Advanced Energy Reports First Quarter 2004 Results Returns to

Profitability; Posts Net Income of $6.9 Million FORT COLLINS,

Colo., April 15 /PRNewswire-FirstCall/ -- Advanced Energy

Industries, Inc. today reported financial results for the first

quarter ended March 31, 2004. Advanced Energy offers a

comprehensive suite of process-centered solutions critical to the

production of semiconductors, flat panel displays, data storage

products, architectural glass and other advanced product

applications. (Logo:

http://www.newscom.com/cgi-bin/prnh/20030825/AEISLOGO) For the 2004

first quarter, revenues were $104.5 million, up 86 percent from

$56.2 million for the first quarter of 2003, and up 40 percent

compared to revenues of $74.7 million for the fourth quarter of

2003. Net income for the first quarter of 2004 was $6.9 million or

$0.21 per diluted share, compared to a net loss of $8.6 million in

the first quarter of 2003, or $0.27 per share. This compares to the

fourth quarter 2003 net loss of $2.4 million, or $0.08 per share.

Net income for the first quarter of 2004 includes approximately

$1.0 million in pretax gains resulting from the sale of certain

marketable securities and the sale of the Company's thermal control

business. Doug Schatz, chairman and chief executive officer, said,

"We experienced strong demand in all product groups, driven by

continued momentum in the semiconductor capital equipment market

and the market leading positions we have secured in high-growth

semiconductor processing applications. This sales growth, coupled

with the progress we've made to streamline our operating

infrastructure, enabled us to achieve significant profitability in

the first quarter. Our commitment to continued product innovation

drives our ability to capture new opportunities and expand our

market reach over a wide range of plasma-based processing

applications. "Our decision to move out of the thermal control

business is part of our continued focus on core competencies. The

wafer chiller line is based on highly differentiated technology,

and we are not willing to devote the resources required to

meaningfully promote and support these products given our target

long-term operating model for sustainable profitability throughout

industry cycles. "Towards the end of the first quarter, we were

seeing indications that order patterns are leveling out as the

market absorbs the recent surge in capital equipment purchases. We

anticipate second quarter revenue in the $107 million to $115

million range and an earnings per share range of $0.20 to $0.25. We

continue to make progress in our transition to a more variable

operating model, targeting sustainable, ongoing improvements to our

incremental operating margin," said Mr. Schatz. First Quarter

Conference Call Management will host a conference call today,

Thursday, April 15, 2004 at 5:00 pm Eastern time to discuss

Advanced Energy's financial results. You may access this conference

call by dialing 888-713-4717. International callers may access the

call by dialing 706-679-7720. For a replay of this teleconference,

please call 706-645-9291, and enter the pass code 6231765. The

replay will be available through Thursday, April 22, 2004. There

will also be a webcast available at http://www.advanced-energy.com/

. About Advanced Energy Advanced Energy is a global leader in the

development and support of technologies critical to high-technology

manufacturing processes used in the production of semiconductors,

flat panel displays, data storage products, compact discs, digital

video discs, architectural glass, and other advanced product

applications. Leveraging a diverse product portfolio and technology

leadership, Advanced Energy creates solutions that maximize process

impact, improve productivity and lower the cost of ownership for

its customers. This portfolio includes a comprehensive line of

technology solutions in power, flow, thermal management, and plasma

and ion beam sources for original equipment manufacturers (OEMs)

and end-users around the world. Advanced Energy operates in

regional centers in North America, Asia and Europe and offers

global sales and support through direct offices, representatives

and distributors. Founded in 1981, Advanced Energy is a publicly

held company traded on the Nasdaq National Market under the symbol

AEIS. For more information, please visit our corporate website:

http://www.advanced-energy.com/. Safe Harbor Statement This press

release contains certain forward-looking statements, including the

company's expectations with respect to Advanced Energy's financial

results for the second quarter of 2004. Forward-looking statements

are subject to known and unknown risks and uncertainties that could

cause actual results to differ materially from those expressed or

implied by such statements. Such risks and uncertainties include,

but are not limited to: the volatility and cyclicality of the

semiconductor and semiconductor capital equipment industries,

Advanced Energy's ongoing ability to develop new products in a

highly competitive industry characterized by increasingly rapid

technological changes, Advanced Energy's ability to successfully

integrate acquired companies' operations, and other risks described

in Advanced Energy's Form 10-K, Forms 10-Q and other reports and

statements, as filed with the Securities and Exchange Commission.

These reports and statements are available on the SEC's website at

http://www.sec.gov/ . Copies may also be obtained from Advanced

Energy's website at http://www.advanced-energy.com/ or contacting

Advanced Energy's investor relations at 970-221-4670. The company

assumes no obligation to update the information in this press

release. CONDENSED CONSOLIDATED INCOME STATEMENTS (UNAUDITED) (in

thousands except per share data) Quarter Ended March 31, 2004 2003

Sales $104,487 $56,158 Cost of sales 66,073 38,208 Gross profit

38,414 17,950 Operating expenses: Research and development 13,410

13,367 Sales and marketing 8,037 8,330 General and administrative

5,767 4,529 Amortization of intangible assets 1,170 1,100

Restructuring charges 220 1,509 Total operating expenses 28,604

28,835 Income (loss) from operations 9,810 (10,885) Other (expense)

income, net (1,155) (2,750) Income (loss) before income taxes 8,655

(13,635) (Provision) Benefit for income taxes (1,731) 5,045 Net

Income (loss) $6,924 $(8,590) Basic net income (loss) per share:

$0.21 $(0.27) Diluted net income (loss) per share: $0.21 $(0.27)

Basic weighted-average common shares outstanding 32,581 32,159

Diluted weighted-average common shares outstanding 33,593 32,159

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (in thousands)

March 31, December 31, 2004 2003 ASSETS Current Assets: Cash and

cash equivalents $43,996 $41,522 Marketable securities 84,045

93,691 Accounts receivable 79,013 61,927 Income tax receivable 465

151 Inventories 72,148 65,703 Other current assets 3,827 5,486

Total current assets 283,494 268,480 Property and equipment, net

45,273 44,725 Deposits and other 6,306 5,630 Goodwill and

intangibles, net 86,529 88,943 Demonstration and customer service

equipment, net 4,266 3,934 Deferred debt issuance costs, net 2,765

3,019 Total assets $428,633 $414,731 LIABILITIES AND STOCKHOLDERS'

EQUITY Current Liabilities: Trade accounts payable $33,072 $23,066

Other current liabilities 26,046 28,216 Current portion of capital

leases and senior borrowings 8,239 8,582 Accrued interest payable

on convertible subordinated notes 1,810 2,460 Total current

liabilities 69,167 62,324 Long-term Liabilities: Capital leases and

senior borrowings 4,935 6,168 Deferred income tax liability, net

4,787 4,672 Convertible subordinated notes payable 187,718 187,718

Other long-term liabilities 2,095 2,015 Total long-term liabilities

199,535 200,573 Total liabilities 268,702 262,897 Stockholders'

equity 159,931 151,834 Total liabilities and stockholders' equity

$428,633 $414,731 CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED) (in thousands) Three Months Ended March 31, 2004 2003

NET CASH USED IN OPERATING ACTIVITIES $(4,344) $(4,579) NET CASH

PROVIDED BY (USED IN) INVESTING ACTIVITIES 8,003 (5,460) NET CASH

USED IN FINANCING ACTIVITIES (1,588) (1,981) EFFECT OF CURRENCY

TRANSLATION ON CASH 403 134 INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS 2,474 (11,886) CASH AND EQUIVALENTS, beginning of

period 41,522 70,188 CASH AND EQUIVALENTS, end of period $43,996

$58,302 http://www.newscom.com/cgi-bin/prnh/20030825/AEISLOGO

http://photoarchive.ap.org/ DATASOURCE: Advanced Energy Industries,

Inc. CONTACT: Mike El-Hillow, Executive Vice President and Chief

Financial Officer, +1-970-407-6570, , or Cathy Kawakami, Director

of Investor Relations, +1-970-407-6732, , both of Advanced Energy

Industries, Inc. Web site: http://www.advanced-energy.com/

Copyright

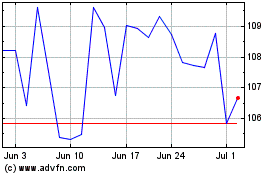

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

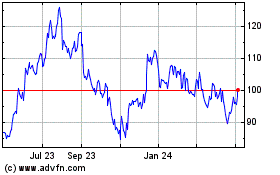

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024