Current Report Filing (8-k)

June 02 2023 - 4:18PM

Edgar (US Regulatory)

false 0001723580 0001723580 2023-06-01 2023-06-01 0001723580 bfi:CommonStockParValue0.0001PerShare2Member 2023-06-01 2023-06-01 0001723580 bfi:RedeemableWarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOf11.50PerShare1Member 2023-06-01 2023-06-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 1, 2023

BurgerFi International, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| 001-38417 |

|

Delaware |

|

82-2418815 |

| (Commission File Number) |

|

(State or Other Jurisdiction of Incorporation) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 200 West Cypress Creek Rd., Suite 220 Fort Lauderdale, FL |

|

33309 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(954) 618-2000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, If Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.0001 per share |

|

BFI |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share |

|

BFIIW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On June 1, 2023, BurgerFi International, Inc. (the “Company”) entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) directly with CG2 Capital LLC (the “Investor”), a Georgia limited liability company, who agreed to purchase 2,868,853 shares of common stock, par value $0.0001 per share, of the Company (the “Shares”), at a price of $1.22 per share, in a registered direct offering. The Shares were offered pursuant to an effective shelf registration statement on Form S-3, as amended (Registration No. 333-268585), and a related prospectus supplement and accompanying base prospectus filed with the Securities and Exchange Commission. On June 1, 2023, the Company closed the transactions contemplated by the Stock Purchase Agreement. The Company received gross proceeds of $3,500,000 before deducting estimated offering expenses. The Company plans to use the net proceeds from the offering for general corporate purposes.

The Stock Purchase Agreement provides that the Investor shall not transfer any shares of Company common stock beneficially owned or owned of record by the Investor pursuant to a registration statement filed in accordance with the Stock Purchase Agreement or in any other manner until the date that is twelve (12) months from the closing of the Investor’s acquisition of Company common stock pursuant to the Stock Purchase Agreement, subject to all requirements under the Securities Act of 1933, as amended, and the rules and regulations thereunder.

The Stock Purchase Agreement also provides that, subject to certain limitations, for so long as the Investor holds 10% or more of the Company’s issued and outstanding common stock, the Company is obligated to use commercially reasonable efforts to cause the Company’s Chairman of the Board to invite one non-voting observer designated by the Investor to the meetings of the Company’s Board of Directors.

The Stock Purchase Agreement also contains customary representations, warranties and covenants.

The foregoing does not purport to be a complete statement of the terms and conditions of the Stock Purchase Agreement and is qualified in its entirety by reference to the full text of the Stock Purchase Agreement, which will be included as an exhibit to the Company’s next Quarterly Report on Form 10-Q.

A copy of the legal opinion of the Company’s counsel, regarding the validity of the Shares offered and sold pursuant to the Stock Purchase Agreement and prospectus supplement, is filed herewith as Exhibit 5.1 and is incorporated by reference herein.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: June 2, 2023

|

|

|

| BURGERFI INTERNATIONAL, INC. |

|

|

| By: |

|

/s/ Stefan K. Schnopp |

|

|

Stefan K. Schnopp, Chief Legal Officer & Corporate Secretary |

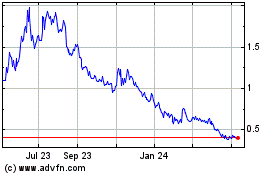

BurgerFi (NASDAQ:BFI)

Historical Stock Chart

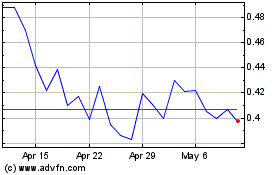

From Jan 2025 to Feb 2025

BurgerFi (NASDAQ:BFI)

Historical Stock Chart

From Feb 2024 to Feb 2025