000130577312/312023Q2FALSE0.040.040.040.040.040.040.040.040.040.040.040.040.040.040.04P1Y0.50.10.060.050.040.110.0830.070.040.040.040.040.040.040.040.040.040.040.040.0400013057732023-01-012023-06-3000013057732023-07-31xbrli:shares00013057732023-06-30iso4217:USD00013057732022-12-31iso4217:USDxbrli:shares0001305773us-gaap:ProductMember2023-04-012023-06-300001305773us-gaap:ProductMember2022-04-012022-06-300001305773us-gaap:ProductMember2023-01-012023-06-300001305773us-gaap:ProductMember2022-01-012022-06-300001305773us-gaap:RoyaltyMember2023-04-012023-06-300001305773us-gaap:RoyaltyMember2022-04-012022-06-300001305773us-gaap:RoyaltyMember2023-01-012023-06-300001305773us-gaap:RoyaltyMember2022-01-012022-06-3000013057732023-04-012023-06-3000013057732022-04-012022-06-3000013057732022-01-012022-06-30xbrli:pure0001305773us-gaap:CommonStockMember2023-03-310001305773us-gaap:AdditionalPaidInCapitalMember2023-03-310001305773us-gaap:RetainedEarningsMember2023-03-310001305773us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100013057732023-03-310001305773us-gaap:CommonStockMemberus-gaap:RestrictedStockMember2023-04-012023-06-300001305773us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001305773us-gaap:RetainedEarningsMember2023-04-012023-06-300001305773us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001305773us-gaap:CommonStockMember2023-06-300001305773us-gaap:AdditionalPaidInCapitalMember2023-06-300001305773us-gaap:RetainedEarningsMember2023-06-300001305773us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001305773us-gaap:CommonStockMember2022-12-310001305773us-gaap:AdditionalPaidInCapitalMember2022-12-310001305773us-gaap:RetainedEarningsMember2022-12-310001305773us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001305773us-gaap:CommonStockMemberus-gaap:RestrictedStockMember2023-01-012023-06-300001305773us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001305773us-gaap:RetainedEarningsMember2023-01-012023-06-300001305773us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001305773us-gaap:CommonStockMember2022-03-310001305773us-gaap:AdditionalPaidInCapitalMember2022-03-310001305773us-gaap:RetainedEarningsMember2022-03-310001305773us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-3100013057732022-03-310001305773us-gaap:CommonStockMemberus-gaap:RestrictedStockMember2022-04-012022-06-300001305773us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001305773us-gaap:RetainedEarningsMember2022-04-012022-06-300001305773us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001305773us-gaap:CommonStockMember2022-06-300001305773us-gaap:AdditionalPaidInCapitalMember2022-06-300001305773us-gaap:RetainedEarningsMember2022-06-300001305773us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-3000013057732022-06-300001305773us-gaap:CommonStockMember2021-12-310001305773us-gaap:AdditionalPaidInCapitalMember2021-12-310001305773us-gaap:RetainedEarningsMember2021-12-310001305773us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100013057732021-12-310001305773us-gaap:CommonStockMemberus-gaap:RestrictedStockMember2022-01-012022-06-300001305773us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300001305773us-gaap:RetainedEarningsMember2022-01-012022-06-300001305773us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-06-300001305773us-gaap:CommonStockMembercfms:MergerAgreementMembercfms:Restor3dIncMember2023-06-220001305773cfms:MergerAgreementMembercfms:Restor3dIncMember2023-06-220001305773cfms:MidCapFinancialServicesLLCTermLoanMembercfms:TermLoanMembercfms:MidCapFinancialServicesLLCMember2021-11-220001305773cfms:MidCapFinancialServicesLLCTermLoanMembercfms:TermLoanMembercfms:MidCapFinancialServicesLLCMember2021-11-222021-11-220001305773us-gaap:CommonStockMembercfms:MergerAgreementMembercfms:Restor3dIncMembercfms:MidCapFinancialServicesLLCMember2023-06-3000013057732022-10-262022-10-260001305773cfms:ImproperClassificationofCostofRevenueMember2023-04-012023-06-300001305773cfms:ImproperClassificationofCostofRevenueMember2023-01-012023-06-300001305773cfms:ImproperClassificationofCostofRevenueMember2022-04-012022-06-300001305773cfms:ImproperClassificationofCostofRevenueMember2022-01-012022-06-300001305773srt:MinimumMember2023-01-012023-06-300001305773srt:MaximumMember2023-01-012023-06-3000013057732023-01-0100013057732022-01-0100013057732023-04-262023-04-260001305773cfms:Paragon28IncMember2021-04-082021-04-080001305773cfms:Paragon28IncMember2021-10-012021-10-310001305773cfms:Paragon28IncMember2022-04-072022-04-070001305773cfms:Paragon28IncMember2021-04-012021-06-300001305773cfms:Paragon28IncMember2022-01-012022-03-3100013057732022-01-012022-12-310001305773us-gaap:ShippingAndHandlingMember2022-04-012022-06-300001305773us-gaap:ShippingAndHandlingMember2023-04-012023-06-300001305773us-gaap:ShippingAndHandlingMember2023-01-012023-06-300001305773us-gaap:ShippingAndHandlingMember2022-01-012022-06-30cfms:segment0001305773us-gaap:StockOptionMember2023-04-012023-06-300001305773us-gaap:StockOptionMember2022-04-012022-06-300001305773us-gaap:StockOptionMember2023-01-012023-06-300001305773us-gaap:StockOptionMember2022-01-012022-06-300001305773us-gaap:TradeAccountsReceivableMember2023-01-012023-06-300001305773us-gaap:TradeAccountsReceivableMember2022-01-012022-12-310001305773cfms:OtherReceivablesMember2023-01-012023-06-300001305773cfms:OtherReceivablesMember2022-01-012022-12-310001305773us-gaap:EquipmentMembersrt:MinimumMember2023-06-300001305773us-gaap:EquipmentMembersrt:MaximumMember2023-06-300001305773us-gaap:EquipmentMember2023-06-300001305773us-gaap:EquipmentMember2022-12-310001305773srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2023-06-300001305773us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2023-06-300001305773us-gaap:FurnitureAndFixturesMember2023-06-300001305773us-gaap:FurnitureAndFixturesMember2022-12-310001305773cfms:ComputerEquipmentAndSoftwareMember2023-06-300001305773cfms:ComputerEquipmentAndSoftwareMember2022-12-310001305773srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2023-06-300001305773us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2023-06-300001305773us-gaap:LeaseholdImprovementsMember2023-06-300001305773us-gaap:LeaseholdImprovementsMember2022-12-310001305773cfms:ReusableInstrumentsMember2023-06-300001305773cfms:ReusableInstrumentsMember2022-12-310001305773cfms:MoldingAndToolingMember2023-06-300001305773cfms:MoldingAndToolingMember2022-12-310001305773srt:MinimumMember2023-06-300001305773srt:MaximumMember2023-06-30cfms:extension0001305773cfms:BillericaFacilityMember2023-06-300001305773srt:MinimumMembercfms:MembersOfScientificAdvisoryBoardMembercfms:RevenueShareAgreementMember2023-01-012023-06-300001305773cfms:MembersOfScientificAdvisoryBoardMembercfms:RevenueShareAgreementMembersrt:MaximumMember2023-01-012023-06-300001305773cfms:RevenueShareAgreementMember2023-04-012023-06-300001305773cfms:RevenueShareAgreementMember2023-01-012023-06-300001305773cfms:RevenueShareAgreementMember2022-04-012022-06-300001305773cfms:RevenueShareAgreementMember2022-01-012022-06-300001305773cfms:ConformisVMedactaMember2019-08-292019-08-29cfms:patent0001305773cfms:ConformisVMedactaMember2022-07-28iso4217:EUR0001305773cfms:OsteoplasticsVConformisMember2020-03-202020-03-200001305773cfms:ConformisVDePuyMember2021-04-302021-04-300001305773cfms:ConformisVExactechMember2021-06-032021-06-030001305773cfms:ConformisVBodycadAndExactechMember2021-06-032021-06-030001305773cfms:ConformisVBodycadAndExactechMember2021-09-102021-09-100001305773cfms:TermLoanMembercfms:MidCapFinancialServicesLLCMember2023-06-300001305773cfms:TermLoanMembercfms:MidCapFinancialServicesLLCMember2022-12-310001305773cfms:MidCapFinancialServicesLLCTermLoanMembercfms:TermLoanMembercfms:LondonInterbankOfferedRateLIBOR1Membercfms:MidCapFinancialServicesLLCMember2021-10-312021-10-310001305773cfms:MidCapFinancialServicesLLCTermLoanMembersrt:MinimumMembercfms:TermLoanMembercfms:LondonInterbankOfferedRateLIBOR1Membercfms:MidCapFinancialServicesLLCMember2021-10-312021-10-310001305773cfms:MidCapFinancialServicesLLCTermLoanMembercfms:TermLoanMembercfms:MidCapFinancialServicesLLCMember2021-10-312021-10-310001305773cfms:MidCapFinancialServicesLLCTermLoanMembercfms:TermLoanMembercfms:MidCapFinancialServicesLLCMembercfms:SecuredOvernightFinancingRateSOFRMember2021-10-312021-10-310001305773cfms:MidCapFinancialServicesLLCTermLoanMembersrt:MinimumMembercfms:TermLoanMembercfms:MidCapFinancialServicesLLCMembercfms:SecuredOvernightFinancingRateSOFRMember2021-10-312021-10-310001305773cfms:TermLoanMembercfms:MidCapFinancialServicesLLCMember2021-11-2200013057732021-03-2900013057732021-03-3000013057732022-10-260001305773cfms:A2019RightsAgreementMember2019-06-252019-06-2500013057732020-03-232020-03-230001305773cfms:CowenSalesAgreementMember2020-08-052020-08-050001305773cfms:ShelfRegistrationStatementMember2021-02-172021-02-170001305773cfms:ShelfRegistrationStatementMember2021-02-170001305773cfms:PreFundedWarrantsMember2020-09-232020-09-230001305773cfms:PreFundedWarrantsMember2020-09-230001305773cfms:RegisteredDirectOfferingMembercfms:WarrantsForPurchaseOfCommonStockMember2020-09-230001305773cfms:WarrantsForPurchaseOfCommonStockMember2020-09-242023-06-300001305773us-gaap:MeasurementInputExpectedTermMembercfms:PreFundedWarrantsMember2020-09-232020-09-230001305773cfms:PreFundedWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2020-09-230001305773cfms:MeasurementInputDividendYieldMembercfms:PreFundedWarrantsMember2020-09-230001305773cfms:PreFundedWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2020-09-230001305773cfms:PreFundedWarrantsMemberus-gaap:MeasurementInputExercisePriceMember2020-09-230001305773us-gaap:MeasurementInputSharePriceMembercfms:PreFundedWarrantsMember2020-09-230001305773cfms:WarrantExchangeAgreementWithArmisticeCapitalMasterFundLtdMember2023-06-220001305773cfms:WarrantsForPurchaseOfCommonStockMember2023-06-300001305773cfms:WarrantsForPurchaseOfCommonStockMember2022-12-310001305773cfms:WarrantsForPurchaseOfCommonStockMember2022-01-012022-12-310001305773cfms:WarrantsForPurchaseOfCommonStockMember2023-01-012023-06-300001305773cfms:EquityIncentivePlan2015Member2023-06-300001305773cfms:EquityIncentivePlan2015Member2023-01-010001305773cfms:EquityIncentivePlan2015Member2021-05-240001305773us-gaap:CommonStockMembercfms:A2019SalesTeamPlanMember2019-04-290001305773us-gaap:CommonStockMembercfms:A2019SalesTeamPlanMember2019-04-292019-04-290001305773us-gaap:CommonStockMembercfms:A2019SalesTeamPlanMember2023-06-300001305773cfms:EmployeeDirectorAndConsultantStockOptionsMember2022-12-310001305773cfms:EmployeeDirectorAndConsultantStockOptionsMember2023-01-012023-06-300001305773cfms:EmployeeDirectorAndConsultantStockOptionsMember2023-06-300001305773us-gaap:RestrictedStockMember2022-12-310001305773us-gaap:RestrictedStockMember2023-01-012023-06-300001305773us-gaap:RestrictedStockMember2023-06-300001305773us-gaap:RestrictedStockMember2023-04-012023-06-300001305773cfms:InducementAwardMembersrt:ChiefFinancialOfficerMember2020-02-012020-02-290001305773srt:ChiefFinancialOfficerMemberus-gaap:RestrictedStockMember2020-02-012020-02-290001305773cfms:InducementAwardMembersrt:ChiefFinancialOfficerMember2022-03-012022-03-310001305773srt:ChiefFinancialOfficerMemberus-gaap:RestrictedStockMember2022-03-012022-03-310001305773cfms:InducementAwardMembersrt:ChiefOperatingOfficerMember2022-04-012022-04-300001305773srt:ChiefOperatingOfficerMemberus-gaap:RestrictedStockMember2022-04-012022-04-300001305773us-gaap:CostOfSalesMember2023-04-012023-06-300001305773us-gaap:CostOfSalesMember2022-04-012022-06-300001305773us-gaap:CostOfSalesMember2023-01-012023-06-300001305773us-gaap:CostOfSalesMember2022-01-012022-06-300001305773us-gaap:SellingAndMarketingExpenseMember2023-04-012023-06-300001305773us-gaap:SellingAndMarketingExpenseMember2022-04-012022-06-300001305773us-gaap:SellingAndMarketingExpenseMember2023-01-012023-06-300001305773us-gaap:SellingAndMarketingExpenseMember2022-01-012022-06-300001305773us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001305773us-gaap:ResearchAndDevelopmentExpenseMember2022-04-012022-06-300001305773us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-300001305773us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-06-300001305773us-gaap:GeneralAndAdministrativeExpenseMember2023-04-012023-06-300001305773us-gaap:GeneralAndAdministrativeExpenseMember2022-04-012022-06-300001305773us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-06-300001305773us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-06-300001305773srt:MinimumMember2022-01-012022-12-310001305773srt:MaximumMember2022-01-012022-12-310001305773cfms:FixedRatioOneMember2022-10-262022-10-260001305773cfms:FixedRatioTwoMember2022-10-262022-10-260001305773cfms:FixedRatioThreeMember2022-10-262022-10-260001305773cfms:ApprovedRatioOneMember2022-10-262022-10-260001305773cfms:ApprovedRatioTwoMember2022-10-262022-10-260001305773cfms:ApprovedRatioThreeMember2022-10-262022-10-260001305773cfms:FixedRatioThreeMember2022-11-012022-11-300001305773cfms:RegisteredDirectOfferingMembercfms:WarrantsForPurchaseOfCommonStockMember2020-09-232020-09-230001305773us-gaap:CommonStockMembercfms:EquityIncentivePlan2015Member2022-01-012022-01-010001305773cfms:EquityIncentivePlan2015Member2021-05-242021-05-240001305773cfms:EquityIncentivePlan2015Member2023-03-312023-03-310001305773us-gaap:CommonStockMembercfms:A2019SalesTeamPlanMember2023-03-312023-03-310001305773srt:ChiefFinancialOfficerMember2020-02-012020-02-290001305773srt:ChiefFinancialOfficerMember2022-03-012022-03-310001305773srt:ChiefOperatingOfficerMember2022-04-012022-04-300001305773country:UScfms:KneeMember2023-04-012023-06-300001305773cfms:HipMembercountry:US2023-04-012023-06-300001305773us-gaap:ProductMembercountry:US2023-04-012023-06-300001305773country:UScfms:KneeMember2022-04-012022-06-300001305773cfms:HipMembercountry:US2022-04-012022-06-300001305773us-gaap:ProductMembercountry:US2022-04-012022-06-300001305773country:DEcfms:KneeMember2023-04-012023-06-300001305773country:DEcfms:HipMember2023-04-012023-06-300001305773country:DEus-gaap:ProductMember2023-04-012023-06-300001305773country:DEcfms:KneeMember2022-04-012022-06-300001305773country:DEcfms:HipMember2022-04-012022-06-300001305773country:DEus-gaap:ProductMember2022-04-012022-06-300001305773us-gaap:NonUsMembercfms:KneeMember2023-04-012023-06-300001305773cfms:HipMemberus-gaap:NonUsMember2023-04-012023-06-300001305773us-gaap:ProductMemberus-gaap:NonUsMember2023-04-012023-06-300001305773us-gaap:NonUsMembercfms:KneeMember2022-04-012022-06-300001305773cfms:HipMemberus-gaap:NonUsMember2022-04-012022-06-300001305773us-gaap:ProductMemberus-gaap:NonUsMember2022-04-012022-06-300001305773cfms:KneeMember2023-04-012023-06-300001305773cfms:HipMember2023-04-012023-06-300001305773cfms:KneeMember2022-04-012022-06-300001305773cfms:HipMember2022-04-012022-06-300001305773country:UScfms:KneeMember2023-01-012023-06-300001305773cfms:HipMembercountry:US2023-01-012023-06-300001305773us-gaap:ProductMembercountry:US2023-01-012023-06-300001305773country:UScfms:KneeMember2022-01-012022-06-300001305773cfms:HipMembercountry:US2022-01-012022-06-300001305773us-gaap:ProductMembercountry:US2022-01-012022-06-300001305773country:DEcfms:KneeMember2023-01-012023-06-300001305773country:DEcfms:HipMember2023-01-012023-06-300001305773country:DEus-gaap:ProductMember2023-01-012023-06-300001305773country:DEcfms:KneeMember2022-01-012022-06-300001305773country:DEcfms:HipMember2022-01-012022-06-300001305773country:DEus-gaap:ProductMember2022-01-012022-06-300001305773us-gaap:NonUsMembercfms:KneeMember2023-01-012023-06-300001305773cfms:HipMemberus-gaap:NonUsMember2023-01-012023-06-300001305773us-gaap:ProductMemberus-gaap:NonUsMember2023-01-012023-06-300001305773us-gaap:NonUsMembercfms:KneeMember2022-01-012022-06-300001305773cfms:HipMemberus-gaap:NonUsMember2022-01-012022-06-300001305773us-gaap:ProductMemberus-gaap:NonUsMember2022-01-012022-06-300001305773cfms:KneeMember2023-01-012023-06-300001305773cfms:HipMember2023-01-012023-06-300001305773cfms:KneeMember2022-01-012022-06-300001305773cfms:HipMember2022-01-012022-06-300001305773country:US2023-06-300001305773country:US2022-12-310001305773country:DE2023-06-300001305773country:DE2022-12-310001305773us-gaap:NonUsMember2023-06-300001305773us-gaap:NonUsMember2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-37474

Conformis, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 56-2463152 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification Number) |

| | | | | |

600 Technology Park Drive Billerica, MA | 01821 |

| (Address of principal executive offices) | (Zip Code) |

(781) 345-9001

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” and "emerging growth company," in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐

|

| | | | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | |

| | Emerging growth company | ☐ |

| | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | | |

| Common Stock, $0.00001 par value | CFMS | The Nasdaq Capital Market | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

As of July 31, 2023, there were 7,877,493 shares of Common Stock, $0.00001 par value per share, outstanding. The number of shares outstanding takes in account the 1-for-25 reverse stock split that was consummated on November 9, 2022.

Conformis, Inc.

INDEX

PART I - FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS

CONFORMIS, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(in thousands, except share and per share data)

| | | | | | | | | | | |

| | June 30, 2023 | | December 31, 2022 |

| | (unaudited) | | |

| Assets | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 26,182 | | | $ | 48,667 | |

| | | |

| Accounts receivable, net | 7,676 | | | 9,773 | |

| Royalty and licensing receivable | 121 | | | 134 | |

| Inventories, net | 19,024 | | | 18,910 | |

| Prepaid expenses and other current assets | 1,616 | | | 1,785 | |

| Total current assets | 54,619 | | | 79,269 | |

| Property and equipment, net | 7,455 | | | 8,154 | |

| Operating lease right-of-use assets | 5,159 | | | 6,078 | |

| Other Assets | | | |

| Restricted cash | 462 | | | 462 | |

| | | |

| | | |

| | | |

| Other long-term assets | 86 | | | 85 | |

| Total assets | $ | 67,781 | | | $ | 94,048 | |

| | | |

| Liabilities and stockholders' equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 3,584 | | | $ | 4,163 | |

| Accrued expenses | 5,252 | | | 7,978 | |

| Operating lease liabilities | 1,936 | | | 1,932 | |

| | | |

| | | |

| | | |

| | | |

| Total current liabilities | 10,772 | | | 14,073 | |

| Other long-term liabilities | 336 | | | 230 | |

| | | |

| | | |

| Long-term debt, less debt issuance costs | 20,639 | | | 20,563 | |

| Operating lease liabilities | 4,009 | | | 5,003 | |

| Total liabilities | 35,756 | | | 39,869 | |

| Commitments and contingencies | | | |

| Stockholders’ equity | | | |

Preferred stock, $0.00001 par value: | | | |

Authorized: 5,000,000 shares authorized at June 30, 2023 and December 31, 2022; no shares issued and outstanding as of June 30, 2023 and December 31, 2022 | — | | — |

Common stock, $0.00001 par value: | | | |

Authorized: 20,000,000 shares authorized at June 30, 2023 and December 31, 2022; 7,878,332 and 7,502,462 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively | — | | | — | |

| Additional paid-in capital | 635,703 | | | 634,647 | |

| Accumulated deficit | (603,906) | | | (581,324) | |

| Accumulated other comprehensive income | 228 | | | 856 | |

| Total stockholders’ equity | 32,025 | | | 54,179 | |

| Total liabilities and stockholders’ equity | $ | 67,781 | | | $ | 94,048 | |

The accompanying notes are an integral part of these consolidated financial statements.

CONFORMIS, INC. AND SUBSIDIARIES

Consolidated Statements of Operations

(unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | | | | | | |

| Product | $ | 12,496 | | | $ | 15,142 | | | $ | 25,187 | | | $ | 30,026 | |

| Royalty and licensing | 527 | | | 153 | | | 673 | | | 820 | |

| Total revenue | 13,023 | | | 15,295 | | | 25,860 | | | 30,846 | |

| Cost of revenue | 11,189 | | | 9,835 | | | 18,923 | | | 19,645 | |

| Gross profit | 1,834 | | | 5,460 | | | 6,937 | | | 11,201 | |

| | | | | | | |

| Operating expenses | | | | | | | |

| Sales and marketing | 4,063 | | | 6,562 | | | 9,114 | | | 13,227 | |

| Research and development | 2,158 | | | 3,958 | | | 4,616 | | | 8,437 | |

| General and administrative | 7,918 | | | 7,693 | | | 14,941 | | | 17,026 | |

| | | | | | | |

| Total operating expenses | 14,139 | | | 18,213 | | | 28,671 | | | 38,690 | |

| Loss from operations | (12,305) | | | (12,753) | | | (21,734) | | | (27,489) | |

| | | | | | | |

| Other income and expenses | | | | | | | |

| Interest income | 6 | | | 14 | | | 15 | | | 31 | |

| Interest expense | (668) | | | (453) | | | (1,305) | | | (904) | |

| | | | | | | |

| | | | | | | |

| Foreign currency exchange transaction (loss) income | (13) | | | (2,432) | | | 455 | | | (3,259) | |

| Total other expenses | (675) | | | (2,871) | | | (835) | | | (4,132) | |

| Loss before income taxes | (12,980) | | | (15,624) | | | (22,569) | | | (31,621) | |

| Income tax (benefit) provision | 31 | | | (100) | | | 13 | | | (66) | |

| | | | | | | |

| Net loss | $ | (13,011) | | | $ | (15,524) | | | $ | (22,582) | | | $ | (31,555) | |

| | | | | | | |

| Net loss per share | | | | | | | |

| Basic and diluted* | $ | (1.78) | | | $ | (2.15) | | | $ | (3.10) | | | $ | (4.39) | |

| | | | | | | |

| Weighted average common shares outstanding | | | | | | | |

| Basic and diluted* | 7,316,286 | | | 7,211,851 | | | 7,291,542 | | | 7,189,634 | |

| | | | | | | |

*Adjusted for the 1-for-25 reverse stock split

The accompanying notes are an integral part of these consolidated financial statements.

CONFORMIS, INC. AND SUBSIDIARIES

Consolidated Statements of Comprehensive (Loss) Income

(unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | | |

| | 2023 | | 2022 | | 2023 | | 2022 | | |

| Net loss | $ | (13,011) | | | $ | (15,524) | | | $ | (22,582) | | | $ | (31,555) | | | |

| Other comprehensive (loss) income | | | | | | | | | |

| Foreign currency translation adjustments | (24) | | | 2,113 | | | (628) | | | 2,850 | | | |

| | | | | | | | | |

| Comprehensive loss | $ | (13,035) | | | $ | (13,411) | | | $ | (23,210) | | | $ | (28,705) | | | |

The accompanying notes are an integral part of these consolidated financial statements.

CONFORMIS, INC. AND SUBSIDIARIES

Consolidated Statements of Changes in Stockholders' Equity

(unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2023 |

| Common Stock | | Additional Paid-In Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Income | | |

| Shares | | Par Value | | | | | Total |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balance, March 31, 2023 | 7,497,138 | | | $ | — | | | $ | 635,268 | | | $ | (590,895) | | | $ | 252 | | | $ | 44,625 | |

| Issuance of common stock—restricted stock | 381,194 | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Compensation expense related to issued stock options and restricted stock awards | — | | | — | | | 435 | | | — | | | — | | | 435 | |

| Net loss | — | | | — | | | — | | | (13,011) | | | — | | | (13,011) | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | (24) | | | (24) | |

| Balance, June 30, 2023 | 7,878,332 | | | $ | — | | | $ | 635,703 | | | $ | (603,906) | | | $ | 228 | | | $ | 32,025 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2023 |

| Common Stock | | Additional Paid-In Capital | | Accumulated Deficit | | Accumulated Other Comprehensive (Loss) Income | | |

| Shares | | Par Value | | | | | Total |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balance, December 31, 2022 | 7,502,462 | | | $ | — | | | $ | 634,647 | | | $ | (581,324) | | | $ | 856 | | | $ | 54,179 | |

| Issuance of common stock—restricted stock | 375,870 | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Compensation expense related to issued stock options and restricted stock awards | — | | | — | | | 1,056 | | | — | | | — | | | 1,056 | |

| Net loss | — | | | — | | | — | | | (22,582) | | | — | | | (22,582) | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | (628) | | | (628) | |

| Balance, June 30, 2023 | 7,878,332 | | | $ | — | | | $ | 635,703 | | | $ | (603,906) | | | $ | 228 | | | $ | 32,025 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2022 |

| Common Stock | | Additional Paid-In Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Income | | |

| Shares* | | Par Value | | | | | Total |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balance, March 31, 2022 | 7,413,309 | | | $ | 2 | | | $ | 633,249 | | | $ | (546,882) | | | $ | (375) | | | $ | 85,994 | |

| Issuance of common stock—restricted stock | 115,774 | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Compensation expense related to issued stock options and restricted stock awards | — | | | — | | | 847 | | | — | | | — | | | 847 | |

| Net loss | — | | | — | | | — | | | (15,524) | | | — | | | (15,524) | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 2,113 | | | 2,113 | |

| Balance, June 30, 2022 | 7,529,083 | | | $ | 2 | | | $ | 634,096 | | | $ | (562,406) | | | $ | 1,738 | | | $ | 73,430 | |

*Adjusted for the 1-for-25 reverse stock split

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2022 |

| Common Stock | | Additional Paid-In Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Income | | |

| Shares* | | Par Value | | | | | Total |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balance, December 31, 2021 | 7,441,696 | | | $ | 2 | | | $ | 632,513 | | | $ | (530,851) | | | $ | (1,112) | | | $ | 100,552 | |

| Issuance of common stock—restricted stock | 87,387 | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Compensation expense related to issued stock options and restricted stock awards | — | | | — | | | 1,583 | | | — | | | — | | | 1,583 | |

| Net loss | — | | | — | | | — | | | (31,555) | | | — | | | (31,555) | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 2,850 | | | 2,850 | |

| Balance, June 30, 2022 | 7,529,083 | | | $ | 2 | | | $ | 634,096 | | | $ | (562,406) | | | $ | 1,738 | | | $ | 73,430 | |

*Adjusted for the 1-for-25 reverse stock split

The accompanying notes are an integral part of these consolidated financial statements.

CONFORMIS, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(unaudited)

(in thousands)

| | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (22,582) | | | $ | (31,555) | |

| | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization expense | 1,835 | | | 2,134 | |

| | | |

| Stock-based compensation expense | 1,056 | | | 1,583 | |

| Unrealized foreign exchange (gain) loss | (495) | | | 3,115 | |

| Non-cash lease expense | 780 | | | 752 | |

| Provision for credit losses | 132 | | | 191 | |

| | | |

| Impairment of long-term assets | 80 | | | — | |

| | | |

| | | |

| Non-cash interest expense | 78 | | | 83 | |

| | | |

| | | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 1,966 | | | (648) | |

| Royalty and licensing receivable | 13 | | | 125 | |

| Inventories | (113) | | | (1,523) | |

| Prepaid expenses and other assets | 167 | | | 60 | |

| | | |

| Accounts payable, accrued expenses and other liabilities | (4,054) | | | (1,079) | |

| | | |

| | | |

| | | |

| | | |

| Net cash used in operating activities | (21,137) | | | (26,762) | |

| | | |

| Cash flows from investing activities: | | | |

| Acquisition of property and equipment | (1,215) | | | (990) | |

| | | |

| | | |

| | | |

| | | |

| Net cash used in investing activities | (1,215) | | | (990) | |

| | | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by financing activities | — | | | — | |

| Foreign exchange effect on cash and cash equivalents | (133) | | | (263) | |

| Decrease in cash, cash equivalents and restricted cash | (22,485) | | | (28,015) | |

| Cash, cash equivalents and restricted cash beginning of period | 49,129 | | | 101,118 | |

| Cash, cash equivalents and restricted cash end of period | $ | 26,644 | | | $ | 73,103 | |

| | | |

| Supplemental information: | | | |

| | | |

| Cash paid for interest | 1,124 | | | 715 | |

| Non cash investing and financing activities: | | | |

| Operating leases right-of-use assets obtained in exchange for lease obligations | (137) | | | 63 | |

| | | |

The accompanying notes are an integral part of these consolidated financial statements.

CONFORMIS, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

Note A—Organization and Basis of Presentation

Conformis, Inc. (together with its subsidiaries, collectively, the “Company”) is a medical technology company that uses its proprietary iFit Image-to-Implant technology platform to develop, manufacture and sell joint replacement implants that are individually sized and shaped, which the Company refers to as personalized, individualized, or sometimes as customized, to fit and conform to each patient’s unique anatomy. The Company also offers Identity Imprint, a new line of total knee replacement products that utilizes a proprietary algorithm to select the implant size that most closely meets the geometric and anatomic requirements of the patient’s knee. Conformis’ sterile, just-in-time, Surgery-in-a-Box delivery system is available with all of its implants and personalized, single-use instruments. The Company’s proprietary iFit technology platform is potentially applicable to all major joints.

The Company was incorporated in Delaware and commenced operations in 2004. The Company introduced its iUni and iDuo in 2007, its iTotal CR in 2011, its iTotal PS in 2015, its Conformis hip system in 2018, and its Identity Imprint in 2021. The Company has its corporate offices in Billerica, Massachusetts.

Merger Agreement with restor3d, Inc.

On June 22, 2023, the “Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with restor3d, Inc. (“restor3d”) and Cona Merger Sub Inc., a wholly owned subsidiary of restor3d (“Merger Sub”). Upon the terms and subject to the conditions set forth in the Merger Agreement, which has been unanimously adopted by the Board of Directors of the Company (the “Board”), Merger Sub will merge with and into the Company, with the Company continuing as the surviving corporation and a wholly owned subsidiary of restor3d (the “Merger”). The Board also unanimously resolved to recommend that the Company’s stockholders vote to adopt and approve the Merger Agreement and the Merger.

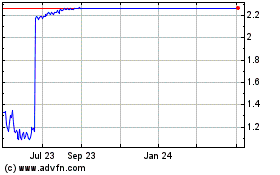

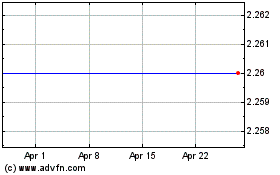

Pursuant to the Merger Agreement, upon the closing of the Merger (the “Closing”), each outstanding share of Company common stock, other than shares owned by the Company, restor3d or Merger Sub (which will be cancelled) and shares with respect to which appraisal rights are properly exercised and not withdrawn under Delaware law, will automatically be converted into the right to receive $2.27 in cash, without interest (the “Merger Consideration”).

If the Merger is consummated, the Company’s common stock will be delisted from The Nasdaq Capital Market and deregistered under the Securities Exchange Act of 1934.

In connection with the Merger, the vesting of each outstanding restricted stock unit of the Company will accelerate, and the holders of such units will receive an amount per unit equal to the Merger Consideration. All stock options and warrants of the Company that are currently outstanding have a strike price per share greater than the Merger Consideration, and will be cancelled in connection with the Merger without payment, unless exercised prior to consummation of the Merger.

The consummation of the Merger is subject to certain customary closing conditions, including (i) the adoption of the Merger Agreement by the holders of a majority of the outstanding shares of the Company’s common stock (the “Stockholder Approval”), and (ii) no temporary restraining order, preliminary or permanent injunction or other order is in effect preventing the consummation of the Merger. Moreover, each party’s obligations to consummate the Merger are subject to certain other conditions, including (a) the accuracy of the other party’s representations and warranties (subject to certain materiality exceptions), (b) the other party’s compliance in all material respects with its obligations under the Merger Agreement, and (c) in the case of restor3d and Merger Sub only, the absence of any event, change, or effect that would, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect (as defined in the Merger Agreement). A special meeting of the stockholders of the Company is scheduled to be held on August 31, 2023 to vote on, among other things, a proposal to adopt the Merger Agreement. Subject to the satisfaction of the closing conditions, the parties anticipate that the Merger will be consummated by the end of the third quarter of 2023.

The Merger Agreement contains representations and warranties and covenants of the parties customary for a transaction of this nature. Until the earlier of the termination of the Merger Agreement and the closing of the Merger, the Company has agreed to use its reasonable best efforts to conduct its business in all material respects in the ordinary course of business and has agreed to certain other operating covenants and to not take certain specified actions prior to the consummation of the Merger, as set forth more fully in the Merger Agreement. The Company has also agreed to convene and hold a meeting of its stockholders for the purpose of obtaining the Stockholder Approval. In addition, the Merger Agreement requires that, subject to certain exceptions, the Board recommend that the Company’s stockholders approve the Merger Agreement.

In addition, the Company has agreed not to initiate, solicit or knowingly encourage takeover proposals from third parties. The Company has also agreed not to provide non-public information to, or, subject to certain exceptions, engage in discussions or negotiations with, third parties regarding takeover proposals. Notwithstanding these restrictions, prior to the receipt of the Stockholder Approval, the Company may under certain circumstances provide non-public information to and participate in discussions or negotiations with third parties with respect to takeover proposals.

Prior to obtaining the Stockholder Approval, the Board may, among other things, change its recommendation that the stockholders approve the Merger Agreement in connection with a Superior Offer or an Intervening Event (in each case, as defined in the Merger Agreement), or terminate the Merger Agreement to enter into an agreement providing for a Superior Offer, subject, in each case, to complying with notice and other specified conditions, including giving restor3d the opportunity to propose revisions to the terms of the Merger Agreement during a period following notice.

The Merger Agreement contains certain termination rights for the Company and restor3d, including, among others, the right of (1) the Company to terminate the Merger Agreement in order to enter into an agreement providing for a Superior Offer (subject to the Company’s compliance with certain obligations under the Merger Agreement related to such Superior Offer and such termination) and (2) restor3d to terminate the Merger Agreement if the Board changes its recommendation with respect to the Merger Agreement. The Merger Agreement also provides that under specified circumstances, including in the event of termination by the Company to enter into an agreement providing for a Superior Offer, the Company will be required to pay restor3d a termination fee of $0.9 million and provide restor3d with a non-exclusive license to the Company’s patents except with respect to certain knee and/or hip applications.

Liquidity and operations

These consolidated financial statements as of June 30, 2023 and for the three and six months ended June 30, 2023 and 2022, and related interim information contained within the notes to the Consolidated Financial Statements, have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business.

Since the Company’s inception in June 2004, it has financed its operations primarily through private placements of preferred stock, its initial public offering in July 2015, other equity financings, debt and convertible debt financings, equipment purchase loans, patent licensing, and product revenue beginning in 2007. The Company has recurring losses and cash used in operating activities for the three and six months ended June 30, 2023 and 2022. At June 30, 2023, the Company had an accumulated deficit of $603.9 million and cash and cash equivalents of $26.2 million, and $0.5 million in restricted cash allocated to a lease deposit.

In addition, as of such date, the Company owed $21 million under its secured credit agreement with MidCap Financial Trust (“MidCap”), as agent, and certain lender parties thereto. The credit agreement provides for a five-year, $21 million secured term loan facility. However, as further described below under “Item 1A. Risk Factors,” if the proposed merger transaction with restor3d is not consummated, absent us raising additional capital, MidCap could allege that a material adverse effect has occurred under the credit agreement, which could permit MidCap to accelerate amounts due under the agreement.

The recurring losses and uncertainties about the Company's ability to raise capital raise substantial doubt about the Company's ability to continue as a going concern within one year after the issuance date to these financial statements. The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

The Company plans to address matters that raise substantial doubt about its ability to continue as a going concern through the completion of the Merger Agreement with restor3d. However, if the merger is not successful, the Company will require additional capital in the near-term to support its business growth and continued operations, and, based on the recent state of equity capital markets and the Company’s exploration of potential financing alternatives, the Company and its board of directors believe that it will be very challenging to obtain such financing on terms that would preserve value for the Company’s current stockholders. Absent the Company being able to obtain a sufficient level of new capital in the near-term, the Company could need to file for bankruptcy protection, which the Company and its board of directors believe would likely result in current Company stockholders receiving little, if any, value for their shares of Company common stock (and, in any event, an amount substantially less than the $2.27 per share of common stock provided for by the Merger Agreement).

Basis of presentation and use of estimates

The preparation of consolidated financial statements in conformity with generally accepted accounting principles in the United States ("U.S. GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenue and expenses during the reporting periods. The most significant estimates used in these consolidated financial statements include revenue recognition, accounts receivable valuation, inventory reserves, impairment assessments, income tax reserves and related allowances, and the lives of property and equipment. Actual results may differ from those estimates. The interim financial statements should be read in conjunction with the audited financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

Unaudited Interim Financial Information

The accompanying Interim Consolidated Financial Statements as of June 30, 2023 and for the three and six months ended June 30, 2023 and 2022, and related interim information contained within the notes to the Consolidated Financial Statements are unaudited. These unaudited interim consolidated financial statements have been prepared in accordance with GAAP. In management’s opinion, the unaudited interim consolidated financial statements have been prepared on the same basis as the audited financial statements and include all adjustments (including normal recurring adjustments) necessary for the fair presentation of the Company’s financial position as of June 30, 2023, results of operations for and stockholders' equity for the three and six months ended June 30, 2023 and 2022, and comprehensive loss, and cash flows for the six months ended June 30, 2023 and 2022. The results for the three and six months ended June 30, 2023 are not necessarily indicative of the results expected for the full year or any interim period.

Note B—Summary of Significant Accounting Policies

The Company's financial results are affected by the selection and application of accounting policies and methods. There were no material changes in the six months ended June 30, 2023 to the application of significant accounting policies and estimates as described in its audited consolidated financial statements for the year ended December 31, 2022.

Concentrations of credit risk and other risks and uncertainties

Financial instruments that subject the Company to credit risk primarily consist of cash, cash equivalents, and accounts receivable. The Company maintains the majority of its cash with accredited financial institutions which mitigates potential risks related to concentration. The Company had $0.6 million as of June 30, 2023 and $1.2 million as of December 31, 2022 held in foreign bank accounts that are not federally insured. In addition, the cash held in U.S bank accounts exceeds the federally insured limits.

The Company and its contract manufacturers rely on sole source suppliers and service providers for certain components. A shortage or stoppage of shipments of the materials or components that the Company purchases could result in a delay in production or adversely affect the Company’s operating results.

For the three and six months ended June 30, 2023, no customer represented greater than 10% of total revenue. For the three and six months ended June 30, 2022, no customer represented greater than 10% of total revenue. As of June 30, 2023 and December 31, 2022, respectively, there was no customer that represented greater than 10% of the total net receivable balance.

Principles of consolidation

The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries including ImaTx, Inc., ConforMIS Europe GmbH, ConforMIS UK Limited, ConforMIS Hong Kong Limited, Conformis India LLP, and Conformis Cares LLC. All intercompany balances and transactions have been eliminated in consolidation.

Cash, cash equivalents and restricted cash

The Company considers all highly liquid investment instruments with original maturities of 90 days or less when purchased to be cash equivalents. The Company’s cash equivalents consist of demand deposits and money market accounts. Demand deposits and money market accounts are carried at cost which approximates their fair value. The Company has recorded restricted cash of $0.5 million as of June 30, 2023 and December 31, 2022. Restricted cash consisted of security provided for lease obligations.

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the consolidated balance sheets that sum to the total of the same such amounts shown in the consolidated statements of cash flows.

| | | | | | | | | | | |

| June 30,

2023 | | December 31,

2022 |

| Cash and cash equivalents | $ | 26,182 | | | $ | 48,667 | |

| Restricted cash | 462 | | | 462 | |

| Total cash, cash equivalents, and restricted cash shown in the statement of cash flows | $ | 26,644 | | | $ | 49,129 | |

Fair value of financial instruments

Certain of the Company’s financial instruments, including cash and cash equivalents (excluding money market funds), accounts receivable, accounts payable, accrued expenses and other liabilities are carried at cost, which approximates their fair value because of the short-term maturity. The carrying value of the debt approximates fair value because the interest rate under the obligation approximates market rates of interest available to the Company for similar instruments.

Accounts receivable and allowance for credit losses

Accounts receivable consist of billed and unbilled amounts due from medical facilities or independent distributors (the "Customer"). Upon completion of a procedure, revenue is recognized and an unbilled receivable is recorded. Under Accounting Standards Codification ("ASC") Topic 606, Revenue from Contracts with Customers ("ASC 606"), an enforceable contract is met either at or prior to the procedure being performed. Upon receipt of a purchase order from the Customer, the billed receivable is recorded and the unbilled receivable is reversed. As a result, the unbilled receivable balance fluctuates based on the timing of the Company's receipt of purchase orders from the medical facilities. In estimating whether accounts receivable can be collected, the Company performs evaluations of customers and continuously monitors collections and payments and estimates an allowance for credit losses based on the aging of the underlying invoices, collections experience to date and any specific collection issues that have been identified. The allowance for credit losses is recorded in the period in which revenue is recorded or when collection risk is identified.

Inventories

Inventories consist of raw materials, work-in-process components and finished goods. Inventories are stated at the lower of cost, determined using the first-in first-out method, or net realizable value. The Company regularly reviews its inventory quantities on hand and related cost and records a provision for any excess or obsolete inventory based on its estimated forecast of product demand and existing product configurations. The Company also reviews its inventory value to determine if it reflects the lower of cost or market, based on net realizable value. Appropriate consideration is given to inventory items sold at negative gross margin, purchase commitments and other factors in evaluating net realizable value. During the three and six months ended June 30,

2023, the Company recognized provisions of $0.6 million and $0.9 million, respectively, to adjust its inventory value to the lower of cost or net realizable value for excess and obsolete reserves, and estimated unused product related to known and potential cancelled cases, which is included in cost of revenue. During the three and six months ended June 30, 2022, the Company recognized provisions of $0.8 million and $2.5 million, respectively, to adjust its inventory value to the lower of cost or net realizable value for excess and obsolete reserves, and estimated unused product related to known and potential cancelled cases, which is included in cost of revenue.

Property and equipment

Property and equipment is stated at cost less accumulated depreciation and is depreciated using the straight-line method over the estimated useful lives of the respective assets. Leasehold improvements are amortized over their useful life or the life of the lease, whichever is shorter. Assets capitalized under capital leases are amortized in accordance with the respective class of assets and the amortization is included with depreciation expense. Maintenance and repair costs are expensed as incurred.

Long-lived assets

The Company tests impairment of long-lived assets when events or changes in circumstances indicate that the assets might be impaired. If changes in circumstances lead the Company to believe that any of its long-lived assets may be impaired, the Company will test the asset group for recoverability, by evaluating whether the estimated undiscounted cash flows, including estimated residual value, generated from the asset group are sufficient to support the carrying value of the assets. During the quarter ended June 30, 2023, the Company had incurred current-period operating losses associated with its asset group, and as such, an assessment for recoverability was performed. Based on the assessment, the Company deemed its asset group to be recoverable, and no impairment charges were recognized for the quarter ended June 30, 2023.

Leases

The Company has elected not to separate non-lease components from all classes of leases. Non-lease components have been accounted for as part of the single lease component to which they are related.

Leases with an anticipated term, inclusive of renewals of 12 months or less are not recorded on the balance sheet; the Company recognizes lease expense for these leases on a straight-line basis over the lease term.

The Company has elected the hindsight practical expedient to determine the lease term for existing leases. This practical expedient enables an entity to use hindsight in determining the lease term when considering options to extend and terminate leases as well as purchase the underlying assets. The operating lease right-of-use assets are subsequently assessed for impairment in accordance with the Company's accounting policy for long-lived assets.

Revenue Recognition

Product Revenue Recognition

Revenue is recognized when, or as, obligations under the terms of a contract are satisfied, which occurs when control of the promised products or services is transferred to customers. Revenue is measured as the amount of consideration the Company expects to receive in exchange for transferring products or services to a customer (“transaction price”). When determining the transaction price of a contract, an adjustment is made if payment from a customer occurs either significantly before or significantly after performance, resulting in a significant financing component. Applying the practical expedient in paragraph 606-10-32-18, the Company does not assess whether a significant financing component exists if the period between when the Company performs its obligations under the contract and when the customer pays is one year or less. None of the Company’s contracts contained a significant financing component as of June 30, 2023. Payment is typically due between 30 and 60 days from invoice.

To the extent that the transaction price includes variable consideration, such as prompt-pay discounts or rebates, the Company estimates the amount of variable consideration that should be included in the transaction price utilizing the expected value to which the Company expects to be entitled. Variable consideration is included in the transaction price if, in the Company’s judgment, it is probable that a significant future reversal of cumulative revenue under the contract will not occur. Actual amounts of consideration ultimately received may differ from the Company's estimates. Estimates of variable consideration and determination of whether to include estimated amounts in the transaction price are based largely on an assessment of the Company’s anticipated performance and all information (historical, current and forecasted) that is reasonably available.

If the contract contains a single performance obligation, the entire transaction price is allocated to the single performance obligation. Contracts that contain multiple performance obligations require an allocation of the transaction price based on the estimated relative standalone selling prices of the promised products or services underlying each performance obligation. The Company determines standalone selling prices based on observable prices or a cost-plus margin approach when one is not available. Revenue is recognized at the time the related performance obligation is satisfied by transferring control of a promised good or service to a customer. The Company's performance obligations are satisfied at the same time, typically upon surgery, therefore, product revenue is recognized at a point in time upon completion of the surgery. Since the Company does not have contracts that extend beyond a duration of one year, there is no transaction price related to performance obligations that have not been satisfied.

Certain customer contracts include terms that allow the Company to bill for orders that are cancelled after the product is manufactured and could result in revenue recognition over time. However, the impact of adopting over time revenue recognition was deemed immaterial.

Under the long-term Distribution Agreement with Stryker, the Company supplies patient specific instrumentation to Stryker and revenue is recognized at a point in time, that is, when Stryker obtains control of the products.

Unconditional rights to consideration are reported as receivables. Incidental items that are immaterial in the context of the contract are recognized as expense. The Company records a contract liability when there is an obligation to transfer goods or services to a customer for which the Company has received consideration from the customer. As of January 1, 2023, the contract liability balance was $0.2 million. There was no contract liability balance recorded as of January 1, 2022. At June 30, 2023, the Company had $0.6 million of contract liabilities recorded on the Consolidated Balance Sheets derived from contracts with customers. There were no contract assets recorded at June 30, 2023. The Company did not have any contract assets or liabilities recorded at June 30, 2022.

Royalty and Licensing Revenue Recognition

The Company receives ongoing sales-based royalties under its license agreement (the "MicroPort License Agreement") with MicroPort Orthopedics Inc., a wholly owned subsidiary of MicroPort Scientific Corporation, (collectively, "MicroPort"). Royalty revenue is recorded at the expected value of the royalty revenue.

On February 9, 2023, the Company entered into a Settlement and License Agreement with Bodycad Laboratories, Inc. ("Bodycad") and Exactech, Inc. ("Exactech"), collectively, (the "Defendants"), pursuant to which the parties have agreed to terms for resolving all of their existing patent disputes. In consideration of the licenses, releases, covenants and other immunities granted by the Company to the Defendants, the Company received an upfront payment following the execution of the Settlement and License Agreement, and will receive an additional payment by June 30, 2023. The agreement provides for the grant of the licenses, covenants-not-to-sue, releases, and other significant deliverables upon receipt of full payment from. These individual rights are not accounted for as separate performance obligations as (i) the nature of the promise, within the context of the agreement, is to transfer combined items to which the promised rights are inputs and (ii) the Company's promise to transfer each individual right described above to the Defendants is not separately identifiable from other promises in the agreement. As a result, the Company accounts for the promises in the agreement as a single performance obligation. The Defendants legally obtained control of the licenses and other rights upon full payment to Conformis. As such, the earnings process was completed and revenue was recognized upon receipt of the full payment, and all other revenue recognition criteria had been met within the scope of ASC 606.

On April 26, 2023, the Company entered into a Settlement and License Agreement with Exactech, pursuant to which the parties have agreed to terms for resolving all of their existing patent disputes. In consideration of the licenses, releases, covenants and other immunities granted by the Company to Exactech, the Company received a payment within 30 days following the execution of the agreement. The agreement provides for the grant of the licenses, covenants-not-to-sue, releases, and other significant deliverables upon receipt of full payment from Exactech. These individual rights are not accounted for as separate performance obligations as (i) the nature of the promise, within the context of the agreement, is to transfer combined items to which the promised rights are inputs and (ii) the Company's promise to transfer each individual right described above to Exactech is not separately identifiable from other promises in the agreement. As a result, the Company accounts for the promises in the agreement as a single performance obligation. Exactech legally obtained control of the licenses and other rights upon full payment to Conformis and the completion of other deliverables.

On April 8, 2021, the Company entered into a license agreement (the “License Agreement”) with Paragon 28, Inc. ("Paragon 28"), granting Paragon 28 a non-exclusive license under a subset of the Company's U.S. patents for the use of patient-specific instruments with off-the-shelf implants in Paragon 28’s APEX 3D Total Ankle Replacement System. In consideration for the license, the Company received $0.5 million upon execution of the License Agreement, another $0.5 million in October 2021, and received an additional $0.5 million from Paragon 28 on April 7, 2022. In connection with this License Agreement, the Company recognized revenue of $1.0 million during the quarter ended June 30, 2021. The remaining $0.5 million was recognized as revenue during the quarter ended March 31, 2022.

On November 8, 2022 the Company entered into a Settlement and License Agreement with Medacta USA, ("Medacta"), pursuant to which both parties have agreed to terms for resolving all of their existing patent disputes. In consideration of the licenses, releases, covenants and other immunities granted by the Company to Medacta, Medacta was required to pay the Company a fee promptly after execution of the Settlement and License Agreement, which was received in full on December 12, 2022. The agreement provides for the grant of the licenses, covenants-not-to-sue, releases, and other significant deliverables upon receipt of the payment from Medacta. These individual rights are not accounted for as separate performance obligations as (i) the nature of the promise, within the context of the agreement, is to transfer combined items to which the promised rights are inputs and (ii) the Company's promise to transfer each individual right described above to Medacta is not separately identifiable from other promises in the agreement. As a result, the Company accounts for the promises in the agreement as a single performance obligation. Medacta legally obtained control of the license and other rights upon payment to Conformis. As such, the earnings process is complete and revenue was recognized upon receipt of the payment, and all other revenue recognition criteria had been met within the scope of ASC 606. In connection with the Settlement and License Agreement, the Company recognized licensing revenue during the year ended December 31, 2022. See “Note H—Commitments and Contingencies, Legal proceedings” for further discussion of the Medacta settlement.

Disaggregation of Revenue

See "Note K—Segment and Geographic Data" for disaggregated product revenue by geography and product category.

Variable Consideration

Revenues from product sales are recorded at the net sales price (transaction price), which includes estimates of variable consideration for which reserves are established and which result from rebates that are offered within contracts between the Company and some of its customers. The amount of variable consideration which is included in the transaction price may be constrained, and is included in the net sales price only to the extent that it is probable that a significant reversal in the amount of the cumulative revenue recognized will not occur in a future period.

The following table summarizes activity for rebate allowance reserve (in thousands): | | | | | | | | | | | | | | |

| | June 30, 2023 | | December 31, 2022 |

| Beginning Balance | | $ | 108 | | | $ | 79 | |

| Provision related to current period sales | | 104 | | | 126 | |

| | | | |

| Payments or credits issued to customers | | (91) | | | (97) | |

| Ending Balance | | $ | 121 | | | $ | 108 | |

Costs to Obtain and Fulfill a Contract

The Company currently expenses commissions paid for obtaining product sales. Sales commissions are paid following the manufacture and implementation of the implant. Due to the period being less than one year, the Company will apply the practical expedient, whereby the Company recognizes the incremental costs of obtaining contracts as an expense when incurred if the amortization period of the assets that the Company otherwise would have recognized is one year or less. These costs are included in sales and marketing expense. Further, the Company incurs costs to buy, build, replenish, restock, sterilize and replace the reusable instrumentation trays associated with the sale of its products and services. The reusable instrument trays are not contract specific and are used for multiple contracts and customers, therefore does not meet the criteria to capitalize under ASC 606.

Shipping and handling costs

Shipping and handling activities prior to the transfer of control to the customer (e.g., when control transfers after delivery) are considered fulfillment activities, and not performance obligations. Amounts invoiced to customers for shipping and handling are classified as revenue. Shipping and handling costs incurred are included in general and administrative expense. Shipping and handling expense was $1.0 million for each of the three months ended June 30, 2023 and 2022, and $2.2 million and $2.4 million for the six months ended June 30, 2023 and 2022, respectively.

Taxes collected from customers and remitted to government authorities

The Company’s policy is to present taxes collected from customers and remitted to government authorities on a net basis and not to include tax amounts in revenue.

Research and development expense

The Company’s research and development costs consist of engineering, product development, quality assurance, clinical and regulatory expense. These costs primarily relate to employee compensation, including salary, benefits and stock-based compensation. The Company also incurs costs related to consulting fees, revenue share, materials and supplies, and marketing studies, including data management and associated travel expense. Research and development costs are expensed as incurred.

Advertising expense

Advertising costs are expensed as incurred, which are included in sales and marketing. Advertising expense was $0.2 million and $0.1 million for the three months ended June 30, 2023 and 2022, respectively, and $0.6 million and $0.2 million for the six months ended June 30, 2023 and 2022, respectively.

Segment reporting

Operating segments are defined as components of an enterprise about which separate financial information is available and is evaluated on a regular basis by the chief operating decision-maker, or decision-making group, in deciding how to allocate resources to an individual segment and in assessing performance of the segment. The Company’s chief operating decision-maker is its chief executive officer. The Company’s chief executive officer reviews financial information presented on an aggregate basis for purposes of allocating resources and evaluating financial performance. The Company has one business segment and there are no segment managers who are held accountable for operations, operating results and plans for products or components below the aggregate Company level. Accordingly, in light of the Company’s current product offerings, management has determined that the primary form of internal reporting is aligned with the offering of the Conformis personalized joint replacement products and that the Company operates as one segment. See “Note K—Segment and Geographic Data.”

Foreign currency translation and transactions

The assets and liabilities of the Company’s foreign operations are translated into U.S. dollars at current exchange rates at the balance sheet date, and income and expense items are translated at average rates of exchange prevailing during the quarter. Net translation gains and losses are recorded in accumulated other comprehensive loss. Gains and losses from foreign currency transactions denominated in foreign currencies, including intercompany balances not of a long-term investment nature, are included in the Consolidated Statements of Operations.

Income taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the consolidated financial statement carrying amounts of existing assets and liabilities and their respective tax bases, operating losses and tax credit carry forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized as income in the period that includes the enactment date.

In evaluating the need for a valuation allowance, the Company considers all reasonably available positive and negative evidence, including recent earnings, expectations of future taxable income and the character of that income. In estimating future taxable income, the Company relies upon assumptions and estimates of future activity including the reversal of temporary differences. Presently, the Company believes that a full valuation allowance is required to reduce deferred tax assets to the amount expected to be realized.

The tax benefit from an uncertain tax position is only recognized if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the consolidated financial statements from these positions are measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate resolution. The Company reviews its tax positions on an annual basis and more frequently as facts surrounding tax positions change. Based on these future events, the Company may recognize uncertain tax positions or reverse current uncertain tax positions, the impact of which would affect the consolidated financial statements.

The Company has operations in the U.S., Germany, the United Kingdom, and India. The operating results of German operations will be permanently reinvested in that jurisdiction. As a result, the Company has only provided for income taxes at local rates when required.

The Company is subject to U.S. federal, state, and foreign income taxes. The Company recorded a provision for income taxes of $31,000 and $(100,000) for the three months ended June 30, 2023 and 2022, respectively and $13,000 and $(66,000) for the six months ended June 30, 2023 and 2022, respectively. The Company recognizes interest and penalties related to income taxes as a component of income tax expense. As of June 30, 2023 and 2022, a cumulative balance of $8,000 and $45,000 of interest and penalties had been accrued, respectively. Please note that as result of the conclusion of a 2017 - 2019 Germany tax audit, the Company has reversed the respective uncertain tax positions for those years, resulting in a reduction of interest and penalties, as they now apply to only tax years 2020 - 2022.

The Inflation Reduction Act (IRA) was enacted on August 16, 2022. Based on review of the IRA, the Company does not expect any impact to its tax provision. In particular, the Company does not expect to pay Corporate Alternative Minimum Tax (CAMT) in future years based on its projected losses and not reaching the income thresholds. The IRA introduces a 15% CAMT for corporations whose average annual adjusted financial statement income for any consecutive three-tax-year period preceding the tax year exceeds $1 billion starting in 2023.

Stock-based compensation

The Company accounts for stock-based compensation in accordance with ASC 718, Stock Based Compensation ("ASC 718"). ASC 718 requires all stock-based payments to employees and consultants, including grants of stock options, to be recognized in the consolidated statements of operations based on their fair values. The Company uses the Black-Scholes option pricing model to determine the weighted-average fair value of options granted and recognizes the compensation expense of stock-based awards on a straight-line basis over the vesting period of the award.

The determination of the fair value of stock-based payment awards utilizing the Black-Scholes option pricing model is affected by the stock price, exercise price, and a number of assumptions, including expected volatility of the stock, expected life of the option, risk-free interest rate and expected dividends on the stock. The Company evaluates the assumptions used to value the awards at each grant date and if factors change and different assumptions are utilized, stock-based compensation expense may differ significantly from what has been recorded in the past. If there are any modifications or cancellations of the underlying unvested securities, the Company may be required to accelerate, increase or cancel any remaining unearned stock-based compensation expense.

Net loss per share

The Company calculates net loss per share in accordance with ASC 260, "Earnings per Share." Basic earnings per share (“EPS”) is calculated by dividing the net income or loss for the period by the weighted average number of common shares outstanding for the period, without consideration for common stock equivalents. Diluted EPS is computed by dividing the net income or loss for the period by the weighted average number of common shares outstanding for the period and the weighted average number of dilutive common stock equivalents outstanding for the period determined using the treasury stock method.

The following table sets forth the computation of basic and diluted earnings per share attributable to stockholders (in thousands, except share and per share data): | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands, except share and per share data) | | 2023 | | 2022 | | 2023 | | 2022 |

| Numerator: | | | | | | | | |

| Basic and diluted loss per share | | | | | | | | |

| Net loss | | $ | (13,011) | | | $ | (15,524) | | | $ | (22,582) | | | $ | (31,555) | |

| Denominator: | | | | | | | | |

| | | | | | | | |

| Basic and diluted weighted average shares* | | 7,316,286 | | | 7,211,851 | | | 7,291,542 | | | 7,189,634 | |

| | | | | | | | |

| Loss per share attributable to Conformis, Inc. stockholders: | | | | | | | | |

| Basic and diluted* | | $ | (1.78) | | | $ | (2.15) | | | $ | (3.10) | | | $ | (4.39) | |

| | | | | | | | |

*Adjusted for the 1-for-25 reverse stock split

The following table sets forth potential shares of common stock equivalents that are not included in the calculation of diluted net loss per share because to do so would be anti-dilutive as of the end of each period presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | Six Months Ended June 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Stock options and restricted stock awards* | | 6,169 | | | 20,686 | | | 20,341 | | | 26,629 | |

| | | | | | | | |

*Adjusted for the 1-for-25 reverse stock split

Recently Adopted Accounting Standards