Analysis: Bad News Barrage Dims Hopes Fed Can Deliver 2019 Rate Hikes

January 03 2019 - 3:31PM

Dow Jones News

By Michael S. Derby

Federal Reserve expectations that it will be able to deliver two

rate rises this year are being battered by mounting economic and

market news that signals trouble for the economy.

The Fed already was expecting the economy to slow this year

after a hot 2018, and the rate rises it projects for 2019 are under

the four made in 2018. But it now looks that even two rate

increases may be difficult to pull off.

Financial markets, by way of prices for federal-funds futures,

have moved to cancel out any expectation of a rate rise. What's

more, some investors and traders now see the central bank moving

rates lower this year.

The shift in sentiment is driven both by volatile markets and

the economic outlook.

On Wednesday, Apple Inc. surprised already rattled investors by

warning of lower revenue tied mostly to weakness in China. Apple's

troubles suggest the slowing in global growth Fed officials already

were expecting may create even greater headwinds to the economy.

The problem may get worse: President Trump economic adviser Kevin

Hassett said in a Wall Street Journal interview that "multinational

firms with profits in China are probably going to see at least that

part of their profit picture sour a little bit."

Another bit of worrisome news came Thursday from the Institute

for Supply Management's December manufacturing index. While it

still shows expanding activity, the index marked its biggest

one-month decline in a decade. Capital Economics told clients that

the deceleration is "the first genuine economic reason for the Fed

to potentially stop interest rates."

A bond-market indicator also is sending a bad signal. The

difference between the three-month Treasury bill and the 10-year

note has narrowed considerably. With the former at 2.41% and the

latter at 2.58% midday Thursday, an inversion in the yield curve is

a real possibility.

Inversions have often preceded recessions, even as economists

still debate whether they correlate with downturns, or cause them.

A recent San Francisco Fed paper said a sustained three-month to

10-year inversion is the most reliable market indicator of

recession.

The Fed has been trying to signal that its monetary policy plans

are far from set in stone. In late December, after the central bank

raised rates, New York Fed leader John Williams went on CNBC to

explain the central bank outlook.

"We are not sitting there thinking we know for sure what's going

to happen," Mr. Williams said. For 2019, "something like two rate

increases would make sense in the context of a really strong

economy moving forward. But we are data dependent and will adjust

our views" depending on what happens.

On Thursday, Dallas Fed leader Robert Kaplan, took a stand

against rate rises. While he still expects the economy to grow this

year, he told Bloomberg Television "we shouldn't be taking any

further action until some of these uncertainties resolve

themselves, and I think that could take several months."

Mr. Kaplan also said he is open to the idea the Fed at some

point may need to moderate its continuing effort to shrink the size

of its balance sheet. The reduction in holdings of Treasury and

mortgage bonds has drawn criticism from some in markets that the

process is tightening financial conditions too much.

So far, the Fed hasn't been buying that line. Fed Chairman

Jerome Powell told reporters after the December Federal Open Market

Committee meeting "the runoff in the balance sheet has been smooth

and has served its purpose. And I don't see us changing that." Mr.

Kaplan, who as a former top Goldman Sachs executive brings a

special sensitivity to financial developments, suggests the

possibility of change on that front has risen since December.

Mr. Powell has several opportunities to weigh in over coming

days. He is set to speak at 10:15 a.m. EST Friday in Atlanta with

former Fed leaders Janet Yellen and Ben Bernanke. He is then slated

to speak Jan. 10 at the Economic Club of Washington.

"The challenge for the Fed is determining whether the markets

are sending credible signals of a pending economic slowdown,"

Oxford Economics told clients. "We look for Powell to soften his

tone and indicate as Williams did that the Fed will be flexible in

adjusting their economic and rate outlook in the face of changing

economic and financial conditions without pledging to pause for a

defined period of time."

Write to Michael S. Derby at michael.derby@wsj.com

(END) Dow Jones Newswires

January 03, 2019 15:16 ET (20:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

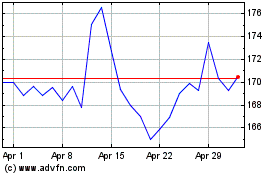

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Jun 2024 to Jul 2024

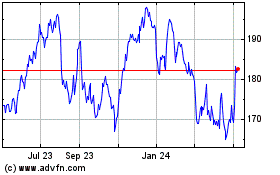

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Jul 2023 to Jul 2024