UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

40-F

(Check

one)

|

[ ]

|

Registration

statement pursuant to Section 12 of the Securities Exchange Act of 1934

|

or

|

[X]

|

Annual

report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

|

For

the fiscal year ended: December 31, 2020

Commission

File Number: 001-38064

Aeterna

Zentaris Inc.

(Exact

name of Registrant as specified in its charter)

|

Ontario,

Canada

|

|

2834

|

|

Not

Applicable

|

|

(Province

or other jurisdiction of

incorporation

or organization)

|

|

(Primary

Standard Industrial

Classification

Code Number (if applicable))

|

|

(I.R.S.

Employer Identification

Number

(if applicable))

|

315

Sigma Drive

Summerville,

South Carolina 29486

(843)

900-3223

(Address

and telephone number of Registrant’s principal executive offices)

Klaus

Paulini, PhD

President

and Chief Executive Officer

Aeterna

Zentaris, Inc.,

315

Sigma Drive

Summerville,

South Carolina 29486

(843)

900-3211

(Name,

address (including zip code) and telephone number (including area code) of agent for service in the United States)

Securities

registered or to be registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Shares

|

|

AEZS

|

|

The

Nasdaq Stock Market

Toronto

Stock Exchange

|

Securities

registered or to be registered pursuant to Section 12(g) of the Act: None

Securities

for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For

annual reports, indicate by check mark the information filed with this Form:

|

[X]

Annual Information Form

|

[X]

Audited Annual Financial Statements

|

Indicate

the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period

covered by the annual report:

Common

Shares outstanding as of December 31, 2020: 62,678,613

Indicate

by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act

during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports); and (2) has

been subject to such filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate

by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the Registrant was required to submit such files).

Yes

[X] No [ ]

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging

Growth Company [ ]

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. [ ]

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements in this Annual Report on Form 40-F (this “Annual Report”) and the exhibits attached hereto are forward-looking

statements under the provisions of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and forward-looking information within the meaning of applicable Canadian securities legislation (collectively, “forward-looking

statements”). Forward-looking statements are subject to risks, uncertainties and contingencies that could cause actual results

to differ materially from those expressed or implied by these forward-looking statements. Investors are cautioned not to put undue

reliance on forward-looking statements. Applicable risks and uncertainties include, but are not limited to, those identified in

the section “Risk Factors” in the Annual Information Form for the year ended December 31, 2020 (the “AIF”)

of Aeterna Zentaris, Inc. (“we,” “our,” or the “Company”), attached as Exhibit 99.1 to this

Annual Report and incorporated herein by reference, and in other filings that the we have made and may make with applicable securities

authorities in the future. Please also see the section “Certain References and Forward-Looking Statements” in our

AIF and the section “About Forward-Looking Statements” in our management’s discussion and analysis for the year

ended December 31, 2020, attached as Exhibits 99.1 and 99.3 to this Annual Report, in each case, incorporated by reference herein,

for a discussion of forward-looking statements. Except as required by applicable law, we do not intend, and undertake no obligation,

to update any forward-looking statements to reflect, in particular, new information or future events, or otherwise.

DIFFERENCES

IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The

Company is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this report in accordance

with Canadian disclosure requirements, which are different from those of the United States. The Company prepares its consolidated

financial statements, which are filed with this Annual Report, in accordance with International Financial Reporting Standards

(“IFRS”) as issued by the International Accounting Standards Board (“IASB”), and which are not comparable

to financial statements of United States companies.

DISCLOSURE

CONTROLS AND PROCEDURES

At

the end of the period covered by this report, an evaluation was carried out under the supervision of and with the participation

of the Company’s management, including the Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”),

of the effectiveness of the design and operation of the Company’s disclosure controls and procedures (as defined in Rule

13a-15(e) and Rule 15d-15(e) under the Exchange Act). The evaluation included documentation review, enquiries and other procedures

considered by management to be appropriate in the circumstances. Based on that evaluation, the Company’s CEO and CFO have

concluded that, as of December 31, 2020, the Company’s disclosure controls and procedures were effective.

It

should be noted that while the Company’s CEO and CFO believe that the Company’s disclosure controls and procedures

provide a reasonable level of assurance that they are effective, they do not expect that the Company’s disclosure controls

and procedures will prevent all errors and fraud. A control system, no matter how well conceived or operated, can provide only

reasonable, not absolute, assurance that the objectives of the control system are met.

MANAGEMENT’S

REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

The

Company’s management, with the participation of the CEO and CFO, is responsible for establishing and maintaining adequate

internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act). The Company’s

internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial

reporting and the preparation of financial statements for external purposes in accordance with IFRS as issued by the IASB. The

Company’s internal control over financial reporting includes those policies and procedures that: (i) pertain to the maintenance

of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Companys;

(ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in

accordance with IFRS, and that receipts and expenditures of the Company are being made only in accordance with authorizations

of Company management; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition,

use or disposition of Company assets that could have a material effect on the financial statements.

Management

conducted an evaluation of the effectiveness of our internal control over financial reporting based on the criteria established

in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission.

Based on this evaluation, management has concluded that our internal control over financial reporting was effective as at December

31, 2020.

ATTESTATION

REPORT OF THE REGISTERED PUBLIC ACCOUNTING FIRM

This

Annual Report does not include an attestation report of the Company’s independent registered public accounting firm

as this requirement is not applicable for non-accelerated filers pursuant to Sections 404(b) and (c) of the Sarbanes-Oxley Act.

CHANGES

IN INTERNAL CONTROL OVER FINANCIAL REPORTING

There

were no changes in the Company’s internal control over financial reporting that occurred during the period covered by this

report that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over

financial reporting.

NOTICES

PURSUANT TO REGULATION BTR

There

were no notices required by Rule 104 of Regulation BTR that the Company sent during the year ended December 31, 2020 concerning

any equity security subject to a blackout period under Rule 101 of Regulation BTR.

AUDIT

COMMITTEE FINANCIAL EXPERT

The

Company’s board of directors has determined that it has at least one audit committee financial expert serving on its audit

committee. Mr. Pierre-Yves Desbiens (CPA, CA, MBA), has been determined to be such audit committee financial expert and is independent,

as that term is defined by the NASDAQ Stock Market LLC’s (“NASDAQ”) listing standards applicable to the Company.

The Securities and Exchange Commission has indicated that the designation of Mr. Desbiens as an audit committee financial expert

does not make Mr. Desbiens an “expert” for any purpose, impose any duties, obligations or liability on Mr. Desbiens

that are greater than those imposed on members of the audit committee and board of directors who do not carry this designation

or affect the duties, obligations or liability of any other member of the audit committee or board of directors.

CODE

OF ETHICS

The

Company has adopted a code of ethics entitled “Code of Conduct and Business Ethics” that applies to all employees,

contractors, officers and directors, including the Company’s CEO, CFO and principal accounting officer. The Company’s

code of ethics is available on the Company’s Internet website: www.zentaris.com. There were no waivers granted in respect

of the Code during the fiscal year ended December 31, 2020. If there is an amendment to the Code, or if a waiver of the Code is

granted to any of Company’s principal executive officer, principal financial officer, principal accounting officer or controller,

the Company intends to disclose any such amendment or waiver by posting such information on the Company’s website. Unless

and to the extent specifically referred to herein, the information on the Company’s website shall not be deemed to be incorporated

by reference in this Annual Report. Except for the Code, and notwithstanding any reference to the Company’s website or other

websites in this Annual Report or in the documents incorporated by reference herein or attached as Exhibits hereto, no information

contained on the Company’s website or any other site shall be incorporated by reference in this Annual Report or in the

documents incorporated by reference herein or attached as Exhibits hereto.

PRINCIPAL

ACCOUNTANT FEES AND SERVICES

The

disclosure provided under “Audit Committee Disclosure—External Auditor Service Fees” in Exhibit 99.1, the Company’s

Annual Information Form, is incorporated by reference herein.

AUDIT

COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

The

disclosure provided under “Audit Committee Disclosure—Pre-Approval Policies and Procedures” in Exhibit 99.1,

the Company’s Annual Information Form, is incorporated by reference herein.

OFF-BALANCE

SHEET ARRANGEMENTS

As

of December 31, 2020, the Company does not have any “off-balance sheet arrangements” (as that term is defined in paragraph

11(ii) of General Instruction B to Form 40-F) that have or are reasonably likely to have a current or future effect on its financial

condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital

resources that is material to investors.

TABULAR

DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The

disclosure provided under “Contractual Obligations and Commitments as at December 31, 2020” in Exhibit 99.3, Management’s

Discussion and Analysis, is incorporated by reference herein.

IDENTIFICATION

OF THE AUDIT COMMITTEE

The

Company has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange

Act and satisfies the requirements of Exchange Act Rule 10A-3. The Company’s audit committee is composed of the following

directors: Mr. Pierre-Yves Desbiens (Chairman), Mr. Peter G. Edwards and Mr. Gilles Gagnon, each of whom is independent, as that

term is defined in the NASDAQ listing standards.

MINE

SAFETY DISCLOSURE

Not

applicable.

CORPORATE

GOVERNANCE

The

Company is generally in compliance with the corporate governance requirements of the NASDAQ except as described below and in the

section “Risk Factors” in the AIF attached as Exhibit 99.1 to this Annual Report. The Company is not in compliance

with the NASDAQ requirement that a quorum for a meeting of the holders of its Common Shares be no less than 33 1/3% of such outstanding

shares. The Company’s bylaws provide that a quorum for purposes of any meeting of its shareholders consists of at least

10% of the outstanding voting shares. The Company benefits from an exemption from the NASDAQ from this quorum requirement because

the quorum provided for in our bylaws complies with home country practices, our governing corporate statute, and with the rules

of the TSX, the home country exchange on which our voting shares are traded. In accordance with applicable current NASDAQ requirements,

we have in the past, and upon request, provided to the NASDAQ letters from outside counsel certifying that these practices are

not prohibited by our home country law.

UNDERTAKING

AND CONSENT TO SERVICE OF PROCESS

A.

Undertaking

The

Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission

staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities in relation

to which the obligation to file this annual report on Form 40-F arises; or transactions in said securities.

B.

Consent to Service of Process

The

Company has previously filed with the Commission a Form F-X in connection with the class of securities in relation to which the

obligation to file this report arises.

Any

change to the name or address of the agent for service of process of the Company shall be communicated promptly to the Commission

by an amendment to the Form F-X referencing the file number of the relevant registration statement.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F

and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

Aeterna

Zentaris Inc.

|

|

|

|

|

|

March

24, 2021

|

By:

|

/s/

Klaus Paulini

|

|

|

Name:

|

Klaus Paulini

|

|

|

Title:

|

President and Chief Executive Officer

|

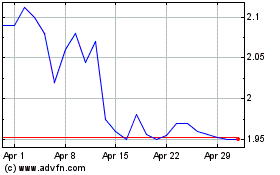

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jun 2024 to Jul 2024

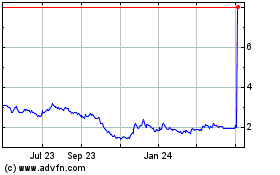

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jul 2023 to Jul 2024