Clearside Biomedical Announces Third Quarter 2022 Financial Results and Provides Corporate Update

November 09 2022 - 7:15AM

Clearside Biomedical, Inc. (NASDAQ:CLSD), a biopharmaceutical

company revolutionizing the delivery of therapies to the back of

the eye through the suprachoroidal space (SCS®), today reported

financial results for the third quarter ended September 30, 2022

and provided a corporate update.

“Based on the encouraging data we reported today

from our OASIS study, we are now positioned to advance our

suprachoroidal CLS-AX program into a larger randomized, controlled

Phase 2 trial,” said George Lasezkay, Pharm.D., J.D., Clearside’s

President and Chief Executive Officer. “We see significant

opportunity across the retinal disease spectrum for CLS-AX, which

combines pan-VEGF inhibition from the highly potent tyrosine kinase

inhibitor, axitinib, with targeted SCS delivery using our SCS

Microinjector®. In addition, the growing level of awareness and

acceptance of SCS delivery in the retinal medical community is

further validating our SCS delivery platform, with recent positive

clinical data presented from four other suprachoroidal trials of

three different novel therapies each delivered with our proprietary

SCS Microinjector.”

Key Highlights

- Reported favorable

results of safety, durability and biologic effect observed in the

higher doses administered in Cohorts 3 and 4 of OASIS, Clearside’s

U.S. based, open-label, dose-escalation Phase 1/2a clinical trial

of CLS-AX in patients with wet AMD.

- Entered into a

Royalty Interest Purchase and Sale Agreement with HealthCare

Royalty Partners, in which Clearside received an initial payment of

$32.5 million, less certain expenses, with the potential to receive

up to $65 million in non-dilutive funding to support ongoing

clinical development of Clearside’s pipeline, and pursuant to which

HealthCare Royalty Partners will receive certain royalties and

milestone payments due to Clearside from XIPERE® (triamcinolone

acetonide injectable suspension) and certain SCS Microinjector

license agreements.

- Clearside’s

commercialization partner, Bausch + Lomb, received XIPERE’s

permanent J-code, a reimbursement code used in the U.S. by

commercial insurers and government payers, which became effective

for provider billing on July 1, 2022.

- XIPERE was

nominated for the 2022 Prix Galien USA Award, which recognizes

outstanding achievements in improving the global human condition

through the development of innovative drugs, technologies, and

other treatments.

- Clearside’s

proprietary SCS delivery platform was highlighted in multiple

presentations and panels at global conferences, including the

American Academy of Ophthalmology (AAO) 2022 Annual Meeting, the

Retina Society, the Ophthalmology Futures Retina Forum 2022, the

American Society of Retina Specialists (ASRS) Annual Meeting, and

the Ophthalmology Innovation Source (OIS) Retina Innovation

Summit.

Third Quarter 2022 Financial

Results

Clearside’s license and other revenue for the

third quarter of 2022 was $0.3 million, compared to $3.1 million

for the third quarter of 2021. This decrease was primarily

attributable to higher revenue from partner licensing agreements in

the third quarter of 2021.

Research and development expenses for the third

quarter of 2022 were $4.6 million, compared to $5.1 million for the

third quarter of 2021. This decrease was primarily attributable to

a decrease in costs in the XIPERE program following approval in

October 2021.

General and administrative expenses for the

third quarter of 2022 were $2.4 million, compared to $2.8 million

for the third quarter of 2021. This decrease was primarily

attributable to a $0.3 million decrease in employee related costs

related for share-based compensation.

Net loss for the third quarter of 2022 was $7.8

million, or $0.13 per share of common stock, compared to a net loss

of $4.9 million, or $0.08 per share of common stock, for the third

quarter of 2021. This decrease was primarily attributable to higher

revenue from partner licensing agreements in the third quarter of

2021.

As of September 30, 2022, Clearside’s cash and

cash equivalents totaled $53.4 million. The Company believes this

cash balance will provide financial runway into 2024.

Conference Call & Webcast

Details

Clearside’s management will host a webcast and

conference call at 8:30 a.m. Eastern Time to provide a corporate

update and to discuss results from the OASIS trial. The live and

archived webcast may be accessed on the Clearside website under the

Investors section: Events and Presentations. The live call can be

accessed by dialing (888) 506-0062 (domestic) or (973) 528-0011

(international) and entering conference code: 111701. An

archive of the webcast will be available for three months.

About Clearside Biomedical

Clearside Biomedical, Inc. is a

biopharmaceutical company revolutionizing the delivery of therapies

to the back of the eye through the suprachoroidal space (SCS®).

Clearside’s SCS injection platform, utilizing the Company’s

proprietary SCS Microinjector®, enables an in-office, repeatable,

non-surgical procedure for the targeted and compartmentalized

delivery of a wide variety of therapies to the macula, retina or

choroid to potentially preserve and improve vision in patients with

sight-threatening eye diseases. Clearside is developing its own

pipeline of small molecule product candidates for administration

via its SCS Microinjector and strategically partners its SCS

delivery platform with companies utilizing other ophthalmic

therapeutic innovations. Clearside’s first product, XIPERE®

(triamcinolone acetonide injectable suspension) for suprachoroidal

use, is commercially available in the U.S. For more information,

please visit www.clearsidebio.com.

Cautionary Note Regarding

Forward-Looking Statements

Any statements contained in this press release

that do not describe historical facts may constitute

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. These statements may be

identified by words such as “believe”, “expect”, “may”, “plan”,

“potential”, “will”, and similar expressions, and are based on

Clearside’s current beliefs and expectations. These forward-looking

statements include statements regarding the clinical development of

CLS-AX, including the initiation of the Phase 2 clinical trial, the

potential benefits of CLS-AX and product candidates using

Clearside’s SCS Microinjector®, potential future payments under the

agreement with HealthCare Royalty Partners and Clearside’s ability

to fund its operations into 2024. These statements involve risks

and uncertainties that could cause actual results to differ

materially from those reflected in such statements. Risks and

uncertainties that may cause actual results to differ materially

include uncertainties inherent in the conduct of clinical trials,

Clearside’s reliance on third parties over which it may not always

have full control, uncertainties regarding the COVID-19 pandemic

and other risks and uncertainties that are described in Clearside’s

Annual Report on Form 10-K for the year ended December 31, 2021,

filed with the U.S. Securities and Exchange Commission (SEC) on

March 11, 2022, Clearside’s Quarterly Report on Form 10-Q for the

quarter ended September 30, 2022, and Clearside’s other Periodic

Reports filed with the SEC. Any forward-looking statements speak

only as of the date of this press release and are based on

information available to Clearside as of the date of this release,

and Clearside assumes no obligation to, and does not intend to,

update any forward-looking statements, whether as a result of new

information, future events or otherwise.

Investor and Media Contacts:

Jenny Kobin Remy Bernarda ir@clearsidebio.com(678) 430-8206

-Financial Tables Follow-

CLEARSIDE BIOMEDICAL,

INC.Selected Financial Data (in

thousands, except share and per share data)(unaudited)

| Statements of

Operations Data |

|

Three Months EndedSeptember

30, |

|

|

Nine Months EndedSeptember

30, |

|

| |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| License and other revenue |

|

$ |

266 |

|

|

$ |

3,074 |

|

|

$ |

997 |

|

|

$ |

3,888 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

4,637 |

|

|

|

5,147 |

|

|

|

14,603 |

|

|

|

14,697 |

|

|

General and administrative |

|

|

2,353 |

|

|

|

2,816 |

|

|

|

8,601 |

|

|

|

8,525 |

|

|

Total operating expenses |

|

|

6,990 |

|

|

|

7,963 |

|

|

|

23,204 |

|

|

|

23,222 |

|

| Loss from operations |

|

|

(6,724 |

) |

|

|

(4,889 |

) |

|

|

(22,207 |

) |

|

|

(19,334 |

) |

| Other income |

|

|

194 |

|

|

|

2 |

|

|

|

220 |

|

|

|

1,001 |

|

| Non-cash interest expense on

liability related the sales of future royalties |

|

|

(1,297 |

) |

|

|

— |

|

|

|

(1,297 |

) |

|

|

— |

|

| Net loss |

|

$ |

(7,827 |

) |

|

$ |

(4,887 |

) |

|

$ |

(23,284 |

) |

|

$ |

(18,333 |

) |

| Net loss per share of common stock — basic and diluted |

|

$ |

(0.13 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.39 |

) |

|

$ |

(0.32 |

) |

| Weighted average shares outstanding — basic and diluted |

|

|

60,188,541 |

|

|

|

59,474,346 |

|

|

|

60,134,821 |

|

|

|

58,095,080 |

|

| Balance Sheet

Data |

September 30, |

|

|

December 31, |

|

| |

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

53,381 |

|

|

$ |

30,436 |

|

| Accounts receivable |

|

123 |

|

|

|

10,000 |

|

| Total assets |

|

55,685 |

|

|

|

42,903 |

|

| Liability related to the sales of

future royalties, net |

|

31,935 |

|

|

|

— |

|

| Total liabilities |

|

37,139 |

|

|

|

4,928 |

|

| Total stockholders’ equity |

|

18,546 |

|

|

|

37,975 |

|

Source: Clearside Biomedical, Inc.

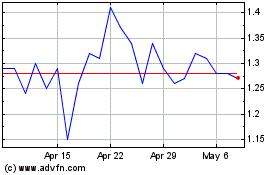

Clearside Biomedical (NASDAQ:CLSD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Clearside Biomedical (NASDAQ:CLSD)

Historical Stock Chart

From Sep 2023 to Sep 2024