In a release issued under the same headline on Wednesday, November

6th by Cellebrite (NASDAQ: CLBT), please note that the dial-in

number was corrected. The corrected release follows:

Cellebrite (NASDAQ: CLBT), a global leader in

premier Digital Investigative solutions for the public and private

sectors, today announced financial results for the three and nine

months ending September 30, 2024.

Yossi Carmil, Cellebrite’s CEO, stated, “We

delivered a strong third-quarter performance that exceeded our

expectations thanks to increasing traction with our AI-driven

Case-to-Closure platform, the impact of our ongoing investment in

market-leading innovation and solid execution on all fronts. We

produced notable ARR growth, surpassed $100 million in quarterly

revenue for the first time in company history and generated

outstanding profitability. Our customers are increasingly

recognizing the value of how Cellebrite’s powerful end-to-end

solutions can enable them to efficiently and effectively address

major pain points in the digital investigative lifecycle. Against

the backdrop of a healthy market, we anticipate a positive fourth

quarter finish to our year and have updated our full-year outlook

accordingly.”

Third-Quarter 2024

Financial Highlights

- Revenue of $106.9 million, up 27% year-over-year

- Subscription revenue was $93.4 million, up 27%

year-over-year

- Annual Recurring Revenue (ARR) of $370.8 million, up 26%

year-over-year

- Recurring revenue dollar-based net retention rate of 124%

- GAAP gross profit and gross margin of $91.4 million and 85.5%,

respectively; Non-GAAP gross profit and gross profit margin of

$92.0 million and 86.1%, respectively

- GAAP net loss of $207.1 million; Non-GAAP net income of $31.8

million

- GAAP diluted loss per share of $(0.99); Non-GAAP diluted EPS of

$0.14

- Adjusted EBITDA and Adjusted EBITDA margin of $31.3 million and

29.3%, respectively

Third-Quarter 2024 and Recent Business

& Operational Highlights

Innovation

- On September

15, 2024, Cellebrite announced Pathfinder in the Cloud with Amazon

Web Services (AWS), allowing customers to access Cellebrite’s

industry-leading investigative analytics solution, Pathfinder,

through the secure Amazon Virtual Private Cloud (VPC). Pathfinder

in the Cloud with AWS, part of Cellebrite’s Case-to-Closure (C2C)

platform, helps agencies of all sizes eliminate both the need to

purchase and maintain physical servers as well as the common

reliance on dedicated server rooms and sensitive compartmented

information facility (SCIF) secure rooms. With this update,

customers can now quickly scale storage and resources based on

demand, while preserving resources as they only pay for what is

needed.

- On September

24, 2024, Cellebrite announced that it received a patent for Remote

Mobile Collection, which equips corporate investigators with

immediate, targeted remote data collection – saving them time and

money. In today’s hybrid work environment, Cellebrite’s SaaS

platforms Endpoint Mobile Now and Endpoint Inspector leverage this

newly patented technology to deliver high value, supporting rapid

data collection and offer greater convenience to the device’s

consenting owner, who can keep their devices during collection

rather than returning them to a corporate office.

Go to Market

- On October 29,

2024, Cellebrite announced that its inaugural Case-to-Closure (C2C)

User Summit, the premier event for digital investigations being

held from March 31 to April 3, 2025, in Washington, D.C., will

feature Tim Tebow as the keynote speaker. Tim Tebow is a two-time

national football champion, Heisman Trophy winner, first-round NFL

draft pick and a former professional baseball player who is also

known for his extensive advocacy work to protect children through

his namesake foundation. At the C2C User Summit, Tim Tebow will

address his foundation’s global fight against human trafficking,

complementing Cellebrite’s Operation Find Them All (OFTA)

initiative, a landmark commitment to accelerating investigations of

online crimes against children.

Capital Markets

- Cellebrite’s

efforts to drive value creation for shareholders underpinned three

major milestones:

- On September

16, 2024, Cellebrite disclosed that 5.0 million Price Adjustment

Shares will be issued and 3.0 million Restricted Sponsored Shares

vested after the dollar volume-weighted average price of the

Company’s ordinary shares was greater than or equal to $15.00 per

share for the 20th trading day within a 30 trading-day period. This

is the second triggering event to occur, following the one that was

announced by the Company on August 15, 2024.

- On September

18, 2024, Cellebrite announced the results of the completed

redemption of all of its outstanding Public and Private Warrants.

Nearly all of the 20.0 million Public Warrants and 100% of the 9.7

million Private Warrants outstanding of August 15, 2024 were

exercised on a cashless basis in exchange for an aggregate of

approximately 10.1 million Ordinary Shares.

- On November 4,

2024, Cellebrite disclosed that 5.0 million Price Adjustment Shares

will be issued after the dollar volume-weighted average price of

the Company’s ordinary shares was greater than or equal to $17.50

per share for the 20th trading day within a 30 trading-day period.

This is the third triggering event to occur, leaving 1.5 million

Restricted Stock Shares that will vest when the dollar

volume-weighted average price of the Company’s ordinary shares is

greater than or equal to $30.00 per share for 20 trading days

within a 30 trading-day period.

Annual General Meeting

- On September

17, 2024, Cellebrite held its 2024 Annual General Meeting of

Shareholders (the “Meeting”). As subsequently disclosed,

shareholders approved all of the proposals brought forth during the

Meeting by the respective requisite majority in accordance with the

Israeli Companies Law, 5759-1999, and the Company’s articles of

association, as described in the Proxy Statement which was

furnished to the Securities and Exchange Commission on August 13,

2024, and sent to shareholders in connection with the Meeting.

Supplemental financial information can be found

on the Investor Relations section of our website

at https://investors.cellebrite.com/financial-information/quarterly-results.

Financial Outlook“We delivered

a very strong third-quarter performance, highlighted by strong

top-line execution, prudent spending and outstanding cash

generation,” stated Dana Gerner, Cellebrite’s CFO. “The

completion of our broad warrant redemption program, combined with

our strong stock price performance over the past several months

that resulted in multiple triggering events, enable us to move

forward with a more optimized capital structure, an increased stock

float and simplified financial reporting. As we look ahead, based

on our results for the first three quarters of the year and our

assessment of the near-term opportunities, we have raised our 2024

revenue and adjusted EBITDA ranges and increased the low end of our

full-year ARR range.”

The Company’s updated 2024 expectations are as follows:

|

|

Fourth-Quarter 2024 Expectations(as of

11/06/24) |

|

Full-Year 2024

Expectations(as of 11/06/24) |

| ARR |

-- |

|

$390 million – $400 million |

| Annual Growth |

-- |

|

23% – 27% |

| Revenue |

$105 million – $109 million |

|

$397 million – $401 million |

| Annual Growth |

13% – 17% |

|

22% – 23% |

| Adjusted EBITDA |

$25 million – $29 million |

|

$94 million – $100 million |

| Adjusted EBITDA margin |

24% – 27% |

|

24% – 25% |

Conference Call

InformationCellebrite will host a live conference call and

webcast later this morning to review the Company’s financial

third-quarter 2024 results and discuss its full-year 2024 outlook.

Pertinent details include:

| Date: |

|

Tuesday, November 6, 2024 |

| Time: |

|

8:30 a.m. ET |

| Call-In Number: |

|

203-518-9783 / 800-267-6316 |

| Conference ID: |

|

CLBTQ324 |

| Event URL: |

|

https://investors.cellebrite.com/events/event-details/cellebrite-q3-2024-financial-results-investor-call-webcast |

| Webcast URL: |

|

https://edge.media-server.com/mmc/p/skb7gjeh |

In conjunction with the conference call and

webcast, historical financial tables and supplemental data will be

available on the quarterly results section of Company’s investor

relations website at

https://investors.cellebrite.com/financial-information/quarterly-results.

Non-GAAP Financial Information and Key

Performance IndicatorsThis press release includes non-GAAP

financial measures. Cellebrite believes that the use of non-GAAP

cost of revenue, non-GAAP gross profit, non-GAAP operating

expenses, non-GAAP operating income, non-GAAP net income, non-GAAP

EPS and Adjusted EBITDA is helpful to investors. These measures,

which the Company refers to as our non-GAAP financial measures, are

not prepared in accordance with GAAP.

The Company believes that the non-GAAP financial

measures provide a more meaningful comparison of its operational

performance from period to period, and offer investors and

management greater visibility to the underlying performance of its

business. Mainly:

- Share-based compensation expenses

utilize varying available valuation methodologies, subjective

assumptions and a variety of equity instruments that can impact a

company's non-cash expenses;

- Acquired intangible assets are

valued at the time of acquisition and are amortized over an

estimated useful life after the acquisition, and

acquisition-related expenses are unrelated to current operations

and neither are comparable to the prior period nor predictive of

future results;

- To the extent that the above

adjustments have an effect on tax (income) expense, such an effect

is excluded in the non-GAAP adjustment to net income;

- Tax expense, depreciation and

amortization expense vary for many reasons that are often unrelated

to our underlying performance and make period-to-period comparisons

more challenging; and

- Financial instruments are

remeasured according to GAAP and vary for many reasons that are

often unrelated to the Company’s current operations and affect

financial income.

Each of our non-GAAP financial measures is an

important tool for financial and operational decision making and

for evaluating our own operating results over different periods of

time. The non-GAAP financial measures do not represent our

financial performance under U.S. GAAP and should not be considered

as alternatives to operating income or net income or any other

performance measures derived in accordance with GAAP. Non-GAAP

measures should not be considered in isolated from, or as an

alternative to, financial measures determined in accordance with

GAAP. Non-GAAP financial measures may not provide information that

is directly comparable to that provided by other companies in our

industry, as other companies in our industry may calculate non-GAAP

financial results differently, particularly related to

non-recurring, unusual items. In addition, there are limitations in

using non-GAAP financial measures because the non-GAAP financial

measures are not prepared in accordance with GAAP, and exclude

expenses that may have a material impact on our reported financial

results. Further, share-based compensation expense has been, and

will continue to be for the foreseeable future, significant

recurring expenses in our business and an important part of the

compensation provided to our employees. In addition, the

amortization of intangible assets is expected recurring expense

over the estimated useful life of the underlying intangible asset

and acquisition-related expenses will be incurred to the extent

acquisitions are made in the future. Furthermore, foreign exchange

rates may fluctuate from one period to another, and the Company

does not estimate movements in foreign currencies.

A reconciliation of each of these non-GAAP

financial measures to their most comparable GAAP measure is set

forth in a table included at the end of this press release, which

is also available on our website at

https://investors.cellebrite.com.

In regard to forward-looking non-GAAP guidance,

we are not able to reconcile the forward-looking Adjusted EBITDA

measure to the closest corresponding GAAP measure without

unreasonable efforts because we are unable to predict the ultimate

outcome of certain significant items including, but not limited to,

fair value movements, share-based payments for future awards, tax

expense, depreciation and amortization expense, and certain

financing and tax items.

Key Performance IndicatorsThis press release

also includes key performance indicators, including annual

recurring revenue and dollar-based retention rate.

Annual recurring revenue (“ARR”) is defined as

the annualized value of active term-based subscription license

contracts and maintenance contracts related to perpetual licenses

in effect at the end of that period. Subscription license contracts

and maintenance contracts for perpetual licenses are annualized by

multiplying the revenue of the last month of the period by 12. The

annualized value of contracts is a legal and contractual

determination made by assessing the contractual terms with our

customers. The annualized value of maintenance contracts is not

determined by reference to historical revenue, deferred revenue or

any other GAAP financial measure over any period. ARR is not a

forecast of future revenues, which can be impacted by contract

start and end dates and renewal rates.

Dollar-based net retention rate (“NRR”) is

calculated by dividing customer recurring revenue by base revenue.

We define base revenue as recurring revenue we recognized from all

customers with a valid license at the last quarter of the previous

year period, during the four quarters ended one year prior to the

date of measurement. We define our customer revenue as the

recurring revenue we recognized during the four quarters ended on

the date of measurement from the same customer base included in our

measure of base revenue, including recurring revenue resulting from

additional sales to those customers.

About Cellebrite Cellebrite’s

(Nasdaq: CLBT) mission is to enable its customers to protect and

save lives, accelerate justice and preserve privacy in communities

around the world. We are a global leader in Digital Investigative

solutions for the public and private sectors, empowering

organizations in mastering the complexities of legally sanctioned

digital investigations by streamlining intelligence processes.

Trusted by thousands of leading agencies and companies worldwide,

Cellebrite’s Digital Investigation platform and solutions transform

how customers collect, review, analyze and manage data in legally

sanctioned investigations. To learn more, visit us at

www.cellebrite.com, https://investors.cellebrite.com, or follow us

on Twitter at @Cellebrite.

Note: References to our website and the websites

of third parties mentioned in this press release are inactive

textual references only, and information contained therein or

connected thereto is not incorporated into this press release.

References to Websites and Social Media

PlatformsReferences to information included on, or

accessible through, websites and social media platforms do not

constitute incorporation by reference of the information contained

at or available through such websites or social media platforms,

and you should not consider such information to be part of this

press release.

Caution Regarding Forward Looking

StatementsThis document includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the United States Private Securities Litigation Reform Act of 1995.

Forward looking statements may be identified by the use of words

such as “forecast,” “intend,” “seek,” “target,” “anticipate,”

“will,” “appear,” “approximate,” “foresee,” “might,” “possible,”

“potential,” “believe,” “could,” “predict,” “should,” “could,”

“continue,” “expect,” “estimate,” “may,” “plan,” “outlook,”

“future” and “project” and other similar expressions that predict,

project or indicate future events or trends or that are not

statements of historical matters. Such forward-looking statements

include estimated financial information for the fourth quarter of

2024 and full-year 2024, and certain statements such as our

customers are increasingly recognizing the value of how

Cellebrite’s powerful end-to-end solutions can enable them to

efficiently and effectively address major pain points in the

digital investigative lifecycle; we anticipate a positive fourth

quarter finish to our year and have updated our full-year outlook

accordingly; the completion of our broad warrant redemption

program, combined with our strong stock price performance over the

past several months that resulted in multiple triggering events,

enable us to move forward with a more optimized capital structure,

an increased stock float and simplified financial reporting; and we

have raised our 2024 revenue and adjusted EBITDA ranges and

increased the mid-point of our ARR range. Such forward-looking

statements including those with respect to fourth-quarter and

full-year 2024 revenue and annual recurring revenue, profitability

and earnings as well as commentary associated with future

performance, strategies, prospects, and other aspects of

Cellebrite’s business are based on current expectations that are

subject to risks and uncertainties. A number of factors could cause

actual results or outcomes to differ materially from those

indicated by such forward-looking statements. These factors

include, but are not limited to: Cellebrite’s ability to keep pace

with technological advances and evolving industry standards;

Cellebrite’s material dependence on the purchase, acceptance and

use of its solutions by law enforcement and government agencies;

real or perceived errors, failures, defects or bugs in Cellebrite’s

DI solutions; Cellebrite’s failure to maintain the productivity of

sales and marketing personnel, including relating to hiring,

integrating and retaining personnel; intense competition in all of

Cellebrite’s markets; the inadvertent or deliberate misuse of

Cellebrite’s solutions; failure to manage its growth effectively;

Cellebrite’s ability to introduce new solutions and add-ons; its

dependency on its customers renewing their subscriptions; the low

volume of business Cellebrite conducts via e-commerce; risks

associated with the use of artificial intelligence; the risk of

requiring additional capital to support the growth of its business;

risks associated with higher costs or unavailability of materials

used to create its hardware product components; fluctuations in

foreign currency exchange rates; lengthy sales cycle for some of

Cellebrite’s solutions; near term declines in new or renewed

agreements; risks associated with inability to retain qualified

personnel and senior management; the security of Cellebrite’s

operations and the integrity of its software solutions; risks

associated with the negative publicity related to Cellebrite’s

business and use of its products; risks related to Cellebrite’s

intellectual property; the regulatory constraints to which

Cellebrite is subject; risks associated with Cellebrite’s

operations in Israel, including the ongoing Israel-Hamas war, the

increased tension between Israel and Iran and its proxies, in

particular the ongoing hostilities between Israel and

Hezbollah, and the risk of a greater regional conflict; risks

associated with different corporate governance requirements

applicable to Israeli companies and risks associated with being a

foreign private issuer and an emerging growth company; market

volatility in the price of Cellebrite’s shares; changing tax laws

and regulations; risks associated with joint, ventures,

partnerships and strategic initiatives; risks associated with

Cellebrite’s significant international operations; risks associated

with Cellebrite’s failure to comply with anti-corruption, trade

compliance, anti-money-laundering and economic sanctions laws and

regulations; risks relating to the adequacy of Cellebrite’s

existing systems, processes, policies, procedures, internal

controls and personnel for Cellebrite’s current and future

operations and reporting needs; and other factors, risks and

uncertainties set forth in the section titled “Risk Factors” in

Cellebrite’s annual report on Form 20-F filed with the SEC on March

21, 2024 and as amended on April 12, 2024, and in other documents

filed by Cellebrite with the U.S. Securities and Exchange

Commission (“SEC”), which are available free of charge at

www.sec.gov. You are cautioned not to place undue reliance upon any

forward-looking statements, which speak only as of the date made,

in this communication or elsewhere. Cellebrite undertakes no

obligation to update its forward-looking statements, whether as a

result of new information, future developments or otherwise, should

circumstances change, except as otherwise required by securities

and other applicable laws.

Contacts:

Investors RelationsAndrew KramerVice President,

Investor Relationsinvestors@cellebrite.com +1 973.206.7760

Media Victor CooperSr. Director of Corporate

Communications + Content

OperationsVictor.cooper@cellebrite.com +1 404.804.5910

|

Cellebrite DI Ltd. |

|

Third-Quarter 2024 Results Summary |

|

(U.S Dollars in thousands) |

| |

| |

For the three months ended |

|

For the nine months ended |

| |

September 30, |

|

September 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Revenue |

106,858 |

|

|

84,179 |

|

|

292,154 |

|

|

232,097 |

|

| Gross profit |

91,414 |

|

|

71,301 |

|

|

247,185 |

|

|

193,782 |

|

| Gross margin |

85.5 |

% |

|

84.7 |

% |

|

84.6 |

% |

|

83.5 |

% |

| Operating income |

19,445 |

|

|

13,479 |

|

|

41,179 |

|

|

18,238 |

|

| Operating margin |

18.2 |

% |

|

16.0 |

% |

|

14.1 |

% |

|

7.9 |

% |

| Net (loss) income |

(207,093 |

) |

|

6,500 |

|

|

(302,276 |

) |

|

(66,453 |

) |

| Cash flow from operating

activities |

41,650 |

|

|

29,178 |

|

|

66,204 |

|

|

58,230 |

|

| |

|

|

|

|

|

|

|

| Non-GAAP Financial

Data: |

|

|

|

|

|

|

|

| Operating income |

29,506 |

|

|

19,252 |

|

|

65,191 |

|

|

34,300 |

|

| Operating margin |

27.6 |

% |

|

22.9 |

% |

|

22.3 |

% |

|

14.8 |

% |

| Net income |

31,847 |

|

|

21,313 |

|

|

71,638 |

|

|

38,927 |

|

| Adjusted EBITDA |

31,334 |

|

|

20,792 |

|

|

70,584 |

|

|

39,220 |

|

| Adjusted EBITDA margin |

29.3 |

% |

|

24.7 |

% |

|

24.2 |

% |

|

16.9 |

% |

|

Cellebrite DI Ltd. |

|

Condensed Consolidated Balance Sheets |

|

(U.S Dollars in thousands) |

| |

| |

|

September 30, |

|

December 31, |

| |

|

2024 |

|

2023 |

| |

|

(Unaudited) |

|

|

| Assets |

|

|

|

|

| Current

assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

136,349 |

|

|

$ |

189,517 |

|

| Short-term deposits |

|

|

143,372 |

|

|

|

74,713 |

|

| Marketable securities |

|

|

91,042 |

|

|

|

38,693 |

|

| Trade receivables (net of

allowance for credit losses of $2,095 and $1,583 as of September

30, 2024 and December 31, 2023, respectively) |

|

|

93,728 |

|

|

|

77,269 |

|

| Prepaid expenses and other

current assets |

|

|

20,668 |

|

|

|

26,400 |

|

| Contract acquisition

costs |

|

|

6,570 |

|

|

|

5,550 |

|

| Inventories |

|

|

9,725 |

|

|

|

9,940 |

|

| Total current

assets |

|

|

501,454 |

|

|

|

422,082 |

|

| |

|

|

|

|

| Non-current

assets |

|

|

|

|

| Other non-current assets |

|

|

7,635 |

|

|

|

7,341 |

|

| Marketable securities |

|

|

42,834 |

|

|

|

28,859 |

|

| Deferred tax assets, net |

|

|

9,292 |

|

|

|

7,024 |

|

| Property and equipment,

net |

|

|

15,918 |

|

|

|

15,896 |

|

| Intangible assets, net |

|

|

11,319 |

|

|

|

10,594 |

|

| Operating lease right-of-use

assets, net |

|

|

12,080 |

|

|

|

14,260 |

|

| Goodwill |

|

|

28,714 |

|

|

|

26,829 |

|

| Total non-current

assets |

|

|

127,792 |

|

|

|

110,803 |

|

| Total

assets |

|

$ |

629,246 |

|

|

$ |

532,885 |

|

| |

|

|

|

|

| Liabilities and

shareholders’ equity |

|

|

|

|

| |

|

|

|

|

| Current

Liabilities |

|

|

|

|

| Trade payables |

|

$ |

7,276 |

|

|

$ |

8,282 |

|

| Other accounts payable and

accrued expenses |

|

|

54,484 |

|

|

|

44,845 |

|

| Deferred revenues |

|

|

206,682 |

|

|

|

195,725 |

|

| Operating lease

liabilities |

|

|

4,478 |

|

|

|

4,972 |

|

| Total current

liabilities |

|

|

272,920 |

|

|

|

253,824 |

|

| |

|

|

|

|

| Long-term

liabilities |

|

|

|

|

| Other long-term

liabilities |

|

|

7,882 |

|

|

|

5,515 |

|

| Deferred revenues |

|

|

42,333 |

|

|

|

47,098 |

|

| Restricted Sponsor Shares

liability |

|

|

— |

|

|

|

47,247 |

|

| Price Adjustment Shares

liability |

|

|

— |

|

|

|

81,715 |

|

| Derivative warrant

liabilities |

|

|

— |

|

|

|

54,117 |

|

| Operating lease

liabilities |

|

|

7,795 |

|

|

|

9,157 |

|

| Total long-term

liabilities |

|

|

58,010 |

|

|

|

244,849 |

|

| Total

liabilities |

|

|

330,930 |

|

|

|

498,673 |

|

| |

|

|

|

|

| Shareholders’

equity |

|

|

|

|

| Share capital |

|

*) |

|

*) |

| Additional paid-in

capital |

|

|

482,118 |

|

|

|

(84,896 |

) |

| Treasury share, NIS 0.00001

par value; 41,776 ordinary shares |

|

|

(85 |

) |

|

|

(85 |

) |

| Accumulated other

comprehensive income |

|

|

416 |

|

|

|

1,050 |

|

| (Accumulated deficit) Retained

earnings |

|

|

(184,133 |

) |

|

|

118,143 |

|

| Total shareholders’

equity |

|

|

298,316 |

|

|

|

34,212 |

|

| Total liabilities and

shareholders’ equity |

|

$ |

629,246 |

|

|

$ |

532,885 |

|

*) Less than 1 USD

|

Cellebrite DI Ltd. |

|

Condensed Consolidated Statements of Income |

|

(U.S Dollars in thousands, except share and per share

data) |

| |

| |

|

For the three months ended |

|

For the nine months ended |

| |

|

September 30, |

|

September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| Revenue: |

|

|

|

|

|

|

|

|

|

Subscription services |

|

$ |

69,339 |

|

|

$ |

54,150 |

|

|

$ |

197,180 |

|

|

$ |

152,029 |

|

| Term-license |

|

|

24,038 |

|

|

|

19,130 |

|

|

|

60,787 |

|

|

|

49,739 |

|

| Total subscription |

|

|

93,377 |

|

|

|

73,280 |

|

|

|

257,967 |

|

|

|

201,768 |

|

| Other non-recurring |

|

|

3,938 |

|

|

|

4,185 |

|

|

|

10,992 |

|

|

|

9,075 |

|

| Professional services

|

|

|

9,543 |

|

|

|

6,714 |

|

|

|

23,195 |

|

|

|

21,254 |

|

| Total

revenue |

|

|

106,858 |

|

|

|

84,179 |

|

|

|

292,154 |

|

|

|

232,097 |

|

| |

|

|

|

|

|

|

|

|

| Cost of

revenue: |

|

|

|

|

|

|

|

|

| Subscription services |

|

|

6,651 |

|

|

|

4,602 |

|

|

|

18,848 |

|

|

|

14,040 |

|

| Term-license |

|

|

— |

|

|

|

4 |

|

|

|

— |

|

|

|

6 |

|

| Total subscription |

|

|

6,651 |

|

|

|

4,606 |

|

|

|

18,848 |

|

|

|

14,046 |

|

| Other non-recurring |

|

|

3,415 |

|

|

|

3,515 |

|

|

|

11,335 |

|

|

|

9,422 |

|

| Professional services |

|

|

5,378 |

|

|

|

4,757 |

|

|

|

14,786 |

|

|

|

14,847 |

|

| Total cost of

revenue |

|

|

15,444 |

|

|

|

12,878 |

|

|

|

44,969 |

|

|

|

38,315 |

|

| |

|

|

|

|

|

|

|

|

| Gross

profit |

|

$ |

91,414 |

|

|

$ |

71,301 |

|

|

$ |

247,185 |

|

|

$ |

193,782 |

|

| |

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Research and development |

|

|

25,926 |

|

|

|

20,451 |

|

|

|

72,816 |

|

|

|

62,635 |

|

| Sales and marketing |

|

|

32,486 |

|

|

|

26,873 |

|

|

|

96,865 |

|

|

|

81,219 |

|

| General and

administrative |

|

|

13,557 |

|

|

|

10,498 |

|

|

|

36,325 |

|

|

|

31,690 |

|

| Total operating

expenses |

|

$ |

71,969 |

|

|

$ |

57,822 |

|

|

$ |

206,006 |

|

|

$ |

175,544 |

|

| |

|

|

|

|

|

|

|

|

| Operating

income |

|

$ |

19,445 |

|

|

$ |

13,479 |

|

|

$ |

41,179 |

|

|

$ |

18,238 |

|

| Financial expense, net |

|

|

(223,982 |

) |

|

|

(6,630 |

) |

|

|

(337,060 |

) |

|

|

(81,456 |

) |

| (Loss) income before tax |

|

|

(204,537 |

) |

|

|

6,849 |

|

|

|

(295,881 |

) |

|

|

(63,218 |

) |

| Tax expense |

|

|

2,556 |

|

|

|

349 |

|

|

|

6,395 |

|

|

|

3,235 |

|

| Net (loss)

income |

|

$ |

(207,093 |

) |

|

$ |

6,500 |

|

|

$ |

(302,276 |

) |

|

$ |

(66,453 |

) |

| |

|

|

|

|

|

|

|

|

| (Losses) earnings per

share |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.99 |

) |

|

$ |

0.03 |

|

|

$ |

(1.50 |

) |

|

$ |

(0.35 |

) |

| Diluted |

|

$ |

(0.99 |

) |

|

$ |

0.03 |

|

|

$ |

(1.50 |

) |

|

$ |

(0.35 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average

shares outstanding |

|

|

|

|

|

|

|

|

| Basic |

|

|

208,705,089 |

|

|

|

191,567,601 |

|

|

|

201,488,572 |

|

|

|

188,697,934 |

|

| Diluted |

|

|

208,705,089 |

|

|

|

204,394,330 |

|

|

|

201,488,572 |

|

|

|

188,697,934 |

|

| |

|

|

|

|

|

|

|

|

| Other comprehensive

(loss) income: |

|

|

|

|

|

|

|

|

| Unrealized income (loss) on

hedging transactions |

|

|

102 |

|

|

|

(85 |

) |

|

|

(748 |

) |

|

|

(59 |

) |

| Unrealized income on

marketable securities |

|

|

844 |

|

|

|

87 |

|

|

|

524 |

|

|

|

213 |

|

| Currency translation

adjustments |

|

|

(1,780 |

) |

|

|

873 |

|

|

|

(410 |

) |

|

|

(93 |

) |

| Total other comprehensive

(loss) income, net of tax |

|

|

(834 |

) |

|

|

875 |

|

|

|

(634 |

) |

|

|

61 |

|

| Total other

comprehensive (loss) income |

|

$ |

(207,927 |

) |

|

$ |

7,375 |

|

|

$ |

(302,910 |

) |

|

$ |

(66,392 |

) |

| |

|

|

|

|

|

|

|

|

|

Cellebrite DI Ltd. |

|

Condensed Consolidated Statements of Cash

Flow |

|

(U.S Dollars in thousands, except share and per share

data) |

| |

| |

|

For the three months ended |

|

For the nine months ended |

| |

|

September 30, |

|

September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| Cash flow from

operating activities: |

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(207,093 |

) |

|

$ |

6,500 |

|

|

$ |

(302,276 |

) |

|

$ |

(66,453 |

) |

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Share-based compensation and

RSU's |

|

|

9,055 |

|

|

|

4,881 |

|

|

|

21,306 |

|

|

|

13,938 |

|

| Amortization of premium,

discount and accrued interest on marketable securities |

|

|

(736 |

) |

|

|

(337 |

) |

|

|

(2,038 |

) |

|

|

(798 |

) |

| Depreciation and

amortization |

|

|

2,622 |

|

|

|

2,380 |

|

|

|

7,878 |

|

|

|

7,396 |

|

| Interest income from

short-term deposits |

|

|

(2,430 |

) |

|

|

(1,845 |

) |

|

|

(7,900 |

) |

|

|

(4,242 |

) |

| Deferred tax assets, net |

|

|

(634 |

) |

|

|

2,373 |

|

|

|

(2,202 |

) |

|

|

2,835 |

|

| Remeasurement of warrant

liability |

|

|

71,271 |

|

|

|

2,054 |

|

|

|

110,664 |

|

|

|

24,317 |

|

| Remeasurement of Restricted

Sponsor Shares |

|

|

37,906 |

|

|

|

2,647 |

|

|

|

65,889 |

|

|

|

22,740 |

|

| Remeasurement of Price

Adjustment Shares liabilities |

|

|

120,008 |

|

|

|

4,779 |

|

|

|

173,051 |

|

|

|

41,376 |

|

| (Increase) decrease in trade

receivables |

|

|

(22,113 |

) |

|

|

(8,779 |

) |

|

|

(16,092 |

) |

|

|

9,338 |

|

| Increase in deferred

revenue |

|

|

20,117 |

|

|

|

13,312 |

|

|

|

5,062 |

|

|

|

23,867 |

|

| Decrease (increase) in other

non-current assets |

|

|

589 |

|

|

|

(4,779 |

) |

|

|

(294 |

) |

|

|

(5,841 |

) |

| Decrease (increase) in prepaid

expenses and other current assets |

|

|

3,334 |

|

|

|

(1,412 |

) |

|

|

6,086 |

|

|

|

(7,036 |

) |

| Changes in operating lease

assets |

|

|

1,244 |

|

|

|

1,438 |

|

|

|

3,885 |

|

|

|

4,138 |

|

| Changes in operating lease

liability |

|

|

(1,019 |

) |

|

|

(1,564 |

) |

|

|

(3,561 |

) |

|

|

(4,526 |

) |

| (Increase) decrease in

inventories |

|

|

(915 |

) |

|

|

(396 |

) |

|

|

236 |

|

|

|

(1,038 |

) |

| Increase (decrease) in trade

payables |

|

|

429 |

|

|

|

2,989 |

|

|

|

(1,162 |

) |

|

|

3,370 |

|

| Increase (decrease) in other

accounts payable and accrued expenses |

|

|

9,184 |

|

|

|

4,904 |

|

|

|

5,864 |

|

|

|

(4,837 |

) |

| Increase (decrease) in other

long-term liabilities |

|

|

831 |

|

|

|

33 |

|

|

|

1,808 |

|

|

|

(314 |

) |

| Net cash provided by operating

activities |

|

|

41,650 |

|

|

|

29,178 |

|

|

|

66,204 |

|

|

|

58,230 |

|

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Purchases of property and

equipment |

|

|

(1,820 |

) |

|

|

(1,082 |

) |

|

|

(5,388 |

) |

|

|

(2,971 |

) |

|

Cash paid in conjunction with acquisitions, net of acquired

cash |

|

|

(2,748 |

) |

|

|

— |

|

|

|

(2,748 |

) |

|

|

— |

|

|

Purchase of intangible assets |

|

|

— |

|

|

|

— |

|

|

|

(904 |

) |

|

|

— |

|

|

Investment in marketable securities |

|

|

(13,428 |

) |

|

|

(15,000 |

) |

|

|

(112,710 |

) |

|

|

(42,005 |

) |

| Proceeds from maturity of

marketable securities |

|

|

13,550 |

|

|

|

14,550 |

|

|

|

48,986 |

|

|

|

44,057 |

|

| Investment in short-term

deposits |

|

|

(46,000 |

) |

|

|

(10,000 |

) |

|

|

(168,000 |

) |

|

|

(64,000 |

) |

| Redemption of short-term

deposits |

|

|

31,781 |

|

|

|

637 |

|

|

|

107,240 |

|

|

|

39,218 |

|

| Net cash used in investing

activities |

|

|

(18,665 |

) |

|

|

(10,895 |

) |

|

|

(133,524 |

) |

|

|

(25,701 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Exercise of options to

shares |

|

|

4,622 |

|

|

|

8,130 |

|

|

|

11,509 |

|

|

|

15,315 |

|

| Proceeds from Employee Share

Purchase Plan |

|

|

864 |

|

|

|

686 |

|

|

|

2,370 |

|

|

|

1,920 |

|

| Exercise of warrants |

|

|

53 |

|

|

|

— |

|

|

|

53 |

|

|

|

— |

|

| Redemption of warrants |

|

|

(11 |

) |

|

|

— |

|

|

|

(11 |

) |

|

|

— |

|

| Net cash provided by financing

activities |

|

|

5,528 |

|

|

|

8,816 |

|

|

|

13,921 |

|

|

|

17,235 |

|

| |

|

|

|

|

|

|

|

|

| Net increase

(decrease) in cash and cash equivalents |

|

|

28,513 |

|

|

|

27,099 |

|

|

|

(53,399 |

) |

|

|

49,764 |

|

| Net effect of Currency

Translation on cash and cash equivalents |

|

|

880 |

|

|

|

(535 |

) |

|

|

231 |

|

|

|

(343 |

) |

| Cash and cash equivalents at

beginning of period |

|

|

106,956 |

|

|

|

110,502 |

|

|

|

189,517 |

|

|

|

87,645 |

|

| Cash and cash

equivalents at end of period |

|

$ |

136,349 |

|

|

$ |

137,066 |

|

|

$ |

136,349 |

|

|

$ |

137,066 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental cash flow

information: |

|

|

|

|

|

|

|

|

| Income taxes paid |

|

$ |

1,348 |

|

|

$ |

673 |

|

|

$ |

3,905 |

|

|

$ |

9,200 |

|

| Non-cash activities |

|

|

|

|

|

|

|

|

|

Operating lease liabilities arising from obtaining right of use assets |

|

$ |

1,616 |

|

|

$ |

— |

|

|

$ |

1,831 |

|

|

$ |

1,258 |

|

| Reclassification of derivative

warrants from liability to equity |

|

$ |

164,770 |

|

|

$ |

— |

|

|

$ |

164,770 |

|

|

$ |

— |

|

| Reclassification of Restricted

Sponsor Shares from liability to equity |

|

$ |

113,136 |

|

|

$ |

— |

|

|

$ |

113,136 |

|

|

$ |

— |

|

| Reclassification of Price

Adjustment Shares from liability to equity |

|

$ |

254,766 |

|

|

$ |

— |

|

|

$ |

254,766 |

|

|

$ |

— |

|

|

Cellebrite DI Ltd. |

|

Reconciliation of GAAP to Non-GAAP Financial

Information |

|

(U.S Dollars in thousands, except share and per share

data) |

| |

| |

For the three months ended |

|

For the nine months ended |

| |

September 30 |

|

September 30 |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Cost of revenue |

$ |

15,444 |

|

|

$ |

12,878 |

|

|

$ |

44,969 |

|

|

$ |

38,315 |

|

| Less: |

|

|

|

|

|

|

|

| Share-based compensation |

|

559 |

|

|

|

435 |

|

|

|

1,652 |

|

|

|

1,235 |

|

| Acquisition-related costs |

|

— |

|

|

|

12 |

|

|

|

2 |

|

|

|

39 |

|

| Non-GAAP cost of revenue |

$ |

14,885 |

|

|

$ |

12,431 |

|

|

$ |

43,315 |

|

|

$ |

37,041 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

For the three months ended |

|

For the nine months ended |

| |

September 30 |

|

September 30 |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| Gross profit |

$ |

91,414 |

|

|

$ |

71,301 |

|

|

$ |

247,185 |

|

|

$ |

193,782 |

|

| Share-based compensation |

|

559 |

|

|

|

435 |

|

|

|

1,652 |

|

|

|

1,235 |

|

| Acquisition-related costs |

|

— |

|

|

|

12 |

|

|

|

2 |

|

|

|

39 |

|

| Non-GAAP gross profit |

$ |

91,973 |

|

|

$ |

71,748 |

|

|

$ |

248,839 |

|

|

$ |

195,056 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

For the three months ended |

|

For the nine months ended |

| |

September 30 |

|

September 30 |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| Operating expenses |

$ |

71,969 |

|

|

$ |

57,822 |

|

|

$ |

206,006 |

|

|

$ |

175,544 |

|

| Less: |

|

|

|

|

|

|

|

| Issuance expenses |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(345 |

) |

| Share-based compensation |

|

8,496 |

|

|

|

4,446 |

|

|

|

19,654 |

|

|

|

12,703 |

|

| Amortization of intangible

assets |

|

794 |

|

|

|

840 |

|

|

|

2,485 |

|

|

|

2,476 |

|

| Acquisition-related costs |

|

212 |

|

|

|

40 |

|

|

|

219 |

|

|

|

(46 |

) |

| Non-GAAP operating

expenses |

$ |

62,467 |

|

|

$ |

52,496 |

|

|

$ |

183,648 |

|

|

$ |

160,756 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

For the three months ended |

|

For the nine months ended |

| |

September 30 |

|

September 30 |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| Operating income |

$ |

19,445 |

|

|

$ |

13,479 |

|

|

$ |

41,179 |

|

|

$ |

18,238 |

|

| Issuance expenses |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(345 |

) |

| Share-based compensation |

|

9,055 |

|

|

|

4,881 |

|

|

|

21,306 |

|

|

|

13,938 |

|

| Amortization of intangible

assets |

|

794 |

|

|

|

840 |

|

|

|

2,485 |

|

|

|

2,476 |

|

| Acquisition-related costs |

|

212 |

|

|

|

52 |

|

|

|

221 |

|

|

|

(7 |

) |

| Non-GAAP operating income |

$ |

29,506 |

|

|

$ |

19,252 |

|

|

$ |

65,191 |

|

|

$ |

34,300 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

For the three months ended |

|

For the nine months ended |

| |

September 30 |

|

September 30 |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| Net (loss) income |

$ |

(207,093 |

) |

|

$ |

6,500 |

|

|

$ |

(302,276 |

) |

|

$ |

(66,453 |

) |

| Issuance expenses |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(345 |

) |

| Share-based compensation |

|

9,055 |

|

|

|

4,881 |

|

|

|

21,306 |

|

|

|

13,938 |

|

| Amortization of intangible

assets |

|

794 |

|

|

|

840 |

|

|

|

2,485 |

|

|

|

2,476 |

|

| Acquisition-related costs |

|

212 |

|

|

|

52 |

|

|

|

221 |

|

|

|

(7 |

) |

| Tax (income) expense |

|

(306 |

) |

|

|

(440 |

) |

|

|

298 |

|

|

|

885 |

|

| Finance expense from financial

derivatives |

|

229,185 |

|

|

|

9,480 |

|

|

|

349,604 |

|

|

|

88,433 |

|

| Non-GAAP net income |

$ |

31,847 |

|

|

$ |

21,313 |

|

|

$ |

71,638 |

|

|

$ |

38,927 |

|

| |

|

|

|

|

|

|

|

| Non-GAAP Earnings per

share: |

|

|

|

|

|

|

|

| Basic |

$ |

0.15 |

|

|

$ |

0.10 |

|

|

$ |

0.34 |

|

|

$ |

0.19 |

|

| Diluted |

$ |

0.14 |

|

|

$ |

0.09 |

|

|

$ |

0.32 |

|

|

$ |

0.18 |

|

| |

|

|

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

| Basic |

|

208,705,089 |

|

|

|

191,567,601 |

|

|

|

201,488,572 |

|

|

|

188,697,934 |

|

| Diluted |

|

226,882,633 |

|

|

|

204,394,330 |

|

|

|

215,424,847 |

|

|

|

202,899,131 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

For the three months ended |

|

For the nine months ended |

| |

September 30 |

|

September 30 |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| Net (loss) income |

$ |

(207,093 |

) |

|

$ |

6,500 |

|

|

$ |

(302,276 |

) |

|

$ |

(66,453 |

) |

| Financial expense, net |

|

223,982 |

|

|

|

6,630 |

|

|

|

337,060 |

|

|

|

81,456 |

|

| Tax expense |

|

2,556 |

|

|

|

349 |

|

|

|

6,395 |

|

|

|

3,235 |

|

| Issuance expenses |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(345 |

) |

| Share-based compensation |

|

9,055 |

|

|

|

4,881 |

|

|

|

21,306 |

|

|

|

13,938 |

|

| Amortization of intangible

assets |

|

794 |

|

|

|

840 |

|

|

|

2,485 |

|

|

|

2,476 |

|

| Acquisition-related costs |

|

212 |

|

|

|

52 |

|

|

|

221 |

|

|

|

(7 |

) |

| Depreciation expenses |

|

1,828 |

|

|

|

1,540 |

|

|

|

5,393 |

|

|

|

4,920 |

|

| Adjusted EBITDA |

$ |

31,334 |

|

|

$ |

20,792 |

|

|

$ |

70,584 |

|

|

$ |

39,220 |

|

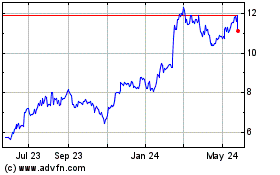

Cellebrite Digital Intel... (NASDAQ:CLBT)

Historical Stock Chart

From Oct 2024 to Nov 2024

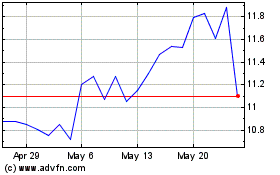

Cellebrite Digital Intel... (NASDAQ:CLBT)

Historical Stock Chart

From Nov 2023 to Nov 2024