SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

(Amendment No. 2)

(Rule 13d-101)

Under the Securities Exchange Act of 1934

AYTU BIOPHARMA, INC.

(Name of Issuer)

Common

Stock, par value $0.0001 per share

(Title of Class of Securities)

054754858

(CUSIP NUMBER)

Taki Vasilakis

130 Main St. 2nd

Floor

New Canaan, CT 06840

(203) 308-4440

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

June 14, 2024

(Date of event which requires filing of this statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g) check the following box ¨.

The information required in the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as

amended (the “Act”), or otherwise subject to the liabilities of that section of the Act but shall be subject to all other

provisions of the Act.

| CUSIP No. 054754858 |

SCHEDULE 13D |

Page 2 of 7 |

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Nantahala Capital Management, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨

(b) ¨

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS*

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e)

¨

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Massachusetts |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

1,086,812 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

1,086,812 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,086,812 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES*

¨

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

18.2%1 |

| 14 |

TYPE OF REPORTING PERSON*

IA, OO |

1 See Item 5.

| CUSIP No. 054754858 |

SCHEDULE 13D |

Page 3 of 7 |

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Wilmot B. Harkey |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨

(b) ¨

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS*

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e)

¨

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

1,086,812 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

1,086,812 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,086,812 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES*

¨

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

18.2%1 |

| 14 |

TYPE OF REPORTING PERSON*

HC, IN |

1 See Item 5.

| CUSIP No. 054754858 |

SCHEDULE 13D |

Page 4 of 7 |

| 1 |

NAME OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Daniel Mack |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨

(b) ¨

|

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS*

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(d) or 2(e)

¨

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

1,086,812 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

1,086,812 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,086,812 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES*

¨

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

18.2%1 |

| 14 |

TYPE OF REPORTING PERSON*

HC, IN |

1 See Item 5.

| CUSIP No. 054754858 |

SCHEDULE 13D |

Page 5 of 7 |

EXPLANATORY NOTE

This Amendment No. 2 (“Amendment

No. 2”) amends and supplements the Schedule 13D filed with the Securities and Exchange Commission on behalf of Nantahala Capital

Management, LLC, a Massachusetts limited liability company (“Nantahala”), Mr. Wilmot B. Harkey and Mr. Daniel Mack, the principals

of Nantahala (collectively, the “Reporting Persons”) on May 26, 2023 (the “Original Schedule 13D”), relating to

Common Stock, par value $0.0001 per share (the “Common Stock”), of Aytu BioPharma, Inc. a Delaware corporation (the “Issuer”)

as previously amended by the Reporting Persons on June 13, 2023. Capitalized

terms used but not defined in this Amendment No. 2 have the meanings set forth in the Original Schedule 13D as previously amended. Except

as specifically provided herein, this Amendment No. 1 does not modify any of the information reported in the Original Schedule 13D as

previously amended.

This Schedule 13D relates

to Common Stock of the Issuer purchased by Nantahala through the accounts of certain private funds and managed accounts (collectively,

the “Nantahala Investors”). Nantahala serves as the investment adviser to the Nantahala Investors and may direct the vote

and dispose of the 1,086,812 shares of Common Stock held by the Nantahala Investors. As the principals of Nantahala, Mr. Harkey and Mr.

Mack may direct the vote and disposition of the 1,086,812 shares of Common Stock held by the Nantahala Investors.

| Item 4. |

Purpose of the Transaction |

Item 4 of the Original Schedule

13D is amended and supplemented as follows:

On June 14, 2024, the Nantahala

Investors exercised their Tranche B warrants, paying approximately $1,296,114 to acquire Exchange Warrants entitling them to purchase

815,217 shares of Common Stock for $0.0001 per share. The Nantahala Investors may not exercise the

Exchange Warrants if such exercise would result in the Nantahala Investors beneficially owning in excess of 9.99% of the outstanding shares

of the Issuer’s Common Stock. The Exchange Warrants, which expire only when exercised in full, are in the same form as the

Pre-Funded Warrant attached as Exhibit 4.1 to Pre-effective Amendment No. 1 to the Registration

Statement on Form S-1, filed by the Issuer with the SEC on June 5, 2023.

| Item 5. |

Interest in Securities of the Issuer |

Item 5 of the Original Schedule

13D is amended and restated as follows:

(a) The aggregate percentage

of Common Stock beneficially owned by the Reporting Persons is based upon a total of 5,972,327 shares of Common Stock outstanding as of

June 18, 2024, as reported by the Issuer in a Current Report filed with the SEC on Form 8-K on the same date.

Nantahala, as the investment

adviser of the Nantahala Investors, may be deemed to beneficially own the 1,086,812 shares of Common Stock held by the Nantahala Investors,

representing approximately 18.2% of the issued and outstanding shares of Common Stock of the Issuer.

In addition, Mr. Harkey and

Mr. Mack, as principals of Nantahala, the investment adviser of the Nantahala Investors, may also be deemed to beneficially own the 1,086,812

shares of Common Stock beneficially held by the Nantahala Investors, representing approximately 18.2% of the issued and outstanding shares

of Common Stock of the Issuer.

(b) Nantahala, Mr. Harkey and Mr. Mack have

the shared power to vote and dispose of the Common Stock reported in this Schedule 13D.

(c) Other

than the transactions reported herein, no Reporting Person or Other Officer has effected any transactions in the Common Stock of the Issuer

since the Original 13D.

(d) The Nantahala Investors

hold the shares of Common Stock reported herein, including more than 5% of the outstanding shares of Common Stock beneficially owned by

the Reporting Persons but held by Blackwell Partners LLC - Series A. No person other than the Nantahala Investors is known to have the

right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, the Common Stock.

(e) Not applicable.

| CUSIP No. 054754858 |

SCHEDULE 13D |

Page 6 of 7 |

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

Item 6 of the Original Schedule

13D is amended and supplemented as follows:

The information set forth in

Item 4 to this Amendment No. 2 to Schedule 13D regarding the Exchange Warrants is incorporated herein by reference.

| Item 7. |

Material to be Filed as Exhibits |

| Exhibit 99.5 |

Form of Pre-Funded Warrant (incorporated by reference to Exhibit 4.10 to Pre-effective Amendment No. 1 to Registration Statement on Form S-1, filed by the Issuer with the SEC on June 5, 2023). |

| CUSIP No. 054754858 |

SCHEDULE 13D |

Page 7 of 7 |

Signatures

After reasonable inquiry and

to the best of their knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: June 18, 2024

| |

NANTAHALA CAPITAL MANAGEMENT, LLC |

| |

|

|

| |

|

|

| |

By: |

/s/ Taki Vasilakis |

| |

|

Taki Vasilakis |

| |

|

Chief Compliance Officer |

| |

|

|

| |

|

|

| |

/s/ Wilmot B. Harkey |

| |

Wilmot B. Harkey |

| |

|

|

| |

|

|

| |

/s/ Daniel Mack |

| |

Daniel Mack |

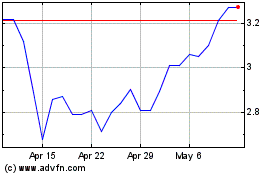

AYTU BioPharma (NASDAQ:AYTU)

Historical Stock Chart

From May 2024 to Jun 2024

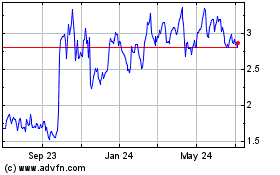

AYTU BioPharma (NASDAQ:AYTU)

Historical Stock Chart

From Jun 2023 to Jun 2024