FALSE000162728200016272822023-08-102023-08-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

August 10, 2023

CALIBERCOS INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| | | | | | | | |

| 001-41703 | | 47-2426901 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

8901 E. Mountain View Rd. Ste. 150, Scottsdale, AZ | | 85258 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(480) 295-7600

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbols | Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 | CWD | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01 Regulation FD Disclosure.

On August 10, 2023, CaliberCos Inc. (the “Company”) issued a press release announcing that it has reached an agreement with L.T.D. Hospitality Group LLC (“L.T.D.”) in which affiliates of L.T.D. have agreed to contribute nine hotel properties to the Company’s subsidiary, Caliber Hospitality Trust, an externally advised private hospitality corporation. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is hereby furnished pursuant to this Item 7.01.

The information disclosed under this Item 7.01, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

Exhibit No. | | Exhibit |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| CaliberCos Inc. |

| | | |

| Date: August 16, 2023 | | |

| | | |

| By: | /s/ John C. Loeffler, II |

| Name: | John C. Loeffler, II |

| Title: | Chairman and Chief Executive Officer |

Exhibit 99.1

Caliber Announces Second Contribution to Caliber Hospitality Trust

•L.T.D. Hospitality Group agrees to contribute nine Virginia-based hotels including IHG and Marriott brands to Caliber Hospitality Trust; the second of several planned contributions

•Upon closing, the contribution will expand Caliber Hospitality’s portfolio to 15 hotels from six and more than double its portfolio valuation to $405 million

•Contribution will also increase Caliber’s FV AUM by 25% and its asset management revenue run rate by approximately $2 million, or 20%

SCOTTSDALE, Ariz., Aug. 10, 2023 — CaliberCos Inc. (NASDAQ: CWD) (“Caliber”), a leading vertically integrated alternative asset manager, today announced that it has reached an agreement with L.T.D. Hospitality Group LLC (“L.T.D.”) in which L.T.D. has agreed to contribute nine hotel properties to its subsidiary, Caliber Hospitality Trust (“CHT”), an externally advised private hospitality corporation. The transaction is subject to customary closing conditions and is expected to close by the end of the third quarter of 2023.

Based in Virginia Beach, Va., L.T.D. is a hospitality management and development company founded in 1983, led by managing principals Neel Desai and Malay Thakkar. All nine properties to be contributed by L.T.D. are in Virginia and include a mix of upscale to upper upscale hotels across multiple IHG and Marriott brands.

Formed in 2022, CHT accepted its initial contribution of six hotels in Arizona in the first quarter of 2023 from Funds managed by Caliber. The value of this initial portfolio was approximately $186 million as of June 30, 2023.

The execution of a contribution agreement with L.T.D. marks CHT’s second contribution of assets, which, upon transaction closing, will grow CHT’s assets under management (“AUM”) to $405 million. Under the terms of the contribution agreement, L.T.D. will receive cash and/or operating partnership units (“OP Units”) in exchange for the contribution of its nine hotels.

Upon closing, this addition will more than double the value of CHT’s current portfolio to $405 million and increase Caliber’s FV AUM1 by approximately 25%. In addition, Caliber’s asset management revenue run rate will further increase by approximately $2 million, or 20%2,

1 Fair value assets under management is defined as the aggregate fair value of the real estate assets the Company manages from which it derives management fees, performance revenues and other fees and expense reimbursements, as of June 30, 2023.

2 Asset management revenue run rate is an estimate that annualizes asset management revenue, which are on a basis that deconsolidates the consolidated funds, for the month ended June 30, 2023.

considering the value of the portfolio contributed and the terms of the contribution and management agreements. Caliber is in active discussions with other potential third parties and expects to make additional announcements in the second half of 2023.

Commenting on CHT’s plans for growth, Caliber CEO Chris Loeffler said, “We believe there are a substantial number of hotel owners across the U.S. who are looking for a compelling alternative to asset sales to access liquidity, reduce and extend debt, pay for property improvement plans, or access well-priced operating and growth capital. These hoteliers are typically highly experienced professionals – second or third generation hotel owners – who are committed to their businesses and see the opportunity that comes with greater scale and access to permanent capital. The Caliber Hospitality Trust offers these potential benefits to contributors who also see a moment in time when distressed assets may offer discounted purchase prices.

“Our model allows our contributor partners to do what they do best – own, invest in, and operate successful hotels – while Caliber provides capital, expertise and other resources including technology, data and analytics, training, and business support services so they can continue to grow their businesses. This partnership enables CHT to expand its real estate portfolio, while also attracting talented and experienced hotel executives with a proven track record of success, deep local market and hospitality sector knowledge, and valuable relationships.

“L.T.D. is an ideal first contributor that validates our strategy. We are very excited to welcome Neel Desai and the L.T.D. team to CHT. Neel has decades of experience, and we look forward to him joining Caliber Hospitality’s Board of Directors to help guide our growth.”

“We are thrilled to join forces with Caliber and CHT and look forward to working closely with the entire Caliber team,” said Neel Desai, managing principal of L.T.D. Hospitality Group. “When L.T.D. bought its first hotel in 1983, we dreamed our business would grow within the Hampton Roads region, known for its thriving economy from industries such as defense, tourism, healthcare and education. Forty years later, our dreams are coming true, and now we have more exciting opportunities ahead by partnering with Caliber Hospitality Trust. We share Caliber’s entrepreneurial approach and growth mindset and are excited to leverage their deep real estate expertise, capital resources and robust operating platform to take our business to the next level while working to create value for all of CHT’s shareholders.”

L.T.D.’s contribution will expand Caliber’s multi-state footprint into Virginia, another vibrant growth market. Hampton Roads comprises the Virginia Beach-Norfolk-Newport News metropolitan area, which has a population of approximately 1.8 million. The region is known for its significant military presence and home to the Port of Virginia, one of the busiest ports on the East Coast. The area is a tourist mecca with 3,000 miles of shoreline with beautiful beaches and hundreds of historical sites and attractions, including Colonial Williamsburg, the historic Jamestown Settlement, the Virginia Air and Space Museum, and Busch Gardens.

Founding Contributors have the opportunity to receive operating capital and an immediate ownership stake in the company through a tax-free exchange for OP Units. Caliber has set a target date of September 30, 2023, for potential partners to sign term sheets to contribute their hotels to CHT. Interested parties should reach out to Invest@CaliberCo.com for additional information.

About CaliberCos Inc.

Caliber (NASDAQ: CWD) is an alternative asset management firm whose purpose is to build generational wealth for investors seeking to access opportunities in real estate. Caliber differentiates itself by creating, managing, and servicing proprietary products, including middle-market investment funds, private syndications, and direct investments, which are managed by our in-house asset services group. The Company leverages access to both the public and private markets to maximize value for its customers and funds. Our funds include investment vehicles focused primarily on real estate, private equity, and debt facilities. Additional information can be found at Caliberco.com and CaliberFunds.co.

About Caliber Hospitality Trust

Caliber Hospitality Trust (“CHT”), an externally advised private hospitality corporation, is a subsidiary of CaliberCos Inc. (NASDAQ: CWD). Led by an experienced team of agile entrepreneurs and specialists, CHT offers a unique opportunity in an UPREIT transaction for hotel owners and managers to access scale on a tax-deferred basis. CHT is targeting middle-market full service, select service, extended stay, and lifestyle hotels in attractive geographic locations. CHT’s asset management technology enables management of mixed asset classes, top-tier brands, and third-party managers, who all interact via an integrated platform.

About L.T.D. Hospitality Group

Founded in 1983, L.T.D. Hospitality Group is headquartered in Virginia Beach, Va., and is comprised of several key lodging-sector business units, including Asset Management, Hotel Management, and Development. L.T.D. is recognized as a distinguished leader in the hospitality industry with a portfolio of premium-branded properties and fast casual eateries.

Forward Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” "will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-

looking statements are based on the Company’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate including, but not limited to, the closing of the transaction with L.T.D. Hospitality Group LLC. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in the final prospectus related to the Company’s public offering filed with the SEC and other reports filed with the SEC thereafter. Forward-looking statements contained in this announcement are made as of this date, and the Company undertakes no duty to update such information except as required under applicable law.

CONTACTS

Caliber:

Samantha Vrcic

+1 480-295-7600

Samantha.Vrcic@caliberco.com

Media Relations:

Kelly McAndrew

Financial Profiles

+1 203-613-1552

KMcAndrew@finprofiles.com

Investor Relations:

Julie Kegley

Financial Profiles

+1 310 622 8246

jkegley@finprofiles.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

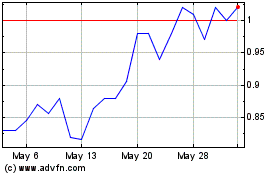

CaliberCos (NASDAQ:CWD)

Historical Stock Chart

From Jun 2024 to Jul 2024

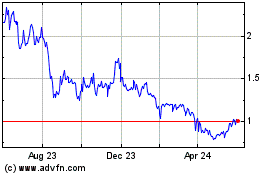

CaliberCos (NASDAQ:CWD)

Historical Stock Chart

From Jul 2023 to Jul 2024