Atea Pharmaceuticals, Inc. (Nasdaq: AVIR) (Atea or Company), a

clinical-stage biopharmaceutical company engaged in the discovery

and development of oral antiviral therapeutics for serious viral

diseases, today reported financial results for the third quarter

ended September 30, 2024 and provided a business update.

“We continue to make significant progress in our HCV program

with the combination of bemnifosbuvir and ruzasvir, which has a

potential best-in-class profile. In the near term, we look forward

to sharing topline results in early December from our Phase 2

combination study and initiating the global Phase 3 program early

next year,” said Jean-Pierre Sommadossi, PhD, Chief Executive

Officer and Founder of Atea Pharmaceuticals. “The unrelenting high

rate of new HCV infections underscores the need for new innovative

therapies that can address the unmet needs of today’s HCV patients,

particularly those with substance abuse disorders and

comorbidities. The HCV commercial market is expected to remain

large, with global net sales exceeding $3

billion, with the US accounting for approximately

half of this market. Based on our target profile that is

convenient, short treatment duration with a low risk of drug-drug

interactions, we are confident that our combination, if approved,

has the potential to gain significant market share and

could increase the number of patients cured.”

Hepatitis C Virus (HCV)

Phase 2 HCV Combination Study: Atea is

currently completing a global Phase 2 clinical study evaluating the

combination of bemnifosbuvir, a nucleotide analog polymerase

inhibitor, and ruzasvir, an NS5A inhibitor, for the treatment of

HCV. This study, which has enrolled 275 treatment-naïve patients,

both with and without compensated cirrhosis, is designed to

evaluate the safety and efficacy of eight weeks of treatment with

the combination consisting of once-daily bemnifosbuvir 550 mg and

ruzasvir 180 mg. The primary endpoints of the study are safety and

sustained virologic response at 12 weeks post-treatment (SVR12) in

the per-protocol treatment adherent population. Secondary and other

endpoints include SVR12 in the per-protocol population regardless

of treatment adherence (efficacy evaluable), virologic failure and

resistance. Atea expects to report topline Phase 2 SVR12 results

from this study in early December 2024.

At the European Association of the Study of the Liver (EASL)

Congress in June 2024, Atea presented clinical data from the

lead-in cohort (n=60) of the ongoing Phase 2 study. With an 8-week

treatment duration, data from the lead-in cohort of non-cirrhotic

patients showed a 97% SVR12 rate in efficacy evaluable patients.

Two subjects (GT1b and GT2b) experienced post-treatment relapse or

failure. Each of these patients had low plasma drug levels and

similar viral mutations at both the baseline and 12-weeks

post-treatment timepoint, which indicated that the relapse or

failure was due to treatment non-adherence rather than viral

resistance. These results also showed a 100% SVR12 rate in

participants infected with genotype 3 (n=13), a historically

difficult-to-treat genotype of HCV. In the lead-in cohort, the

combination regimen was well tolerated, with no drug-related

serious adverse events or treatment discontinuations.

Data also presented at EASL included additional preclinical data

further demonstrating a high barrier to resistance and favorable

pharmacokinetics (PK) for bemnifosbuvir and a low risk of drug-drug

interactions for ruzasvir. Atea has previously reported a low risk

of drug-drug interactions for bemnifosbuvir.

Atea is currently planning for an End of Phase 2 meeting with

the US Food and Drug Administration early in the first quarter of

2025 to support the initiation of the Phase 3 program.

Atea has selected and is manufacturing a fixed dose combination

(FDC) tablet for its upcoming Phase 3 program. The FDC tablet

reduces the daily pill count from four to two tablets, enhancing

patient convenience, with no food effect demonstrated in recent

studies.

New Data Presentations at Upcoming Scientific

Meetings

At The Liver Meeting 2024, being held from November 15-19, 2024,

three posters supportive of the combination of bemnifosbuvir and

ruzasvir as a potential treatment for HCV will be presented. The

posters detail additional safety and resistance data for

bemnifosbuvir and present multiscale modeling data estimating the

effectiveness of the combination of bemnifosbuvir and ruzasvir in

blocking HCV replication and viral assembly and secretion.

At the American College of Pharmacometrics meeting, being held

on November 11, 2024, supportive data from an integrated population

PK model that was developed to simultaneously characterize the PK

profile of bemnifosbuvir and its metabolites will be presented.

COVID-19

Phase 3 SUNRISE-3 Trial: In September 2024,

Atea announced results from the Phase 3 SUNRISE-3 trial, a global,

multicenter, randomized, double-blind, placebo-controlled study

evaluating bemnifosbuvir in patients with mild to moderate

COVID-19. The trial did not meet its primary endpoint of a

statistically significant reduction in all-cause hospitalization or

death through Day 29. Total enrollment for the monotherapy cohort

consisted of 2,221 high-risk patients randomized 1:1 to receive

bemnifosbuvir 550 mg twice-daily (BID) or placebo BID for five

days. In the trial, bemnifosbuvir was shown to be generally safe

and well tolerated.

The evolving nature of COVID-19, including milder disease

presentations and a reduction in hospitalizations due to COVID-19

related severe respiratory disease, pose significant challenges in

demonstrating a clinical impact with a direct-acting antiviral such

as bemnifosbuvir. Given the trial results and the changing

landscape of the pandemic, Atea will not pursue a regulatory

pathway forward for bemnifosbuvir for COVID-19.

Third Quarter 2024 Financial Results

Cash, Cash Equivalents and Marketable

Securities: $482.8 million at September 30, 2024 compared

to $502.2 million at June 30, 2024.

Research and Development Expenses: Research and

development expenses decreased by $2.0 million from $28.2 million

for the three months ended September 30, 2023 to $26.2 million for

the three months ended September 30, 2024. The net decrease was

primarily driven by lower external spend related to our COVID-19

Phase 3 SUNRISE-3 clinical trial offset by higher spend related to

our HCV Phase 2 clinical trial of the combination of bemnifosbuvir

and ruzasvir.

General and Administrative Expenses: General

and administrative expenses decreased by $1.6 million from $12.6

million for the three months ended September 30, 2023 to $11.0

million for the three months ended September 30, 2024. The net

decrease was primarily related to lower professional fees.

Interest Income and Other, Net: Interest income

and other, net, decreased by $1.6 million for the three months

ended September 30, 2024 compared to the three months ended

September 30, 2023, primarily due to lower investment balances.

Income Taxes: We recorded income tax expense of

$0.2 million for each of the three months ended September 30, 2024

and 2023.

| |

|

Condensed Consolidated Statement of Operations and

Comprehensive Loss |

|

(in thousands, except share and per share amounts) |

|

(unaudited) |

| |

| |

|

Three Months

EndedSeptember 30, |

|

|

Nine Months

EndedSeptember 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

26,159 |

|

|

$ |

28,181 |

|

|

$ |

118,430 |

|

|

$ |

79,198 |

|

|

General and administrative |

|

|

11,043 |

|

|

|

12,604 |

|

|

|

35,494 |

|

|

|

38,391 |

|

| Total operating expenses |

|

|

37,202 |

|

|

|

40,785 |

|

|

|

153,924 |

|

|

|

117,589 |

|

| Loss from operations |

|

|

(37,202 |

) |

|

|

(40,785 |

) |

|

|

(153,924 |

) |

|

|

(117,589 |

) |

| Interest income and other,

net |

|

|

6,277 |

|

|

|

7,864 |

|

|

|

19,782 |

|

|

|

21,466 |

|

| Loss before income taxes |

|

|

(30,925 |

) |

|

|

(32,921 |

) |

|

|

(134,142 |

) |

|

|

(96,123 |

) |

| Income tax expense |

|

|

(226 |

) |

|

|

(221 |

) |

|

|

(700 |

) |

|

|

(669 |

) |

| Net loss |

|

$ |

(31,151 |

) |

|

$ |

(33,142 |

) |

|

$ |

(134,842 |

) |

|

$ |

(96,792 |

) |

| Other comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on available-for-sale investments |

|

|

921 |

|

|

|

48 |

|

|

|

434 |

|

|

|

422 |

|

| Comprehensive loss |

|

$ |

(30,230 |

) |

|

$ |

(33,094 |

) |

|

$ |

(134,408 |

) |

|

$ |

(96,370 |

) |

| Net loss per share - basic and

diluted |

|

$ |

(0.37 |

) |

|

$ |

(0.40 |

) |

|

$ |

(1.60 |

) |

|

$ |

(1.16 |

) |

| Weighted-average number of

common shares - basic and diluted |

|

|

84,422,000 |

|

|

|

83,399,769 |

|

|

|

84,198,117 |

|

|

|

83,374,328 |

|

|

Selected Condensed Consolidated Balance Sheet

Data |

|

(in thousands) |

|

(unaudited) |

| |

|

|

|

|

|

|

| |

|

September 30, 2024 |

|

|

December 31, 2023 |

|

| |

|

|

|

|

|

|

|

Cash, cash equivalents and marketable securities |

|

|

482,813 |

|

|

|

578,106 |

|

| Working capital(1) |

|

|

461,716 |

|

|

|

558,079 |

|

| Total assets |

|

|

490,957 |

|

|

|

594,968 |

|

| Total liabilities |

|

|

32,436 |

|

|

|

39,776 |

|

| Total stockholder's

equity |

|

|

458,521 |

|

|

|

555,192 |

|

|

(1 |

) |

Atea defines working capital as current assets less current

liabilities. See the Company’s condensed consolidated financial

statements in its Quarterly Report on Form 10-Q for the three

months ended September 30, 2024 for further detail regarding its

current assets and liabilities. |

Conference Call and Webcast

Atea will host a conference call and live audio webcast to

discuss third quarter 2024 financial results and provide a business

update today at 4:30 p.m. ET. To access the live conference call,

participants may register here. The live audio webcast of the call

will be available under "Events and Presentations" in the Investor

Relations section of the Atea Pharmaceuticals website at

ir.ateapharma.com. To participate via telephone, please register in

advance here. Upon registration, all telephone participants will

receive a confirmation email detailing how to join the conference

call, including the dial-in number along with a unique passcode and

registrant ID that can be used to access the call. While not

required, it is recommended that participants join the call ten

minutes prior to the scheduled start. An archive of the audio

webcast will be available on Atea Pharmaceuticals’ website

approximately two hours after the conference call and will remain

available for at least 90 days following the event.

About Bemnifosbuvir and Ruzasvir for Hepatitis

C Virus (HCV)

Bemnifosbuvir has been shown in in vitro studies to be

approximately 10-fold more active than sofosbuvir (SOF) against a

panel of laboratory strains and clinical isolates of HCV GT

1–5. In vitro studies have also demonstrated

bemnifosbuvir remained fully active against SOF

resistance-associated substitutions (S282T), with up to 58-fold

more potency than SOF. The PK profile of bemnifosbuvir supports

once-daily dosing for the treatment of HCV. Bemnifosbuvir has been

shown to have a low risk for drug-drug interactions. Bemnifosbuvir

has been administered to over 2,200 subjects and has been

well-tolerated at doses up to 550 mg for durations up to 12 weeks

in healthy subjects and patients.

Ruzasvir has demonstrated highly potent and pan-genotypic

antiviral activity in preclinical (picomolar range) and clinical

studies. Ruzasvir has been administered to over 1,500 HCV-infected

patients at daily doses of up to 180 mg for 12 weeks and has

demonstrated a favorable safety profile. The PK profile of ruzasvir

supports once-daily dosing.

About Atea Pharmaceuticals

Atea is a clinical-stage biopharmaceutical company focused on

discovering, developing and commercializing oral antiviral

therapies to address the unmet medical needs of patients with

serious viral infections. Leveraging Atea’s deep understanding of

antiviral drug development, nucleos(t)ide chemistry, biology,

biochemistry and virology, Atea has built a proprietary

nucleos(t)ide prodrug platform to develop novel product candidates

to treat single stranded ribonucleic acid, or ssRNA, viruses, which

are a prevalent cause of serious viral diseases. Atea plans to

continue to build its pipeline of antiviral product candidates by

augmenting its nucleos(t)ide platform with other classes of

antivirals that may be used in combination with its nucleos(t)ide

product candidates. Our lead program and current focus is on the

development of the combination of bemnifosbuvir, a nucleotide

analog polymerase inhibitor and ruzasvir, an NS5A inhibitor, to

treat hepatitis C virus. For more information, please

visit www.ateapharma.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements in this press release include but

are not limited to the anticipated timing for reporting the topline

results from Atea’s Phase 2 trial of the combination of

bemnifosbuvir and ruzasvir for the treatment of HCV, meeting with

the FDA, and potential initiation of the HCV Phase 3 program. When

used herein, words including “will,” “plans”, and similar

expressions are intended to identify forward-looking statements. In

addition, any statements or information that refer to expectations,

beliefs, plans, projections, objectives, performance or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking. All forward-looking

statements are based upon Atea’s current expectations and various

assumptions. Atea believes there is a reasonable basis for its

expectations and beliefs, but they are inherently uncertain. Atea

may not realize its expectations, and its beliefs may not prove

correct. Actual results could differ materially from those

described or implied by such forward-looking statements as a result

of various important factors, including, without limitation,

dependence on the success of Atea’s most advanced product

candidates, in particular the combination of bemnifosbuvir and

ruzasvir for the treatment of hepatitis C; as well as the other

important factors discussed under the caption “Risk Factors” in

Atea’s Quarterly Report on Form 10-Q for the quarter ended June 30,

2024 as such factors may be updated from time to time in its other

filings with the SEC, which are accessible on the SEC’s website at

www.sec.gov. These and other important factors could cause actual

results to differ materially from those indicated by the

forward-looking statements made in this press release. Any such

forward-looking statements represent management’s estimates as of

the date of this press release. While Atea may elect to update such

forward-looking statements at some point in the future, except as

required by law, it disclaims any obligation to do so, even if

subsequent events cause our views to change. These forward-looking

statements should not be relied upon as representing Atea’s views

as of any date subsequent to the date of this press release.

Contacts

Jonae BarnesSVP, Investor Relations and Corporate

Communications617-818-2985barnes.jonae@ateapharma.com

Will O’ConnorPrecision

AQ212-362-1200will.oconnor@precisionaq.com

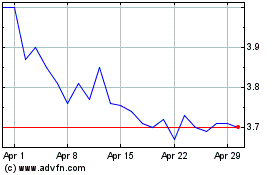

Atea Pharmaceuticals (NASDAQ:AVIR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Atea Pharmaceuticals (NASDAQ:AVIR)

Historical Stock Chart

From Dec 2023 to Dec 2024