Atour Lifestyle Holdings Limited (“Atour” or the “Company”)

(NASDAQ: ATAT), a leading hospitality and lifestyle company in

China, today announced its unaudited financial results for the

third quarter ended September 30, 2023.

Third Quarter of 2023 Operational

Highlights

As of September 30, 2023, there were 1,112

hotels with a total of 128,681 hotel rooms in operation across

Atour’s hotel network, representing a rapid increase of 26.4% and

25.3% year-over-year in terms of the number of hotels and hotel

rooms, respectively. As of September 30, 2023, there were 577

manachised hotels under development in our pipeline.

The average daily room rate4 (“ADR”) was

RMB495 for the third quarter of 2023, compared with RMB424 for the

third quarter of 2022 and RMB475 for the previous quarter. The ADR

for the third quarter of 2023 recovered to 111.2% of 2019’s level

for the same period.

The occupancy rate4 was 82.4% for the third

quarter of 2023, compared with 72.0% for the third quarter of 2022

and 77.1% for the previous quarter. The occupancy rate for the

third quarter of 2023 recovered to 106.6% of 2019’s level for the

same period.

The revenue per available room4 (“RevPAR”) was

RMB424 for the third quarter of 2023, compared with RMB321 for the

third quarter of 2022 and RMB384 for the previous quarter. The

RevPAR for the third quarter of 2023 recovered to 117.8% of 2019’s

level for the same period.

The GMV5 generated from our scenario-based

retail business was RMB302 million for the third quarter of 2023,

representing an increase of 292.0% year-over-year.

“In the third quarter of 2023, we sustained our

robust growth and delivered remarkable performance across our

business lines,” said Mr. Haijun Wang, Founder, Chairman and CEO of

Atour. “Our ADR and occupancy rate continued to rise significantly

in the third quarter, boosting RevPAR to a record high. While

maintaining strong momentum in hotel signings and openings, we also

persisted in advancing product innovation. In November, we

officially launched our new flagship product in the upper midscale

segment, Atour 4.0 'With Nature.' Through comprehensive upgrades

and unique deep-sleep-inspired amenities, Atour 4.0 creates a space

infused with contentment and relaxation for our guests, reflecting

our relentless pursuit of delivering the ultimate accommodation

experience. Additionally, our scenario-based retail business

achieved outstanding results this quarter, with GMV reaching a new

record high. Leveraging our deep understanding of customers’ real

needs and our efficient mechanism for new product development, we

successfully launched several blockbuster Atour Planet products,

further solidifying our leading position in the sleep market.

Moving forward, we will remain dedicated to Atour’s original

aspirations, guaranteeing exceptional customer experiences in

accommodation and beyond while creating an intimate ambiance where

people can warmly connect,” Mr. Wang concluded.

Third Quarter of 2023 Unaudited Financial

Results

|

|

|

Q3 2022 |

|

Q3 2023 |

|

(RMB in thousands) |

|

|

|

|

|

Revenues: |

|

|

|

|

| Manachised hotels |

|

427,038 |

|

781,112 |

| Leased hotels |

|

159,565 |

|

238,190 |

| Retail revenues and

others |

|

83,510 |

|

274,802 |

| Net

revenues |

|

670,113 |

|

1,294,104 |

| |

Net revenues. Our net revenues

for the third quarter of 2023 increased by 93.1% to RMB1,294

million (US$177 million) from RMB670 million for the same period of

2022, mainly driven by the robust growth in both hotel and

scenario-based retail businesses.

- Manachised hotels. Revenues from

our manachised hotels for the third quarter of 2023 increased by

82.9% to RMB781 million (US$107 million) from RMB427 million for

the same period of 2022. This increase was primarily driven by the

ongoing expansion of our hotel network and the growth of RevPAR.

The total number of our manachised hotels increased from 847 as of

September 30, 2022, to 1,080 as of September 30, 2023. RevPAR of

our manachised hotels surpassed 2019’s level and increased to

RMB418 for the third quarter of 2023 from RMB317 for the same

period of 2022.

- Leased hotels. Revenues from our

leased hotels for the third quarter of 2023 increased by 49.3% to

RMB238 million (US$33 million) from RMB160 million for the same

period of 2022. This increase was primarily due to the growth of

RevPAR, which surpassed 2019’s level and increased to RMB571 for

the third quarter of 2023 from RMB384 for the same period of

2022.

- Retail revenues and others.

Revenues from retail and others for the third quarter of 2023

increased by 229.1% to RMB275 million (US$38 million) from RMB84

million for the same period of 2022, with scenario-based retail

revenues growing by 291.7% year-over-year to RMB235 million. This

increase was driven by widespread recognition of our retail brand

and compelling product offerings, as well as improved product

development and distribution capabilities.

| |

|

Q3 2022 |

|

Q3 2023 |

| (RMB in thousands) |

|

|

|

|

| Operating costs and

expenses: |

|

|

|

|

|

Hotel operating costs |

|

(389,108 |

) |

|

(616,537 |

) |

| Other operating costs |

|

(44,945 |

) |

|

(130,682 |

) |

| Selling and marketing

expenses |

|

(30,405 |

) |

|

(112,273 |

) |

| General and administrative

expenses |

|

(45,591 |

) |

|

(79,382 |

) |

| Technology and development

expenses |

|

(16,446 |

) |

|

(20,367 |

) |

| Total operating costs

and expenses |

|

(526,495 |

) |

|

(959,241 |

) |

| |

Operating costs and expenses

for the third quarter of 2023 were RMB959 million (US$131 million).

Excluding the impact from share-based compensation expenses of

RMB10 million, operating costs and expenses for the third quarter

of 2023 increased by 80.3% to RMB949 million, compared with RMB526

million for the same period of 2022.

- Hotel operating costs for the third

quarter of 2023 increased by 58.4% to RMB617 million (US$85

million) from RMB389 million for the same period of 2022. This

increase was mainly due to the increase in variable costs, such as

supply chain costs, associated with the continued growth of our

hotel business. Hotel operating costs accounted for 60.5% of

manachised and leased hotels’ revenues for the third quarter of

2023, compared with 66.3% for the same period of 2022. The decrease

was attributable to the increase in hotel revenues driven by the

ongoing expansion of our hotel network and the growth of

RevPAR.

- Other operating costs primarily

consist of costs for our scenario-based retail business and other

businesses. Other operating costs for the third quarter of 2023

increased by 190.8% to RMB131 million (US$18 million) from RMB45

million for the same period of 2022, primarily driven by increased

costs associated with the rapid growth of our scenario-based retail

business. Other operating costs accounted for 47.6% of retail

revenues and others for the third quarter of 2023, compared with

53.8% for the same period of 2022. The decrease was attributable to

the improved profitability of our retail business.

- Selling and marketing expenses for

the third quarter of 2023 increased by 269.3% to RMB112 million

(US$15 million) from RMB30 million for the same period of 2022.

This increase was mainly due to the rapid growth of our

scenario-based retail business particularly driven by online

channels. Selling and marketing expenses accounted for 8.7% of net

revenues for the third quarter of 2023, compared with 4.5% for the

same period of 2022.

- General and administrative expenses

for the third quarter of 2023 were RMB79 million (US$11 million).

Excluding the impact from share-based compensation expenses of RMB9

million, general and administrative expenses for the third quarter

of 2023 increased by 53.3% to RMB70 million, compared with RMB46

million for the same period of 2022. General and administrative

expenses, excluding the impact from share-based compensation

expenses, accounted for 5.4% of net revenues for the third quarter

of 2023, compared with 6.8% for the same period of 2022.

- Technology and development expenses

for the third quarter of 2023 were RMB20 million (US$3 million),

compared with RMB16 million for the same period of 2022.

Other operating income

primarily consists of income from government subsidies and

value-added tax related benefits. Other operating income for the

third quarter of 2023 was RMB6 million (US$1 million), compared

with RMB5 million for the same period of 2022.

Income from operations for the

third quarter of 2023 was RMB341 million (US$47 million), compared

with RMB148 million for the same period of 2022.

Other expenses, net for the

third quarter of 2023 was RMB1 million (US$0.2 million), which was

generally in line with the same period of 2022.

Income tax expense for the

third quarter of 2023 was RMB94 million (US$13 million), compared

with RMB41 million for the same period of 2022.

Net income for the third

quarter of 2023 was RMB262 million (US$36 million), compared with

RMB111 million for the same period of 2022.

Adjusted net income (non-GAAP)

for the third quarter of 2023 was RMB272 million (US$37 million),

representing an increase of 144.7% compared with RMB111 million for

the same period of 2022.

Basic and diluted income per

share/American depositary share (ADS). For the third

quarter of 2023, basic income per share was RMB0.63 (US$0.09), and

diluted income per share was RMB0.63 (US$0.09). Basic income per

ADS for the third quarter of 2023 was RMB1.89 (US$0.27), and

diluted income per ADS was RMB1.89 (US$0.27).

EBITDA (non-GAAP) for the third

quarter of 2023 was RMB370 million (US$51 million), compared with

RMB171 million for the same period of 2022.

Adjusted EBITDA (non-GAAP) for

the third quarter of 2023 was RMB380 million (US$52 million),

representing an increase of 122.4% compared with RMB171 million for

the same period of 2022.

Cash flows. Operating cash

inflow for the third quarter of 2023 was RMB543 million (US$74

million). Investing cash outflow and financing cash outflow for the

third quarter of 2023 were RMB779 million (US$107 million) and

RMB98 million (US$13 million), respectively.

Cash and cash equivalents and restricted

cash. As of September 30, 2023, the Company had a total

balance of cash and cash equivalents and restricted cash of RMB2.2

billion (US$301 million).

Debt financing. As of September

30, 2023, the Company had total outstanding borrowings of RMB72

million (US$10 million) and the unutilized credit facility

available to the Company was RMB380 million.

______________________________1 Adjusted

net income (non-GAAP) is defined as net income excluding

share-based compensation expenses.2 EBITDA (non-GAAP) is

defined as earnings before interest expense, interest income,

income tax expense and depreciation and

amortization.3 Adjusted EBITDA (non-GAAP) is defined as EBITDA

excluding share-based compensation expenses.4 Excludes hotel

rooms that were previously requisitioned by the government for

quarantine needs in response to the COVID-19 outbreak or otherwise

became unavailable due to temporary hotel closures. ADR and RevPAR

are calculated based on tax inclusive room rates. “ADR” refers to

the average daily room rate, which means room revenue divided by

the number of rooms in use for a given period; “Occupancy rate”

refers to the number of rooms in use divided by the number of

available rooms for a given period; “RevPAR” refers to revenue per

available room, which is calculated by total revenues during a

period divided by the number of available rooms of our hotels

during the same period.5 “GMV” refers to gross merchandise

value, which is the total value of confirmed orders placed by our

end customers with us or our franchisees, as the case may be, and

sold as part of our retail business, regardless of whether the

products are delivered or returned, calculated based on the prices

of the ordered products net of any discounts offered to our end

customers.

Conference Call

The Company will host a conference call at 8:00 AM U.S. Eastern

time on Thursday, November 16, 2023 (or 9:00 PM Beijing/Hong Kong

time on the same day).

A live webcast of the conference call will be available on the

Company’s investor relations website at https://ir.yaduo.com,

and a replay of the webcast will be available following the

session.

For participants who wish to join the conference call via

telephone, please pre-register using the link provided below. Upon

registering, each participant will receive a set of participant

dial-in numbers and a personal PIN in order to join the conference

call.

Details for the conference call are as follows:

Event Title: Atour Third Quarter 2023 Earnings Conference

CallPre-registration

Link: https://register.vevent.com/register/BI7b474638520c4f9d93533dc6ffedd502

Use of Non-GAAP Financial Measures

To supplement the Company’s unaudited

consolidated financial results presented in accordance with U.S.

Generally-Accepted Accounting Principles (“GAAP”), the Company uses

the following non-GAAP measures defined as non-GAAP financial

measures by the U.S. Securities and Exchange Commission: adjusted

net income (loss), which is defined as net income (loss) excluding

share-based compensation expenses; EBITDA, which is defined as

earnings before interest expense, interest income, income tax

expense and depreciation and amortization; adjusted EBITDA, which

is defined as EBITDA excluding share-based compensation expenses.

The presentation of these non-GAAP financial measures is not

intended to be considered in isolation or as a substitute for the

financial information prepared and presented in accordance with

U.S. GAAP. For more information on these non-GAAP financial

measures, please see the table captioned “Reconciliations of GAAP

and non-GAAP results” set forth at the end of this release.

The Company believes that EBITDA is widely used

by other companies in the hospitality industry and may be used by

investors as a measure of the financial performance. Given the

significant investments that the Company has made in leasehold

improvements and other fixed assets of leased hotels, depreciation

and amortization comprises a significant portion of the Company’s

cost structure. The Company believes that EBITDA will provide

investors with a useful tool for comparability between periods

because it eliminates depreciation and amortization attributable to

capital expenditures. Adjusted net income and adjusted EBITDA

provide meaningful supplemental information regarding the Company’s

performance by excluding share-based compensation expenses, as the

investors can better understand the Company’s performance and

compare business trends among different reporting periods on a

consistent basis excluding share-based compensation expenses which

are not expected to result in cash payment. The Company believes

that both management and investors benefit from referring to these

non-GAAP financial measures in assessing the Company’s performance

and when planning and forecasting future periods. These non-GAAP

financial measures also facilitate management’s internal

comparisons to the Company’s historical performance. The Company

believes these non-GAAP financial measures are also useful to

investors in allowing for greater transparency with respect to

supplemental information used regularly by Company management in

financial and operational decision-making. The accompanying tables

provide more details on the reconciliations between GAAP financial

measures that are most directly comparable to non-GAAP financial

measures.

The use of these non-GAAP measures has certain

limitations as the excluded items have been and will be incurred

and are not reflected in the presentation of these non-GAAP

measures. Each of these items should also be considered in the

overall evaluation of the results. The Company compensates for

these limitations by providing the relevant disclosure of the

relevant items both in its reconciliations to the U.S. GAAP

financial measures and in its consolidated financial statements,

all of which should be considered when evaluating the performance

of the Company.

In addition, these measures may not be

comparable to similarly titled measures utilized by other companies

since such other companies may not calculate these measures in the

same manner as the Company does.

About Atour Lifestyle Holdings Limited

Atour Lifestyle Holdings Limited (NASDAQ: ATAT)

is a leading hospitality and lifestyle company in China, with a

distinct portfolio of lifestyle hotel brands. Atour is the leading

upper midscale hotel chain in China and is the first Chinese hotel

chain to develop a scenario-based retail business. Atour is

committed to bringing innovations to China’s hospitality industry

and building new lifestyle brands around hotel offerings. For more

information, please visit https://ir.yaduo.com.

Investor Relations Contact

Atour Lifestyle Holdings LimitedEmail: ir@yaduo.com

Piacente Financial CommunicationsEmail: Atour@tpg-ir.comTel:

+86-10-6508-0677

—Financial Tables and Operational Data

Follow—

|

ATOUR LIFESTYLE HOLDINGS LIMITEDUNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(All amounts in thousands, except share data and per share

data, or otherwise noted) |

|

|

|

|

|

|

|

|

|

|

|

As of |

|

As of |

|

|

|

December 31, |

|

September 30, |

|

|

|

2022 |

|

2023 |

|

|

|

RMB |

|

RMB |

|

USD1 |

| Assets |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

| Cash and cash equivalents |

|

1,589,161 |

|

2,197,677 |

|

301,217 |

| Short-term investments |

|

157,808 |

|

783,861 |

|

107,437 |

| Accounts receivable |

|

132,699 |

|

143,446 |

|

19,661 |

| Prepayments and other current

assets |

|

133,901 |

|

246,319 |

|

33,761 |

| Amounts due from related

parties |

|

53,630 |

|

117,830 |

|

16,150 |

| Inventories |

|

57,460 |

|

113,660 |

|

15,578 |

| Total current

assets |

|

2,124,659 |

|

3,602,793 |

|

493,804 |

| Non-current

assets |

|

|

|

|

|

|

| Restricted cash |

|

946 |

|

644 |

|

88 |

| Contract costs |

|

67,270 |

|

84,166 |

|

11,536 |

| Property and equipment,

net |

|

360,300 |

|

305,979 |

|

41,938 |

| Operating lease right-of-use

assets |

|

1,932,000 |

|

1,737,158 |

|

238,097 |

| Intangible assets, net |

|

5,537 |

|

4,643 |

|

636 |

| Goodwill |

|

17,446 |

|

17,446 |

|

2,391 |

| Other assets |

|

141,335 |

|

135,625 |

|

18,590 |

| Deferred tax assets |

|

112,533 |

|

85,238 |

|

11,683 |

| Total non-current

assets |

|

2,637,367 |

|

2,370,899 |

|

324,959 |

| Total

assets |

|

4,762,026 |

|

5,973,692 |

|

818,763 |

|

|

|

|

|

|

|

|

| Liabilities and

shareholders’ equity |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

| Operating lease liabilities,

current |

|

319,598 |

|

301,967 |

|

41,388 |

| Accounts payable |

|

184,901 |

|

410,294 |

|

56,236 |

| Deferred revenue, current |

|

202,996 |

|

334,634 |

|

45,865 |

| Salary and welfare

payable |

|

103,539 |

|

147,558 |

|

20,225 |

| Accrued expenses and other

payables |

|

330,282 |

|

648,202 |

|

88,843 |

| Income taxes payable |

|

31,336 |

|

118,092 |

|

16,186 |

| Short-term borrowings |

|

142,828 |

|

70,000 |

|

9,594 |

| Current portion of long-term

borrowings |

|

29,130 |

|

- |

|

- |

| Amounts due to related

parties |

|

3,004 |

|

2,326 |

|

319 |

| Total current

liabilities |

|

1,347,614 |

|

2,033,073 |

|

278,656 |

| Non-current

liabilities |

|

|

|

|

|

|

| Operating lease liabilities,

non-current |

|

1,805,402 |

|

1,613,495 |

|

221,148 |

| Deferred revenue,

non-current |

|

277,841 |

|

348,476 |

|

47,762 |

| Long-term borrowings,

non-current portion |

|

2,000 |

|

2,000 |

|

274 |

|

Other non-current liabilities |

|

141,763 |

|

180,887 |

|

24,793 |

| Total non-current

liabilities |

|

2,227,006 |

|

2,144,858 |

|

293,977 |

| Total

liabilities |

|

3,574,620 |

|

4,177,931 |

|

572,633 |

______________________________1 Translations of balances in the

consolidated financial statements from RMB into US$ for the third

quarter of 2023 and as of September 30, 2023 are solely for

readers’ convenience and were calculated at the rate of US$1.00=RMB

7.2960, representing the exchange rate set forth in the H.10

statistical release of the Federal Reserve Board on September 30,

2023.

|

ATOUR LIFESTYLE HOLDINGS LIMITEDUNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(All amounts in thousands, except share data and per share

data, or otherwise noted) |

|

|

|

|

|

|

|

|

|

|

|

As of |

|

As of |

|

|

|

December 31, |

|

September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

|

|

RMB |

|

RMB |

|

USD1 |

| Shareholders’

equity |

|

|

|

|

|

|

|

Class A ordinary shares |

|

229 |

|

|

244 |

|

|

33 |

|

|

Class B ordinary shares |

|

56 |

|

|

56 |

|

|

8 |

|

|

Additional paid in capital |

|

1,286,189 |

|

|

1,500,836 |

|

|

205,707 |

|

| Retained earnings (accumulated

deficit) |

|

(78,304 |

) |

|

287,172 |

|

|

39,360 |

|

| Accumulated other

comprehensive income (loss) |

|

(10,865 |

) |

|

15,141 |

|

|

2,075 |

|

|

Total shareholders’

equity attributable to shareholders of the

Company |

|

1,197,305 |

|

|

1,803,449 |

|

|

247,183 |

|

| Non-controlling interests |

|

(9,899 |

) |

|

(7,688 |

) |

|

(1,053 |

) |

|

Total shareholders’

equity |

|

1,187,406 |

|

|

1,795,761 |

|

|

246,130 |

|

| Commitments and

contingencies |

|

- |

|

|

- |

|

|

- |

|

| Total liabilities and

shareholders’ equity |

|

4,762,026 |

|

|

5,973,692 |

|

|

818,763 |

|

|

ATOUR LIFESTYLE HOLDINGS LIMITEDUNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME |

|

(All amounts in thousands, except share data and per share

data, or otherwise noted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

|

|

RMB |

|

RMB |

|

USD1 |

|

RMB |

|

RMB |

|

USD1 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Manachised hotels |

|

427,038 |

|

|

781,112 |

|

|

107,060 |

|

|

995,977 |

|

|

1,854,393 |

|

|

254,166 |

|

|

Leased hotels |

|

159,565 |

|

|

238,190 |

|

|

32,647 |

|

|

414,020 |

|

|

645,024 |

|

|

88,408 |

|

|

Retail revenues and others |

|

83,510 |

|

|

274,802 |

|

|

37,665 |

|

|

226,813 |

|

|

661,332 |

|

|

90,643 |

|

| Net

revenues |

|

670,113 |

|

|

1,294,104 |

|

|

177,372 |

|

|

1,636,810 |

|

|

3,160,749 |

|

|

433,217 |

|

| Operating costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotel operating costs |

|

(389,108 |

) |

|

(616,537 |

) |

|

(84,503 |

) |

|

(1,037,383 |

) |

|

(1,507,682 |

) |

|

(206,645 |

) |

|

Other operating costs |

|

(44,945 |

) |

|

(130,682 |

) |

|

(17,912 |

) |

|

(118,550 |

) |

|

(323,157 |

) |

|

(44,292 |

) |

| Selling and marketing

expenses |

|

(30,405 |

) |

|

(112,273 |

) |

|

(15,388 |

) |

|

(85,937 |

) |

|

(262,682 |

) |

|

(36,004 |

) |

| General and administrative

expenses |

|

(45,591 |

) |

|

(79,382 |

) |

|

(10,880 |

) |

|

(132,968 |

) |

|

(346,036 |

) |

|

(47,428 |

) |

| Technology and development

expenses |

|

(16,446 |

) |

|

(20,367 |

) |

|

(2,792 |

) |

|

(50,216 |

) |

|

(54,988 |

) |

|

(7,537 |

) |

| Total operating costs

and expenses |

|

(526,495 |

) |

|

(959,241 |

) |

|

(131,475 |

) |

|

(1,425,054 |

) |

|

(2,494,545 |

) |

|

(341,906 |

) |

| Other operating income |

|

4,816 |

|

|

6,475 |

|

|

887 |

|

|

31,583 |

|

|

43,653 |

|

|

5,983 |

|

| Income from

operations |

|

148,434 |

|

|

341,338 |

|

|

46,784 |

|

|

243,339 |

|

|

709,857 |

|

|

97,294 |

|

| Interest income |

|

3,887 |

|

|

8,456 |

|

|

1,159 |

|

|

9,485 |

|

|

20,812 |

|

|

2,853 |

|

| Gain from short-term

investments |

|

2,773 |

|

|

8,875 |

|

|

1,216 |

|

|

6,537 |

|

|

23,197 |

|

|

3,179 |

|

| Interest expense |

|

(1,534 |

) |

|

(723 |

) |

|

(99 |

) |

|

(4,855 |

) |

|

(4,326 |

) |

|

(593 |

) |

| Other expenses, net |

|

(1,181 |

) |

|

(1,471 |

) |

|

(202 |

) |

|

(3,059 |

) |

|

(4,442 |

) |

|

(609 |

) |

| Income before income

tax |

|

152,379 |

|

|

356,475 |

|

|

48,858 |

|

|

251,447 |

|

|

745,098 |

|

|

102,124 |

|

| Income tax expense |

|

(41,239 |

) |

|

(94,408 |

) |

|

(12,939 |

) |

|

(72,762 |

) |

|

(225,804 |

) |

|

(30,949 |

) |

| Net

income |

|

111,140 |

|

|

262,067 |

|

|

35,919 |

|

|

178,685 |

|

|

519,294 |

|

|

71,175 |

|

| Less: net income (loss)

attributable to non-controlling interests |

|

(190 |

) |

|

1,049 |

|

|

144 |

|

|

(1,692 |

) |

|

2,211 |

|

|

303 |

|

| Net income

attributable to the Company |

|

111,330 |

|

|

261,018 |

|

|

35,775 |

|

|

180,377 |

|

|

517,083 |

|

|

70,872 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

111,140 |

|

|

262,067 |

|

|

35,919 |

|

|

178,685 |

|

|

519,294 |

|

|

71,175 |

|

| Other comprehensive

income |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustments, net of nil income taxes |

|

4,728 |

|

|

3,014 |

|

|

413 |

|

|

9,404 |

|

|

26,006 |

|

|

3,564 |

|

| Other comprehensive

income, net of income taxes |

|

4,728 |

|

|

3,014 |

|

|

413 |

|

|

9,404 |

|

|

26,006 |

|

|

3,564 |

|

| Total comprehensive

income |

|

115,868 |

|

|

265,081 |

|

|

36,332 |

|

|

188,089 |

|

|

545,300 |

|

|

74,739 |

|

| Comprehensive income (loss)

attributable to non-controlling interests |

|

(190 |

) |

|

1,049 |

|

|

144 |

|

|

(1,692 |

) |

|

2,211 |

|

|

303 |

|

| Comprehensive income

attributable to the Company |

|

116,058 |

|

|

264,032 |

|

|

36,188 |

|

|

189,781 |

|

|

543,089 |

|

|

74,436 |

|

| Net income per ordinary

share |

|

|

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

0.30 |

|

|

0.63 |

|

|

0.09 |

|

|

0.48 |

|

|

1.28 |

|

|

0.18 |

|

| —Diluted |

|

0.30 |

|

|

0.63 |

|

|

0.09 |

|

|

0.48 |

|

|

1.25 |

|

|

0.17 |

|

| Weighted average ordinary

shares used in calculating net income per ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

376,970,454 |

|

|

412,683,043 |

|

|

412,683,043 |

|

|

376,970,454 |

|

|

403,206,606 |

|

|

403,206,606 |

|

| —Diluted |

|

376,970,454 |

|

|

416,140,935 |

|

|

416,140,935 |

|

|

376,970,454 |

|

|

414,425,523 |

|

|

414,425,523 |

|

|

ATOUR LIFESTYLE HOLDINGS LIMITED UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

(In thousands of RMB, except share data and per share data,

or otherwise noted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

|

|

RMB |

|

RMB |

|

USD1 |

|

RMB |

|

RMB |

|

USD1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash generated from operating activities |

|

179,713 |

|

|

543,072 |

|

|

74,434 |

|

|

318,695 |

|

|

1,424,637 |

|

|

195,263 |

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Payment for purchases of

property and equipment |

|

(6,699 |

) |

|

(4,487 |

) |

|

(615 |

) |

|

(23,795 |

) |

|

(31,897 |

) |

|

(4,372 |

) |

| Proceeds from disposal of

property and equipment |

|

- |

|

|

670 |

|

|

92 |

|

|

- |

|

|

670 |

|

|

92 |

|

| Payment for purchases of

intangible assets |

|

(542 |

) |

|

- |

|

|

- |

|

|

(1,142 |

) |

|

- |

|

|

- |

|

| Payment for purchases of

short-term investments |

|

(764,350 |

) |

|

(2,494,000 |

) |

|

(341,831 |

) |

|

(1,850,550 |

) |

|

(5,826,210 |

) |

|

(798,549 |

) |

| Proceeds from maturities of

short-term investments |

|

767,123 |

|

|

1,719,014 |

|

|

235,610 |

|

|

1,857,087 |

|

|

5,213,708 |

|

|

714,599 |

|

| Net cash used in

investing activities |

|

(4,468 |

) |

|

(778,803 |

) |

|

(106,744 |

) |

|

(18,400 |

) |

|

(643,729 |

) |

|

(88,230 |

) |

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition of non-controlling

interest |

|

(350 |

) |

|

- |

|

|

- |

|

|

(350 |

) |

|

- |

|

|

- |

|

| Proceeds from borrowings |

|

- |

|

|

- |

|

|

- |

|

|

169,000 |

|

|

40,000 |

|

|

5,482 |

|

| Repayment of borrowings |

|

(3,000 |

) |

|

(848 |

) |

|

(116 |

) |

|

(76,480 |

) |

|

(141,958 |

) |

|

(19,457 |

) |

| Proceeds from stock option

exercises |

|

- |

|

|

53,159 |

|

|

7,286 |

|

|

- |

|

|

53,159 |

|

|

7,286 |

|

| Payment for dividends |

|

- |

|

|

(150,579 |

) |

|

(20,639 |

) |

|

- |

|

|

(150,579 |

) |

|

(20,638 |

) |

| Payment for initial public

offering costs |

|

- |

|

|

- |

|

|

- |

|

|

(721 |

) |

|

- |

|

|

- |

|

| Net cash (used in)

generated from financing activities |

|

(3,350 |

) |

|

(98,268 |

) |

|

(13,469 |

) |

|

91,449 |

|

|

(199,378 |

) |

|

(27,327 |

) |

| Effect of exchange rate

changes on cash and cash equivalents and restricted cash |

|

1,271 |

|

|

3,014 |

|

|

414 |

|

|

5,066 |

|

|

26,684 |

|

|

3,657 |

|

| Net increase in cash,

cash equivalents and restricted cash |

|

173,166 |

|

|

(330,985 |

) |

|

(45,365 |

) |

|

396,810 |

|

|

608,214 |

|

|

83,363 |

|

| Cash and cash equivalents and

restricted cash at the beginning of the period |

|

1,263,173 |

|

|

2,529,306 |

|

|

346,670 |

|

|

1,039,529 |

|

|

1,590,107 |

|

|

217,942 |

|

| Cash and cash

equivalents and restricted cash at the end of the

period |

|

1,436,339 |

|

|

2,198,321 |

|

|

301,305 |

|

|

1,436,339 |

|

|

2,198,321 |

|

|

301,305 |

|

|

ATOUR LIFESTYLE HOLDINGS LIMITEDUNAUDITED

RECONCILIATION OF GAAP AND NON-GAAP RESULTS |

|

(In thousands of RMB, except share data and per share data,

or otherwise noted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

|

|

RMB |

|

RMB |

|

USD1 |

|

RMB |

|

RMB |

|

USD1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (GAAP) |

|

111,140 |

|

|

262,067 |

|

|

35,919 |

|

|

178,685 |

|

|

519,294 |

|

|

71,175 |

|

| Share-based compensation

expenses, net of tax effect of nil2 |

|

- |

|

|

9,924 |

|

|

1,360 |

|

|

- |

|

|

161,502 |

|

|

22,136 |

|

| Adjusted net income

(non-GAAP) |

|

111,140 |

|

|

271,991 |

|

|

37,279 |

|

|

178,685 |

|

|

680,796 |

|

|

93,311 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

|

|

RMB |

|

RMB |

|

USD1 |

|

RMB |

|

RMB |

|

USD1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(GAAP) |

|

111,140 |

|

|

262,067 |

|

|

35,919 |

|

|

178,685 |

|

|

519,294 |

|

|

71,175 |

|

| Interest income |

|

(3,887 |

) |

|

(8,456 |

) |

|

(1,159 |

) |

|

(9,485 |

) |

|

(20,812 |

) |

|

(2,853 |

) |

| Interest expense |

|

1,534 |

|

|

723 |

|

|

99 |

|

|

4,855 |

|

|

4,326 |

|

|

593 |

|

| Income tax expense |

|

41,239 |

|

|

94,408 |

|

|

12,940 |

|

|

72,762 |

|

|

225,804 |

|

|

30,949 |

|

| Depreciation and

amortization |

|

20,854 |

|

|

21,413 |

|

|

2,935 |

|

|

61,449 |

|

|

65,599 |

|

|

8,991 |

|

| EBITDA

(non-GAAP) |

|

170,880 |

|

|

370,155 |

|

|

50,734 |

|

|

308,266 |

|

|

794,211 |

|

|

108,855 |

|

| Share-based compensation

expenses, net of tax effect of nil2 |

|

- |

|

|

9,924 |

|

|

1,360 |

|

|

- |

|

|

161,502 |

|

|

22,136 |

|

| Adjusted EBITDA

(non-GAAP) |

|

170,880 |

|

|

380,079 |

|

|

52,094 |

|

|

308,266 |

|

|

955,713 |

|

|

130,991 |

|

______________________________2 The share-based compensation

expenses were recorded at entities in PRC. Share-based compensation

expenses were non-deductible expenses in PRC. Therefore, there is

no tax impact for share-based compensation expenses adjustment for

non-GAAP financial measures.

Key Operating Data

| |

Number of Hotels |

|

Number of Rooms |

|

|

Opened in Q3 2023 |

Closed in Q3 2023 |

As ofSeptember 30, 2023 |

|

As ofSeptember 30, 2023 |

| Manachised hotels |

81 |

2 |

1,080 |

|

123,831 |

| Leased hotels |

- |

1 |

32 |

|

4,850 |

| Total |

81 |

3 |

1,112 |

|

128,681 |

| |

|

As of September 30,

2023 |

| Brand |

Positioning |

Properties |

Rooms |

| |

|

Manachised |

Leased |

|

| A.T. House |

Luxury |

- |

1 |

214 |

| Atour S |

Upscale |

54 |

8 |

9,430 |

| ZHOTEL |

Upscale |

1 |

- |

52 |

| Atour |

Upper midscale |

835 |

22 |

99,907 |

| Atour X |

Upper midscale |

97 |

- |

10,605 |

| Atour Light |

Midscale |

93 |

1 |

8,473 |

| Total |

|

1,080 |

32 |

128,681 |

| |

Three Months EndedSeptember 30,

2019 |

|

Three Months EndedSeptember 30,

2022 |

|

Three Months EndedJune 30,

2023 |

|

Three Months EndedSeptember 30,

2023 |

| |

|

|

|

|

|

|

|

| Occupancy

rate3 (in

percentage) |

|

|

|

|

|

|

|

|

Manachised hotels |

76.4% |

|

|

72.0% |

|

|

76.8% |

|

|

82.2% |

|

|

Leased hotels |

85.8% |

|

|

71.6% |

|

|

83.0% |

|

|

86.6% |

|

|

All hotels |

77.3% |

|

|

72.0% |

|

|

77.1% |

|

|

82.4% |

|

|

|

|

|

|

|

|

|

|

|

ADR3 (in

RMB) |

|

|

|

|

|

|

|

|

Manachised hotels |

432.1 |

|

|

419.5 |

|

|

468.1 |

|

|

489.4 |

|

|

Leased hotels |

550.5 |

|

|

506.3 |

|

|

611.5 |

|

|

629.9 |

|

|

All hotels |

445.4 |

|

|

424.3 |

|

|

474.8 |

|

|

495.4 |

|

|

|

|

|

|

|

|

|

|

|

RevPAR3 (in

RMB) |

|

|

|

|

|

|

|

|

Manachised hotels |

344.5 |

|

|

317.4 |

|

|

376.6 |

|

|

417.9 |

|

|

Leased hotels |

497.5 |

|

|

384.4 |

|

|

536.8 |

|

|

571.4 |

|

|

All hotels |

360.0 |

|

|

321.1 |

|

|

383.6 |

|

|

424.1 |

|

______________________________3 Excludes hotel rooms that were

previously requisitioned by the government for quarantine needs in

response to the COVID-19 outbreak or otherwise became unavailable

due to temporary hotel closures. ADR and RevPAR are calculated

based on tax inclusive room rates.

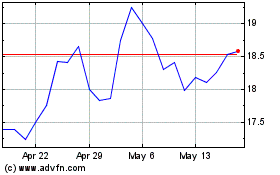

Atour Lifestyle (NASDAQ:ATAT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Atour Lifestyle (NASDAQ:ATAT)

Historical Stock Chart

From Jan 2024 to Jan 2025