ContraFect Corporation (Nasdaq:

CFRX), a clinical-stage biotechnology company focused on

the discovery and development of direct lytic agents (DLAs),

including lysins and amurin peptides, as new medical modalities for

the treatment of life-threatening, antibiotic-resistant infections,

today announces business updates and financial results for the

first quarter ended March 31, 2023.

“As a physician-scientist, I am truly excited to

have begun dosing patients in our Phase 1b/2 clinical study of

intra-articular exebacase for the treatment of chronic prosthetic

joint infections of the knee. There has been no change in the

standard of care for this disease, which is surgical revision, in

the past 40-plus years and we finally have the potential to change

the paradigm,” said Roger J. Pomerantz, M.D., ContraFect’s

President, Chief Executive Officer, and Chairman. “And on top of

this, we remain on track to file an IND for our second program,

CF-370, one of the first engineered lysins targeting Gram-negative

pathogens, around the middle of this year. Resistant Gram-negative

infections are an area of global unmet medical need where we could

make a significant difference with the potential to improve

clinical outcomes for patients, including against resistant

Pseudomonas, Acinetobacter and Klebsiella

species.”

First Quarter 2023 Highlights and Recent

Developments

- In April 2023, the

Company announced the first patient had been dosed in the Phase

1b/2 of exebacase in the setting of an arthroscopic debridement,

antibiotics, irrigation, and retention (DAIR) procedure in patients

with chronic prosthetic joint infections (PJI) of the knee due to

Staphylococcus aureus (S. aureus) or Coagulase-Negative

Staphylococci (CoNS). The patient was treated at the Hôspices

Civils de Lyon in Lyon, France, the clinical site where the study

is being conducted.The Phase 1b/2 study of exebacase is a

randomized, double-blind, placebo-controlled clinical study

conducted in France to assess the safety, pharmacokinetics (PK),

and efficacy of intra-articularly administered exebacase in

patients with chronic PJI of the knee due to S. aureus or CoNS. The

study will be conducted in two parts. Part I will assess efficacy

at an early, six-week timepoint in addition to safety and PK. Part

II will be a long-term clinical safety and efficacy follow-up for a

period of up to two years. Patients entering the study will be

randomized 3:1 to either exebacase or placebo, with patients

receiving study drug in the setting of a of a minimally-invasive

arthroscopic debridement, antibiotics, irrigation, and retention

(DAIR) Procedure.

- In April 2023, at the 33rd European

Congress of Clinical Microbiology & Infectious Diseases

(ECCMID) Annual Meeting held from April 15-18, 2023 in Copenhagen,

Denmark, the Company provided an oral presentation of data from the

study of the efficacy of CF-370, in addition to amikacin, in a

neutropenic rabbit lung infection model. The study demonstrated

that CF-370 is efficacious against an extensively drug-resistant

(XDR) strain of P. aeruginosa. The most significant reductions in

bacterial density occurred with the administration of multiple

doses of CF-370 in addition to amikacin as compared to all other

treatment arms.

- ContraFect also presented multiple

posters at the ECCMID Annual Meeting, including new data on the use

of electron microscopy to elucidate the mechanism of CF-370’s

potent bacteriolytic activity against P. aeruginosa, Klebsiella

pneumoniae (K. pneumoniae), Acinetobacter baumannii (A. baumannii),

Escherichia coli (E. coli), Enterobacter cloacae (E. cloacae) and

Stenotrophomonas maltophilia (S. maltophilia) and the capacity of

CF-370 to disrupt the outer membrane and depolarize the inner

membrane of P. aeruginosa, K. pneumoniae, A. baumannii, E. coli, E.

cloacae and S. maltophilia. This depolarization impairs swarming

motility and prevents biofilm formation, both resulting in

decreased pathogenic virulence.New data was also presented

demonstrating exebacase’s in vitro bactericidal and antibiofilm

activity against Staphylococcus aureus strains associated with

pulmonary exacerbations of cystic fibrosis patients, including

antibiotic-resistant isolates.

- In March 2023, the Company closed

on a $10.0 million registered direct offering and concurrent

private placement of warrants to purchase common stock. The

proceeds provide important capital to support the advancement of

exebacase into the Phase 1b/2 study of patients with chronic PJI,

and of CF-370 toward a mid-year investigational new drug (IND)

application.

First Quarter 2023 Financial Results

- Research and

development (R&D) expenses were $5.3 million for the first

quarter of 2023 compared to $12.7 million in the comparable period

in 2022. This decrease was primarily attributable to significantly

reduced expenditures on late-stage development activities including

the contract research organizations (CROs) to support the continued

closure of the Phase 3 DISRUPT study of exebacase, the chemistry,

manufacturing and controls (CMC) activities for exebacase, external

clinical consultants and headcount and related personnel costs as a

result of the restructuring of the Company’s workforce in the third

quarter of 2022.

- General and administrative

(G&A) expenses were $3.6 million for the first quarter of 2023

compared to $3.3 million in the comparable period in 2022. This

increase was primarily attributable to an increase in costs for

consulting fees and related expenses incurred to support the

continued listing of our common stock on Nasdaq.

- Net loss was $1.4 million, or a

loss of $0.69 per share, for the first quarter of 2023 compared to

net loss of $20.2 million, or a loss of $41.00 per share, for the

comparable period in 2022. The net loss in the current period

includes a $7.4 million, or $3.75 per share, non-cash gain related

to the change in fair value of the Company’s warrant liabilities.

In the prior year period, the net loss included a $4.2 million, or

$8.57 per share, non-cash charge from the change in the fair value

of the Company’s warrant liabilities.

- As of March 31, 2023, ContraFect

had cash, cash equivalents and marketable securities of $13.9

million.

About ContraFect:

ContraFect is a biotechnology company focused on

the discovery and development of DLAs, including lysins and amurin

peptides, as new medical modalities for the treatment of

life-threatening, antibiotic-resistant infections. An estimated

700,000 deaths worldwide each year are attributed to

antimicrobial-resistant infections. We intend to address life

threatening infections using our therapeutic product candidates

from our platform of DLAs, which include lysins and amurin

peptides. Lysins are a new class of DLAs which are recombinantly

produced antimicrobial proteins with a novel mechanism of action

associated with the rapid killing of target bacteria, eradication

of biofilms and synergy with conventional antibiotics. Amurin

peptides are a novel class of DLAs which exhibit broad-spectrum

activity against a wide range of antibiotic-resistant Gram-negative

pathogens, including P. aeruginosa, Acinetobacter

baumannii, and Enterobacter species. We believe that the

properties of our lysins and amurin peptides will make them

suitable for targeting antibiotic-resistant organisms, such as MRSA

and P. aeruginosa, which can cause serious infections such as

bacteremia, pneumonia and osteomyelitis. We have completed a Phase

2 clinical trial for the treatment of Staph

aureus bacteremia, including endocarditis, with our lead lysin

candidate, exebacase, which is the first lysin to enter clinical

studies in the U.S. Exebacase was granted Breakthrough Therapy

designation by the FDA for the treatment of MRSA bloodstream

infections, including right-sided endocarditis, when used in

addition to SOC anti-staphylococcal antibiotics.

Follow ContraFect on

Twitter @ContraFectCorp and LinkedIn.

Activities related to exebacase during the

period of performance under the contract will be funded in part

with federal funds from HHS; ASPR; BARDA, under contract number

75A501212C00021.

Forward-Looking Statements

This press release contains, and our officers

and representatives may make from time to time, “forward-looking

statements” within the meaning of the U.S. federal securities laws.

Forward-looking statements can be identified by words such as

“projects,” “may,” “will,” “could,” “would,” “should,” “believes,”

“expects,” “anticipates,” “estimates,” “intends,” “plans,”

“potential,” “promise” or similar references to future periods.

Examples of forward-looking statements in this release include,

without limitation, statements made by Dr. Pomerantz, including the

Phase 1b/2 patient dosing and the timing of the CF-370 IND filing,

whether the Company can change the surgical revision standard of

care paradigm for chronic PJI, whether CF-370 is one of the first

engineered lysins targeting Gram-negative pathogens, whether the

Company could make a significant difference and improve patient

clinical outcomes, ContraFect’s ability to discover and develop

DLAs as new medical modalities for the treatment of

life-threatening, antibiotic-resistant infections, the Company’s

financial results, financial position, balance sheets and statement

of operations, whether the offering proceeds will support the

advancement of exebacase in the Phase1b/2 study and CF-370 toward

an IND application, whether ContraFect will address

life-threatening infections using therapeutic candidates from its

DLA platform, whether lysins are a new class of DLAs which are

recombinantly produced, antimicrobial proteins with a novel

mechanism of action associated with the rapid killing of target

bacteria, eradication of biofilms and synergy with conventional

antibiotics, whether amurins are a novel class of DLAs which

exhibit broad-spectrum activity against a wide range of

antibiotic-resistant Gram-negative pathogens, and whether the

properties of ContraFect’s lysins and amurins will make them

suitable for targeting antibiotic-resistant organisms, such as MRSA

and P. aeruginosa. Forward-looking statements are statements that

are not historical facts, nor assurances of future performance.

Instead, they are based on ContraFect’s current beliefs,

expectations and assumptions regarding the future of its business,

future plans, strategies, projections, anticipated events and

trends, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject

to inherent risks, uncertainties and changes in circumstances that

are difficult to predict and many of which are beyond ContraFect’s

control, including, without limitation, that ContraFect has and

expects to continue to incur significant losses, ContraFect’s need

for additional funding, which may not be available, the occurrence

of any adverse events related to the discovery, development and

commercialization of ContraFect’s product candidates such as

unfavorable clinical trial results, insufficient supplies of drug

products, the lack of regulatory approval, or the unsuccessful

attainment or maintenance of patent protection, changes in

management may negatively affect ContraFect’s business and other

important risks detailed under the caption “Risk Factors” in

ContraFect's Annual Report on Form 10-K for the year ended December

31, 2022 and its other filings with the Securities and Exchange

Commission. Actual results may differ from those set forth in the

forward-looking statements. Any forward-looking statement made by

ContraFect in this press release is based only on information

currently available and speaks only as of the date on which it is

made. Except as required by applicable law, ContraFect expressly

disclaims any obligations to publicly update any forward-looking

statements, whether written or oral, that may be made from time to

time, whether as a result of new information, future developments

or otherwise.

CONTRAFECT

CORPORATIONCondensed Balance Sheets

|

(in thousands) |

|

|

|

|

|

|

March 31,2023 |

|

|

December 31,2022 |

|

|

|

(unaudited) |

(audited) |

|

Assets |

|

|

|

Current assets: |

|

|

|

Cash and cash equivalents |

$ |

11,866 |

|

|

$ |

8,907 |

|

|

Marketable securities |

|

2,025 |

|

|

|

4,775 |

|

|

Prepaid expenses |

|

2,060 |

|

|

|

1,382 |

|

|

Other current assets |

|

1,747 |

|

|

|

2,642 |

|

|

|

|

|

|

Total current assets |

|

17,698 |

|

|

|

17,706 |

|

|

Property and equipment, net |

|

587 |

|

|

|

627 |

|

|

Operating lease right-of-use assets |

|

2,162 |

|

|

|

2,241 |

|

|

Other assets |

|

105 |

|

|

|

105 |

|

|

|

|

|

|

Total assets |

$ |

20,552 |

|

|

$ |

20,679 |

|

|

|

|

|

| |

|

|

| |

|

|

|

Liabilities and stockholders’ deficit |

|

|

|

Current liabilities |

$ |

19,652 |

|

|

$ |

20,840 |

|

|

Warrant liabilities |

|

1,899 |

|

|

|

9,299 |

|

|

Long-term portion of lease liabilities |

|

2,100 |

|

|

|

2,210 |

|

|

Other liabilities |

|

38 |

|

|

|

182 |

|

|

|

|

|

|

Total liabilities |

|

23,689 |

|

|

|

32,531 |

|

|

|

|

|

|

Total stockholders’ deficit |

|

(3,137 |

) |

|

|

(11,852 |

) |

|

|

|

|

|

Total liabilities and stockholders’ deficit |

$ |

20,552 |

|

|

$ |

20,679 |

|

|

|

|

|

CONTRAFECT

CORPORATIONStatements of Operations

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

(unaudited) |

|

Operating expenses: |

|

|

|

Research and development |

$ |

5,295 |

|

|

$ |

12,725 |

|

|

General and administrative |

|

3,563 |

|

|

|

3,254 |

|

|

|

|

|

|

Total operating expenses |

|

8,858 |

|

|

|

15,979 |

|

|

|

|

|

|

Loss from operations |

|

(8,858 |

) |

|

|

(15,979 |

) |

|

Other income (expense): |

|

|

|

Interest income, net |

|

87 |

|

|

|

34 |

|

|

Change in fair value of warrant liabilities |

|

7,400 |

|

|

|

(4,212 |

) |

|

|

|

|

|

Total other (expense) income, net |

|

7,487 |

|

|

|

(4,178 |

) |

|

|

|

|

|

Net loss |

$ |

(1,371 |

) |

|

$ |

(20,157 |

) |

|

|

|

|

|

Per share information: |

|

|

|

Net loss per share of common stock, basic and diluted |

$ |

(0.69 |

) |

|

$ |

(41.00 |

) |

|

|

|

|

|

Basic and diluted weighted average shares outstanding |

|

1,975,476 |

|

|

|

491,626 |

|

|

|

|

|

In this release, management has presented its

financial position as of March 31, 2023 and its operating results

for the three months ended March 31, 2023 and 2022 in accordance

with U.S. Generally Accepted Accounting Principles (GAAP). All

share and per share amounts have been adjusted for all periods

presented to reflect a one-for-eighty reverse stock split effected

on February 14, 2023. The Company's financial position as of

December 31, 2022 has been extracted from the Company's audited

financial statements included in its Annual Report on Form 10-K

filed with the Securities and Exchange Commission on March 31,

2023. You should refer to the Company's Annual Report on Form 10-K

for a complete discussion of financial information.

Investor Relations Contacts:

Michael MessingerContraFect CorporationEmail:

mmessinger@contrafect.com

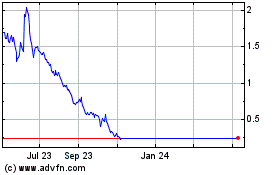

ContraFect (NASDAQ:CFRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

ContraFect (NASDAQ:CFRX)

Historical Stock Chart

From Dec 2023 to Dec 2024