BOS Reports Financial Results for the Third Quarter and First Nine Months of the Year 2021

November 30 2021 - 7:59AM

BOS Better Online Solutions Ltd. ("BOS" or the "Company") (NASDAQ:

BOSC) reported financial results for the third quarter and first

nine months of the year 2021.

Eyal Cohen, BOS's CEO, stated: "We have made progress in the

first nine months of the year 2021 as compared to the comparable

period last year:

- Revenues grew by 6%

- Gross profit increased by 15%

- Net income of $351,000 in the first nine months of the year

2021 as compared to a $1.2 million net loss in the comparable

period last year

- A fifth consecutive profitable quarter.

The Robotics division’s operating loss has decreased

significantly, to $489,000 in the first nine months of 2021 from

$2.4 million in the comparable period last year. However, the

Robotics division did not yet reach the breakeven point as

previously projected. We expect the Robotics division to breakeven

in the year 2022. We believe in the long-term growth potential of

our Robotics division because of the increasing shortage in

manpower for industrial and logistic processes.

The devaluation of the US dollar against the NIS in the first

nine months of 2021 yielded an increase in our operating expenses

by approximately $170,000 as compared to the comparable period last

year."

Avidan Zelicovsky, BOS's President, stated: "The global shortage

in commodities has presented an opportunity for our Supply Chain

division. We have launched a new service for our electronic

industry clients that significantly shortens the lead time for the

electronic components. This service has been a growth engine of

this division in the first nine months of 2021".

Eyal Cohen, BOS's CEO, added:" In view of the third quarter

results, we have revised our outlook for the year 2021 in respect

of our net income, to be between $400,000 and $600,000 instead of

$1,000,000. Our outlook for the year 2021 revenues has not been

changed and remains $33 million. We will announce our outlook for

the year 2022 during the first quarter of the year 2022".

BOS will host a conference call on Tuesday, November 30, 2021,

at 9:00 a.m. EST, 4:00 p.m., Israel Time. A question-and-answer

session will follow management's presentation. To access the

conference call, please dial one of the following numbers:

US: +1-888-281-1167, International:

+972-3-9180644.

For those unable to listen to the live

call, a replay of the call will be available the next day on the

BOS website: www.boscom.com

About BOS

BOS provides services and systems for

inventory production and management in three channels:

- Services – The Supply Chain division provides inventory

procurement and kitting.

- Integration – the RFID division provides off-the-shelf software

and equipment to track and manage inventory in the production floor

and warehouse.

- Development – the Intelligent Robotics division develops and

builds custom-made robotic cells for the industrial and logistic

processes.

Contact:Eyal Cohen, CEO+972-542525925

| eyalc@boscom.com

Use of Non-GAAP Financial InformationBOS

reports financial results in accordance with US GAAP and herein

provides some non-GAAP measures. These non-GAAP measures are not in

accordance with, nor are they a substitute for, GAAP measures.

These non-GAAP measures are intended to supplement the Company's

presentation of its financial results that are prepared in

accordance with GAAP. The Company uses the non-GAAP measures

presented to evaluate and manage the Company's operations

internally. The Company is also providing this information to

assist investors in performing additional financial analysis that

is consistent with financial models developed by research analysts

who follow the Company. The reconciliation set forth below is

provided in accordance with Regulation G and reconciles the

non-GAAP financial measures with the most directly comparable GAAP

financial measures.

Safe Harbor Regarding Forward-Looking

StatementsThe forward-looking statements contained herein

reflect management's current views with respect to future events

and financial performance. These forward-looking statements are

subject to certain risks and uncertainties that could cause the

actual results to differ materially from those in the

forward-looking statements, all of which are difficult to predict

and many of which are beyond the control of BOS. These risk factors

and uncertainties include, amongst others, the dependency of sales

being generated from one or few major customers, the uncertainty of

BOS being able to maintain current gross profit margins, inability

to keep up or ahead of technology and to succeed in a highly

competitive industry, failure to successfully integrate and achieve

the potential benefits of the acquisition of the business

operations of Imdecol Ltd. (the Robotics business line), inability

to maintain marketing and distribution arrangements and to expand

our overseas markets, uncertainty with respect to the prospects of

legal claims against BOS, the effect of exchange rate fluctuations,

general worldwide economic conditions, the impact of the COVID-19

virus and continued availability of financing for working capital

purposes and to refinance outstanding indebtedness; and additional

risks and uncertainties detailed in BOS' periodic reports and

registration statements filed with the US Securities and Exchange

Commission. BOS undertakes no obligation to publicly update or

revise any such forward-looking statements to reflect any change in

its expectations or in events, conditions or circumstances on which

any such statements may be based, or that may affect the likelihood

that actual results will differ from those set forth in the

forward-looking statements.

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

U.S. dollars in thousands |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended |

|

Three months ended |

|

September 30, |

September 30, |

|

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

|

|

|

|

|

|

Revenues |

|

$ |

24,555 |

|

|

$ |

23,125 |

|

|

$ |

7,998 |

|

|

$ |

8,179 |

|

|

Cost of revenues |

|

|

19,697 |

|

|

|

18,153 |

|

|

|

6,423 |

|

|

|

6,435 |

|

|

Inventory Impairment |

|

|

- |

|

|

|

752 |

|

|

|

- |

|

|

|

81 |

|

|

Gross profit |

|

|

4,858 |

|

|

|

4,220 |

|

|

|

1,575 |

|

|

|

1,663 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

154 |

|

|

|

71 |

|

|

|

40 |

|

|

|

50 |

|

|

Sales and marketing |

|

|

2,902 |

|

|

|

2,933 |

|

|

|

973 |

|

|

|

978 |

|

|

General and administrative |

|

|

1,343 |

|

|

|

1,251 |

|

|

|

466 |

|

|

|

408 |

|

|

Impairment of Goodwill and intangible

assets |

|

|

- |

|

|

|

988 |

|

|

|

- |

|

|

|

- |

|

|

Total operating costs and expenses |

|

|

4,399 |

|

|

|

5,243 |

|

|

|

1,479 |

|

|

|

1,436 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

|

459 |

|

|

|

(1,023 |

) |

|

|

96 |

|

|

|

227 |

|

|

Financial income (expenses), net |

|

|

(107 |

) |

|

|

(235 |

) |

|

|

(9 |

) |

|

|

(98 |

) |

|

Other income, net |

|

|

- |

|

|

|

50 |

|

|

|

- |

|

|

|

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before taxes on income (loss) |

|

|

352 |

|

|

|

(1,208 |

) |

|

|

87 |

|

|

|

179 |

|

|

Taxes on income |

|

|

(1 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Net income (loss) |

|

$ |

351 |

|

|

$ |

(1,208 |

) |

|

$ |

87 |

|

|

$ |

179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net income (loss) per share |

|

$ |

0.07 |

|

|

$ |

(0.28 |

) |

|

$ |

0.02 |

|

|

$ |

0.04 |

|

|

Weighted average number of shares used in computing basic net

income per share |

|

|

5,201 |

|

|

|

4,284 |

|

|

|

5,223 |

|

|

|

4,329 |

|

|

Weighted average number of shares used in computing diluted net

income per share |

|

|

5,421 |

|

|

|

4,284 |

|

|

|

5,613 |

|

|

|

4,339 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of outstanding shares as of September 30, 2021 and 2020 |

|

|

5,237 |

|

|

|

4,321 |

|

|

|

5,237 |

|

|

|

4,321 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEETS |

|

(U.S. dollars in thousands)

|

|

|

|

|

|

|

September30, 2021 |

|

|

December31, 2020 |

|

|

|

|

(Unaudited) |

|

|

(Audited) |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,002 |

|

$ |

1,036 |

|

Restricted bank deposits |

|

|

236 |

|

|

140 |

|

Trade receivables |

|

|

8,846 |

|

|

9,172 |

|

Other accounts receivable and prepaid expenses |

|

|

1,226 |

|

|

1,311 |

|

Inventories |

|

|

5,149 |

|

|

4,871 |

|

|

|

|

|

|

| Total current assets |

|

|

17,459 |

|

|

16,530 |

| |

|

|

|

|

| LONG-TERM ASSETS |

|

|

44 |

|

|

59 |

| |

|

|

|

|

| PROPERTY AND EQUIPMENT,

NET |

|

|

1,139 |

|

|

956 |

| |

|

|

|

|

| OPERATING LEASE RIGHT-OF-USE

ASSETS, NET |

|

|

992 |

|

|

767 |

| |

|

|

|

|

| OTHER INTANGIBLE ASSETS,

NET |

|

|

25 |

|

|

40 |

| |

|

|

|

|

| GOODWILL |

|

|

4,676 |

|

|

4,676 |

| |

|

|

|

|

| Total assets |

|

$ |

24,335 |

|

$ |

23,028 |

|

|

|

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEETS |

|

(U.S. dollars in thousands)

|

|

|

|

|

|

|

|

September 30, |

|

December 31, 2020 |

|

2021 |

|

|

|

|

(Unaudited) |

|

(Audited) |

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

Current maturities of long term loans |

$ |

825 |

|

$ |

815 |

|

Operating lease liabilities, current |

|

495 |

|

|

557 |

|

Trade payables |

|

5,060 |

|

|

5,492 |

|

Employees and payroll accruals |

|

769 |

|

|

985 |

|

Deferred revenues |

|

742 |

|

|

601 |

|

Advances net of inventory in process |

|

106 |

|

|

68 |

|

Accrued expenses and other liabilities |

|

231 |

|

|

391 |

|

|

|

|

|

|

Total current liabilities |

|

8,228 |

|

|

8,909 |

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

Long-term loans, net of current maturities |

|

756 |

|

|

1,216 |

|

Operating lease liabilities, non-current |

|

628 |

|

|

367 |

|

Long term deferred revenues |

|

190 |

|

|

303 |

|

Accrued severance pay |

|

336 |

|

|

364 |

|

|

|

|

|

|

Total long-term liabilities |

|

1,910 |

|

|

2,250 |

|

|

|

|

|

|

|

|

|

|

|

TOTAL SHAREHOLDERS' EQUITY |

|

14,197 |

|

|

11,869 |

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity |

$ |

24, 335 |

|

$ |

23,028 |

| |

|

|

|

|

CONDENSED CONSOLIDATED EBITDA |

|

(U.S. dollars in thousands) |

|

|

|

|

|

Nine months

ended |

|

Three months

ended |

|

September 30, |

September

30, |

|

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| |

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

$ |

459 |

|

$ |

(1,023 |

) |

|

$ |

96 |

|

$ |

227 |

|

Add: |

|

|

|

|

|

|

|

|

| Impairment

of Goodwill and other intangible assets |

|

|

- |

|

|

988 |

|

|

|

- |

|

|

- |

| Amortization

of intangible assets |

|

|

15 |

|

|

36 |

|

|

|

5 |

|

|

5 |

| Stock-based

compensation |

|

|

44 |

|

|

57 |

|

|

|

13 |

|

|

18 |

|

Depreciation |

|

|

175 |

|

|

208 |

|

|

|

64 |

|

|

66 |

| EBITDA |

|

$ |

693 |

|

$ |

266 |

|

|

$ |

178 |

|

$ |

316 |

| |

|

|

|

|

|

|

|

|

|

SEGMENT INFORMATION |

|

(U.S. dollars in thousands) |

|

|

|

|

RFID |

|

|

|

IntelligentRobotics |

|

Intercompany |

|

|

Consolidated |

|

SupplyChainSolutions |

|

|

|

|

|

|

Nine months ended September 30, |

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

9,193 |

|

$ |

14,168 |

|

|

1,340 |

|

|

$ |

(146 |

) |

|

$ |

24,555 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

2,212 |

|

|

2,683 |

|

|

(37 |

) |

|

|

- |

|

|

|

4,858 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allocated operating expenses |

|

1,641 |

|

|

1,788 |

|

|

452 |

|

|

|

- |

|

|

|

3,881 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unallocated operating expenses* |

|

- |

|

|

- |

|

|

- |

|

|

|

|

|

|

518 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations |

$ |

571 |

|

$ |

895 |

|

$ |

(489 |

) |

|

|

- |

|

|

|

459 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial expenses and tax on income |

|

|

|

|

|

|

|

|

|

|

(108 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

|

|

|

|

|

|

|

|

$ |

351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RFID |

|

|

SupplyChainSolutions |

|

IntelligentRobotics |

|

Intercompany |

|

|

Consolidated |

|

|

|

|

|

|

Nine months ended September 30, |

|

|

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

8,976 |

|

|

$ |

13,825 |

|

$ |

367 |

|

|

$ |

(43 |

) |

|

$ |

23,125 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (loss) |

|

2,223 |

|

|

|

2,882 |

|

|

(885 |

) |

|

|

- |

|

|

|

4,220 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allocated operating expenses |

|

1,524 |

|

|

|

1,730 |

|

|

534 |

|

|

|

- |

|

|

|

3,788 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impairment of goodwill and intangible assets |

|

- |

|

|

|

- |

|

|

988 |

|

|

|

- |

|

|

|

988 |

|

|

|

|

- |

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

Unallocated operating expenses* |

|

|

|

|

|

|

|

|

|

|

|

467 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations |

$ |

699 |

|

|

$ |

1,152 |

|

$ |

(2,407 |

) |

|

|

- |

|

|

|

(1,023 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial expenses and tax on income |

|

|

|

|

|

|

|

|

|

|

|

(185 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

|

|

|

|

|

|

|

|

$ |

(1,208 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEGMENT INFORMATION |

|

(U.S. dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RFID |

|

|

SupplyChainSolutions |

|

IntelligentRobotics |

|

|

|

Intercompany |

|

|

Consolidated |

|

|

|

|

|

|

Three months ended September 30, |

|

|

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

2,871 |

|

|

$ |

4,919 |

|

$ |

304 |

|

|

|

$ |

(96 |

) |

|

$ |

7,998 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (loss) |

|

660 |

|

|

|

984 |

|

|

(69 |

) |

|

|

|

- |

|

|

|

1,575 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allocated operating expenses |

|

529 |

|

|

|

640 |

|

|

116 |

|

|

|

|

- |

|

|

|

1,285 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unallocated operating expenses* |

|

|

|

|

|

|

|

|

|

|

|

|

|

194 |

|

|

|

|

- |

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

Income (loss) from operations |

$ |

131 |

|

|

$ |

344 |

|

$ |

(185 |

) |

|

|

|

- |

|

|

|

96 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial income and tax on income |

|

|

|

|

|

|

|

|

|

|

|

|

|

(9 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

87 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RFID |

|

|

SupplyChainSolutions |

|

|

IntelligentRobotics |

|

|

|

Intercompany |

|

|

Consolidated |

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

|

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

3,264 |

|

$ |

4,849 |

|

$ |

66 |

|

|

$ |

- |

|

$ |

8,179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (loss) |

|

749 |

|

|

1,013 |

|

|

(99 |

) |

|

|

- |

|

|

1,663 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allocated operating expenses |

|

518 |

|

|

586 |

|

|

205 |

|

|

|

- |

|

|

1,309 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impairment of goodwill and intangible assets |

|

- |

|

|

- |

|

|

- |

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unallocated operating expenses* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

127 |

|

|

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

Income (loss) from operations |

$ |

238 |

|

$ |

427 |

|

$ |

(311 |

) |

|

|

- |

|

|

227 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial expenses and tax on income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(48 |

) |

|

Net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Unallocated operating expenses include costs not specific to a

particular segment but are general to the group, such as expenses

incurred for insurance of directors and officers,public company

fees, legal fees, and other similar corporate costs.

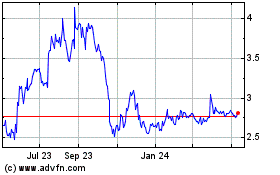

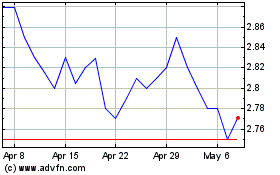

BOS Better Online Soluti... (NASDAQ:BOSC)

Historical Stock Chart

From Aug 2024 to Sep 2024

BOS Better Online Soluti... (NASDAQ:BOSC)

Historical Stock Chart

From Sep 2023 to Sep 2024