Canoo Inc. (NASDAQ: GOEV), (“Canoo” or the “Company”), an advanced

high-tech mobility company, announced today that it will effect a

1-for-20 reverse stock split of its common stock, par value $0.0001

per share (“Common Stock”), that will become effective on December

24, 2024, at 8:00 a.m., Eastern Time (“Effective Date”). Canoo’s

Common Stock will continue to trade on The Nasdaq Capital Market

under the existing ticker symbol "GOEV" and will begin trading on a

split-adjusted basis when the market opens on December 24, 2024.

The new CUSIP number for Canoo’s Common Stock following the reverse

stock split will be 13803R300.

At the Company’s Annual Meeting of Stockholders held on December

6, 2024 (the “Annual Meeting”), the Company’s stockholders granted

the Company’s board of directors (the “Board”) the discretion to

effect one or more consolidations of the issued and outstanding

shares of the Company’s Common Stock with each reverse stock split

ratio ranging from 1:2 up to 1:30 through an amendment to its

Second Amended and Restated Certificate of Incorporation; provided

that (i) the Company shall not effect reverse stock splits that, in

the aggregate, exceed 1:60 and (ii) any reverse stock split is

completed prior to the one-year anniversary of the date on which

the reverse stock split proposal is approved by the Company’s

stockholders. The Board approved a 1-for-20 reverse split ratio,

and the Company filed a Certificate of Amendment to its Second

Amended and Restated Certificate of Incorporation on December 19,

2024, to effect the reverse stock split.

The Board implemented the reverse stock split with the objective

of bringing the Company into compliance with the minimum bid price

requirement for maintaining the listing of its Common Stock on

Nasdaq, and to make the bid price more attractive to a broader

group of institutional and retail investors. Nasdaq requires, among

other things, that a listing company’s common stock maintains a

minimum bid price of at least $1.00 per share. To evidence

compliance with this requirement, the closing bid price of the

Company’s Common Stock must be at least $1.00 per share for a

minimum of ten consecutive business days by June 2, 2025.

As a result of the reverse stock split, every 20 shares of the

Company’s Common Stock will automatically be combined into one

share of Common Stock. The reverse stock split will affect all

stockholders uniformly and will not alter any stockholder’s

percentage ownership interest in the Company’s equity, except for

immaterial adjustments that may result from the treatment of

fractional shares as described below. No fractional shares will be

issued in connection with the reverse stock split.

Canoo’s transfer agent, Continental Stock Transfer & Trust

Company (“Continental”), will aggregate all fractional shares of

our Common Stock and sell them as soon as practicable after the

Effective Date at the then-prevailing prices on the open market, on

behalf of those stockholders who would otherwise be entitled to

receive a fractional share of our Common Stock as a result of the

reverse stock split. The Company expects that Continental will

conduct the sale in an orderly fashion at a reasonable pace and

that it may take several days to sell all the aggregated fractional

shares of our Common Stock (the “Aggregated Fractional Shares”).

After the completion of such sale, stockholders of record who

otherwise would be entitled to receive fractional shares (i.e.,

stockholders that hold a number of pre-reverse stock split shares

of Common Stock not evenly divisible by the final ratio) will

instead receive their respective pro rata share of the total

proceeds of that sale (the “Total Sale Proceeds”). These

stockholders will be entitled to a cash payment (without interest),

in lieu of any fractional shares, in an amount equal to: (a) their

respective fractional share interest, multiplied by (b) a share

price equal to (i) the Total Sale Proceeds, divided by (ii) the

Aggregated Fractional Shares. There will not be a reduction in the

total number of authorized shares of Common Stock.

As of the Effective Date, the number of shares of Common Stock

available for issuance under the Company’s equity incentive plans

and issuable pursuant to equity awards immediately prior to the

reverse stock split will be proportionately adjusted by the reverse

stock split. The exercise prices of the Company’s outstanding

options and equity awards will be adjusted in accordance with their

respective terms.

The combination of, and reduction in, the number of issued

shares of Common Stock as a result of the reverse stock split will

occur automatically at the Effective Date without any additional

action on the part of our stockholders. Continental is acting as

the exchange agent for the reverse stock split and will send

stockholders a transaction statement indicating the number of

shares of Common Stock stockholders hold after the reverse stock

split. Stockholders owning shares via a broker, bank, trust or

other nominee will have their positions automatically adjusted to

reflect the reverse stock split, subject to such broker’s

particular processes, and will not be required to take any action

in connection with the reverse stock split.

Additional information regarding the reverse stock split is

available on the Form 8-K filed December 192, 2024, as well as in

the Company’s definitive proxy statement filed with the Securities

and Exchange Commission on October 8, 2024, a copy of which is

available at www.sec.gov and on the Company’s website. For more

information, visit www.canoo.com

About Canoo

Founded in 2017, Canoo Inc. (NASDAQ: GOEV) is an automotive tech

company that manufactures electric cargo vehicles, built to

deliver, for large commercial, government and fleet customers

globally. The company has developed design-forward innovative

electric vehicles with steer-by-wire technology on its common

modular platform with end-to-end software plus power solutions.

Canoo’s platform is purpose-built to maximize the vehicle interior

space and is customizable to support a wide range of business and

government applications. Headquartered in Justin, Texas, Canoo has

teams located in California, Michigan and Oklahoma with world-class

vehicle and battery facilities in Oklahoma City. For more

information please visit www.canoo.com and investors.canoo.com.

Forward-Looking StatementsThe information in

this press release includes "forward-looking statements" within the

meaning of the "safe harbor" provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward- looking

statements may be identified by the use of words such as

"estimate," "plan," "project," "forecast," "intend," "will,"

"expect," "anticipate," "believe," "seek," "target" or other

similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These

forward-looking statements include, but are not limited to,

statements about our plans, expectations and objectives with

respect to the results and timing of the reverse stock split and

the effect the reverse stock split will have on the Company’s

ability to regain compliance with the Nasdaq Listing standards.

These statements are based on various assumptions, whether or not

identified in this press release, and on the current expectations

of Canoo's management and are not predictions of actual

performance. These forward-looking statements are provided for

illustrative purposes only and are not intended to serve as, and

must not be relied on by any investor as, a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or

impossible to predict and will differ from assumptions. Many actual

events and circumstances are beyond the control of Canoo. These

forward-looking statements are subject to a number of risks and

uncertainties, including changes in domestic and foreign business,

market, financial, political and legal conditions; Canoo's ability

to access future capital, via debt or equity markets, or other

sources; the rollout of Canoo's business and the timing of expected

business milestones and commercial launch; future market adoption

of Canoo's offerings; risks related to Canoo's go-to-market

strategy and manufacturing strategy; the effects of competition on

Canoo's future business, and those factors discussed under the

captions "Risk Factors" and "Management's Discussion and Analysis

of Financial Condition and Results of Operations" in Canoo's Annual

Report on Form 10-K for the fiscal year ended December 31, 2023

filed with the U.S. Securities and Exchange Commission (the "SEC")

on April 1, 2024, as well as its past and future Quarterly Reports

on Form 10-Q and other filings with the SEC, copies of which may be

obtained by visiting Canoo's Investors Relations website at

investors.canoo.com or the SEC's website at www.sec.gov. If any of

these risks materialize or our assumptions prove incorrect, actual

results could differ materially from the results implied by these

forward-looking statements. There may be additional risks that

Canoo does not presently know or that Canoo currently believes are

immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements reflect Canoo's expectations, plans or

forecasts of future events and views as of the date of this press

release. Canoo anticipates that subsequent events and developments

will cause Canoo's assessments to change.

However, while Canoo may elect to update these forward-looking

statements at some point in the future, Canoo specifically

disclaims any obligation to do so. These forward-looking statements

should not be relied upon as representing Canoo's assessments as of

any date subsequent to the date of this press release. Accordingly,

undue reliance should not be placed upon the forward-looking

statements.

Media Contactpress@canoo.com

Investor Relations ContactIR@canoo.com

Source: Canoo Inc.

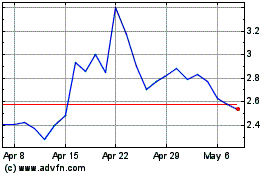

Canoo (NASDAQ:GOEV)

Historical Stock Chart

From Nov 2024 to Dec 2024

Canoo (NASDAQ:GOEV)

Historical Stock Chart

From Dec 2023 to Dec 2024