0001158172false00011581722024-07-232024-07-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 23, 2024

COMSCORE, INC.

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-33520 | | 54-1955550 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

11950 Democracy Drive

Suite 600

Reston, Virginia 20190

(Address of principal executive offices, including zip code)

(703) 438–2000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 per share | | SCOR | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Overview

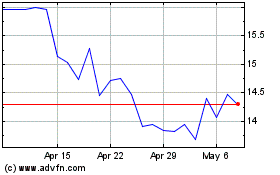

On July 24, 2024, comScore, Inc. (the "Company") issued 13.3 million additional shares of Series B Convertible Preferred Stock, par value $0.001 ("Preferred Stock") to the existing holders of Preferred Stock in exchange for cancellation of the Company's obligation to pay accrued dividends totaling $32.8 million to such holders for annual dividend periods ended in 2023 and 2024. As of the issuance date, the additional shares of Preferred Stock were convertible into approximately 0.7 million shares of the Company's Common Stock, par value $0.001 ("Common Stock"), representing an effective conversion price of $49.438 per share for the canceled dividend obligation, a substantial premium to the current trading price of the Common Stock.

The additional shares of Preferred Stock have the same terms and conditions as the Preferred Stock previously issued by the Company, including that holders are entitled to cumulative dividends at a rate of 7.5% per annum, payable annually in arrears and subject to increase under certain circumstances. As previously disclosed, this rate was increased in 2023 and 2024 in connection with prior deferrals of the Company's dividend obligation for such years, resulting in a rate of 9.5% per annum on the deferred dividend balance. Upon issuance of the additional Preferred Stock on July 24, 2024, the dividend rate returned to 7.5% per annum for all outstanding Preferred Stock.

In connection with the issuance, the Company and the holders of Preferred Stock also entered into an amendment to the Stockholders Agreement between the parties. Among other things, the amendment reduced the $100.0 million special dividend threshold set forth in the Stockholders Agreement by an amount equal to the liquidation preference of the additional Preferred Stock ($32.8 million). After further reducing the threshold by annual dividends paid in prior years, the current special dividend threshold is $47.0 million. To date, the Company has not received any request under the Stockholders Agreement to pay a special dividend.

Background

As previously disclosed, each holder of Preferred Stock temporarily waived until July 31, 2024 its right to receive annual dividends that would have been payable, pursuant to the terms and conditions of the Certificate of Designations relating to the Preferred Stock (as amended to date, the "Certificate of Designations"), for the dividend periods ended June 29, 2023 (the "2023 Dividends") and June 29, 2024 (the "2024 Dividends," and the temporary waivers of the 2023 Dividends and 2024 Dividends, the "Prior Waivers"). Pursuant to the Prior Waivers and the Certificate of Designations, the 2023 Dividends and the 2024 Dividends continued to accrue and accumulate at a rate of 9.5% per annum during the temporary waiver period. As of July 24, 2024, the 2023 Dividends and 2024 Dividends, together with amounts accrued and accumulated thereon, totaled $32.8 million.

Stock Issuance

On July 24, 2024 (the "Issuance Date"), the Company issued an aggregate of 13.3 million additional shares of Preferred Stock (the "Issuance") to the existing holders of Preferred Stock, Charter Communications Holding Company, LLC, Liberty Broadband Corporation and Pine Investor, LLC (the "Stockholders"), in exchange for (a) permanent waivers of their right to receive the 2023 Dividends and the 2024 Dividends and (b) each Stockholder's entry into the Amended and Restated Stockholders Agreement (as defined below). As of the Issuance Date, in accordance with the terms and conditions of the Certificate of Designations, the additional shares of Preferred Stock were convertible into approximately 0.7 million shares of Common Stock. The additional shares of Preferred Stock have the same terms and conditions as the Preferred Stock previously issued by the Company.

The summary of the rights, preferences and privileges of the Preferred Stock described above is qualified in its entirety by reference to the Certificate of Designations, filed as Exhibit 3.2 to the Company's Current Report on Form 8-K filed with the Securities and Exchange Commission (the "SEC") on March 15, 2021; the Amendment to the Certificate of Designations, filed as Exhibit 3.2 to the Company's Current Report on Form 8-K filed with the SEC on June 22, 2023; and the Second Amendment to the Certificate of Designations, filed as Exhibit 3.1 to the Company's Current Report on Form 8-K filed with the SEC on June 18, 2024.

Subscription Agreements

On the Issuance Date, the Company entered into a Subscription Agreement with each Stockholder to effect the Issuance. The Subscription Agreements contain representations, warranties and covenants of each Stockholder, as well as other obligations of the parties. The Subscription Agreements also provide for registration rights with respect to the Preferred Stock and the shares of Common Stock issuable upon conversion of such Preferred Stock in accordance with the terms of the Registration Rights Agreement, dated March 10, 2021, by and between the Company and the parties thereto.

The foregoing summary of the Subscription Agreements does not purport to be complete and is subject to, and is qualified in its entirety by, the full text of the Subscription Agreements, copies of which are attached as Exhibits 10.1, 10.2 and 10.3 to this Current Report on Form 8-K and are incorporated herein by reference.

Amended and Restated Stockholders Agreement

In connection with the Issuance and on the Issuance Date, the Company and the Stockholders also amended and restated the Stockholders Agreement, dated March 10, 2021, by and among the Company and the parties thereto (the "Original Stockholders Agreement" and as amended and restated, the "Amended and Restated Stockholders Agreement").

The Amended and Restated Stockholders Agreement, among other things, (a) removed the provisions of the Original Stockholders Agreement that had either expired by their terms or been rendered inapplicable with the passage of time, (b) gave effect to the Issuance, and (c) clarified the impact of the Issuance and potential future issuances of Preferred Stock and Common Stock as dividends pursuant to the Certificate of Designations. The Amended and Restated Stockholders Agreement clarified that additional shares of Preferred Stock issued in the Issuance, and any Preferred Stock or Common Stock that may be issuable in the future as dividends, do not increase any Stockholder's right to designate individuals to serve on the Company's Board of Directors (the "Board").

The Original Stockholders Agreement provided Stockholders with the right to require the Company to pay a one-time dividend (the "Special Dividend") equal to the highest dividend the Board determines can be paid at the time subject to certain limitations. Under the Original Stockholders Agreement, if an aggregate $100 million of Special Dividends and Annual Dividends (as defined in the Certificate of Designations) have been paid on the Preferred Stock, the Company is required, subject to certain limitations, to use any remaining amount of the Special Dividend to pay a pro rata dividend on the Common Stock (with the Preferred Stock participating on an as-converted basis). The Amended and Restated Stockholders Agreement clarified that the $100.0 million Special Dividend threshold is reduced by $32.8 million, equal to the aggregate liquidation preference of the additional Preferred Stock issued in the Issuance. Immediately following the Issuance, and taking into account Annual Dividends previously paid, the current Special Dividend threshold is $47.0 million.

Under the Original Stockholders Agreement, subject to certain conditions, each Stockholder agreed to vote, or provide a written consent or proxy with respect to, its Voting Stock (as defined in the Original Stockholders Agreement) (a) in favor of each Stockholder's director designees, and (b) in a neutral manner in the election of any directors nominated by the Board for election who are not designees of a Stockholder. The Amended and Restated Stockholders Agreement clarified that the additional shares of Preferred Stock issued in the Issuance, as well as any Preferred Stock or Common Stock that may be issuable in the future as dividends pursuant to the Certificate of Designations, are subject to this obligation. In addition, the Amended and Restated Stockholders Agreement provided that to the extent any outstanding shares of Common Stock held by a Stockholder as of the Issuance Date would otherwise cause the aggregate voting power of all Voting Stock held by the Stockholders to exceed 49.99% on the record date for any vote, such Stockholder will vote, or provide a written consent or proxy with respect to, such Common Stock in a neutral manner on all matters upon which such Stockholder is entitled to vote, with such provision to expire when the aggregate voting power of the Stockholders ceases to exceed 49.99%. As previously disclosed, the Certificate of Designations already provides for neutral voting on all matters with respect to Preferred Stock that exceeds 16.66% per Stockholder or 49.99% in aggregate on an as-converted basis.

The foregoing summary of the Amended and Restated Stockholders Agreement does not purport to be complete and is subject to, and is qualified in its entirety by, the full text of the Amended and Restated Stockholders Agreement, which is attached as Exhibit 10.4 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K is incorporated into this Item 3.02 by reference.

The Preferred Stock and Common Stock issuable upon conversion of the Preferred Stock that were, or will be, issued as part of or following the Issuance, as applicable, were, or will be, issued without registration under the Securities Act of 1933, as amended (the "Securities Act"), in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act.

The terms of conversion of the Preferred Stock are as previously disclosed and as set forth in the Certificate of Designations.

Item 3.03 Material Modification to Rights of Security Holders.

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K is incorporated into this Item 3.03 by reference.

In connection with entry into the Subscription Agreements and the Amended and Restated Stockholders Agreement, on July 23, 2024, each Stockholder consented to the Issuance, or waived its voting rights with respect thereto, under the Original Stockholders Agreement and Section 12 of the Certificate of Designations. The foregoing summary does not purport to be complete and is subject

to, and is qualified in its entirety by, the full text of Exhibits 4.1, 4.2 and 4.3 to this Current Report on Form 8-K, which are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 4.1 | | |

| | |

| 4.2 | | |

| | |

| 4.3 | | |

| | |

| 10.1 | | |

| | |

| 10.2 | | |

| | |

| 10.3 | | |

| | |

| 10.4 | | |

| | |

101.INS | | XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

| | |

101.SCH | | Inline XBRL Taxonomy Extension Schema Document |

| | |

101.CAL | | Inline XBRL Taxonomy Extension Calculation Linkbase Document |

| | |

101.DEF | | Inline XBRL Taxonomy Extension Definition Linkbase Document |

| | |

101.LAB | | Inline XBRL Taxonomy Extension Label Linkbase Document |

| | |

101.PRE | | Inline XBRL Taxonomy Extension Presentation Linkbase Document |

| | |

104 | | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| comScore, Inc. |

| |

| By: | | /s/ Mary Margaret Curry |

| | Mary Margaret Curry |

| | Chief Financial Officer and Treasurer |

Date: July 25, 2024

Series B Preferred Stockholder Waiver

July 23, 2024

ELECTRONIC MAIL

| | |

comScore, Inc.

11950 Democracy Drive, Suite 600

Reston, VA 20190

Attention: Ashley Wright, General Counsel, Corporate and Securities

Email: |

Dear Ms. Wright:

Reference is made to that certain (i) Certificate of Designations of Series B Convertible Preferred Stock, par value $0.001 (the “Series B Preferred Stock”), of comScore, Inc. (the “Company”), dated as of March 10, 2021 and amended as of June 16, 2023 and June 17, 2024 (the “Certificate of Designations”) and (ii) Stockholders Agreement, dated as of March 10, 2021, by and among the Company and the stockholders party thereto (the “Stockholders Agreement”). The undersigned is the holder of record of 27,509,203 shares of Series B Preferred Stock. The Company expects to issue additional shares of Series B Preferred Stock to the undersigned and the other holders of Series B Preferred Stock pursuant to Subscription Agreements to be entered into between the Company and each such holder (the “Proposed Issuance”).

The undersigned hereby irrevocably and unconditionally waives (and consents to such waiver for purposes of Section 4.1(a) of the Stockholders Agreement) the voting rights of Section 12 of the Certificate of Designations and any other procedural or notice requirements or similar rights with respect to the Proposed Issuance.

The undersigned hereby consents, pursuant to Section 4.1(b) of the Stockholders Agreement, to the Proposed Issuance.

IN WITNESS WHEREOF, the undersigned executes this Waiver as of the date first written above.

| | | | | |

CHARTER COMMUNICATIONS HOLDING COMPANY, LLC

By: Charter Communications, Inc. Its Manager |

| |

| By: | /s/ Jeffrey B. Murphy |

| Name: | Jeffrey B. Murphy |

| Title: | SVP, Corporate Finance & Development |

Series B Preferred Stockholder Waiver

July 23, 2024

ELECTRONIC MAIL

| | |

comScore, Inc.

11950 Democracy Drive, Suite 600

Reston, VA 20190

Attention: Ashley Wright, General Counsel, Corporate and Securities

Email: |

Dear Ms. Wright:

Reference is made to that certain (i) Certificate of Designations of Series B Convertible Preferred Stock, par value $0.001 (the “Series B Preferred Stock”), of comScore, Inc. (the “Company”), dated as of March 10, 2021 and amended as of June 16, 2023 and June 17, 2024 (the “Certificate of Designations”) and (ii) Stockholders Agreement, dated as of March 10, 2021, by and among the Company and the stockholders party thereto (the “Stockholders Agreement”). The undersigned is the holder of record of 27,509,203 shares of Series B Preferred Stock. The Company expects to issue additional shares of Series B Preferred Stock to the undersigned and the other holders of Series B Preferred Stock pursuant to Subscription Agreements to be entered into between the Company and each such holder (the “Proposed Issuance”).

The undersigned hereby irrevocably and unconditionally waives (and consents to such waiver for purposes of Section 4.1(a) of the Stockholders Agreement) the voting rights of Section 12 of the Certificate of Designations and any other procedural or notice requirements or similar rights with respect to the Proposed Issuance.

The undersigned hereby consents, pursuant to Section 4.1(b) of the Stockholders Agreement, to the Proposed Issuance.

IN WITNESS WHEREOF, the undersigned executes this Waiver as of the date first written above.

| | | | | |

| LIBERTY BROADBAND CORPORATION |

| |

| By: | /s/ Craig Troyer |

| Name: | Craig Troyer |

| Title: | Senior Vice President |

Series B Preferred Stockholder Waiver

July 23, 2024

ELECTRONIC MAIL

| | |

comScore, Inc.

11950 Democracy Drive, Suite 600

Reston, VA 20190

Attention: Ashley Wright, General Counsel, Corporate and Securities

Email: |

Dear Ms. Wright:

Reference is made to that certain (i) Certificate of Designations of Series B Convertible Preferred Stock, par value $0.001 (the “Series B Preferred Stock”), of comScore, Inc. (the “Company”), dated as of March 10, 2021 and amended as of June 16, 2023 and June 17, 2024 (the “Certificate of Designations”) and (ii) Stockholders Agreement, dated as of March 10, 2021, by and among the Company and the stockholders party thereto (the “Stockholders Agreement”). The undersigned is the holder of record of 27,509,203 shares of Series B Preferred Stock. The Company expects to issue additional shares of Series B Preferred Stock to the undersigned and the other holders of Series B Preferred Stock pursuant to Subscription Agreements to be entered into between the Company and each such holder (the “Proposed Issuance”).

The undersigned hereby irrevocably and unconditionally waives (and consents to such waiver for purposes of Section 4.1(a) of the Stockholders Agreement) the voting rights of Section 12 of the Certificate of Designations and any other procedural or notice requirements or similar rights with respect to the Proposed Issuance.

The undersigned hereby consents, pursuant to Section 4.1(b) of the Stockholders Agreement, to the Proposed Issuance.

IN WITNESS WHEREOF, the undersigned executes this Waiver as of the date first written above.

| | | | | |

| PINE INVESTOR LLC |

| |

| By: | /s/ Jacob B. Hansen |

| Name: | Jacob B. Hansen |

| Title: | Managing Director |

SUBSCRIPTION AGREEMENT

comScore, Inc.

11950 Democracy Drive, Suite 600

Reston, Virginia 20190

The undersigned (the “Investor”) hereby confirms its agreement with comScore, Inc., a Delaware corporation (the “Issuer”), as follows:

1.This Subscription Agreement (this “Agreement”), is made as of the date set forth below between the Issuer and the Investor.

2.Agreement to Sell and Purchase the Securities. Subject to the terms and conditions set forth in this Agreement, in exchange for (i) Investor’s irrevocable and unconditional waiver of its right to receive (a) the Annual Dividends (as defined in the Certificate of Designations) accrued through, but excluding, June 30, 2023, that would have been payable to such Investor pursuant to Section 4(c) of the Certificate of Designations on June 30, 2023 (the “2023 Dividends”), (b) the Annual Dividends accrued from June 30, 2023 through, but excluding, June 30, 2024, that would have been payable to such Investor pursuant to Section 4(c) of the Certificate of Designations on June 30, 2024 (the “2024 Dividends”) and (c) all amounts accrued and accumulated on the 2023 Dividends and 2024 Dividends from and including their respective Dividend Payment Dates (as defined in the Certificate of Designations) pursuant to Section 4(c) of the Certificate of Designations (the amounts in clauses (a) – (c), the “Deferred Dividends,” and such waiver, the “Dividend Waiver”), and (ii) Investor’s entry into an Amended and Restated Stockholders Agreement, in the form attached hereto as Annex A (the “A&R Stockholders Agreement”), the Issuer hereby agrees to issue to Investor, and Investor hereby grants the Dividend Waiver and agrees to subscribe for and purchase, 4,419,098 Preferred Shares (as defined below) (the “Acquired Shares” and such subscription and issuance, the “Subscription”).

3.Issuer Representations and Warranties. The Issuer represents and warrants that it has authorized the sale and issuance of shares of (i) Series B Convertible Preferred Stock, par value $0.001 per share, of the Issuer (the “Preferred Shares”) and (ii) common stock, par value $0.001 per share, of the Issuer (the “Common Stock”) into which such Preferred Shares are convertible (the “Underlying Shares”), in each case, in accordance with and subject to the terms of the Certificate of Designations of the Preferred Shares dated as of March 10, 2021 (as amended, the “Certificate of Designations”). The board of directors of the Issuer has adopted and approved resolutions intending to exempt any acquisitions or dispositions of Preferred Shares and Underlying Shares in connection with this Agreement or pursuant to the terms of the Certificate of Designations by the Investor from short-swing liability pursuant to Rule 16b-3 under the Exchange Act.

4.Investor Representations and Warranties.

A.Investor has the requisite power and authority to: (a) execute and deliver this Agreement and each other agreement contemplated hereby; (b) perform its

covenants and obligations hereunder and thereunder; and (c) consummate the transactions contemplated by this Agreement and each other agreement contemplated hereby. The execution and delivery of this Agreement and each other agreement contemplated hereby by the Investor, the performance by the Investor of its covenants and obligations hereunder and thereunder and the consummation of the transactions contemplated by this Agreement and each other agreement contemplated hereby have been duly authorized by all necessary action on the part of the Investor and no additional action on the part of the Investor is necessary. This Agreement and each other agreement contemplated hereby have been duly executed and delivered by the Investor and, assuming the due authorization, execution and delivery by the Issuer, constitute legal, valid and binding obligations of the Investor, enforceable against the Investor in accordance with their terms, except as such enforceability (A) may be limited by applicable bankruptcy, insolvency, reorganization, moratorium and other similar laws affecting or relating to creditors’ rights generally; and (B) is subject to general principles of equity.

B.Investor represents and warrants that, as of the date hereof, it (i) is a “qualified institutional buyer” (as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”)) or an “accredited investor” (within the meaning of Rule 501(a) under the Securities Act), (ii) is acquiring the Acquired Shares only for its own account and not for the account of others, or if Investor is subscribing for the Acquired Shares as a fiduciary or agent for one or more investor accounts, each owner of such account is a “qualified institutional buyer” (as defined above) and Investor has full investment discretion with respect to each such account, and the full power and authority to make the acknowledgements, representations and agreements herein on behalf of each owner of each such account and (iii) is not acquiring the Acquired Shares with a view to, or for offer or sale in connection with, any distribution thereof in violation of the Securities Act.

C.Investor understands that the Acquired Shares are being offered in a transaction not involving any public offering within the meaning of the Securities Act and that the Acquired Shares have not been registered under the Securities Act. Investor understands that the Acquired Shares may not be resold, transferred, pledged or otherwise disposed of by Investor absent an effective registration statement under the Securities Act, except (i) to the Issuer or a subsidiary thereof, (ii) to non-U.S. persons pursuant to offers and sales that occur outside the United States within the meaning of Regulation S under the Securities Act, (iii) pursuant to Rule 144 under the Securities Act, or (iv) pursuant to another applicable exemption from the registration requirements of the Securities Act, and that any certificates or book-entry records representing the Acquired Shares shall contain a legend to such effect. Investor understands and agrees that the Acquired Shares will be subject to transfer restrictions and, as a result of these transfer restrictions, Investor may not be able to readily resell the Acquired Shares and may be

required to bear the financial risk of an investment in the Acquired Shares for an indefinite period of time. Investor understands that it has been advised to consult legal counsel prior to making any offer, resale, pledge or transfer of any of the Acquired Shares.

D.Investor understands that the Acquired Shares are being offered and sold in reliance on a transactional exemption from the registration requirements of federal and state securities laws and that the Issuer is relying upon the truth and accuracy of the representations, warranties, agreements, acknowledgments and understandings of the Investor set forth herein in order to determine the applicability of such exemptions and the suitability of the Investor to acquire the Acquired Shares.

E.Investor understands and agrees that Investor is purchasing the Acquired Shares directly from the Issuer. Investor further acknowledges that there have been no representations, warranties, covenants and agreements made to Investor by the Issuer or any of its officers or directors, expressly or by implication, other than those representations, warranties, covenants and agreements included in this Agreement.

F.In making its decision to subscribe for and purchase the Acquired Shares, Investor represents that it has relied solely upon its own independent investigation. Investor acknowledges and agrees that Investor has received such information as Investor deems necessary in order to make an investment decision with respect to the Acquired Shares. Investor represents and agrees that Investor and Investor’s professional advisor(s), if any, have had the full opportunity to ask such questions, receive such answers and obtain such information as Investor and such Investor’s professional advisor(s), if any, have deemed necessary to make an investment decision with respect to the Acquired Shares. Investor acknowledges that it is aware that there are substantial risks incident to the purchase and ownership of the Acquired Shares. Investor has such knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of an investment in the Acquired Shares, and Investor has sought such accounting, legal and tax advice as Investor has considered necessary to make an informed investment decision. Alone, or together with any professional advisor(s), Investor represents and acknowledges that Investor has adequately analyzed and fully considered the risks of an investment in the Acquired Shares and determined that the Acquired Shares are a suitable investment for Investor and that Investor is able at this time and in the foreseeable future to bear the economic risk of a total loss of Investor’s investment in the Acquired Shares.

5.Registration Rights. The Acquired Shares and the Underlying Shares shall be considered Registrable Securities, as such term is defined in that certain Registration Rights Agreement by and among the Issuer and the purchasers named therein, dated as of March 10, 2021 (the “Registration Rights Agreement”), and the Investor shall have such registration and

other rights with respect to the Acquired Shares and the Underlying Shares as are provided to a Holder under the Registration Rights Agreement. The Issuer hereby agrees to use its reasonable best efforts to register the resale of the Acquired Shares and any Underlying Shares within 6 months of the date hereof in accordance with the provisions of the Registration Rights Agreement.

6.Closing and Delivery of the Acquired Shares.

A.Conditions to the Obligations of the Parties.

(I)Conditions to the Issuer’s Obligations. The Issuer’s obligation to issue and sell the Acquired Shares to the Investor shall be subject to the accuracy of the representations and warranties made by the Investor and the fulfillment of those undertakings of the Investor to be fulfilled prior to the Closing, in each case, as contained in this Agreement.

(II)Conditions to the Investor’s Obligations. The Investor’s obligation to purchase the Acquired Shares will be subject to (i) the delivery by the Issuer of the Acquired Shares in accordance with the provisions of this Agreement and (ii) the accuracy of the representations and warranties made by the Issuer and the fulfillment of those undertakings of the Issuer to be fulfilled prior to the Closing, in each case as contained in this Agreement.

B.Closing.

(I)The completion of the purchase and sale of the Acquired Shares (the “Closing”) shall occur, unless otherwise agreed upon by the Issuer, at Vinson & Elkins L.L.P., Texas Tower, 845 Texas Avenue, Suite 4700, Houston, Texas 77002 on the date hereof.

(II)At the Closing, the Issuer shall cause to be delivered to the Investor in book-entry form the Acquired Shares registered in the name of the Investor or, if so indicated on the Investor Questionnaire attached hereto as Exhibit A, in the name of a nominee designated by the Investor.

(III)Each book entry for the Acquired Shares shall contain a notation, and each certificate (if any) evidencing the Acquired Shares, shall be stamped or otherwise imprinted with a legend as set forth in the A&R Stockholders Agreement.

(IV)At the Closing, the parties hereto shall execute and deliver the A&R Stockholders Agreement and such additional documents and take such additional actions as the parties reasonably may deem to be practical and necessary in order to consummate the Subscription as contemplated by this Agreement.

7.Survival of Representations, Warranties and Agreements. Notwithstanding any investigation made by any party to this Agreement, all covenants, agreements, representations and warranties made by the Issuer and the Investor herein will survive the execution of this Agreement, the delivery to the Investor of the Acquired Shares and the payment therefor.

8.Notices. Any notice or communication required or permitted hereunder shall be in writing and either delivered personally, emailed or telecopied, sent by overnight mail via a reputable overnight carrier, or sent by certified or registered mail, postage prepaid, and shall be deemed to be given and received (a) when so delivered personally, (b) when sent, with no mail undeliverable or other rejection notice, if sent by email, or (c) five (5) business days after the date of mailing to the address below or to such other address or addresses as such person may hereafter designate by notice given hereunder:

(I)if to the Issuer, to:

comScore, Inc.

11950 Democracy Drive

Suite 600

Reston, Virginia 20190

Attention: Ashley Wright

Email:

With a copy (which shall not constitute notice) to:

Vinson & Elkins LLP

Texas Tower

845 Texas Avenue, Suite 4700

Houston, Texas 77002

Attention: Scott Rubinsky

Email:

(II)if to the Investor, at its address on the signature page hereto, or at such other address or addresses as may have been furnished to the Issuer in writing.

9.Changes. This Agreement may not be modified or amended except pursuant to an instrument in writing signed by the Issuer and the Investor.

10.Headings. The headings of the various sections of this Agreement have been inserted for convenience of reference only and will not be deemed to be part of this Agreement.

11.Severability. In case any provision contained in this Agreement should be invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of the remaining provisions contained herein will not in any way be affected or impaired thereby.

12.Governing Law. This Agreement will be governed by, and construed in accordance with, the internal laws of the State of Delaware, without giving effect to the principles of conflicts of law that would require the application of the laws of any other jurisdiction. Except as set forth below, no proceeding may be commenced, prosecuted or continued in any court other than the Court of Chancery of the State of Delaware and any state appellate court therefrom within the State of Delaware, which courts shall have jurisdiction over the adjudication of such matters, and the parties hereby consent to the jurisdiction of such courts and personal service with respect thereto. All parties hereby waive all right to trial by jury in any proceeding (whether based upon contract, tort or otherwise) in any way arising out of or relating to this Agreement. All parties agree that a final judgment in any such proceeding brought in any such court shall be conclusive and binding upon each party and may be enforced in any other courts in the jurisdiction of which a party is or may be subject, by suit upon such judgment.

13.Counterparts. This Agreement may be executed in two or more counterparts, each of which will constitute an original, but all of which, when taken together, will constitute but one instrument, and will become effective when one or more counterparts have been signed by each party hereto and delivered to the other parties. Delivery of an executed counterpart by facsimile or portable document format (.pdf) shall be effective as delivery of a manually executed counterpart thereof.

14.Fees and Expenses. Each party shall pay the fees and expenses of its advisers, counsel, accountants and other experts, if any, and all other expenses incurred by such party incident to the negotiation, preparation, execution, delivery and performance of this Agreement.

[Remainder of Page Left Blank Intentionally. Signature Page Follows.]

Please confirm that the foregoing correctly sets forth the agreement between us by signing in the space provided below for that purpose.

Dated as of: July 24, 2024

| | | | | |

CHARTER COMMUNICATIONS HOLDING COMPANY, LLC

By: Charter Communications, Inc., Its Manager |

| |

| By: | /s/ Jeffrey B. Murphy |

| Print Name: | Jeffrey B. Murphy |

| Title: | SVP, Corporate Finance & Development |

| Address: | 400 Washington Blvd.

Stamford, Connecticut 06902 |

| E-mail: | |

Agreed and Accepted

this 24th day of July 2024:

| | | | | | | | |

| | |

| COMSCORE, INC. |

| |

| By: | | /s/ Mary Margaret Curry |

| Name: | | Mary Margaret Curry |

Title: | | Chief Financial Officer and Treasurer |

EXHIBIT A

COMSCORE, INC.

INVESTOR QUESTIONNAIRE

[Intentionally Omitted]

SUBSCRIPTION AGREEMENT

comScore, Inc.

11950 Democracy Drive, Suite 600

Reston, Virginia 20190

The undersigned (the “Investor”) hereby confirms its agreement with comScore, Inc., a Delaware corporation (the “Issuer”), as follows:

1.This Subscription Agreement (this “Agreement”), is made as of the date set forth below between the Issuer and the Investor.

2.Agreement to Sell and Purchase the Securities. Subject to the terms and conditions set forth in this Agreement, in exchange for (i) Investor’s irrevocable and unconditional waiver of its right to receive (a) the Annual Dividends (as defined in the Certificate of Designations) accrued through, but excluding, June 30, 2023, that would have been payable to such Investor pursuant to Section 4(c) of the Certificate of Designations on June 30, 2023 (the “2023 Dividends”), (b) the Annual Dividends accrued from June 30, 2023 through, but excluding, June 30, 2024, that would have been payable to such Investor pursuant to Section 4(c) of the Certificate of Designations on June 30, 2024 (the “2024 Dividends”) and (c) all amounts accrued and accumulated on the 2023 Dividends and 2024 Dividends from and including their respective Dividend Payment Dates (as defined in the Certificate of Designations) pursuant to Section 4(c) of the Certificate of Designations (the amounts in clauses (a) – (c), the “Deferred Dividends,” and such waiver, the “Dividend Waiver”), and (ii) Investor’s entry into an Amended and Restated Stockholders Agreement, in the form attached hereto as Annex A (the “A&R Stockholders Agreement”), the Issuer hereby agrees to issue to Investor, and Investor hereby grants the Dividend Waiver and agrees to subscribe for and purchase, 4,419,098 Preferred Shares (as defined below) (the “Acquired Shares” and such subscription and issuance, the “Subscription”).

3.Issuer Representations and Warranties. The Issuer represents and warrants that it has authorized the sale and issuance of shares of (i) Series B Convertible Preferred Stock, par value $0.001 per share, of the Issuer (the “Preferred Shares”) and (ii) common stock, par value $0.001 per share, of the Issuer (the “Common Stock”) into which such Preferred Shares are convertible (the “Underlying Shares”), in each case, in accordance with and subject to the terms of the Certificate of Designations of the Preferred Shares dated as of March 10, 2021 (as amended, the “Certificate of Designations”). The board of directors of the Issuer has adopted and approved resolutions intending to exempt any acquisitions or dispositions of Preferred Shares and Underlying Shares in connection with this Agreement or pursuant to the terms of the Certificate of Designations by the Investor from short-swing liability pursuant to Rule 16b-3 under the Exchange Act.

4.Investor Representations and Warranties.

A.Investor has the requisite power and authority to: (a) execute and deliver this Agreement and each other agreement contemplated hereby; (b) perform its

covenants and obligations hereunder and thereunder; and (c) consummate the transactions contemplated by this Agreement and each other agreement contemplated hereby. The execution and delivery of this Agreement and each other agreement contemplated hereby by the Investor, the performance by the Investor of its covenants and obligations hereunder and thereunder and the consummation of the transactions contemplated by this Agreement and each other agreement contemplated hereby have been duly authorized by all necessary action on the part of the Investor and no additional action on the part of the Investor is necessary. This Agreement and each other agreement contemplated hereby have been duly executed and delivered by the Investor and, assuming the due authorization, execution and delivery by the Issuer, constitute legal, valid and binding obligations of the Investor, enforceable against the Investor in accordance with their terms, except as such enforceability (A) may be limited by applicable bankruptcy, insolvency, reorganization, moratorium and other similar laws affecting or relating to creditors’ rights generally; and (B) is subject to general principles of equity.

B.Investor represents and warrants that, as of the date hereof, it (i) is a “qualified institutional buyer” (as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”)) or an “accredited investor” (within the meaning of Rule 501(a) under the Securities Act), (ii) is acquiring the Acquired Shares only for its own account and not for the account of others, or if Investor is subscribing for the Acquired Shares as a fiduciary or agent for one or more investor accounts, each owner of such account is a “qualified institutional buyer” (as defined above) and Investor has full investment discretion with respect to each such account, and the full power and authority to make the acknowledgements, representations and agreements herein on behalf of each owner of each such account and (iii) is not acquiring the Acquired Shares with a view to, or for offer or sale in connection with, any distribution thereof in violation of the Securities Act.

C.Investor understands that the Acquired Shares are being offered in a transaction not involving any public offering within the meaning of the Securities Act and that the Acquired Shares have not been registered under the Securities Act. Investor understands that the Acquired Shares may not be resold, transferred, pledged or otherwise disposed of by Investor absent an effective registration statement under the Securities Act, except (i) to the Issuer or a subsidiary thereof, (ii) to non-U.S. persons pursuant to offers and sales that occur outside the United States within the meaning of Regulation S under the Securities Act, (iii) pursuant to Rule 144 under the Securities Act, or (iv) pursuant to another applicable exemption from the registration requirements of the Securities Act, and that any certificates or book-entry records representing the Acquired Shares shall contain a legend to such effect. Investor understands and agrees that the Acquired Shares will be subject to transfer restrictions and, as a result of these transfer restrictions, Investor may not be able to readily resell the Acquired Shares and may be

required to bear the financial risk of an investment in the Acquired Shares for an indefinite period of time. Investor understands that it has been advised to consult legal counsel prior to making any offer, resale, pledge or transfer of any of the Acquired Shares.

D.Investor understands that the Acquired Shares are being offered and sold in reliance on a transactional exemption from the registration requirements of federal and state securities laws and that the Issuer is relying upon the truth and accuracy of the representations, warranties, agreements, acknowledgments and understandings of the Investor set forth herein in order to determine the applicability of such exemptions and the suitability of the Investor to acquire the Acquired Shares.

E.Investor understands and agrees that Investor is purchasing the Acquired Shares directly from the Issuer. Investor further acknowledges that there have been no representations, warranties, covenants and agreements made to Investor by the Issuer or any of its officers or directors, expressly or by implication, other than those representations, warranties, covenants and agreements included in this Agreement.

F.In making its decision to subscribe for and purchase the Acquired Shares, Investor represents that it has relied solely upon its own independent investigation. Investor acknowledges and agrees that Investor has received such information as Investor deems necessary in order to make an investment decision with respect to the Acquired Shares. Investor represents and agrees that Investor and Investor’s professional advisor(s), if any, have had the full opportunity to ask such questions, receive such answers and obtain such information as Investor and such Investor’s professional advisor(s), if any, have deemed necessary to make an investment decision with respect to the Acquired Shares. Investor acknowledges that it is aware that there are substantial risks incident to the purchase and ownership of the Acquired Shares. Investor has such knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of an investment in the Acquired Shares, and Investor has sought such accounting, legal and tax advice as Investor has considered necessary to make an informed investment decision. Alone, or together with any professional advisor(s), Investor represents and acknowledges that Investor has adequately analyzed and fully considered the risks of an investment in the Acquired Shares and determined that the Acquired Shares are a suitable investment for Investor and that Investor is able at this time and in the foreseeable future to bear the economic risk of a total loss of Investor’s investment in the Acquired Shares.

5.Registration Rights. The Acquired Shares and the Underlying Shares shall be considered Registrable Securities, as such term is defined in that certain Registration Rights Agreement by and among the Issuer and the purchasers named therein, dated as of March 10, 2021 (the “Registration Rights Agreement”), and the Investor shall have such registration and

other rights with respect to the Acquired Shares and the Underlying Shares as are provided to a Holder under the Registration Rights Agreement. The Issuer hereby agrees to use its reasonable best efforts to register the resale of the Acquired Shares and any Underlying Shares within 6 months of the date hereof in accordance with the provisions of the Registration Rights Agreement.

6.Closing and Delivery of the Acquired Shares.

A.Conditions to the Obligations of the Parties.

(I)Conditions to the Issuer’s Obligations. The Issuer’s obligation to issue and sell the Acquired Shares to the Investor shall be subject to the accuracy of the representations and warranties made by the Investor and the fulfillment of those undertakings of the Investor to be fulfilled prior to the Closing, in each case, as contained in this Agreement.

(II)Conditions to the Investor’s Obligations. The Investor’s obligation to purchase the Acquired Shares will be subject to (i) the delivery by the Issuer of the Acquired Shares in accordance with the provisions of this Agreement and (ii) the accuracy of the representations and warranties made by the Issuer and the fulfillment of those undertakings of the Issuer to be fulfilled prior to the Closing, in each case as contained in this Agreement.

B.Closing.

(I)The completion of the purchase and sale of the Acquired Shares (the “Closing”) shall occur, unless otherwise agreed upon by the Issuer, at Vinson & Elkins L.L.P., Texas Tower, 845 Texas Avenue, Suite 4700, Houston, Texas 77002 on the date hereof.

(II)At the Closing, the Issuer shall cause to be delivered to the Investor in book-entry form the Acquired Shares registered in the name of the Investor or, if so indicated on the Investor Questionnaire attached hereto as Exhibit A, in the name of a nominee designated by the Investor.

(III)Each book entry for the Acquired Shares shall contain a notation, and each certificate (if any) evidencing the Acquired Shares, shall be stamped or otherwise imprinted with a legend as set forth in the A&R Stockholders Agreement.

(IV)At the Closing, the parties hereto shall execute and deliver the A&R Stockholders Agreement and such additional documents and take such additional actions as the parties reasonably may deem to be practical and necessary in order to consummate the Subscription as contemplated by this Agreement.

7.Survival of Representations, Warranties and Agreements. Notwithstanding any investigation made by any party to this Agreement, all covenants, agreements, representations and warranties made by the Issuer and the Investor herein will survive the execution of this Agreement, the delivery to the Investor of the Acquired Shares and the payment therefor.

8.Notices. Any notice or communication required or permitted hereunder shall be in writing and either delivered personally, emailed or telecopied, sent by overnight mail via a reputable overnight carrier, or sent by certified or registered mail, postage prepaid, and shall be deemed to be given and received (a) when so delivered personally, (b) when sent, with no mail undeliverable or other rejection notice, if sent by email, or (c) five (5) business days after the date of mailing to the address below or to such other address or addresses as such person may hereafter designate by notice given hereunder:

(I)if to the Issuer, to:

comScore, Inc.

11950 Democracy Drive

Suite 600

Reston, Virginia 20190

Attention: Ashley Wright

Email:

With a copy (which shall not constitute notice) to:

Vinson & Elkins LLP

Texas Tower

845 Texas Avenue, Suite 4700

Houston, Texas 77002

Attention: Scott Rubinsky

Email:

(II)if to the Investor, at its address on the signature page hereto, or at such other address or addresses as may have been furnished to the Issuer in writing.

9.Changes. This Agreement may not be modified or amended except pursuant to an instrument in writing signed by the Issuer and the Investor.

10.Headings. The headings of the various sections of this Agreement have been inserted for convenience of reference only and will not be deemed to be part of this Agreement.

11.Severability. In case any provision contained in this Agreement should be invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of the remaining provisions contained herein will not in any way be affected or impaired thereby.

12.Governing Law. This Agreement will be governed by, and construed in accordance with, the internal laws of the State of Delaware, without giving effect to the principles of conflicts of law that would require the application of the laws of any other jurisdiction. Except as set forth below, no proceeding may be commenced, prosecuted or continued in any court other than the Court of Chancery of the State of Delaware and any state appellate court therefrom within the State of Delaware, which courts shall have jurisdiction over the adjudication of such matters, and the parties hereby consent to the jurisdiction of such courts and personal service with respect thereto. All parties hereby waive all right to trial by jury in any proceeding (whether based upon contract, tort or otherwise) in any way arising out of or relating to this Agreement. All parties agree that a final judgment in any such proceeding brought in any such court shall be conclusive and binding upon each party and may be enforced in any other courts in the jurisdiction of which a party is or may be subject, by suit upon such judgment.

13.Counterparts. This Agreement may be executed in two or more counterparts, each of which will constitute an original, but all of which, when taken together, will constitute but one instrument, and will become effective when one or more counterparts have been signed by each party hereto and delivered to the other parties. Delivery of an executed counterpart by facsimile or portable document format (.pdf) shall be effective as delivery of a manually executed counterpart thereof.

14.Fees and Expenses. Each party shall pay the fees and expenses of its advisers, counsel, accountants and other experts, if any, and all other expenses incurred by such party incident to the negotiation, preparation, execution, delivery and performance of this Agreement.

[Remainder of Page Left Blank Intentionally. Signature Page Follows.]

Please confirm that the foregoing correctly sets forth the agreement between us by signing in the space provided below for that purpose.

Dated as of: July 24, 2024

| | | | | |

| LIBERTY BROADBAND CORPORATION |

| |

| By: | /s/ Craig Troyer |

| Print Name: | Craig Troyer |

| Title: | Senior Vice President |

| Address: | 12300 Liberty Boulevard |

| Englewood, CO 80112 |

| E-mail: | |

| Phone: | |

Agreed and Accepted

this 24th day of July 2024:

| | | | | | | | |

| | |

| COMSCORE, INC. |

| |

| By: | | /s/ Mary Margaret Curry |

| Name: | | Mary Margaret Curry |

Title: | | Chief Financial Officer and Treasurer |

EXHIBIT A

COMSCORE, INC.

INVESTOR QUESTIONNAIRE

[Intentionally Omitted]

SUBSCRIPTION AGREEMENT

comScore, Inc.

11950 Democracy Drive, Suite 600

Reston, Virginia 20190

The undersigned (the “Investor”) hereby confirms its agreement with comScore, Inc., a Delaware corporation (the “Issuer”), as follows:

1.This Subscription Agreement (this “Agreement”), is made as of the date set forth below between the Issuer and the Investor.

2.Agreement to Sell and Purchase the Securities. Subject to the terms and conditions set forth in this Agreement, in exchange for (i) Investor’s irrevocable and unconditional waiver of its right to receive (a) the Annual Dividends (as defined in the Certificate of Designations) accrued through, but excluding, June 30, 2023, that would have been payable to such Investor pursuant to Section 4(c) of the Certificate of Designations on June 30, 2023 (the “2023 Dividends”), (b) the Annual Dividends accrued from June 30, 2023 through, but excluding, June 30, 2024, that would have been payable to such Investor pursuant to Section 4(c) of the Certificate of Designations on June 30, 2024 (the “2024 Dividends”) and (c) all amounts accrued and accumulated on the 2023 Dividends and 2024 Dividends from and including their respective Dividend Payment Dates (as defined in the Certificate of Designations) pursuant to Section 4(c) of the Certificate of Designations (the amounts in clauses (a) – (c), the “Deferred Dividends,” and such waiver, the “Dividend Waiver”), and (ii) Investor’s entry into an Amended and Restated Stockholders Agreement, in the form attached hereto as Annex A (the “A&R Stockholders Agreement”), the Issuer hereby agrees to issue to Investor, and Investor hereby grants the Dividend Waiver and agrees to subscribe for and purchase, 4,419,098 Preferred Shares (as defined below) (the “Acquired Shares” and such subscription and issuance, the “Subscription”).

3.Issuer Representations and Warranties. The Issuer represents and warrants that it has authorized the sale and issuance of shares of (i) Series B Convertible Preferred Stock, par value $0.001 per share, of the Issuer (the “Preferred Shares”) and (ii) common stock, par value $0.001 per share, of the Issuer (the “Common Stock”) into which such Preferred Shares are convertible (the “Underlying Shares”), in each case, in accordance with and subject to the terms of the Certificate of Designations of the Preferred Shares dated as of March 10, 2021 (as amended, the “Certificate of Designations”). The board of directors of the Issuer has adopted and approved resolutions intending to exempt any acquisitions or dispositions of Preferred Shares and Underlying Shares in connection with this Agreement or pursuant to the terms of the Certificate of Designations by the Investor from short-swing liability pursuant to Rule 16b-3 under the Exchange Act.

4.Investor Representations and Warranties.

A.Investor has the requisite power and authority to: (a) execute and deliver this Agreement and each other agreement contemplated hereby; (b) perform its

covenants and obligations hereunder and thereunder; and (c) consummate the transactions contemplated by this Agreement and each other agreement contemplated hereby. The execution and delivery of this Agreement and each other agreement contemplated hereby by the Investor, the performance by the Investor of its covenants and obligations hereunder and thereunder and the consummation of the transactions contemplated by this Agreement and each other agreement contemplated hereby have been duly authorized by all necessary action on the part of the Investor and no additional action on the part of the Investor is necessary. This Agreement and each other agreement contemplated hereby have been duly executed and delivered by the Investor and, assuming the due authorization, execution and delivery by the Issuer, constitute legal, valid and binding obligations of the Investor, enforceable against the Investor in accordance with their terms, except as such enforceability (A) may be limited by applicable bankruptcy, insolvency, reorganization, moratorium and other similar laws affecting or relating to creditors’ rights generally; and (B) is subject to general principles of equity.

B.Investor represents and warrants that, as of the date hereof, it (i) is a “qualified institutional buyer” (as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”)) or an “accredited investor” (within the meaning of Rule 501(a) under the Securities Act), (ii) is acquiring the Acquired Shares only for its own account and not for the account of others, or if Investor is subscribing for the Acquired Shares as a fiduciary or agent for one or more investor accounts, each owner of such account is a “qualified institutional buyer” (as defined above) and Investor has full investment discretion with respect to each such account, and the full power and authority to make the acknowledgements, representations and agreements herein on behalf of each owner of each such account and (iii) is not acquiring the Acquired Shares with a view to, or for offer or sale in connection with, any distribution thereof in violation of the Securities Act.

C.Investor understands that the Acquired Shares are being offered in a transaction not involving any public offering within the meaning of the Securities Act and that the Acquired Shares have not been registered under the Securities Act. Investor understands that the Acquired Shares may not be resold, transferred, pledged or otherwise disposed of by Investor absent an effective registration statement under the Securities Act, except (i) to the Issuer or a subsidiary thereof, (ii) to non-U.S. persons pursuant to offers and sales that occur outside the United States within the meaning of Regulation S under the Securities Act, (iii) pursuant to Rule 144 under the Securities Act, or (iv) pursuant to another applicable exemption from the registration requirements of the Securities Act, and that any certificates or book-entry records representing the Acquired Shares shall contain a legend to such effect. Investor understands and agrees that the Acquired Shares will be subject to transfer restrictions and, as a result of these transfer restrictions, Investor may not be able to readily resell the Acquired Shares and may be

required to bear the financial risk of an investment in the Acquired Shares for an indefinite period of time. Investor understands that it has been advised to consult legal counsel prior to making any offer, resale, pledge or transfer of any of the Acquired Shares.

D.Investor understands that the Acquired Shares are being offered and sold in reliance on a transactional exemption from the registration requirements of federal and state securities laws and that the Issuer is relying upon the truth and accuracy of the representations, warranties, agreements, acknowledgments and understandings of the Investor set forth herein in order to determine the applicability of such exemptions and the suitability of the Investor to acquire the Acquired Shares.

E.Investor understands and agrees that Investor is purchasing the Acquired Shares directly from the Issuer. Investor further acknowledges that there have been no representations, warranties, covenants and agreements made to Investor by the Issuer or any of its officers or directors, expressly or by implication, other than those representations, warranties, covenants and agreements included in this Agreement.

F.In making its decision to subscribe for and purchase the Acquired Shares, Investor represents that it has relied solely upon its own independent investigation. Investor acknowledges and agrees that Investor has received such information as Investor deems necessary in order to make an investment decision with respect to the Acquired Shares. Investor represents and agrees that Investor and Investor’s professional advisor(s), if any, have had the full opportunity to ask such questions, receive such answers and obtain such information as Investor and such Investor’s professional advisor(s), if any, have deemed necessary to make an investment decision with respect to the Acquired Shares. Investor acknowledges that it is aware that there are substantial risks incident to the purchase and ownership of the Acquired Shares. Investor has such knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of an investment in the Acquired Shares, and Investor has sought such accounting, legal and tax advice as Investor has considered necessary to make an informed investment decision. Alone, or together with any professional advisor(s), Investor represents and acknowledges that Investor has adequately analyzed and fully considered the risks of an investment in the Acquired Shares and determined that the Acquired Shares are a suitable investment for Investor and that Investor is able at this time and in the foreseeable future to bear the economic risk of a total loss of Investor’s investment in the Acquired Shares.

5.Registration Rights. The Acquired Shares and the Underlying Shares shall be considered Registrable Securities, as such term is defined in that certain Registration Rights Agreement by and among the Issuer and the purchasers named therein, dated as of March 10, 2021 (the “Registration Rights Agreement”), and the Investor shall have such registration and

other rights with respect to the Acquired Shares and the Underlying Shares as are provided to a Holder under the Registration Rights Agreement. The Issuer hereby agrees to use its reasonable best efforts to register the resale of the Acquired Shares and any Underlying Shares within 6 months of the date hereof in accordance with the provisions of the Registration Rights Agreement.

6.Closing and Delivery of the Acquired Shares.

A.Conditions to the Obligations of the Parties.

(I)Conditions to the Issuer’s Obligations. The Issuer’s obligation to issue and sell the Acquired Shares to the Investor shall be subject to the accuracy of the representations and warranties made by the Investor and the fulfillment of those undertakings of the Investor to be fulfilled prior to the Closing, in each case, as contained in this Agreement.

(II)Conditions to the Investor’s Obligations. The Investor’s obligation to purchase the Acquired Shares will be subject to (i) the delivery by the Issuer of the Acquired Shares in accordance with the provisions of this Agreement and (ii) the accuracy of the representations and warranties made by the Issuer and the fulfillment of those undertakings of the Issuer to be fulfilled prior to the Closing, in each case as contained in this Agreement.

B.Closing.

(I)The completion of the purchase and sale of the Acquired Shares (the “Closing”) shall occur, unless otherwise agreed upon by the Issuer, at Vinson & Elkins L.L.P., Texas Tower, 845 Texas Avenue, Suite 4700, Houston, Texas 77002 on the date hereof.

(II)At the Closing, the Issuer shall cause to be delivered to the Investor in book-entry form the Acquired Shares registered in the name of the Investor or, if so indicated on the Investor Questionnaire attached hereto as Exhibit A, in the name of a nominee designated by the Investor.

(III)Each book entry for the Acquired Shares shall contain a notation, and each certificate (if any) evidencing the Acquired Shares, shall be stamped or otherwise imprinted with a legend as set forth in the A&R Stockholders Agreement.

(IV)At the Closing, the parties hereto shall execute and deliver the A&R Stockholders Agreement and such additional documents and take such additional actions as the parties reasonably may deem to be practical and necessary in order to consummate the Subscription as contemplated by this Agreement.

7.Survival of Representations, Warranties and Agreements. Notwithstanding any investigation made by any party to this Agreement, all covenants, agreements, representations and warranties made by the Issuer and the Investor herein will survive the execution of this Agreement, the delivery to the Investor of the Acquired Shares and the payment therefor.

8.Notices. Any notice or communication required or permitted hereunder shall be in writing and either delivered personally, emailed or telecopied, sent by overnight mail via a reputable overnight carrier, or sent by certified or registered mail, postage prepaid, and shall be deemed to be given and received (a) when so delivered personally, (b) when sent, with no mail undeliverable or other rejection notice, if sent by email, or (c) five (5) business days after the date of mailing to the address below or to such other address or addresses as such person may hereafter designate by notice given hereunder:

(I)if to the Issuer, to:

comScore, Inc.

11950 Democracy Drive

Suite 600

Reston, Virginia 20190

Attention: Ashley Wright

Email:

With a copy (which shall not constitute notice) to:

Vinson & Elkins LLP

Texas Tower

845 Texas Avenue, Suite 4700

Houston, Texas 77002

Attention: Scott Rubinsky

Email:

(II)if to the Investor, at its address on the signature page hereto, or at such other address or addresses as may have been furnished to the Issuer in writing.

9.Changes. This Agreement may not be modified or amended except pursuant to an instrument in writing signed by the Issuer and the Investor.

10.Headings. The headings of the various sections of this Agreement have been inserted for convenience of reference only and will not be deemed to be part of this Agreement.

11.Severability. In case any provision contained in this Agreement should be invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of the remaining provisions contained herein will not in any way be affected or impaired thereby.

12.Governing Law. This Agreement will be governed by, and construed in accordance with, the internal laws of the State of Delaware, without giving effect to the principles of conflicts of law that would require the application of the laws of any other jurisdiction. Except as set forth below, no proceeding may be commenced, prosecuted or continued in any court other than the Court of Chancery of the State of Delaware and any state appellate court therefrom within the State of Delaware, which courts shall have jurisdiction over the adjudication of such matters, and the parties hereby consent to the jurisdiction of such courts and personal service with respect thereto. All parties hereby waive all right to trial by jury in any proceeding (whether based upon contract, tort or otherwise) in any way arising out of or relating to this Agreement. All parties agree that a final judgment in any such proceeding brought in any such court shall be conclusive and binding upon each party and may be enforced in any other courts in the jurisdiction of which a party is or may be subject, by suit upon such judgment.

13.Counterparts. This Agreement may be executed in two or more counterparts, each of which will constitute an original, but all of which, when taken together, will constitute but one instrument, and will become effective when one or more counterparts have been signed by each party hereto and delivered to the other parties. Delivery of an executed counterpart by facsimile or portable document format (.pdf) shall be effective as delivery of a manually executed counterpart thereof.

14.Fees and Expenses. Each party shall pay the fees and expenses of its advisers, counsel, accountants and other experts, if any, and all other expenses incurred by such party incident to the negotiation, preparation, execution, delivery and performance of this Agreement.

[Remainder of Page Left Blank Intentionally. Signature Page Follows.]

Please confirm that the foregoing correctly sets forth the agreement between us by signing in the space provided below for that purpose.

Dated as of: July 24, 2024

PINE INVESTOR LLC

By: /s/ Jacob B. Hansen

Print Name: Jacob B. Hansen

Title: Managing Director

Address: c/o Cerberus Capital Management, LP

875 3rd Ave., 14th Floor. New York, NY 10022

E-mail:

Phone:

Agreed and Accepted

this 24th day of July 2024:

| | | | | | | | |

| | |

| COMSCORE, INC. |

| |

| By: | | /s/ Mary Margaret Curry |

| Name: | | Mary Margaret Curry |

Title: | | Chief Financial Officer and Treasurer |

EXHIBIT A

COMSCORE, INC.

INVESTOR QUESTIONNAIRE

[Intentionally Omitted]

AMENDED AND RESTATED

STOCKHOLDERS AGREEMENT

This AMENDED AND RESTATED STOCKHOLDERS AGREEMENT (this “Agreement” or the “Amended and Restated Stockholders Agreement”), dated as of July 24, 2024 (the “Effective Date”), is entered into by and among comScore, Inc., a Delaware corporation (the “Company”), Charter Communications Holding Company, LLC, a Delaware limited liability company (the “Charter Stockholder”), Liberty Broadband Corporation, a Delaware corporation (the “Liberty Broadband Stockholder”), and Pine Investor, LLC, a Delaware limited liability company (the “Cerberus Stockholder,” and together with the Charter Stockholder and the Liberty Broadband Stockholder, the “Stockholders”).

WHEREAS, on January 7, 2021, (a) the Company and the Charter Stockholder entered into that certain Series B Convertible Preferred Stock Purchase Agreement (the “Charter Purchase Agreement”), (b) the Company and Qurate Retail, Inc., a Delaware corporation (together with its affiliates, “Qurate Stockholder”) entered into that certain Series B Convertible Preferred Stock Purchase Agreement, and on May 16, 2023, the Qurate Stockholder subsequently transferred its shares of Preferred Stock (as defined below) to Liberty Broadband (collectively, the “Liberty Broadband Purchase Agreement”), and (c) the Company and the Cerberus Stockholder entered into that certain Series B Convertible Preferred Stock Purchase Agreement (together with the Charter Purchase Agreement and the Liberty Broadband Purchase Agreement, the “Purchase Agreements”) relating to the issuance and sale of shares of Series B Convertible Preferred Stock, par value $0.001 per share, of the Company (together with any such shares of Series B Convertible Preferred Stock issued as payment for accrued dividends in accordance with the Certificate of Designations (as defined herein) and the Additional Series B Shares (as defined below), the “Preferred Stock” and the transactions contemplated by the Purchase Agreements, the “Transactions”); and

WHEREAS, on March 10, 2021 (the “Closing Date”), pursuant to the Purchase Agreements, the Company, Charter Stockholder, Cerberus Stockholder and Qurate Stockholder entered into that certain Stockholders Agreement to set forth certain understandings among such parties, including with respect to certain matters related to their ownership of Preferred Stock (the “Stockholders Agreement”).

WHEREAS, on July 24, 2024, the Company and each of the Stockholders entered into a Subscription Agreement (collectively, the “Subscription Agreements”), relating to the issuance and sale of additional shares of Preferred Stock on the terms and subject to the conditions set forth in the Subscription Agreements (the “Additional Series B Issuance”, and such shares, the “Additional Series B Shares”).

WHEREAS, the Company and the Stockholders wish to enter into this Agreement in order to amend and restate the Stockholders Agreement in its entirety.

NOW, THEREFORE, in consideration of the mutual covenants contained herein and for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

Section 1.1 Definitions. As used in this Agreement, the following terms shall have the following meanings:

“Acquired EBITDA” means with respect to any Acquired Entity or Business (any of the foregoing, a “Pro Forma Entity”) for any period, the amount for such period of Consolidated EBITDA of such Pro Forma Entity (determined as if references to the Company and its Subsidiaries in the definition of the term “Consolidated EBITDA” were references to such Pro Forma Entity and its Subsidiaries which will become Subsidiaries), all as determined on a consolidated basis for such Pro Forma Entity.

“Acquired Entity or Business” shall have the meaning set forth in the definition of “Consolidated EBITDA”.

“Activist Investor” means, as of any date, any Person (other than a Stockholder or any of its Affiliates, as of the date hereof) that has been identified on the most recent “SharkWatch 50” list, or any publicly disclosed Affiliate funds of such Person.

“Additional Common Stock” shall have the meaning set forth in Section 2.1(e)(iii).

“Additional Series B Issuance” shall have the meaning set forth in Recitals.

“Additional Series B Shares” shall have the meaning set forth in Recitals.

“Affiliate” means, with respect to any Person, any other Person that, directly or indirectly, controls, is controlled by or is under common control with such Person. For purposes of this definition, the term “control” (including, with correlative meanings, the terms “controlling,” “controlled by” and “under common control with”), as used with respect to any Person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of that Person, whether through the ownership of voting securities or partnership or other ownership interests, by contract or otherwise; provided, that (i) the Company and its Subsidiaries shall not be deemed to be Affiliates of any Stockholder or any of its Affiliates, (ii) “portfolio companies” (as such term is customarily used among institutional investors) in which any Stockholder or any of its Affiliates has an investment (whether as debt or equity) shall not be deemed Affiliates of such Stockholder, (iii) a Stockholder shall not be deemed an Affiliate of any other Stockholder solely as a result of their entry into the Transactions, the Stockholders Agreement, this Agreement or the transactions contemplated by the Subscription Agreements, (iv) Directors designated by any Stockholder shall not be deemed Affiliates of the Company or its Subsidiaries and (v) the Liberty Broadband Stockholder shall not be deemed an Affiliate of the Charter Stockholder, and vice versa.

Any Person shall be deemed to “beneficially own”, to have “beneficial ownership” of, or to be “beneficially owning” any securities (which securities shall also be deemed “beneficially owned” by such Person) that such Person or any of its Permitted Transferees (within the meaning of clauses (i) and (ii) of such defined term) is deemed to “beneficially own” within the meaning of Rules 13d-3 and 13d-5 under the Exchange Act, without regard to the requirement that the right to acquire the beneficial ownership of any securities must be exercisable within sixty (60) days (including assuming conversion of all shares of Preferred Stock, if any, owned by such Person to Common Stock).

“Agreement” shall have the meaning set forth in Preamble.

“Antitrust Approval” has the meaning set forth in Section 3.7.

“Antitrust Law” means the Sherman Antitrust Act, the Clayton Antitrust Act, the Hart-Scott-Rodino Antitrust Improvements Act of 1976, the Federal Trade Commission Act and all other Laws that are designed or intended to prohibit, restrict or regulate actions having the purpose or effect of monopolization or restraint of trade or significant impediments or lessening of competition or the creation or strengthening of a dominant position through merger or acquisition, in any case that are applicable to the Transaction.

“as-converted basis” means, prior to the conversion of all outstanding shares of Preferred Stock into shares of Common Stock, with respect to the outstanding shares of Common Stock as of any date, all outstanding shares of Common Stock calculated on a basis in which all shares of Common Stock issuable upon conversion of the outstanding shares of Preferred Stock (at the conversion rate in effect on such date in accordance with the Certificate of Designations) are assumed to be outstanding as of such date and disregarding any other securities or derivatives that are convertible or exercisable into, or exchangeable for, any shares of Common Stock.

“Assigning Stockholder” shall have the meaning set forth in Section 6.11(b).

“Board” means the Board of Directors of the Company.

“business day” means any day other than Saturday or Sunday or a day on which commercial banks are authorized or required by law to be closed in New York, New York.

“Buying Stockholder” shall have the meaning set forth in Section 2.1(e).

“Bylaws” means the Amended and Restated Bylaws of the Company (as amended from time to time).

“Capital Stock” means, with respect to any Person, any and all shares of, interests in, rights to purchase, warrants to purchase, options for, participations in or other equivalents of or interests in (however designated) stock issued by such Person.