FORT COLLINS, Colo., July 23 /PRNewswire-FirstCall/ -- Advanced

Energy Industries, Inc. (NASDAQ:AEIS) today announced financial

results for the second quarter ended June 30, 2008. Sales of $88.0

million were driven by a 36% sequential increase in sales to

non-semiconductor markets, which reached 48% of our total sales.

Sales to the solar market led the way, topping 14% of total sales

for the quarter, while service revenues also hit a record high.

Total second quarter sales declined 1% versus the first quarter of

2008, and declined 14.6% from $103.0 million in the second quarter

of 2007, both due to the continued weakness in the semiconductor

capital equipment market. Our book to bill ratio for the quarter

was strong at 1.05:1. Gross margin for the second quarter was 40.1%

versus 43.6% in the second quarter of 2007 due to lower sales and

the related overhead absorption. Sequentially, gross margins were

fractionally down from 40.3% in the first quarter of 2008. Net

income for the second quarter of 2008 was $5.9 million, or $0.14

per diluted share, as cost reduction efforts controlled our

operating expenses, compared to $11.7 million, or $0.25 per diluted

share in the second quarter of 2007. Net income decreased

sequentially from $6.0 million in the first quarter of 2008, but

earnings per diluted share for the second quarter of 2008 were

slightly higher due to shares repurchased during the quarter. "We

executed on our diversification strategy, growing non-semiconductor

revenue to record levels this quarter. Sales in each of our major

non-semiconductor markets demonstrated strong growth, and demand

for our products in the solar market reached its highest level

yet," said Dr. Hans Betz, president and chief executive officer of

Advanced Energy. "Further, we believe our ability to address these

emerging markets will serve us well as we develop new applications

for our technology and navigate through this cycle in the

semiconductor market." Third Quarter 2008 Guidance The Company

anticipates third quarter 2008 results to be within the following

ranges: -- Sales of $82 million to $88 million. -- Earnings per

share of $0.07 to $0.12 Second Quarter 2008 Conference Call

Management will host a conference call today, Wednesday, July 23,

2008 at 5:00 pm Eastern Daylight Time to discuss Advanced Energy's

financial results. Domestic callers may access this conference call

by dialing 877-627-6511 and International callers may access the

call by dialing 719-325-4916. Participants will need to provide the

conference passcode 9067934. For a replay of this teleconference,

please call 888-203-1112, or 719-457-0820 and enter the passcode

9067934. The replay will be available through 12:00 a.m. Eastern

Daylight Time, July 25, 2008. A webcast will also be available on

the Investor Relations webpage at http://ir.advanced-energy.com/.

About Advanced Energy Advanced Energy(R) develops innovative power

and control technologies that enable high-growth, plasma thin-film

manufacturing processes worldwide, including semiconductors, flat

panel displays, data storage products, solar cells, architectural

glass, and other advanced product applications. Advanced Energy(R)

also develops grid connect inverters for the solar energy market.

The Company's expectations with respect to financial results for

the third quarter of 2008 are forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Forward-looking

statements are subject to known and unknown risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied by such statements. Such risks and

uncertainties include, but are not limited to: the volatility and

cyclicality of the industries the company serves, particularly the

semi-conductor industry, the timing of orders received from

customers, the company's ability to realize cost improvement

benefits from the global operations initiatives underway, and

unanticipated changes to management's estimates, reserves or

allowances. These and other risks are described in Advanced

Energy's Form 10-K, Forms 10-Q and other reports and statements

filed with the Securities and Exchange Commission. These reports

and statements are available on the SEC's website at

http://www.sec.gov/. Copies may also be obtained from Advanced

Energy's website at http://www.advanced-energy.com/ or by

contacting Advanced Energy's investor relations at 970-407-6555.

Forward-looking statements are made and based on information

available to the company on the date of this press release. The

company assumes no obligation to update the information in this

press release. CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED) (in thousands, except per share data) Three Months

Ended Six Months Ended June 30, March 31, June 30, 2008 2007 2008

2008 2007 Sales $87,996 $103,049 $88,887 $176,883 $210,372 Cost of

sales 52,720 58,094 53,039 105,759 117,108 Gross profit 35,276

44,955 35,848 71,124 93,264 Operating expenses: Research and

development 13,762 12,911 13,085 26,847 24,946 Selling, general and

administrative 13,955 15,414 14,468 28,423 30,632 Amortization of

intangible assets 226 202 240 466 526 Restructuring charges 393 158

674 1,067 2,950 Total operating expenses 28,336 28,685 28,467

56,803 59,054 Income from operations 6,940 16,270 7,381 14,321

34,210 Other income, net 996 1,505 905 1,901 3,059 Income from

continuing operations before income taxes 7,936 17,775 8,286 16,222

37,269 Provision for income taxes (2,073) (6,108) (2,320) (4,393)

(12,931) Net income $5,863 $11,667 $5,966 $11,829 $24,338 Basic

earnings per share $0.14 $0.26 $0.13 $0.27 $0.54 Diluted earnings

per share $0.14 $0.25 $0.13 $0.27 $0.53 Basic weighted-average

common shares outstanding 41,869 45,161 44,662 43,265 45,051

Diluted weighted-average common shares outstanding 42,290 45,992

45,065 43,686 45,834 CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) (in thousands) June 30, December 31, 2008 2007 ASSETS

Current assets: Cash and cash equivalents $106,178 $94,588

Marketable securities 33,556 110,676 Accounts receivable, net

61,301 64,188 Inventories, net 48,431 50,532 Deferred income taxes

15,243 23,696 Other current assets 4,485 4,289 Total current assets

269,194 347,969 Property and equipment, net 30,434 30,912 Long-term

investments 36,002 1,483 Deposits and other 5,831 5,562 Goodwill

and intangibles, net 70,160 67,768 Customer service equipment, net

1,069 1,236 Deferred income tax assets, net 15,629 4,098 Total

assets $428,319 $459,028 LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities: Trade accounts payable $13,364 $12,424 Other

accrued expenses 27,836 29,590 Total current liabilities 41,200

42,014 Long-term liabilities 9,611 9,953 Total liabilities 50,811

51,967 Stockholders' equity 377,508 407,061 Total liabilities and

stockholders' equity $428,319 $459,028

http://www.newscom.com/cgi-bin/prnh/20030825/AEISLOGO

http://photoarchive.ap.org/ DATASOURCE: Advanced Energy Industries,

Inc. CONTACT: Lawrence D. Firestone, +1-970-407-6570, , or Annie

Leschin, or Vanessa Lehr, +1-970-407-6555, , all of Advanced Energy

Industries, Inc. Web site: http://www.advanced-energy.com/

http://ir.advanced-energy.com/

Copyright

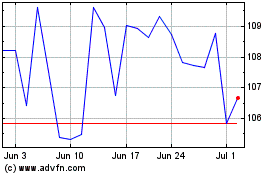

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

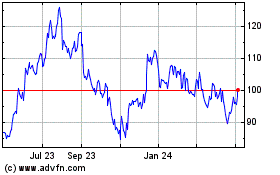

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024