false

0000913277

0000913277

2024-03-08

2024-03-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 8, 2024

CLARUS

CORPORATION

(Exact name of registrant as specified in its

charter)

Delaware

(State or other jurisdiction

of incorporation) |

001-34767

(Commission File Number) |

58-1972600

(IRS Employer

Identification Number) |

2084

East 3900 South, Salt Lake City,

Utah

(Address of principal executive offices) |

84124

(Zip Code) |

Registrant’s telephone number, including

area code: (801) 278-5552

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which

registered |

| Common

Stock, par value $.0001 per share |

|

CLAR |

|

NASDAQ

Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

¨ |

Emerging growth company |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

On March 8, 2024, the Company

delivered letters (each, a “Letter” and collectively, the “Letters”) to each of Greenhouse Funds LLLP and its

affiliates (collectively, “Greenhouse”) and Mr. Warren B. Kanders and its affiliates (collectively, “Kanders”)

approving their respective requests to be permitted under the Company’s Rights Agreement dated as of February 12, 2008 to increase

their beneficial ownership to up to 15.0% of the Company’s outstanding shares of common stock with respect to Greenhouse and up

to 26.7% of the Company’s outstanding shares of common stock with respect to Kanders.

Such approval set forth in

each respective Letter is conditioned upon, and subject to, among other things: (i) Greenhouse not increasing its beneficial ownership

to in excess of 15.0% of the Company’s outstanding shares of common stock and Kanders not increasing its beneficial ownership to

in excess of 26.7% of the Company’s outstanding shares of common stock; and (ii) each of Greenhouse and Kanders increasing its respective

beneficial ownership to up to the applicable permitted percentage of the Company’s outstanding shares of common stock set forth

in the respective Letters, if at all, on or before the twelve month anniversary of the date of each Letter.

Furthermore, in the event

that Greenhouse or Kanders reduces its respective beneficial ownership to below 9.9% of the Company’s outstanding shares of common

stock, the applicable respective Letters with such party shall immediately terminate and Greenhouse or Kanders, as applicable, would need

to obtain a new approval from the Company’s Board of Directors before seeking to again increase its respective beneficial ownership

to in excess of 9.9% of the Company’s outstanding shares of common stock.

Mr. Kanders is the Company’s

Executive Chairman of the Board of Directors and a member of the Company’s Board of Directors.

Copies of the Letters are

attached to this Current Report on Form 8-K as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference as if fully

set forth herein. The foregoing summary description of the Letters is not intended to be complete and is qualified in its entirety by

the complete text of the Letters.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

Dated: March 8, 2024

| |

|

| |

CLARUS CORPORATION |

| |

|

| |

By: |

/s/ Michael J. Yates |

| |

Name: Michael J. Yates |

| |

Title: Chief Financial Officer |

Exhibit 99.1

Clarus Corporation

2084 East 3900 South,

Salt Lake City, Utah 84124

March 8, 2024

Via Email (jmilano@greenhousefunds.com)

Joseph M. Milano, CFA

Greenhouse Funds LLLP

605 S Eden St. Suite 250

Baltimore, MD 21231

Dear Mr. Milano:

I am responding to your request that Greenhouse

Funds LLLP and its Affiliates (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended) (collectively,

“Greenhouse”) be permitted under Clarus Corporation’s (the “Company”) Rights Agreement dated as of February

12, 2008 (the “Rights Agreement”) to acquire beneficial ownership up to 15.0% of the Company’s outstanding shares of

common stock. We note that Greenhouse has beneficial ownership of 4,538,107 shares of the Company’s common stock, as publicly disclosed

by Greenhouse in the Schedule 13G as of December 31, 2023, filed by it with the Securities and Exchange Commission on February 14, 2024,

which represents approximately 11.9% of the Company’s outstanding shares of common stock.

The Company’s Board of Directors has considered

Greenhouse’s request to acquire beneficial ownership up to 15.0% of the Company’s outstanding shares of common stock, and

has determined to approve Greenhouse’s request to increase its current beneficial ownership to up to 15.0% of the Company’s

outstanding shares of common stock, provided that the foregoing determination is conditioned upon, and subject to Greenhouse: (i) not

increasing such beneficial ownership to in excess of 15.0% of the Company’s outstanding shares of common stock; (ii) remaining continuously

eligible to report its ownership of the Company’s common stock on Schedule 13G; and (iii) increasing such beneficial ownership to

up to 15.0% of the Company’s outstanding shares of common stock on or before the twelve month anniversary of the date of this letter.

Please note that in the event that Greenhouse reduces

its beneficial ownership to below 9.9%, the approval granted pursuant to this letter shall immediately terminate and Greenhouse would

need to obtain a new approval from the Company’s Board of Directors before seeking to again increase its beneficial ownership to

in excess of 9.9% of the Company’s outstanding shares of common stock.

Should you have any further questions, please do

not hesitate to contact me.

| |

Very truly yours, |

| |

|

| |

CLARUS CORPORATION |

| |

|

| |

By: |

/s/ Michael J. Yates |

| |

|

Name: |

Michael J. Yates |

| |

|

Title: |

Chief Financial Officer |

| Accepted and Agreed to |

|

| as of the Date First Set Forth Above: |

|

| |

|

| |

Greenhouse Funds LLLP |

|

| |

|

| |

|

| |

By: |

/s/ Joseph M. Milano |

|

| |

Name: Joseph M. Milano |

|

| |

Title: Chief Investment Officer |

|

Exhibit 99.2

Clarus Corporation

2084 East 3900 South,

Salt Lake City, Utah 84124

March 8, 2024

Via Email (wbkanders@kanders.com)

Warren B. Kanders

c/o Kanders & Company, Inc.

250 Royal Palm Way

Suite 201

Palm Beach, Florida 33480

Dear Mr. Kanders:

I am responding to your request that you and your

Affiliates (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended) be permitted under Clarus Corporation’s

(the “Company”) Rights Agreement dated as of February 12, 2008 (the “Rights Agreement”) to acquire beneficial

ownership up to 26.7% of the Company’s outstanding shares of common stock. We note that you and your Affiliates have beneficial

ownership of 6,525,421 shares of the Company’s common stock, as publicly disclosed by you and your Affiliates in the Schedule 13D/A

filed with the Securities and Exchange Commission on January 30, 2024, which represents approximately 16.7% of the Company’s outstanding

shares of common stock.

The Company’s Board of Directors has considered

your and your Affiliates’ request to acquire beneficial ownership up to 26.7% of the Company’s outstanding shares of common

stock, and has determined to approve your and your Affiliates’ request to increase such current beneficial ownership to up to 26.7%

of the Company’s outstanding shares of common stock, provided that the foregoing determination is conditioned upon, and subject

to you and your Affiliates: (i) not increasing such beneficial ownership to in excess of 26.7% of the Company’s outstanding shares

of common stock; and (ii) increasing such beneficial ownership to up to 26.7% of the Company’s outstanding shares of common stock

on or before the twelve month anniversary of the date of this letter.

Please note that in the event that you and your

Affiliates reduce your beneficial ownership to below 9.9%, the approval granted pursuant to this letter shall immediately terminate and

you and your Affiliates would need to obtain a new approval from the Company’s Board of Directors before seeking to again increase

your beneficial ownership to in excess of 9.9% of the Company’s outstanding shares of common stock.

Should you have any further questions, please do

not hesitate to contact me.

| |

Very truly yours, |

| |

|

| |

CLARUS CORPORATION |

| |

|

| |

By: |

/s/ Michael J. Yates |

| |

|

Name: |

Michael J. Yates |

| |

|

Title: |

Chief Financial Officer |

| Accepted and Agreed to |

|

| as of the Date First Set Forth Above: |

|

| |

|

| |

|

| |

/s/ Warren B. Kanders |

|

| |

Warren B. Kanders |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

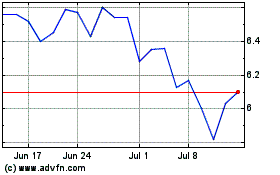

Clarus (NASDAQ:CLAR)

Historical Stock Chart

From Apr 2024 to May 2024

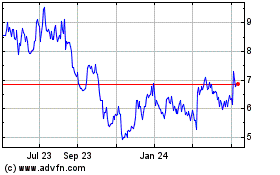

Clarus (NASDAQ:CLAR)

Historical Stock Chart

From May 2023 to May 2024