Transformative Actions Taken in Fiscal

2024

Subscription Fee Growth of 8% and 10% in Q4

and Fiscal 2024

American Software, Inc. (NASDAQ: AMSWA) today reported

preliminary financial results for the fourth quarter and fiscal

year 2024. During the second quarter of fiscal year 2024, we

divested our non-core information technology staffing firm, The

Proven Method and its results are included in discontinuing

operations.

“Fiscal 2024 was a pivotal year for our company, as we divested

several non-core assets, introduced next-generation AI-first supply

chain planning solutions, and reached a definitive agreement to

eliminate our dual class structure,” said Allan Dow, CEO and

President of American Software. “As we enter fiscal 2025, our

pipeline has expanded meaningfully, thanks in part to increasing

client interest in cloud conversions to realize the benefits of our

new AI capabilities. Although we expect the rising demand for our

solutions to accelerate subscription fee growth, our fiscal 2025

guidance assumes that ongoing macroeconomic headwinds will continue

to weigh on customer spending decisions in the near-term.”

Fiscal Year 2025 Financial Outlook from Continuing

Operations:

- Total revenues of $104.0 million to $108.0 million, including

total recurring revenues of $87.0 million to $89.0 million.

- Adjusted EBITDA of $15.0 million to $16.4 million.

Key Fourth Quarter Financial Highlights from Continuing Operations:

- Subscription fees were $14.1 million for the quarter ended

April 30, 2024, an 8% increase compared to $13.0 million for the

same period last year.

- Total revenues for the quarter ended April 30, 2024 decreased

5% to $25.4 million, compared to $26.8 million for the same period

of the prior year, principally due to a decline in license fee,

services and maintenance fee revenue.

- Recurring revenue streams for Maintenance and Subscriptions

were $21.5 million or 85% of total revenues in the quarter ended

April 30, 2024 compared to $21.2 million or 79% of total revenues

in the same period of the prior year.

- Maintenance revenues for the quarter ended April 30, 2024

decreased 9% to $7.4 million compared to $8.2 million for the same

period last year partially due to the divestiture of the

Transportation group in November, 2023 and client conversions to

the cloud.

- Professional services and other revenues for the quarter ended

April 30, 2024 decreased 23% to $3.7 million for the quarter ended

April 30, 2024 compared to $4.8 million for the same period last

year. The decline was primarily driven by lower than expected

seasonal project work and outsourcing of some services to systems

integrators and other service providers.

- Software license revenues were $0.2 million for the quarter

ended April 30, 2024 compared to $0.7 million in the same period

last year, continuing the focus on cloud services sales.

- Operating earnings for the quarter ended April 30, 2024 were

$0.7 million compared to $2.2 million for the same period last

year.

- GAAP net earnings from continuing operations for the quarter

ended April 30, 2024 were $2.3 million or $0.07 per fully diluted

share compared to $2.9 million or $0.09 per fully diluted share for

the same period last year.

- Adjusted net earnings from continuing operations for the

quarter ended April 30, 2024, which excludes non-cash stock-based

compensation expense and amortization of acquisition-related

intangibles, were $4.0 million or $0.12 per fully diluted share

compared to $4.2 million or $0.12 per fully diluted share for the

same period last year.

- EBITDA from continuing operations was $1.5 million for the

quarter ended April 30, 2024 compared to $3.0 million for the same

period last year.

- Adjusted EBITDA from continuing operations was $3.1 million for

the quarter ended April 30, 2024 compared to $4.3 million for the

same period last year. Adjusted EBITDA represents GAAP net earnings

adjusted for amortization of intangibles, depreciation, interest

income & other, net, income tax expense and non-cash

stock-based compensation expense.

Key Fiscal 2024 Financial Highlights from Continuing Operations:

- Subscription fees were $55.3 million for the twelve months

ended April 30, 2024, a 10% increase compared to $50.4 million for

the same period last year, while Software license revenues were

$1.0 million compared to $2.8 million for the same period last

year.

- Total revenues for the twelve months ended April 30, 2024

decreased 5% to $102.5 million compared to $108.3 million for the

same period last year.

- Recurring revenue streams for Maintenance and Cloud Services

were $86.7 million and $85.0 million or 85% and 78% of total

revenues for the twelve-month periods ended April 30, 2024 and

2023, respectively.

- Maintenance revenues for the twelve months ended April 30, 2024

were $31.4 million, a 9% decrease compared to $34.6 million for the

same period last year.

- Professional services and other revenues for the twelve months

ended April 30, 2024 decreased 28% to $14.8 million compared to

$20.5 million for the same period last year. The decline was

primarily driven by lower project work and outsourcing of some

services to systems integrators and other service providers.

- For the twelve months ended April 30, 2024, the Company

reported continuing operating earnings of approximately $4.1

million compared to $9.9 million for the same period last

year.

- GAAP net earnings from continuing operations were approximately

$9.7 million or $0.29 per fully diluted share for the twelve months

ended April 30, 2024 compared to $10.0 million or $0.29 per fully

diluted share for the same period last year.

- Adjusted net earnings from continuing operations for the twelve

months ended April 30, 2024, which exclude stock-based compensation

expense and amortization of acquisition-related intangibles,

increased 15% to $17.0 million or $0.51 per fully diluted share,

compared to $14.8 million or $0.44 per fully diluted share for the

same period last year.

- EBITDA from continuing operations decreased by 34% to $8.5

million for the twelve months ended April 30, 2024 compared to

$13.0 million for the same period last year.

- Adjusted EBITDA from continuing operations decreased 18% to

$14.9 million for the twelve months ended April 30, 2024 compared

to $18.2 million for the twelve months ended April 30, 2023.

Adjusted EBITDA represents GAAP net earnings adjusted for

amortization of intangibles, depreciation, interest income &

other, net, income tax expense and non-cash stock-based

compensation.

The overall financial condition of the Company remains strong,

with cash and investments of approximately $83.8 million. During

the fourth quarter of fiscal year 2024, the Company paid

shareholder dividends of approximately $3.7 million.

Key Fourth Quarter and Fiscal Year 2024 highlights:

Clients & Channels

- Notable new and existing customers placing orders with the

Company in the fourth quarter include: Bob’s Discount Furniture,

Inc., CertainTeed LLC., Hamilton Beach Brands, Inc., Johnson

Controls Inc., Landau Uniforms, Manna Pro Products and Yokohama TWS

S.P.a.

- During the quarter, SaaS subscription and software license

agreements were signed with customers located in the following

countries: Australia, Italy, Mexico, New Zealand, and the United

States.

Company & Technology

- During the quarter, Logility earned the title of Leader in the

2024 Gartner Magic Quadrant for Supply Chain Planning Solutions.

This recognition was based on the Company’s vision and execution

capabilities highlighting the AI-driven approach to boosting

agility and precision in supply chain management.

- In February, Logility announced the delivery of generative AI

capabilities, extending its AI-first approach for supply chain

management. Leveraging the AI-native platform, Logility’s GenAI

aids in mastering the complexity of supply chain data, helping

enterprises to make faster decisions that deliver competitive

advantage.

- Logility also introduced enhanced capabilities to its Digital

Supply Chain Platform. These enhancements included:

- AI-powered dynamic inventory modeling - enhanced network

optimization delivers a more holistic view by solving for the best

supply chain configuration while simultaneously calculating

inventory levels.

- Decision Command Center – helps supply chain leaders mitigate

supply chain risk by offering a holistic approach to supply chain

processes, leveraging data and intelligence to enhance

decision-making and drive value across the entire supply chain

ecosystem.

- Logility was featured in Supply Chain Brain in an article

authored by Lisa Henriott, SVP of product marketing, outlining

three critical steps to mastering total inventory optimization in

2024. The article discussed Logility’s methods for improving

inventory management to boost supply chain efficiency and

performance.

- In March, Logility was featured on the ISM Supply Chain

Unfiltered podcast represented by Andrew Driscoll, vice president

strategic accounts, and Scott Tillman, vice president of

innovation. They talked about the challenges of inventory

management and how Logility’s optimization tools can help.

- In April, Logility was highlighted in the list of Top 100

Supply Chain Technology providers in the April issue of Inbound

Logistics.

Earlier in FY2024, Logility released significant solution

advancements including:

- The introduction of DemandAI+ which offers features that

combines advanced AI-driven demand planning, with optional

generative AI in a single solution designed to elevate planning

capabilities across the supply chain. Analysts cite a 20 – 24%

improvement in forecast accuracy for clients who adopt DemandAI+.

This offering leverages the assets gained in the acquisition of

Garvis B.V., a visionary SaaS startup that combines optional large

language models (ChatGPT) with AI-native demand forecasting.

- InventoryAI+, a powerful new offering designed to optimize

inventory with advanced AI and machine learning to enable clients

to lower costs while improving service. Building on existing

capabilities, Inventory AI+ empowers planners to resolve issues in

real-time and achieve higher levels of supply chain

performance.

About American Software, Inc.

Atlanta-based American Software, Inc. (NASDAQ: AMSWA),

through its operating entity Logility, delivers optimized demand,

inventory, manufacturing, and supply planning tools – helping give

executives the confidence and control to increase margins and

service levels, while delivering sustainable supply chains.

Logility is a market-leading provider of AI-first supply chain

management solutions engineered to help organizations build

sustainable digital supply chains that improve people’s lives and

the world we live in. The company’s approach is designed to

reimagine supply chain planning by shifting away from traditional

“what happened” processes to an AI-driven strategy that combines

the power of humans and machines to predict and be ready for what’s

coming. Logility’s fully integrated, end-to-end platform helps

clients know faster, turn uncertainty into opportunity, and

transform the supply chain from a cost center to an engine for

growth.

With over 650 clients in 80 countries, Logility is proud to

partner with some of the world’s leading brands, such as Reynolds

Consumer Products, Denso, Sandvik, and Ansell. The company is

headquartered in Atlanta, GA. Logility is a wholly-owned subsidiary

of American Software, Inc. (NASDAQ: AMSWA). Learn more at

www.logility.com. You can learn more about American Software at

www.amsoftware.com.

Operating and Non-GAAP Financial Measures

American Software, Inc. (the “Company”) includes non-GAAP

financial measures (EBITDA, adjusted EBITDA, adjusted net earnings

and adjusted net earnings per share) in the summary financial

information provided with this press release as supplemental

information relating to its operating results. This financial

information is not in accordance with, or an alternative for,

GAAP-compliant financial information and may be different from the

operating or non-GAAP financial information used by other

companies. The Company believes that this presentation of EBITDA,

adjusted EBITDA, adjusted net earnings and adjusted net earnings

per share provides useful information to investors regarding

certain additional financial and business trends relating to its

financial condition and results of operations. EBITDA represents

GAAP net earnings adjusted for amortization of intangibles,

depreciation, interest income & other, net, and income tax

expense. Adjusted EBITDA represents GAAP net earnings adjusted for

amortization of intangibles, depreciation, interest income &

other, net, income tax expense and non-cash stock-based

compensation expense.

Forward Looking Statements

This press release contains forward-looking statements that are

subject to substantial risks and uncertainties. There are a number

of factors that could cause actual results or performance to differ

materially from what is anticipated by statements made herein.

These factors include, but are not limited to, continuing U.S. and

global economic uncertainty and the timing and degree of business

recovery; the irregular pattern of the Company’s revenues;

dependence on particular market segments or customers; competitive

pressures; market acceptance of the Company’s products and

services; technological complexity; undetected software errors;

potential product liability or warranty claims; risks associated

with new product development; the challenges and risks associated

with integration of acquired product lines, companies and services;

uncertainty about the viability and effectiveness of strategic

alliances; the Company’s ability to satisfy in a timely manner all

Securities and Exchange Commission (SEC) required filings and the

requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and

the rules and regulations adopted under that Section; as well as a

number of other risk factors that could affect the Company’s future

performance. For further information about risks the Company could

experience as well as other information, please refer to the

Company’s current Form 10-K and other reports and documents

subsequently filed with the SEC. For more information, contact:

Kevin Liu, American Software, Inc., (626) 657-0013 or email

kliu@amsoftware.com.

Logility® is a registered trademark of Logility, Inc. Other

products mentioned in this document are registered, trademarked or

service marked by their respective owners.

AMERICAN SOFTWARE, INC. Consolidated Statements of

Operations Information (In thousands, except per share data,

unaudited)

Fourth Quarter Ended

Twelve Months Ended

April 30,

April 30,

2024

2023

Pct

Chg.

2024

2023

Pct

Chg.

Revenues from continuing operations: Subscription fees

$

14,059

$

13,021

8

%

$

55,294

$

50,412

10

%

License fees

160

727

(78

%)

955

2,752

(65

%)

Professional services & other

3,741

4,844

(23

%)

14,848

20,531

(28

%)

Maintenance

7,428

8,173

(9

%)

31,418

34,557

(9

%)

Total Revenues

25,388

26,765

(5

%)

102,515

108,252

(5

%)

Cost of Revenues from continuing operations:

Subscription services

4,440

4,149

7

%

18,208

15,831

15

%

License fees

51

164

(69

%)

219

705

(69

%)

Professional services & other

2,783

3,392

(18

%)

11,393

14,074

(19

%)

Maintenance

1,396

1,652

(15

%)

6,273

6,409

(2

%)

Total Cost of Revenues

8,670

9,357

(7

%)

36,093

37,019

(3

%)

Gross Margin

16,718

17,408

(4

%)

66,422

71,233

(7

%)

Operating expenses from continuing operations: Research and

development

4,592

4,547

1

%

17,656

17,767

(1

%)

Sales and marketing

5,360

4,805

12

%

21,443

20,339

5

%

General and administrative

5,897

5,782

2

%

22,672

23,134

(2

%)

Amortization of acquisition-related intangibles

197

25

688

%

543

106

412

%

Total Operating Expenses

16,046

15,159

6

%

62,314

61,346

2

%

Operating Earnings from continuing operations

672

2,249

(70

%)

4,108

9,887

(58

%)

Interest Income & Other, Net

1,749

1,028

70

%

7,475

2,336

220

%

Earnings from continuing operations Before Income Taxes

2,421

3,277

(26

%)

11,583

12,223

(5

%)

Income Tax Expense

114

356

(68

%)

1,889

2,238

(16

%)

Net Earnings from continuing operations

$

2,307

$

2,921

(21

%)

$

9,694

$

9,985

(3

%)

(Loss)/Earnings from discontinuing operations, Net of Income

Taxes (1)

$

(133

)

$

4

nm

$

1,679

$

327

413

%

Net Earnings

$

2,174

$

2,925

(26

%)

$

11,373

#

$

10,312

10

%

Earnings per common share from continuing operations:

(2) Basic

$

0.07

$

0.09

(22

%)

$

0.29

$

0.29

0

%

Diluted

$

0.07

$

0.09

(22

%)

$

0.29

$

0.29

0

%

Earnings per common share from discontinuing operations:

(2) Basic

$

-

$

-

-

$

0.05

$

0.01

400

%

Diluted

$

-

$

-

-

$

0.05

$

0.01

400

%

Earnings per common share: (2) Basic

$

0.07

$

0.09

(22

%)

$

0.34

$

0.30

13

%

Diluted

$

0.07

$

0.09

(22

%)

$

0.34

$

0.30

13

%

Weighted average number of common shares outstanding:

Basic

33,220

33,916

33,689

33,761

Diluted

33,292

33,993

33,725

33,992

nm- not meaningful AMERICAN SOFTWARE, INC.

NON-GAAP MEASURES OF PERFORMANCE (In thousands, except

per share data, unaudited)

Fourth Quarter Ended

Twelve Months Ended

April 30,

April 30,

2024

2023

Pct

Chg.

2024

2023

Pct

Chg.

NON-GAAP Operating Earnings: Operating Earnings from

continuing operations (GAAP Basis)

$

672

$

2,249

(70

%)

$

4,108

$

9,887

(58

%)

Amortization of acquisition-related intangibles

381

233

64

%

2,577

835

209

%

Stock-based compensation

1,600

1,232

30

%

6,320

5,151

23

%

NON-GAAP Operating Earnings from continuing operations:

2,653

3,714

(29

%)

13,005

15,873

(18

%)

Non-GAAP Operating Earnings from continuing operations,

as a % of revenue

10

%

14

%

13

%

15

%

Fourth Quarter Ended

Twelve Months Ended

April 30,

April 30,

2024

2023

Pct

Chg.

2024

2023

Pct

Chg.

NON-GAAP EBITDA: Net Earnings from continuing operations

(GAAP Basis)

$

2,307

$

2,921

(21

%)

$

9,694

$

9,985

(3

%)

Income Tax Expense

114

356

(68

%)

1,889

2,238

(16

%)

Interest Income & Other, Net

(1,749

)

(1,028

)

70

%

(7,475

)

(2,336

)

220

%

Amortization of intangibles

428

447

(4

%)

2,954

2,032

45

%

Depreciation

370

324

14

%

1,485

1,129

32

%

EBITDA from continuing operations (earnings before interest,

taxes, depreciation and amortization)

1,470

3,020

(51

%)

8,547

13,048

(34

%)

Stock-based compensation

1,600

1,232

30

%

6,320

5,151

23

%

Adjusted EBITDA from continuing operations

$

3,070

$

4,252

(28

%)

$

14,867

$

18,199

(18

%)

EBITDA from continuing operations, as a percentage of

revenues

6

%

11

%

8

%

12

%

Adjusted EBITDA, from continuing operations, as a

percentage of revenues

12

%

16

%

15

%

17

%

Fourth Quarter Ended

Twelve Months Ended

April 30,

April 30,

2024

2023

Pct

Chg.

2024

2023

Pct

Chg.

NON-GAAP Earnings Per Share Net Earnings from continuing

operations (GAAP Basis)

$

2,307

$

2,921

(21

%)

$

9,694

$

9,985

(3

%)

Amortization of acquisition-related intangibles (3)

333

204

63

%

2,130

675

216

%

Stock-based compensation (3)

1,400

1,081

30

%

5,224

4,162

26

%

Adjusted Net Earnings from continuing operations

$

4,040

$

4,206

(4

%)

$

17,048

$

14,822

15

%

Adjusted non-GAAP diluted earnings per share from

continuing operations

$

0.12

$

0.12

0

%

$

0.51

$

0.44

16

%

Fourth Quarter Ended

Twelve Months Ended

April 30,

April 30,

2024

2023

Pct

Chg.

2024

2023

Pct

Chg.

NON-GAAP Earnings Per Share Net Earnings from continuing

operations (GAAP Basis)

$

0.07

$

0.09

(22

%)

$

0.29

$

0.29

0

%

Amortization of acquisition-related intangibles (3)

0.01

-

nm

$

0.06

0.02

200

%

Stock-based compensation (3)

0.04

0.03

33

%

$

0.16

0.13

23

%

Adjusted Net Earnings from continuing operations

$

0.12

$

0.12

0

%

$

0.51

$

0.44

16

%

Fourth Quarter Ended

Twelve Months Ended

April 30,

April 30,

2024

2023

Pct

Chg.

2024

2023

Pct

Chg.

Amortization of acquisition-related intangibles Cost of

Subscription Services

$

184

$

208

(12

%)

$

2,033

$

729

179

%

Operating expenses

197

25

688

%

544

106

413

%

Total amortization of acquisition-related intangibles

$

381

$

233

64

%

$

2,577

$

835

209

%

Stock-based compensation Cost of revenues

$

85

$

66

29

%

$

336

$

244

38

%

Research and development

172

139

24

%

685

576

19

%

Sales and marketing

362

143

153

%

1,402

711

97

%

General and administrative

981

884

11

%

3,897

3,620

8

%

Total stock-based compensation

$

1,600

$

1,232

30

%

$

6,320

$

5,151

23

%

(1) For more information, please see note F related to

discontinuing operations in the Company’s unaudited condensed

consolidated financial statements filed on December 11, 2023. (2) -

Basic per share amounts are the same for Class A and Class B

shares. Diluted per share amounts for Class A shares are shown

above. Continuing operations diluted per share for Class B shares

under the two-class method are $0.07 and $0.29 for the three and

twelve months ended April 30, 2024, respectively. Continuing

diluted per share for Class B shares under the two-class method are

$0.09 and $0.29 for the three and twelve months ended April 30,

2023, respectively. (3) -Continuing and discontinuing operations

are tax affected using the effective tax rate excluding discrete

items in the following table.

Three Months

Ended

April 30, 2024

Three Months

Ended

April 30, 2023

Twelve Months

Ended

April 30, 2024

Twelve Months

Ended

April 30, 2023

Continuing Operations

12.5

%

12.3

%

17.3

%

19.2

%

Discontinuing Operations

nm

94.9

%

29.4

%

41.0

%

Consolidated Operations

18.0

%

12.8

%

19.4

%

20.2

%

nm- not meaningful

AMERICAN SOFTWARE, INC.

Consolidated Balance Sheet Information (In thousands)

(Unaudited)

April 30,

April 30,

2024

2023

Cash and Cash Equivalents

$

59,512

$

90,696

Short-term Investments

24,261

23,451

Accounts Receivable: Billed

28,043

24,653

Unbilled

296

2,604

Total Accounts Receivable, net

28,339

27,257

Prepaid expenses and other current assets

6,584

7,833

Total Current Assets

118,696

149,237

Investments - Non-current

-

486

PP&E, net

5,554

6,444

Capitalized Software, net

11

391

Goodwill

45,782

29,558

Other Intangibles, net

10,567

2,143

Other Non-current Assets

11,834

6,609

Total Assets

$

192,444

$

194,868

Accounts Payable

$

1,248

$

2,142

Accrued Compensation and Related costs

2,805

4,268

Dividend Payable

3,657

3,756

Other Current Liabilities

5,012

3,733

Deferred Revenues

47,621

43,124

Current Liabilities

60,343

57,023

Other Long-term Liabilities

1,620

288

Total Liabilities

61,963

57,311

Shareholders' Equity

130,481

137,557

Total Liabilities & Shareholders' Equity

$

192,444

$

194,868

AMERICAN SOFTWARE, INC. Condensed Consolidated

Cashflow Information (In thousands) (Unaudited)

Twelve Months Ended

April 30,

2024

2023

Net cash provided by (used in) operating activities of

continuing operations

$

15,132

$

(739

)

Cash provided by operating activities of discontinued operations

1,679

359

Net cash provided by operating activities

16,811

(380

)

Purchases of property and equipment, net of disposals

(567

)

(3,922

)

Purchase of business, net of cash acquired

(25,041

)

(6,500

)

Proceeds from sale of business

660

-

Net cash used in investing activities of continuing operations

(24,948

)

(10,422

)

Net cash provided by investing activities of discontinued

operations

1,825

-

Net cash used in investing activities

(23,123

)

(10,422

)

Dividends paid

(14,927

)

(14,833

)

Purchases of common stock

(10,235

)

-

Proceeds from exercise of stock options

290

5,641

Net cash used in financing activities of continuing operations

(24,872

)

(9,192

)

Net Cash used in financing activities of discontinued operations

-

-

Net cash used in financing activities

(24,872

)

(9,192

)

Net change in cash and cash equivalents

(31,184

)

(19,994

)

Cash and cash equivalents at beginning of period

90,696

110,690

Cash and cash equivalents at end of period

$

59,512

$

90,696

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240606888079/en/

Vincent C. Klinges Chief Financial Officer American Software,

Inc. (404) 264-5477

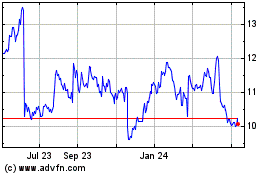

American Software (NASDAQ:AMSWA)

Historical Stock Chart

From Nov 2024 to Dec 2024

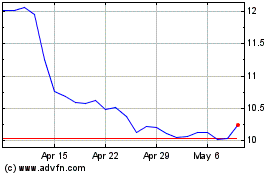

American Software (NASDAQ:AMSWA)

Historical Stock Chart

From Dec 2023 to Dec 2024