Advanced Energy Industries, Inc. (Nasdaq GM: AEIS) today

announced financial results for the second quarter ended June 30,

2010. Total sales for the second quarter were $115.2 million,

representing an all-time high for the company in a single quarter

and producing earnings of $0.31 per diluted share. The results

highlighted in this release include our Aera® mass flow controller

business that is currently being divested, as well as the inclusion

of two months of operating results from PV Powered.

“We had an outstanding second quarter, with $154 million in

bookings and $115 million in revenue, including PV Powered and the

flow business. As our semiconductor revenues continued to grow, the

semiconductor industry demonstrated its momentum again this

quarter,” said Dr. Hans Betz, chief executive officer.

"Our recent acquisition of PV Powered contributed significantly

to our higher inverter revenues and backlog, which we anticipate

will provide momentum for the second half of 2010. PV Powered also

contributed to our bottom line, delivering a profitable second

quarter ahead of expectations and making the acquisition

immediately accretive. The addition of this excellent team and

product line to our Solaron inverter business positions us to forge

ahead and take the leading position in the US market for inverters

and expand worldwide.”

"Additionally, today we announced that we are divesting our flow

business. We see this move as a crucial part of our corporate

strategy to focus the company on becoming the market leader in

power conversion and capitalize on future growth

opportunities.”

Semiconductor sales rose 9.9% sequentially to $53.5 million,

representing 46.4% of total sales for the quarter. Sales to the

non-semiconductor thin film markets increased 87.2% sequentially to

$35.9 million, representing 31.2% of total sales for the quarter.

Inverter sales grew substantially with the addition of PV Powered

to $14.4 million to 12.5% of total sales compared to $2.3 million

in the first quarter. Service revenue was flat sequentially at

$11.4 million, representing 9.9% of total sales for the

quarter.

Bookings for the second quarter, including $15.3 million for the

mass flow controller business, hit a record of $154.3 million, or a

60.0% increase, compared to $96.7 million in the first quarter of

2010, resulting in a book-to-bill ratio of 1.34:1 for the second

quarter. Ending backlog for the second quarter increased 52.0%

sequentially to $123.6 million, including $14.4 million for the

flow business, compared to $81.3 million at the end of the first

quarter of 2010.

Advanced Energy also announced that it has entered into an

agreement to sell its flow business, related product lines and all

related assets including the real property in Japan to Hitachi

Metals, Ltd. for $44 million in cash, subject to an adjustment

based on inventory balance at closing. The company anticipates this

transaction will close in the third quarter of 2010 subject to

satisfaction of customary closing conditions.

As a result of this transaction, the financial results for our

flow business will be recorded in discontinued operations on a net

basis beginning with the second quarter 2010. These amounts are

revenue of $15.1 million, gross profit of $5.3 million, operating

expenses of $1.7 million and net income of $2.2 million, or $0.05

per diluted share in the quarter ended June 30, 2010. Comparable

results for the flow business for the second quarter of 2009 were

revenues of $3.7 million, gross profit of $0.6 million, operating

expenses of $1.3 million and a net loss of $0.4 million, or

$0.01 per diluted share. For comparative purposes, the financial

results discussed below assume the adjustments for the divestiture

have been made.

Excluding the flow business, sales for the second quarter of

2010 increased 43.6% to $100.1 million from $69.7 million in the

first quarter of 2010, and up substantially from $31.9 million in

the second quarter of 2009.

Gross margin for the second quarter was 44.5%, compared with

41.9% in the first quarter of 2010, as a result of higher revenues

and leverage from overhead absorption. This compares to gross

margin of 22.8% in the same period last year.

Operating expenses for the second quarter increased to $31.5

million. This increase was significantly driven by the addition of

approximately two months of operating costs associated with the

acquisition of PV Powered, including an additional $767,000 of

amortization of acquired intangible assets.

Second quarter net income from continuing operations was $11.5

million or $0.26 per diluted share, compared to net income from

continuing operations of $4.9 million or $0.11 per diluted share in

the first quarter of 2010. In the same period a year ago, net loss

from continuing operations was $16.0 million or a loss of $0.38 per

share.

Cash, cash equivalents and investments were $128.9 million at

the end of the second quarter, versus $163.4 million in the first

quarter reflecting the $35 million payment for the PV Powered

acquisition.

Third Quarter 2010 Guidance

The Company anticipates third quarter 2010 results from

continuing operations, without revenues from the flow business, to

be within the following ranges:

- Sales of $130.0 million to

$140.0 million

- Earnings per share of $0.36 to

$0.44

Announcement of Agreement to Sell Aera Flow Controller and

Related Product Lines to Hitachi Metals, Ltd.

This earnings release should be read in conjunction with our

press release regarding the sale of the Aera flow business

transaction dated July 21, 2010.

Second Quarter 2010 Conference Call

Management will host a conference call tomorrow, Thursday July

22, 2010, at 8:30 a.m. Eastern Daylight Time to discuss Advanced

Energy's financial results. Domestic callers may access this

conference call by dialing (888) 713-4717. International callers

may access the call by dialing (816) 650-2836. Participants will

need to provide a conference pass code 86106130. For a replay of

this teleconference, please call (800) 642-1687 or (706) 645-9291,

and enter the pass code 86106130. The replay will be available

through 12:00 a.m. Eastern Daylight Time, July 24, 2010. A webcast

will also be available on the Investor Relations Web page at

http://ir.advanced-energy.com.

About Advanced Energy

Advanced Energy (NASDAQ: AEIS) is a global leader in innovative

power and control technologies for high-growth, thin-film

manufacturing and solar-power generation. Advanced Energy is

headquartered in Fort Collins, Colorado, with dedicated support and

service locations around the world. For more information, go to

www.advanced-energy.com.

Forward-Looking Language

The Company’s expectations with respect to guidance to financial

results for the third quarter ending September 30, 2010 are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. Forward-looking statements are subject to known and

unknown risks and uncertainties that could cause actual results to

differ materially from those expressed or implied by such

statements. Such risks and uncertainties include, but are not

limited to: the effects of global macroeconomic conditions upon

demand for our products, the volatility and cyclicality of the

industries the company serves, particularly the semiconductor

industry, the timing of orders received from customers, the

company's ability to realize cost improvement benefits, and

unanticipated changes to management's estimates, reserves or

allowances. These and other risks are described in Advanced

Energy's Form 10-K, Forms 10-Q and other reports and statements

filed with the Securities and Exchange Commission. These reports

and statements are available on the SEC's website at www.sec.gov.

Copies may also be obtained from Advanced Energy's website at

www.advancedenergy.com or by contacting Advanced Energy's investor

relations at 970-407-6555. Forward-looking statements are made and

based on information available to the company on the date of this

press release. The company assumes no obligation to update the

information in this press release.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED) (in thousands, except per share data)

Three Months Ended Six Months

Ended June 30, March 31, June 30,

2010 2009 2010 2010 2009

Sales $ 100,107 $ 31,898 $ 69,687 $ 169,794 $ 60,996 Cost of sales

55,548 24,616

40,480

96,028 47,644 Gross profit

44,559 7,282 29,207 73,766 13,352 44.5 % 22.8 % 41.9 % 43.4 % 21.9

% Operating expenses: Research and development 13,515 10,308 11,143

24,658 20,965 Selling, general and administrative 17,183 9,359

12,228 29,411 17,923 Impairment of goodwill - - - - 63,260

Amortization of intangible assets 767 - - 767 102 Restructuring

charges - 739 - -

4,135 Total operating expenses 31,465

20,406 23,371 54,836

106,384 Income (loss) from operations

13,094 (13,124 ) 5,836 18,930 (93,032 ) Other income, net

220 627 386 606

909 Income (loss) from operations before income taxes

13,314 (12,497 ) 6,222 19,536 (92,123 ) Provision (benefit) for

income taxes 1,857 3,110 1,371

3,228 2,602 Net income (loss)

from continuing operations $ 11,457 $ (15,607 ) $ 4,851

$ 16,308 $ (94,725 ) Basic earnings (loss) per

share $ 0.27 $ (0.37 ) $ 0.12 $ 0.38 $ (2.26 ) Diluted earnings

(loss) per share $ 0.26 $ (0.37 ) $ 0.11 $ 0.38 $ (2.26 )

Basic weighted-average common shares outstanding 42,806 41,948

42,074 42,440 41,915 Diluted weighted-average common shares

outstanding 43,327 41,948 42,680 43,004 41,915

GAIN (LOSS) FROM DISCONTINUED OPERATIONS, NET OF

INCOME TAXES $ 2,162 $ (427 ) $ 1,366 $ 3,529

$ (1,072 ) BASIC EARNINGS (LOSS) PER SHARE $ 0.05 $ (0.01 )

$ 0.03 $ 0.08 $ (0.03 ) DILUTED EARNINGS (LOSS) PER SHARE $ 0.05 $

(0.01 ) $ 0.03 $ 0.08 $ (0.03 )

NET INCOME (LOSS) $ 13,619 $ (16,034 ) $ 6,217 $

19,836 $ (95,797 ) BASIC EARNINGS (LOSS) PER SHARE $

0.32 $ (0.38 ) $ 0.15 $ 0.47 $ (2.29 ) DILUTED EARNINGS (LOSS) PER

SHARE $ 0.31 $ (0.38 ) $ 0.15 $ 0.46 $ (2.29 ) BASIC

WEIGHTED—AVERAGE COMMON SHARES OUTSTANDING 42,806 41,948 42,074

42,440 41,915 DILUTED WEIGHTED—AVERAGE COMMON SHARES OUTSTANDING

43,327 41,948 42,680 43,004 41,915

CONDENSED CONSOLIDATED

BALANCE SHEETS (in thousands) June 30,

December 31, 2010 2009 ASSETS Current assets: Cash

and cash equivalents $ 116,795 $ 133,106 Marketable securities

12,066 44,401 Accounts receivable, net 75,175 50,267 Inventories,

net 54,515 28,567 Deferred income taxes 9,183 9,223 Income taxes

receivable 3,245 - Assets held for sale 32,276 26,460 Other current

assets 7,532 5,641 Total current assets 310,787

297,665 Property and equipment, net 22,244 18,687

Deposits and other 8,814 9,295 Goodwill and intangibles, net 98,139

- Deferred income tax assets, net 20,268 19,479 Total

assets $ 460,252 $ 345,126 LIABILITIES AND

STOCKHOLDERS' EQUITY Current liabilities: Accounts payable $

35,549 $ 23,802 Other accrued expenses 30,750 24,055 PVP Contingent

liability 38,967 - Liabilities of business held for sale

1,493 1,477 Total current liabilities 106,759 49,335

Long-term liabilities 42,860 17,457 Total

liabilities 149,619 66,791 Stockholders' equity

310,633 278,335 Total liabilities and stockholders' equity $

460,252 $ 345,126

RECONCILIATION OF CONSOLIDATED

STATEMENTS OF OPERATIONS (LOSS) FOR DISCONTINUED OPERATIONS

(in thousands) March 31, 2010

June 30, 2010 Consolidated

DiscontinuedOperations

Adjusted Q12010

Consolidated

DiscontinuedOperations

Adjusted Q22010

Total sales $ 81,552 $ 11,865 $ 69,687 $ 115,191 $ 15,084 $ 100,107

Cost of sales 48,444 7,964 40,480 65,302 9,754 55,548

Gross

profit 33,108 3,901 29,207 49,889 5,330 44,559 OPERATING

EXPENSES: R&D 11,590 447 11,143 13,959 444 13,515 Selling,

general and administrative 13,283 1,054 12,228 18,342 1,159 17,183

Intangible amortization 122 122 - 891 124 767 Total Operating

Expenses 24,995 1,623 23,371 33,192 1,727 31,465

Operating

Income 8,113 2,278 5,836 16,697

3,603 13,094 Other Income (Expense) 386 - 386 220 -

220

Pre-tax income 8,499 2,278 6,222

16,917 3,603 13,314 Provision for income taxes

2,282 911 1,371 3,299 1,442 1,857

Net Income $ 6,217

$ 1,367 $ 4,851 $ 13,618 $ 2,161 $

11,457 Diluted Earnings per Share $ 0.15 $

0.03 $ 0.11 $ 0.31 $ 0.05 $ 0.26

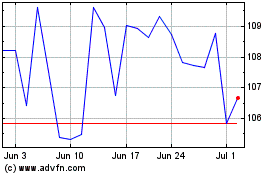

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

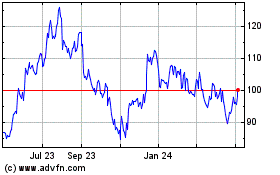

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024