false

0001434524

0001434524

2024-12-06

2024-12-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

December 6, 2024

CLEARSIGN TECHNOLOGIES CORPORATION

(Exact name of registrant as specified in charter)

| Delaware |

|

001-35521 |

|

26-2056298 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

8023 E. 63rd Place, Suite 101

Tulsa,

Oklahoma 74133

(Address of Principal Executive Offices)

(Zip Code)

(918) 236-6461

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2 below).

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13(e)-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which

registered |

| Common Stock |

|

CLIR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth

company ¨ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

On December 6, 2024,

ClearSign Technologies Corporation (the “Company”) received a letter from the Listing Qualifications Department of the Nasdaq

Stock Market (“Nasdaq”) stating that, because the Company’s common stock had a closing bid price at or above $1.00 per

share for a minimum of 10 consecutive business days, the Company had regained compliance with the minimum bid price requirement of $1.00

per share for continued listing on Nasdaq, as set forth in Nasdaq Listing Rule 5550(a)(2), and that the matter is now closed. A copy

of the press release issued on December 9, 2024, announcing the receipt of the notice is attached hereto as Exhibit 99.1.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated: December 9, 2024

| |

CLEARSIGN TECHNOLOGIES CORPORATION |

| |

|

|

| |

By: |

/s/ Colin James Deller |

| |

Name: |

Colin James Deller |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

ClearSign Technologies

Corporation Regains Compliance with Nasdaq’s Minimum Bid Price Requirement

TULSA,

Oklahoma, December 9, 2024 -- ClearSign Technologies Corporation (Nasdaq: CLIR) (“ClearSign”

or the “Company”), an emerging leader in industrial combustion and sensing technologies that support decarbonization,

improve operational and energy efficiency, enable the use of hydrogen as a fuel and enhance safety while dramatically reducing

emissions, announces that it has received a notice from the Listing Qualifications Department of the Nasdaq Stock Market (“Nasdaq”)

on December 6, 2024, informing ClearSign that it has regained compliance with the minimum bid price requirement under

Nasdaq Listing Rule 5550(a)(2) for continued listing on Nasdaq.

ClearSign was previously

notified on May 2, 2024, that its common stock failed to maintain a minimum bid price of $1.00 over the previous

30 consecutive business days as required by Nasdaq’s Listing Rules. In order to regain compliance with the rule, ClearSign was

required to maintain a minimum closing bid price of $1.00 or more for at least 10 consecutive business days. This requirement

was met on December 5, 2024, the tenth consecutive business day that the closing bid price of ClearSign’s common stock

was above $1.00. Consequently, ClearSign is now in compliance with Nasdaq’s minimum bid price requirement and its common stock

will continue to be listed on Nasdaq.

About ClearSign

Technologies Corporation

ClearSign

Technologies Corporation designs and develops products and technologies for the purpose of decarbonization

and improving key performance characteristics of industrial and commercial systems, including operational performance, energy efficiency,

emission reduction, safety, the use of hydrogen as a fuel and overall cost-effectiveness. Our patented technologies, embedded in established

OEM products as ClearSign Core™ and ClearSign Eye™ and other sensing configurations, enhance the performance of combustion

systems and fuel safety systems in a broad range of markets, including the energy (upstream oil production and down-stream refining),

commercial/industrial boiler, chemical, petrochemical, transport and power industries. For more information, please visit www.clearsign.com.

Cautionary note

on forward-looking statements

All statements

in this press release that are not based on historical fact are “forward-looking statements.” You can find many (but not

all) of these statements by looking for words such as “approximates,” “believes,” “hopes,” “expects,”

“anticipates,” “estimates,” “projects,” “intends,” “plans,” “would,”

“should,” “could,” “may,” “will” or other similar expressions. While management has based

any forward-looking statements included in this press release on its current expectations on the Company’s strategy, plans, intentions,

performance, or future occurrences or results, the information on which such expectations were based may change. These forward-looking

statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties and other factors,

many of which are outside of the Company’s control, which could cause actual results to materially differ from such statements.

Such risks, uncertainties and other factors include, but are not limited to: the Company’s ability to maintain compliance with

Nasdaq’s Listing Rules; the performance of the Company’s burners, including related fuel and electricity savings and its

ability to lower NOx emissions; the Company’s ability to successfully deliver, install, and meet the performance obligations of

the Company’s products, including process burners, boiler burners and flare products, in the markets the Company operate and sell

its products in; the Company’s ability to successfully fabricate and ship its boiler burner products timely; the Company’s

ability to further expand into other geographic markets; the Company’s ability to further expand the sale of ultra-low NOx process

and boiler burners; the Company’s ability to successfully perform engineering orders and performance optimization processes included

therein; general business and economic conditions; the performance of management and the Company’s employees; the Company’s

ability to obtain financing, when needed; the Company’s ability to compete with competitors; whether the Company’s technology

will be accepted and adopted and other factors identified in the Company’s Annual Report on Form 10-K filed with the U.S.

Securities and Exchange Commission and available at www.sec.gov and other factors that are detailed in the Company’s

periodic and current reports available for review at www.sec.gov. Furthermore, the Company operates in a competitive environment

where new and unanticipated risks may arise. Accordingly, investors should not place any reliance on forward-looking statements as a

prediction of actual results. The Company disclaims any intention to, and, except as may be required by law, undertakes no obligation

to, update or revise forward-looking statements to reflect events or circumstances that subsequently occur or of which the Company hereafter

become aware.

For further information:

Investor Relations:

Matthew Selinger

Firm IR Group for ClearSign

+1 415-572-8152

mselinger@firmirgroup.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

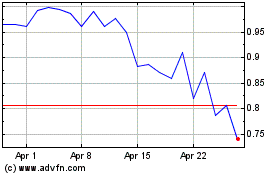

ClearSign Technologies (NASDAQ:CLIR)

Historical Stock Chart

From Dec 2024 to Jan 2025

ClearSign Technologies (NASDAQ:CLIR)

Historical Stock Chart

From Jan 2024 to Jan 2025