Current Report Filing (8-k)

August 24 2022 - 7:01AM

Edgar (US Regulatory)

0001318484

false

0001318484

2022-08-24

2022-08-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of The Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): August 24, 2022

Citi Trends, Inc.

(Exact name of

registrant as specified in its charter)

| Delaware |

|

000-51315 |

|

52-2150697 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| 104 Coleman Boulevard, Savannah, Georgia |

|

31408 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (912) 236-1561

Former

name or former address, if changed since last report: Not applicable

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre- commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common stock, $0.01 par value |

CTRN |

Nasdaq Stock Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. |

Entry into a Material Definitive Agreement. |

As previously disclosed, on March 14, 2022, Citi

Trends, Inc. (the “Company”) entered into an Agreement for Purchase and Sale of Real Property (the “Purchase Agreement”)

with an affiliate of Oak Street Real Estate Capital, LLC (“Oak Street”), pursuant to which the parties agreed to consummate

a sale and leaseback transaction (the “Sale and Leaseback Transaction”). Under the terms of the Purchase Agreement, the Company

agreed to sell its distribution center located in Darlington, South Carolina (the “Darlington Property”) for a purchase price

of $37,136,400, and at the Company’s discretion, its distribution center located in Roland, Oklahoma (the “Roland Property”)

for a purchase price of $34,829,182, both of which are subject to upward adjustment by up to $9,205,771 for the Darlington Property and

up to $1,400,500 for the Roland Property for the Company’s planned capital expenditures at each of the properties. The Company completed

the sale of the Darlington Property on April 19, 2022.

The

Company announced on August 24, 2022, after completing its diligence process, that it has elected to sell the Roland Property for

a sales price of $36,229,682. Oak Street’s obligation to consummate the purchase of the Roland Property is subject to due diligence

and other customary closing conditions as provided in the Purchase Agreement. Upon the closing of the sale of the Roland Property, the

Company will enter into a long-term net lease with Oak Street (the “Lease”), pursuant to which the Company will lease the

Roland Property from Oak Street. Pursuant to the Lease, the Company will lease back from Oak Street the Roland Property at an initial

annual base rent of approximately $2.7 million for the first year (including capital expenditures). The rent is payable monthly in advance,

with annual 2.00% increases. The Lease will be for a fifteen-year term and include six subsequent five-year renewal options.

The closing of the sale of the Roland Property,

if elected by the Company, is expected to provide the Company with net proceeds (after tax and transaction-related costs) of approximately

$32 million. The Company intends to use the net proceeds from the Sale and Leaseback Transaction to provide additional liquidity and for

other corporate purposes, including potential share repurchases as determined by the Company’s board of directors. The closing of the sale of the Roland Property is expected to occur in September 2022.

| Item 2.02. | Results of Operations and Financial Condition. |

On August 24, 2022, the Company issued a press

release reporting its financial results for the second quarter ended July 30, 2022 (the “Press Release”). A copy of the Press

Release is attached to this Current Report on Form 8-K (the “Current Report”) as Exhibit 99.1, the contents of which

are incorporated herein solely for purposes of this Item 2.02 disclosure by this reference.

The information contained in this Item 2.02, including

the Press Release attached to this Current Report, is being furnished and shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section.

The information in this Item 2.02, including the Press Release, shall not be incorporated by reference into any filings under the Securities

Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference

in any such filing.

| Item 9.01. | Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

CITI TRENDS, INC. |

| |

|

| Date: August 24, 2022 |

By: |

/s/ Heather Plutino |

| |

Name: |

Heather Plutino |

| |

Title: |

Chief Financial Officer |

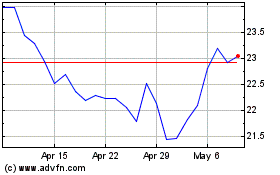

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Apr 2023 to Apr 2024