2ndUPDATE: Apple Surges Back Above $600, Erasing Most Of Recent Loss

April 25 2012 - 12:28PM

Dow Jones News

Shares of Apple Inc. (AAPL) surged back above $600 Wednesday as

Wall Street applauded the technology bellwether's strong quarterly

results.

The stock recently traded up 9.1% to $611.29, erasing in one

fell swoop much of what it lost over the previous 11 sessions. The

stock had been up as much as 10.3% at an intraday high of $618, the

highest price seen since April 18.

At current prices, the stock has retraced 67% of the decline

from its April 9 all-time closing high of $636.23. Ahead of the

earnings report, Tuesday's close of $560.28 was a six-week low.

A host of Wall Street analysts have helped fuel the gains by

suggesting the shares still have a lot further to rally.

Goldman Sachs bumped up Apple's price target to $850 from $750,

Wedbush Morgan lifted its target to $800 from $570, and Canaccord

Genuity raised its target to $775 from $740.

J.P. Morgan said "Apple remains in a league of its own," while

Gabelli & Co. said Apple's valuation "remains very

compelling."

Apple's rise far outpaced its peers', and the rally was having a

historic impact on the broader market. At one point Wednesday, the

stock's heavy weighting contributed about 6 points to the S&P

500-stock index's overall gain, or about one-third of its climb,

according to S&P Indices senior index analyst Howard

Silverblatt. An influence of that degree would be the biggest daily

impact Apple has ever had on the index.

The S&P 500 was recently up 14 points, or 1%, at 1386.

Meanwhile, the Dow Jones Industrial Average, which doesn't include

Apple as a component, was up 76 points, or 0.6%, at 13077.

In addition, shares of Apple suppliers also rose Wednesday. Chip

maker OmniVision Technologies Inc. (OVTI) gained 6.7% in

late-morning trade, on pace for its biggest increase since March 6.

Cirrus Logic (CRUS) climbed 8.7% and Broadcom Corp. (BRCM) added

5.1%.

Ahead of Apple's results, investors had grown increasingly

worried that iPhone sales might disappoint, as carriers Verizon

Communications Inc. (VZ) and AT&T Inc. (T) reported

year-over-year iPhone sales declines.

But Apple said after Tuesday's close that it sold 35.1 million

iPhone units last quarter, well above expectations of about 30

million. And earnings rose 94% from year-ago levels to $11.62

billion, or $12.30 a share, on revenue growth of 59%, to $39.19

billion.

Analysts surveyed by FactSet Research had been expecting, on

average, earnings of $10.16 a share on revenue of $36.96

billion.

Dave Rolfe, chief investment officer at Wedgewood Partners, said

it was a "classic dominant Apple quarter."

"The only chink in the armor, which is really not a chink at

all, iPad numbers came in in-line," Rolfe said.

-By Tomi Kilgore, Dow Jones Newswires; 212-416-2470;

tomi.kilgore@dowjones.com

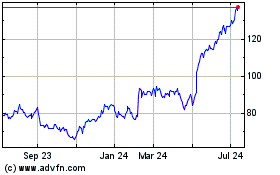

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

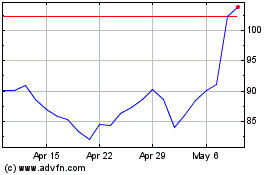

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024