false

0001041859

0001041859

2024-12-17

2024-12-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

December 17, 2024

| THE CHILDREN’S PLACE, INC. |

| (Exact Name of Registrant as Specified in Charter) |

| |

| Delaware |

| (State or Other Jurisdiction of Incorporation) |

| 0-23071 |

31-1241495 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| |

|

| 500 Plaza Drive, Secaucus, New Jersey |

07094 |

| (Address of Principal Executive Offices) |

(Zip Code) |

| (201) 558-2400 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12-b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class |

Trading

Symbol(s) |

Name of each exchange on

which registered |

| Common Stock, $0.10 par value |

PLCE |

NASDAQ Global Select Market |

| Item 2.02 | Results of Operations and Financial Condition. |

On December 17, 2024, the Company issued a press release announcing certain estimates of its financial results for the first six weeks

of the fourth quarter of the fiscal year ending February 1, 2025 (“Fiscal 2024”). A copy of the press release is being furnished

herewith as Exhibit 99.1.

The preliminary unaudited

information in this Current Report is being furnished pursuant to Item 2.02 of Form 8-K, insofar as it discloses historical information

regarding the Company’s results of operations and financial condition as of and for the fourth quarter of Fiscal 2024. In accordance

with General Instruction B.2 of Form 8-K, such information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed

“filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statement and Exhibits. |

Forward-Looking

Statements

This Current Report on Form 8-K, including Exhibit 99.1, contains or

may contain forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of

1995, including but not limited to statements relating to the Company’s strategic initiatives and results of operations, including

adjusted net income (loss) per diluted share. Forward-looking statements typically are identified by use of terms such as “may,”

“will,” “should,” “plan,” “project,” “expect,” “anticipate,” “estimate”

and similar words, although some forward-looking statements are expressed differently. These forward-looking statements are based upon

the Company’s current expectations and assumptions and are subject to various risks and uncertainties that could cause actual results

and performance to differ materially. Some of these risks and uncertainties are described in the Company’s filings with the Securities

and Exchange Commission, including in the “Risk Factors” section of its annual report on Form 10-K for the fiscal year ended

February 3, 2024. Included among the risks and uncertainties that could cause actual results and performance to differ materially are

the risk that the Company will be unable to achieve operating results at levels sufficient to fund and/or finance the Company’s

current level of operations and repayment of indebtedness, the risk that the Company will be unsuccessful in gauging fashion trends and

changing consumer preferences, the risks resulting from the highly competitive nature of the Company’s business and its dependence

on consumer spending patterns, which may be affected by changes in economic conditions (including inflation), the risk that changes in

the Company’s plans and strategies with respect to pricing, capital allocation, capital structure, investor communications and/or

operations may have a negative effect on the Company’s business, the risk that the Company’s strategic initiatives to increase

sales and margin, improve operational efficiencies, enhance operating controls, decentralize operational authority and reshape the Company’s

culture are delayed or do not result in anticipated improvements, the risk of delays, interruptions, disruptions and higher costs in the

Company’s global supply chain, including resulting from disease outbreaks, foreign sources of supply in less developed countries,

more politically unstable countries, or countries where vendors fail to comply with industry standards or ethical business practices,

including the use of forced, indentured or child labor, the risk that the cost of raw materials or energy prices will increase beyond

current expectations or that the Company is unable to offset cost increases through value engineering or price increases, various types

of litigation, including class action litigations brought under securities, consumer protection, employment, and privacy and information

security laws and regulations, the imposition of regulations affecting the importation of foreign-produced merchandise, including duties

and tariffs, risks related to the existence of a controlling shareholder, and the uncertainty of weather patterns. Readers are cautioned

not to place undue reliance on these forward-looking statements, which speak only as of the date they were made. The Company undertakes

no obligation to release publicly any revisions to these forward-looking statements that may be made to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated events.

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 17, 2024

| |

THE CHILDREN’S PLACE, INC. |

| |

|

| |

|

|

| |

By: |

/s/ Jared Shure |

| |

Name: |

Jared Shure |

| |

Title: |

Chief Administrative Officer, General Counsel & Corporate Secretary |

Exhibit 99.1

THE CHILDREN’S PLACE REPORTS PRELIMINARY

PARTIAL

FOURTH QUARTER SALES RESULTS THROUGH DECEMBER

14, 2024

Secaucus, New Jersey – December 17, 2024

– The Children’s Place, Inc. (Nasdaq: PLCE), an omni-channel children’s specialty portfolio of brands, today announced

preliminary partial fourth quarter net sales results for the six-week period starting on November 3, 2024 and ending December 14, 2024.

Net sales for

the six-week period starting on November 3, 2024 and ending December 14, 2024 increased 3.4%, compared to the six-week period starting

on October 29, 2023 and ending December 9, 2023, which, represents a year-over-year increase, and does improve on the year-to-date trend

experienced during the third quarter of fiscal 2024. In terms of channel sales results during the reported six-week period, the Company

experienced a decrease in brick-and-mortar revenue due to a lower store count and a smaller than expected decrease in e-commerce revenue

as the Company has continued to rationalize its unprofitable promotional strategies, but these decreases were offset by an increase

in wholesale revenue.

Comparable retail

sales decreased 8.9% for the six-week period starting on November 3, 2024 and ending December 14, 2024, as compared to the six-week period

starting on October 29, 2023 and ending December 9, 2023, largely driven by decreases in e-commerce revenue, as the Company proactively

sacrificed unprofitable sales to improve profitability.

Preliminary Results

The preliminary net sales results for the part

of the fourth quarter of fiscal 2024 in this press release are preliminary, unaudited results that take into account data from only part

of the fourth quarter, and reflect certain estimates and assumptions that are subject to change. Our actual results for the part of the

fourth quarter set forth above may differ materially from these preliminary results due to the completion of our financial closing procedures,

final adjustments and other developments that may arise between the date of this press release and the time that financial results for

the fiscal year ending February 1, 2025 are finalized. In addition, the sales, financial

and other performance of the Company, and trends stated above in respect thereof, may not continue and/or may change during the remainder

of the fourth quarter and/or thereafter. These preliminary financial results should not be viewed as a substitute for full financial statements

prepared in accordance with U.S. GAAP.

Forward-Looking Statements

This press release contains or may contain

forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including

but not limited to statements relating to the Company’s strategic initiatives and results of operations, including net sales results,

channel sales results and comparable retail sales for the part of the

fourth quarter of fiscal 2024. Forward-looking statements typically are identified by use of terms such as “may,” “will,”

“should,” “plan,” “project,” “expect,” “anticipate,” “estimate”

and similar words, although some forward-looking statements are expressed differently. These forward-looking statements are based upon

the Company’s current expectations and assumptions and are subject to various risks and uncertainties that could cause actual results

and performance to differ materially. Some of these risks and uncertainties are described in the Company’s filings with the Securities

and Exchange Commission, including in the “Risk Factors” section of its annual report on Form 10-K for the fiscal year ended

February 3, 2024. Included among the risks and uncertainties that could cause actual results and performance to differ materially are

the risk that the Company will be unable to achieve operating results at levels sufficient to fund and/or finance the Company’s

current level of operations and repayment of indebtedness, the risk that the Company will be unsuccessful in gauging fashion trends and

changing consumer preferences, the risks resulting from the highly competitive nature of the Company’s business and its dependence

on consumer spending patterns, which may be affected by changes in economic conditions (including inflation), the risk that changes in

the Company’s plans and strategies with respect to pricing, capital allocation, capital structure, investor communications and/or

operations may have a negative effect on the Company’s business, the risk that the Company’s strategic initiatives to increase

sales and margin, improve operational efficiencies, enhance operating controls, decentralize operational authority and reshape the Company’s

culture are delayed or do not result in anticipated improvements, the risk of delays, interruptions, disruptions and higher costs in the

Company’s global supply chain, including resulting from disease outbreaks, foreign sources of supply in less developed countries,

more politically unstable countries, or countries where vendors fail to comply with industry standards or ethical business practices,

including the use of forced, indentured or child labor, the risk that the cost of raw materials or energy prices will increase beyond

current expectations or that the Company is unable to offset cost increases through value engineering or price increases, various types

of litigation, including class action litigations brought under securities, consumer protection, employment, and privacy and information

security laws and regulations, the imposition of regulations affecting the importation of foreign-produced merchandise, including duties

and tariffs, risks related to the existence of a controlling shareholder, the risk that the sales, financial and other performance of

the Company, and trends stated above in respect thereof, may not continue and/or may change during the remainder of the fourth quarter

and/or thereafter, and the uncertainty of weather patterns. Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date they were made. The Company undertakes no obligation to release publicly any revisions to

these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence

of unanticipated events.

Contact: Investor Relations (201) 558-2400

ext. 14500

v3.24.4

Cover

|

Dec. 17, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 17, 2024

|

| Entity File Number |

0-23071

|

| Entity Registrant Name |

THE CHILDREN’S PLACE, INC.

|

| Entity Central Index Key |

0001041859

|

| Entity Tax Identification Number |

31-1241495

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

500 Plaza Drive

|

| Entity Address, City or Town |

Secaucus

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07094

|

| City Area Code |

201

|

| Local Phone Number |

558-2400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.10 par value

|

| Trading Symbol |

PLCE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

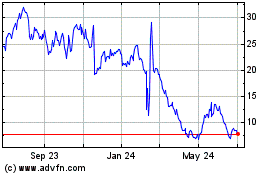

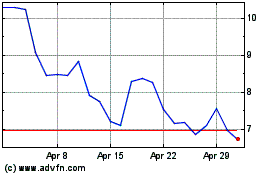

Childrens Place (NASDAQ:PLCE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Childrens Place (NASDAQ:PLCE)

Historical Stock Chart

From Dec 2023 to Dec 2024