FORT COLLINS, Colo., Oct. 24 /PRNewswire-FirstCall/ -- Advanced

Energy Industries, Inc. (NASDAQ:AEIS) today announced financial

results for the third quarter ended September 30, 2007. Sales were

$90.5 million for the third quarter of 2007, consistent with the

Company's revised guidance given on August 30, 2007. This

represented a decrease of 16.0% from $107.7 million in the third

quarter of 2006, and a sequential decline of 12.1% compared to

$103.0 million in the second quarter of 2007. Gross margin for the

third quarter was 40.6%, down from 43.7% in the third quarter of

2006, and down from 43.6% in the second quarter of 2007. This was

primarily due to lower revenues, an additional charge of $2.2

million to cost of goods sold, and costs related to the transition

of manufacturing from Stolberg, Germany to China. The additional

charges were related to a change in the estimate of warranty

expense for two products, which resulted in a 2.4% reduction in

gross margin. The company also incurred a net charge of $1.4

million related to a foreign exchange loss during the quarter, as

the Yen and Euro strengthened relative to the US dollar. Net income

for the third quarter of 2007 was $5.9 million, or $0.13 per

diluted share, compared to $17.0 million, or $0.38 per diluted

share in the third quarter of 2006, and $11.7 million or $0.25 in

the second quarter of 2007. "Our revenue was in line with our pre

announcement due to the weakness in the semiconductor equipment

market. The gross margin did not meet our objective due to the

increased warranty expense. In the near term we expect to see

continued softness in the semiconductor equipment and flat panel

display markets with modest growth in our other markets," said Dr.

Hans Betz, president and chief executive officer of Advanced

Energy. "We made additional progress in the strategic

diversification of our business notably with the successful

introduction of our Solaron(TM) inverter product line." Fourth

Quarter 2007 Guidance The Company anticipates fourth quarter 2007

results to be within the following ranges: -- Sales of $86 million

to $90 million. -- Earnings per share of $0.12 to $0.14 Third

Quarter 2007 Conference Call Management will host a conference call

today, Wednesday, October 24, 2007 at 5:00 pm eastern daylight time

to discuss Advanced Energy's financial results. You may access this

conference call by dialing (888)-713-4717. International callers

may access the call by dialing (706)-634-7937. Participants will

need to provide a conference passcode 20284265. For a replay of

this teleconference, please call (800)-642-1687 or (706) 645-9291,

and enter the passcode 20284265. The replay will be available

through October 27, 2007. A webcast will also be available on the

Investor Relations webpage at http://ir.advanced-energy.com/. About

Advanced Energy Advanced Energy(R) develops innovative power and

control technologies that enable high-growth, plasma thin-film

manufacturing processes worldwide, including semiconductors, flat

panel displays, data storage products, solar cells, architectural

glass, and other advanced product applications. Advanced Energy(R)

also develops grid connect inverters for the solar energy market.

The Company's expectations with respect to financial results for

the fourth quarter of 2007 are forward looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements are subject to known and unknown risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied by such statements. Such risks and

uncertainties include, but are not limited to: the volatility and

cyclicality of the industries the company serves, the timing of

orders received from customers, the company's ability to realize

cost improvement benefits from the global operations initiatives

underway, the company's dependence on sole and limited source

suppliers, fluctuating currency rates, and unanticipated changes to

management's estimates, reserves or allowances. These and other

risks are described in Advanced Energy's Form 10-K, Forms 10-Q and

other reports and statements filed with the Securities and Exchange

Commission. These reports and statements are available on the SEC's

website at http://www.sec.gov/. Copies may also be obtained from

Advanced Energy's website at http://www.advanced-energy.com/ or by

contacting Advanced Energy's investor relations at 970-407-6555.

Forward-looking statements are made and based on information

available to the company on the date of this press release. The

company assumes no obligation to update the information in this

press release. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED) (in thousands, except per share data) Three Months

Ended Nine Months Ended September 30, June 30, September 30, 2007

2006 2007 2007 2006 Sales $90,492 $107,688 $103,049 $300,863

$306,209 Cost of sales 53,765 60,674 58,094 170,873 175,885 Gross

profit 36,727 47,014 44,955 129,990 130,324 Operating expenses:

Research and development 12,937 11,345 12,911 37,883 32,608

Selling, general and administrative 15,537 16,856 15,414 46,169

45,502 Amortization of intangible assets 201 453 202 727 1,383

Restructuring charges 556 31 158 3,505 91 Total operating expenses

29,231 28,685 28,685 88,284 79,584 Income from operations 7,496

18,329 16,270 41,706 50,740 Other income, net 308 1,044 1,505 3,367

3,617 Income from continuing operations before income taxes 7,804

19,373 17,775 45,073 54,357 Provision for income taxes (1,948)

(2,381) (6,108) (14,879) (6,580) Income from continuing operations

5,856 16,992 11,667 30,194 47,777 Gain on sale of discontinued

assets - - - - 138 Income from discontinued operations - - - - 138

Net income $5,856 $16,992 $11,667 $30,194 $47,915 Net income per

basic share Income from continuing operations $0.13 $0.38 $0.26

$0.67 $1.07 Income from discontinued operations $- $- $- $- $0.00

Basic earnings per share $0.13 $0.38 $0.26 $0.67 $1.07 Net income

per diluted share Income from continuing operations $0.13 $0.38

$0.25 $0.66 $1.06 Income from discontinued operations $- $- $- $-

$0.00 Diluted earnings per share $0.13 $0.38 $0.25 $0.66 $1.06

Basic weighted-average common shares outstanding 45,248 44,762

45,161 45,117 44,679 Diluted weighted-average common shares

outstanding 45,761 45,166 45,992 45,696 45,168 CONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED) (in thousands) September

30, December 31, 2007 2006 ASSETS Current assets: Cash and cash

equivalents $76,878 $58,240 Marketable securities 108,154 85,978

Accounts receivable, net 69,704 74,794 Inventories, net 57,388

52,778 Deferred income taxes 21,740 24,434 Assets held for sale

1,345 - Other current assets 5,877 4,503 Total current assets

341,086 300,727 Property and equipment, net 30,677 33,571 Deposits

and other 8,296 2,640 Goodwill and intangibles, net 67,013 65,584

Customer service equipment, net 939 832 Deferred income tax assets,

net 4,222 8,549 Total assets $452,233 $411,903 LIABILITIES AND

STOCKHOLDERS' EQUITY Current liabilities: Trade accounts payable

$15,578 $16,310 Other accrued expenses 28,488 36,619 Total current

liabilities 44,066 52,929 Long-term liabilities 9,851 3,184 Total

liabilities 53,917 56,113 Stockholders' equity 398,316 355,790

Total liabilities and stockholders' equity $452,233 $411,903

http://www.newscom.com/cgi-bin/prnh/20030825/AEISLOGO

http://photoarchive.ap.org/ DATASOURCE: Advanced Energy Industries,

Inc. CONTACT: Lawrence D. Firestone, +1-970-407-6570, , or Annie

Leschin or Brooke Deterline, +1-970-407-6555, , all of Advanced

Energy Industries, Inc. Web site: http://www.advanced-energy.com/

Copyright

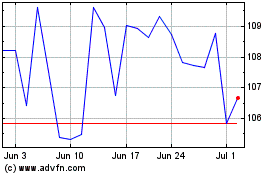

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

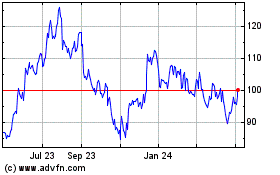

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024