UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment

No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒

Definitive Proxy Statement

☐

Definitive Additional Materials

☐

Soliciting Material Under Rule 14a-12

AYRO,

INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

☒

No fee required.

☐

Fee previously paid with preliminary materials.

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

AYRO,

INC.

900

E. Old Settlers Boulevard, Suite 100, Round Rock, Texas 78664

August

18, 2023

To

Our Stockholders:

You

are cordially invited to attend the special meeting of stockholders of AYRO, Inc. to be held at 12:00 p.m. Eastern Time on Thursday,

September 14, 2023. We have decided to hold this special meeting virtually via live webcast on the internet because hosting a virtual

special meeting enables greater stockholder attendance and participation from any location around the world, improves meeting efficiency

and our ability to communicate effectively with our stockholders, and reduces the cost and environmental impact of the special meeting.

You will be able to attend the special meeting, vote and submit your questions during the special meeting by visiting www.virtualshareholdermeeting.com/AYRO2023SM.

You will not be able to attend the special meeting in person.

Details

regarding the meeting, the business to be conducted at the meeting, and information about AYRO, Inc. that you should consider when you

vote your shares are described in the accompanying proxy statement.

At

the special meeting, we will ask stockholders (i) to authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance

of shares of our common stock, par value $0.0001 per share (“Common Stock”) underlying shares of convertible preferred stock

and warrants issued by us pursuant to the terms of that certain Securities Purchase Agreement, dated August 7, 2023, by and among AYRO,

Inc. and the investors named therein and an engagement agreement between the Company and Palladium Capital Group, LLC, in an amount equal

to or in excess of 20% of our Common Stock outstanding before the issuance of such convertible preferred stock and warrants (including

any amortization payments made to the holders of convertible preferred stock in the form of issuance of shares of Common Stock and upon

the operation of anti-dilution provisions contained in such convertible preferred stock and warrants), (ii) to approve an amendment

to our amended and restated certificate of incorporation, as amended (the “Charter”), to effect, at the discretion of our

board of directors (the “Board”) but prior to the one-year anniversary of the date of on which stockholders approve such

proposal, a reverse stock split of all of the outstanding shares of our Common Stock, at a ratio in the range of 1-for-2 to 1-for-10,

with such ratio to be determined by the Board in its discretion and included in a public announcement, (iii) to approve an amendment

to the Charter to increase the number of authorized shares of Common Stock from 100,000,000 to 200,000,000 and to make a corresponding

change to the number of authorized shares of capital stock, (iv) approve an amendment to the AYRO, Inc. 2020 Long-Term Incentive Plan

to increase the aggregate number of shares available for the grant of awards by 5,750,000 shares, to a total of 9,839,650 shares

of Common Stock, and (v) to adjourn the special meeting to a later date or dates, if necessary or appropriate, to permit further

solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of

the aforementioned proposals. The Board recommends the approval of these proposals. Such other business will be transacted as may properly

come before the special meeting.

We

hope you will be able to attend the special meeting. Whether or not you plan to attend the special meeting, we hope you will vote promptly.

Information about voting methods is set forth in the accompanying proxy statement.

Thank

you for your continued support of AYRO, Inc. We look forward to seeing you at the special meeting.

| Sincerely, |

|

| |

|

| /s/ Joshua N. Silverman |

|

| Joshua N. Silverman |

|

| Chairman of the Board of Directors |

|

AYRO,

INC.

900

E. Old Settlers Boulevard, Suite 100, Round Rock, Texas 78664

August

18, 2023

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TIME:

12:00 p.m. Eastern Time

DATE:

Thursday, September 14, 2023

ACCESS:

The

special meeting will be held at 12:00 p.m. Eastern Time on Thursday, September 14, 2023, virtually via live webcast on the Internet.

You will be able to attend the special meeting, vote and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/AYRO2023SM

and entering the 16-digit control number included in the proxy card that you receive. For further information about the virtual special

meeting, please see the Questions and Answers about the Meeting beginning on page 2.

PURPOSES:

| 1. |

A

proposal to authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our common stock,

par value $0.0001 per share (“Common Stock”) underlying shares of convertible preferred stock and warrants issued

by us pursuant to the terms of that certain Securities Purchase Agreement, dated August 7, 2023, by and among AYRO, Inc. (the “Company”)

and the investors named therein, and an engagement agreement between the Company and Palladium Capital Group, LLC, in an amount equal

to or in excess of 20% of our Common Stock outstanding before the issuance of such convertible preferred stock and warrants

(including any amortization payments made to the holders of such convertible preferred stock in the form of issuance of shares of

Common Stock and upon the operation of anti-dilution provisions contained in such convertible preferred stock and warrants)

(the “Issuance Proposal”); |

| 2. |

A

proposal to approve an amendment to our amended and restated certificate of incorporation, as amended (the “Charter”),

to effect, at the discretion of our board of directors (the “Board”) but prior to the one-year anniversary of the date

on which the reverse stock split is approved by the Company’s stockholders at the special meeting, a reverse stock split of

all of the outstanding shares of our Common Stock, at a ratio in the range

of 1-for-2 to 1-for-10, with such ratio to be determined by the Board in its discretion and included in a public announcement (the

“Reverse Stock Split Proposal”); |

| |

|

| 3. |

A

proposal to approve an amendment to the Charter to authorize the Board, at the Board’s discretion, to increase the number of

authorized shares of Common Stock from 100,000,000 to 200,000,000 and to make a corresponding change to the number of authorized

shares of capital stock (the “Share Increase Proposal”); |

| |

|

| 4. |

A proposal to approve an amendment

(the “Incentive Plan Amendment”) to the AYRO, Inc. 2020 Long-Term Incentive Plan

(the “Plan” or the “2020 LTIP”) to increase the aggregate number

of shares available for the grant of awards by 5,750,000 shares, to a total of 9,839,650 shares

of common stock (the “Incentive Plan Amendment Proposal”); |

| |

|

| 5. |

A

proposal to adjourn the special meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and

vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Issuance

Proposal, the Reverse Stock Split Proposal, the Share Increase Proposal or the Incentive Plan Amendment Proposal (the

“Adjournment Proposal”); and |

| |

|

| 6. |

To

transact such other business that is properly presented at the special meeting and any adjournments or postponements thereof. |

WHO

MAY VOTE:

You

may vote on the Reverse Stock Split Proposal, the Share Increase Proposal, the Adjournment Proposal and the Incentive Plan

Amendment Proposal if you were the record owner of AYRO, Inc. Common Stock, Series H-6 Convertible Preferred Stock, par value $0.0001

per share (“Series H-6 Preferred Stock”), or Series H-7 Convertible Preferred Stock, par value $0.0001 per share, at the

close of business on August 14, 2023. You may vote on the Issuance Proposal if you were the record owner of AYRO, Inc. Common Stock or

Series H-6 Preferred Stock at the close of business on August 14, 2023.

All

stockholders are cordially invited to attend the special meeting. Whether you plan to attend the special meeting or not, we urge you

to vote and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke

your proxy at any time before it is voted at the special meeting. If you participate in and vote your shares at the special meeting,

your proxy will not be used.

| BY ORDER OF OUR BOARD OF DIRECTORS |

|

| |

|

| /s/ Joshua N. Silverman |

|

| Joshua N. Silverman |

|

| Chairman of the Board of Directors |

|

TABLE

OF CONTENTS

Annex

ANNEX A – TEXT OF REVERSE STOCK SPLIT AMENDMENT

ANNEX B – TEXT OF SHARE INCREASE AMENDMENT

ANNEX C – TEXT OF INCENTIVE PLAN AMENDMENT

ANNEX D – FIRST AMENDMENT TO AYRO, INC. 2020 LONG-TERM INCENTIVE PLAN

ANNEX E – AYRO, INC. 2020 LONG-TERM INCENTIVE PLAN

AYRO,

INC.

900

E. Old Settlers Boulevard, Suite 100, Round Rock, Texas 78664

PROXY

STATEMENT FOR THE AYRO, INC.

SPECIAL

MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 14, 2023

This

proxy statement, along with the accompanying notice of special meeting of stockholders, contains information about the special meeting

of stockholders of AYRO, Inc., including any adjournments or postponements of the special meeting. We are holding the special meeting

at 12:00 p.m. Eastern Time on Thursday, September 14, 2023. For the reasons set forth in the cover letter to which this proxy statement

is attached, this special meeting will be a virtual meeting via live webcast on the Internet. You will be able to attend our special

meeting, vote and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/AYRO2023SM. You will not be

able to attend the special meeting in person.

In

this proxy statement, we refer to AYRO, Inc. as “AYRO,” “the Company,” “we” and “us.”

This

proxy statement relates to the solicitation of proxies by our board of directors for use at the special meeting.

On

or about August 23, 2023, we intend to begin sending this proxy statement, the attached Notice of Special Meeting of Stockholders

and the enclosed proxy card to all stockholders entitled to vote at the special meeting.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON SEPTEMBER 14, 2023

This

proxy statement, the Notice of Special Meeting of Stockholders and our form of proxy card are available for viewing, printing and downloading

at www.virtualshareholdermeeting.com/AYRO2023SM. To view these materials please have your 16-digit control number(s) available that appears

on your proxy card. On this website, you can also elect to receive future distributions of our proxy materials to stockholders by electronic

delivery.

QUESTIONS

AND ANSWERS ABOUT THE SPECIAL MEETING

Why

is the Company Soliciting My Proxy?

Our

board of directors (the “Board”) is soliciting your proxy to vote at the special meeting of stockholders to be held virtually,

on Thursday, September 14, 2023, at 12:00 p.m. Eastern Time, and any adjournments or any postponements of the meeting,

which we refer to as the special meeting. This proxy statement, along with the accompanying Notice of Special Meeting of Stockholders,

summarizes the purposes of the meeting and the information you need to know to vote at the special meeting.

We

have made available to you on the Internet or have sent you this proxy statement, the Notice of Special Meeting of Stockholders and the

proxy card because you owned shares of our common stock, par value $0.0001 per share (“Common Stock”), Series H-6 Convertible

Preferred Stock, par value $0.0001 per share (“Series H-6 Preferred Stock”), or Series H-7 Convertible Preferred Stock, par

value $0.0001 per share (“Series H-7 Preferred Stock”), on August 14, 2023 (the Record Date”). We intend to commence

distribution of the proxy materials to stockholders on or about August 23, 2023.

Why

are you seeking approval for the issuance of shares of Common Stock in connection with the Offering?

On

August 7, 2023, we entered into a securities purchase agreement (the “Purchase Agreement”) with certain existing investors

(the “Investors”) in a private placement, pursuant to which we agreed to sell up to (i) an aggregate of 22,000 shares

of our newly-designated Series H-7 Preferred Stock (“Preferred Shares”), with a stated value of $1,000 per share (the “Stated

Value”), initially convertible into up to 22,000,000 shares of our Common Stock at a conversion price (the “Conversion Price”)

of $1.00 per share (the “Conversion Shares”), and (ii) warrants (the “Investor Warrants”) to acquire up to an

aggregate of 22,000,000 shares of Common Stock (the “Investor Warrant Shares,” and the transactions contemplated by the

Purchase Agreement, the “Offering”) at an initial exercise price of $1.00 per share (as may be adjusted, the

“Exercise Price”). In connection with the Offering, we also entered into an engagement agreement (the “Engagement

Agreement”) between the Company and Palladium Capital Group, LLC (“Palladium”), the placement agent for the Offering,

pursuant to which the we agreed to issue to Palladium or its designees warrants with substantially the same terms as the Investor

Warrants (“Placement Agent Warrants,” and together with the Investor Warrants, the “Warrants”) to purchase

an aggregate of 440,000 shares of Common Stock at the Exercise Price (“Placement Agent Warrant Shares,” and together with

the Investor Warrant Shares, the “Warrant Shares”). The Conversion Price is subject to customary adjustments for stock

dividends, stock splits, reclassifications and the like, and subject to price-based adjustment in the event of any issuances of Common

Stock, or securities convertible, exercisable or exchangeable for Common Stock, at a price below the then-applicable Conversion Price

(subject to certain exceptions). The Conversion Price may also be voluntarily reduced by the Company to any amount and for any period

of time deemed appropriate by the Board at any time with the prior written consent of the holders of at least a majority of the outstanding

Preferred Shares, subject to the rules and regulations of Nasdaq. Any reduction in the Conversion Price will result in an increased

number of shares of Common Stock being issuable upon the payment of dividends in respect of the Preferred Shares or upon the conversion

of the Preferred Shares and additional dilution to existing investors.

We

are required to redeem the Series H-7 Preferred Stock in 12 equal monthly installments, commencing on a date between February 7, 2024

and August 7, 2025, at the election of the Investor. The amortization payments due upon such redemption are payable, at our election,

in cash at 105% of the Installment Redemption Amount (as defined in the Series H-7 Certificate of Designations), or subject to

certain limitations, in shares of Common Stock valued at the lower of (i) the Conversion Price then in effect and (ii) the greater of

(A) eighty percent (80%) of the average of the three lowest closing prices of our Common Stock during the thirty trading day period immediately

prior to the date the amortization payment is due or (B) the lower of (I) $0.144 (subject to adjustment for stock splits, stock dividends,

stock combinations, recapitalizations or other similar events) and (II) 20% of the Minimum Price (as defined below) on the date of receipt

of the Nasdaq Stockholder Approval (as defined below) (the lower of (I) and (II), the “Floor Price,” and the lower

of (i) and (ii), the “Installment Conversion Price”), which amortization amounts are subject to certain adjustments as set

forth in the Series H-7 Certificate of Designations. Further, the holders of the Series H-7 Preferred Stock are entitled to dividends

of 8% per annum, compounded monthly, which is payable in cash or shares of Common Stock at our option. Upon conversion or redemption,

the holders of the Preferred Shares are also entitled to receive a dividend make-whole payment assuming for calculation purposes that

the stated value remained outstanding through and including the twelve (12) month anniversary of the first installment date as elected

by the respective holder. To the extent the number of shares of Common Stock issued in connection with the Offering is greater than anticipated,

the market price of our Common Stock could decline further.

Nasdaq

Listing Rule 5635(d) generally requires us to obtain stockholder approval prior to issuing 20% or more of our outstanding shares of Common

Stock in the Offering. For more information, see “Issuance Proposal” contained elsewhere in this proxy statement.

Why

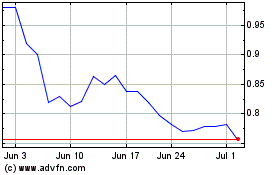

are you seeking approval to effect a reverse stock split?

As

previously reported, on October 3, 2022, we received a letter from the Listing Qualifications Department of The Nasdaq Stock Market (“Nasdaq”)

indicating that, based upon the closing bid price of our Common Stock for the 30 consecutive business day period between August 19, 2022

and September 30, 2022, we did not meet the minimum bid price of $1.00 per share required for continued listing on The Nasdaq Capital

Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”). The letter also indicated that the

Company would be provided with a compliance period of 180 calendar days, or until April 3, 2023 (the “Compliance Period”),

in which to regain compliance pursuant to Nasdaq Listing Rule 5810(c)(3)(A).

On

April 4, 2023, we received a letter from Nasdaq notifying us that the Compliance Period had been extended by an additional 180 days,

or until October 2, 2023. Nasdaq’s determination was based on us meeting the continued listing requirement for market value of

publicly held shares and all other applicable requirements for initial listing on the Nasdaq Capital Market, with the exception of the

Minimum Bid Price Requirement, and our written notice of our intention to cure the deficiency during the extended Compliance Period by

effecting a reverse stock split, if necessary. In order to regain compliance with Nasdaq’s minimum bid price requirement, our Common

Stock must maintain a minimum closing bid price of $1.00 for at least ten consecutive business days during the Compliance Period.

On

August 6, 2023, subject to stockholder approval, the Board approved an amendment to our Charter to effect, at the discretion of the Board

but prior to the one-year anniversary of the date of on which stockholders approved such proposal, a reverse stock split (the “Reverse

Stock Split”) of all of the outstanding shares of Common Stock, at a ratio in the range of 1-for-2 to 1-for-10, with such ratio

to be determined by the Board in its discretion and included in a public announcement (the “Reverse Stock Split Proposal”).

The primary goal of the Reverse Stock Split is to increase the per share market price of our Common Stock to meet the minimum per share

bid price requirements for continued listing on The Nasdaq Capital Market. We believe that a range of Reverse Stock Split ratios provides

us with the most flexibility to achieve the desired results of the Reverse Stock Split.

We

are submitting the Reverse Stock Split Proposal to our stockholders for approval in order to increase the trading price of our Common

Stock to meet the minimum per share bid price requirement for continued listing on The Nasdaq Capital Market. We believe increasing the

trading price of our Common Stock may also assist in our capital-raising efforts by making our Common Stock more attractive to a broader

range of investors. Accordingly, we believe that the Reverse Stock Split is in our stockholders’ best interests.

Why

are you seeking approval to increase the number of authorized shares of Common Stock?

Our

Board has unanimously adopted a resolution declaring advisable, and recommending to our stockholders for their approval, an amendment

to our Charter (the “Share Increase Amendment,” and the proposal to approve such amendment, the “Share Increase Proposal”)

to authorize the Board, at the Board’s discretion, to increase the number of authorized shares of Common Stock from 100,000,000

to 200,000,000 and to make a corresponding change to the number of authorized shares of capital stock (the “Share Increase”).

The form of the proposed Share Increase Amendment is attached to this proxy statement as Annex B.

Pursuant

to the Purchase Agreement, we are obligated to reserve for issuance shares of Common Stock equal to the sum of (i) 150% of the maximum

number of Conversion Shares issuable upon conversion of all of the shares of Series H-7 Preferred Stock then outstanding (assuming for

purposes hereof that the Series H-7 Preferred Stock is convertible at the Floor Price without taking into account any limitations on

the conversion of the Preferred Shares set forth in the Series H-7 Certificate of Designations), and (ii) 150% of the maximum number

of Warrant Shares initially issuable upon exercise of all the Warrants then outstanding without taking into account any limitations on

the exercise of the Warrants set forth therein (collectively, the “Required Reserve Amount”).

If

at any time the number of shares of Common Stock authorized and reserved for issuance is not sufficient to meet the Required Reserve

Amount, we are obligated pursuant to the Purchase Agreement to promptly take all corporate action necessary to authorize and reserve

a sufficient number of shares, including, without limitation, calling a special meeting of stockholders to authorize additional shares

to meet our obligations and using our best efforts to obtain stockholder approval of an increase in such authorized number of shares

to meet the Required Reserve Amount. We currently do not have a sufficient number of authorized shares of Common Stock to meet the Required

Reserve Amount. Accordingly, we must hold a special meeting of stockholders to increase the number of authorized shares of Common Stock

in order to meet the Required Reserve Amount. The Share Increase Amendment is intended to fulfill this obligation.

Why are you seeking approval for an amendment

to the Plan?

We believe that operation

of the Plan is a necessary and powerful tool in enabling us to attract and retain the best available personnel for positions of substantial

responsibility; to provide additional incentive to key employees, key contractors, and non-employee directors; and to promote the success

of our business. The Plan is expected to provide flexibility to our compensation methods in order to adapt the compensation of such employees,

contractors, and directors to a changing business environment, after giving due consideration to competitive conditions and the impact

of federal tax laws. We have strived to use our Plan resources effectively and to maintain an appropriate balance between stockholder

interests and the ability to recruit and retain valuable employees. However, we believe there is an insufficient number of shares remaining

under our Plan to meet our current and projected needs. Accordingly, it is the judgment of the Board that the Incentive Plan Amendment

is in the best interest of the Company and its stockholders. We believe that the Incentive Plan Amendment, which increases the number

of shares of Common Stock available for issuance pursuant to awards under the Plan, reflects best practices in our industry and is appropriate

to permit the grant of equity awards at expected levels for the future.

Why

Are You Holding a Virtual Special Meeting?

This

special meeting will be held in a virtual meeting format only to enhance stockholder access, participation and communication.

How

Do I Access the Virtual Special Meeting?

The

live webcast of the special meeting will begin promptly at 11:00 a.m. Eastern Time. Online access to the audio webcast will open 15 minutes

prior to the start of the special meeting to allow time for you to log-in and test your device’s audio system. The virtual special

meeting is running the most updated version of the applicable software and plugins. You should ensure you have a strong Internet connection

wherever you intend to participate in the special meeting. You should also allow plenty of time to log in and ensure that you can hear

streaming audio prior to the start of the special meeting.

To

be admitted to the virtual special meeting, you will need to log-in at www.virtualshareholdermeeting.com/AYRO2023SM using the 16-digit

control number found on the proxy card or voting instruction card previously mailed or made available to stockholders entitled to vote

at the special meeting.

What

Happens if There Are Technical Difficulties during the Special Meeting?

Beginning

15 minutes prior to, and during, the special meeting, we will have technicians ready to assist you with any technical difficulties you

may have accessing the virtual special meeting or voting at the special meeting. If you encounter any difficulties accessing the virtual

special meeting during the check-in or meeting time, please call 844-986-0822 (US) or 303-562-9302 (international).

Who

May Vote?

Only

holders of record of our Common Stock, Series H-6 Preferred Stock and Series H-7 Preferred Stock at the close of business on the Record

Date will be entitled to vote at the special meeting. On the Record Date, there were 37,732,530 shares of our Common Stock outstanding

and entitled to vote on the proposals described in this proxy statement.

On

the Record Date, there were 50 shares of Series H-6 Preferred Stock, which are convertible into 1,440 shares of Common

Stock, issued and outstanding, and after application of the conversion price applicable for determination of the maximum number of votes

a holder of Series H-6 Preferred Stock is entitled to cast pursuant to the terms of the Certificate of Designations, Preferences and

Rights of the Series H-6 Preferred Stock (“Series H-6 Certificate of Designations”), subject also to the beneficial ownership

limitation as set forth in the Series H-6 Certificate of Designations, holders of Series H-6 Preferred Stock are entitled to an aggregate

of 1,000 votes on the proposals described in this proxy statement.

On

the Record Date, there were 22,000 shares of Series H-7 Preferred Stock, which are initially convertible into 22,000,000

shares of Common Stock, issued and outstanding. Pursuant to the terms of the Series H-7 Certificate of Designations (as defined below),

each share of Series H-7 Preferred Stock entitles the holder thereof to cast that number of votes per share of Series H-7 Preferred Stock

equal to the number of Conversion Shares underlying the Series H-7 Preferred Stock determined by dividing the Stated Value by $0.72 per

share on the Share Increase Proposal, the Reverse Stock Split Proposal, the Incentive Plan Amendment Proposal (as defined below)

and the Adjournment Proposal (as defined below). Holders of shares of Series H-7 Preferred Stock are not entitled to vote such shares

on the Issuance Proposal (as defined below).

If,

on the Record Date, your shares of our Common Stock,

Series H-6 Preferred Stock or Series H-7 Preferred Stock were registered directly in your name with our transfer agent, Issuer Direct

Corporation, then you are a stockholder of record.

If,

on the Record Date, your shares were held, not in

your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner

of shares held in “street name” and the proxy materials are being forwarded to you by that organization. The organization

holding your account is considered to be the stockholder of record for purposes of voting at the special meeting. As a beneficial owner,

you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend

the special meeting. However, since you are not the stockholder of record, you may not vote your shares at the special meeting unless

you request and obtain a valid proxy from your broker or other agent.

You

do not need to attend the special meeting to vote your shares. Shares represented by valid proxies, received in time for the special

meeting and not revoked prior to the special meeting, will be voted at the special meeting. For instructions on how to change or revoke

your proxy, see “May I Change or Revoke My Proxy?” below.

How

Many Votes Do I Have?

Each

share of our Common Stock that you own entitles you to one vote.

Pursuant

to the terms of the Series H-6 Certificate of Designations, each share of Series H-6 Preferred entitles the holder thereof to cast that

number of votes per share of Series H-6 Preferred Stock equal to the number of whole shares of Common Stock into which the Series H-6

Preferred Stock beneficially owned by such holder are convertible as of the Record Date (subject to the 9.99% beneficial ownership limitations)

on all matters presented to the stockholders, voting together with the holders of Common Stock as a single class; however, pursuant to

the terms of the Series H-6 Preferred Stock as set forth in the Series H-6 Certificate of Designations, holders of Series H-6 Preferred

Stock in no event shall be permitted to exercise a greater number of votes than such holders would have been entitled to cast if the

Series H-6 Preferred Stock had immediately been converted into shares of Common Stock at a conversion price equal to $3.60. Accordingly,

each holder of Series H-6 Preferred Stock is entitled to exercise votes for approximately 20.0 shares for each share of Series H-6 Preferred

Stock held.

Pursuant

to the terms of the Series H-7 Certificate of Designations, each share of Series H-7 Preferred Stock entitles the holder thereof to cast

that number of votes per share of Series H-7 Preferred Stock equal to the number of Conversion Shares underlying the Series H-7 Preferred

Stock determined by dividing the Stated Value by $0.72 per share. Accordingly, each holder of Series H-7 Preferred Stock is entitled

to exercise votes for approximately 1,389 shares for each share of Series H-7 Preferred Stock held.

How

Do I Vote?

Whether

you plan to attend the special meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive

through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed

via the Internet or telephone. If you properly submit a proxy without giving specific voting instructions, your shares will be voted

in accordance with our Board’s recommendations as noted below. Voting by proxy will not affect your right to attend the special

meeting.

Record

Holders

If

your shares are registered directly in your name through our stock transfer agent, Issuer Direct Corporation, or you have stock certificates

registered in your name, you may vote:

| ☐ |

By

Internet or by telephone. Follow the instructions included in the proxy card to vote over the Internet or by telephone. |

| ☐ |

By

mail. If you received a proxy card by mail, you can vote by mail by completing, signing and returning the proxy card as instructed

on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with

our Board’s recommendations as noted below. |

| ☐ |

At

the time of the virtual special meeting. If you attend the virtual special meeting, you may vote your shares online at the time

of the meeting. |

Telephone

and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time

on September 13, 2023.

Beneficial

Owners

If

your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions

from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and

Internet voting may also be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered

in your own name and you plan to vote your shares in person at the special meeting, you should contact your broker or agent to obtain

a legal proxy or broker’s proxy card and bring it to the special meeting in order to vote.

How

Does Our Board Recommend that I Vote on the Proposals?

Our

Board recommends that you vote “FOR” the approval, for purposes of complying with Nasdaq Listing Rule 5635(d), of the issuance

of shares of our Common Stock underlying the Series H-7 Preferred Stock and Warrants issued by us pursuant to the terms of the Purchase

Agreement and the Engagement Agreement in an amount equal to or in excess of 20% of our Common Stock outstanding before the issuance

of such Preferred Shares and Warrants (including any amortization payments made to the holders of the Preferred Shares in the form of

issuance of shares of Common Stock and upon the operation of anti-dilution provisions contained in such Preferred Shares and Warrants)

(collectively, the “Issuance Proposal”).

Our

Board also recommends that you vote “FOR” the Reverse Stock Split Proposal.

Our

Board also recommends that you vote “FOR” the Share Increase Proposal.

Our Board recommends that

you vote “FOR” the Incentive Plan Amendment Proposal.

Our

Board also recommends that you vote “FOR” the proposal to adjourn the special meeting to a later date or dates, if necessary

or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in

connection with, the approval of the Issuance Proposal, the Reverse Stock Split Proposal, the Share Increase Proposal or the

Incentive Plan Amendment Proposal (the “Adjournment Proposal”).

If

any other matter is presented at the special meeting, your proxy provides that your shares will be voted by the proxy holder listed in

the proxy in accordance with the proxy holder’s best judgment. At the time this proxy statement was first made available, we knew

of no matters that needed to be acted on at the special meeting, other than those discussed in this proxy statement.

May

I Change or Revoke My Proxy?

If

you give us your proxy after receiving this proxy statement, you may change or revoke it at any time before the special meeting. You

may change or revoke your proxy in any one of the following ways:

| ☐ |

if

you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as

instructed above; |

| ☐ |

by

re-voting by Internet or by telephone as instructed above; |

| ☐ |

by

notifying David E. Hollingsworth, Chief Financial Officer, in writing before the special meeting that you have revoked your proxy;

or |

| ☐ |

by

attending the virtual special meeting and voting your shares online at the meeting. Attending the special meeting virtually will

not in and of itself revoke a previously submitted proxy. |

Your

most current vote, whether by proxy via telephone, Internet, proxy card, or virtually at the meeting, is the one that will be counted.

What

if I Receive More Than One Proxy Card?

You

may receive more than one proxy card if you hold shares of our Common Stock in more than one account, which may be in registered form

or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that

all of your shares are voted.

Will

My Shares be Voted if I Do Not Vote?

If

your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above

under “How Do I Vote?” If your shares are held in street name and you do not provide voting instructions to the bank, broker

or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority

to vote your unvoted shares on the Reverse Stock Split Proposal and the Adjournment Proposal without

receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This

ensures your shares will be voted at the special meeting and in the manner you desire. A “broker non-vote” will occur if

your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary

voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

What

Vote is Required to Approve Each Proposal and How are Votes Counted?

The

affirmative vote of the holders of a majority of the voting power of the shares present in person or by proxy at

the special meeting and entitled to vote on the Issuance Proposal is required to approve the Issuance Proposal. Abstentions will have

the effect of a vote against this proposal. Brokerage firms do not have authority to vote customers’ unvoted shares held by the

firms in street name on this proposal. Holders of shares of Series H-7 Preferred Stock are not entitled to vote such shares on the Issuance

Proposal.

The

affirmative vote of the holders of a majority of the voting power of the shares present in person or by proxy at the special meeting

and entitled to vote on the Reverse Stock Split Proposal is required to approve the Reverse Stock Split Proposal. Abstentions will have

the effect of a vote against this proposal. Brokerage firms have authority to vote customers’ unvoted shares held by the firms

in street name on this proposal.

The

affirmative vote of the holders of a majority of the voting power of the shares present in person or by proxy at the special meeting

and entitled to vote on the Share Increase Proposal is required to approve the Share Increase Proposal. Abstentions will have the effect

of a vote against this proposal. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms

in street name on this proposal.

The affirmative vote of

the holders of a majority of the voting power of the shares present in person or by proxy at the special meeting and entitled to vote

on the Incentive Plan Amendment Proposal is required to approve the Incentive Plan Amendment Proposal. Abstentions will have the effect

of a vote against this proposal. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street

name on this proposal.

The

affirmative vote of the holders of a majority of the voting power of the shares present, either in attendance virtually or represented

by proxy, at the Special Meeting and entitled to vote on the Adjournment Proposal is necessary to approve such proposal. Abstentions

will have the effect of a vote against this proposal. Brokerage firms have authority to vote customers’ unvoted shares held

by the firms in street name on this proposal.

Where

Can I Find the Voting Results of the Special Meeting?

The

preliminary voting results will be announced at the special meeting, and we will publish preliminary, or final results if available,

in a Current Report on Form 8-K within four business days of the special meeting. If final results are unavailable at the time we file

the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the

final voting results are known.

What

Are the Costs of Soliciting these Proxies?

We

will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax

or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other

institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies.

We will then reimburse them for their expenses.

We

have engaged Alliance Advisors, LLC to assist in the solicitation of proxies and provide related advice and informational support, for

a services fee, plus customary disbursements, which are not expected to exceed $35,000 in total.

What

Constitutes a Quorum for the Special Meeting?

The

presence, in person or by proxy, of the holders of one-third of the voting power of all outstanding shares of our capital stock issued,

outstanding and entitled to vote at the special meeting is necessary to constitute a quorum at the special meeting. Votes and abstentions

of stockholders of record who are present at the special meeting in person or by proxy are counted for purposes of determining whether

a quorum exists.

Who

should I contact if I have any questions about how to vote?

If

you have any questions about how to vote your shares, you may contact our proxy solicitor at:

Alliance

Advisors, LLC

200

Broadacres Drive, 3rd Floor Bloomfield, NJ 07003

Telephone:

855-976-3327

Attending

the Special Meeting

The

special meeting will be held in a virtual meeting format only. To attend the virtual special meeting, go to www.virtualshareholdermeeting.com/AYRO2023SM

shortly before the meeting time, and follow the instructions for downloading the Webcast. If you miss the special meeting, you can view

a replay of the Webcast at www.virtualshareholdermeeting.com/AYRO2023SM until one year from the date of the meeting. You need not attend

the special meeting in order to vote.

Householding

of Disclosure Documents

Some

brokers or other nominee record holders may be sending you a single set of our proxy materials if multiple AYRO stockholders live in

your household. This practice, which has been approved by the SEC, is called “householding.” Once you receive notice from

your broker or other nominee record holder that it will be “householding” our proxy materials, the practice will continue

until you are otherwise notified or until you notify them that you no longer want to participate in the practice. Stockholders who participate

in householding will continue to have access to and utilize separate proxy voting instructions.

We

will promptly deliver a separate copy of our proxy materials to you if you write or call our Chief Financial Officer at: 900 E. Old Settlers

Boulevard, Suite 100, Round Rock, Texas 78664. If you want to receive your own set of our proxy materials in the future or, if you share

an address with another stockholder and together both of you would like to receive only a single set of proxy materials, you should contact

your broker or other nominee record holder directly or you may contact us at the above address and phone number.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth information regarding the beneficial ownership of our voting securities as of the Record Date by (i)

each person known to us to beneficially own five percent (5%) or more of any class of our voting securities; (ii) each of our Named

Executive Officers (as defined in Item 402 of Regulation S-K) and directors; and (iii) all of our current directors and executive

officers as a group.

The percentages of voting

securities beneficially owned are reported on the basis of regulations of the Securities and Exchange Commission (“SEC”)

governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a beneficial

owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of the security,

or investment power, which includes the power to dispose of or to direct the disposition of the security. Shares of Common Stock beneficially

owned and the respective percentages of beneficial ownership of Common Stock assumes the exercise of all options, warrants (including

the Warrants issued in the Offering) and other securities convertible into Common Stock beneficially owned by such person or entity currently

exercisable or exercisable within 60 days of the Record Date. The number of shares of Common Stock beneficially owned by the principal

stockholders and the percentage of shares outstanding, as set forth below, take into account certain limitations on the exercise of warrants

to purchase Common Stock.

Except

as indicated in the footnotes to this table, to our knowledge and subject to community property laws where applicable, each beneficial

owner named in the table below has sole voting and sole investment power with respect to all shares beneficially owned and each person’s

address is c/o AYRO, Inc., 900 E. Old Settlers Boulevard, Suite 100, Round Rock, Texas 78664.

| Name | |

Number

of Shares of Common Stock Beneficially Owned (1) | | |

Percentage

of Class | | |

Number

of Shares of Series H-7 Preferred Stock Beneficially Owned (2) | | |

Percentage

of Class | | |

Total

Voting Power | |

| 5%

Beneficial Owner | |

| | | |

| | | |

| | | |

| | | |

| | |

| Alpha

Capital Anstalt (3) | |

| 3,890,883 | | |

| 9.55 | % | |

| 3,000 | | |

| 13.64 | % | |

| 11.80 | % |

| The

Hewlett Fund LP (4) | |

| 2,000,000 | | |

| 5.03 | % | |

| 2,000 | | |

| 9.09 | % | |

| 7.00 | % |

| Mainfield

Enterprise, Inc. (5) | |

| 1,981,742 | | |

| 4.99 | % | |

| 2,500 | | |

| 11.36 | % | |

| 7.99 | % |

| Richard

Abbe/ Iroquois Capital Management L.L.C. (6) | |

| 4,060,117 | | |

| 9.99 | % | |

| 14,000 | | |

| 63.64 | % | |

| 34.42 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Named

Executive Officers and Directors | |

| | | |

| | | |

| | | |

| | | |

| | |

| George

Devlin (7) | |

| 216,125 | | |

| * | | |

| - | | |

| - | | |

| - | |

| Sebastian

Giordano (8) | |

| 226,234 | | |

| * | | |

| - | | |

| - | | |

| - | |

| David

E. Hollingsworth | |

| - | | |

| * | | |

| - | | |

| - | | |

| - | |

| Zvi

Joseph (9) | |

| 200,953 | | |

| * | | |

| - | | |

| - | | |

| - | |

| Richard

Perley (10) | |

| 59,752 | | |

| * | | |

| - | | |

| - | | |

| - | |

| Joshua

Silverman (11) | |

| 395,493 | | |

| 1.05 | % | |

| - | | |

| - | | |

| - | |

| Greg

Schiffman (12) | |

| 220,254 | | |

| * | | |

| - | | |

| - | | |

| - | |

| Curtis

Smith (13) | |

| 225,313 | | |

| * | | |

| - | | |

| - | | |

| - | |

| Wayne

R. Walker (14) | |

| 175,399 | | |

| * | | |

| - | | |

| - | | |

| - | |

| Thomas

M. Wittenschlaeger (15) | |

| 50,000 | | |

| * | | |

| - | | |

| - | | |

| - | |

| All

current executive officers and Directors as a group (8 persons) | |

| 1,484,458 | | |

| 3.93 | % | |

| - | | |

| - | | |

| 2.17 | % |

| |

1. |

Percentage

of Common Stock ownership is based on 37,732,530 shares of Common Stock issued and outstanding as of the Record Date. Beneficial

ownership assumes full exercise of the Warrants subject to a 4.99% or 9.99% blocker, as applicable. |

| |

2. |

Percentage

of Series H-7 Preferred Stock ownership is based on 22,000 shares of Series H-7 Preferred Stock issued and outstanding as

of the Record Date. |

| |

|

|

| |

3. |

Based

on a Schedule 13G/A filed on August 4, 2023 by Alpha Capital Anstalt and on certain information made available to the Company.

The address of Alpha Capital Anstalt is Altenbach 8, FL-9490 Vaduz, Furstentums, Liechtenstein. Alpha Capital Anstalt is the beneficial

owner of 890,883 shares of Common Stock, 3,000 shares

of Series H-7 Preferred Stock and Warrants to purchase 3,000,000 shares of Common Stock exercisable within 60 days of the Record

Date (subject to a 9.99% beneficial ownership blocker). |

| |

|

|

| |

4. |

Based

on certain information made available to the Company. The address of The Hewlett Fund LP is 100 Merrick Road, Suite 400W, Rockville

Centre, NY 11570. The Hewlett Fund LP is the beneficial owner of 2,000 shares of Series H-7 Preferred Stock and Warrants to purchase

2,000,000 shares of Common Stock exercisable within 60 days of the Record Date (subject to a 9.99% beneficial ownership blocker). |

| |

|

|

| |

5. |

Based

on certain information made available to the Company. The address of Mainfield Enterprises Inc. is Ariel House, 74 Charlotte Street,

London W1T4QJ, United Kingdom. Mainfield Enterprises is the beneficial owner of 2,500 shares of Series H-7 Preferred Stock and Warrants

to purchase 2,500,000 shares of Common Stock exercisable within 60 days of the Record Date (subject to a 4.99% beneficial ownership

blocker). |

| |

|

|

| |

6. |

Based

on a Schedule 13G/A jointly filed on February 24, 2022 by Richard Abbe (“Mr. Abbe”), Kimberly Page (“Ms. Page”)

and Iroquois Capital Management L.L.C. and on certain information made available to the Company. Represents (i) 1,125,000 shares

of Common Stock, warrants exercisable within 60 days of the Record Date to purchase 9,829,003 shares of Common Stock, and preferred

stock convertible into 963 shares of Common Stock and 9,000 shares of Series H-7 Preferred Stock held by Iroquois Capital Investment

Group LLC (“ICIG”) and (ii) 23,000 shares of Common Stock, warrants exercisable within 60 days of the Record Date to

purchase 6,133,569 shares of Common Stock, preferred stock convertible into 1,868 shares of Common Stock and 5,000 shares of Series

H-7 Preferred Stock held by Iroquois Master Fund Ltd. (“IMF”), all of which are subject to a 9.99% beneficial ownership

blocker. Mr. Abbe exercises sole voting and dispositive power over the shares held by ICIG and shares voting and dispositive power

over the shares held by IMF with Ms. Page. As such, Mr. Abbe may be deemed to be the beneficial owner of all shares of common stock

held by and underlying the warrants and shares of preferred stock (each subject to certain beneficial ownership blockers) held by

ICIG and IMF and Ms. Page may be deemed to be the beneficial owner of all shares of common stock held by and underlying the warrants

and shares of preferred stock (each subject to certain beneficial ownership blockers) held by IMF. |

| |

7. |

Mr.

Devlin’s total includes 216,125 shares of Common Stock. |

| |

|

|

| |

8. |

Mr.

Giordano’s total includes 226,234 shares of Common Stock. |

| |

|

|

| |

9. |

Mr.

Joseph’s total includes 200,953 shares of Common Stock. |

| |

|

|

| |

10. |

Mr.

Perley’s total includes options to purchase 59,752 shares of Common Stock that are exercisable within 60 days of the Record

Date. |

| |

|

|

| |

11. |

Mr.

Silverman’s total includes 395,493 shares of Common Stock. |

| |

|

|

| |

12. |

Mr.

Schiffman’s total includes 220,254 shares of Common Stock. |

| |

|

|

| |

13. |

Mr.

Smith’s total includes options to purchase 225,313 shares of commons stock that are exercisable within 60 days of the Record

Date. |

| |

|

|

| |

14. |

Mr.

Walker’s total includes 175,399 shares of Common Stock. |

| |

|

|

| |

15. |

Mr.

Wittenschlaeger’s total includes 50,000 shares of Common Stock. |

EXECUTIVE COMPENSATION

Compensation Philosophy and Process

The responsibility for establishing,

administering and interpreting our policies governing the compensation and benefits for our executive officers and making compensation

decisions with respect to such executive officers lies with our Compensation and Human Resources Committee. Prior to such amendment and

restatement, compensation decisions were made by the Board following the recommendation of the Compensation and Human Resources Committee.

In the fiscal year ended December 31, 2022, the Company did not retain the services of any compensation consultants.

The goals of our executive

compensation program are to attract, motivate and retain individuals with the skills and qualities necessary to support and develop our

business within the framework of our size and available resources. In 2021, we designed our executive compensation program to achieve

the following objectives:

| |

● |

attract and retain executives experienced in developing and delivering

products such as our own; |

| |

● |

motivate and reward executives whose experience and skills are critical

to our success; |

| |

● |

reward performance; and |

| |

● |

align the interests of our executive officers and other key employees

with those of our stockholders by motivating our executive officers and other key employees to increase stockholder value. |

Summary Compensation

Table

The

following table sets forth all compensation earned, in all capacities, during the fiscal years ended December 31, 2022 and 2021 by the

Company’s named executive officers.

Name and Principal

Position |

|

Year |

|

Salary ($) |

|

|

Bonus ($) |

|

|

Stock Awards ($) (1) |

|

|

Option Awards ($) (1) |

|

|

All other compensation

($) |

|

|

Total ($) |

|

| Thomas M. Wittenschlaeger (2) |

|

2022 |

|

|

263,700 |

|

|

|

132,500 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

396,200 |

|

| Chief Executive Officer |

|

2021 |

|

|

71,106 |

|

|

|

- |

|

|

|

1,117,092 |

|

|

|

- |

|

|

|

- |

|

|

|

1,188,198 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| David E. Hollingsworth (3) |

|

2022 |

|

|

209,675 |

|

|

|

87,100 |

|

|

|

2,760 |

|

|

|

- |

|

|

|

- |

|

|

|

299,535 |

|

| Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Curtis Smith (4) |

|

2022 |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

245,833 |

|

|

|

245,833 |

|

| Former Chief Financial Officer |

|

2021 |

|

|

226,506 |

|

|

|

50,000 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

276,506 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Richard Perley (5) |

|

2022 |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

245,833 |

|

|

|

245,833 |

|

| Former Chief Marketing Officer |

|

2021 |

|

|

149,998 |

|

|

|

50,002 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

200,000 |

|

| |

(1) |

The dollar amounts in this column represent the aggregate grant

date fair value computed in accordance with FASB ASC Topic 718. The assumptions underlying the determination of fair value of the

awards are set forth in Note 3 of the financial statements included in our Annual Report on Form 10-K filed with the SEC on March

23, 2022 |

| |

(2) |

Appointed as an officer of the Company effective as of September

23, 2021. |

| |

(3) |

Appointed as an officer of the Company effective as of January 14,

2022. |

| |

(4) |

Resigned effective as of January 14, 2022. |

| |

(5) |

Terminated engagement with the Company effective as of January 14,

2022. |

Corporate History

On

May 28, 2020, pursuant to the previously announced Agreement and Plan of Merger, dated December 19, 2019 (the “Merger Agreement”),

by and among AYRO, ABC Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of the Company (“Merger Sub”),

and AYRO Operating Company, Inc., a Delaware corporation previously known as AYRO, Inc. (“AYRO Operating”), Merger Sub was

merged with and into AYRO Operating, with each issued and outstanding share of AYRO Operating’s common stock, including shares

underlying AYRO Operating’s outstanding equity awards and warrants, being converted into the right to receive 1.3634 shares of

the Company’s Common Stock, and with AYRO Operating continuing after the merger as the surviving entity and a wholly owned subsidiary

of the Company (the “Merger”).

From September 2021 through

January 2022, the Company underwent a change in management. In September 2021, Mr. Wittenschlaeger joined the Company as Chief Executive

Officer. Following the hiring of Mr. Wittenschlaeger, in January 2022 Messrs. Smith and Perley resigned from their respective positions

as Chief Financial Officer and Chief Marketing Officer and Mr. Hollingsworth was hired as the Company’s Interim Chief Financial

Officer. On August 22, 2022, the Company appointed Mr. Hollingsworth as Chief Financial Officer.

The Company has entered into

executive employment agreements with Messrs. Wittenschlaeger and Hollingsworth. Prior to the Merger, AYRO Operating had entered into

an employment agreement with Mr. Smith. Immediately prior to the effective time of the Merger, AYRO Operating entered into an amendment

to the executive employment agreement with Mr. Smith, effective upon completion of the Merger.

Mr. Perley provided services

as a contractor to AYRO Operating pursuant to an independent contractor agreement AYRO Operating entered into with an entity controlled

by Mr. Perley.

Narrative Disclosure to Summary Compensation

Table

The material terms of the

employment agreements and the independent contractor agreements with the named executive officers of the Company are summarized below.

Executive Employment Agreement with Thomas

M. Wittenschlaeger

On September 23, 2021, the

Company entered into an executive employment agreement (the “Wittenschlaeger Employment Agreement”) with Mr. Wittenschlaeger

setting forth the terms and conditions of Mr. Wittenschlaeger’s employment as the Company’s Chief Executive Officer, effective

September 23, 2021. Pursuant to the Wittenschlaeger Employment Agreement, Mr. Wittenschlaeger will serve as the Chief Executive Officer

of the Company for a two-year initial term commencing on September 23, 2021, which term may be renewed for up to three successive one-year

terms, unless earlier terminated by either party in accordance with the terms of the Wittenschlaeger Employment Agreement. Subject to

the approval of the Company’s stockholders, Mr. Wittenschlaeger also serves as a member of the Board.

The Wittenschlaeger Employment

Agreement provides that Mr. Wittenschlaeger is entitled to receive an annual base salary of two hundred-eighty thousand dollars ($280,000),

payable in equal installments semi-monthly pursuant to the Company’s normal payroll practices. For the 2021 fiscal year, Mr. Wittenschlaeger

was eligible to receive a partial bonus as determined by the Board, based upon the achievement of short-term target objectives and performance

criteria as agreed upon by Mr. Wittenschlaeger and the Board, with such partial bonus payable no later than March 15, 2022. Mr. Wittenschlaeger

is also eligible to receive, for subsequent fiscal years during the term of his employment, periodic bonuses up to 50% of his annual

base salary upon achievement of target objectives and performance criteria, payable on or before March 15 of the fiscal year following

the fiscal year to which the bonus relates. For the fiscal year ended December 31, 2022, Mr. Wittenschlaeger was awarded a bonus of $132,500.

Targets and performance criteria shall be established by the Board after consultation with Mr. Wittenschlaeger, but the evaluation of

Mr. Wittenschlaeger’s performance shall be at the Board’s sole discretion. The Wittenschlaeger Employment Agreement also

entitles Mr. Wittenschlaeger to receive customary benefits and reimbursement for ordinary business expenses and relocation expenses of

$15,000.

In connection with Wittenschlaeger’s

appointment and as an inducement to enter into the Wittenschlaeger Employment Agreement, the Company granted Mr. Wittenschlaeger 450,000

shares of the Company’s restricted Common Stock, pursuant to a restricted stock award agreement entered into by the Company with

Mr. Wittenschlaeger on September 23, 2021, which shares shall vest in tranches of 90,000 shares upon the achievement of certain stock

price, market capitalization and business milestones.

The Company may terminate

Mr. Wittenschlaeger’s employment due to death or disability, for cause (as defined in the Wittenschlaeger Employment Agreement)

at any time after providing written notice to Mr. Wittenschlaeger, and without cause at any time upon thirty days’ written notice.

Mr. Wittenschlaeger may terminate his employment without good reason (as defined in the Wittenschlaeger Employment Agreement) at any

time upon thirty days’ written notice or with good reason, which requires delivery of a notice of termination within ninety days

after Mr. Wittenschlaeger first learns of the existence of the circumstances giving rise to good reason, and failure of the Company to

cure the circumstances giving rise to the good reason within thirty days following delivery of such notice.

If Mr. Wittenschlaeger’s

employment is terminated by the Company for cause or if Mr. Wittenschlaeger resigns, Mr. Wittenschlaeger shall receive, within thirty

days of such termination, any accrued but unpaid base salary and expenses required to be reimbursed pursuant to the Wittenschlaeger Employment

Agreement. If Mr. Wittenschlaeger’s employment is terminated due to his death or disability, Mr. Wittenschlaeger or his estate

will receive the accrued obligation Mr. Wittenschlaeger would have received upon termination by the Company for cause or by Mr. Wittenschlaeger

by resignation, and any earned, but unpaid, bonus for services rendered during the year preceding the date of termination.

If Mr. Wittenschlaeger’s

employment is terminated by the Company without cause (as defined in the Wittenschlaeger Employment Agreement) or upon non-renewal or

by Mr. Wittenschlaeger for good reason, Mr. Wittenschlaeger is entitled to receive the accrued obligation Mr. Wittenschlaeger would have

received upon termination by the Company for cause or by Mr. Wittenschlaeger by resignation, and any earned, but unpaid, bonus for services

rendered during the year preceding the date of termination. In addition, subject to compliance with the restrictive covenants set forth

in the Wittenschlaeger Employment Agreement and the execution of a release of claims in favor of the Company, the Company will pay the

following severance payments and benefits: (i) an amount equal to twelve months’ base salary, payable in equal monthly installments

over a twelve-month severance period; (ii) an amount equal to the greater of (x) the most recent annual bonus earned by Mr. Wittenschlaeger,

(y) the average of the immediately preceding two year’s annual bonuses earned by Mr. Wittenschlaeger, or (z) if Mr. Wittenschlaeger’s

termination of employment occurs during the first calendar year of the initial employment term before any annual bonus for a full twelve-month

period of service has been paid, then the target bonus Mr. Wittenschlaeger is eligible for under the Wittenschlaeger Employment Agreement;

provided that, other than the first year of the Wittenschlaeger Employment Agreement, no bonus amount shall be payable if the bonuses

for the year of termination are subject to achievement of performance goals and such performance goals are not achieved by the Company

for such year; and (iii) an amount intended to assist Mr. Wittenschlaeger with his post-termination health coverage, provided however,

he is under no obligation to use such amounts to pay for continuation of coverage under the Company’s group health plan pursuant

to COBRA.

If Mr. Wittenschlaeger’s

employment is terminated by the Company without cause or by Mr. Wittenschlaeger for good reason or upon non-renewal within 12 months

following a change in control (as defined in the Wittenschlaeger Employment Agreement), Mr. Wittenschlaeger shall receive the severance

payments and benefits he would receive in the event that the Company terminates Mr. Wittenschlaeger’s employment without cause

or upon non-renewal or by Mr. Wittenschlaeger for good reason set forth above. In addition, certain performance milestones for his equity

award will be waived, and certain unvested restricted shares shall immediately vest and no longer be subject to any holding period.

The Wittenschlaeger Employment

Agreement also contains customary provisions relating to, among other things, confidentiality, non-competition, non-solicitation, non-disparagement,

and assignment of inventions requirements.

Executive Employment Agreement with David

E. Hollingsworth

In connection with Mr. Hollingsworth’s

appointment as the Company’s Chief Financial Officer, on August 23, 2022, the Company entered into an executive employment agreement

(the “Hollingsworth Employment Agreement”) with Mr. Hollingsworth setting forth the terms and conditions of Mr. Hollingsworth’s

employment, effective August 23, 2022. Pursuant to the Hollingsworth Employment Agreement, Mr. Hollingsworth will serve as the Chief

Financial Officer of the Company for a two-year initial term commencing on August 23, 2022, which term may be renewed for up to two successive

one-year terms, unless earlier terminated by either party in accordance with the terms of the Hollingsworth Employment Agreement.

The Hollingsworth Employment

Agreement provides that Mr. Hollingsworth is entitled to receive an annual base salary of two hundred-thirty thousand dollars ($230,000),

payable in equal installments semi-monthly pursuant to the Company’s normal payroll practices. For each fiscal year during the

term of his employment, Mr. Hollingsworth is eligible to receive periodic bonuses of up to 40% of his annual base salary upon achievement

of target objectives and performance criteria, payable on or before March 15 of the fiscal year following the fiscal year to which the

bonus relates. Targets and performance criteria shall be established by the Board after consultation with Mr. Hollingsworth and the Company’s

Chief Executive Officer, but the evaluation of Mr. Hollingsworth’s performance shall be at the Board’s sole discretion. For

the fiscal year ended December 31, 2022, Mr. Hollingsworth was awarded a bonus of $87,100. The Hollingsworth Employment Agreement also

entitles Mr. Hollingsworth to receive customary benefits and reimbursement for ordinary business expenses.

In connection with Mr. Hollingsworth’s

appointment and as an inducement to enter into the Hollingsworth Employment Agreement, the Company granted Mr. Hollingsworth 100,000

shares of the Company’s restricted Common Stock, which shares shall vest in tranches of 25,000 shares upon the achievement of certain

stock price, market capitalization and business milestones.

The Company may terminate

Mr. Hollingsworth’s employment due to death or disability, for cause (as defined in the Hollingsworth Employment Agreement) at

any time after providing written notice to Mr. Hollingsworth, and without cause at any time upon thirty days’ written notice. Mr.

Hollingsworth may terminate his employment without good reason (as defined in the Hollingsworth Employment Agreement) at any time upon

thirty days’ written notice or with good reason, which requires delivery of a notice of termination within ninety days after Mr.

Hollingsworth first learns of the existence of the circumstances giving rise to good reason, and failure of the Company to cure the circumstances

giving rise to the good reason within thirty days following delivery of such notice.

If Mr. Hollingsworth’s

employment is terminated by the Company for cause, as a result of Mr. Hollingsworth’s resignation or as a result of the expiration

of the term of the Hollingsworth Employment Agreement, Mr. Hollingsworth shall receive, within thirty days of such termination, any accrued

but unpaid base salary and expenses required to be reimbursed pursuant to the Hollingsworth Employment Agreement.

If Mr. Hollingsworth’s

employment is terminated due to his death or disability, Mr. Hollingsworth or his estate will receive the accrued obligations Mr. Hollingsworth

would have received upon termination by the Company for cause or by Mr. Hollingsworth by resignation, and any earned, but unpaid, bonus

for services rendered during the year preceding the date of termination.

If Mr. Hollingsworth’s

employment is terminated by the Company without cause (as defined in the Hollingsworth Employment Agreement) or by Mr. Hollingsworth

for good reason, Mr. Hollingsworth is entitled to receive the accrued obligations he would have received upon termination by the Company

for cause or by Mr. Hollingsworth by resignation, and any earned, but unpaid, bonus for services rendered during the year preceding the

date of termination. In addition, subject to compliance with the restrictive covenants set forth in the Hollingsworth Employment Agreement

and the execution of a release of claims in favor of the Company, the Company will pay the following severance payments and benefits:

(i) an amount equal to twelve months’ base salary, payable in equal monthly installments over a twelve-month severance period;

(ii) an amount equal to the greater of (x) the most recent annual bonus earned by Mr. Hollingsworth, (y) the average of the immediately

preceding two year’s annual bonuses earned by Mr. Hollingsworth, or (z) if Mr. Hollingsworth’s termination of employment

occurs during the first calendar year of the initial employment term before any annual bonus for a full twelve-month period of service

has been paid, then the target bonus Mr. Hollingsworth is eligible for under the Hollingsworth Employment Agreement; provided that no

bonus amount shall be payable if the bonuses for the year of termination are subject to achievement of performance goals and such performance

goals are not achieved by the Company for such year; and (iii) an amount intended to assist Mr. Hollingsworth with his post-termination

health coverage, provided, however, that he is under no obligation to use such amounts to pay for continuation of coverage under the

Company’s group health plan pursuant to COBRA.

The Hollingsworth Employment

Agreement also contains customary provisions relating to, among other things, confidentiality, non-competition, non-solicitation, non-disparagement,

and assignment of inventions requirements.

Executive Employment Agreement with Curtis

Smith

Pre-Merger Smith Employment Agreement

Pursuant to his employment

agreement, effective March 8, 2018, and to subsequent actions by AYRO Operating’s board of directors, Curtis E. Smith was entitled

to a base salary of $200,000 and a target annual bonus in the amount of 25% of his annual base salary. The target annual bonus was based

on Mr. Smith’s performance, as determined by AYRO Operating’s board of directors in its sole discretion, against fundamental

corporate and/or individual objectives to be determined by AYRO Operating’s board of directors. Mr. Smith was eligible to participate

in the 2017 LTIP (as defined below), subject to the discretion of AYRO Operating’s board of directors, if and when the board of

directors determined to make a grant to him. Pursuant to Mr. Smith’s employment agreement, as consideration for entering into the

employment agreement, AYRO Operating granted nonqualified options to acquire 109,072 shares of AYRO Operating common stock (giving effect

to the Exchange Ratio and Reverse Split) with an exercise price of $2.446 in March 2018.

Smith Employment Agreement Amendment

On May 28, 2020, immediately

prior to the effective time of the Merger, AYRO Operating entered into an amendment to its executive employment agreement with Mr. Smith