Proposal represents 46% premium to UniFirst’s

90-day average price as of January 6, 2025

Combination would accelerate benefits to

customers, employee-partners and shareholders from ongoing

technology investments

Cintas Corporation (Nasdaq: CTAS) today announced that it

submitted a proposal to the Board of Directors of UniFirst

Corporation (NYSE: UNF) to acquire all outstanding common and class

B shares of UniFirst for $275.00 per share (the “Proposal”) in

cash. The Proposal implies a total value for UniFirst of

approximately $5.3 billion and offers UniFirst shareholders a 46%

premium to UniFirst’s ninety-day average closing price as of

January 6, 2025.

The Proposal was initially delivered to the UniFirst Board on

November 8, 2024. Despite Cintas’ multiple attempts to engage in a

collaborative discussion, including a willingness to identify

potential sources of additional value that would enable Cintas to

increase its offer price and the Company’s openness to exploring

alternative forms of consideration for the benefit of UniFirst

shareholders, UniFirst’s Board has refused to meet.

Todd Schneider, President and Chief Executive Officer of Cintas,

said, “We firmly believe in the compelling strategic fit between

our two companies, and our offer would deliver immediate and

compelling value to UniFirst shareholders. The combination would

also amplify the benefits of Cintas and UniFirst’s ongoing

technology investments to drive growth and benefit our collective

customers and employee-partners.”

“While we would have preferred to have discussions with UniFirst

in private, this is the second time in nearly three years that

UniFirst has refused our constructive attempts to engage on an

extremely compelling offer. Our decision to publicize our Proposal

reflects our conviction in the merits of the combination, the value

we place on UniFirst and its team and belief that UniFirst

shareholders should know the value they stand to realize. We call

on the UniFirst Board, its controlling shareholders and management

team to immediately engage with us to reach a mutually acceptable

definitive agreement that delivers the full value of this

combination for shareholders and other stakeholders.”

The combined company would provide innovative products and

outstanding service to well over 1 million business customers

across the US and Canada. Cintas has an exceptional track record of

organic growth, and the combination with UniFirst would provide

additional processing capacity and greater route density which

would further enhance customer service.

- Compelling Strategic and Industrial Logic Delivers Benefits

for Combined Company’s Customers and Employee-Partners: Cintas

and UniFirst are a compelling strategic fit with shared priorities

to enhance service for customers. A combination would accelerate

the benefits of the companies’ investments in technology and create

opportunities to leverage the combined infrastructure and route

networks. Together, Cintas and UniFirst would also be better able

to meet the challenges posed by continued and increasing

competition from much larger and better-capitalized companies

focused on increasing their garment and facility solutions and

investing in last mile fleets.

- Opportunity for UniFirst Team: Like UniFirst, Cintas has

a nearly century-long heritage and deep family roots, and Cintas

greatly respects the Croatti family and UniFirst team and the way

they serve their customers. An enduring value at Cintas is the

importance of its employees, whom it calls “partners,” sharing

collectively in the Company’s success. Cintas would welcome

UniFirst employees and ensure opportunities to develop and prosper

within Cintas.

- Delivering Compelling, Immediate and Certain Value for

UniFirst and Cintas Shareholders: Under the terms of the

Proposal, UniFirst shareholders would receive an immediate and

compelling 46% premium for their UniFirst shares in cash. The

proposed acquisition is expected to be accretive to Cintas

shareholders and would unlock attractive operating cost synergies

for the combined company. 79% of UniFirst common shares are held by

investors that also own Cintas stock.

- Clear Path to Completion: Cintas has conducted

significant work on the regulatory front, including with leading

regulatory counsel and other advisors, and is confident in the path

through regulatory review and closing.

Customary Approvals and No Financing

Contingency

Completion of the contemplated transaction is contingent upon

reaching a definitive agreement and would be subject to the

satisfaction of customary closing conditions, including receipt of

UniFirst shareholder and required regulatory approvals. The

proposed transaction would not be subject to any financing

contingencies or approval by Cintas’ shareholders. The cash

consideration would be financed from Cintas cash on hand, committed

lines of credit and/or other available sources of financing.

Engagement History

Cintas initially approached UniFirst and delivered an indication

of interest to acquire UniFirst for $255 per share (the “Prior

Proposal”) on February 7, 2022, an offer that represented a 43%

premium to UniFirst’s closing price on that date. UniFirst

summarily rejected that offer in February 2022 without any

substantive engagement with Cintas. Since that time, UniFirst

shares have declined 5% -- during the same period, the S&P 500

has appreciated 33% and Cintas stock has appreciated 95%.

On November 8, 2024, Cintas delivered its Proposal to acquire

UniFirst for $275 per share. After Cintas reiterated the Proposal

and expressed a desire to meet in person to reach a collaborative

agreement on November 25, 2024, UniFirst rejected the Proposal on

November 27, 2024, without any further engagement.

On December 3, 2024, Cintas reiterated its Proposal to UniFirst

and requested an in person meeting to discuss the Proposal, as well

as potential sources of additional value that would allow Cintas to

increase its offer. UniFirst again rejected the Proposal on

December 9, 2024, and refused any further engagement.

On December 20, 2024, Cintas reiterated the Proposal and its

willingness to meet with UniFirst and expressed a commitment to

address UniFirst’s comments outlined in UniFirst’s rejection,

including that Cintas may be willing to increase its Proposal of

$275 per share should UniFirst’s value creation plan justify such

an increase. Cintas also indicated a willingness to discuss ways to

preserve the UniFirst legacy post a transaction. UniFirst again

refused to engage despite our best efforts to arrange collaborative

discussions.

The current Proposal of $275 per share in cash represents a:

- 46% premium to UniFirst's ninety-day average closing price as

of January 6, 2025;

- 54% premium to UniFirst's closing price on February 7, 2022,

the date of Cintas’ Prior Proposal.

The full text of the letters exchanged between Cintas and

UniFirst from November 8, 2024, to the most recent on January 7,

2025, are included below.

Letters Exchanged Between Cintas and

UniFirst

November 8, 2024

Raymond C. Zemlin, Chairman of the Board of

Directors Steven S. Sintros, President and Chief Executive Officer

UniFirst Corporation 68 Jonspin Road Wilmington, MA 01887

Gentlemen:

I have appreciated our prior discussions

regarding the potential combination of UniFirst Corporation

(“UniFirst”) with Cintas Corporation (“Cintas”). As you know, we

admire UniFirst for its track record of performance and the quality

of its people. We firmly believe there is a compelling strategic

and cultural fit between our two companies, and that Cintas would

provide an excellent long-term home for UniFirst. Our combination

would help maximize the success of UniFirst's operations and people

over the long-term.

On behalf of Cintas, I would like to express

Cintas' strong interest in pursuing a combination with UniFirst. To

that end, we are pleased to submit this non-binding proposal (this

“Proposal”) to acquire UniFirst in a transaction with an implied

total transaction value of approximately $5.2 billion.

Specifically, we propose a transaction in which UniFirst

shareholders will receive $275 per share for 100% of the

outstanding UniFirst common and Class B shares. Common shareholders

will receive value of approximately $4.2 billion and Class B

shareholders will receive value of approximately $1 billion.

The proposed purchase price per share of $275

represents a 48% premium to UniFirst's ninety-day average closing

price. This price also represents a 54% premium to UniFirst's

closing price on February 7, 2022 when Cintas provided you an

indication of interest to acquire UniFirst for $255 per share (the

“Prior Proposal”).

We believe our Proposal represents a

compelling proposition for UniFirst and its shareholders. We would

like to emphasize the following characteristics of our Proposal in

particular:

- A combination of Cintas and UniFirst has a strong strategic and

industrial logic, would create a leading company in the industry,

better able to meet the challenges posed by continued and

increasing competition from much larger and better-capitalized

companies that are focused on increasing their garment and facility

solutions and investing in last mile fleets;

- Our Proposal represents a meaningful increase from our Prior

Proposal;

- The proposed transaction would not be subject to any financing

contingencies or approval by Cintas' shareholders;

- We have done substantial work on the regulatory front,

including engaging leading antitrust lawyers at Davis Polk &

Wardwell, LLP and economists at Compass Lexecon, and we are

confident that we have a path to obtaining the regulatory approvals

necessary to consummate the proposed transaction; and

- We stand ready to commence and complete due diligence quickly,

and to discuss and agree on the terms of a definitive agreement in

parallel.

We believe that your board members, as well

as your shareholders, will enthusiastically support this Proposal.

Interestingly, both Blackrock and The Vanguard Group are

significant shareholders of both our companies.

We believe the employees of UniFirst will be

critical to the long-term success of the combined company. Cintas

has a history of providing leadership and growth opportunities

across its global organization to employees of acquired businesses.

At the appropriate time, we look forward to discussing the

retention of key talent and the best way to integrate our

respective teams to ensure successful leadership of the combined

business. Our objective would be to ensure that UniFirst's

management and employees have the opportunity to develop and

prosper within the Cintas organization.

During several of my prior conversations with

Steve as well as on your earnings calls, you discussed the

importance of three critical areas of investment - CRM, Brand and

ERP. Interestingly, we have identified technology and brand as

significant priorities for Cintas in the coming years. The

priorities of our organizations being well-aligned speaks to how

important these areas are and the value that could be derived by

putting our companies together and leveraging these subjects for

the greater benefit of our collective employees, customers and

shareholders. In addition, we would be able to better leverage our

infrastructure and route networks to enhance service to our

customers and prospects enabling us to better compete in an

increasingly competitive environment. Our opportunities together

are both compelling and exciting.

This proposal is non-binding and does not

constitute, or create any legally binding obligation, liability or

commitment by Cintas, or any of its affiliates, regarding the

proposed transaction unless and until a definitive agreement is

executed by Cintas and UniFirst. Cintas reserves the right to

withdraw this proposal at its discretion.

I want to assure you that the proposed

transaction is a top priority within our organization. Our

executive management and advisors are prepared to commence private

engagement immediately. We are committed to devoting the required

resources that are necessary to quickly and efficiently complete

our due diligence and finalize mutually acceptable definitive

agreements on customary terms for a transaction of this nature.

Given our familiarity with UniFirst, we will require only the

completion of limited business due diligence along with customary

public company legal due diligence in order to proceed with the

proposed transaction.

Once again, we believe there is no better

time than now to combine our companies and create a world class

organization to even further benefit our customers, employees and

shareholders. We are excited about this opportunity and are

prepared to move forward expeditiously. Please provide a formal,

written response regarding this Proposal to me no later than

November 22, 2024. We welcome the opportunity to discuss this

Proposal with you at your convenience.

Sincerely, Todd M. Schneider President &

Chief Executive Officer

__________

November 25, 2024

Sent Via Email to Scott Chase, Secretary of

UniFirst Corporation

Raymond C. Zemlin, Chairman of the Board of

Directors Steven S. Sintros, President and Chief Executive Officer

UniFirst Corporation 68 Jonspin Road Wilmington, MA 01887

Gentlemen:

Steve called me on Friday, November 22, 2024,

to respond to our proposal from November 8, 2024 for the

acquisition of 100% of the outstanding common and Class B shares of

UniFirst ("UniFirst") by Cintas Corporation ("Cintas") for $275 per

share (the "Proposal"). I understand from our conversation that

UniFirst requires more time to respond to our Proposal. I want to

reiterate that we believe the Proposal is extremely attractive to

UniFirst and its shareholders.

We prefer to engage in discussions with

UniFirst in private. We are ready to engage with you immediately to

work towards a mutually acceptable definitive agreement, including

the mix of consideration - cash or cash and stock - that would be

most compelling to your shareholders. In connection with that, we

would like to meet with you in person during the week of December

2nd to discuss deal terms and the path to completing a transaction.

I will attend the meeting along with our CFO, General Counsel and

outside counsel. Please let me know by Wednesday, November 27th

which day next week is most convenient for your team to meet. At

that point we can set a location for the meeting.

As we expressed in our November 8 letter, we

firmly believe there is a compelling strategic and cultural fit

between our two companies. A combination would create a leading

provider of business services and enhance our collective ability to

serve customers and support employees, including by accelerating

the benefits of ongoing investments in technology. Together, Cintas

and UniFirst would be better able to meet the challenges posed by

continued and increasing competition from much larger and

better-capitalized companies that are focused on increasing their

garment and facility solutions and investing in last mile

fleets.

Approximately 79% of UniFirst common shares

are held by investors which also own Cintas stock. Our Proposal

would deliver compelling value to UniFirst shareholders,

specifically a:

- 45% premium to UniFirst's ninety-day average closing price as

of November 22, 2024; and

- 54% premium to UniFirst's closing price on February 7, 2022

when Cintas provided you an indication of interest to acquire

UniFirst for $255 per share (the "Prior Proposal").

We are prepared to move quickly and

efficiently to finalize mutually acceptable definitive agreements

on customary terms for a transaction of this nature, including:

- Diligence. We have followed UniFirst closely for many

years and conducted extensive due diligence over that time. We

expect to have limited and specific confirmatory due diligence

requirements.

- Timing. We would work towards signing and announcing a

definitive agreement before year-end.

- Regulatory. Cintas has engaged leading regulatory

counsel and is confident in the path through regulatory review and

closing.

- Financing. Our Proposal is not subject to any financing

condition and any cash consideration would be financed from cash on

hand, committed lines of credit and/or other available sources of

financing.

- Certainty. Our Board of Directors supports the proposed

transaction. Cintas shareholder approval will not be required.

I want to reiterate that the proposed

transaction is a top priority within our organization, and we

believe there is no better time than now to combine our companies

and create a world class organization to even further benefit our

customers, employees and shareholders. Cintas is committed to

reaching a definitive agreement and to moving forward

expeditiously. I look forward to discussing next steps this week

and hearing back from you by November 27th on dates your team is

available to meet in person next week.

Sincerely, Todd M. Schneider President &

Chief Executive Officer

__________

November 27, 2024

Todd M. Schneider President and Chief

Executive Officer Cintas Corporation 6800 Cintas Boulevard Mason,

Ohio 45040 By email – [email address redacted]

Dear Todd,

We are in receipt of your letters dated

November 8, 2024, and November 25, 2024, which included an

unsolicited, non-binding and conditional proposal to acquire

UniFirst at $275 per share.

After careful consideration, the UniFirst

Board of Directors has unanimously concluded that your proposal is

not in the best interests of UniFirst, its shareholders and other

stakeholders.

Sincerely, Raymond C. Zemlin Chairman of the

Board of Directors

Steven S. Sintros President and Chief

Executive Officer

__________

December 3, 2024

Sent Via Email to Scott Chase, Secretary of

UniFirst Corporation

Raymond C. Zemlin, Chairman of the Board of

Directors Steven S. Sintros, President and Chief Executive Officer

UniFirst Corporation 68 Jonspin Road Wilmington, MA 01887

Gentlemen:

I received your letter dated November 27,

2024 responding to my letter dated November 25, 2024 reiterating

our proposal from November 8, 2024 to acquire 100% of the

outstanding common and Class B shares of UniFirst ("UniFirst") by

Cintas Corporation ("Cintas") for $275 per share (the "Proposal").

Your response is surprising given that in my conversation with

Steve on November 22 he appeared to indicate serious consideration

would be given to our Proposal, including with the help of outside

advisors. Despite the fact that 79% of UniFirst common shares are

held by investors that also own Cintas stock and the significant

premium being offered to UniFirst shareholders, our invitation to

meet with you directly to discuss our Proposal has once again been

ignored. This is the second time in just under three years that you

and your fellow directors have failed to have substantive

engagement or discussions with Cintas regarding value-enhancing

alternatives for shareholders. I am hopeful we can have further

private discussions regarding our Proposal.

In our brief engagement in February 2022, you

indicated that UniFirst believed that the execution of its

strategic plan would deliver meaningful value to UniFirst

shareholders. Yet, since February 7, 2022 when Cintas provided you

an indication of interest to acquire UniFirst for $255 per share

(the "Prior Proposal"), your stock has appreciated approximately

12%, approximately one-third of the 35% appreciation in the S&P

500 and well below the 134% appreciation in Cintas stock.

We believe that our Proposal offers a unique

opportunity to deliver value to your shareholders and enhance our

collective ability to serve customers and support employees,

including by accelerating the benefits of ongoing investments in

technology. There is no better time than now to combine our

companies and create a world class organization to even further

benefit our customers, employees and shareholders.

We remain prepared to move forward

immediately with our Proposal of $275 per share in cash which would

deliver certain and compelling value to UniFirst shareholders,

specifically a:

- 44% premium to UniFirst's ninety day average closing price as

of December 2, 2024; and

- 54% premium to UniFirst's closing price on February 7, 2022,

the date of our Prior Proposal.

We prefer to engage with you in

collaborative, private discussions with minimal disruption to your

management team to reach a mutually acceptable definitive

agreement. We want to meet with you in person during the week of

December 9th, including discussions about potential sources of

additional value that could allow us to increase our Proposal. As

part of this direct engagement, we are also prepared to discuss a

mix of cash and stock consideration if that is preferable to your

shareholders.

I want to reiterate that the proposed

transaction is a top priority within our organization and we remain

prepared to move quickly and efficiently to finalize mutually

acceptable definitive agreements on customary terms for a

transaction of this nature, including:

- Diligence. We expect to have limited and specific

confirmatory due diligence requirements.

- Timing. We would work towards signing and announcing a

definitive agreement before year-end.

- Regulatory. Cintas has engaged leading regulatory

counsel and is confident in the path through regulatory review and

closing. We are prepared to have our counsel immediately engage

with you and your counsel to discuss the extensive work we have

done to date (including with our economist) on the regulatory front

and our path to closing of the transaction.

- Financing. Our Proposal is not subject to any financing

condition and any cash consideration would be financed from cash on

hand, committed lines of credit and/or other available sources of

financing.

- Certainty. Our Board of Directors supports the proposed

transaction. Cintas shareholder approval will not be required.

We are very motivated to conclude a

transaction that benefits both companies as well as our respective

shareholders. We understand you are in the process of closing your

first quarter but we look forward to your response no later than

December 6, 2024.

Sincerely, Todd M. Schneider President &

Chief Executive Officer

__________

December 9, 2024

Todd M. Schneider President and Chief

Executive Officer Cintas Corporation 6800 Cintas Boulevard Mason,

Ohio 45040 By email – [email address redacted]

Dear Todd,

We are in receipt of your letter dated

December 3, 2024, requesting a meeting with UniFirst to discuss

Cintas Corporation's November 2024 unsolicited, non-binding, and

conditional proposal to acquire UniFirst for $275 per share.

As stated in our letter dated November 27,

2024, the UniFirst Board of Directors carefully considered Cintas

Corporation's offer and unanimously concluded that the proposal is

not in the best interests of UniFirst, its shareholders, and other

stakeholders. In making its determination, the UniFirst Board of

Directors considered the offer price, execution and business risks,

feedback from some of UniFirst's largest shareholders by voting

power, and UniFirst's future growth and value creation

opportunities.

As such, we see no need for us to engage

regarding your proposal.

Sincerely, Raymond C. Zemlin Chairman of the

Board of Directors

Steven S. Sintros President and Chief

Executive Officer

__________

December 20, 2024

Sent Via Email to Scott Chase, Secretary of

UniFirst Corporation

Raymond C. Zemlin, Chairman of the Board of

Directors Steven S. Sintros, President and Chief Executive Officer

UniFirst Corporation 68 Jonspin Road Wilmington, MA 01887

Gentlemen:

On behalf of Cintas Corporation ("Cintas"), I

am writing to reiterate our proposal to acquire 100% of the

outstanding common and Class B shares of UniFirst Corporation

("UniFirst") by Cintas for $275 per share in cash (the "Proposal").

In my continued effort to engage with you, I believe it's

appropriate to address each of the points in your letter dated

December 9, 2024. I want to provide additional clarity on each

point since these considerations formed the basis for the UniFirst

Board of Directors to unanimously conclude that our Proposal is not

in the best interest of UniFirst, its shareholders and other

stakeholders.

With respect to price, we understand that

UniFirst's directors have unanimously concluded that a 44% premium

offer to UniFirst's ninety-day average closing price as of December

2, 2024 does not warrant a meeting to explore how a transaction

with Cintas can deliver substantial value to your shareholders. Our

Proposal represents an approximate premium of 55% over UniFirst's

closing price as of December 19, 2024. The rejection of our

Proposal and the associated premium is surprising to us given

UniFirst's 2024 stock performance as well as its stock performance

over the past few years. We are confident your common shareholders

would find these premiums compelling since 79% of UniFirst common

shares are held by investors that also own Cintas stock.

In your response, you reference UniFirst's

future growth and value creation opportunities. As indicated in our

letter to you dated December 3, 2024, we are prepared to increase

our Proposal above $275 per share should UniFirst's value creation

plan justify such an increase. We are also prepared to discuss the

form and mix of consideration to make the transaction tax-efficient

to all shareholders.

As part of the direct engagement we have

proposed, we would like the opportunity to meet directly with Class

B shareholders and the Croatti family so we can share ideas that

would enable the UniFirst and Croatti legacy in our industry to

continue into the future.

For example, Scott Farmer and I have

discussed the possibility of Cynthia Croatti, or her designee,

joining the Board of Directors of Cintas. We believe Cynthia's many

years of experience at UniFirst would offer meaningful

contributions to our combined company, employees and customers.

We would also welcome a discussion regarding

how this transaction would have minimal impact on UniFirst

employees. At Cintas, we pride ourselves on being a great home for

our employee-partners, and we believe UniFirst employees would feel

the same way. UniFirst employees will be an important asset of our

combined company. During our meeting, we'd be ready to share how

and why we think bringing UniFirst employees into the Cintas family

would be a win-win for everyone involved.

We are confident that we can reach acceptable

deal terms and bridge any concerns if we engage directly with your

key stakeholders.

With respect to execution and business risk,

our executive management and advisors remain confident that there

is an expeditious path to completing a transaction. We are prepared

to commence direct engagement with you and your advisors

immediately to promptly finalize mutually acceptable definitive

agreements on customary terms for a transaction of this nature,

including:

- Diligence. We expect to have limited and specific

confirmatory due diligence requirements.

- Timing. We would work towards signing and announcing a

definitive agreement in January, 2025.

- Regulatory. Cintas has engaged leading regulatory

counsel and is confident in the path through regulatory review and

closing. We are prepared to have our counsel immediately engage

with you and your counsel to discuss the extensive work we have

done to date (including with our economist) on the regulatory front

and our path to closing the transaction.

- Financing. Our Proposal is not subject to any financing

condition and any cash consideration would be financed from cash on

hand, committed lines of credit and/or other available sources of

financing.

- Certainty. Our Board of Directors supports the proposed

transaction. Cintas shareholder approval will not be required.

Our Proposal offers a unique opportunity to

deliver value to your shareholders and enhance our collective

ability to serve customers and support employees, including by

accelerating the benefits of ongoing investments in technology.

Together, Cintas and UniFirst would be better able to meet the

challenges posed by continued and increasing competition from much

larger and better-capitalized companies that are focused on

increasing their garment and facility solutions and investing in

last mile fleets.

I want to reiterate that the proposed

transaction is a top priority within our organization. We are very

motivated to conclude a transaction that benefits both companies as

well as our respective customers, employees and shareholders. We

urge you to engage with us and our advisors openly and without

delay for the mutual benefit of our respective stakeholders.

We would like to meet with your deal team

and/or Class B shareholders in person no later than January 10,

2025 to discuss deal terms and the path to completing a

transaction. Please let me know no later than January 3, 2025 which

days your team is available to meet in person.

Sincerely, Todd M. Schneider President &

Chief Executive Officer

__________

January 7, 2025

Sent Via Email to Scott Chase, Secretary of

UniFirst Corporation

Raymond C. Zemlin, Chairman of the Board of

Directors Steven S. Sintros, President and Chief Executive Officer

UniFirst Corporation 68 Jonspin Road Wilmington, MA 01887

Gentlemen:

On behalf of Cintas Corporation (“Cintas”), I

am writing to reiterate our proposal to acquire 100% of the

outstanding common and Class B shares of UniFirst Corporation

("UniFirst") by Cintas for $275 per share in cash (the “Proposal”).

Our Proposal delivers compelling value to UniFirst shareholders,

specifically a:

- 46% premium to UniFirst's ninety-day average closing price as

of January 6, 2025;

- 54% premium to UniFirst's closing price on February 7, 2022

when Cintas provided you an indication of interest to acquire

UniFirst for $255 per share (the "Prior Proposal").

We are disappointed that our continued

efforts to engage in discussions on the basis of this Proposal have

been rejected, despite the fact that 79% of UniFirst common shares

are held by investors that also own Cintas stock and the

significant premium being offered to UniFirst shareholders.

The terse response we received on November

27, 2024 rejecting our Proposal did not provide anything

constructive on the economic terms or conditions of our Proposal.

Our subsequent December 3, 2024 request for an in-person meeting,

including our willingness to discuss potential sources of

additional value that would allow us to increase our Proposal, was

also rejected. Our most recent December 20, 2024 request for

engagement included a willingness to discuss ways to preserve the

UniFirst legacy and the potential to include Cynthia Croatti or her

designee on the Cintas Board post a transaction.

Given your refusal to engage despite our best

efforts to arrange collaborative discussions, we have determined it

is prudent to publicize this letter, ensuring that UniFirst

shareholders are aware of the immediate, certain and compelling

value they stand to realize. Accordingly, we are issuing a press

release with the contents of this letter and our prior

correspondence.

We believe that our Proposal offers a unique

opportunity to deliver value to your shareholders and enhance our

collective ability to serve customers and support employees,

including by accelerating the benefits of ongoing investments in

technology. Like UniFirst, Cintas has a nearly century-long

heritage and deep family roots, and Cintas greatly respects the

Croatti family and UniFirst team and the way you serve your

customers. Cintas would welcome UniFirst employees and ensure

opportunities to develop and prosper within Cintas. Together,

Cintas and UniFirst would be better able to meet the challenges

posed by continued and increasing competition from much larger and

better-capitalized companies that are focused on increasing their

garment and facility solutions and investing in last mile

fleets.

Our executive management and advisors remain

prepared to commence direct engagement with you and your advisors

immediately to quickly and efficiently finalize mutually acceptable

definitive agreements on customary terms for a transaction of this

nature, including:

- Diligence. We expect to have limited and specific

confirmatory due diligence requirements.

- Timing. We would work towards signing and announcing a

definitive agreement in January 2025.

- Regulatory. Cintas has engaged leading regulatory

counsel and is confident in the path through regulatory review and

closing. We are prepared to have our counsel immediately engage

with you and your counsel to discuss the extensive work we have

done to date (including with a leading economics consulting group)

on the regulatory front and our path to closing the

transaction.

- Financing. Our Proposal is not subject to any financing

condition and any cash consideration would be financed from cash on

hand, committed lines of credit and/or other available sources of

financing.

- Certainty. Our Board of Directors supports the proposed

transaction. Cintas shareholder approval will not be required.

I want to reiterate that the proposed

transaction is a top priority within our organization, and we

believe there is no better time than now to combine our companies

and create a world class organization to even further benefit our

customers, employees and shareholders.

We are very motivated to conclude a

transaction that benefits both companies as well as our respective

shareholders. We urge you to engage with us and our advisors openly

and without delay for the mutual benefit of our respective

stakeholders.

Sincerely, Todd M. Schneider President &

Chief Executive Officer

Advisors

BDT & MSD Partners is acting as Cintas’ financial advisor,

and Davis Polk & Wardwell LLP is serving as legal advisor.

Cintas

Cintas Corporation helps more than one million businesses of all

types and sizes get Ready™ to open their doors with confidence

every day by providing products and services that help keep their

customers’ facilities and employees clean, safe and looking their

best. With offerings including uniforms, mats, mops, restroom

supplies, first aid and safety products, fire extinguishers and

testing, and safety training, Cintas helps customers get Ready for

the Workday®. Headquartered in Cincinnati, Cintas is a publicly

held Fortune 500 company traded over the Nasdaq Global Select

Market under the symbol CTAS and is a component of both the

Standard & Poor’s 500 Index and Nasdaq-100 Index.

Forward Looking

Statements

This document contains statements that constitute

"forward-looking statements" within the meaning of the federal

securities laws. All statements other than statements regarding

historical facts, including, without limitation, statements

regarding our current expectations, estimates and projections about

our industry, our business or a transaction with UniFirst

Corporation (“UniFirst”), are forward-looking statements. We

caution investors that any forward-looking statements are subject

to risks and uncertainties that may cause actual results and future

trends to differ materially from those matters expressed in or

implied by such forward-looking statements. Investors are cautioned

not to place undue reliance on forward-looking statements. Among

the risks and uncertainties that could cause actual results to

differ from those described in forward-looking statements are the

following: the risk that a transaction with UniFirst may not be

consummated; the risk that a transaction with UniFirst may be less

accretive than expected, or may be dilutive, to Cintas’ earnings

per share, which may negatively affect the market price of Cintas

common shares; the possibility that Cintas and UniFirst will incur

significant transaction and other costs in connection with a

potential transaction, which may be in excess of those anticipated

by Cintas; the risk that Cintas may fail to realize the benefits

expected from a transaction; the risk that the combined company may

be unable to achieve anticipated synergies or that it may take

longer than expected to achieve those synergies; the risk that any

announcements relating to, or the completion of, a transaction

could have adverse effects on the market price of Cintas common

shares; and the risk related to any unforeseen liability and future

capital expenditure of Cintas related to a transaction.

For additional factors affecting the business of Cintas, refer

to Part I – Item 1A. Risk Factors of our Annual Report on Form 10-K

for the fiscal year ended May 31, 2024 (the “2024 10-K”), and other

filings with the U.S. Securities and Exchange Commission (the

“SEC”).

Important Information for Investors and

Security Holders

This document relates to a proposal which Cintas has made for an

acquisition of UniFirst. In furtherance of this proposal and

subject to future developments, Cintas may file one or more

registration statements, proxy statements, tender offer statements

or other documents with the SEC. This document is not a substitute

for any proxy statement, registration statement, tender offer

statement or other document Cintas may file with the SEC in

connection with the proposed transaction.

Investors and security holders of Cintas are urged to read the

proxy statement(s), registration statement, tender offer statement

and/or other documents filed with the SEC carefully in their

entirety if and when they become available as they will contain

important information about the proposed transaction. Any

definitive proxy statement(s) (if and when available) will be

mailed to stockholders of Cintas, as applicable. Investors and

security holders will be able to obtain free copies of these

documents (if and when available) and other documents filed with

the SEC by Cintas through the website maintained by the SEC at

http://www.sec.gov.

No Offer or Solicitation; Participants

in the Solicitation

This document shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any jurisdiction. No

offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

This document is neither a solicitation of a proxy nor a

substitute for any proxy statement or other filing that may be made

with the SEC. Nonetheless, Cintas and its directors and certain of

its executive officers may be considered participants in the

solicitation of proxies in connection with the proposed

transaction. Information about the directors and executive officers

of Cintas is set forth in its proxy statement for its 2024 annual

meeting of shareholders (the “2024 Proxy Statement”), which was

filed with the SEC on September 19, 2024 and is available here.

Information about the directors and executive officers of Cintas,

their ownership of Cintas common stock, and Cintas’ transactions

with related persons is set forth in the sections entitled

“Election of Directors”, “Board Diversity”, “Board’s Roles and

Responsibilities”, “Board Committees and Meetings”, “Nonemployee

Director Compensation for Fiscal 2024”, “Fiscal 2024 Director

Compensation Table”, “Compensation Committee Report”, “Executive

Compensation”, “Compensation Discussion and Analysis”, “Fiscal 2024

Summary Compensation Table”, “Grants of Plan-Based Awards for

Fiscal 2024”, “Outstanding Equity Awards at Fiscal 2024 Year-End”,

“Option Exercises and Stock Vested for Fiscal 2024”, “Nonqualified

Deferred Compensation for Fiscal 2024”, “Potential Payments upon

Termination, Retirement or Change in Control”, “CEO Pay Ratio”,

“Pay Versus Performance”, “Approval, on an Advisory Basis, of Named

Executive Officer Compensation”, “Approval of the Cintas

Corporation 2016 Amended and Restated Equity and Incentive

Compensation Plan”, “Principal Shareholders”, “Security Ownership

of Director Nominees and Executive Officers”, and “Related Party

Transactions” of the 2024 Proxy Statement. Information about the

directors and executive officers of Cintas, their ownership of

Cintas common stock, and Cintas’ transactions with related persons

is also set forth in the sections entitled “Security Ownership of

Certain Beneficial Owners and Management and Related Stockholder

Matters” of the 2024 10-K, which was filed with the SEC on July 25,

2024 and is available here. To the extent holdings of Cintas common

stock by the directors and executive officers of Cintas have

changed from the amounts of Cintas common stock held by such

persons as reflected in the 2024 Proxy Statement and 2024 10-K,

such changes have been or will be reflected on Statements of Change

in Ownership on Form 4 filed with the SEC, including: the Form 4s

filed by Robert Coletti on December 11, 2024 and November 1, 2024,

Joseph Scaminace on November 1, 2024, Karen Carnahan on November 1,

2024, Melanie Barstad on November 1, 2024, Martin Mucci on November

1, 2024, Beverly Carmichael on November 1, 2024, and Ronald Tysoe

on November 1, 2024. Free copies of these documents may be obtained

as described above.

Any information concerning UniFirst contained in this document

has been taken from, or based upon, publicly available information.

Although Cintas does not have any information that would indicate

that any information contained in this document that has been taken

from such documents is inaccurate or incomplete, Cintas does not

take any responsibility for the accuracy or completeness of such

information. To date, Cintas has not had access to the books and

records of UniFirst.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250106529496/en/

Investors: J. Michael Hansen, Executive Vice President

& Chief Financial Officer – 513-972-2079; Jared S. Mattingley,

Vice President - Treasurer & Investor Relations -

513-972-4195

Media: Bryan Locke/Lindsay Molk, FGS Global –

cintas@fgsglobal.com

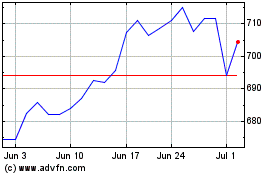

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Dec 2024 to Jan 2025

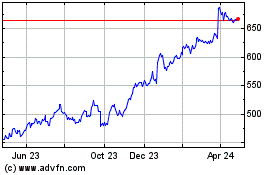

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jan 2024 to Jan 2025