worked to attract more

shoppers online or invested in store operations benefited from

robust consumer spending over the holidays, even as a stock market

swoon and a government shutdown led some investors to worry about

an economic slowdown.

Like Walmart, Target has shifted its focus toward growing

online, offering more options to receive web orders at home or pick

up those orders in stores. Target said Thursday online sales grew

29% over the holidays. Costco has worked to keep prices for its

bulk goods low and added a wider product selection online.

Bed Bath & Beyond also reported encouraging results, saying

Wednesday it was ahead of schedule on improving profit margins.

Same-store sales at the home-goods retailer continued to decline,

but the report sent its stock up by as much as 20% in after-hours

trading.

Some retailers have continued to struggle as shopping shifts

online and away from department stores. On Tuesday, J.C. Penney Co.

said sales fell 3.5% during the nine weeks ending Jan. 5 and that

it planned to close more stores this year, continuing a stretch of

weak sales figures.

L Brands said comparable sales for its Victoria's Secret brand

declined during the holiday season and margins suffered, sending

shares down more than 7% in morning trading Thursday.

Overall holiday shopping continued to shift online. Traffic to

physical stores fell 3% between Nov. 18 and Dec. 29, according to

ShopperTrak, which uses cameras to track shoppers in stores.

On Thursday Target also said chief financial officer Cathy Smith

will retire. Target said it has hired a search firm to find her

replacement and is considering internal and external candidates.

Ms. Smith, who joined the company as CFO in 2015, will stay in her

role until a successor is named and act as an adviser until May

2020, said the company.

The company left its financial guidance unchanged. Target still

expects fourth quarter 2018 comparable sales to grow around 5% and

full-year earnings to be between $5.30 and $5.50 per share.

--Micah Maidenberg, Kimberly Chin and Suzanne Kapner contributed

to this article.

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

January 10, 2019 10:59 ET (15:59 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

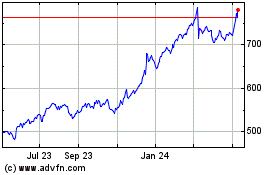

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Aug 2024 to Sep 2024

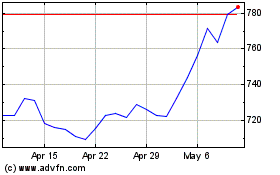

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Sep 2023 to Sep 2024