By Erich Schwartzel and Cameron McWhirter

More than a year before Friday's "Batman v Superman: Dawn of

Justice" was scheduled to hit theaters, a Michigan lobbyist backed

by the billionaire Koch Brothers was already giving the superhero

epic a bad review.

The main objection of Annie Patnaude, deputy state director for

the Michigan office of Americans for Prosperity, was the $35

million in tax credits given to the movie for filming in the state.

"It's Batman versus Superman, versus road repairs, income-tax

relief or any number of other priorities for Michigan families and

businesses," said Ms. Patnaude. About four months later, state

legislators killed the tax-credit program.

It was another victory for Americans for Prosperity, the

free-market political-advocacy group backed by conservative

billionaire brothers Charles and David Koch. The industrialists'

network of Americans for Prosperity staff and supporters across the

country are keeping busy, taking aim at the film tax credits that

have revamped how Hollywood does business. A spokesman for the Koch

brothers referred questions to Americans for Prosperity.

Americans for Prosperity is also targeting what it considers

unfair tax breaks for other industries and has launched campaigns

against Medicaid expansion, among other causes.

Over the past several years, Americans for Prosperity has

successfully organized campaigns to eliminate or reduce tax breaks

for entertainment productions in several states despite years of

bipartisan support in some cases and billions spent by governments

and private industry on soundstage infrastructure and work-training

programs. The group has found a natural adversary in what it

decries as "Hollywood handouts," calling out legislators who

accepted on-camera cameos and targeting politicians up for

re-election with ads lampooning their association with A-list

stars.

Americans for Prosperity President Tim Phillips said the "core

principle for us is ending government cronyism." He added: "This is

an insidious example of government picking winners and losers with

taxpayer dollars."

The Americans for Prosperity campaigns, along with shifting

state economics, have helped dial back several years of film

tax-credit fever across the country, one that created several

thriving miniproduction hubs in states far from California.

Thirty-five states have film tax programs, and nearly every

major-studio movie budget includes a line for subsidies. But just

as that has become the norm, Americans for Prosperity has launched

a nationwide campaign against the incentives, an opening salvo in

its fight against corporate tax breaks. After initial success in

several states, the group is targeting filmmaking hubs like Georgia

and anywhere they feel they can make headway. Even the specter of

political controversy can send productions scurrying to other

states.

Hollywood's moves across the country have forced it to weigh in

on other state debates. On Wednesday, several Hollywood production

companies said they would stop shooting in Georgia unless

Republican Gov. Nathan Deal vetoed legislation called the Free

Exercise Protection Act, which was passed this month by the

GOP-dominated Legislature. The act permits faith-based

organizations to fire employees if their "religious beliefs and

practices are not in accord" with the organization's. It also

allows faith-based groups to decline services for the same reason.

Gay-rights groups argue such wording would allow churches to

discriminate against gay or transgender people.

Walt Disney Co. and AMC Networks were among the companies saying

they would leave the state. Disney's Marvel Studios has filmed

several blockbusters in the state, including the upcoming "Captain

America: Civil War," and AMC's "The Walking Dead" has been an

economic boon to the Georgia town where the zombie thriller films.

Many nonentertainment businesses also have condemned the

legislation. Mr. Deal has spoken out against the bill but has said

he hasn't made up his mind whether he will veto it. He has until

May 3 to decide.

As critics attack the film credits in the U.S., foreign

countries, including Canada, the U.K. and Australia, are ramping up

their attempts to lure filmmakers.

Americans for Prosperity's animosity toward film tax credits is

playing out at the state level, but it is backed by two

billionaires who likely will have significant influence in the 2016

presidential election and state races nationwide.

Ten states have eliminated film-incentive programs since 2009,

which doesn't include some of the reductions made in program

funding in other states, according to Entertainment Partners, a

production-incentive consulting firm in Burbank, Calif. Some states

have dropped or reduced the programs in response to larger budget

problems, some driven by the steep drop in oil prices.

In Florida, Koch-backed radio ads told lawmakers to stop

supporting "Hollywood tycoons" by funding movies shot in their

state, highlighting salacious fare like the male-stripper drama

"Magic Mike." The organization's state director in New Jersey

testified in November that legislators should shun "glitz and

glamour" and instead focus on striking down a tax increase on gas.

Even Montana's tiny program was eliminated after Joe Balyeat, a

former Montana state senator then working as the director of

American for Prosperity's state office, became the first person

ever to testify against the subsidy.

"It was a surprise attack," said Deny Staggs, Montana's film

commissioner. Legislators, some of whom were already skeptical of

the subsidy, eliminated the program. The current state director for

Americans for Prosperity, David Herbst, said it didn't matter to

his group how small the Montana film-incentive program was. "We're

not just there for the big fights," he said.

The group has found common cause with liberal policy groups in

Kentucky, Florida and Louisiana that oppose the credits. "I would

be delighted if the folks at AFP, who we have not always seen

eye-to-eye with, would be at the table arguing for limits to this

program," said Jan Moller, director of the Louisiana Budget

Project, a liberal policy group.

Americans for Prosperity's playbook was on full display in North

Carolina, where the film industry in 2013 awarded $61 million in

incentives and was having its biggest year when the group took aim.

The state's generous tax-credit program, built over the past decade

with general political support, offered a 25% refundable tax

credit, as much as $20 million per production. Refundable credits

reimburse a company for its investments, even if it doesn't owe

state taxes.

The subsidies had attracted major films like "The Hunger Games"

and "Iron Man 3." But then mailers produced by Americans for

Prosperity started arriving in mailboxes, splashed with photos of

Tom Cruise and asking if voters really wanted their tax dollars

going to millionaire celebrities.

"We needed about three sentences to explain our position," said

Aaron Syrett, then North Carolina's film commissioner. "They needed

two words: Tom Cruise."

Soon after, the 2014 elections went overwhelmingly to

Republicans and an Americans for Prosperity board member, Art Pope,

became state budget director. Proponents brought industry vendors

to the state capitol to meet with lawmakers in an effort to gin up

support. But the film tax credit was drastically reduced to a $10

million grant program that was only recently raised to $30

million.

Union officials say productions have headed elsewhere. Georgia

wooed away the "Hunger Games" sequels as well as some television

productions.

"We were outspent and outgunned the whole time," said Jason

Rosin, business agent for a film workers' union that spans North

Carolina, South Carolina and Georgia. Following the legislative

change, the proportion of his members living in North Carolina

plummeted, he said.

Americans for Prosperity, co-founded and supported by the owners

of the closely held Koch Industries, is known as a pro-free-market,

pro-business organization that supports limited government

involvement in the marketplace. It has no qualms criticizing

Republicans who support incentives, especially in GOP-dominated

states where the subsidies have been popular but where tea-party

activism is high. "Despite their rhetoric about limited government

and limiting government expenditures...Republicans definitely bear

more responsibility," said Mr. Phillips.

The Motion Picture Association of America, representing the six

major Hollywood studios, has been the leading lobbying force for

film tax programs as the subsidies have grown more important for

its members. When a tax credit comes up for debate, the MPAA

lobbies lawmakers with economic-impact studies and dispatches a

representative or studio executive to testify and lobby in its

favor--appearing over the past year in Florida, Louisiana, North

Carolina and Michigan, among others.

In recent years, Americans for Prosperity officials failed to

get anywhere in Georgia, now one of the most popular destinations

for Hollywood.

But this legislative session, the group has started lobbying to

convince politicians that the state's credits--some of the most

generous in the U.S.--should be rolled back. The group plans to

build legislative and grass-roots support this year, then back

specific legislation next year, said Michael Harden, the group's

lobbyist in Atlanta.

Support for film credits in Georgia, once widespread, "has hit

its high-water mark," he said. Mr. Deal has spoken out in support

of the credits in recent weeks--endorsements that have led some

political observers in his state to wonder if he is girding for a

fight.

(MORE TO FOLLOW) Dow Jones Newswires

March 25, 2016 15:47 ET (19:47 GMT)

Any attempt to pull back the Georgia program would face

significant opposition, since the state's officials have embraced

their new identity: "Y'allywood." Billions have been spent in

soundstage construction near Atlanta in recent years. The state

paid out $226.8 million in credits in 2013. Credits for 2014 are

still being processed, though $101.5 million has been paid out so

far, according to the state Department of Revenue.

Another bout is expected in Florida, where Americans for

Prosperity will fight proponents seeking renewed funding.

Supporters point to "Live by Night," a film being directed by Ben

Affleck and set in Ybor City, the Latin section of Tampa, Fla.

Because tax credits are more generous in Georgia, the production

built a mini-Ybor City replica in Brunswick, Ga.

"It's easy to vilify an industry that's seen as rich and

powerful and glamorous, and not see what the reality is: people who

are working long crew days," said Agustin G. Corbella, chairman of

a Florida government council that encourages film production in the

state.

Chris Hudson, state director of the Americans for Prosperity

chapter in Florida, said his organization has fought tax credits in

the state for nearly three years and won't stop now. "You don't see

them doing this for plumbers," he said.

(END) Dow Jones Newswires

March 25, 2016 15:47 ET (19:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

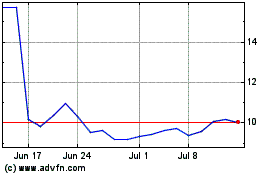

AMC Networks (NASDAQ:AMCX)

Historical Stock Chart

From Jun 2024 to Jul 2024

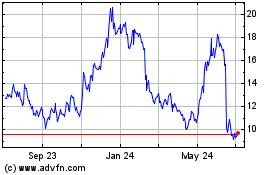

AMC Networks (NASDAQ:AMCX)

Historical Stock Chart

From Jul 2023 to Jul 2024