Current Report Filing (8-k)

November 23 2022 - 4:31PM

Edgar (US Regulatory)

8-K0001365916FALSE12/3100013659162022-11-172022-11-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

____________________

Date of report (Date of earliest event reported): November 17, 2022

Amyris, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-34885 | 55-0856151 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 5885 Hollis Street, Suite 100, | Emeryville, | CA | 94608 |

| (Address of Principal Executive Offices) | (Zip Code) |

| | | | | | | | | | | |

| | (510) | 450-0761 | |

| | (Registrant’s telephone number, including area code) | |

| | | | | | | | |

| | | |

| | (Former name or former address, if changed since last report.) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | AMRS | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02 Unregistered Sales of Equity Securities.

On November 22, 2022 Amyris, Inc. (the “Company”) sold and issued 3,953,489 shares of the Company’s common stock (the “Unregistered Securities”) to WeMedia Shopping Network Holdings Co., Limited. (the “Selling Stockholder”) pursuant to two negotiated agreements (collectively the “WM Agreements”) for equity of the Selling Stockholder: one agreement covering 1,162,791 shares of the Company's common stock and another agreement covering 2,790,698 shares of the Company's common stock. The issuance was made as a private placement pursuant to the exemption from registration under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”).

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

In connection with its annual governance review cycle, on November 17, 2022, the Board of Directors (the "Board") of the Company adopted Amended and Restated Bylaws of the Company (the “Bylaws”), which became effective immediately. The Bylaws have been revised to, among other things:

•enhance procedural mechanics and disclosure requirements relating to stockholder nominees for election as a director as well as address matters relating to the universal proxy rules adopted by the Securities and Exchange Commission (the “SEC”), including, among other things, adding a requirement that a stockholder seeking to nominate director(s) at an annual meeting include a representation that such stockholder intends to solicit proxies in accordance with, and otherwise comply with, Rule 14a-19;

•align provisions with the Delaware General Corporation Law (the “DGCL”) relating to matters such as (i) delivery of notices of stockholder meetings and communications regarding adjourned stockholder meetings and (ii) the requirement that companies indemnify directors and officers without the need to satisfy conduct requirements;

•provide that unless the Company consents in writing to the selection of an alternative forum, the federal district courts of the United States shall be the exclusive forum for the resolution of any claim arising under the Securities Act;

•make certain other clarifying, conforming, and ministerial changes.

The foregoing description of the Bylaws does not purport to be complete and is qualified in its entirety by reference to the full text of the Bylaws, a copy of which is attached hereto as Exhibit 3.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 8.01. Other Events.

The information contained in Item 3.02 of this Current Report on Form 8-K in relation to the WM Agreements is incorporated herein by reference.

Pursuant to the terms and conditions of the WM Agreements, the Company agreed to file a prospectus supplement, which supplements the Prospectus filed with the SEC on April 7, 2021 together with a Registration Statement on Form S-3ASR (File No. 333-255105), to register the resale of the Unregistered Securities (the “Offering”), under which the Selling Stockholder may sell its Unregistered Securities. The Company will not receive any proceeds from the Offering.

A copy of the opinion of Fenwick & West LLP, relating to the validity of certain of the shares in connection with the Offering, is filed with this Current Report on Form 8-K as Exhibit 5.1.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| 3.1 | | |

| 5.1 | | |

| 23.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | AMYRIS, INC. | |

| | | | |

| | | | |

| Date: November 23, 2022 | By: | /s/ Han Kieftenbeld | |

| | | Han Kieftenbeld | |

| | | Chief Financial Officer |

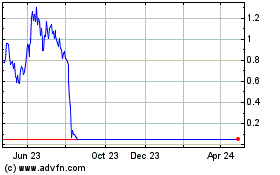

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Jul 2023 to Jul 2024