FALSE000181809300018180932024-11-122024-11-120001818093us-gaap:CommonStockMember2024-11-122024-11-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 12, 2024

The Beauty Health Company

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39565 | | 85-1908962 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

2165 Spring Street

Long Beach, CA

(Address of principal executive offices)

(800) 603-4996

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | | SKIN | | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 12, 2024, The Beauty Health Company (the “Company”) issued a press release and will hold a conference call regarding its financial results for its quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished with this Item 2.02, including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

The Company is making reference to non-GAAP financial information in both the press release and the conference call. A reconciliation of GAAP to non-GAAP results is provided in the attached Exhibit 99.1 press release.

The Company announces material information to the public through a variety of means, including filings with the Securities and Exchange Commission, press releases, public conference calls, and on the Company’s investor relations website (https://investors.beautyhealth.com/) as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. |

| Description |

|

| |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: November 12, 2024 | The Beauty Health Company |

| | |

| By: | /s/ Michael Monahan |

| Name: | Michael Monahan |

| Title: | Chief Financial Officer |

BeautyHealth Reports Third Quarter 2024 Financial Results

Delivers third quarter net sales of $78.8 million;

Delivers improved profitability as strategic initiatives start to take hold

Successfully launches Hydralock HA Booster

Long Beach, Calif., November 12, 2024 – The Beauty Health Company (NASDAQ: SKIN) (“BeautyHealth”), home to flagship brand Hydrafacial, today announced financial results for the third quarter ended September 30, 2024 ("Q3 2024").

“We delivered revenue above the midpoint of our guidance, with growth in consumables sales driven by sustained demand for Hydrafacial treatments and the successful launch of the Hydralock HA Booster” said BeautyHealth Chief Executive Officer Marla Beck. “Our ability to expand gross margins and achieve adjusted EBITDA profitability in the third quarter reflects the positive impact of our operational excellence initiatives and disciplined expense management.”

Ms. Beck added, “During the quarter, we made the strategic decision to centralize our global manufacturing footprint in Long Beach by year-end and conclude our relationship with our third-party manufacturing partner in China. This move is a key step in simplifying our operations and aligning our business with the most scalable and profitable growth opportunities. We also completed a comprehensive evaluation of our sales organization and are implementing new processes, technologies and analytics to improve our lead pipeline and overall execution. Additionally, we strengthened our commercial leadership team with the appointments of a new Chief Revenue Officer and Chief Marketing Officer, both of whom joined BeautyHealth subsequent to quarter end. While there’s still more work to be done, we are confident that the actions we’ve taken to date are setting the foundation for our return to profitable growth and Hydrafacial’s long-term success.”

For the quarter, net sales of $78.8 million decreased (19.1)% relative to the same period in 2023. Third quarter results reflect lower equipment sales partially offset by steady growth in consumables net sales. The Company revised its full year net sales guidance lower due to continued pressure on delivery systems sales and improved its adjusted EBITDA guidance to reflect stronger profitability in the third quarter.

Key Operational and Business Metrics

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

Unaudited ($ in millions) (1) | 2024 | | 2023 | | 2024 | | 2023 |

| Delivery Systems net sales | $ | 27.6 | | | $ | 51.0 | | | $ | 98.6 | | | $ | 162.0 | |

| Consumables net sales | 51.2 | | | 46.4 | | | 152.2 | | | 139.2 | |

Total net sales | $ | 78.8 | | | $ | 97.4 | | | $ | 250.8 | | | $ | 301.2 | |

| Gross profit (loss) | $ | 40.6 | | | $ | (12.6) | | | $ | 130.0 | | | $ | 109.4 | |

| Gross margin | 51.6 | % | | (12.9) | % | | 51.8 | % | | 36.3 | % |

Adjusted gross profit(2) | $ | 54.7 | | | $ | 60.9 | | | $ | 151.2 | | | $ | 197.0 | |

Adjusted gross margin(2) | 69.5 | % | | 62.5 | % | | 60.3 | % | | 65.4 | % |

| Net loss | $ | (18.3) | | | $ | (73.8) | | | $ | (18.8) | | | $ | (90.7) | |

Adjusted EBITDA(2) | $ | 8.1 | | | $ | 9.1 | | | $ | 3.2 | | | $ | 21.0 | |

Adjusted EBITDA margin(2) | 10.2 | % | | 9.3 | % | | 1.3 | % | | 7.0 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

Unaudited | 2024 | | 2023 | | 2024 | | 2023 |

Total delivery systems sold | 1,118 | | | 2,140 | | | 3,820 | | | 6,736 | |

| Active install base | 34,162 | | | 30,074 | | | 34,162 | | | 30,074 | |

__________________________

(1) Amounts may not sum due to rounding.

(2) See "Non-GAAP Financial Measures" below.

Financial Highlights

•Net sales were $78.8 million for the third quarter of 2024, a decrease of (19.1)%, compared to the prior year period ("Q3 2023"), due to lower delivery systems net sales.

•Gross margin was 51.6% in Q3 2024 compared to (12.9)% in Q3 2023. The improvement in gross margin was primarily due to the absence of charges and inventory write-downs associated with the Syndeo Program of $63.1 million in Q3 2023 and lower inventory related charges and product costs, partially offset by $8 million of manufacturing optimization related costs incurred in 2024.

•Adjusted gross margin was 69.5% in Q3 2024 compared to 62.5% in Q3 2023. The improvement in adjusted gross margin was primarily due to lower inventory related charges and product costs, higher average selling price for equipment net sales, and favorable mix shift towards consumable net sales.

•Net loss was $(18.3) million in Q3 2024 compared to net loss of $(73.8) million in Q3 2023. The change compared to the prior year was primarily due to costs associated with the Syndeo Program in 2023.

•Adjusted EBITDA was $8.1 in Q3 2024 compared to adjusted EBITDA of $9.1 in Q3 2023. The decline in adjusted EBITDA was primarily due to lower net sales partially offset by higher gross margin and lower operational spend.

•The Company placed 1,118 delivery systems during the quarter compared to 2,140 in the prior year period, reflecting a challenging macroeconomic environment in addition to the prior year international launch of Syndeo Delivery System ("Syndeo").

Balance Sheet and Cash Flow Highlights

•Cash, cash equivalents, and restricted cash were approximately $358.9 million as of September 30, 2024 compared to approximately $523.0 million as of December 31, 2023. The change was primarily due to the repurchase of convertible senior notes during the first half of 2024.

•The Company had approximately 7 million private placement warrants and approximately 124.1 million shares of Class A common stock outstanding as of September 30, 2024.

Revised Financial Guidance as of November 2024

| | | | | |

| |

| |

| |

| |

| Fiscal Year 2024 | |

| Net sales | $322 – $332 million |

Adjusted EBITDA(1) | ($2) – $4 million |

__________________________

(1) See "Non-GAAP Financial Measures" below.

Revised financial guidance reflects the following assumptions:

•Revised full-year net sales guidance reflects continued downward pressure on delivery systems sales.

•Revised full-year adjusted EBITDA guidance reflects the improved Q3 2024 gross margin performance and reduction in operational spend.

•Assumes no material deterioration in general market conditions or other unforeseen circumstances beyond the Company's control, such as foreign currency exchange rates.

•Excludes any unannounced acquisitions, dispositions or financings.

Regional Operational and Business Metrics

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

Unaudited ($ in millions) (1) | 2024 | | 2023 | | 2024 | | 2023 |

| Delivery Systems net sales | | | | | | | |

| Americas | $ | 16.2 | | | $ | 20.3 | | | $ | 54.1 | | | $ | 73.1 | |

| Asia-Pacific (“APAC”) | 4.9 | | | 18.0 | | | 18.9 | | | 46.4 | |

| Europe, the Middle East and Africa (“EMEA”) | 6.5 | | | 12.7 | | | 25.6 | | | 42.4 | |

| Total Delivery Systems net sales | $ | 27.6 | | | $ | 51.0 | | | $ | 98.6 | | | $ | 162.0 | |

| | | | | | | |

| Consumables net sales | | | | | | | |

| Americas | $ | 35.6 | | | $ | 31.4 | | | $ | 105.8 | | | $ | 95.2 | |

APAC | 5.9 | | | 6.7 | | | 17.5 | | | 17.1 | |

| EMEA | 9.6 | | | 8.3 | | | 28.9 | | | 26.9 | |

| Total Consumables net sales | $ | 51.2 | | | $ | 46.4 | | | $ | 152.2 | | | $ | 139.2 | |

| | | | | | | |

| Net sales | | | | | | | |

| Americas | $ | 51.9 | | | $ | 51.7 | | | $ | 159.9 | | | $ | 168.3 | |

APAC | 10.8 | | | 24.7 | | | 36.4 | | | 63.5 | |

| EMEA | 16.1 | | | 21.1 | | | 54.4 | | | 69.3 | |

| Total net sales | $ | 78.8 | | | $ | 97.4 | | | $ | 250.8 | | | $ | 301.2 | |

| | | | | | | |

| Delivery Systems sold | | | | | | | |

| Americas | 634 | | | 776 | | | 2,046 | | | 2,844 | |

APAC | 215 | | | 752 | | | 771 | | | 1,942 | |

| EMEA | 269 | | | 612 | | | 1,003 | | | 1,950 | |

| Total Delivery Systems sold | 1,118 | | | 2,140 | | | 3,820 | | | 6,736 | |

__________________________

(1) Amounts may not sum due to rounding.

Conference Call

BeautyHealth will host a conference call on Tuesday, November 12, 2024, at 4:30 p.m. ET to review its third quarter 2024 financial results. The call may be accessed via live webcast through the Events & Presentations page on our Investor Relations website at https://investors.beautyhealth.com. A replay of the conference call will be available approximately three hours after the conclusion of the call and can be accessed online at https://investors.beautyhealth.com.

Non-GAAP Financial Measures

In addition to results determined in accordance with accounting principles generally accepted in the United States of America ("GAAP"), management utilizes certain non-GAAP financial measures such as adjusted gross profit, adjusted gross margin, adjusted EBITDA, and adjusted EBITDA margin for purposes of evaluating ongoing operations and for internal planning and forecasting purposes.

Management believes that these non-GAAP financial measures, when reviewed collectively with the Company’s GAAP financial information, provide useful supplemental information to investors in assessing the Company's operating performance. These non-GAAP financial measures should not be considered as an alternative to GAAP financial information or as an indication of operating performance or any other measure of performance derived in accordance with GAAP, and may not provide information that is directly comparable to that provided by other companies in its industry, as these other companies may calculate non-GAAP financial measures differently, particularly related to unusual items.

Adjusted gross profit is gross profit (loss) excluding the effects of depreciation expense, amortization expense, stock-based compensation expense and other items such as manufacturing optimization costs; write-off of discontinued, excess and obsolete product; Syndeo Program; and Syndeo product optimization logistics & service costs. Adjusted gross margin represents adjusted gross profit as a percentage of net sales.

Adjusted EBITDA is calculated as net loss excluding the effects of expense (benefit) for income taxes; depreciation expense; amortization expense; stock-based compensation expense; interest expense; interest income; other income, net; change in fair value of warrant liability; foreign currency (gain) loss, net; manufacturing optimization costs; write-off of discontinued, excess and obsolete product; Syndeo Program; Syndeo product optimization logistics & service costs; litigation related costs; transaction related costs; and severance, restructuring and other. Adjusted EBITDA margin represents adjusted EBITDA as a percentage of net sales.

The Company does not provide a reconciliation of its fiscal 2024 adjusted EBITDA guidance to net loss, the most directly comparable forward looking GAAP financial measures, due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, which cannot be done without unreasonable efforts, including adjustments that could be made for changes in fair value of warrant liabilities, integration and acquisition-related expenses, amortization expenses, non-cash stock-based compensation, gains/losses on foreign currency, and other charges reflected in our reconciliation of historic numbers, the amount of which, based on historical experience, could be significant. The presentation of this financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. The Company's fiscal 2024 adjusted EBITDA guidance is merely an outlook and is not a guarantee of future performance. Stockholders should not rely or place an undue reliance on such forward-looking statements. See “Forward-Looking Statements” for additional information.

The Beauty Health Company

Condensed Consolidated Statements of Comprehensive Income (Loss) (1)

($ in millions, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 78.8 | | | $ | 97.4 | | | $ | 250.8 | | | $ | 301.2 | |

| Cost of sales | 38.2 | | | 110.0 | | | 120.8 | | | 191.7 | |

| Gross profit (loss) | 40.6 | | | (12.6) | | | 130.0 | | | 109.4 | |

| Operating expenses: | | | | | | | |

| Selling and marketing | 27.6 | | | 30.7 | | | 91.8 | | | 112.5 | |

| Research and development | 1.1 | | | 1.8 | | | 5.1 | | | 7.1 | |

| General and administrative | 33.4 | | | 37.0 | | | 93.7 | | | 102.5 | |

| Total operating expenses | 62.2 | | | 69.5 | | | 190.6 | | | 222.0 | |

| Loss from operations | (21.5) | | | (82.1) | | | (60.6) | | | (112.6) | |

| Interest expense | 2.5 | | | 3.4 | | | 7.9 | | | 10.3 | |

| Interest income | (4.9) | | | (6.8) | | | (14.4) | | | (16.8) | |

| Other income, net | (0.1) | | | (4.9) | | | (33.5) | | | (5.3) | |

| Change in fair value of warrant liabilities | (0.4) | | | (5.9) | | | (3.0) | | | (8.4) | |

| Foreign currency transaction (gain) loss, net | (2.3) | | | 2.3 | | | 0.2 | | | 0.7 | |

| Loss before provision for income taxes | (16.3) | | | (70.3) | | | (17.8) | | | (93.1) | |

| Income tax expense (benefit) | 1.9 | | | 3.5 | | | 0.9 | | | (2.4) | |

| Net loss | (18.3) | | | (73.8) | | | (18.8) | | | (90.7) | |

| Comprehensive loss, net of tax: | | | | | | | |

| Foreign currency translation adjustments | 1.2 | | | (1.1) | | | (0.7) | | | (0.6) | |

| Comprehensive loss | $ | (17.1) | | $ | (74.9) | | $ | (19.4) | | $ | (91.3) |

| Net loss per share | | | | | | | |

| Basic | $ | (0.15) | | $ | (0.56) | | $ | (0.15) | | $ | (0.68) |

| Diluted | $ | (0.15) | | $ | (0.56) | | $ | (0.31) | | $ | (0.68) |

| Weighted average common shares outstanding | | | | | | | |

| Basic | 124,057,602 | | | 132,896,626 | | | 123,630,811 | | | 132,679,547 | |

| Diluted | 124,057,602 | | | 132,896,626 | | | 142,667,209 | | | 132,679,547 | |

__________________________

(1)Amounts may not sum due to rounding.

The Beauty Health Company

Condensed Consolidated Balance Sheets (1)

($ in millions)

(Unaudited)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash, cash equivalents, and restricted cash | $ | 358.9 | | $ | 523.0 |

| Accounts receivable, net | 36.3 | | 54.7 |

| Inventories | 73.4 | | 91.3 |

| Income tax receivable | 0.4 | | 0.3 |

| Prepaid expenses and other current assets | 16.0 | | 28.9 |

| Total current assets | 485.0 | | 698.3 |

| Property and equipment, net | 7.6 | | 14.2 |

| Right-of-use assets, net | 14.6 | | 12.1 |

| Intangible assets, net | 51.0 | | 62.1 |

| Goodwill | 125.5 | | 125.8 |

| Deferred income tax assets, net | 1.2 | | 0.5 |

| Other assets | 14.7 | | 16.0 |

| TOTAL ASSETS | $ | 699.5 | | $ | 929.1 |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 23.1 | | $ | 44.8 |

| Accrued payroll-related expenses | 16.5 | | 22.0 |

| Lease liabilities, current | 4.8 | | 4.6 |

| Income tax payable | 1.4 | | 2.8 |

Syndeo Program reserves | — | | 21.0 |

| Other accrued expenses | 28.1 | | 19.8 |

| Total current liabilities | 73.9 | | 115.0 |

| Lease liabilities, non-current | 12.1 | | 9.3 |

| Deferred income tax liabilities, net | 1.1 | | 0.7 |

| Warrant liabilities | 0.6 | | 3.6 |

| Convertible senior notes, net | 551.4 | | 738.4 |

| Other long-term liabilities | 0.7 | | 2.8 |

| TOTAL LIABILITIES | $ | 639.8 | | $ | 869.7 |

| | | |

| Stockholders’ equity: | | | |

Class A Common Stock | $ | — | | | $ | — | |

| Additional paid-in capital | 561.1 | | | 541.3 | |

| Accumulated other comprehensive loss | (3.7) | | | (3.0) | |

| Accumulated deficit | (497.6) | | | (478.9) | |

| Total stockholders’ equity | $ | 59.7 | | | $ | 59.4 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 699.5 | | | $ | 929.1 | |

__________________________

(1)Amounts may not sum due to rounding.

The Beauty Health Company

Condensed Consolidated Statement of Cash Flows (1)

($ in millions)

(Unaudited)

| | | | | | | | | | | | |

| Nine Months Ended September 30, | |

| 2024 | | 2023 | |

| Cash, cash equivalents, and restricted cash at beginning of period | $ | 523.0 | | $ | 568.2 | |

| Operating activities: | | | | |

| Net loss | (18.8) | | | (90.7) | | |

| Non-cash adjustments: | 51.6 | | | 82.2 | | |

| Change in operating assets and liabilities: | | | | |

| Accounts receivable | 13.3 | | | 6.0 | | |

| Inventories | (7.5) | | | 3.4 | | |

| Prepaid expenses, other current assets, and income tax receivable | 8.0 | | | (16.2) | | |

| Accounts payable, accrued expenses, and income tax payable | (39.5) | | | 50.1 | | |

| Other, net | (7.5) | | | (7.9) | | |

| Net cash (used for) provided by operating activities | (0.3) | | | 26.9 | | |

| Net cash used for investing activities | (5.9) | | | (29.3) | | |

| Net cash used for financing activities | (157.6) | | | (6.1) | | |

| Net change in cash, cash equivalents, and restricted cash | (163.8) | | | (8.5) | | |

| Effect of foreign currency translation | (0.3) | | | (0.2) | | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 358.9 | | | $ | 559.4 | | |

__________________________

(1)Amounts may not sum due to rounding.

The following table reconciles gross profit (loss) to adjusted gross profit for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

Unaudited ($ in millions) (1) | 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 78.8 | | | $ | 97.4 | | | $ | 250.8 | | | $ | 301.2 | |

| | | | | | | |

| Gross profit (loss) | $ | 40.6 | | | $ | (12.6) | | | $ | 130.0 | | | $ | 109.4 | |

| Gross margin | 51.6 | % | | (12.9) | % | | 51.8 | % | | 36.3 | % |

| | | | | | | |

| Adjusted to exclude the following: | | | | | | | |

| Depreciation expense | 1.0 | | | 0.7 | | | 1.8 | | | 1.8 | |

| Amortization expense | 3.2 | | | 2.7 | | | 9.8 | | | 9.7 | |

| Stock-based compensation expense | 0.2 | | | 0.5 | | | (0.1) | | | 1.2 | |

| Manufacturing optimization costs | 7.6 | | | — | | | 7.6 | | | — | |

| Write-off of discontinued, excess and obsolete product | 2.0 | | | 6.4 | | | 2.0 | | | 10.4 | |

| Syndeo Program | — | | | 63.1 | | | — | | | 63.1 | |

| Syndeo product optimization logistics & service costs | — | | | — | | | — | | | 1.4 | |

| Adjusted gross profit | $ | 54.7 | | | $ | 60.9 | | | $ | 151.2 | | | $ | 197.0 | |

| Adjusted gross margin | 69.5 | % | | 62.5 | % | | 60.3 | % | | 65.4 | % |

__________________________(1)Amounts may not sum due to rounding.

The following table reconciles net loss to adjusted EBITDA for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

Unaudited ($ in millions) (1) | 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 78.8 | | | $ | 97.4 | | | $ | 250.8 | | | $ | 301.2 | |

| | | | | | | |

| Net loss | $ | (18.3) | | | $ | (73.8) | | | $ | (18.8) | | | $ | (90.7) | |

| Adjusted to exclude the following: | | | | | | | |

| Expense (benefit) for income taxes | 1.9 | | | 3.5 | | | 0.9 | | | (2.4) | |

| Depreciation expense | 3.1 | | | 2.5 | | | 8.5 | | | 7.0 | |

| Amortization expense | 6.5 | | | 5.5 | | | 18.6 | | | 17.7 | |

| Stock-based compensation expense | 7.7 | | | 8.2 | | | 20.8 | | | 20.3 | |

| Interest expense | 2.5 | | | 3.4 | | | 7.9 | | | 10.3 | |

| Interest income | (4.9) | | | (6.8) | | | (14.4) | | | (16.8) | |

| Other income, net | (0.1) | | | (4.9) | | | (33.5) | | | (5.3) | |

| Change in fair value of warrant liabilities | (0.4) | | | (5.9) | | | (3.0) | | | (8.4) | |

| Foreign currency (gain) loss, net | (2.3) | | | 2.3 | | | 0.2 | | | 0.7 | |

| Manufacturing optimization costs | 7.6 | | | — | | | 7.6 | | | — | |

| Write-off of discontinued, excess and obsolete product | 2.0 | | | 6.4 | | | 2.0 | | | 10.4 | |

| Syndeo Program | — | | | 63.1 | | | — | | | 63.1 | |

| Syndeo product optimization logistics & service costs | — | | | — | | | — | | | 1.4 | |

| Litigation related costs | 2.5 | | | — | | | 3.7 | | | 1.5 | |

| Transaction related costs | — | | | — | | | — | | | 0.8 | |

| Severance, restructuring and other | 0.2 | | | 5.5 | | | 2.5 | | | 11.3 | |

| Adjusted EBITDA | $ | 8.1 | | | $ | 9.1 | | | $ | 3.2 | | | $ | 21.0 | |

| Adjusted EBITDA margin | 10.2 | % | | 9.3 | % | | 1.3 | % | | 7.0 | % |

__________________________

(1)Amounts may not sum due to rounding.

About The Beauty Health Company

The Beauty Health Company (NASDAQ: SKIN) is a global category-creating company delivering millions of skin health experiences every year that help consumers reinvent their relationship with their skin, bodies and self-confidence. Our brands are pioneers: Hydrafacial™ in hydradermabrasion, SkinStylus™ in microneedling, and Keravive™ in scalp health. Together, with our powerful global community of estheticians, partners and consumers, we are personalizing skin health for all ages, genders, skin tones, and skin types. We are committed to being ever more mindful in how we conduct our business to positively impact our communities and the planet. Find a local provider at https://hydrafacial.com/find-a-provider/, and learn more at beautyhealth.com or LinkedIn.

Forward-Looking Statements

Certain statements made in this release are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, including statements regarding The Beauty Health Company’s strategy, plans, objectives, initiatives and financial outlook. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside The Beauty Health Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. As such, readers are cautioned not to place undue reliance on any forward-looking statements.

Important factors that may affect actual results or outcomes include, among others: The Beauty Health Company’s ability to manage growth; The Beauty Health Company’s ability to execute its business plan; potential litigation involving The Beauty Health Company; changes in applicable laws or regulations; the possibility that The Beauty Health Company may be adversely affected by other economic, business, and/or competitive factors; and other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the U.S. Securities and Exchange Commission (the “SEC”) and in the Company’s subsequent filings with the SEC. There may be additional risks that the Company does not presently know of or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. The Beauty Health Company does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Contacts

Investors: IR@beautyhealth.com

Press: Press@beautyhealth.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementEquityComponentsAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

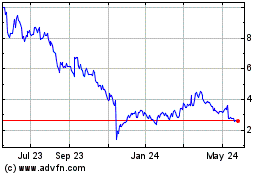

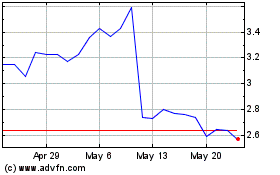

Beauth Health (NASDAQ:SKIN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Beauth Health (NASDAQ:SKIN)

Historical Stock Chart

From Feb 2024 to Feb 2025