Advanced Energy Reports Fourth Quarter and Year-End 2003 Results

FORT COLLINS, Colo., Feb. 12 /PRNewswire-FirstCall/ -- Advanced

Energy today reported financial results for the fourth quarter and

year ended December 31, 2003. Advanced Energy is a leading global

provider of critical solutions used in the production of

semiconductors, flat panel displays, data storage products and

other advanced applications. (Logo:

http://www.newscom.com/cgi-bin/prnh/20030825/AEISLOGO ) Fourth

Quarter Review For the 2003 fourth quarter, revenue was $74.7

million, up 30 percent from $57.4 million for the fourth quarter of

2002, and up 9 percent compared to $68.6 million for the third

quarter of 2003. The company generated income from operations of

$319,000 for the fourth quarter of 2003, compared to a loss from

operations of $5.7 million for the third quarter of 2003. The net

loss for the fourth quarter of 2003 was $2.4 million, or $0.08 per

share, compared to the net loss of $22.0 million, or $0.68 per

share, for the fourth quarter of 2002 and a net loss of $27.4

million, or $0.85 per share, for the third quarter of 2003. The

fourth quarter of 2002 includes pre-tax charges of $13.1 million

relating to excess and obsolete inventory and warranty reserves,

and other items. The third quarter 2003 net loss included a

non-cash charge of $22.4 million related to a reduction in the

carrying value of the Company's net deferred tax assets. Full Year

Review For the full year 2003, revenue was $262.4million, compared

with $238.9 million for the full year 2002, a 10 percent increase.

Net loss for the full year 2003 was $44.2 million, or $1.37 per

share, compared with a net loss of $41.4 million, or $1.29 per

share, for the full year 2002. Doug Schatz, chairman and chief

executive officer, said, "Industry fundamentals are improving, and

we are experiencing strong demand in all product groups, primarily

driven by our semiconductor and flat panel customers. Our sales to

semiconductor original equipment manufacturers (OEMs) in the fourth

quarter of 2003 increased 22 percent compared to the 2003 third

quarter, and sales to flat panel display OEMs increased 38 percent

from the prior quarter. Our ability to secure key designs in

high-growth semiconductor segments such as 300mm etch and chemical

vapor deposition (CVD) puts us in a strong position to benefit as

the industry accelerates its transition to larger wafers, as well

as to smaller line widths and advanced materials such as copper and

low-k dielectrics. "In this accelerating order environment, we

continue to focus on improving internal efficiencies and cost

control. The initial improvements have shown through in our fourth

quarter performance, and we posted income from operations for the

first time in ten quarters. Looking ahead, we expect to gain

greater leverage from the changes we have made, such as our

manufacturing operation in China and our transition to a

world-class Asian supply base. "Based on our strong market position

and the continued order momentum, we anticipate first quarter

revenue in the $95 to $100 million range and earnings per share in

the range of $0.12 to $0.17," said Mr. Schatz. Fourth Quarter and

Year-End Conference Call Management will host a conferencecall

today, Thursday, February 12, 2004 at 5:00 pm Eastern time to

discuss the financial results. You may access this conference call

by dialing 888-713-4717, or 706-679-7220 for international callers.

For a replay of this teleconference, please call706-645-9291,

passcode 4682617. The replay will be available through Thursday,

February 19, 2004. There will also be a webcast available on the

Advanced Energy Website, http://www.advanced-energy.com/ . About

Advanced Energy Advanced Energy is a global leader in the

development and support of technologies critical to high-technology

manufacturing processes used in the production of semiconductors,

flat panel displays, data storage products, compact discs, digital

video discs, architectural glass,and other advanced product

applications. Leveraging a diverse product portfolio and technology

leadership, Advanced Energy creates solutions that maximize process

impact, improve productivity and lower cost of ownership for its

customers. This portfolio includes a comprehensive line of

technology solutions in power, flow, thermal management, plasma and

ion beam sources, and integrated process monitoring and control for

original equipment manufacturers (OEMs) and end-users around the

world. Advanced Energy operates in regional centers in North

America, Asia and Europe and offers global sales and support

through direct offices, representatives and distributors. Founded

in 1981, Advanced Energy is a publicly held company traded on the

Nasdaq National Market under the symbol AEIS. For more information,

please visit our corporate website: http://www.advanced-energy.com/

. Safe Harbor Statement This press release contains certain

forward-looking statements subject to known and unknown risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statements. Such risks and

uncertainties include, but are not limited to, our ability to

manage the operations of our new manufacturing facility in China,

our customers' acceptance of products manufactured at our Chinese

manufacturing facility, the volatility and cyclicality of the

semiconductor and semiconductor capital equipment industries, the

timing of orders received from our customers, ourability to execute

on the cost reduction initiatives currently underway, and other

risks described in Advanced Energy's Form 10-K, Forms 10-Q as well

as other reports and statements filed with the Securities and

Exchange Commission. These reports and statements are available on

the SEC's website at http://www.sec.gov/ . Copies may also be

obtained by contacting Advanced Energy's investor relations at

970-407-6732. The company assumes no obligation to update the

information in this press release. CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED) (in thousands, except per

share data) Three Months Ended Twelve Months Ended December 31,

December 31, 2003 2002 2003 2002 Sales $74,731 $57,444 $262,402

$238,898 Cost of sales (2) 48,100 52,970 174,455 170,138 Gross

profit 26,631 4,474 87,947 68,760 Operating expenses: Research and

development 12,750 12,975 51,647 48,995 Sales and marketing 7,095

9,739 31,015 34,940 General and administrative 4,250 7,556 18,324

25,110 Amortization of intangible assets 1,199 1,904 4,612 5,423

Litigation damages -- -- -- 5,313 Restructuring charges 1,018 5,840

4,306 9,060 Impairment of intangible assets -- 1,904 1,175 1,904

Total operating expenses 26,312 39,918 111,079 130,745 Income

(loss)from operations 319 (35,444) (23,132) (61,985) Other

(expense) income, net (1) (1,957) 1,663 (9,308) (1,707) Loss before

income taxes (1,638) (33,781) (32,440) (63,692) (Provision) benefit

for income taxes (1) (801) 11,824 (11,801) 22,293 Net loss $(2,439)

$(21,957) $(44,241) $(41,399) Basic and diluted net loss per share

$(0.08) $(0.68) $(1.37) $(1.29) Basic and diluted weighted-average

common shares outstanding 32,433 32,111 32,271 32,026 (1) In the

fourth quarter of 2002, Advanced Energy recorded a gain on the

extinguishment of debt, net of related income taxes, as a result of

the Company's previously announced repurchase of a portion of its

convertible debt. The gain was previously reported as an

extraordinary gain, net of related tax effects. In connection with

the issuance of Statement of Financial Accounting Standards No.

145, the gain before any tax effect has been reclassified to other

(expense) income. The loss before income taxes and income tax

benefit were adjusted accordingly. (2) In the fourth quarter of

2002, Advanced Energy recorded charges of $11.5 million as cost of

sales for excess and obsolete inventory and warranty reserves.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (in thousands)

December 31, December 31, 2003 2002 ASSETS Current Assets: Cash and

cash equivalents $41,522 $70,188 Marketable securities 93,691

102,159 Accounts receivable 61,927 43,885 Income tax receivable 151

14,720 Inventories 65,703 57,306 Other current assets 5,486 6,828

Deferred income tax assets, net -- 17,510 Total current assets

268,480 312,596 Property and equipment, net 44,725 41,178 Deposits

and other 5,630 5,181 Goodwill and intangibles, net 88,943 86,601

Deferred debt issuance costs 3,019 4,091 Demonstration and customer

service equipment, net 3,934 6,086 Total assets $414,731 $455,733

LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Trade

accounts payable $23,066 $16,055 Other current liabilities 28,216

31,064 Current portion of capital leases and senior borrowings

8,582 15,197 Accrued interest payableon convertible subordinated

notes 2,460 2,338 Total current liabilities 62,324 64,654 Long-term

Liabilities: Capital leases and senior borrowings 6,16810,665 Other

long-term liabilities 2,015 694 Deferred income tax liability, net

4,672 8,663 Convertible subordinated notes payable 187,718 187,718

Total long-term liabilities 200,573 207,740 Total liabilities

262,897 272,394 Stockholders' equity 151,834 183,339 Total

liabilities and stockholders' equity $414,731 $455,733 CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) (in thousands)

Twelve Months Ended December 31, 2003 2002 NET CASH USED IN

OPERATING ACTIVITIES $(12,986) $(15,305) NET CASH (USED IN)

PROVIDED BY INVESTING ACTIVITIES (8,590) 24,311 NET CASH USED IN

FINANCING ACTIVITIES (8,608) (22,634) EFFECT OF CURRENCY

TRANSLATION ON CASH 1,518 1,861 DECREASE IN CASH AND CASH

EQUIVALENTS (28,666) (11,767) CASH AND EQUIVALENTS, beginning of

period 70,188 81,955 CASH AND EQUIVALENTS, end of period $41,522

$70,188 http://www.newscom.com/cgi-bin/prnh/20030825/AEISLOGO

http://photoarchive.ap.org/ DATASOURCE: Advanced Energy CONTACT:

Mike El-Hillow, Executive Vice President, Chief Financial Officer,

+1-970-407-6570, , or Cathy Kawakami, Director of Investor

Relations, +1-970-407-6732, , both of Advanced Energy Industries,

Inc. Web site: http://www.advanced-energy.com/

Copyright

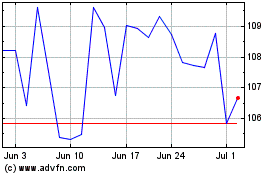

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

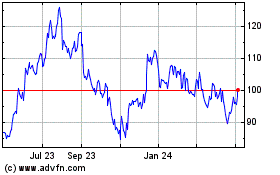

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024