Advanced Energy Announces Second Quarter Results

July 25 2011 - 5:11PM

- Revenue of $138.2 million, a 38.1% increase over Q2,

2010

- Operating Income of $17.3 million, 12.5% of

revenue

- EPS of $0.31 share

Advanced Energy Industries, Inc. (Nasdaq:AEIS) today announced

financial results for the second quarter ended June 30, 2011. The

company posted second quarter sales of $138.2 million, operating

income of 12.5%, and earnings of $0.31 per diluted share from

continuing operations.

"Our renewables business in the second quarter was pressured by

several industry dynamics, including declining panel prices,

increasing competition, and changing incentive programs, which

impacted our results more than anticipated. We were nonetheless

pleased that our thin films business unit was in-line with

expectations," said Dr. Hans Betz, chief executive officer.

"Looking at our expectations for the remainder of 2011, we believe

the benefits of our diversification strategy become clear. As our

thin film business softens with market cyclicality, our renewables

business is poised to capture previously-deferred business as

customers initiate projects in order to take advantage of tax

credits by year-end. Longer-term, we continue to see demand for our

utility-scale inverter products in North America and remain

confident that Advanced Energy's strategy of selling based on

levelized cost of energy (LCOE), superior uptime performance and

best-in-class service offering will continue to differentiate us in

the market."

Thin Film Business Unit

Thin Films business unit sales were $97.3 million versus $85.7

million in the same period of 2010, a 13.5% improvement year over

year. Total Thin Film sales met our expectations this quarter,

although declined slightly on a sequential basis from $100.1

million in the first quarter of 2011. Strength in our flat panel

display market this quarter was somewhat offset by the initial

signs of a pause in semiconductor capital spending, as well as the

overcapacity and resulting price declines in the solar panel

industry.

Renewables Business Unit

Renewables business unit sales were $40.8 million in the quarter

versus $14.4 million in the same period of 2010. The significant

year-over-year improvement reflects the acquisition of PV Powered

and the ongoing growth of the North American solar equipment

market. Renewable sales were impacted by several industry dynamics

during the quarter, leading to slower than anticipated sequential

growth of 9%.

Operating income was $17.3 million or 12.5% of revenue. Net

income from continuing operations was $13.5 million or $0.31 per

diluted share, compared to net income from continuing operations of

$18.8 million or $0.43 per diluted share in the first quarter of

2011.

Bookings for the second quarter were $101.7 million.

Third Quarter 2011

Guidance

The Company anticipates third quarter 2011 results from

continuing operations, to be within the following ranges:

- Sales of $130 million to $145 million

- Earnings per share of $0.20 to $0.30

Second Quarter 2011 Conference

Call

Management will host a conference call tomorrow, Tuesday, July

26, 2011, at 8:30 a.m. Eastern Daylight Time to discuss Advanced

Energy's financial results. Domestic callers may access this

conference call by dialing (866) 362-4820. International callers

may access the call by dialing (617) 597-5345. Participants will

need to provide a conference pass code 76215669. For a replay of

this teleconference, please call (888) 286-8010 or (617) 801-6888,

and enter the pass code 29763068. The replay will be available for

two weeks following the conference call. A webcast will also be

available on the Investor Relations web page at

http://ir.advanced-energy.com.

About Advanced Energy

Advanced Energy (NASDAQ: AEIS - News) is a global leader in

innovative power and control technologies forthin-film

manufacturing and high-growth solar-power generation. Advanced

Energy is headquartered in Fort Collins, Colorado, with dedicated

support and service locations around the world. For more

information, go to www.advanced-energy.com.

Forward-Looking Language

The Company's expectations with respect to guidance to financial

results for the third quarter ending September 30, 2011 and

statements that are not historical information are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements are subject to known and unknown risks

and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. Such

risks and uncertainties include, but are not limited to: the

effects of global macroeconomic conditions upon demand for our

products, the volatility and cyclicality of the industries the

company serves, particularly the semiconductor industry, the

continuation of RPS (renewable portfolio standards), the timing and

availability of incentives and grant programs in the US and Europe

related to the renewable energy market, renewable energy project

delays resulting from solar panel price declines and increased

competition in the solar inverter equipment market, the timing of

orders received from customers, the company's ability to realize

benefits from cost improvement efforts, the ability to source

materials and manufacture products, and unanticipated changes to

management's estimates, reserves or allowances. These and other

risks are described in Advanced Energy's Form 10-K, Forms 10-Q and

other reports and statements filed with the Securities and Exchange

Commission. These reports and statements are available

on the SEC's website at www.sec.gov. Copies may also be obtained

from Advanced Energy's website at www.advancedenergy.com or by

contacting Advanced Energy's investor relations at 970-407-6555.

Forward-looking statements are made and based on information

available to the company on the date of this press release. The

company assumes no obligation to update the information in this

press release.

| |

|

|

|

|

|

| ADVANCED ENERGY INDUSTRIES,

INC. |

|

|

|

|

|

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED) |

|

|

|

|

| (in thousands, except per share

data) |

|

|

|

|

|

| |

|

|

|

|

|

| |

Three Months

Ended |

Six Months

Ended |

| |

June

30, |

March 31, |

June

30, |

| |

2011 |

2010 |

2011 |

2011 |

2010 |

| |

|

|

|

|

|

| SALES |

$ 138,154 |

$ 100,107 |

$ 137,652 |

$ 275,806 |

$ 169,794 |

| COST OF SALES |

82,777 |

55,548 |

75,607 |

158,384 |

96,028 |

| GROSS PROFIT |

55,377 |

44,559 |

62,045 |

117,422 |

73,766 |

| |

40.1% |

44.5% |

45.1% |

42.6% |

43.4% |

| OPERATING EXPENSES: |

|

|

|

|

|

| Research and development |

17,137 |

13,515 |

15,862 |

32,999 |

24,657 |

| Selling, general and administrative |

20,001 |

17,183 |

20,905 |

40,906 |

29,412 |

| Amortization of intangible assets |

921 |

767 |

921 |

1,842 |

767 |

| Total operating expenses |

38,059 |

31,465 |

37,688 |

75,747 |

54,836 |

| |

|

|

|

|

|

| INCOME FROM OPERATIONS |

17,318 |

13,094 |

24,357 |

41,675 |

18,930 |

| |

|

|

|

|

|

| Other income, net |

92 |

220 |

663 |

755 |

605 |

| Income from continuing operations before

income taxes |

17,410 |

13,314 |

25,020 |

42,430 |

19,535 |

| Provision for income taxes |

3,898 |

1,857 |

6,254 |

10,152 |

3,228 |

| INCOME FROM CONTINUING OPERATIONS |

13,512 |

11,457 |

18,766 |

32,278 |

16,307 |

| |

|

|

|

|

|

| Results from discontinued operations, net of

tax |

74 |

2,162 |

140 |

214 |

3,529 |

| |

|

|

|

|

|

| INCOME FROM DISCONTINUED OPERATIONS, NET OF

INCOME TAXES |

74 |

2,162 |

140 |

214 |

3,529 |

| |

|

|

|

|

|

| NET INCOME |

$ 13,586 |

$ 13,619 |

$ 18,906 |

$ 32,492 |

$ 19,836 |

| |

|

|

|

|

|

| Basic weighted-average common shares

outstanding |

43,571 |

42,806 |

43,440 |

43,505 |

42,440 |

| Diluted weighted-average common shares

outstanding |

44,187 |

43,327 |

44,133 |

44,156 |

43,004 |

| |

|

|

|

|

|

| EARNINGS PER SHARE: |

|

|

|

|

|

| CONTINUING OPERATIONS: |

|

|

|

|

|

| BASIC EARNINGS PER SHARE |

$ 0.31 |

$ 0.27 |

$ 0.43 |

$ 0.74 |

$ 0.38 |

| DILUTED EARNINGS PER SHARE |

$ 0.31 |

$ 0.26 |

$ 0.43 |

$ 0.73 |

$ 0.38 |

| |

|

|

|

|

|

| DISCONTINUED OPERATIONS |

|

|

|

|

|

| BASIC EARNINGS PER SHARE |

$ 0.00 |

$ 0.05 |

$ 0.00 |

$ 0.00 |

$ 0.08 |

| DILUTED EARNINGS PER SHARE |

$ 0.00 |

$ 0.05 |

$ 0.00 |

$ 0.00 |

$ 0.08 |

| |

|

|

|

|

|

| NET INCOME: |

|

|

|

|

|

| BASIC EARNINGS PER

SHARE |

$ 0.31 |

$ 0.32 |

$ 0.44 |

$ 0.75 |

$ 0.47 |

| DILUTED EARNINGS PER

SHARE |

$ 0.31 |

$ 0.31 |

$ 0.43 |

$ 0.74 |

$ 0.46 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| ADVANCED ENERGY INDUSTRIES,

INC. |

|

|

|

|

|

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

|

|

|

|

| (in thousands) |

|

|

|

|

|

| |

|

|

|

|

|

| |

June 30, |

December

31, |

|

|

|

| |

2011 |

2010 |

|

|

|

| ASSETS |

|

|

|

|

|

| |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

| Cash and cash equivalents |

$ 135,564 |

$ 130,914 |

|

|

|

| Marketable securities |

10,124 |

9,640 |

|

|

|

| Accounts receivable, net |

128,802 |

119,893 |

|

|

|

| Inventories, net |

100,392 |

77,593 |

|

|

|

| Deferred income taxes |

7,689 |

7,510 |

|

|

|

| Income taxes receivable |

2,388 |

6,061 |

|

|

|

| Other current assets |

11,689 |

10,156 |

|

|

|

| Total current assets |

396,648 |

361,767 |

|

|

|

| |

|

|

|

|

|

| Property and equipment, net |

38,408 |

34,569 |

|

|

|

| |

|

|

|

|

|

| Deposits and other |

8,795 |

8,874 |

|

|

|

| Goodwill and intangibles, net |

93,094 |

96,781 |

|

|

|

| Deferred income tax assets, net |

5,059 |

3,166 |

|

|

|

| Total assets |

$ 542,004 |

$ 505,157 |

|

|

|

| |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

| |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

| Accounts payable |

$ 48,828 |

$ 56,185 |

|

|

|

| Other accrued expenses |

47,130 |

46,140 |

|

|

|

| Total current liabilities |

95,958 |

102,325 |

|

|

|

| |

|

|

|

|

|

| Long-term liabilities |

30,393 |

28,864 |

|

|

|

| |

|

|

|

|

|

| Total liabilities |

126,351 |

131,189 |

|

|

|

| |

|

|

|

|

|

| Stockholders' equity |

415,653 |

373,968 |

|

|

|

| Total liabilities and stockholders'

equity |

$ 542,004 |

$ 505,157 |

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| ADVANCED ENERGY INDUSTRIES,

INC. |

|

|

|

|

|

| SEGMENT INFORMATION |

|

|

|

|

|

| (in thousands) |

|

|

|

|

|

| |

|

|

|

|

|

| |

Three Months

Ended |

Six Months

Ended |

| |

June

30, |

March 31, |

June

30, |

| |

2011 |

2010 |

2011 |

2011 |

2010 |

| SALES: |

|

|

|

|

|

| Thin Films |

$ 97,331 |

$ 85,697 |

$ 100,099 |

$ 197,430 |

$ 153,120 |

| Renewables |

40,823 |

14,410 |

37,553 |

78,376 |

16,674 |

| Total Sales |

138,154 |

100,107 |

137,652 |

275,806 |

169,794 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| OPERATING INCOME: |

|

|

|

|

|

| Thin Films |

$ 20,042 |

|

$ 24,824 |

$ 44,866 |

|

| Renewables |

321 |

|

2,512 |

2,833 |

|

| Total segment operating income |

20,363 |

|

27,336 |

47,699 |

|

| Corporate expenses |

(3,045) |

|

(2,979) |

(6,024) |

|

| Other income, net |

92 |

|

663 |

755 |

|

| Income from continuing operations before

income taxes |

$ 17,410 |

|

$ 25,020 |

$ 42,430 |

|

CONTACT: Danny Herron

Advanced Energy Industries, Inc.

970.407.6570

danny.herron@aei.com

Annie Leschin/Vanessa Lehr

Advanced Energy Industries, Inc.

970.407.6555

ir@aei.com

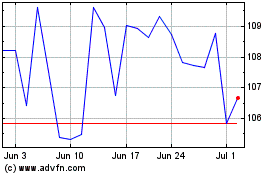

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

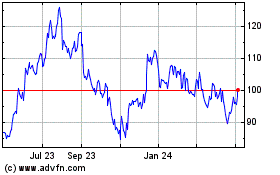

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024