As filed with the Securities and Exchange Commission on September 1, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| | | | | | | | |

| Berry Corporation (bry) |

| (Exact Name of Registrant as Specified in its Charter) |

|

| Delaware | | 81-5410470 |

| (State or other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer

Identification Number) |

|

16000 N. Dallas Parkway, Suite 500, Dallas, Texas 75248 (661) 616-3900 |

| (Address, including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) |

|

A. T. (Trem) Smith President, Chief Executive Officer and Board Chair 16000 N. Dallas Parkway, Suite 500, Dallas, Texas 75248 (661) 616-3900 |

| (Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service) |

|

| Copies to: |

Sarah K. Morgan Vinson & Elkins L.L.P. 1001 Fannin, Suite 2500 Houston, Texas 77002-6760 (713) 758-2222 |

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer ☐ | | Accelerated filer ☒ | | Non-accelerated filer ☐ | | Smaller reporting company ☐ |

| Emerging Growth Company ☒ | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The securities described herein may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any state or jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated September 1, 2022

Berry Corporation (bry)

$500,000,000

Common Stock

Preferred Stock

Debt Securities

At the time of filing we have no current plans to do so, however, from time to time in one or more offerings, we may offer and sell (i) common stock, (ii) preferred stock and (iii) debt securities issued by Berry Corporation (bry) (“Berry Corp.”) . We refer to the common stock, the preferred stock and the debt securities collectively as the “securities.” The aggregate initial offering price of all securities sold by us under this prospectus will not exceed $500,000,000.

We may offer and sell these securities on a delayed or continuous basis to or through one or more underwriters, dealers or agents, or directly to investors, in amounts, at prices and on terms to be determined by market conditions and other factors at the time of the offering. This prospectus describes only the general terms of these securities and the general manner in which we may offer these securities. The specific terms of any securities we offer will, if not included in this prospectus or information incorporated by reference herein, be included in a supplement to this prospectus. The prospectus supplement may describe the specific manner in which we will offer these securities and also may add, update or change information contained in this prospectus.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus, including the documents incorporated by reference, and any amendments or supplements carefully before you make your investment decision.

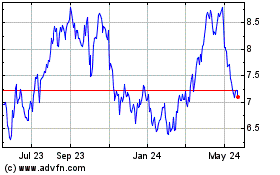

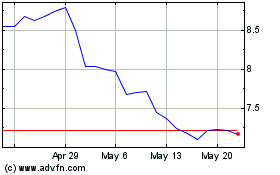

Our common stock is listed on the Nasdaq Global Select Market (the “NASDAQ”) under the symbol “BRY.” We will provide information in the related prospectus supplement for the trading market, if any, for any other securities that may be offered.

Investing in our securities involves risks. Please see “Risk Factors” beginning on page 2 of this prospectus Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus, any prospectus supplement and the documents we have incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with information different from that contained in this prospectus, any prospectus supplement or any free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell these securities only in jurisdictions where offers and sales are permitted. The information in this prospectus or any prospectus supplement is accurate only as of the date of this prospectus or such prospectus supplement, regardless of the time of delivery of this prospectus, any prospectus supplement or any sale of the securities. We will disclose any material changes in our affairs in an amendment to this prospectus, a prospectus supplement or a future filing with the SEC incorporated by reference in this prospectus or any prospectus supplement.

ABOUT THIS PROSPECTUS

Additional information, including our financial statements and the notes thereto, is incorporated in this prospectus by reference to our reports filed with the SEC. Please read “Where You Can Find More Information” below. You are urged to read this prospectus carefully, including “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” and the documents incorporated by reference in their entirety before investing in our securities.

When we use the terms “we,” “us,” “our,” the “Company,” or similar words in this prospectus, unless the context otherwise requires, we are referring to Berry Corp. and its subsidiary, Berry Petroleum Company, LLC (“Berry LLC”), and as of October 1, 2021 this also includes C&J Well Services, LLC (“CJWS”) and CJ Berry Well Services Management, LLC (“C&J Management”).

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 (including the exhibits, schedules and amendments thereto) under the Securities Act, with respect to the securities that may be offered hereby. This prospectus does not contain all of the information set forth in the registration statement and the exhibits and schedules thereto. For further information with respect to the securities offered hereby, we refer you to the registration statement and the exhibits and schedules filed therewith. Statements contained in this prospectus as to the contents of any contract, agreement or any other document are summaries of the material terms of such contract, agreement or other document and are not necessarily complete. With respect to each of these contracts, agreements or other documents filed as an exhibit to the registration statement, reference is made to the exhibits for a more complete description of the matter involved.

We are required to file annual and quarterly reports and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. The address of the SEC’s website is www.sec.gov.

We maintain an Internet site at www.bry.com. We do not incorporate our Internet site, or the information contained on that site or connected to that site, into this prospectus or this registration statement.

We make available free of charge on our website, all materials that we have filed electronically with the SEC, including our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Section 16 reports, proxy statements for our annual and special stockholder meetings and amendments to these reports as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC. Our filings will also be available to the public from commercial document retrieval services.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with the SEC. This means we can disclose important information to you without actually including the specific information in this prospectus by referring to those documents. The information incorporated by reference is an important part of this prospectus.

If information in incorporated documents conflicts with information in this prospectus, you should rely on the most recent information. If information in an incorporated document conflicts with information in another incorporated document, you should rely on the most recent incorporated document.

We incorporate by reference the documents listed below, any documents we may file pursuant to the Securities Exchange Act of 1934 (the “Exchange Act”) after the date of the filing of the registration statement of which this prospectus forms a part and prior to the effectiveness of the registration statement and any future filings made with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, excluding any information furnished and not filed with the SEC, from the date of this prospectus until the termination of each offering under this prospectus:

•our Current Reports on Form 8-K filed on March 18, 2022, April 12, 2022, May 26, 2022, June 1, 2022, June 9, 2022 and August 3, 2022 (in each case, excluding any information furnished and not filed pursuant to Item 2.02 or 7.01 or corresponding information furnished under Item 9.01 or included as an exhibit); and •the description of our common stock contained in our registration statement on Form 8-A, filed on July 24, 2018, including any amendments or reports filed for the purpose of updating such description. You may request a copy of any document incorporated by reference in this prospectus, at no cost, by writing or calling us at the following address:

Berry Corporation (bry)

16000 N. Dallas Parkway, Suite 500

Dallas, Texas 75248

(661) 616-3900

Attention: Investor Relations

You should rely only on the information incorporated by reference or provided in this prospectus. We have not authorized anyone else to provide you with any information. You should not assume that the information incorporated by reference or provided in this prospectus is accurate as of any date other that the date on the front of each document.

ABOUT BERRY CORPORATION (BRY)

Our Company

We are a western United States independent upstream energy company with a focus on onshore, low geologic risk, long-lived conventional oil and gas reserves in the San Joaquin basin of California and the Uinta basin of Utah, with well servicing and abandonment capabilities in California. Since October 1, 2021, we have operated in two business segments: (i) development and production (“D&P”) and (ii) well servicing and abandonment.

Our Corporate Structure

Berry Corp. is a holding company that was incorporated as a Delaware corporation in February 2017 for the purpose of facilitating an initial public offering (“IPO”) of common equity and to become the sole managing member of Berry LLC. On October 1, 2021, we completed the acquisition of one of the largest upstream well servicing and abandonment businesses in California, which operates as CJWS and now constitutes our well servicing and abandonment segment.

As the sole member of each of Berry LLC, CJWS and C&J Management (together, the “Subsidiaries”), Berry Corp. operates and controls all of the business and affairs of the Subsidiaries and, through the Subsidiaries, conducts our business. Berry Corp. consolidates the financial results of the Subsidiaries. Berry Corp. has no independent assets or operations and its principal assets are controlling equity interests in Berry LLC, C&J Management and CJWS.

Corporate Information

Berry Corp.’s principal executive office is located at 16000 N. Dallas Pkwy, Ste. 500, Dallas, Texas 75248 and our telephone number at that address is (661) 616-3900. Our web address is www.bry.com. Information contained in or accessible through our website is not, and should not be deemed to be, part of this prospectus.

RISK FACTORS

An investment in our securities involves a significant degree of risk. You should carefully consider the risk factors and all of the other information included in this prospectus and the documents we have incorporated by reference into this prospectus, including those under the heading “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, before making an investment decision. Any of these risks and uncertainties could have a material adverse effect on our business, production, growth plans, reserves quantities or value, operating or capital costs, financial condition, results of operations and our ability to meet our capital expenditure plans and other obligations and financial commitments.

The risks included in this prospectus and the documents we have incorporated by reference into this prospectus are not the only risks we face. We may experience additional risks and uncertainties not currently known to us, or as a result of developments occurring in the future. Conditions that we currently deem to be immaterial may also have material adverse effects similar to those noted above.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information included or incorporated by reference in this prospectus or in any accompanying prospectus supplement includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical facts included in this prospectus that address plans, activities, events, objectives, goals, strategies, or developments that the Company expects, believes or anticipates will or may occur in the future, such as those regarding our financial position, liquidity, cash flows, financial and operating results, capital program and development and production plans, operations and business strategy, potential acquisition and other strategic opportunities, reserves, hedging activities, capital expenditures, return of capital, our shareholder return model and the payment of future dividends, future repurchases of stock or debt, capital investments, our ESG strategy and the initiation of new projects or business in connection therewith, recovery factors, and other guidance, are forward-looking statements. These statements are based upon various assumptions, many of which are based, in turn, upon further assumptions. Although we believe that these assumptions were reasonable when made, these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control. Therefore, such forward-looking statements involve significant risks and uncertainties that could materially affect our expected financial position, financial and operating results, liquidity, cash flows, and business prospects. Actual results may differ from anticipated results, sometimes materially, and reported results should not be considered an indication of future performance. You can typically identify forward-looking statements by words such as aim, anticipate, achievable, believe, budget, continue, could, effort, estimate, expect, forecast, goal, guidance, intend, likely, may, might, objective, outlook, plan, potential, predict, project, seek, should, target, will or would and other similar words that reflect the prospective nature of events or outcomes. For any such forward-looking statement that includes a statement of the assumptions or bases underlying such forward-looking statement, we caution that while we believe such assumptions or bases to be reasonable and make them in good faith, assumed facts or bases almost always vary from actual results, sometimes materially. Material risks that may affect us are discussed above in “Risk Factors” in this prospectus, in any applicable prospectus supplement and in the documents incorporated by reference, including our most recent Annual Report on Form 10-K.

Factors (but not necessarily all the factors) that could cause results to differ include, among others:

•the regulatory environment, including availability or timing of, and conditions imposed on, obtaining and/or maintaining permits and approvals, including those necessary for drilling and/or development projects;

•the impact of current, pending and/or future laws and regulations, and of legislative and regulatory changes and other government activities, including those related to permitting, drilling, completion, well stimulation, operation, maintenance or abandonment of wells or facilities, managing energy, water, land, greenhouse gases or other emissions, protection of health, safety and the environment, or transportation, marketing and sale of our products;

•global economic trends, geopolitical risks and general economic and industry conditions;

•overall domestic and global political and economic conditions;

•the actions of foreign producers, importantly including OPEC+ and changes in OPEC+'s production levels;

•volatility of oil, natural gas and NGL prices;

•the California and global energy future, including the factors and trends that are expected to shape it, such as concerns about climate change and other air quality issues, the transition to a low-emission economy and the expected role of different energy sources;

•supply of and demand for oil, natural gas and NGLs;

•disruptions to, capacity constraints in, or other limitations on the pipeline systems that deliver our oil and natural gas and other processing and transportation considerations;

•inability to generate sufficient cash flow from operations or to obtain adequate financing to fund capital expenditures, meet our working capital requirements or fund planned investments;

•price fluctuations and availability of natural gas and electricity and the cost of steam;

•our ability to use derivative instruments to manage commodity price risk;

•our ability to meet our planned drilling schedule and to successfully drill wells that produce oil and natural gas in commercially viable quantities;

•concerns about climate change and other air quality issues;

•uncertainties associated with estimating proved reserves and related future cash flows;

•our ability to replace our reserves through exploration and development activities;

•drilling and production results, lower-than-expected production, reserves or resources from development projects or higher-than-expected decline rates;

•our ability to obtain timely and available drilling and completion equipment and crew availability and access to necessary resources for drilling, completing and operating wells;

•changes in tax laws;

•effects of competition;

•uncertainties and liabilities associated with acquired and divested assets;

•our ability to make acquisitions and successfully integrate any acquired businesses;

•market fluctuations in electricity prices and the cost of steam;

•asset impairments from commodity price declines;

•large or multiple customer defaults on contractual obligations, including defaults resulting from actual or potential insolvencies;

•geographical concentration of our operations;

•the creditworthiness and performance of our counterparties with respect to our hedges;

•impact of derivatives legislation affecting our ability to hedge;

•failure of risk management and ineffectiveness of internal controls;

•catastrophic events, including wildfires, earthquakes and pandemics;

•environmental risks and liabilities under federal, state, tribal and local laws and regulations (including remedial actions);

•potential liability resulting from pending or future litigation;

•our ability to recruit and/or retain key members of our senior management and key technical employees;

•information technology failures or cyberattacks; and.

•governmental actions and political conditions, as well as the actions by other third parties that are beyond our control.

Any forward-looking statement speaks only as of the date on which such statement is made. Except as required by law, we undertake no responsibility to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise.

All forward-looking statements, expressed or implied, included in this prospectus are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.

USE OF PROCEEDS

Except as otherwise provided in an applicable prospectus supplement, we will use the net proceeds we receive from the sale of the securities covered by this prospectus for general corporate purposes, which may include, among other things, the repayment or refinancing of all or a portion of our debt, funding acquisitions of assets or businesses and organic growth.

The actual application of proceeds we receive from any particular offering of securities using this prospectus will be described in the applicable prospectus supplement relating to such offering.

DESCRIPTION OF DEBT SECURITIES

The debt securities covered by this prospectus (the “debt securities”) will be general unsecured obligations of Berry Corp. Berry Corp. will issue debt securities under an indenture to be entered into with a trustee we will name in the prospectus supplement relating to such securities, which we refer to in this prospectus as the indenture.

We have summarized selected provisions of the indenture and the debt securities below. This summary is not complete. We have filed the form of indenture with the SEC as an exhibit to the registration statement, and you should read the indenture for provisions that may be important to you.

In this summary, unless we state otherwise or the context clearly indicates otherwise, all references to “we,” “us” or “our” or “the issuer” refer to Berry Corp.

General

The indenture does not limit the amount of debt securities that may be issued under the indenture, and does not limit the amount of other unsecured debt or securities that may be issued. The issuer may issue debt securities under the indenture from time to time in one or more series, each in an amount authorized prior to issuance.

The debt securities will either constitute the issuer’s senior unsecured indebtedness and will rank equally in right of payment with all of the issuer’s other unsecured and unsubordinated debt and senior in right of payment to all of the issuer’s subordinated indebtedness, or constitute the issuer’s subordinated unsecured indebtedness and will rank junior to all of the issuer’s senior indebtedness and may rank equally with or senior to other subordinated indebtedness the issuer may issue from time to time. The debt securities will be effectively subordinated to, and thus have a junior position to, the issuer’s secured indebtedness with respect to the assets securing that indebtedness.

The indenture does not contain any covenants or other provisions designed to protect holders of the debt securities in the event the issuer participates in a highly leveraged transaction or upon a change of control. The indenture also does not contain provisions that give holders of the debt securities the right to require it to repurchase their securities in the event of a decline in the issuer’s credit rating for any reason, including as a result of a takeover, recapitalization or similar restructuring or otherwise.

Terms

The prospectus supplement relating to any series of debt securities being offered will include specific terms relating to the offering. These terms will include some or all of the following:

•the guarantor of the debt securities, if any;

•whether the debt securities will be senior or subordinated debt securities;

•the price at which the issuer will issue the debt securities;

•the title of the debt securities;

•the total principal amount of the debt securities;

•whether the issuer will issue the debt securities in individual certificates to each holder or in the form of temporary or permanent global securities held by a depositary on behalf of holders;

•the date or dates on which the principal of and any premium on the debt securities will be payable;

•any interest rate, the date from which interest will accrue, interest payment dates and record dates for interest payments;

•whether and under what circumstances the issuer will pay any additional amounts with respect to the debt securities;

•the place or places where payments on the debt securities will be payable;

•any provisions for optional redemption or early repayment;

•any sinking fund or other provisions that would obligate the issuer to redeem, purchase or repay the debt securities;

•the denominations in which the issuer will issue the debt securities if other than $1,000 and integral multiples of $1,000;

•whether payments on the debt securities will be payable in foreign currency or currency unit or another form and whether payments will be payable by reference to any index or formula;

•the portion of the principal amount of debt securities that will be payable if the maturity is accelerated, if other than the entire principal amount;

•any additional means of defeasance of the debt securities, any additional conditions or limitations to defeasance of the debt securities or any changes to those conditions or limitations;

•any changes or additions to the events of default or covenants described in this prospectus;

•any restrictions or other provisions relating to the transfer or exchange of debt securities;

•any terms for the conversion or exchange of the debt securities for other securities; and

•any other terms of the debt securities not inconsistent with the applicable indenture.

The issuer may sell the debt securities at a discount, which may be substantial, below their stated principal amount. These debt securities may bear no interest or interest at a rate that at the time of issuance is below market rates. If the issuer sells these debt securities, the issuer will describe in the prospectus supplement any material United States federal income tax consequences and other special considerations.

If the issuer sells any of the debt securities for any foreign currency or currency unit or if payments on the debt securities are payable in any foreign currency or currency unit, the issuer will describe in the prospectus supplement the restrictions, elections, tax consequences, specific terms and other information relating to those debt securities and the foreign currency or currency unit.

Events of Default

Unless the issuer informs you otherwise in the applicable prospectus supplement, the following are events of default with respect to a series of debt securities:

•failure to pay interest on any debt security of that series for 30 days when due;

•failure to pay principal of or any premium on any debt security of that series when due;

•failure to deposit any sinking fund payment for 30 days when due;

•failure to comply with any agreement in that series of debt securities or the indenture (other than an agreement or covenant that has been included in the indenture solely for the benefit of other series of debt securities) for 60 days after written notice by the trustee or by the holders of at least 25% in principal amount of the outstanding debt securities issued under the indenture that are affected by that failure;

•specified events involving bankruptcy, insolvency or reorganization of the issuer; and

•any other event of default provided for that series of debt securities.

A default under one series of debt securities will not necessarily be a default under any other series. If a default or event of default for any series of debt securities occurs, is continuing and is known to the trustee, the trustee will notify the holders of applicable debt securities within 60 days after it occurs. The trustee may withhold notice to the holders of the debt securities of any default or event of default, except in any payment on the debt securities, if the trustee in good faith determines that withholding notice is in the interests of the holders of those debt securities.

If an event of default for any series of debt securities occurs and is continuing, the trustee or the holders of at least 25% in principal amount of the outstanding debt securities of the series affected by the default (or, in some cases, 25% in principal amount of all debt securities issued under the indenture that are affected, voting as one class) may declare the principal of and all accrued and unpaid interest on those debt securities to be due and payable immediately. If an event of default relating to certain events of bankruptcy, insolvency or reorganization of the issuer occurs, the principal of and accrued and unpaid interest on all the debt securities issued under the indenture will become immediately due and payable without any action on the part of the trustee or any holder. At any time after a declaration of acceleration has been made, the holders of a majority in principal amount of the outstanding

debt securities of the series affected by the default (or, in some cases, of all debt securities issued under the indenture that are affected, voting as one class) may in some cases rescind this accelerated payment requirement and its consequences.

A holder of a debt security of any series issued under the indenture may pursue any remedy under the indenture only if:

•the holder has previously given to the trustee written notice of a continuing event of default with respect to such series;

•the holders of at least 25% in principal amount of the outstanding debt securities of that series make a written request to the trustee to pursue the remedy;

•the holders offer to the trustee indemnity satisfactory to the trustee against any loss, liability or expense;

•during that 60-day period, the holders of a majority in principal amount of the debt securities of that series do not give the trustee a direction inconsistent with the request.

This provision does not, however, affect the right of a holder of a debt security to sue for enforcement of any overdue payment.

In most cases, the trustee will be under no obligation to exercise any of its rights or powers under the indenture at the request or direction of any of the holders unless those holders have offered to the trustee indemnity satisfactory to it. Subject to this provision for indemnification, the holders of a majority in principal amount of the outstanding debt securities of a series (or of all debt securities issued under the applicable indenture that are affected, voting as one class) generally may direct the time, method and place of:

•conducting any proceeding for any remedy available to the trustee; or

•exercising any trust or power conferred on the trustee relating to or arising as a result of an event of default.

If an event of default occurs and is continuing, the trustee will be required to use the degree of care and skill of a prudent person in the conduct of his own affairs.

The indentures require the issuer to furnish to the trustee annually a statement as to the issuer’s performance of certain of the issuer’s obligations under the indentures and as to any default in performance.

Defeasance and Discharge

Defeasance. When we use the term defeasance, we mean discharge from some or all of the issuer’s obligations under the indenture. If the issuer deposits with the trustee under the indenture any combination of money or government securities sufficient to make payments on the debt securities of a series issued under the indenture on the dates those payments are due, then, at the issuer’s option, either of the following will occur:

•the issuer will be discharged from the issuer’s obligations with respect to the debt securities of that series (“legal defeasance”); or

•the issuer will no longer have any obligation to comply with specified restrictive covenants with respect to the debt securities of that series, the covenant described under “-Consolidation, Merger and Sales of Assets” and other specified covenants under the indenture, and the related events of default will no longer apply (“covenant defeasance”).

If a series of debt securities is defeased, the holders of the debt securities of that series will not be entitled to the benefits of the applicable indenture, except for obligations to register the transfer or exchange of debt securities, replace stolen, lost or mutilated debt securities or maintain paying agencies and hold money for payment in trust. In the case of covenant defeasance, the issuer’s obligation to pay principal, premium and interest on the debt securities will also survive.

Unless the issuer informs you otherwise in the prospectus supplement, the issuer will be required to deliver to the trustee an opinion of counsel that the deposit and related defeasance would not cause the holders of the debt securities to recognize income, gain or loss for U.S. federal income tax purposes and that the holders would be subject to U.S. federal income tax on the same amounts, in the same manner and at the same times as would have been the case if the deposit and related defeasance had not occurred. If the issuer elects legal defeasance, that

opinion of counsel must be based upon a ruling from the United States Internal Revenue Service or a change in law to that effect.

Satisfaction and Discharge. In addition, the indenture will cease to be of further effect with respect to the debt securities of a series issued under the indenture, subject to exceptions relating to compensation and indemnity of the trustee under the indenture and repayment to the issuer of excess money or government securities, when either:

•all outstanding debt securities of that series have been delivered to the trustee for cancellation; or

•all outstanding debt securities of that series not delivered to the trustee for cancellation either:

◦have become due and payable,

◦will become due and payable at their stated maturity within one year, or

◦are to be called for redemption within one year; and

◦the issuer has deposited with the trustee any combination of money or government securities in trust sufficient to pay the entire indebtedness on the debt securities of that series when due; and the issuer has paid all other sums payable by the issuer with respect to the debt securities of that series.

Book-Entry Debt Securities

The issuer may issue the debt securities of a series in the form of one or more global debt securities that would be deposited with a depositary or its nominee identified in the prospectus supplement. The issuer may issue global debt securities in either temporary or permanent form. The issuer will describe in the prospectus supplement the terms of any depositary arrangement and the rights and limitations of owners of beneficial interests in any global debt security.

Governing Law

New York law will govern the indenture and the debt securities.

The Trustee

The issuer will name the trustee under the indenture in the prospectus supplement. The trustee will be qualified to act under the Trust Indenture Act of 1939, as amended.

DESCRIPTION OF CAPITAL STOCK

Berry Corp.’s authorized capital stock consists of 750,000,000 shares of common stock, par value $0.001 per share, and 250,000,000 shares of preferred stock, par value $0.001 per share. As of July 31, 2022 there were 78,760,354 shares of common stock and no shares of preferred stock outstanding.

The following description of the capital stock of Berry Corp. is based upon the Second Amended and Restated Certificate of Incorporation of Berry Corp. (the “Certificate of Incorporation”), the Third Amended and Restated Bylaws of Berry Corp. (the “Bylaws”) and applicable provisions of law. We have summarized certain portions of the Certificate of Incorporation and the Bylaws below. The summary is not complete and is subject to, and is qualified in its entirety by express reference to, the provisions of applicable law and to the Certificate of Incorporation and Bylaws.

Common Stock

Dividends

Holders of the common stock are entitled to dividends in the amounts and at the times declared by Berry Corp.’s board of directors in its discretion out of any assets or funds of Berry Corp. legally available for the payment of dividends.

Voting

Each holder of shares of the common stock is entitled to one vote for each share of the common stock on all matters presented to the stockholders of Berry Corp. (including the election of directors). The holders of shares of common stock have no cumulative voting rights. All elections of directors are determined by a plurality of the votes cast, and except as otherwise required by law or by the rules of any stock exchange upon which Berry Corp.’s securities are listed or as otherwise provided in the Bylaws or Certificate of Incorporation, all other matters are determined by a majority of the votes cast affirmatively or negatively, on such matter. In addition, the board of directors has adopted a policy whereby in an uncontested election of directors, any nominee who receives a greater number of “withhold” votes with respect to his or her election than votes “for” his or her election must offer their resignation. Action required or permitted to be taken at an annual or special meeting of stockholders may be taken without a meeting or vote if a written consent setting forth the action is signed by at least the minimum number of votes necessary to authorize or take such action at a meeting.

Liquidation

The holders of the common stock will share equally and ratably in Berry Corp.’s assets on liquidation after payment or provision for all liabilities and any preferential liquidation rights of any preferred stock then outstanding.

Other Rights

The holders of the common stock do not have preemptive rights to purchase shares of Berry Corp.’s stock. The common stock is not convertible, redeemable, assessable or entitled to the benefits of any sinking or repurchase fund. The rights, preferences and privileges of holders of the common stock will be subject to those of the holders of any shares of preferred stock that Berry Corp. may issue in the future.

Under the terms of the Certificate of Incorporation, Berry Corp. is prohibited from issuing any non-voting equity securities to the extent required under Section 1123(a)(6) of the U.S. Bankruptcy Code (“Bankruptcy Code”) and only for so long as Section 1123 of the Bankruptcy Code is in effect and applicable to Berry Corp.

Preferred Stock

The Certificate of Incorporation authorizes our board of directors, subject to any limitations prescribed by law, without further stockholder approval, to establish and to issue from time to time one or more classes or series of preferred stock, par value $0.001 per share, covering up to an aggregate of 250,000,000 shares of preferred stock. The board of directors may determine the number of shares in each such series and fix the designation, powers, preferences, rights, qualifications, limitations and restrictions of such series. The number of authorized shares of preferred stock may be increased or decreased by the affirmative vote of the holders of a majority of the voting power of all then-outstanding shares of capital stock of Berry Corp. entitled to vote thereon, without a vote of the holders of the preferred stock, or of any series thereof, unless a vote of any such holders is required pursuant to the terms of any preferred stock designation.

Limitation of Liability of Directors and Indemnification Matters

The Certificate of Incorporation provides that no director shall be personally liable to Berry Corp. or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability (i) for any breach of the director’s duty of loyalty to Berry Corp. or its stockholders, (ii) for any act or omission not in good faith or which involves intentional misconduct or a knowing violation of law, (iii) under Section 174 of the Delaware General Corporation Law (the “DGCL”) or (iv) for any transaction from which the director derived an improper personal benefit. The effect of this provision is to eliminate Berry Corp.’s and its stockholders’ rights, through stockholders’ derivative suits on Berry Corp.’s behalf, to recover monetary damages against a director for certain breaches of fiduciary duty as a director.

Any amendment, repeal or modification of these provisions will be prospective only and would not affect any limitation on liability of a director for acts or omissions that occurred prior to any such amendment, repeal or modification.

Berry Corp. has entered into indemnification agreements with each of its directors and executive officers. These indemnification agreements require Berry Corp. to indemnify these individuals to the fullest extent permitted under Delaware law against liabilities that may arise by reason of their service as a director or executive officer of Berry Corp. In addition, Berry Corp. is also required to advance expenses incurred by such individuals in connection with any proceeding arising by reason of their service. The Certificate of Incorporation also provides that we will indemnify our directors and officers to the fullest extent permitted under Delaware law.

Anti-Takeover Provisions of the Certificate of Incorporation, the Bylaws and the DGCL

The Certificate of Incorporation, the Bylaws and the DGCL contain provisions that may have some anti-takeover effects and may delay, defer or prevent a takeover attempt or a removal of Berry Corp.’s incumbent officers or directors that a stockholder might consider in his, her or its best interest, including those attempts that might result in a premium over the market price for shares held by the stockholders.

Delays in or Prevention of a Change in Control

Provisions in Berry Corp.’s Bylaws could have an effect of delaying, deferring or preventing a change in control of Berry Corp.

Amendment of the Bylaws

The Certificate of Incorporation and the Bylaws grant to the board of directors the power to adopt, amend, restate or repeal the Bylaws, as permitted under the DGCL, provided that no bylaw adopted by the stockholders may be amended, repealed or readopted by the board of directors if such bylaw so provides. The stockholders may adopt, amend, restate or repeal the Bylaws but only by a vote of holders of a majority in voting power of the outstanding shares of stock entitled to vote thereon, voting together as a single class in addition to any approval required by law, the Bylaws or the terms of any preferred stock.

Other Limitations on Stockholder Actions

•Advance notice is required for stockholders to nominate directors or to submit proposals for consideration at meetings of stockholders. These procedures provide that notice of stockholder proposals must be timely given in writing to our corporate secretary prior to the meeting at which the action is to be taken. Generally, to be timely, notice must be received at our principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary date we first mailed our proxy materials for the annual meeting for the preceding year. The Bylaws specify the requirements as to form and content of all stockholders’ notices. These requirements may preclude stockholders from bringing matters before the stockholders at an annual or special meeting,

•Directors may be removed from office, either for or without cause, by the affirmative vote of the holders of a majority of the voting power of the then-outstanding shares of capital stock entitled to vote generally in the election of directors.

•Stockholders may call a special meeting only upon request of at least 25% of the voting power of the shares entitled to vote in the election of directors.

Forum Selection

The Certificate of Incorporation generally provides that unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware (the “Court of Chancery”) will, to the fullest extent permitted by applicable law, be the sole and exclusive forum for:

•any derivative action or proceeding brought on our behalf;

•any action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers or other employees to us or our stockholders;

•any action asserting a claim against us or our directors, officers or employees arising pursuant to any provision of the DGCL, our Certificate of Incorporation or Bylaws; or

•any action asserting a claim against us or our directors, officers or employees that is governed by the internal affairs doctrine;

in each such case subject to such Court of Chancery having personal jurisdiction over the indispensable parties named as defendants therein.

The exclusive forum provision would not apply to suits brought to enforce any liability or duty created by the Securities Act of 1933, as amended (“Securities Act”) or the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or any other claim for which the federal courts have exclusive jurisdiction. To the extent that any such claims may be based on federal law claims, Section 27 of the Exchange Act creates exclusive jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. Furthermore, Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder.

Although we believe these provisions will benefit us by providing increased consistency in the application of Delaware law for the specified types of actions and proceedings, the provisions may have the effect of discouraging lawsuits against our directors, officers, employees and agents. The enforceability of similar exclusive forum provisions in other companies’ certificates of incorporation has been challenged in legal proceedings, and it is possible that, in connection with one or more actions or proceedings described above, a court could rule that this provision in the Certificate of Incorporation is inapplicable or unenforceable.

Corporate Opportunity

Under the Certificate of Incorporation, to the extent permitted by law:

•our stockholders are permitted to make investments in competing businesses;

•if any individual who is a director of Berry Corp. and is otherwise an employee, officer or a director of a stockholder (each such person, a “Dual Role Person”) becomes aware of a potential business opportunity, transaction or other matter, they will have no duty to communicate or offer that opportunity to us; and

•we have renounced our interest in, or in being offered an opportunity to participate in, such corporate opportunities presented to a Dual Role Person.

Newly Created Directorships and Vacancies on the Board of Directors

Under the Bylaws any vacancies on the board of directors for any reason and any newly created directorships resulting from any increase in the number of directors may be filled (i) by the board of directors upon a vote of a majority of the remaining directors then in office, even if they constitute less than a quorum of the board of directors or by a sole remaining director or (ii) by the stockholders at a special or annual meeting or by written consent of holders of a majority of the voting power of the shares entitled to vote in connection with the election of the directors, voting together as a single class.

Registration Rights

The Amended and Restated Registration Rights Agreement, dated June 28, 2018, among Berry Corp. and the holder party thereto (the “Registration Rights Agreement”) generally requires us to file a shelf registration statement with the SEC as soon as practicable. We filed such shelf registration statement, as amended, with the SEC on December 11, 2018 (File No. 333-228740).

The Registration Rights Agreement also requires us to effect demand registrations, which the specified holders may request to be underwritten, and underwritten shelf takedowns from the initial shelf registration if requested by holders of a specified percentage of Registrable Securities (as defined in the Registration Rights Agreement), subject to customary conditions and restrictions. If Registrable Securities are to be distributed in an underwritten public offering and our common stock is not then listed on a national securities exchange or quoted on a recognized trading market, we must use commercially reasonable efforts to cause the Registrable Securities to be listed on a national securities exchange as promptly as practicable.

If we propose to file a registration statement under the Securities Act or conduct a shelf takedown with respect to a public offering of any class of our equity securities, the specified holders have “piggyback” registration rights to include their Registrable Securities in the registration statement subject to customary conditions and restrictions.

At any time when we are required to file public reports with the SEC under the Securities Act or the Exchange Act, the Registration Rights Agreement requires us to use commercially reasonable efforts to timely comply with the reporting requirements. If we are not subject to these reporting requirements, we must make available information necessary for the specified holders of Registrable Securities to resell their Registrable Securities in compliance with Section 4(a)(7), Rule 144, Rule 144A and Regulation S, if available, without registration under the Securities Act and within the limitations of the applicable exemptions.

The Registration Rights Agreement will terminate when there are no longer any Registrable Securities outstanding. As of August 31, 2022, there were up to 34,542,168 shares of our common stock registered for resale pursuant to our obligations under the Registration Rights Agreement.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, LLC (“AST”). AST’s address is 6201 15th Avenue, Brooklyn, New York 11219, and AST’s phone number is (718) 921-8200.

Listing

Our common stock is listed on the NASDAQ under the symbol “BRY.”

PLAN OF DISTRIBUTION

We may sell securities pursuant to this prospectus and any accompanying prospectus supplement in and outside the United States (1) through underwriters or dealers, (2) directly to purchasers, including our affiliates and stockholders, (3) through agents, (4) in “at the market offerings” to or through a market maker or into an existing trading market, or in a rights offering or a securities exchange or otherwise or (5) through a combination of any of these methods. The prospectus supplement, if required, will include the following information:

•the terms of the offering;

•the names of any underwriters or agents;

•the name or names of any managing underwriter or underwriters;

•the purchase price of the securities;

•the estimated net proceeds to us from the sale of the securities;

•any delayed delivery arrangements;

•any underwriting discounts, commissions and other items constituting underwriters’ compensation;

•any discounts or concessions allowed or reallowed or paid to dealers; and

•any commissions paid to agents.

Sale Through Underwriters or Dealers

If underwriters are used in the sale, the underwriters will acquire the securities for their own account for resale to the public, either on a firm commitment basis or a best efforts basis. The underwriters may resell the securities from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale. Underwriters may offer securities to the public either through underwriting syndicates represented by one or more managing underwriters or directly by one or more firms acting as underwriters. Unless we inform you otherwise in the prospectus supplement, the obligations of the underwriters to purchase the securities will be subject to certain conditions. The underwriters may change from time to time any offering price and any discounts or concessions allowed or reallowed or paid to dealers.

During and after an offering through underwriters, the underwriters may purchase and sell the securities in the open market. These transactions may include overallotment and stabilizing transactions and purchases to cover syndicate short positions created in connection with the offering. The underwriters may also impose a penalty bid, which means that selling concessions allowed to syndicate members or other broker-dealers for the offered securities sold for their account may be reclaimed by the syndicate if the offered securities are repurchased by the syndicate in stabilizing or covering transactions. These activities may stabilize, maintain or otherwise affect the market price of the offered securities, which may be higher than the price that might otherwise prevail in the open market. If commenced, the underwriters may discontinue these activities at any time.

If dealers are used, we will sell the securities to them as principals. The dealers may then resell those securities to the public at varying prices determined by the dealers at the time of resale. We will include in the prospectus supplement the names of the dealers and the terms of the transaction.

Direct Sales and Sales Through Agents

We may sell the securities directly. In this case, no underwriters or agents would be involved. We may also sell the securities through agents designated from time to time. In the prospectus supplement, we will name any agent involved in the offer or sale of the offered securities, and we will describe any commissions payable to the agent. Unless we inform you otherwise in the prospectus supplement, any agent will agree to use its reasonable best efforts to solicit purchases for the period of its appointment.

We may sell the securities directly to institutional investors or others who may be deemed to be underwriters within the meaning of the Securities Act with respect to any sale of securities. We will describe the terms of any such sales in the prospectus supplement.

Remarketing Arrangements

Offered securities may also be offered and sold, if so indicated in the applicable prospectus supplement, in connection with a remarketing upon their purchase, in accordance with a redemption or repayment pursuant to their terms, or otherwise, by one or more remarketing firms, acting as principals for their own accounts or as agents for us. Any remarketing firm will be identified and the terms of its agreements, if any, with us and its compensation will be described in the applicable prospectus supplement. Remarketing firms may be deemed to be underwriters, as that term is defined in the Securities Act, in connection with the securities remarketed.

Delayed Delivery Contracts

If we so indicate in the prospectus supplement, we may authorize agents, underwriters or dealers to solicit offers from certain types of institutions to purchase securities from us at the public offering price under delayed delivery contracts. These contracts would provide for payment and delivery on a specified date in the future. The contracts would be subject only to those conditions described in the prospectus supplement. The prospectus supplement will describe the commission payable for solicitation of those contracts.

General Information

We may have agreements with the agents, dealers, underwriters and remarketing firms to indemnify them against certain civil liabilities, including liabilities under the Securities Act, or to contribute with respect to payments that the agents, dealers, underwriters or remarketing firms may be required to make. Agents, dealers, underwriters and remarketing firms may be customers of, engage in transactions with, or perform services for us in the ordinary course of their businesses.

Unless otherwise specified in the applicable prospectus supplement each series of securities will be a new issue and will have no established trading market, other than our common stock, which is listed on the NASDAQ. We may elect to list any series of securities on an exchange, but we are not obligated to do so.

LEGAL MATTERS

The validity of our securities offered by this prospectus will be passed upon for us by Vinson & Elkins L.L.P., Houston, Texas. Any underwriters or agents will be advised about other issues relating to any offering by their own counsel to be named in an applicable prospectus supplement.

EXPERTS

The consolidated financial statements of Berry Corporation (bry) and its subsidiaries as of December 31, 2021 and 2020, and for each of the years in the three-year period ended December 31, 2021, have been incorporated by reference herein in reliance upon the report of KPMG LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in auditing and accounting.

Certain estimates of our oil and natural gas reserves and related information included or incorporated by reference in this prospectus have been derived from reports prepared by the independent engineering firm, DeGolyer and MacNaughton. All such information has been so included on the authority of such firms as experts regarding the matters contained in their reports.

Berry Corporation (bry)

$500,000,000

Common Stock

Preferred Stock

Debt Securities

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

Set forth below is a table of the registration fee for the SEC and estimates of all other expenses to be paid by the registrant in connection with the issuance and distribution of the securities described in the registration statement:

| | | | | |

SEC registration fee | $ 46,350 |

Accounting fees and expenses | * |

Legal fees and expenses | * |

Printing and engraving fees and expenses | * |

Miscellaneous | * |

Total | $ * |

* These fees are calculated based on the number of issuances and amount of securities offered and accordingly cannot be estimated at this time.

Item 15. Indemnification of Directors and Officers.

We are incorporated in Delaware. Under Section 145 of the DGCL, a Delaware corporation has the power, under specified circumstances, to indemnify its directors, officers, employees and agents in connection with actions, suits or proceedings, whether civil, criminal or administrative, brought against them by a third party or in the right of the corporation, by reason that they were or are such directors, officers, employees or agents, against expenses and liabilities incurred in any such action, suit or proceeding so long as they acted in good faith and in a manner that they reasonably believed to be in, or not opposed to, the best interests of such corporation, and with respect to any criminal action, that they had no reasonable cause to believe their conduct was unlawful. With respect to suits by or in the right of such corporation, however, indemnification is generally limited to attorneys’ fees and other expenses and is not available if such person is adjudged to be liable to such corporation unless the court determines that indemnification is appropriate. A Delaware corporation also has the power to purchase and maintain insurance for such persons. The statute provides that it is not exclusive of other indemnification that may be granted by a corporation’s certificate of incorporation, bylaws, disinterested director vote, stockholder vote, agreement or otherwise.

Section 102(b)(7) of the DGCL provides that a certificate of incorporation may contain a provision eliminating or limiting the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director provided that such provisions may not eliminate or limit the liability of a director (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 (relating to liability for unauthorized acquisitions or redemptions of, or dividends on, capital stock) of the DGCL, or (iv) for any transaction from which the director derived an improper personal benefit. Article 9 of the Certificate of Incorporation limits its directors’ personal liability to the fullest extent permitted by the DGCL. Article 10 of the Certificate of Incorporation provides that we will indemnify any director or officer who was or is a party or is threatened to be made a party to or is involved in any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (a “proceeding”), by reason of the fact that he or she is or was a director or officer of Berry Corp. or is or was serving at the request of Berry Corp. as a director, officer, manager, employee or agent of another corporation or of a limited liability company, partnership, joint venture, trust or other enterprise, except that we will indemnify any such person seeking indemnification in connection with a proceeding initiated by that person, only if that proceeding was authorized by the board of directors. The right to indemnification includes the right to be paid the expenses incurred in defending any such proceeding in advance of its final disposition.

We have also entered into indemnification agreements with each of our directors and officers which provide contractual rights to indemnity and expense advancement and include related provisions meant to facilitate the indemnitees’ receipt of such benefits. Under these indemnification agreements, we must maintain directors and officers insurance. The terms of the indemnification agreements provide that we will indemnify the officers and directors against all losses that occur as a result of the indemnitee’s corporate status, including, without limitation, all liability arising out of the sole, contributory, comparative or other negligence, or active or passive wrongdoing of the indemnitee. Except with respect to certain specified matters, the only limitation that will exist upon our indemnification obligations pursuant to the agreements is that we are not obligated to make any payment to an indemnitee that is finally adjudged to be prohibited by applicable law. Under the indemnification agreements, we also agree to pay all expenses for which we may be jointly liable with an indemnitee and to waive any potential right

of contribution we might otherwise have. Further, we agree to advance expenses to indemnitees in connection with proceedings brought as a result of the indemnitee’s corporate status.

The above discussion of the Certificate of Incorporation, indemnification agreements with our officers and directors, and Sections 102(b)(7) and 145 of the DGCL is not intended to be exhaustive and is qualified in its entirety by such Certificate of Incorporation, indemnification agreements, and statutes.

Berry Corp. currently maintains an insurance policy which, within the limits and subject to the terms and conditions thereof, covers certain expenses and liabilities that may be incurred by directors and officers in connection with proceedings that may be brought against them as a result of an act or omission committed or suffered while acting as a director or officer.

Item 16. Exhibits

| | | | | |

Exhibit

Number | Description |

| 1.1** | Form of Underwriting Agreement |

| 2.1 | |

| 3.1 | |

| 3.2 | |

| 3.3 | |

| 3.4 | |

| 4.1 | |

| 4.2 | |

| 4.3 | |

| 4.4 | |

| 4.5** | Form of Debt Securities |

| 4.6** | Form of Preferred Stock Designation |

| 5.1* | |

| 23.1* | |

| 23.2* | |

| 23.3* | |

| 24.1* | |

25.1† | Statement of Eligibility and Qualification of the Trustee under the Senior Indenture under the Trust Indenture Act of 1939, as amended on Form T-1 |

| 107* | |

____________

* Filed herewith.

** To be filed, if necessary, as an exhibit to a report pursuant to Section 13(a) or 15(d) of the Exchange Act or in a post-effective amendment to this registration statement.

† To be filed under subsection (a) of Section 310 of the Trust Indenture Act of 1939, as amended.

Item 17. Undertakings.

The undersigned registrant hereby undertakes:

(1) to file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement;

i. to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

ii. to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

iii. to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (i), (ii) and (iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) that, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof;

(3) to remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering;

(4) that, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

i. Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

ii. Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date;

(5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

i. Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

ii. Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

iii. The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or their respective securities provided by or on behalf of the undersigned registrant; and

iv. Any other communication that is an offer in any offering made by the undersigned registrant to the purchaser.

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of their counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

The undersigned registrant hereby undertakes that:

(1) For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b) (1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective.

(2) For the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

The undersigned registrant hereby undertakes to file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of Section 310 of the Trust Indenture Act in accordance with the rules and regulations prescribed by the Commission under Section 305(b)(2) of the Act.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Dallas, State of Texas, on September 1, 2022.

Berry Corporation (bry)

By: /s/A. T. “Trem” Smith

Name: A. T. “Trem” Smith

Title: President, Chief Executive Officer and Board Chair

Each person whose signature appears below hereby constitutes and appoints Arthur T. Smith, Cary D. Baetz and Danielle Hunter, and each of them, any of whom may act without the joinder of the other, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution for him or her in any and all capacities, to sign any or all amendments or post-effective amendments to this registration statement, or any registration statement for the same offering that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933, as amended, and to file the same, with exhibits hereto and other documents in connection therewith or in connection with the registration of the securities under the Securities Act of 1933, as amended, with the Securities and Exchange Commission, granting unto such attorneys-in-fact and agents full power and authority to do and perform each and every act and thing requisite and necessary in connection with such matters and hereby ratifying and confirming all that such attorneys-in-fact and agents or his or her substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities indicated on September 1, 2022.

Berry Corporation (bry)

| | | | | |

| Signature | Title |

| |

| /s/A.T. “Trem” Smith | President, Chief Executive Officer, and Board Chair |

| A.T. “Trem” Smith | (Principal Executive Officer) |

| |

| /s/Cary Baetz | Executive Vice President and Chief Financial Officer, |

| Cary Baetz | and Director (Principal Financial Officer) |

| |