Citizens First Financial Corp. Announces Preliminary Unaudited

Results and Dividend to Be Paid BLOOMINGTON, Ill., Feb. 7

/PRNewswire-FirstCall/ -- Citizens First Financial Corp. (the

"Company")(NASDAQ:CFSB), the parent company of Citizens Savings

Bank (the "Bank"), announced that the Board of Directors has

declared a dividend of $0.10 per share to be paid on February 23,

2005, to stockholders of record on February 9, 2005. In addition,

the Company announced net income for the year ended December 31,

2004 of $2,987,000, compared to net income of $1,636,000 for the

year ended December 31, 2003, an increase of $1,351,000 or 82.6%.

The Company had basic and diluted earnings per share of $1.98 and

$1.87, respectively for the year ended December 31, 2004 compared

to basic and diluted earnings per share of $1.11 and $1.01,

respectively, for the year ended December 31, 2003. The Company had

net income for the three months ended December 31, 2004 of

$970,000, compared to a net loss of $324,000 for the three months

ended December 31, 2003. The Company had basic and diluted earnings

per share of $0.64 and $0.61, respectively for the three months

ended December 31, 2004, compared to basic and diluted loss per

share of $0.22, for the three months ended December 31, 2003. "By

any measuring device, the year 2004 has proven to be an outstanding

year for our company and our shareholders", said C. William

Landefeld, President and Chief Executive Officer. "The Company's

net income of $2,987,000 and basic earnings per share of $1.98 were

record results", Landefeld said. "The Bank's regulators lifted the

Memorandum of Understanding from the Bank in December 2004 and in

November 2004 the Company signed a definitive agreement to sell to

Main Street Trust, Inc.," continued Landefeld. "This resulted in a

stock price of $32.50 at year-end, compared to a stock price of

$25.50 per share at year-end 2003," he said. Net interest income

increased slightly from $10,672,000 for the year ended December 31,

2003 to $10,697,000 for the year ended December 31, 2004, an

increase of $25,000. Interest income decreased to $17,373,000 for

the year ended December 31, 2004 from $19,533,000 for the year

ended December 31, 2003. The decrease was attributable to a 47

basis point decrease in the average yield on interest-earning

assets and an $11.4 million decrease in the average balance of

interest earning assets. Interest expense decreased to $6,676,000

for the year ended December 31, 2004 from $8,861,000 for the year

ended December 31, 2003. The decrease was due to a 63 basis point

decrease in the average rate paid on interest-bearing liabilities

and a $13.8 million decrease in the average balance of

interest-bearing liabilities. The provision for loan losses changed

from $2,462,000 for the year ended December 31, 2003 to a credit of

($472,000) for the year ended December 31, 2004, a change of

$2,934,000. The improvement was primarily due to recoveries on

previously charged-off loans, a decrease in the overall loan

portfolio and improvements in the balance and value of collateral

for non-performing and potential problem loans. Total

non-performing and potential problem loans decreased from

$24,066,000 at December 31, 2003 to $13,681,000 at December 31,

2004, a decrease of $10,385,000 or 43.2%. Noninterest income

decreased from $3,259,000 for the year ended December 31, 2003 to

$2,608,000 for the year ended December 31, 2004, a decrease of

$651,000. The decrease was primarily due to a decrease of

$1,181,000 in net gains on loan sales and $238,000 in net gains on

sale of land in a real estate joint venture, offset by an increase

of $659,000 in net gain from sale of premises and equipment

resulting from the sale of a branch office building. Noninterest

expense increased from $8,890,000 for the year ended December 31,

2003 to $9,063,000 for the year ended December 31, 2004, an

increase of $173,000. Not included in net income or the earnings

per share data is a tax benefit related to stock options exercised

in 2004 in the amount of $451,000. This benefit was recorded as an

increase to equity capital during the fourth quarter of 2004. The

Company has previously announced a Special Meeting of Stockholders

at 10:00 a.m. on March 8, 2005 at the Chateau, 1601 Jumer Drive,

Bloomington, Illinois to vote on the Agreement and Plan of Merger

between the Company and Main Street Trust, Inc. The Record Date for

shareholders eligible to vote at the Annual Meeting was January 17,

2005. The Bank currently has five offices in central Illinois.

CITIZENS FIRST FINANCIAL CORP. SELECTED FINANCIAL INFORMATION (In

thousands except for per share data) 12/31/04 12/31/03 (Unaudited)

Balance Sheet Data Total assets $328,266 $349,515 Cash and cash

equivalents $38,103 $16,831 Investment securities $26,055 $20,746

FHLB stock $16,153 $15,206 Loans held for sale $587 $376 Loans

$237,243 $282,477 Allowance for loan losses $2,736 $3,072 Deposits

$231,009 $250,013 Borrowings $58,675 $63,975 Equity capital $36,047

$32,992 Book value per common share $23.25 $22.00 Quarter ended

Twelve months ended 12/31/04 12/31/03 12/31/04 12/31/03 (Unaudited)

(Unaudited) (Unaudited) Summary of Operations Interest income

$4,186 $4,829 $17,373 $19,533 Interest expense 1,562 2,137 6,676

8,861 Net interest income 2,624 2,692 10,697 10,672 Provision

(credit) for loan losses (363) 1,595 (472) 2,462 Noninterest income

1,203 663 2,608 3,259 Noninterest expense 2,686 2,342 9,063 8,890

Income (loss) before income tax 1,504 (582) 4,714 2,579 Income tax

expense (benefit) 534 (258) 1,727 943 Net income (loss) $970 $

(324) $ 2,987 $ 1,636 Earnings (loss) per share: Basic $ 0.64

$(0.22) $1.98 $1.11 Diluted $ 0.61 $(0.22) $1.87 $1.01 Ratios Based

on Net Income Return on average stockholders' equity 11.14% (3.89)%

8.77% 6.11% Return on average assets 1.18% (0.37)% 0.88% 0.55% Net

interest yield on average earning assets 3.41% 3.28% 3.38% 3.27%

DATASOURCE: Citizens First Financial Corp. CONTACT: C. William

Landefeld, President & Chief Executive Officer, of Citizens

First Financial Corp., +1-309-661-8700

Copyright

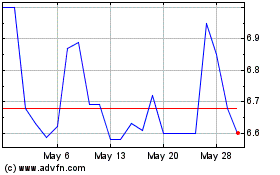

CFSB Bancorp (NASDAQ:CFSB)

Historical Stock Chart

From Nov 2024 to Dec 2024

CFSB Bancorp (NASDAQ:CFSB)

Historical Stock Chart

From Dec 2023 to Dec 2024