Cirrus Logic, Inc. (Nasdaq: CRUS), a leader in high-precision

analog and digital signal processing components, today announced

financial results for the second quarter of fiscal year 2010, which

ended Sept. 26, 2009.

Revenue for the quarter was $55.7 million compared to $53.3

million during the second quarter of fiscal year 2009 and $37.5

million in the previous quarter. Gross margin for the quarter was

52 percent, down from 56 percent in the quarter a year ago and flat

compared to 52 percent reported for the previous quarter.

Total GAAP operating expenses for the quarter were approximately

$22.5 million, up from $19.8 million in the previous quarter. GAAP

operating expenses in the second quarter included a net benefit of

approximately $1.4 million related to the sale of certain patents

as well as an additional $165,000 in facilities restructuring

credits. GAAP operating expenses also include charges of $1.3

million for stock-based compensation and $400,000 in

acquisition-related amortization of intangibles. Non-GAAP operating

expenses for the quarter were approximately $22.4 million, compared

to $20.9 million for the June quarter.

Income from operations on a GAAP basis was approximately $6.4

million. Excluding the items noted above, non-GAAP income from

operations was $6.7 million.

Cirrus Logic reported second quarter GAAP net income of

approximately $6.8 million, or $0.10 per share based on 65.5

million average diluted shares outstanding. Excluding the items

noted above, on a non-GAAP basis the company reported net income of

$7.0 million, or $0.11 per share.

“We are extremely pleased with our Q2 results, as revenue and

gross margin exceeded our expectations, driven by both new audio

product ramps as well as a modest recovery across our other product

lines,“ said Jason Rhode, president and chief executive officer,

Cirrus Logic. “We expect further revenue growth in Q3, coupled with

gross margin improvements due to a higher mix of Energy revenue as

well as continued improvements to our product cost structures.”

Outlook for Third Quarter FY 2010 (ending December 26,

2009):

- Revenue is expected to range

between $58 million and $62 million;

- Gross margin is expected to be

between 52 percent and 54 percent; and

- Combined R&D and SG&A

expenses are expected to range between $23 million and $25 million,

which include approximately $2 million in share-based compensation

and amortization of acquisition-related intangibles expenses.

Conference Call

Cirrus Logic management will hold a conference call to discuss

the company’s results for the second quarter of fiscal year 2010,

on Oct. 20, 2009 at 10:30 a.m. EDT. Those wishing to join should

call 480-629-9820, or 877-941-8631 (Conference ID: 4165423) at

approximately 10:20 a.m. EDT. A replay of the conference call will

also be available beginning one hour after the completion of the

call, until Oct. 27, 2009. To access the recording, dial

303-590-3030, or toll-free at 800-406-7325 (Conference ID:

4165423). A live and an archived webcast of the conference call

will also be available via the investor section of the company’s

website at www.cirrus.com.

Cirrus Logic, Inc.

Celebrating its 25th year as a leading fabless semiconductor

company in 2009, Cirrus Logic develops high-precision, analog and

mixed-signal integrated circuits for a broad range of innovative

customers. Building on its diverse analog and signal-processing

patent portfolio, Cirrus Logic delivers highly optimized products

for a variety of audio and energy-related applications. The company

operates from headquarters in Austin, Texas, with offices in

Tucson, Ariz., Europe, Japan and Asia. More information about

Cirrus Logic is available at www.cirrus.com.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a

GAAP basis, Cirrus has provided non-GAAP financial information,

including non-GAAP operating expenses, non-GAAP net income,

non-GAAP net income from operations, and non-GAAP diluted earnings

per share. A reconciliation of the adjustments to GAAP results is

included in the tables below. Non-GAAP financial information is not

meant as a substitute for GAAP results, but is included because

management believes such information is useful to our investors for

informational and comparative purposes. In addition, certain

non-GAAP financial information is used internally by management to

evaluate and manage the company. As a note, the non-GAAP financial

information used by Cirrus Logic may differ from that used by other

companies. These non-GAAP measures should be considered in addition

to, and not as a substitute for, the results prepared in accordance

with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters

set forth in this news release contain forward-looking statements,

including our estimates of third quarter fiscal year 2010 revenue,

gross margin, combined research and development and selling,

general and administrative expense levels, share-based compensation

expense, and amortization of acquired intangible expenses. In some

cases, forward-looking statements are identified by words such as

“expect,” “anticipate,” “target,” “project,” “believe,” “goals,”

“opportunity,” “estimates,” and “intend,” variations of these types

of words and similar expressions are intended to identify these

forward-looking statements. In addition, any statements that refer

to our plans, expectations, strategies or other characterizations

of future events or circumstances are forward-looking statements.

These forward-looking statements are based on our current

expectations, estimates and assumptions and are subject to certain

risks and uncertainties that could cause actual results to differ

materially. These risks and uncertainties include, but are not

limited to, the following: overall economic pressures and general

market and economic conditions; overall conditions in the

semiconductor market; the level of orders and shipments during the

third quarter of fiscal year 2010, as well as customer

cancellations of orders, or the failure to place orders consistent

with forecasts; the loss of a key customer; pricing pressures; and

the risk factors listed in our Form 10-K for the year ended March

28, 2009, and in our other filings with the Securities and Exchange

Commission, which are available at www.sec.gov. The foregoing

information concerning our business outlook represents our outlook

as of the date of this news release, and we undertake no obligation

to update or revise any forward-looking statements, whether as a

result of new developments or otherwise.

Cirrus Logic and Cirrus are trademarks of Cirrus Logic Inc.

Summary financial data

follows:

CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED STATEMENT OF

OPERATIONS (unaudited) (in thousands, except per

share data)

Three Months Ended

Six Months Ended

Sep. 26, Jun. 27, Sep. 27, Sep.

26, Sep. 27, 2009 2009 2008

2009 2008 Q2'10 Q1'10 Q2'09

Q2'10 Q2'09 Audio products $ 41,271 $ 24,787 $ 30,604

$ 66,058 $ 52,634 Energy products 14,403

12,727 22,674 27,130

44,655

Net revenue

55,674 37,514

53,278 93,188

97,289

Cost of sales

26,700 17,927 23,292

44,627 42,652

Gross Profit

28,974 19,587 29,986 48,561

54,637 Operating expenses: Research and

development 12,355 12,508 10,864 24,863 22,469 Selling, general and

administrative 11,746 10,071 11,597 21,817 23,600 Restructuring and

other costs (165 ) - - (165 ) - Provision for litigation expenses -

(2,745 ) 1,771 (2,745 ) 1,771 Patent agreement, net (1,400 )

- - (1,400 ) - Total

operating expenses 22,536 19,834

24,232 42,370 47,840

Operating income (loss)

6,438 (247 ) 5,754 6,191

6,797 Interest income, net 376 463 637 839 1,573

Other income (expense), net

(21 ) (18 ) (52 ) (39 ) 143

Income (loss) before income taxes 6,793 198

6,339 6,991 8,513 Provision (benefit) for

income taxes 29 (23 ) (16 ) 6

20

Net income (loss) $ 6,764

$ 221 $ 6,355

$ 6,985 $ 8,493 Basic income

(loss) per share: Basic income (loss) per share: $ 0.10 $ - $ 0.10

$ 0.11 $ 0.13 Diluted income (loss) per share: $ 0.10 $ - $ 0.10 $

0.11 $ 0.13 Weighted average number of shares: Basic 65,281

65,254 64,971 65,268 65,797 Diluted 65,473 65,341 65,317 65,392

66,264

Prepared in accordance with

Generally Accepted Accounting Principles

CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED BALANCE SHEET (in

thousands)

Sep. 26,

Mar. 28, Sep. 27, 2009 2009

2008 (unaudited) (unaudited) ASSETS Current assets Cash and

cash equivalents $ 20,692 $ 31,504 $ 55,566 Restricted investments

5,755 5,755 5,755 Marketable securities 62,191 79,346 48,565

Accounts receivable, net 26,160 10,814 25,556 Inventories 22,497

19,878 28,106 Other current assets 4,618 5,359

7,794 Total Current Assets 141,913 152,656

171,342 Long-term marketable securities 35,391 3,627 -

Property and equipment, net 18,788 19,367 20,779 Intangibles, net

22,856 23,309 24,559 Goodwill 6,027 6,027 6,194 Other assets

1,925 2,018 2,301 Total Assets $

226,900 $ 207,004 $ 225,175 LIABILITIES

AND STOCKHOLDERS' EQUITY Current liabilities Accounts payable $

20,758 $ 9,886 $ 17,620 Accrued salaries and benefits 6,873 6,432

7,552 Other accrued liabilities 4,894 6,004 8,657 Deferred income

on shipments to distributors 3,728 3,426

7,751 Total Current Liabilities 36,253 25,748

41,580 Long-term restructuring accrual 548 931 1,285 Other

long-term obligations 7,265 7,397 7,093 Stockholders'

equity: Capital stock 948,371 945,455 942,853 Accumulated deficit

(764,966 ) (771,951 ) (766,933 ) Accumulated other comprehensive

loss (571 ) (576 ) (703 ) Total Stockholders'

Equity 182,834 172,928 175,217

Total Liabilities and Stockholders' Equity $ 226,900

$ 207,004 $ 225,175 Prepared in accordance

with Generally Accepted Accounting Principles

CIRRUS LOGIC,

INC. RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL

INFORMATION (unaudited, in thousands, except per share

data) (not prepared in accordance with GAAP)

We use these Non-GAAP financial

numbers to assist us in the management of the Company because we

believe that this information provides a more consistent and

complete understanding of the underlying results and trends of the

ongoing business due to the uniqueness of these charges.

Three Months Ended Six Months Ended

Sep. 26, Jun. 27, Sep. 27, Sep.

26, Sep. 27, 2009 2009 2008

2009 2008 Net Income Reconciliation

Q2'10

Q1'10 Q2'09 Q2'10 Q2'09

GAAP Net Income

$ 6,764 $ 221 $ 6,355

$ 6,985 $ 8,493

Acquisition related items

404 404 364 808 36

Stock based compensation

expense

1,383 1,353 1,230 2,736 2,900

Facility and other related

adjustments

- (22 ) (34 ) (22 ) 216

Provision for Litigation

expenses

- (2,745 ) 1,771 (2,745 ) 1,771

Restructing and other costs,

net

(165 ) - - (165 ) - Impairment of Intangibles - - - - 11 Patent

agreement, net (1,400 ) - -

(1,400 ) -

Non-GAAP Net Income (Loss)

$ 6,986 $ (789 ) $

9,686 $ 6,197 $

13,427 Earnings Per Share reconciliation

GAAP Diluted income per share $ 0.10 $

- $ 0.10 $ 0.11 $

0.13 Effect of Acquisition related items 0.01 0.01 - 0.01 -

Effect of Stock based compensation expense 0.02 0.02 0.02 0.04 0.04

Effect of Facility and other

related adjustments

- - - - - Effect of Provision for Litigation expenses - (0.04 )

0.03 (0.04 ) 0.03 Effect of Restructing and other costs, net - - -

- - Effect of Impairment of Intangibles - - - - - Effect of Patent

agreement, net (0.02 ) - -

(0.02 ) -

Non-GAAP Net income (loss) per

share $ 0.11 $ (0.01

) $ 0.15 $ 0.10

$ 0.20 Operating Income Reconciliation

GAAP Operating Income (Loss) $ 6,438 $

(247 ) $ 5,754 $ 6,191

$ 6,797 Stock compensation expense - COGS 43 52 48 95

245 Stock compensation expense - R&D 428 514 446 942 1,023

Stock compensation expense - SG&A 912 787 736 1,699 1,632

Amortization of acquisition intangibles 404 404 364 808 36 Facility

and other related adjustments - (22 ) (34 ) (22 ) 216 Provision for

litigation expenses - (2,745 ) 1,771 (2,745 ) 1,771 Restructing and

other costs, net (165 ) - - (165 ) - Impairment of Intangibles - -

- - 11 Patent agreement, net (1,400 ) -

- (1,400 ) -

Non-GAAP Operating

Income (Loss) $ 6,660 $

(1,257 ) $ 9,085 $

5,403 $ 11,731 Operating

Expense Reconciliation

GAAP Operating Expenses $

22,536 $ 19,834 $ 24,232

$ 42,370 $ 47,840 Stock compensation

expense - R&D (428 ) (514 ) (446 ) (942 ) (1,023 ) Stock

compensation expense - SG&A (912 ) (787 ) (736 ) (1,699 )

(1,632 ) Amortization of acquisition intangibles (404 ) (404 ) (364

) (808 ) (36 ) Facility and other related adjustments - 22 34 22

(216 ) Provision for litigation expenses - 2,745 (1,771 ) 2,745

(1,771 ) Restructing and other costs, net 165 - - 165 - Impairment

of Intangibles - - - - (11 ) Patent agreement, net 1,400

- - 1,400 -

Non-GAAP Operating Expenses $ 22,357

$ 20,896 $ 20,949

$ 43,253 $ 43,151

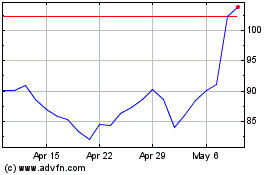

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

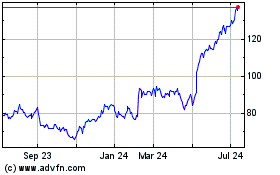

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024