BurgerFi International, Inc. (Nasdaq: BFI, BFIIW) (“BurgerFi” or

the “Company”), owner of one of the nation’s leading fast-casual

“better burger” dining concepts through the BurgerFi brand, and the

high-quality, casual dining pizza and wings concept under the name

Anthony’s Coal Fired Pizza & Wings (“Anthony’s”) brand, today

reported financial results for the third quarter ended October 2,

2023.

Highlights for the Third Quarter

2023

- Total revenue was $39.5 million in the

third quarter 2023 compared to $43.3 million in the prior period

- Consolidated systemwide sales decreased to $65.3 million

compared to $70.6 million in the prior period

- Same-store sales decreased 5% at

Anthony’s in the third quarter of 2023 compared to the prior

period

- Systemwide sales for BurgerFi

decreased 9% to $35.7 million in the third quarter compared to the

prior period

- Systemwide same-store sales decrease of 11% at BurgerFi in the

third quarter of 2023 compared to the prior period

- Opened five BurgerFi franchised

locations and acquired four from franchisees year to date, and

expects to open an additional nine BurgerFi locations, including

the first dual-brand franchise location and a flagship restaurant

in New York City with the unveiling of its Better Burger Lab

experience.

- Hourly turnover declined significantly

from the prior period at both brands, with Anthony’s performing

better than industry benchmarks, while BurgerFi made considerable

progress and is on track to achieve similar improvements.

Management turnover improved at BurgerFi, approaching industry

benchmarks.

- Consolidated food, beverage and paper

expense margin improved 220 basis points compared to the prior

period

- Consolidated restaurant-level

operating expenses increased 100 basis points compared to the prior

period

- Net loss increased to $5.0 million, or

$(0.19) per diluted share, in the third quarter 2023 compared to

net loss of $3.3 million or $(0.15) per diluted share in the prior

period

- Adjusted EBITDA1 of $0.8 million in

the third quarter 2023 compared to $1.6 million in the prior

period

Management Commentary

Carl Bachmann, Chief Executive Officer of

BurgerFi stated, “Our third quarter performance is not reflective

of what we believe these brands and the people at this organization

can and will accomplish. Having arrived here ten days into the

quarter, these results are in no way indicative of our work to date

or where we intend to take the business. Using my prior experience

at enhancing pizza and burger concepts, BurgerFi is now

implementing strategic priorities that should position the Company

for long term, profitable growth.”

Bachmann continued, “Many of the initial

initiatives we put in place are already taking hold, including the

expanded menus at BurgerFi and Anthony’s. Most recently, we

successfully executed the biggest enhancement of the BurgerFi menu

in company history, adding wings and salad bowls, and the response

has been resounding. At the end of the month, we will also launch

chicken sandwiches. At Anthony’s, we added a Chicken Alfredo and

Artichoke Pizza, and two pasta dishes -- Spaghetti and Meatballs

and Italian Fettuccine Alfredo. We have already decreased turnover

at both brands and significantly reduced training labor which has

resulted in higher consumer satisfaction scores as well as faster

throughput and ticket times. These are leading indicators that we

are on the right path towards higher sales and margins.”

Christopher Jones, Chief Financial Officer of

BurgerFi, added, “Looking forward, with the combination of new unit

growth and improving same store sales trends driven by our expanded

offering and overall more effective marketing messages, we

anticipate BurgerFi returning to positive comps in early 2024 and

positive EBITDA by the second half of 2024. Additionally, we are

equally confident in the return to positive comps and increased

EBITDA at Anthony’s, driven by similar initiatives, including menu

modification, an aggressive focus on food cost and the benefits

from an updated POS platform. Perhaps most importantly, we are also

setting the stage with the franchising of company-owned stores

starting as early as the first quarter of 2024.”

Third Quarter 2023 Key

Metrics1 Summary

| |

Consolidated |

|

| |

Quarter Ended |

|

Nine Months Ended |

|

| (in thousands, except

for percentage data) |

October 2, 2023 |

|

October 3, 2022 |

|

October 2, 2023 |

|

October 3, 2022 |

|

|

Systemwide Restaurant Sales |

$ |

65,278 |

|

|

$ |

70,627 |

|

|

$ |

209,406 |

|

|

$ |

218,014 |

|

|

| Systemwide Restaurant Sales

Growth |

|

(8 |

)% |

|

|

(2 |

)% |

|

|

(4 |

)% |

|

|

1 |

% |

|

| Systemwide Restaurant

Same-Store Sales Growth |

|

(8 |

)% |

|

|

(2 |

)% |

|

|

(4 |

)% |

|

|

— |

% |

|

| Corporate-Owned Restaurant

Sales |

$ |

37,324 |

|

|

$ |

40,284 |

|

|

$ |

121,442 |

|

|

$ |

124,319 |

|

|

| Corporate-Owned Restaurant

Sales Growth |

|

(7 |

)% |

|

|

4 |

% |

|

|

(2 |

)% |

|

|

7 |

% |

|

| Corporate-Owned Restaurant

Same-Store Sales Growth |

|

(7 |

)% |

|

|

1 |

% |

|

|

(3 |

)% |

|

|

3 |

% |

|

| Franchise Restaurant

Sales |

$ |

27,954 |

|

|

$ |

30,343 |

|

|

$ |

87,964 |

|

|

$ |

93,695 |

|

|

| Franchise Restaurant Sales

Growth |

|

(8 |

)% |

|

|

(8 |

)% |

|

|

(6 |

)% |

|

|

(6 |

)% |

|

| Franchise Restaurant

Same-Store Sales Growth |

|

(9 |

)% |

|

|

(5 |

)% |

|

|

(6 |

)% |

|

|

(4 |

)% |

|

| Digital Channel % of

Systemwide Sales |

|

32 |

% |

|

|

34 |

% |

|

|

32 |

% |

|

|

35 |

% |

|

| |

| |

Quarter Ended |

|

| |

October 2, 2023 |

|

October 3, 2022 |

|

|

(in thousands, except for percentage data) |

BurgerFi |

|

Anthony's |

|

BurgerFi |

|

Anthony's2 |

|

|

Systemwide Restaurant Sales |

$ |

35,738 |

|

|

$ |

29,540 |

|

|

$ |

39,147 |

|

|

$ |

31,480 |

|

|

|

Systemwide Restaurant Sales Growth |

|

(9 |

)% |

|

|

(6 |

)% |

|

|

(5 |

)% |

|

|

4 |

% |

|

|

Systemwide Restaurant Same-Store Sales Growth |

|

(11 |

)% |

|

|

(5 |

)% |

|

|

(6 |

)% |

|

|

4 |

% |

|

|

Corporate-Owned Restaurant Sales |

$ |

7,784 |

|

|

$ |

29,540 |

|

|

$ |

8,804 |

|

|

$ |

31,480 |

|

|

|

Corporate-Owned Restaurant Sales Growth |

|

(12 |

)% |

|

|

(6 |

)% |

|

|

4 |

% |

|

|

4 |

% |

|

|

Corporate-Owned Restaurant Same-Store Sales Growth |

|

(15 |

)% |

|

|

(5 |

)% |

|

|

(11 |

)% |

|

|

4 |

% |

|

|

Franchise Restaurant Sales |

$ |

27,954 |

|

|

|

N/ |

A |

|

$ |

30,343 |

|

|

|

N/ |

A |

|

|

Franchise Restaurant Sales Growth |

|

(8 |

)% |

|

|

N/ |

A |

|

|

(8 |

)% |

|

|

N/ |

A |

|

|

Franchise Restaurant Same-Store Sales Growth |

|

(9 |

)% |

|

|

N/ |

A |

|

|

(5 |

)% |

|

|

N/ |

A |

|

|

Digital Channel % of Systemwide Sales |

|

31 |

% |

|

|

33 |

% |

|

|

33 |

% |

|

|

36 |

% |

|

| |

| |

Nine Months Ended |

|

| |

October 2, 2023 |

|

October 3, 2022 |

|

|

(in thousands, except for percentage data) |

BurgerFi |

|

Anthony's |

|

BurgerFi |

|

Anthony's2 |

|

|

Systemwide Restaurant Sales |

$ |

114,861 |

|

|

$ |

94,545 |

|

|

$ |

122,159 |

|

|

$ |

95,855 |

|

|

|

Systemwide Restaurant Sales Growth |

|

(6 |

)% |

|

|

(1 |

)% |

|

|

(3 |

)% |

|

|

6 |

% |

|

|

Systemwide Restaurant Same-Store Sales Growth |

|

(8 |

)% |

|

|

— |

% |

|

|

(5 |

)% |

|

|

6 |

% |

|

|

Corporate-Owned Restaurant Sales |

$ |

26,897 |

|

|

$ |

94,545 |

|

|

$ |

28,464 |

|

|

$ |

95,855 |

|

|

|

Corporate-Owned Restaurant Sales Growth |

|

(6 |

)% |

|

|

(1 |

)% |

|

|

12 |

% |

|

|

6 |

% |

|

|

Corporate-Owned Restaurant Same-Store Sales Growth |

|

(12 |

)% |

|

|

— |

% |

|

|

(10 |

)% |

|

|

6 |

% |

|

|

Franchise Restaurant Sales |

$ |

87,964 |

|

|

|

N/ |

A |

|

$ |

93,695 |

|

|

|

N/ |

A |

|

|

Franchise Restaurant Sales Growth |

|

(6 |

)% |

|

|

N/ |

A |

|

|

(6 |

)% |

|

|

N/ |

A |

|

|

Franchise Restaurant Same-Store Sales Growth |

|

(6 |

)% |

|

|

N/ |

A |

|

|

(4 |

)% |

|

|

N/ |

A |

|

|

Digital Channel % of Systemwide Sales |

|

31 |

% |

|

|

33 |

% |

|

|

34 |

% |

|

|

37 |

% |

|

| |

| 1.

Refer to “Key Metrics Definitions” and “About Non-GAAP

Financial Measures” sections below. |

| 2.

Included within Systemwide Restaurant Sales Growth,

Systemwide Restaurant Same-Store Sales Growth, Corporate-Owned

Restaurant Sales Growth and

Corporate-Owned Restaurant Same-Store Sales Growth data presented

above is information for Anthony's for the

respective periods in 2021 which is presented only for

informational purposes as Anthony's was not under common ownership

until November 2021, the date of

acquisition. |

| |

Third Quarter 2023 Financial

Results

Total revenue in the third quarter of 2023

decreased 9% to $39.5 million compared to $43.3 million in the

year-ago quarter, primarily driven by a decrease in same-store

sales at BurgerFi and Anthony’s partially offset by the additional

revenue from new restaurants opened during the period. For the

BurgerFi brand, same-store sales decreased 15% and 9% in

corporate-owned and franchised locations, respectively. For the

Anthony’s brand, same-store sales for the third quarter decreased

5% over the prior year period.

Restaurant-level operating expenses for the

third quarter of 2023 were $32.9 million compared to $35.2 million

in the third quarter of 2022. For the Anthony's brand,

restaurant-level operating expenses, as a percentage of sales,

increased 20 basis points for the third quarter of 2023, compared

to the third quarter of 2022, due to lower leverage on sales

partially offset by lower food, beverage and paper costs. For the

BurgerFi brand, restaurant-level operating expenses, as a

percentage of sales, increased 440 basis points for the third

quarter of 2023, compared to the third quarter of 2022, primarily

due to lower leverage on sales.

Net loss in the third quarter was $5.0 million

compared to a net loss of $3.3 million in the year-ago quarter,

primarily due to decrease in same store sales and the absence of

gains on employee retention credits compared to the prior period,

partially offset by lower depreciation and amortization expenses,

lower share-based compensation expense and gain on change in value

of warrant liability.

Adjusted EBITDA in the third quarter of 2023

decreased $0.8 million to $0.8 million compared to $1.6 million in

the third quarter of 2022, driven by lost leverage on sales

partially offset by lower food costs. See the definition of

Adjusted EBITDA, a financial measure that is a non-generally

accepted accounting principle in the United States (“GAAP”), and

the reconciliation to the most comparable GAAP measure below.

Restaurant Development

As of October 2, 2023, the Company operated

and franchised 169 total restaurants of which 110 were BurgerFi (26

corporate-owned and 84 franchised) and 59 were corporate-owned

Anthony’s. During the third quarter 2023, there was one

corporate-owned Anthony’s and three franchise BurgerFi

closures.

Year to date, BurgerFi opened five franchised

locations. For the fourth quarter to date, the Company acquired two

locations from franchisees and expects to open an additional nine

BurgerFi locations, including the first dual-brand franchise

location and a flagship restaurant in New York City with the

unveiling of its Better Burger Lab experience.

2023 Outlook

Management is updating its outlook for the

fiscal year 2023:

- Annual revenues of $160 -170

million

- Consolidated low single-digit same-store sales decline for

corporate-owned locations

- 12-15 new franchised restaurants, including one new

Anthony's

- Adjusted EBITDA of $6 -8 million

- Capital expenditures of approximately $2 million

Conference Call

The Company will hold a conference call today, November 15,

2023, at 8:30 a.m. Eastern time to discuss its third quarter 2023

results.

Date: Wednesday, November 15, 2023Time: 8:30 a.m. Eastern

timeToll-free dial-in number: 1-833-816-1403International dial-in

number: (412) 317-0496Conference ID: 10182500

Please call the conference telephone number 5-10

minutes prior to the start time. An operator will register your

name and organization.

The conference call will be broadcast live and

available for two weeks for replay on the Company’s Investor

Relations website at ir.burgerfi.com.

Key Metrics Definitions

The following definitions apply to the terms listed below:

“Systemwide Restaurant Sales” is presented as

informational data in order to understand the aggregation of

franchised stores sales, ghost kitchen and corporate-owned store

sales performance. Systemwide Restaurant Sales growth refers to the

percentage change in sales at all franchised restaurants, ghost

kitchens and corporate-owned restaurants in one period from the

same period in the prior year. Systemwide Restaurant Same-Store

Sales growth refers to the percentage change in sales at all

franchised restaurants, ghost kitchens, and corporate-owned

restaurants after 14 months of operations. See definition below for

“Same-Store Sales”.

“Corporate-Owned Restaurant Sales” represent the

sales generated only by corporate-owned restaurants.

Corporate-Owned Restaurant Sales growth refers to the percentage

change in sales at all corporate-owned restaurants in one period

from the same period in the prior year. Corporate-Owned Restaurant

Same-Store Sales growth refers to the percentage change in sales at

all corporate-owned restaurants after 14 months of operations.

These measures highlight the performance of existing

corporate-owned restaurants.

“Franchise Restaurant Sales” represent the sales

generated only by franchisee-owned restaurants and are not recorded

as revenue, however, the royalties based on a percentage of these

franchise restaurant sales are recorded as revenue. Franchise

Restaurant Sales growth refers to the percentage change in sales at

all franchised restaurants in one period from the same period in

the prior year. Franchise Restaurant Same-Store Sales growth refers

to the percentage change in sales at all franchised restaurants

after 14 months of operations. These measures highlight the

performance of existing franchised restaurants.

“Same-Store Sales” is used to evaluate the

performance of our store base, which excludes the impact of new

stores and closed stores, in both periods under comparison. We

include a restaurant in the calculation of Same-Store Sales after

14 months of operations. A restaurant which is temporarily closed,

is included in the Same-Store Sales computation. A restaurant which

is closed permanently, such as upon termination of the lease, or

other permanent closure, is immediately removed from the Same-Store

Sales computation. Our calculation of Same-Store Sales may not be

comparable to others in the industry.

“Digital Channel” % of systemwide sales is used

to measure performance of our investments made in our digital

platform and partnerships with third party delivery partners. We

believe our digital platform capabilities are a vital element to

continuing to serve our customers and will continue to be a

differentiator for the Company as compared to some of our

competitors. Digital Channel as percentages of Systemwide

Restaurant Sales are indicative of the sales placed through our

digital platforms and the percentage of those digital sales when

compared to total sales at all our franchised and corporate-owned

restaurants.

“Adjusted EBITDA,” a non-GAAP measure, is

defined as net loss before goodwill impairment, lease termination

recovery, employee retention credits, share-based compensation

expense, depreciation and amortization expense, interest expense

(which includes accretion on the value of preferred stock and

interest accretion on the related party note), restructuring costs,

merger, acquisition and integration costs, legal settlements, net

of gains, store closure costs, loss (gain) on change in value of

warrant liability, pre-opening costs, (gain) loss on sale of assets

and income tax expense (benefit).

Unless otherwise stated, Systemwide Restaurant

Sales, Systemwide Sales growth, and Same-Store Sales are presented

on a systemwide basis, which means they include franchise

restaurants and company-owned restaurants. Franchise restaurant

sales represent sales at all franchise restaurants and are revenues

to our franchisees. We do not record franchise sales as revenues;

however, our royalty revenues and brand royalty revenues are

calculated based on a percentage of franchise sales.

About BurgerFi International (Nasdaq: BFI,

BFIIW)

BurgerFi International, Inc. is a leading

multi-brand restaurant company that develops, markets, and acquires

fast-casual and premium-casual dining restaurant concepts around

the world, including corporate-owned stores and franchises.

BurgerFi International is the owner and franchisor of the two

following brands with a combined 169 locations.

BurgerFi. BurgerFi is among the nation’s

fast-casual better burger concepts with 110 BurgerFi restaurants

(84 franchised and 26 corporate-owned) as of October 2, 2023.

BurgerFi is chef-founded and committed to serving fresh,

all-natural and quality food at all locations, online and via

first-party and third-party deliveries. BurgerFi uses 100% American

Angus Beef with no steroids, antibiotics, growth hormones,

chemicals or additives. BurgerFi's menu also includes high-quality

Wagyu Beef Blend Burgers, Antibiotic and Cage-Free Chicken

offerings, Hand-Cut Sides, and Frozen Custard Shakes. BurgerFi was

named "The Very Best Burger" at the 2023 edition of the nationally

acclaimed SOBE Wine and Food Festival and “Best Fast Food Burger”

in USA Today’s 10Best 2023 Readers’ Choice Awards for its BBQ Rodeo

Burger, "Best Fast Casual Restaurant" in USA Today's 10Best 2023

Readers' Choice Awards for the third consecutive year, QSR

Magazine's Breakout Brand of 2020 and Fast Casual's 2021 #1 Brand

of the Year. In 2021, Consumer Reports awarded BurgerFi an “A Grade

Angus Beef” rating for the third consecutive year. To learn more

about BurgerFi or to find a full list of locations, please visit

www.burgerfi.com. Download the BurgerFi App on iOS or Android

devices for rewards and 'Like' or follow @BurgerFi on Instagram,

Facebook and Twitter. BurgerFi® is a Registered Trademark of

BurgerFi IP, LLC, a wholly-owned subsidiary of BurgerFi.

Anthony’s. Anthony’s was acquired by BurgerFi on

November 3, 2021 and is a premium pizza and wing brand that

operates 59 corporate-owned casual restaurant locations, as of

October 2, 2023. Known for serving fresh, never frozen and

quality ingredients, Anthony’s is centered around a 900-degree

coal-fired oven with menu offerings including “well-done” pizza,

coal-fired chicken wings, homemade meatballs, and a variety of

handcrafted sandwiches and salads. Anthony’s was named “The Best

Pizza Chain in America” by USA Today's Great American Bites and

“Top 3 Best Major Pizza Chain” by Mashed in 2021. To learn more

about Anthony’s, please visit www.acfp.com.

About Non-GAAP Projected Financial Measures

To supplement our consolidated financial

statements, which are prepared and presented in accordance with

GAAP, we use the measure Adjusted EBITDA. The presentation of this

financial information is not intended to be considered in isolation

or as a substitute for, or superior to, the financial information

prepared and presented in accordance with GAAP.

We use this non-GAAP financial measure for

financial and operational decision-making and as a means to

evaluate period-to-period comparisons. We believe that this

non-GAAP financial measure provides meaningful supplemental

information regarding our performance and liquidity by excluding

certain items that may not be indicative of our recurring core

business operating results. We believe that both management and

investors benefit from referring to this non-GAAP financial measure

in assessing our performance and when planning, forecasting, and

analyzing future periods. This non-GAAP financial measure also

facilitates management’s internal comparisons to our historical

performance and liquidity as well as comparisons to our

competitors’ operating results. We believe this non-GAAP financial

measure is useful to investors both because (1) it allows for

greater transparency with respect to key metrics used by management

in its financial and operational decision-making and (2) it is used

by our institutional investors and the analyst community to help

them analyze the health of our business.

There are a number of limitations related to the

use of this non-GAAP financial measure. We compensate for these

limitations by providing specific information regarding the GAAP

amounts excluded from this non-GAAP financial measure and

evaluating this non-GAAP financial measure together with its

relevant financial measures in accordance with GAAP.

A reconciliation of Adjusted EBITDA guidance is

not being provided due to the nature of this forward-looking

non-GAAP measure containing certain elements that are impractical

to predict given their market-based nature, such as share-based

compensation expense and gain and losses on change in value of

warrant liabilities, without unreasonable efforts. For the same

reasons, we are unable to address the probable significance of the

unavailable information, nor can we accurately predict all of the

components of the applicable non-GAAP financial measure and

reconciling adjustments thereto; accordingly, guidance for the

corresponding GAAP measure may be materially different than

guidance for the non-GAAP measure. Such forward looking information

is also subject to uncertainty and various risks, and there can be

no assurance that any forecasted results or conditions will

actually be achieved.

Forward-Looking Statements

This press release may contain “forward-looking

statements” as defined in the Private Securities Litigation Reform

Act of 1995, including statements relating to BurgerFi's estimates

of its future business outlook, liquidity, prospects or financial

results, long-term opportunities, executing on growth and

improvement strategies, new franchise opportunities, increased

revenue, liquidity, improved operating margins in both brands,

improved labor trends, seasonality trends, product improvements,

including new products and services, expected customer acceptance,

improved operating efficiencies, store opening plans, and

expectations regarding adjusted EBITDA in 2023 and EBITDA in 2024,

as well as statements set forth under the section titled “2023

Outlook” above. Forward-looking statements generally can be

identified by words such as “anticipates,” “believes,” “estimates,”

“expects,” “intends,” “plans,” “predicts,” “projects,” “will be,”

“will continue,” “will likely result,” and similar expressions.

These forward-looking statements are based on current expectations

and assumptions that are subject to risks and uncertainties, which

could cause our actual results to differ materially from those

reflected in the forward-looking statements. Factors that could

cause or contribute to such differences include, but are not

limited to, those discussed in our Annual Report on Form 10-K for

the year ended January 2, 2023, and those discussed in other

documents we file with the Securities and Exchange Commission,

including our ability to continue to access liquidity from our

credit agreement and remain compliant with financial covenants

therein, as well as to successfully realize the expected benefits

of the acquisition of Anthony’s or any other factors. All

subsequent written and oral forward-looking statements attributable

to BurgerFi or persons acting on BurgerFi’s behalf are expressly

qualified in their entirety by the cautionary statements included

in this press release. We undertake no obligation to revise or

publicly release the results of any revision to these

forward-looking statements, except as required by law. Given these

risks and uncertainties, readers are cautioned not to place undue

reliance on such forward-looking statements.

Investor Relations:ICRMichelle

Michalski IR-BFI@icrinc.com646-277-1224

Company Contact:BurgerFi International

Inc.IR@burgerfi.com

Media Relations Contact:Ink Link MarketingKim

Miller Kmiller@inklinkmarketing.com

|

BurgerFi International Inc., and Subsidiaries |

|

Consolidated Balance Sheets |

| |

| |

Unaudited |

|

|

|

|

(in thousands, except for per share data) |

October 2, 2023 |

|

January 2, 2023 |

|

|

Assets |

|

|

|

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

|

|

|

Cash |

$ |

9,746 |

|

|

$ |

11,917 |

|

|

|

Accounts receivable, net |

|

1,229 |

|

|

|

1,926 |

|

|

|

Inventory |

|

1,376 |

|

|

|

1,320 |

|

|

|

Assets held for sale |

|

732 |

|

|

|

732 |

|

|

|

Prepaid expenses and other current assets |

|

972 |

|

|

|

2,564 |

|

|

|

Total Current Assets |

$ |

14,055 |

|

|

$ |

18,459 |

|

|

|

Property & equipment, net |

|

17,987 |

|

|

|

19,371 |

|

|

|

Operating right-of-use assets, net |

|

46,070 |

|

|

|

45,741 |

|

|

|

Goodwill |

|

31,621 |

|

|

|

31,621 |

|

|

|

Intangible assets, net |

|

153,091 |

|

|

|

160,208 |

|

|

|

Other assets |

|

1,114 |

|

|

|

1,380 |

|

|

|

Total Assets |

$ |

263,938 |

|

|

$ |

276,780 |

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

Current Liabilities |

|

|

|

|

Accounts payable - trade and other |

$ |

8,216 |

|

|

$ |

8,464 |

|

|

|

Accrued expenses |

|

8,179 |

|

|

|

10,589 |

|

|

|

Short-term operating lease liability |

|

12,252 |

|

|

|

9,924 |

|

|

|

Short-term borrowings, including finance leases |

|

3,539 |

|

|

|

4,985 |

|

|

|

Other current liabilities |

|

2,700 |

|

|

|

6,241 |

|

|

|

Total Current Liabilities |

$ |

34,886 |

|

|

$ |

40,203 |

|

|

| Non-Current

Liabilities |

|

|

|

|

|

|

|

|

|

Long-term borrowings, including finance leases |

|

49,396 |

|

|

|

53,794 |

|

|

|

Redeemable preferred stock, $0.0001 par value, 10,000,000 shares

authorized, 2,120,000 shares issued and outstanding as of

October 2, 2023 and January 2, 2023, $53 million principal

redemption value, respectively |

|

54,545 |

|

|

|

51,418 |

|

|

|

Long-term operating lease liability |

|

40,672 |

|

|

|

40,748 |

|

|

|

Related party note payable |

|

14,450 |

|

|

|

9,235 |

|

|

|

Deferred income taxes |

|

1,223 |

|

|

|

1,223 |

|

|

|

Other non-current liabilities |

|

1,120 |

|

|

|

1,212 |

|

|

|

Total Liabilities |

$ |

196,292 |

|

|

$ |

197,833 |

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

|

|

|

Common stock, $0.0001 par value, 100,000,000 shares

authorized,26,805,474, and 22,257,772 shares issued and outstanding

as of October 2, 2023 and January 2, 2023, respectively |

|

2 |

|

|

|

2 |

|

|

|

Additional paid-in capital |

|

314,905 |

|

|

|

306,096 |

|

|

|

Accumulated deficit |

|

(247,261 |

) |

|

|

(227,151 |

) |

|

|

Total Stockholders' Equity |

$ |

67,646 |

|

|

$ |

78,947 |

|

|

|

Total Liabilities and

Stockholders Equity |

$ |

263,938 |

|

|

$ |

276,780 |

|

|

| |

|

BurgerFi International Inc., and Subsidiaries |

|

Consolidated Statements of Operations |

|

(Unaudited) |

|

|

| |

Quarter Ended |

|

Nine Months Ended |

|

|

(in thousands, except for per share data) |

October 2, 2023 |

|

October 3, 2022 |

|

October 2, 2023 |

|

October 3, 2022 |

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restaurant sales |

$ |

37,324 |

|

|

$ |

40,361 |

|

|

$ |

121,448 |

|

|

$ |

124,954 |

|

|

|

Royalty and other fees |

|

1,698 |

|

|

|

2,465 |

|

|

|

5,858 |

|

|

|

7,179 |

|

|

|

Royalty - brand development and co-op |

|

458 |

|

|

|

429 |

|

|

|

1,328 |

|

|

|

1,351 |

|

|

|

Total Revenue |

$ |

39,480 |

|

|

$ |

43,255 |

|

|

$ |

128,634 |

|

|

$ |

133,484 |

|

|

|

Restaurant level operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food, beverage and paper costs |

|

9,947 |

|

|

|

11,665 |

|

|

|

32,329 |

|

|

|

37,017 |

|

|

|

Labor and related expenses |

|

11,853 |

|

|

|

12,217 |

|

|

|

37,769 |

|

|

|

37,126 |

|

|

|

Other operating expenses |

|

7,199 |

|

|

|

7,464 |

|

|

|

22,415 |

|

|

|

22,077 |

|

|

|

Occupancy and related expenses |

|

3,933 |

|

|

|

3,848 |

|

|

|

11,697 |

|

|

|

11,575 |

|

|

|

General and administrative expenses |

|

4,638 |

|

|

|

5,511 |

|

|

|

17,027 |

|

|

|

18,943 |

|

|

|

Depreciation and amortization expense |

|

3,272 |

|

|

|

4,253 |

|

|

|

9,794 |

|

|

|

13,427 |

|

|

|

Share-based compensation expense |

|

172 |

|

|

|

1,010 |

|

|

|

5,401 |

|

|

|

9,295 |

|

|

|

Brand development, co-op and advertising expenses |

|

999 |

|

|

|

1,159 |

|

|

|

3,028 |

|

|

|

2,998 |

|

|

|

Goodwill and intangible asset impairment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

55,168 |

|

|

|

Restructuring costs and other charges, net |

|

515 |

|

|

|

568 |

|

|

|

2,688 |

|

|

|

1,608 |

|

|

|

Total Operating

Expenses |

$ |

42,528 |

|

|

$ |

47,695 |

|

|

$ |

142,148 |

|

|

$ |

209,234 |

|

|

|

Operating Loss |

|

(3,048 |

) |

|

|

(4,440 |

) |

|

|

(13,514 |

) |

|

|

(75,750 |

) |

|

|

Interest expense, net |

|

(2,219 |

) |

|

|

(2,245 |

) |

|

|

(6,508 |

) |

|

|

(6,562 |

) |

|

|

Gain (Loss) on change in value of warrant liability |

|

224 |

|

|

|

726 |

|

|

|

(167 |

) |

|

|

2,050 |

|

|

|

Other income, net |

|

85 |

|

|

|

2,627 |

|

|

|

81 |

|

|

|

2,546 |

|

|

|

Loss before income taxes |

$ |

(4,958 |

) |

|

$ |

(3,332 |

) |

|

$ |

(20,108 |

) |

|

$ |

(77,716 |

) |

|

|

Income tax (expense) benefit |

|

— |

|

|

|

— |

|

|

|

(2 |

) |

|

|

447 |

|

|

|

Net loss |

$ |

(4,958 |

) |

|

$ |

(3,332 |

) |

|

$ |

(20,110 |

) |

|

$ |

(77,269 |

) |

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

26,793,358 |

|

|

|

22,253,232 |

|

|

|

25,078,410 |

|

|

|

22,146,258 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

$ |

(0.19 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.80 |

) |

|

$ |

(3.49 |

) |

|

| |

|

BurgerFi International Inc., and Subsidiaries |

|

Consolidated Reconciliation of Net Loss to Adjusted

EBITDA |

|

(Non-GAAP) (Unaudited) |

|

|

| |

Quarter Ended |

|

| |

Consolidated |

BurgerFi |

|

Anthony's |

|

|

(in thousands) |

October 2, 2023 |

|

October 3, 2022 |

|

October 2, 2023 |

|

October 3, 2022 |

|

October 2, 2023 |

|

October 3, 2022 |

|

|

Revenue by Segment |

$ |

39,480 |

|

|

$ |

43,255 |

|

|

$ |

9,940 |

|

|

$ |

11,775 |

|

|

$ |

29,540 |

|

|

$ |

31,480 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA Reconciliation by Segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(4,958 |

) |

|

$ |

(3,332 |

) |

|

$ |

(4,167 |

) |

|

$ |

(1,752 |

) |

|

$ |

(791 |

) |

|

$ |

(1,580 |

) |

|

|

Employee retention credits |

|

— |

|

|

|

(2,626 |

) |

|

|

— |

|

|

|

(2,626 |

) |

|

|

— |

|

|

|

— |

|

|

|

Share-based compensation expense |

|

172 |

|

|

|

1,010 |

|

|

|

177 |

|

|

|

1,010 |

|

|

|

(5 |

) |

|

|

— |

|

|

|

Depreciation and amortization expense |

|

3,272 |

|

|

|

4,253 |

|

|

|

2,123 |

|

|

|

2,212 |

|

|

|

1,149 |

|

|

|

2,041 |

|

|

|

Interest expense |

|

2,219 |

|

|

|

2,245 |

|

|

|

1,033 |

|

|

|

1,003 |

|

|

|

1,186 |

|

|

|

1,242 |

|

|

|

Restructuring costs |

|

353 |

|

|

|

— |

|

|

|

311 |

|

|

|

— |

|

|

|

42 |

|

|

|

— |

|

|

|

Merger, acquisition and integration costs |

|

96 |

|

|

|

168 |

|

|

|

62 |

|

|

|

168 |

|

|

|

34 |

|

|

|

— |

|

|

|

Legal settlements, net of gains |

|

(193 |

) |

|

|

81 |

|

|

|

(289 |

) |

|

|

81 |

|

|

|

96 |

|

|

|

— |

|

|

|

Store closure costs |

|

162 |

|

|

|

568 |

|

|

|

64 |

|

|

|

548 |

|

|

|

98 |

|

|

|

20 |

|

|

|

Gain on change in value of warrant liability |

|

(224 |

) |

|

|

(726 |

) |

|

|

(224 |

) |

|

|

(726 |

) |

|

|

— |

|

|

|

— |

|

|

|

(Gain) loss on sale of assets |

|

(85 |

) |

|

|

1 |

|

|

|

7 |

|

|

|

(5 |

) |

|

|

(92 |

) |

|

|

6 |

|

|

|

Adjusted EBITDA |

$ |

814 |

|

|

$ |

1,642 |

|

|

$ |

(903 |

) |

|

$ |

(87 |

) |

|

$ |

1,717 |

|

|

$ |

1,729 |

|

|

|

|

| |

|

BurgerFi International Inc., and Subsidiaries |

|

Consolidated Reconciliation of Net Loss to Adjusted

EBITDA |

|

(Non-GAAP) (Unaudited) |

|

|

| |

Nine Months Ended |

|

| |

Consolidated |

BurgerFi |

|

Anthony's |

|

|

(in thousands) |

October 2, 2023 |

|

October 3, 2022 |

|

October 2, 2023 |

|

October 3, 2022 |

|

October 2, 2023 |

|

October 3, 2022 |

|

|

Revenue by Segment |

$ |

128,634 |

|

|

$ |

133,484 |

|

|

$ |

34,089 |

|

|

$ |

37,628 |

|

|

|

94,545 |

|

|

$ |

95,856 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA Reconciliation by Segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(20,110 |

) |

|

$ |

(77,269 |

) |

|

$ |

(18,924 |

) |

|

$ |

(36,439 |

) |

|

$ |

(1,186 |

) |

|

$ |

(40,830 |

) |

|

|

Goodwill impairment |

|

— |

|

|

|

55,168 |

|

|

|

— |

|

|

|

17,505 |

|

|

|

— |

|

|

|

37,663 |

|

|

|

Lease termination recovery |

|

(42 |

) |

|

|

— |

|

|

|

(42 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

Employee retention credits |

|

— |

|

|

|

(2,626 |

) |

|

|

— |

|

|

|

(2,626 |

) |

|

|

— |

|

|

|

— |

|

|

|

Share-based compensation expense |

|

5,401 |

|

|

|

9,295 |

|

|

|

5,380 |

|

|

|

9,295 |

|

|

|

21 |

|

|

|

— |

|

|

|

Depreciation and amortization expense |

|

9,794 |

|

|

|

13,427 |

|

|

|

6,360 |

|

|

|

7,335 |

|

|

|

3,434 |

|

|

|

6,092 |

|

|

|

Interest expense |

|

6,508 |

|

|

|

6,562 |

|

|

|

2,955 |

|

|

|

2,960 |

|

|

|

3,553 |

|

|

|

3,602 |

|

|

|

Restructuring costs |

|

2,397 |

|

|

|

— |

|

|

|

1,389 |

|

|

|

— |

|

|

|

1,008 |

|

|

|

— |

|

|

|

Merger, acquisition and integration costs |

|

723 |

|

|

|

2,472 |

|

|

|

624 |

|

|

|

2,359 |

|

|

|

99 |

|

|

|

113 |

|

|

|

Legal settlements, net of gains |

|

317 |

|

|

|

393 |

|

|

|

218 |

|

|

|

393 |

|

|

|

99 |

|

|

|

— |

|

|

|

Store closure costs |

|

333 |

|

|

|

1,134 |

|

|

|

138 |

|

|

|

1,134 |

|

|

|

195 |

|

|

|

— |

|

|

|

Loss (gain) on change in value of warrant liability |

|

167 |

|

|

|

(2,050 |

) |

|

|

167 |

|

|

|

(2,050 |

) |

|

|

— |

|

|

|

— |

|

|

|

Pre-opening costs |

|

— |

|

|

|

474 |

|

|

|

— |

|

|

|

474 |

|

|

|

— |

|

|

|

— |

|

|

|

(Gain) loss on sale of assets |

|

(96 |

) |

|

|

1 |

|

|

|

1 |

|

|

|

(5 |

) |

|

|

(97 |

) |

|

|

6 |

|

|

|

Income tax expense (benefit) |

|

2 |

|

|

|

(447 |

) |

|

|

— |

|

|

|

(451 |

) |

|

|

2 |

|

|

|

4 |

|

|

|

Adjusted EBITDA |

$ |

5,394 |

|

|

$ |

6,534 |

|

|

$ |

(1,734 |

) |

|

$ |

(116 |

) |

|

$ |

7,128 |

|

|

$ |

6,650 |

|

|

| |

|

BurgerFi International Inc., and Subsidiaries |

|

Consolidated Restaurant Level Operating

Expenses |

|

(Unaudited) |

|

|

| |

Quarter Ended |

|

Nine Months Ended |

|

| |

October 2, 2023 |

|

October 3, 2022 |

|

October 2, 2023 |

|

October 3, 2022 |

|

|

(in thousands) |

In dollars |

|

% of restaurant sales |

|

In dollars |

|

% of restaurant sales |

|

In dollars |

|

% of restaurant sales |

|

In dollars |

|

% of restaurant sales |

|

|

Restaurant Sales |

$ |

37,324 |

|

|

|

100.0 |

% |

|

$ |

40,361 |

|

|

|

100.0 |

% |

|

$ |

121,448 |

|

|

|

100.0 |

% |

|

$ |

124,954 |

|

|

|

100.0 |

% |

|

|

Restaurant level operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food, beverage and paper costs |

|

9,947 |

|

|

|

26.7 |

% |

|

|

11,665 |

|

|

|

28.9 |

% |

|

|

32,329 |

|

|

|

26.6 |

% |

|

|

37,017 |

|

|

|

29.6 |

% |

|

|

Labor and related expenses |

|

11,853 |

|

|

|

31.8 |

% |

|

|

12,217 |

|

|

|

30.3 |

% |

|

|

37,769 |

|

|

|

31.1 |

% |

|

|

37,126 |

|

|

|

29.7 |

% |

|

|

Other operating expenses |

|

7,199 |

|

|

|

19.3 |

% |

|

|

7,464 |

|

|

|

18.5 |

% |

|

|

22,415 |

|

|

|

18.5 |

% |

|

|

22,077 |

|

|

|

17.7 |

% |

|

|

Occupancy and related expenses |

|

3,933 |

|

|

|

10.5 |

% |

|

|

3,848 |

|

|

|

9.5 |

% |

|

|

11,697 |

|

|

|

9.6 |

% |

|

|

11,575 |

|

|

|

9.3 |

% |

|

|

Total |

$ |

32,932 |

|

|

|

88.2 |

% |

|

$ |

35,194 |

|

|

|

87.2 |

% |

|

$ |

104,210 |

|

|

|

85.8 |

% |

|

$ |

107,795 |

|

|

|

86.3 |

% |

|

|

|

|

Anthony’s Brand Only |

|

Restaurant Level Operating Expenses |

|

(Unaudited) |

|

|

| |

Quarter Ended |

|

Nine Months Ended |

|

| |

October 2, 2023 |

|

October 3, 2022 |

|

October 2, 2023 |

|

October 3, 2022 |

|

|

(in thousands) |

In dollars |

|

% of restaurant sales |

|

In dollars |

|

% of restaurant sales |

|

In dollars |

|

% of restaurant sales |

|

In dollars |

|

% of restaurant sales |

|

|

Restaurant Sales |

$ |

29,540 |

|

|

|

100.0 |

% |

|

$ |

31,480 |

|

|

|

100.0 |

% |

|

$ |

94,545 |

|

|

|

100.0 |

% |

|

$ |

95,856 |

|

|

|

100.0 |

% |

|

|

Restaurant level operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food, beverage and paper costs |

|

7,633 |

|

|

|

25.8 |

% |

|

|

8,927 |

|

|

|

28.4 |

% |

|

|

24,371 |

|

|

|

25.8 |

% |

|

|

27,837 |

|

|

|

29.0 |

% |

|

|

Labor and related expenses |

|

9,295 |

|

|

|

31.5 |

% |

|

|

9,551 |

|

|

|

30.3 |

% |

|

|

29,384 |

|

|

|

31.1 |

% |

|

|

28,809 |

|

|

|

30.1 |

% |

|

|

Other operating expenses |

|

5,374 |

|

|

|

18.2 |

% |

|

|

5,482 |

|

|

|

17.4 |

% |

|

|

16,501 |

|

|

|

17.5 |

% |

|

|

16,044 |

|

|

|

16.7 |

% |

|

|

Occupancy and related expenses |

|

3,021 |

|

|

|

10.2 |

% |

|

|

2,942 |

|

|

|

9.3 |

% |

|

|

8,978 |

|

|

|

9.5 |

% |

|

|

8,803 |

|

|

|

9.2 |

% |

|

|

Total |

$ |

25,323 |

|

|

|

85.7 |

% |

|

$ |

26,902 |

|

|

|

85.5 |

% |

|

$ |

79,234 |

|

|

|

83.8 |

% |

|

$ |

81,493 |

|

|

|

85.0 |

% |

|

| |

|

BurgerFi Brand Only |

|

Restaurant Level Operating Expenses |

|

(Unaudited) |

| |

| |

Quarter Ended |

|

Nine Months Ended |

|

| |

October 2, 2023 |

|

October 3, 2022 |

|

October 2, 2023 |

|

October 3, 2022 |

|

|

(in thousands) |

In dollars |

|

% of restaurant sales |

|

In dollars |

|

% of restaurant sales |

|

In dollars |

|

% of restaurant sales |

|

In dollars |

|

% of restaurant sales |

|

|

Restaurant Sales |

$ |

7,784 |

|

|

|

100.0 |

% |

|

$ |

8,881 |

|

|

|

100.0 |

% |

|

$ |

26,903 |

|

|

|

100.0 |

% |

|

$ |

29,098 |

|

|

|

100.0 |

% |

|

|

Restaurant level operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food, beverage and paper costs |

|

2,314 |

|

|

|

29.7 |

% |

|

|

2,738 |

|

|

|

30.8 |

% |

|

|

7,958 |

|

|

|

29.6 |

% |

|

|

9,180 |

|

|

|

31.5 |

% |

|

|

Labor and related expenses |

|

2,558 |

|

|

|

32.9 |

% |

|

|

2,666 |

|

|

|

30.0 |

% |

|

|

8,385 |

|

|

|

31.2 |

% |

|

|

8,317 |

|

|

|

28.6 |

% |

|

|

Other operating expenses |

|

1,825 |

|

|

|

23.4 |

% |

|

|

1,982 |

|

|

|

22.3 |

% |

|

|

5,914 |

|

|

|

22.0 |

% |

|

|

6,033 |

|

|

|

20.7 |

% |

|

|

Occupancy and related expenses |

|

912 |

|

|

|

11.7 |

% |

|

|

906 |

|

|

|

10.2 |

% |

|

|

2,719 |

|

|

|

10.1 |

% |

|

|

2,772 |

|

|

|

9.5 |

% |

|

|

Total |

$ |

7,609 |

|

|

|

97.8 |

% |

|

$ |

8,292 |

|

|

|

93.4 |

% |

|

$ |

24,976 |

|

|

|

92.8 |

% |

|

$ |

26,302 |

|

|

|

90.4 |

% |

|

|

|

|

BurgerFi International Inc., and Subsidiaries |

|

Segment Unit Counts |

|

|

| |

Quarter EndedOctober 2, 2023 |

|

Nine Months EndedOctober 2, 2023 |

|

|

|

Corporate-owned |

|

Franchised |

|

Total |

|

Corporate-owned |

|

Franchised |

|

Total |

|

|

Total BurgerFi and Anthony's brands |

85 |

|

84 |

|

169 |

|

85 |

|

84 |

|

169 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BurgerFi stores, beginning of the period |

27 |

|

87 |

|

114 |

|

25 |

|

89 |

|

114 |

|

|

BurgerFi stores opened |

— |

|

— |

|

— |

|

— |

|

5 |

|

5 |

|

|

BurgerFi stores acquired / (transferred) |

— |

|

— |

|

— |

|

2 |

|

(2) |

|

— |

|

|

BurgerFi stores closed |

(1) |

|

(3) |

|

(4) |

|

(1) |

|

(8) |

|

(9) |

|

|

BurgerFi total stores, end of the period |

26 |

|

84 |

|

110 |

|

26 |

|

84 |

|

110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anthony's stores, beginning of period |

60 |

|

— |

|

60 |

|

60 |

|

— |

|

60 |

|

|

Anthony's stores closed |

(1) |

|

— |

|

(1) |

|

(1) |

|

— |

|

(1) |

|

|

Anthony's total stores, end of the period |

59 |

|

— |

|

59 |

|

59 |

|

— |

|

59 |

|

| |

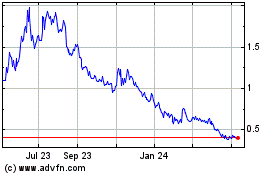

BurgerFi (NASDAQ:BFI)

Historical Stock Chart

From Dec 2024 to Jan 2025

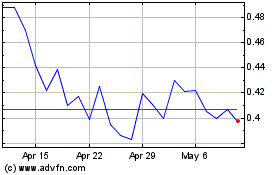

BurgerFi (NASDAQ:BFI)

Historical Stock Chart

From Jan 2024 to Jan 2025