As filed with the Securities and Exchange Commission on January 3, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Bridgeline Digital, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

52-2263942

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

100 Sylvan Road, Suite G700

Woburn, MA 01801

(Address of principal executive offices)

Bridgeline Digital, Inc. 2016 Stock Incentive Plan, as Amended

(Full title of the plan)

Thomas R. Windhausen

Chief Financial Officer

100 Sylvan Road, Suite G700

Woburn, MA 01801

(781) 376-5555

(Name, address, and telephone number of agent for service)

Copies to:

Irvin Brum, Esq.

Dominick Ragno, Esq.

Ruskin Moscou Faltischek, P.C.

1425 RXR Plaza, East Tower, 15th Floor

Uniondale, New York 11556

(516) 663-6600

(516) 663-6643 (facsimile)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

Smaller reporting company ☒

|

| |

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

Bridgeline Digital, Inc. (the “Company”) has prepared this Registration Statement in accordance with the requirements of Form S-8 under the Securities Act of 1933, as amended (the “Securities Act”), to register an additional 750,000 shares of the Company’s common stock, par value $0.001 per share (“Common Stock”), issuable pursuant to the Company’s 2016 Stock Incentive Plan, as amended (the “Plan”), of which 650,000 shares underlying stock options have been granted to certain officers, directors, and employees of the Company. The Plan provides for the grant of incentive stock options, non-qualified stock options, shares of our Common Stock, restricted shares of Common Stock, restricted stock units, stock appreciation rights, dividend equivalent rights and other stock-based awards (collectively, “Awards”). Awards may be granted to the Company’s officers, directors, employees and outside consultants and advisors who are eligible to receive Awards under the Plan. The Company previously registered shares available for issuance under the Plan on: (i) a registration statement on Form S-8 filed with the Securities and Exchange Commission (“Commission”) on August 17, 2016 (Registration No. 333-213185) (the “2016 Registration Statement”), (ii) a registration statement on Form S-8 filed with the Commission on November 19, 2019 (Registration No. 333-234771) (the “2019 Registration Statement”), and (iii) a registration statement on Form S-8 filed with the Commission on May 13, 2022 (Registration No. 333-264937) (the “2022 Registration Statement” and together with the 2019 Registration Statement, and 2016 Registration Statement, collectively, the “Prior Registration Statements”).

Pursuant to General Instruction E to Form S-8, the contents of the Prior Registration Statements are hereby incorporated by reference except to the extent supplemented, amended or superseded by the information set forth herein. Only those items of Form S-8 containing new information not contained in the Prior Registration Statements are presented herein.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

|

Item 3.

|

Incorporation of Documents By Reference

|

The following documents previously filed with the Commission by Bridgeline Digital, Inc. (“we,” “us,” “our”, “Company”, “Registrant”, or “Bridgeline”) are hereby incorporated by reference in this Registration Statement:

| |

(a)

|

The Company’s Annual Report on Form 10-K for the year ended September 30, 2023, filed with the Commission on December 27, 2023; and

|

| |

(b)

|

The description of the Company’s Common Stock contained in its Registration Statement on Form 8-A, filed with the Commission on June 28, 2007 (which incorporates such description of the Common Stock from the Company’s Registration Statement on Form SB-2, originally filed with the Commission on December 13, 2006 and as subsequently amended, which description is also hereby incorporated by reference), including any amendment or report filed for the purpose of updating such description.

|

All documents filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act on or subsequent to the effective date hereof and prior to the filing of a post-effective amendment hereto that indicates that all securities offered hereby have been sold or that deregisters all such securities then remaining unsold, shall be deemed to be incorporated herein by reference and to be a part hereof from the date of filing of such documents; provided, however, that documents or information deemed to have been furnished and not filed in accordance with the rules of the Commission shall not be incorporated by reference into this Registration Statement. Any statement contained herein or in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed to constitute a part of this Registration Statement, except as so modified or superseded.

|

4.1

|

Amended and Restated Certificate of Incorporation, as amended (incorporated by reference to Exhibit 3.1 to the Company’s Quarterly Report on Form 10-Q filed with the SEC on May 15, 2013)

|

|

4.2

|

Amended and Restated By-Laws (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the SEC on December 14, 2018)

|

|

4.3

|

Amendment to the Amended and Restated Bylaws of Bridgeline Digital, Inc., dated September 9, 2021 (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the SEC on September 10, 2021)

|

|

5.1*

|

Opinion of Ruskin Moscou Faltischek, P.C.

|

|

23.1*

|

Consent of PKF O’Connor Davies, LLP

|

|

23.2*

|

Consent of Ruskin Moscou Faltischek, P.C. (contained in Exhibit 5.1 hereof)

|

|

24.1*

|

Power of Attorney (included on the signature page of this Registration Statement)

|

|

99.1

|

Bridgeline Digital Inc. 2016 Stock Incentive Plan (incorporated by reference to Appendix B of the Company’s DEF 14A filed with the SEC on March 22, 2016)

|

|

99.2

|

First Amendment to the Bridgeline Digital Inc. 2016 Stock Incentive Plan (incorporated by reference to Appendix B of the Company’s DEF 14A filed with the SEC on August 23, 2019)

|

|

99.3

|

Second Amendment to the Bridgeline Digital Inc. 2016 Stock Incentive Plan (incorporated by reference to Appendix A of the Company’s DEF 14A filed with the SEC on February 14, 2022)

|

|

99.4*

|

Third Amendment to the Bridgeline Digital, Inc. 2016 Stock Incentive Plan

|

|

107*

|

Filing Fee Table

|

* Filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Woodbury, New York, on this 3rd day of January 2024.

|

|

Bridgeline Digital, Inc.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas R. Windhausen

|

|

|

|

|

Thomas R. Windhausen

|

|

|

|

|

Chief Financial Officer

|

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each of the undersigned constitutes and appoints Roger Kahn and Thomas R. Windhausen, and each of them, his or her lawful attorneys-in-fact and agents with full power and authority to do any and all acts and things and to execute any and all instruments which said attorneys and agents, and any one of them, determine may be necessary or advisable or required to enable compliance with the Securities Act of 1933, as amended, and any rules or regulations or requirements of the Securities and Exchange Commission in connection with this Registration Statement. Without limiting the generality of the foregoing power and authority, the powers granted include the power and authority to sign the names of the undersigned officers and directors in the capacities indicated below to this Registration Statement, to any and all amendments, both pre-effective and post-effective, and supplements to this Registration Statement, and to any and all instruments or documents filed as part of or in conjunction with this Registration Statement or amendments or supplements thereof, and each of the undersigned hereby ratifies and confirms that all said attorneys and agents, or any one of them, shall do or cause to be done by virtue hereof. This Power of Attorney may be signed in several counterparts.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities indicated as of January 3, 2024.

|

Signature

|

|

Title

|

|

Date

|

| |

|

|

|

|

| |

|

|

|

|

|

/s/ Roger Kahn

|

|

President, Chief Executive

|

|

January 3, 2024 |

|

Roger Kahn

|

|

Officer, and Director

(Principal Executive Officer)

|

|

|

| |

|

|

|

|

|

/s/ Thomas R. Windhausen

|

|

Chief Financial Officer,

|

|

January 3, 2024 |

|

Thomas R. Windhausen

|

|

Treasurer, and Secretary

(Principal Financial Officer)

|

|

|

| |

|

|

|

|

|

/s/ Joni Kahn

|

|

Chairperson

|

|

January 3, 2024 |

|

Joni Kahn

|

|

|

|

|

| |

|

|

|

|

|

/s/ Kenneth Galaznik

|

|

Director

|

|

January 3, 2024 |

|

Kenneth Galaznik

|

|

|

|

|

| |

|

|

|

|

|

/s/ Scott Landers

|

|

Director

|

|

January 3, 2024 |

|

Scott Landers

|

|

|

|

|

| |

|

|

|

|

|

/s/ Michael Taglich

|

|

Director

|

|

January 3, 2024 |

|

Michael Taglich

|

|

|

|

|

Exhibit 5.1

Writer's Direct Dial: (516) 663-6600

Writer's Direct Fax: (516) 663-6643

Bridgeline Digital, Inc.

100 Sylvan. Road, Suite G700

Woburn, MA 01801

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We have acted as counsel for Bridgeline Digital, Inc., a Delaware corporation (the “Company”), in connection with the preparation and filing with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Act”), of a Registration Statement on Form S-8 (the “Registration Statement”) relating to the offering of up to an aggregate of an additional 750,000 shares (the “Shares”) of the Company’s common stock, $0.001 par value, pursuant to the Bridgeline Digital, Inc. 2016 Stock Incentive Plan, as amended (the “Plan”). In arriving at the opinions expressed below, we have examined and relied on the following documents:

(i) the Registration Statement;

(ii) the Plan;

(iii) the Certificate of Incorporation of the Company, and all amendments thereto;

(iv) the By-Laws of the Company in force as of the date hereof; and

(v) certain resolutions of the Board of Directors of the Company.

In addition, we have examined and relied on the originals or copies certified or otherwise identified to our satisfaction of all such other records, documents and instruments of the Company and such other persons, and we have made such investigations of law, as we have deemed appropriate as a basis for the opinions expressed below. We have assumed the genuineness of all signatures and the authenticity of all documents submitted to us as originals and the conformity to the original documents of all documents submitted to us as certified or photostatic copies. In making our examination of executed documents, we have assumed that the parties thereto, other than the Company, had the power, corporate or other, to enter into and perform all obligations thereunder and have also assumed the due authorization by all requisite action, corporate or other, and the execution and delivery by such parties of such documents and the validity and binding effect thereof on such parties. Furthermore, we have assumed that payment of the appropriate exercise price of the options issued under the Plan will be made at the time of exercise in accordance with the Plan.

Based upon the foregoing, we are of the opinion that the Shares have been validly authorized, and upon issuance and delivery in the manner contemplated by the Registration Statement and the Plan, the Shares will be validly issued, fully paid and non-assessable. We assume no obligation to supplement this opinion letter if any applicable law changes after the date hereof or if we become aware of any fact that might change the opinions expressed herein after the date hereof.

This opinion is intended solely for the benefit of the Company and, without our prior written consent, this opinion may not be furnished to (by summary or otherwise) or relied upon by any person, firm or entity and may not be quoted or copied in whole or in part or otherwise referred to in any other document or communication or filed with any governmental agency or person, except as set forth herein.

We consent to the filing of this opinion as Exhibit 5.1 to the Registration Statement and to the reference to our Firm in the Registration Statement. In giving this consent, we do not admit that we are within the category of persons whose consent is required by Section 7 of the Act.

|

Very truly yours,

/s/ Ruskin Moscou Faltischek P.C.

RUSKIN MOSCOU FALTISCHEK P.C.

|

Exhibit 23.1

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM’S CONSENT

We consent to the incorporation by reference in this Registration Statement of Bridgeline Digital, Inc. Form S-8 filed under the Securities Act of 1933, as amended, of our report dated December 27, 2023, with respect to our audit of the consolidated financial statements of Bridgeline Digital, Inc. as of September 30, 2023, and for the year then ended, originally appearing in the Annual Report on Form 10-K of Bridgeline Digital, Inc. for the year ended September 30, 2023.

/s/PKF O’Connor Davies, LLP

New York, NY

January 3, 2024

Exhibit 99.4

AMENDMENT NO. 3

TO

BRIDGELINE DIGITAL, INC.

2016 STOCK INCENTIVE PLAN

This Amendment No. 3 (this “Amendment”) to the Bridgeline Digital, Inc. 2016 Stock Incentive Plan (as may be amended from time to time, the “Plan”), is made as of June 1, 2023. Capitalized terms used herein without definition shall have the meanings ascribed to such terms in the Plan.

WHEREAS, Section 13 of the Plan permits the Board of Directors to amend the Plan, subject, in the case of amendments requiring stockholder approval under the rules of any securities exchange on which the Stock may then be listed, to the approval by the Company's stockholders of such amendment;

WHEREAS, the Board of Directors desires to amend the Plan to increase the number of Shares available for grant under the Plan;

WHEREAS, this Amendment shall be submitted to the Company’s stockholders for approval, and shall become effective as of the date on which the Company’s stockholders approve such Amendment (the “Effective Date”); and

WHEREAS, if the Company’s stockholders fail to approve this Amendment, the existing Plan shall continue in full force and effect.

NOW, THEREFORE, pursuant to Section 13 of the Plan, the Plan is hereby amended as follows, effective as of the Effective Date:

1. Section 3(a) of the Plan is hereby amended and restated in its entirety to read as follows:

(a) Shares Issuable. The maximum number of shares of Stock which may be issued in respect of Awards (including Stock Appreciation Rights) granted under the Plan, subject to adjustment upon changes in capitalization of the Company as provided in this Section 3, shall be 2,400,000 shares. The maximum number of shares of Stock which may be issued in respect of Incentive Stock Options granted under the Plan, subject to adjustment upon changes in capitalization of the Company as provided in Section 3, shall be 2,400,000 shares. For purposes of this limitation, the shares of Stock underlying any Awards which are forfeited, cancelled, reacquired by the Company or otherwise terminated (other than by exercise), shares that are tendered in payment of the exercise price of any Award and shares that are tendered or withheld for tax withholding obligations shall be added back to the shares of Stock with respect to which Awards may be granted under the Plan. Shares issued under the Plan may be authorized but unissued shares or shares reacquired by the Company.

2. Except as expressly amended by this Amendment, all terms and conditions of the Plan shall remain in full force and effect.

IN WITNESS WHEREOF, the Company, buy its duly executed officer, has executed this Amendment to the Bridgeline Digital, Inc. 2016 Stock Incentive Plan, as of the date first indicated above.

|

|

Bridgeline Digital, Inc.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas Windhausen

|

|

|

|

|

Thomas Windhausen

|

|

|

|

|

Chief Financial Officer

|

|

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Bridgeline Digital, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1 - Newly Registered Securities

|

Security

Type

|

Security Class

Title

|

Fee Calculation

Rule

|

Amount

Registered

(1)

|

Proposed

Maximum

Offering Price

Per Unit (2)

|

Maximum

Aggregate

Offering Price

|

Fee Rate

|

Amount of

Registration Fee

|

|

Equity

|

Common stock,

par value

$0.001 per

share

|

457(c) and 457(h)

|

100,000

|

$0.87

|

$87,000

|

0.00014760

|

$12.85

|

|

Equity

|

Common stock,

par value

$0.001 per

share

|

457(h)

|

450,000

|

$1.18

|

$531,000

|

0.00014760

|

$78.38

|

|

Equity

|

Common stock,

par value

$0.001 per

share

|

457(h)

|

200,000

|

$1.19

|

$238,000

|

0.00014760

|

$35.13

|

|

Total Offering Amounts

|

|

$856,000

|

|

$126.35

|

|

Total Fees Previously Paid

|

|

|

|

-

|

|

Total Fee Offsets

|

|

|

|

-

|

|

Net Fees Due

|

|

|

|

$126.35

|

| |

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (“Securities Act”), this Registration Statement shall also cover any additional shares of the Registrant’s Common Stock that become issuable in respect of the securities identified in the above table by reason of any share dividend, share split, recapitalization or other similar transaction effected without the Registrant’s receipt of consideration that results in an increase in the number of the outstanding shares of the Registrant’s Common Stock.

|

| |

(2)

|

Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) and (h) under the Securities Act, using the average of the high and low sales price as reported on the Nasdaq Capital Market on December 29, 2023.

|

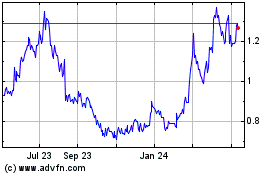

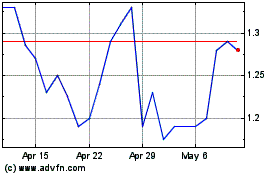

Bridgeline Digital (NASDAQ:BLIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bridgeline Digital (NASDAQ:BLIN)

Historical Stock Chart

From Apr 2023 to Apr 2024