Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 16 2023 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2023

Commission File Number: 001-39978

CN ENERGY GROUP. INC.

Building 2-B, Room 206, No. 268 Shiniu Road

Liandu District, Lishui City, Zhejiang Province

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Explanatory Note

As previously disclosed, on

December 30, 2022, CN Energy Group. Inc., a British Virgin Islands company (the “Company”), entered into a securities purchase

agreement (the “Purchase Agreement”) with Streeterville Capital, LLC, a Utah limited liability company (the “Investor”),

pursuant to which the Company issued to the Investor an unsecured promissory note, on December 30,

2022, in the original principal amount of $3,230,000.00 (the “Note”, and together with the Purchase Agreement, the “Agreement”),

convertible into Class A ordinary shares, no par value, of the Company (“Class A Ordinary Shares”), for $3,000,000.00 in gross

proceeds.

Under the Agreement, the Investor

has the right to redeem the Note sixty (60) days after the purchase price of the Note was delivered by the Investor to the Company, and

redemptions may be satisfied in cash or Class A Ordinary Shares, at the Company’s election. However, the Company will be required

to pay the redemption amount in cash, if there is an Equity Conditions Failure (as defined in the Note). If the Company elects to satisfy

a redemption in Class A Ordinary Shares, such Class A Ordinary Shares shall be issued at a redemption conversion price of the lower of

(i) $2.00 per share, subject to adjustment as provided in the Note, and (ii) 80% of the Nasdaq Minimum Price (as defined in the Note).

The Note does not contain

a floor price for the possible future redemption conversions into Class A Ordinary Shares, and a future conversion pursuant to the Agreement

could potentially result in a substantial dilutive effect on the existing shareholders of the Company. Pursuant to the relevant Nasdaq

Listing Rule guidance, the Nasdaq Staff has stated its position that, in determining whether the issuance of a future priced security

raises public interest concerns, Nasdaq Staff will consider, among other things, whether a future priced security includes features to

limit the potential dilutive effect of its conversion or exercise, including floors on the conversion or exercise price. To limit the

potential dilutive effect of a redemption conversion on the existing shareholders of the Company, the board of directors of the Company

approved on February 15, 2023 that the Company shall repay the Note in cash in the event any redemption conversions would result in the

aggregate effective conversion price falling below $0.12.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: February 16, 2023

| |

CN Energy Group. Inc. |

| |

|

|

| |

By: |

/s/ Kangbin Zheng |

| |

Name: |

Kangbin Zheng |

| |

Title: |

Chief Executive Officer |

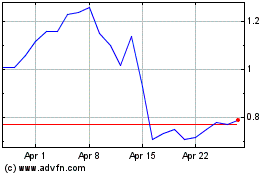

CN Energy (NASDAQ:CNEY)

Historical Stock Chart

From Aug 2024 to Sep 2024

CN Energy (NASDAQ:CNEY)

Historical Stock Chart

From Sep 2023 to Sep 2024